Future of the defined contribution pension market: the case for greater consolidation

Updated 30 March 2022

Applies to England, Scotland and Wales

Introduction

In September 2020, in the consultation ‘Improving outcomes for members of defined contribution schemes’[footnote 1], the government set out that while consolidation is, to some degree, already happening, the rate at which this is occurring is slower than is needed. This call for evidence has been launched to understand the barriers to further consolidation of the occupational trust-based Defined Contribution (DC) market in the UK.

The purpose of this document is therefore to set out the background to the current situation, to offer some initial analysis and to pose questions as to the best way forward in the interests of pension savers.

About this call for evidence

Who this call for evidence is aimed at

This call for evidence is aimed at:

- pension scheme service providers, other industry bodies and professionals

- pension scheme trustees

- civil society organisations

- pension scheme members and beneficiaries

- pension academics

- any other interested stakeholders

Scope

Pensions policy is a reserved matter in Scotland and Wales, this call for evidence therefore applies to England, Wales and Scotland.

Duration

The call for evidence will run for 6 weeks, starting on 21 June 2021 and ending on 30 July 2021. Please ensure your response reaches us by that date as any replies received later may not be taken into account.

How to respond to this call for evidence

Please send your responses to:

Aysha Ahmed and Andrew Blair

Email: pensions.investment@dwp.gov.uk

Note: When responding please indicate whether you are responding as an individual or representing the views of an organisation and whether you are content for your response to be quoted in a future response the government issues and whether you would prefer this to be anonymous.

Government response

We will aim to publish our response to this call for evidence on the GOV.UK website later this year.

How we consult

Feedback on the consultation process

We value your feedback on how well we consult or seek evidence. If you have any comments on the process of this consultation (as opposed to comments about the issues which are the subject of the consultation), please address them to:

DWP Consultation Co-ordinator caxtonhouse.legislation@dwp.gov.uk

Freedom of information

The information you send us may need to be passed to colleagues within the Department for Work and Pensions (DWP), published in a summary of responses received and referred to in the published consultation report.

All information contained in your response, including personal information, may be subject to publication or disclosure if requested under the Freedom of Information Act 2000. By providing personal information for the purposes of the public consultation exercise, it is understood that you consent to its disclosure and publication. If this is not the case, you should limit any personal information provided, or remove it completely. If you want the information in your response to the consultation to be kept confidential, you should explain why as part of your response, although we cannot guarantee to do this.

To find out more about the general principles of Freedom of Information and how it is applied within DWP, please contact the Central Freedom of Information team: freedom-of-information-request@dwp.gov.uk.

The Central Freedom of Information team cannot advise on a specific consultation exercises, only on Freedom of Information issues. Read more information about The Freedom of Information Act.

Ministerial foreword

There is no doubt in my mind that there must be further consolidation in the occupational defined contribution (DC) pensions market. This is the direction of travel.

We know from other countries such as Australia that scale is the biggest driver in achieving value for money for savers and ultimately better retirement outcomes.

Further consolidation will drive better outcomes for members through better governance and greater investment in illiquid assets.

Larger, better governed schemes are able to develop more innovative investment strategies. There are also fantastic opportunities for schemes to invest in the UK; in innovation, in infrastructure, in clean growth - underpinned by the UK’s net zero ambitions. By not consolidating quickly enough schemes will not have the capability to grasp these opportunities with both hands. It is important that they move more quickly. This will ensure savers do not miss out but this will also help the UK build back better.

In September 2020, I consulted on new regulations to require trustees of schemes with less than £100 million in assets to justify their continued existence via a new value for members assessment. This will come into force from this Autumn. This was phase one and now we turn to phase two which will be looking to drive consolidation further and faster.

In this call for evidence, I want to gather evidence on the barriers and opportunities for greater consolidation of schemes with between £100 million and £5 billon of assets under management. I am keen to hear ideas about how to incentivise consolidation for these schemes.

I am also seeking evidence on the barriers to a scheme winding-up and transferring its members elsewhere. What is stopping schemes from doing this? What ideas do you have for how government and industry can overcome those barriers?

This evidence-gathering exercise is the next step on this journey but further action will follow, starting with schemes up to £5 billion. It is not my intention to stop at £5 billion but given the present size of the UK market, this is the appropriate cut off- for now. I strongly encourage views for this call for evidence to help shape further policy on consolidation in the DC market.

Guy Opperman MP

Minister for Pensions and Financial Inclusion

Chapter 1: The state of the DC market

Trends in the DC market

1. Since the introduction of automatic enrolment in 2012, the UK has seen significant growth in the number of DC schemes and exponential growth in the number of people saving into occupational DC schemes. As of 2020, more than 10 million savers had been automatically-enrolled into a workplace pension and there were some 1,560 DC schemes (excluding micro schemes but including hybrid schemes)[footnote 2].

2. The majority of newly-enrolled savers are saving into a Master Trust with memberships of non-hybrid DC Master Trusts having increased from 270,000, at the beginning of 2012, to just over 18.6 million in 2021. There are 36 authorised Master Trusts with assets in excess of £52.7 billion. Clearly, greater concentration of members and assets is occurring not just into DC but into larger DC schemes, specifically Master Trusts.

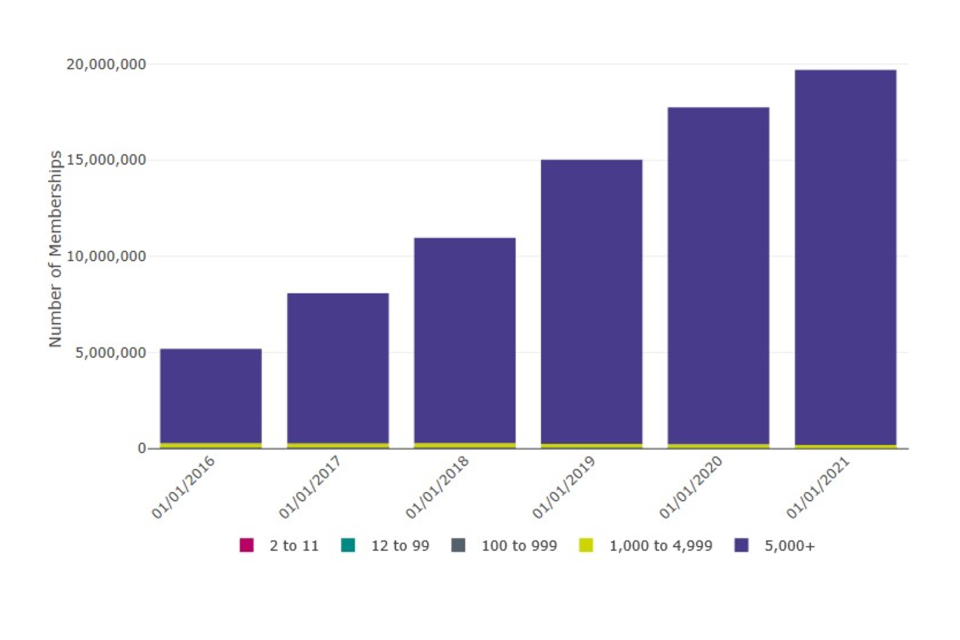

Figure 1: Occupational DC scheme memberships (including micro schemes) being used for AE by membership size group (excluding hybrid schemes)

""

| Date | 2 to 11 | 12 to 99 | 100 to 999 | 1,000 to 4,999 | 5,000+ |

|---|---|---|---|---|---|

| 01/01/2016 | 1,000 | 2,000 | 57,000 | 223,000 | 4,909,000 |

| 01/01/2017 | 1,000 | 3,000 | 58,000 | 212,000 | 7,811,000 |

| 01/01/2018 | 2,000 | 3,000 | 58,000 | 225,000 | 10,676,000 |

| 01/01/2019 | 2,000 | 3,000 | 52,000 | 193,000 | 14,776,000 |

| 01/01/2020 | 2,000 | 2,000 | 41,000 | 187,000 | 17,514,000 |

| 01/01/2021 | 1,000 | 1,000 | 30,000 | 162,000 | 19,502,000 |

Source: TPR: DC Trust: Presentation of scheme return data 2020 - 2021

3. Given the significant increase in members and members’ contributions to DC schemes, the size of the market in terms of assets is also growing significantly.

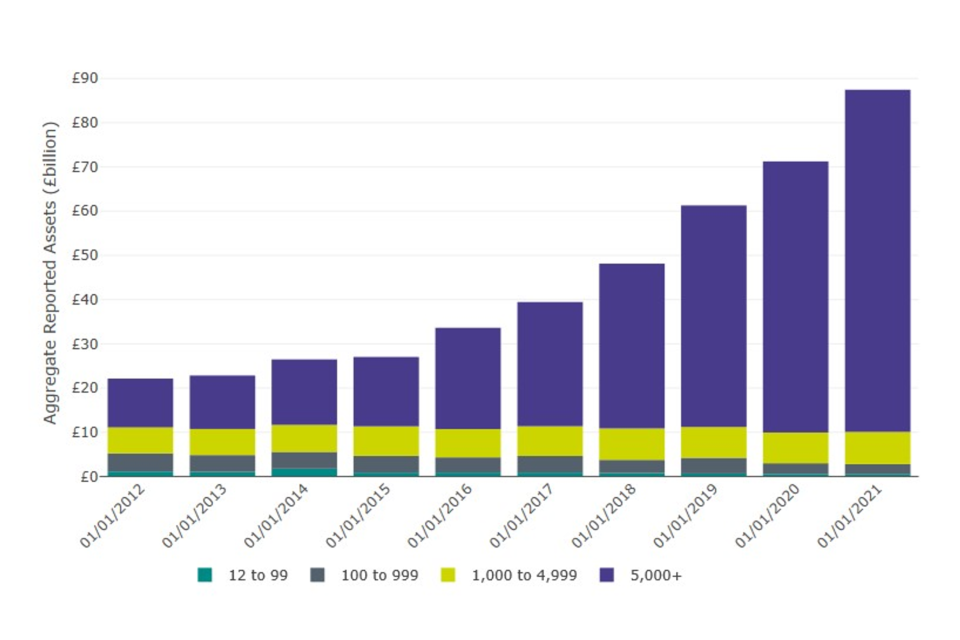

Figure 2: Aggregate reported assets in occupational DC schemes by membership size group (excluding hybrid schemes)

""

| Date | 12 to 99 | 100 to 999 | 1,000 to 4,999 | 5,000+ |

|---|---|---|---|---|

| 01/01/2012 | £1,122,000,000 | £4,108,000,000 | £5,872,000,000 | £11,040,000,000 |

| 01/01/2013 | £1,020,000,000 | £3,821,000,000 | £5,904,000,000 | £12,087,000,000 |

| 01/01/2014 | £1,759,000,000 | £3,808,000,000 | £6,092,000,000 | £14,812,000,000 |

| 01/01/2015 | £879,000,000 | £3,776,000,000 | £6,684,000,000 | £15,687,000,000 |

| 01/01/2016 | £883,000,000 | £3,436,000,000 | £6,398,000,000 | £22,902,000,000 |

| 01/01/2017 | £884,000,000 | £3,742,000,000 | £6,728,000,000 | £28,095,000,000 |

| 01/01/2018 | £780,000,000 | £2,985,000,000 | £7,099,000,000 | £37,266,000,000 |

| 01/01/2019 | £668,000,000 | £3,559,000,000 | £6,953,000,000 | £50,116,000,000 |

| 01/01/2020 | £559,000,000 | £2,433,000,000 | £6,948,000,000 | £61,312,000,000 |

| 01/01/2021 | £493,000,000 | £2,310,000,000 | £7,272,000,000 | £77,382,000,000 |

Source: TPR: DC Trust: Presentation of scheme return data 2020 - 2021

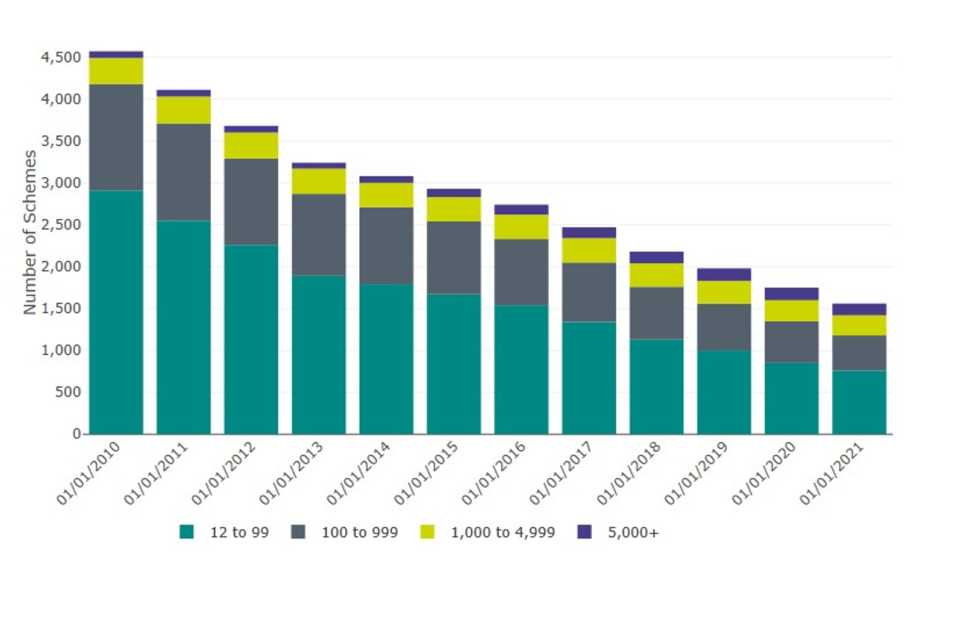

4. Whilst the number of members saving into an occupational DC scheme and the size of the DC market in terms of assets have grown, the number of DC schemes has continued to fall year-on-year. Many schemes set up following automatic enrolment’s introduction have closed and the asset growth and membership has become concentrated in fewer DC schemes.

Figure 3: Occupational DC schemes by membership size group (including hybrid schemes)

""

| Date | 12 to 99 | 100 to 999 | 1,000 to 4,999 | 5,000+ |

|---|---|---|---|---|

| 01/01/2010 | 2,910 | 1,270 | 310 | 80 |

| 01/01/2011 | 2,550 | 1,160 | 320 | 80 |

| 01/01/2012 | 2,260 | 1,030 | 310 | 80 |

| 01/01/2013 | 1,890 | 980 | 300 | 70 |

| 01/01/2014 | 1,790 | 920 | 290 | 80 |

| 01/01/2015 | 1,670 | 870 | 290 | 100 |

| 01/01/2016 | 1,540 | 790 | 290 | 120 |

| 01/01/2017 | 1,340 | 710 | 290 | 130 |

| 01/01/2018 | 1,130 | 630 | 280 | 140 |

| 01/01/2019 | 1,000 | 560 | 270 | 150 |

| 01/01/2020 | 850 | 500 | 250 | 150 |

| 01/01/2021 | 760 | 420 | 240 | 140 |

Source: TPR: DC Trust: Presentation of scheme return data 2020 - 2021

The rate of consolidation

5. If the current trend for falling numbers of DC schemes by between 8 to 10% each year continues, we would expect there to be around 1,000 (non-micro) DC schemes operating in five years’ time. Government believes that this is too many schemes and wants to accelerate the pace of scheme consolidation over this period so that there are significantly fewer schemes.

6. The government has already taken action. In February 2019[footnote 3], we made the case for a more consolidated DC pensions market. We explained that consolidation may help to ensure that all savers are receiving the best value from well-governed schemes that can achieve economies of scale, especially at the lower end of the market. We also set out that in our view consolidation will also deliver greater opportunities for members to access a more diverse range of investment products and investment strategies to the benefit of both the pension saver and the broader UK economy.

7. We then took action in our September 2020 consultation ‘Improving outcomes for members of defined contribution schemes’ with measures to introduce a more detailed value for member assessment for schemes below £100 million. This was designed to improve governance and better serve members of such schemes whilst quickening the pace of consolidation considerably.

8. For the c.1,200 schemes in scope, this means critically assessing various aspects of the scheme to come to a conclusion on whether the scheme currently offers value for members. The most important aspect of this is ‘net returns’. Trustees of these schemes must compare the net returns (investment performance less costs and charges) they offer members with three larger schemes. If trustees conclude that their scheme is not providing good value for members, they must explain to the Pensions Regulator whether they intend to move their members into another scheme or, if not, what steps they will take to improve.

9. The government believes this intervention will not only serve to improve member outcomes in the long-term by ensuring more savers are in large, well-governed, better performing schemes but will reduce the numbers of schemes at a faster pace. However, the value for money assessment and subsequent wind up process will take time so we are interested in views on how to build on the value for money assessment and further accelerate the pace of consolidation for schemes under £100 million.

10. This call for evidence is also looking ahead to the second phase of consolidation for schemes. The value for money assessment only applies to schemes below £100 million so we are interested in views on how to incentivise consolidation for medium to large schemes with assets between £100 million and £5 billion.

Question 1

Do you agree that the government is right to aim for fewer, larger schemes going forward? Are there any risks?

Question 2

What impact will the new value for members assessment have on consolidation of schemes under £100m? If you were a scheme that did not pass the value for members assessment, would you look to “wind up” or “look to improve” and how would you go about this? Beyond the value for money assessment, could government, regulators and industry accelerate the pace of consolidation for schemes under £100m?

Question 3

How can government incentivise schemes with assets of between £100m-£5bn to consolidate?

Chapter 2: Driving greater consolidation

Benefits of greater consolidation

11. In our response[footnote 5] to our original consultation, the government has asked schemes that have existed for at least three years and with total assets below £100 million to assess whether their scheme provides value for members and to report the outcome to the Pensions Regulator (TPR) as well as in their annual chair’s statement sent to members.

12. If trustees conclude that their scheme does not provide good value for members, the expectation is that they will take immediate action to start winding up and consolidate members into a larger, better run pension scheme, unless they can make improvements to their scheme both rapidly and cost effectively.

13. Our objective is to improve member outcomes through:

- governance: Larger schemes are less likely to fail key governance criteria and will therefore better meet requirements placed on them by government, in the best interest of members

- charges: Member charges are typically lower in larger schemes. As a result of economies of scale, larger schemes are able to negotiate lower service provider fees and can generally do more with less

- investments: Larger schemes are generally more likely to perform better, however this relationship is not linear (see Chapter 3). Larger schemes are more likely to have access to a diverse range of asset classes including innovative investment opportunities

14. There may also be longer term savings for employers who close an in-house scheme. We welcome evidence of the size of these potential savings, i.e. the amount currently spent on a single-employer scheme by the sponsor, and whether this ‘benefit’ to the employer might feed through as a benefit to members. For example, it might be the case that the trustees of the scheme recommend to the employer that the savings are distributed amongst members via greater employer contributions.

15. The government is working with the pensions industry to tackle the growth of deferred small pots in the automatic enrolment workplace pensions market. The Pensions and Lifetime Savings Association (PLSA) and the Association of British Insurers (ABI) have jointly convened an industry co-ordination group, focusing on the administration challenges and processes that would be necessary to underpin a durable, large scale deferred small pot consolidation system. We welcome views and evidence on how greater consolidation of the DC market could alter the deferred small pots challenge – in particular in relation to benefits to member benefits.

Value for members’ metrics

16. We are keen to align as much as possible with work undertaken by the Financial Conduct Authority and the Pensions Regulator on measuring and benchmarking value for money. The consultation paper ‘CP20/9: Driving value for money in pensions’[footnote 6] launched in 2020 seeks to promote a consistent approach for assessing value for money and consults on specific measures. Responses to this paper will help to inform the work DWP carries out as it moves forward with further consolidation.

Overcoming barriers to consolidation

17. The government is aware that many schemes are exploring consolidation. Schemes of all sizes, in different circumstances, are making efforts to close and move members into larger schemes, typically Master Trusts.

18. Other schemes may either be reluctant to close and consolidate or are experiencing delays to the process. The government wants to avoid a situation in which trustees determine members would be better served elsewhere but regulatory, commercial or practical barriers delay or prevent consolidation.

19. Potential barriers to consolidation that government has identified include:

- unwillingness of potential receiving schemes to accept ‘low value’ members – some ‘low value’ members may be less attractive to providers than others. There is a question about the role of Master Trusts in accepting ‘low value’ members

- cost – the act of closing a scheme and transferring members into a new arrangement with another provider can involve significant upfront costs whilst this process, which can often last two years, takes place. The scheme may not be able to afford these costs in one given year despite potential future savings. Other schemes may consider membership of a Master Trust to be more expensive in terms of charges. Single-employer schemes tend not to charge members for administration whereas Master Trusts traditionally do. Therefore, whilst the employer could save on administration, the member may pay more

- tax – we welcome schemes and scheme consultant views on the different tax arrangements that would apply for a scheme to continue to operate a single-employer trust arrangement as opposed to moving members into a Master Trust. There may be different tax rates on contributions or aspect of the scheme that may create disincentives to close an in-house pension scheme

- bespoke arrangements – some smaller schemes may have specific arrangements for members that are particularly flexible or generous which Master Trusts may not be willing to honour or which would cost the member more in charges to keep

- cultural factors – some employers and their employees may prefer to have a scheme run by and for the employees rather than outsourced to a Master Trust provider. In other instances, some trustees may not have the knowledge or awareness of an alternative to operating as a small scheme

- charging structures – schemes may select different charging structures and therefore combining schemes may mean a certain proportion of members are being charged under a different structure to the rest of the membership or the way that those new members are being charged must change. The government recently launched a consultation on permitted charges structures[footnote 7] and we welcome views on whether those proposals may mitigate this risk

Question 4

Assuming a scheme wishes to consolidate, how significant are the barriers identified above? Are there others? How do barriers vary for medium-larger schemes?

How can the government, regulators and industry remove these barriers?

How can government incentivise consolidation for schemes between £100m and £5bn especially where there may be a proportion of members who have smaller pots and therefore may be less attractive to receiving schemes? Could government incentivise trustees of both the merging and receiving schemes to take a mixed economy of smaller and larger pots or could this be provided by the market at a suitable cost, and without imposing additional cost consequences on members?

Mitigating risks

20. Based on responses to previous consultations and discussions with industry, government believes that greater consolidation of DC schemes would bring a variety of benefits to members. However, the government would be interested in views on how to mitigate the potential risks of greater consolidation at a faster pace.

21. Examples include a reduction in the number of schemes leading to less choice and reduced competition. Another consideration is short-term costs of wind-up being passed onto members.

Question 5

How can we mitigate any risks associated with scheme consolidation?

International evidence

22. Government has reviewed international good practice examples and met with officials from the Australian government – it is the case that consolidation in Australia has led to fewer, larger schemes and lower charges and more diversified investment portfolios. However, the average charge in the UK is significantly lower than other countries meaning there may be less scope for UK DC schemes to reduce charges by the same extent as a result of consolidation. While the reviewed international evidence shows that larger funds often have a more diversified investment portfolio, it does not seem to show a clear link between fund size and returns.

Question 6

What other international good practice exists?

Investment strategies

23. Some stakeholders believe that by allocating a proportion of assets to illiquids, risk-adjusted returns could be improved over the longer-term through greater diversification and the potential for stronger performance. Larger schemes have the governance, resource and/or capacity to invest in a more diverse portfolio and their size allows them to more easily negotiate on fees when investing in private markets, an area that could offer better returns for members but is often inaccessible without paying a premium.

24. Consolidation has the potential to put these kind of investment strategies in the reach of a greater number of pension scheme members. We welcome views on how important consolidation is, or how significant lack of scale is as a barrier. This is just one barrier that the government is seeking to address, with industry, as part of the work ongoing in the Productive Finance Working Group.

Chapter 3: The future of the DC market

What does ‘good’ look like?

25. Improved member outcomes will be achieved through a range of measures. Driving consolidation of members into fewer, larger occupational DC schemes is one key part of this.

Competition

26. Another important factor is what drives competition between schemes. Currently, government believes that the main driver of competition between schemes is price. However, gross investment returns, which have tended to vary between 6 and 12 percentage points for Master Trusts, have a greater impact on the size of a member’s pot than charges which tend to vary between 0.2 and 0.5 percentage points.

27. As part of the consultation ‘Improving outcomes for members of defined contribution schemes’, we proposed requiring all relevant schemes to publish the net returns of the default arrangement whereas the requirement at present is only to publish costs and charges. In the June 2021 consultation response, we confirm that this requirement will be put into law via regulations. Our aim is that this starts to shift the discussion on what constitutes ‘good value’ from simply ‘the cheapest’ to a broader assessment of value. We welcome views on how this could be emphasised further.

Question 7

How important is scheme consolidation in driving better member outcomes?

What more can government and industry do to move away from a narrow focus on low costs and charges to a broader assessment of value for money that encompasses investment strategies whether innovative or otherwise and overall net returns?

Future government approach

28. As set out earlier, the government is now focusing on proposals for phase two of consolidation for medium to large schemes. We are keen to get views on how to incentivise greater consolidation, with a focus on schemes between £100 million and £5 billion. The government will continue to review the asset threshold below which schemes must conduct a comprehensive value for members’ assessment (currently £100 million) and invites views on how a similar but more tailored approach could be applied to schemes above £100 million.

29. We are open to innovative and creative ideas. We would also like views and idea for how to implement options previously floated by respondents to various consultations, including:

- creating a new value for members assessment specifically for single-employer schemes

- setting a floor on net returns below which schemes must explore winding-up the scheme

- greater powers for the Regulator to act where they have evidence of poor governance/performance

- financially incentivising employer sponsors of single employer trusts to close the scheme

30. The government will act to improve member outcomes but we are also keen to understand what more industry, and specific groups within the sector, can do to create a more efficient, member-focussed DC market.

Question 8

How can government, regulators and industry incentivise scheme consolidation?

Question 9

Is there anything else, not covered in the other questions, that the government should consider?

Annex: List of questions

Question 1

Do you agree that the government is right to aim for fewer, larger schemes going forward? Are there any risks?

Question 2

What impact will the new value for members assessment have on consolidation of schemes under £100 million ? If you were a scheme that did not pass the value for members assessment, would you look to “wind up” or “look to improve” and how would you go about this? Beyond the value for money assessment, could government, regulators and industry accelerate the pace of consolidation for schemes under £100 million ?

Question 3

How can government incentivise schemes with assets of between £100 million to £5 billion to consolidate?

Question 4

Assuming a scheme wishes to consolidate, how significant are the barriers identified above? Are there others? How do barriers vary for medium-larger schemes?

How can the government, regulators and industry remove these barriers?

How can government incentivise consolidation for schemes between £100 million and £5 billion especially where there may be a proportion of members who have smaller pots and therefore may be less attractive to receiving schemes? Could government incentivise trustees of both the merging and receiving schemes to take a mixed economy of smaller and larger pots or could this be provided by the market at a suitable cost, and without imposing additional cost consequences on members?

Question 5

How can we mitigate any risks associated with scheme consolidation?

Question 6

What other international good practice exists?

Question 7

How important is scheme consolidation in driving better member outcomes?

What more can government and industry do to move away from a narrow focus on low costs and charges to a broader assessment of value for money that encompasses investment strategies whether innovative or otherwise and overall net returns?

Question 8

How can government, regulators and industry incentivise scheme consolidation?

Question 9

Is there anything else, not covered in the other questions, that the government should consider?

-

Improving outcomes for members of defined contribution pension schemes ↩

-

DC trust scheme return data 2020 - 2021, The Pensions Regulator ↩

-

Improving outcomes for members of defined contribution pension schemes ↩

-

CP20/9: Driving value for money in pensions, Financial Conduct Authority ↩

-

Permitted charges within Defined Contribution pension schemes ↩