Increasing the Renewable Transport Fuel Obligation buy-out price to ensure continued greenhouse gas savings

Updated 25 September 2020

Consultation proposals

Summary

This consultation seeks to ensure the continued decarbonisation of road transport fuels through the supply of renewable fuels under the Renewable Transport Fuel Obligation (RTFO). Biofuels supported under the RTFO have successfully reduced greenhouse gas (GHG) emissions from transport over the last 12 years and will make up a third of the UK’s transport carbon budget contribution.

Carbon budgets are made under the Climate Change Act, and every tonne of GHG emitted between now and 2050 will count[footnote 1]. Where emissions rise in one sector, the UK will have to achieve corresponding falls in another. In 2018 biofuels reduced carbon emissions from transport by over 3.5 million tonnes.

However, recent increases in the cost of biofuels relative to petrol and diesel mean that there is a risk that suppliers will ‘buy-out’ of their obligations to supply renewable transport fuel. This would result in lost GHG savings and a gap in UK carbon budgets as well as risking long-term impacts on the UK biofuels industry.

We therefore propose to increase the RTFO buy-out price to ensure the continued supply of biofuels and other renewable fuels and the GHG savings they deliver.

Support available for renewable transport fuels

The UK has two schemes which support the use of low carbon fuels for transport; the RTFO and the Motor Fuel (Road Vehicle and Non-Road Mobile Machinery) Greenhouse Gas Emissions Regulations 2012 (GHG Regulations).

The Renewable Transport Fuel Obligation

The RTFO commenced on 15 April 2008 and delivers reductions in GHG emissions from fuel used for transport purposes by encouraging the supply of renewable fuels. The scheme works by setting annual obligations on suppliers,[footnote 2] increasing from 9.75% in 2020 to 12.4% in 2032, which can be met by supplying renewable fuel or purchasing renewable transport fuel certificates (RTFCs) from other suppliers.

RTFCs are issued to suppliers of sustainable[footnote 3] renewable transport fuel and this trading mechanism enables obligated suppliers to meet their obligation in a cost-effective manner. Alternatively, suppliers can pay a fixed sum for each litre of fuel for which they wish to ‘buy-out’ of their obligation. It is likely that additional costs incurred by the fuel supplier from meeting their obligations are passed on to the motorist.

Fuel suppliers are likely to buy-out when the price of RTFCs consistently exceeds the buy-out price. The buy-out therefore provides a safety net to prevent the cost of this policy disproportionately impacting motorists by placing a cap on the maximum costs which can be incurred. It also provides flexibility for fuel suppliers in unusual circumstances such as a short-term fuel supply issue or other unforeseen event. As such, the buy-out option is an integral part of the RTFO.

The buy-out price is specified in the RTFO Order and stands at a fixed level of 30p/litre. This value has not increased since the start of the RTFO in 2008. To date, there has been no significant buy-out from the RTFO as it has been cheaper to supply biofuels or purchase RTFCs than pay the buy-out price.

Since 2019 obligated fuel suppliers have had to meet a second obligation to supply development fuels[footnote 4], which has its own separate buy-out of 80p/litre. This consultation is regarding buy-out of the main obligation and the development fuel obligation is not considered further here.

The Motor Fuel (Road Vehicle and Mobile Machinery) Greenhouse Gas Emissions Regulations 2012

The GHG Regulations require suppliers to report annually on the amount, energy content and GHG emissions of relevant fuels supplied.

The GHG Regulations also set GHG reduction targets for suppliers of 4% in 2019 and 6% in 2020 compared to the 2010 fossil fuel baseline (94.1 CO2e/MJ). This obligation works alongside, but separately from, the RTFO.

Sustainable renewable fuel supplied under the GHG Regulations is awarded ‘GHG credits’ which have a cash value and can be traded with other suppliers (in the same way as RTFCs). Fuel suppliers can also buy-out of their GHG reduction obligations by paying a buy-out of 7.4p per kg of CO2e emitted above the reduction target.

There are no GHG reduction targets set beyond 2020. This consultation does not propose further targets in the GHG regulations at this time; however, the potential for future targets remains under review.

Risk of buy-out under the RTFO and consequences

Since autumn 2019, RTFCs have been trading very close to the buy-out price. This is caused by the difference in cost between biofuels and petrol or diesel (the spread) (see Figure 1 in Annex A). Indications are that the combination of support provided to renewable fuels through the RTFO and GHG Regulations mean suppliers are so far continuing to supply renewable fuel to meet their RTFO obligation rather than buying out, even when the RTFC price has edged above 30p.

Risk of increased GHG emissions from transport fuels

When suppliers buy out they are no longer supplying renewable fuel to meet their obligation, and the associated GHG savings are lost. If we do not act, we risk losing annual GHG savings of up to 6.5 million tonnes of CO2e (see Table 3 in Annex A). This would have significant knock on impacts for meeting current and future carbon budgets.

Biofuels and biofuel feedstocks are traded as commodities in a global market. They will therefore be supplied where the return is highest. There is currently high demand for biofuels and biofuel feedstocks across the world - particularly in the EU - driven by the need to meet the targets set out in the Renewable Energy Directives, with countries and sectors effectively competing for these commodities. This has driven prices higher and therefore increased the likelihood of RTFC prices exceeding the current buy-out price.

Risk to UK industry

Whilst the renewable fuels and feedstocks supplied in the UK come from across the world, there is also an important UK production base, notably situated in the North of England and Scotland.

The UK renewable fuels industry is reliant on the support delivered by the RTFO. If UK demand for renewable fuels drops significantly due to buy-out, these fuel producers will risk losing a significant market for their products. Reduced certainty of a market will also risk future investments.

Proposed solution

We propose to increase the buy-out price for the main RTFO obligation. This would reduce the risk of obligated suppliers choosing to buy-out thereby maintaining GHG savings and providing greater certainty of support to the UK renewable fuels industry. We have analysed two options which are set out in further detail in the accompanying cost-benefit analysis at Annex A.

Option 1 - Increase the RTFO buy-out price from 30p/litre to 50p/litre (preferred)

This is in line with the combined maximum level of support available to biofuels in 2020 from the RTFO and the GHG Regulations (which do not contain a target beyond 2020).

The maximum additional cost (which is likely passed to the motorist) would be 2p/litre.

By increasing the potential level of support to this level it future proofs the scheme against increased costs and provides greater certainty of delivering continued GHG savings in transport. It also provides certainty to industry that investments in UK biofuel facilities will have a market. This will be necessary for continued decarbonisation as we progress on the path to net zero.

Option 2 - Increase the RTFO buy-out price from 30p/litre to 40p/litre (alternative)

This is broadly in line with the level the buyout price would be if it had kept pace with inflation.

The maximum additional cost (which is likely passed to the motorist) would be 1p/litre.

This increase offers a lower level of protection for GHG savings and a lower level of certainty for UK renewable fuels industry.

Consultation questions

Question 1: Do you agree that we should increase the buy-out price under the RTFO as soon as possible? (Agree/Disagree).

Question 2: If you agree that we should increase the buy-out price under the RTFO, do you agree that it should be 50p/litre? (Agree/Disagree).

Question 3: Would an increase to the RTFO buy-out price to 40p/litre be acceptable to you? (Yes/No).

For all questions provide reasoning for your answers and any evidence you may have to support your position using the downloadable response form.

Next steps

Our aim is to introduce any changes that result from this consultation in time for the 2021 obligation period i.e. they would apply in legislation from 1st January 2021. In order for this is to happen, legislation would need to be laid in Parliament in October.

Given the short timescales involved and the multiple pressures on Parliamentary time, there is a risk that this timetable will not be met. If the legislation is delayed this could mean any increases to the buy-out price would not be applied until 1st January 2022. We will keep stakeholders informed should we need to develop alternative options.

How to respond

The consultation period began on 28 July 2020 and will run until midnight on 11th August 2020 and ensure that your response reaches us before the closing date. Further copies or need alternative formats (Braille, audio CD, and so on) can be requested at LowCarbonFuel.Consultation@dft.gov.uk.

Consultation responses are also sent to LowCarbonFuel.Consultation@dft.gov.uk.

When responding, use the response form stating whether you are responding as an individual or representing the views of an organisation. If responding on behalf of a larger organisation, make clear who the organisation represents and, where applicable, how the views of members were assembled.

Freedom of Information

Information provided in response to this consultation, including personal information, may be subject to publication or disclosure in accordance with the Freedom of Information Act 2000 (FOIA) or the Environmental Information Regulations 2004.

If you want information that you provide to be treated as confidential, please be aware that, under the FOIA, there is a statutory Code of Practice with which public authorities must comply and which deals, amongst other things, with obligations of confidence.

In view of this it would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information, we will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on the Department.

The department will process your personal data in accordance with the Data Protection Act (DPA) and in the majority of circumstances this will mean that your personal data will not be disclosed to third parties.

Confidentiality and data protection

The Department for Transport (DfT) is carrying out this consultation to gather evidence on proposals to increase the Renewable Transport Fuel Obligation buy-out price. This consultation and the processing of personal data that it entails is necessary for the exercise of our functions as a government department. If your answers contain any information that allows you to be identified, DfT will, under data protection law, be the Controller for this information.

As part of this consultation we’re asking for your name and email address. This is in case we need to ask you follow-up questions about any of your responses. You do not have to give us this personal information. If you do provide it, we will use it only for the purpose of asking follow-up questions.

DfT’s privacy policy has more information about your rights in relation to your personal data, how to complain and how to contact the Data Protection Officer.

Your information will be kept on a secure IT system within DfT and destroyed within 12 months after the consultation has been completed.

Annex A: Cost Benefit Analysis for Increasing the Renewable Transport Fuel Obligation buy-out price to ensure continued greenhouse gas savings

Summary

As set out in the main consultation document recent increases in the cost of biofuels relative to petrol and diesel mean that there is a risk that suppliers will ‘buy-out’ of their obligations to supply renewable transport fuel.

This cost-benefit analysis provides data which illustrates why the increasing cost of biofuels relative to petrol/diesel mean that buy-out could occur and consequentially, projected GHG savings of over 6 million tonnes of carbon dioxide equivalent per year (MtCO2e/year) could be lost. This would result in a gap in UK carbon budgets as well as risking long-term impacts on the UK biofuels industry.

We therefore propose to increase the RTFO buy-out price to ensure the continued supply of biofuels and other renewable fuels and the GHG savings they deliver. We have analysed the impacts of increasing the buy-out from £0.30/l to £0.40/l or £0.50/l. These increases could result in maximum increases in fuel prices of £0.01 and £0.02 per litre of fuel, respectively, but could be as little as no additional cost, depending on the cost of biofuel relative to petrol/diesel.

Increasing the buy-out to £0.50/l would provide greater certainty that renewable fuel will be supplied under the RTFO and therefore that the expected GHG savings will be delivered as well as providing greater certainty to the industry of a UK market.

Risk of buy-out under the RTFO has recently increased

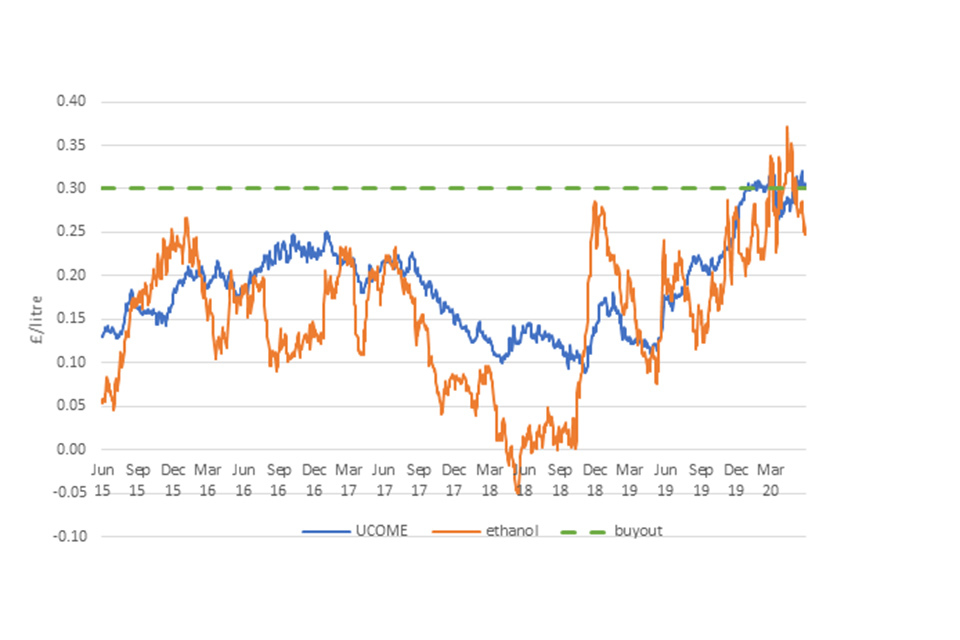

Recent increases in the cost of biofuels relative to petrol and diesel mean that there is a risk that suppliers will ‘buy-out’ of their obligations to supply renewable transport fuel. The differential between the fossil fuel and biofuel price has been above the RTFO buy-out price recently - Figure 1 shows how the cost of supplying biofuel has exceeded the RTFO buy-out price on several occasions since August 2019.

This is also reflected in the cost of Renewable Transport Fuel Certificates (RTFCs) which stakeholders tell us have been trading very close to or above the buy-out price since autumn 2019.

Figure 1[footnote 5] Biofuel supply costs and buy-out from 9th June 2015 to 9th June 2020[footnote 6].

Chart with daily mid-point UCOME and ethanol biofuel costs from 9 June 2015 to 9 June 2020 and 30p constant buyout cost. Since August 2019 the spread between fossil fuel and biodiesel prices has risen and exceeded the buyout price several times.

Indications are that suppliers are, so far, continuing to supply renewable fuel to meet their RTFO obligation rather than planning to buy-out. This can be explained by the additional support provided by the GHG Regulations which means that currently it still makes economic sense to supply the renewable fuel.

The GHG Regulations set GHG reduction targets on fuel suppliers of 4% and 6% for 2019 and 2020, respectively. Suppliers earn GHG credits for supplying biofuels and other lower carbon fuels with one GHG credit awarded for every kg of CO2e saved above the target. The GHG credits are traded between suppliers in order for suppliers to cost effectively meet their GHG reduction obligations.

Because GHG credits are awarded for each kg of CO2e saved, and RTFCs are awarded for each litre of renewable fuel supplied, their values cannot be directly compared. In order to assess the maximum level of support the GHG regulations can provide we have taken the average GHG saving of a litre of the two most common fuel types[footnote 7] to estimate the maximum additional value that GHG credits provide for a ‘typical’ litre of biofuel - see Table 1.

Table 1 Estimates of the maximum additional support that GHG credits provide for renewable fuels adjusted for a ‘typical’ litre of biofuel

| GHG Regulations maximum support level (£/tCO2e) | Energy content (MJ/litre) | Average GHG saving (2019) (gCO2e/MJ) | Average GHG saving (2019) (gCO2e/litre) | GHG Regulations maximum support level (£/litre) | |

|---|---|---|---|---|---|

| Used cooking oil biodiesel | 74 | 33 | 84.2 | 2779 | 0.21 |

| Crop bioethanol | 74 | 21 | 66.3 | 1392 | 0.10 |

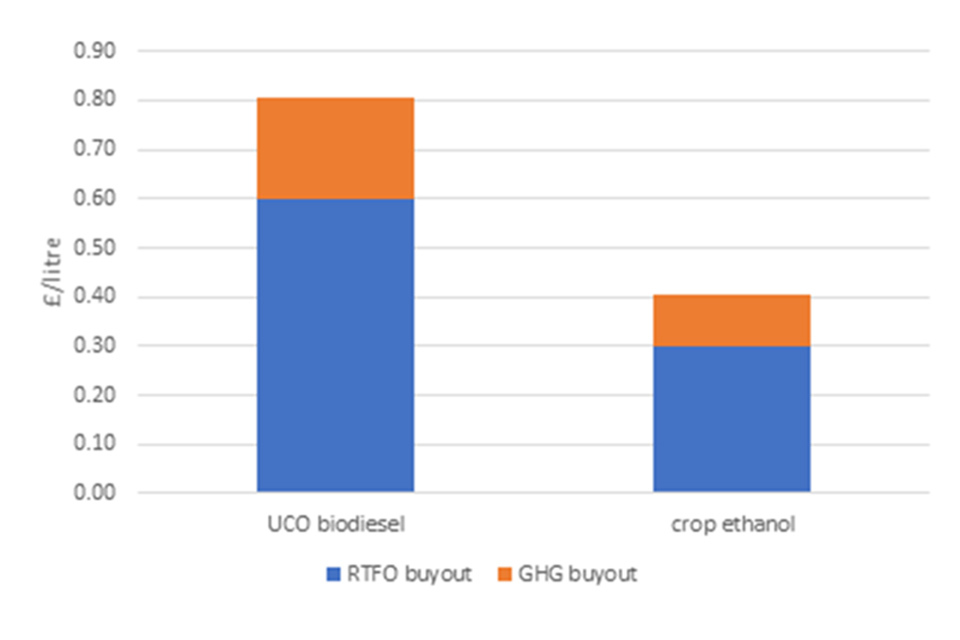

Biofuels derived from waste feedstocks are eligible for double the amount of support under the RTFO. This means that the maximum support available to a litre of biofuel from waste such as UCO is £0.60/l and for a biofuel derived from crops it is £0.30/l. Taking account of this, the combined maximum support provided by the RTFO and GHG Regulations in 2020 is £0.81/l for biodiesel from used cooking oil and £0.40/l for crop derived bioethanol - see Figure 2.

Figure 2 Maximum combined support level for selected biofuels under the RTFO and GHG obligations[footnote 8]

Comparison between the maximum support from supplying UCO biodiesel and crop ethanol under combined RTFO and GHG buyout policies. For UCO biodiesel, 60p was RTFO buyout, 21p GHG for 81p total. For crop ethanol, 30p was RTFO buyout, 10p GHG for 40p total.

Based on the volumes of biodiesel and bioethanol supplied in 2019 (see Table 2), and the maximum level of support offered by the GHG Regulations (see Table 1) we have calculated the maximum incentive offered by the GHG Regulations as a weighted average across all of the biofuel supplied. This is £0.18/l.

Table 2 2019 biodiesel[footnote 9] and bioethanol volumes[footnote 10]

| Million litres | Bioethanol | Biodiesel and off road biodiesel |

|---|---|---|

| 2019 volumes (report 4) | 756.46 | 1763.15 |

Risk of increased GHG emissions from transport fuels

When suppliers buy-out they are no longer supplying renewable fuel to meet their obligation, and the associated GHG savings are lost. Table 3 shows the amount of CO2e that we expect to be saved through renewable fuels being supplied under the RTFO. This shows GHG savings of between 6.3 MtCO2e and 6.5 MtCO2e per year between 2021 to 2030. If we do not act to ensure these renewable fuels continue to be supplied, we risk losing these annual GHG savings of up to 6.5 MtCO2e.

Table 3 Estimated GHG savings from the RTFO, MtCO2e

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Saving | 6.3 | 6.3 | 6.4 | 6.4 | 6.4 | 6.4 | 6.3 | 6.5 | 6.5 | 6.5 | 64 |

The carbon value of these volumes is shown in Table 4. The monetised, discounted value of these maximum carbon savings is estimated at between £388m and £655m per year (based on BEIS’ current carbon appraisal values).

Table 4 Monetised, discounted value of GHG savings set out in Table 3

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Central | 443 | 438 | 434 | 426 | 419 | 410 | 401 | 400 | 395 | 388 |

| High | 665 | 657 | 650 | 639 | 628 | 616 | 602 | 601 | 592 | 581 |

If the buy-out price is not increased there is a risk that these carbon saving benefits will be lost. To continue delivering these GHG savings in a world of high price spreads (difference in cost between biofuel and fossil fuel supply), we propose to amend the RTFO such that there is a higher buy-out price. This means that the cost to the motorist is capped at the new buy-out price.

Biofuels and biofuel feedstocks are traded as commodities in a global market. They will therefore be supplied where the return is highest. There is currently high demand for biofuels and biofuel feedstocks across the world - particularly in the EU - driven by the need to meet the targets set out in the Renewable Energy Directives, with countries and sectors effectively competing for these commodities. This has driven prices higher and therefore increased the likelihood of RTFC prices exceeding the current buy-out price.

Risk to UK industry

Whilst the renewable fuels and feedstocks supplied in the UK come from across the world, there is also an important UK production base, notably situated in the North of England and Scotland.

The UK renewable fuels industry is reliant on the support delivered by the RTFO. If UK demand for renewable fuels drops significantly due to buy-out, these fuel producers will risk losing a significant market for their products. Reduced certainty of a market will also risk future investments.

Proposed solution

We therefore propose to increase the level of the RTFO buy-out price as there is a significant risk of buy-out occurring leading to the RTFO not delivering its core objective to decarbonise transport. The risk of buy-out and losing GHG savings increases from 1 Jan 2021 as the additional support to biofuels that is provided through the award of GHG credits from the GHG Regulations will not be available as there are no GHG reduction targets beyond 2020.

Option 1 - Increase the RTFO buy-out price from £0.30/l to £0.50/l (preferred)

This is in line with the combined level of support available to biofuels in 2020 from the RTFO and the GHG Regulations. As set out above, the additional level of support provided by the GHG regulations is up to £0.48/l (when added to the current RTFO buy-out of £0.30/litre this gives £0.48/litre).

By increasing the potential level of support to this level it future proofs the scheme against increased costs and provides greater certainty of delivering continued GHG savings in transport. It also provides certainty to industry that investments in the UK biofuel facilities we need to continue decarbonising as we progress on the path to net zero will have a market.

Option 2 - Increase the RTFO buy-out price from £0.30/l to £0.40/l (alternative)

The RTFO buy-out price has remained at £0.30/litre since the introduction of the RTFO in 2008 and has not kept pace with inflation. Based on HMT’s GDP deflator, inflation between 2008 and 2021 is around 25.7%. Applying this to the current RTFO buy-out would result in it being £0.38.

This proposed level of increase is therefore broadly in line with the level the buyout price would be if it had kept pace with inflation.

This increase minimises the cost to the motorist but offers a lower level of protection for GHG savings and a lower level of certainty for UK renewable fuels industry.

Impact of increasing the RTFO buy-out price

Since the RTFO began in 2008, the cost of supplying biofuel has increased due to factors including inflation and increased competition for biofuels and biofuel feedstocks across sectors and countries. Since the markets for fossil fuels and renewable fuels are highly volatile, it is impossible to predict the actual impact of an increased RTFO buy-out price in 2021 to 2030.

However, we can estimate the range of possible impacts under different scenarios:

- Scenario 1. No impact. GHG emissions continue to be delivered by the RTFO at no additional cost to the motorist

This means that no buy-out takes place because the spread between fossil fuel and biofuel supply costs is below the original buy-out price of £0.30/litre (or £0.60/litre for wastes eligible for double reward). An increased buy-out price in this scenario therefore has no impact on costs or GHG emission savings.

- Scenario 2. GHG emission savings continue to be delivered by the RTFO but at an increased cost to motorists

If the spread is between £0.30/litre and the new increased buy-out price it makes better economic sense for a supplier to continue to supply biofuels than to buy-out of their obligation. This means that GHG savings continue when they otherwise would not have - albeit at a greater cost.

- Scenario 3. No GHG savings, high cost

In this scenario the spread between fossil fuel and biofuel costs is above the new buy-out price. This would likely result in biofuels not being supplied under the RTFO as fuel suppliers would choose to buy-out of their obligation. This cost of buying out would likely be passed on to motorists. The consequences are that no GHG emissions would be saved and the motorist would also still be facing higher costs. We intend to set the buy-out price such that this scenario has a low likelihood of occurring. To avoid this scenario, it is important that the buy-out price is kept under review.

The maximum costs of different buy-out options

This section explains the potential impacts of an increase in the RTFO buy-out prices under scenarios 2 and 3.

At any buy-out price there is a risk that the full obligation will be bought out and that no carbon is saved while high costs are still passed on to motorists. The buy-out price acts as a cap on the costs of the RTFO by effectively setting a maximum price that an obligated supplier will pay for an RTFC.

Table 5 presents our estimates of the maximum cost of buy-out under the proposed new buy-out prices, relative to the maximum cost of buy-out under the current price. Note that the figures for buy-out at £0.30/l represent the estimated costs of the current scheme - i.e. the baseline against which the increases are being compared.

Table 5 Maximum additional discounted cost of a higher buy-out price (£ million)

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Buy-out at £0.30/l | 1,433 | 1,392 | 1,354 | 1,309 | 1,264 | 1,219 | 1,173 | 1,163 | 1,143 | 1,120 | 12,569 |

| Buy-out at £0.40/l | 1,910 | 1,856 | 1,806 | 1,745 | 1,685 | 1,625 | 1,563 | 1,550 | 1,525 | 1,494 | 16,759 |

| Diff. from £0.30/l | +478 | +464 | +451 | +436 | +421 | +406 | +391 | +388 | +381 | +373 | +4,190 |

| Buy-out at £0.50/l | 2,388 | 2,320 | 2,257 | 2,181 | 2,107 | 2,031 | 1,954 | 1,938 | 1,906 | 1,867 | 20,948 |

| Diff. from £0.30/l | +955 | +928 | +903 | +872 | +843 | +812 | +782 | +775 | +762 | +747 | +8,379 |

It is likely that the additional costs of supplying renewable fuel are passed on to the motorist through an increase in fuel prices at the pump. The maximum additional cost (which is likely passed to the motorist) equates to £0.01/l and £0.02/l at buy-out cost of £0.40/litre and £0.50/litre, respectively - see Table 6.

Table 6 Additional discounted cost of a higher buy-out price per litre passed on to motorist (£ million)

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Buy-out at 40p/l | 1.2 | 1.1 | 1.1 | 1.1 | 1.0 | 1.0 | 1.0 | 0.9 | 0.9 | 0.9 |

| Buy-out at 50p/l | 2.3 | 2.3 | 2.2 | 2.1 | 2.0 | 2.0 | 1.9 | 1.8 | 1.8 | 1.7 |

Based on the current obligation, we estimate that raising the buy-out price from its current level to £0.40/litre would result in a maximum additional discounted cost of £373-478 million per year, whilst raising it to £0.50/l would result in a maximum additional discounted cost of £747-955 million per year. It is possible that the motorist would still be paying theses additional costs and not receiving the GHG benefits, if suppliers bought out of their obligations. These are the additional costs that would be incurred under scenario 3 above.

Under scenario 2, where spreads are below the buy-out price, the costs incurred by businesses would be lower (and lie somewhere between the costs presented and zero). These costs therefore reflect the upper bound of potential costs from the higher buy-out prices.

Suppliers buying-out of the RTFO would also adversely impact the UK renewable fuels and feedstocks industry - see Risk to UK industry.

Using the cost estimates in Table 5 and estimated RTFO carbon savings we can present these carbon savings in terms of the cost of carbon - see Table 7.

Table 7 Discounted maximum abatement cost per ton of carbon (£/tCO2e)

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Buy-out at £0.30/l | 229 | 221 | 213 | 205 | 198 | 191 | 185 | 180 | 176 | 172 |

| Buy-out at £0.40/l | 305 | 294 | 284 | 274 | 264 | 255 | 246 | 240 | 235 | 230 |

| Buy-out at £0.50/l | 381 | 368 | 355 | 342 | 330 | 319 | 308 | 300 | 293 | 287 |

Based on the current obligation and different potential buy-out prices, we estimate the maximum discounted abatement cost would be between £172/tCO2e and £381/tCO2e million.

Conclusion

If suppliers were to buy-out of their obligation the maximum GHG savings lost would be an estimated 64 MtCO2e between 2021 and 2030 as seen in Table 3. At the current buy-out price this would result in a maximum discounted cost to the motorist over the period of £12,569 million with no GHG savings.

Based on our analysis if we increased the buy-out to £0.50/l the maximum discounted cost to the motorist would increase to £20,948 million over the period.

These are the maximum costs, but the additional costs may be significantly lower, and (even) as low as zero should the additional cost of supplying biofuels relative to petrol/diesel fall and remain below £0.30/l.

Footnotes

-

International maritime and aviation are excluded from the UK’s carbon budgets. ↩

-

Obligated suppliers are those supplying >450,000 litres per year of petrol, diesel, gas oil or renewable fuel to road transport or non-road mobile machinery (NRMM). NRMM includes inland waterway vessels which do not normally operate at sea, tractors, and recreational craft that do not normally operate at sea. The RTFO also provides support for renewable aviation fuels. ↩

-

Sustainability criteria include protection for loss of biodiversity and destruction of land with high carbon stocks (e.g. forest or peatland) as well as minimum GHG savings. Biofuels derived from wastes are eligible for double reward and there is a limit on the amount of crop derived biofuel which can be supplied. ↩

-

Development fuels are advanced renewable fuels of strategic importance and include fuels suitable for aviation and heavy goods vehicles (for example, which can be supplied as a high blend). ↩

-

UCOME = used cooking oil methyl ester - the most common form of biodiesel. Figure 1 takes into account double-counting for UCOME. ↩

-

biodiesel from used cooking oil and bioethanol from crops. ↩

-

UCO = used cooking oil. Wastes, such as UCO are eligible for double the level of support under the RTFO and are awarded 2 x RTFCs. ↩

-

Off road biodiesel meaning fuel supplied to non-road mobile machinery (NRMM). NRMM includes inland waterway vessels which do not normally operate at sea, tractors, and recreational craft that do not normally operate at sea. ↩

-

Volumes are taken from the latest RTFO statistics. ↩