Chapter 5: Updates to Statutory Guidance: Reporting costs, charges and other information

Updated 21 June 2021

Background

1. Department for Work and Pensions (DWP) has received queries and feedback on the production and presentation of compounding costs and charges illustrations. To provide clarification, we are proposing draft amendments to the statutory guidance on “Reporting of costs, charges and other information: guidance for trustees and managers of relevant occupational schemes.” This is provided at Annex G.

2. Trustees are concerned that the reporting requirements are disproportionately burdensome for the value they offer to scheme members. We believe this to be a result of an unintended interpretation of the existing guidance and, consequently, the blurring of the policy intent.

The intent is that trustees communicate the compounding effect of costs and charges on retirement funds to scheme members simply and clearly.

3. We acknowledge the concerns and accept the feedback that the statutory guidance could be updated in order to set out more clearly the minimum expectations required when producing these illustrations.

4. The statutory guidance is not intended to be wholly prescriptive. We continue to encourage trustees to present costs and charges illustrations in a way they believe to be most beneficial to their members.

These proposed updates are concerned with preventing unintended interpretations of the guidance which result in unnecessary anxiety for trustees, and the production of information in levels of both complexity and volume that are not required, and may be unhelpful for scheme members.

5. We welcome views from trustees, scheme managers and other stakeholders on whether the proposed updates to the guidance will indeed provide greater clarity as to the minimum expectations with regards to the content of illustrations and the way in which they should be presented and published.

Updates to the Statutory Guidance

6. The main proposed updates and additions to the existing statutory guidance are covered below. Like the guidance itself, this list is not exhaustive.

Production of an Illustration

7. We have sought to draw out the distinction between schemes with a single price for scheme members of all employers, and schemes with multiple defaults and variable charges.

8. For schemes with a single price for all members, as a minimum, trustees simply need to identify the default arrangement(s), lowest charging and highest charging self-select funds in which members are invested, as shown in Figure 1 in the guidance.

9. A small number of stakeholders from schemes with both a large number of employers and a range of different charges for each of those employers are concerned that they must provide an illustration for every single fund offered by the scheme, leading to an onerous production task. This is not the case.

10. While we do expect an illustration to be produced for each individual employer’s default fund, we propose that the scheme need only produce an illustration of: the default fund, the lowest charging self-select fund and highest charge self-select fund offered to the respective employer.

An example of a minimum expectation for a scheme with multiple defaults is shown in Figure 2 in the guidance. For practical reasons we have shown an example of a scheme with just two default funds.

Nonetheless, using this example as a principle guide, if the scheme had 20 different employer default funds, they would still only have to produce 20 illustrations in order to be consistent with the statutory guidance.

11. The examples in the guidance are not wholly prescriptive. We present them as a visual model of the minimum that may be required. We encourage schemes to disclose additional illustrations where they believe these would be useful to members. This may be especially useful for deferred members of the scheme.

We are aware of numerous examples from stakeholders who already do this and we are supportive of further more personalised disclosure.

12. We have sought to provide clarity for schemes with multiple defaults or variable charges, in terms of presenting both savings pot sizes and real-terms investment return assumptions.

We advise that the pot size used should be a median across the whole scheme, rather than producing a median for each default, or for each employer. Our intention in relation to the real-terms investment return is that this only needs to be shown for each fund or arrangement for which an illustration is provided.

Publication of costs, charges and other information

13. In updating this section of our original guidance we address the misinterpretation that trustees and scheme managers must contain all costs and charges information in a single, often very large, online document.

Many stakeholders have told us that they fear they risk not complying with the Chair’s Statement requirements if they split the material into multiple documents.

14. We want to make it clear that all the information - not just costs and charges compounding illustrations - under regulation 29A of the Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013[footnote 44] can be published over a number of linked documents or pages.

15. We explicitly outline this fact in paragraph 77 of the new guidance, stating that: “The Statement of Investment Principles, the Chair’s Statement (inclusive of charges and transaction cost information, value for money assessment and default SIP), and the relevant section of the Annual Report (the implementation statement) do not necessarily have to be produced as a single web-page or PDF document.”

16. We also state that when the Chair’s Statement is circulated in print format, it can simply be a collation of all the relevant documents.

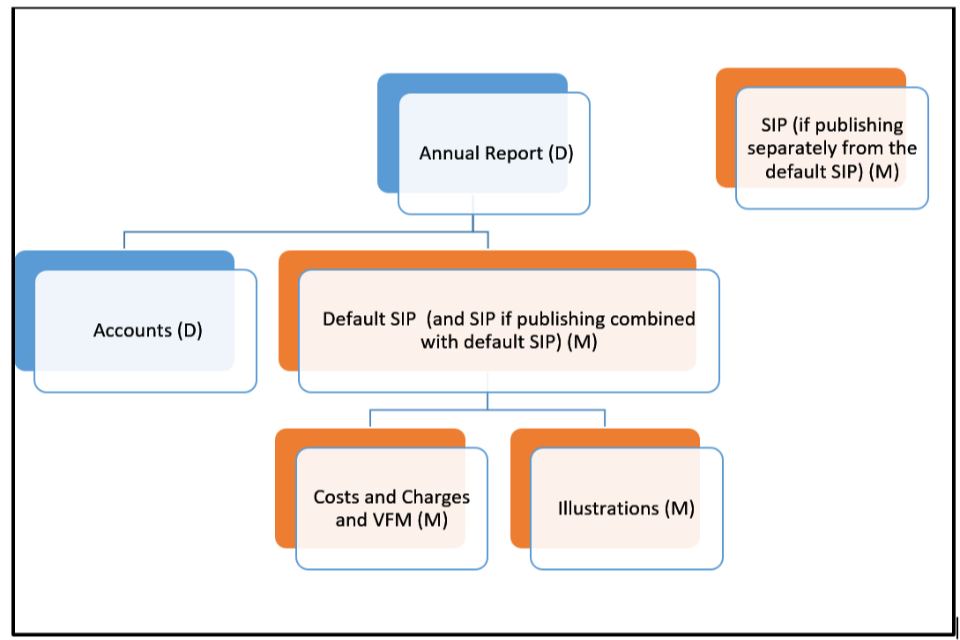

17. We have added a diagram (Figure 3 in the guidance) to provide a visual representation of how documents can be produced as a series of interlinked documents which is compliant with regulation 29A. We included it here with accompanying illustration notes to further emphasise this point.

Figure 1 – Illustration of a document chain which is consistent with Regulation 29A

1. Figure 1 depicts a flow chart showing how the documents can be presented.

2. At the top of the flow chart is a box labelled ‘Annual Report’.

3. Flowing out of this box is a box labelled ‘Accounts’ and a separate box labelled ‘Default SIP (and SIP if publishing combined with default SIP)’.

4. This illustrates that trustees can provide a link to the Accounts and Default SIP from their Annual Report and present them separately.

5. Flowing out of the box labelled ‘Default SIP (and SIP if publishing combined with default SIP)’ are 2 additional boxes, one labelled ‘Costs and Charges and VFM’ and another labelled ‘Illustrations’.

6. This illustrates that trustees can provide a link to their costs and charges and VFM information and the compounding illustrations from their Default SIP and present them separately.

7. Directly to the right of the flow chart is a box labelled ‘SIP (if publishing separately from the default SIP)’.

8. This is to illustrate the SIP can be presented separately from the default SIP.

9. Collectively all the documents referenced in the separate boxes of the flow chart are the Annual Report and Accounts.

10. The boxes labelled ‘Default SIP (and SIP if publishing combined with default SIP)’, ‘Costs and Charges and VFM’, ‘Illustrations’ and ‘SIP (if publishing separately from the default SIP)’ all have an additional label (M).

11. (M) stands for ‘Mandatory publishing requirement’. All boxes with this label represent documents which collectively are the published parts of the Chair’s Statement.

12. The boxes labelled ‘Annual Report’ and Accounts’ have an additional label (D).

13. (D) stands for ‘Discretionary publishing requirement’. This illustrates that there is no legal requirement to publish the documents labelled (D).

18. We have used the labels ‘(D)’ and ‘(M)’ to clearly distinguish between the different publishing requirements for each of the documents. It is a mandatory requirement to publish the documents labelled ‘(M)’. Alternatively, for the documents labelled ‘(D)’ it is a discretionary requirement and they only need to be made available to members on request. We also want to make it clear that while acknowledging this distinction in the guidance, we do not seek to discourage the voluntary publication of additional documents.

19. We welcome comments on whether the proposed updates and additions to this guidance provide more clarity on the production and publication of costs and charges information, and if not, where further clarity is required. We are not seeking feedback on whether or not this information should be presented to scheme members.

Question 10: Do you believe that the proposed updates to the statutory guidance increases clarity about the minimum expectations on both the production and publication of costs and charges information?

Are there any areas where further clarity might be required?

-

Regulations 29A was inserted by The Occupational Pension Schemes (Administration and Disclosure) (Amendment) Regulations 2018 ↩