Technical consultation on the draft Banks and Building Societies (Priorities on Insolvency) Order 2018

Updated 29 November 2018

1. Introduction

1.1 The subject of this consultation

This consultation invites views on the government’s approach to transpose the EU Bank Creditor Hierarchy Directive (“the directive”)[footnote 1].

The consultation is accompanied by draft implementing legislation.

This consultation provides interested parties with the opportunity to engage with the government on how it can best implement the directive into UK law. It aims to:

- explain the directive’s amendments to article 108 of the Bank Recovery and Resolution Directive (BRRD)[footnote 2]

- present the government’s proposed approach to implementation

- detail and explain the government’s draft implementation regulations

- provide stakeholders with a list of questions to assist preparation of their written input into the consultation process

1.2 Who should read this?

This consultation should be read by those who will be affected by the changes proposed. This could include UK banks and building societies, any individual, firm or group that is a market participant or involved in the application of insolvency law in the financial sector.

1.3 The government’s approach to the Bank Creditor Hierarchy Directive negotiations

On 23 June 2016, the EU referendum took place and the people of the UK voted to leave the EU. Until exit negotiations are concluded, the UK remains a full member of the EU and all the rights and obligations of EU membership remain in force. During this period, the government will continue to negotiate, implement and apply EU legislation. The outcome of these EU withdrawal negotiations will determine what arrangements apply in relation to EU legislation in future once the UK has left the EU.

The government supported the fast tracking of the directive through the EU negotiations, alongside other EU member states. This was because the directive is anticipated to help firms to meet their minimum requirement for own funds and eligible liabilities (MREL).

The government’s objective for the negotiation was to maintain the UK’s preferred approach towards MREL, as set out in the Bank of England’s MREL Statement of Policy, which is to require subordination of MREL resources. This must be by structural subordination, except in the case of building societies which, given their structures, do not have the option of structural subordination. The directive does not require firms to use statutory subordination to meet subordination requirements. Therefore, the directive does not prevent the UK’s approach to structural subordination.

2. Bank Creditor Hierarchy Directive (“the directive”)

2.1 Introduction

The directive originates from a Commission proposal in November 2016[footnote 3], which was part of a wider package of reforms to further strengthen the resilience of EU banks[footnote 4]. The wider package is still subject to negotiations between the Council and the European Parliament. However, the directive was fast tracked and was agreed by the EU Council and the European Parliament on 12 December 2017[footnote 5]. It came into force on 28 December 2017 and has a transposition deadline for member states of 29 December 2018[footnote 6]. The directive introduces a harmonised approach across the EU, by requiring member states to create a new class of debt in their creditor hierarchy.

When a financial firm fails, losses are imposed on creditors in insolvency or via resolution. The creditor hierarchy dictates the order in which the assets are distributed to creditors and in what priority. The directive amends the creditor hierarchy in article 108 of the BRRD to establish a new class of non-preferred senior debt. Creditors in the new class will only be entitled to receive proceeds from any remaining assets once other creditors with a higher priority have been paid in full.

2.2 Minimum requirement for own funds and eligible liabilities (MREL)

The directive introduces statutory subordination across the EU, enabling firms to issue a new class of subordinated instrument towards meeting their minimum requirement for own funds and eligible liabilities (MREL). MREL comprises the firm’s regulatory capital and debt instruments that meet certain eligibility criteria and is the loss absorbing capacity that EU banks are required to hold to bear losses in resolution. The purpose of MREL is to help ensure that if institutions fail the resolution authority can use these financial resources to absorb losses and recapitalise the continuing business. As a result, MREL is a critical element of an effective resolution strategy.

To enhance the credibility and feasibility of being able to impose losses in a resolution, the resolution authority may require MREL instruments to rank below the liabilities in the creditor hierarchy, which are related to the bank’s day-to-day operations and the critical functions it provides to its customers. The lower ranking of MREL liabilities, which is known as a subordination requirement, means they are readily available to absorb losses and recapitalise the financial firm. This helps to ensure that vital economic functions provided by firms are not disrupted and reduces the risk of breaching the no creditor worse off (NCWO) safeguard in the event of a resolution. The NCWO safeguard ensures that no shareholder or creditor is left worse off after a resolution than they would have been after an insolvency.

There are three methods for achieving the subordination of MREL instruments; these are set out in the Total Loss-absorbing Capacity (TLAC) term sheet[footnote 7]. First, ‘contractual subordination involves the creditor agreeing under the terms of the debt to be paid behind ordinary creditors in insolvency. Secondly, the debt can be ‘structurally subordinated’ to the other creditors of an operating bank by issuing the debt from a parent holding company that owns the operating bank. Finally, a debt can be ‘statutorily subordinated’ by legislation, if such legislation exists.

TLAC and MREL pursue the same objective of ensuring that banks have sufficient loss-absorbing and recapitalisation capacity. The implementation of the rest of the TLAC standard into EU law requires wider updates to the framework for setting MREL. These other updates are included in the wider package of reforms proposed by the Commission in November 2016.

The primary motivation for fast tracking the Directive was to introduce a harmonised approach across the EU to the availability of statutory subordination, which is one of the subordination methods provided for in the TLAC standard. The directive reflects the importance of clarity for creditors of their position in the hierarchy.

The directive provides for statutory subordination by introducing a harmonised class of debt that is subordinated in the creditor hierarchies across EU member states. This new class of debt can be used to meet MREL requirements. In line with the TLAC term sheet, while the directive provides for statutory subordination it does not require this method of subordination to be used in order to meet MREL requirements.

2.3 The creditor hierarchy as amended by the Bank Creditor Hierarchy Directive

As explained in section 2.1, the directive amends article 108 of the BRRD to require a new class of non-preferred senior debt to be inserted into in the creditor hierarchy. The amended article 108 provides that debt instruments which meet the specified conditions are to have a lower ranking than ordinary unsecured claims but a higher ranking in an insolvency than capital instruments and subordinated liabilities that do not qualify as own funds instruments. Within classes, creditors rank pari passu and assets are distributed equally.

The directive’s amendments to article 108 of the BRRD make no changes to the existing preference for certain depositors in insolvency[footnote 8]. The directive gives preferential status to deposits covered by a deposit guarantee scheme, which in the UK is the Financial Services Compensation Scheme (FSCS). In an insolvency, the FSCS would pay out to covered depositors and take their place in the insolvency proceedings for the amount equal to the payments made.

Equally, the directive’s amendments to article 108 of the BRRD make no changes to the other depositor preference requirements provided for by the original article 108 of the BRRD. Depositor preference means that the following, which themselves rank equally, have a higher ranking than the claims of ordinary unsecured creditors in an insolvency:

- deposits from natural persons and micro, small and medium sized businesses which are eligible for protection under the deposit guarantee scheme but exceed the coverage limit

- deposits from natural persons and micro, small and medium sized businesses that would be eligible for such protection were they not made through branches located outside of the EU

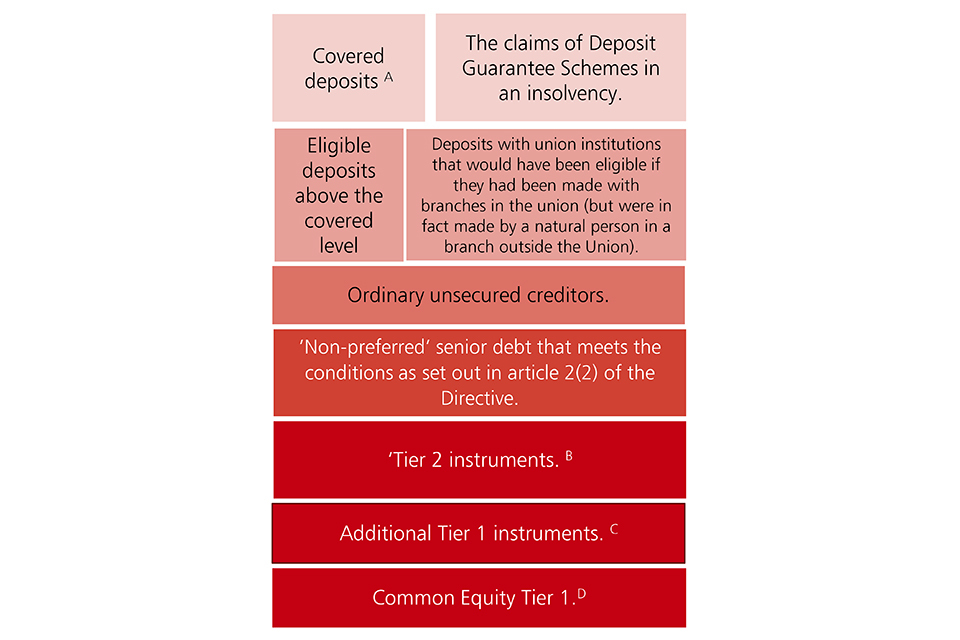

The impact of the amended article 108 of the BRRD is illustrated in Box 1.

Box 1: The creditor hierarchy as required by BRRD Article 108 (as amended by the directive)

The impact of the amended article 108 of the Bank Recovery and Resolution Directive is illustrated in Box 1.

Notes: A - The coverage level provided for in Article 6 of Directive 2014/49/EU. In the UK, the FSCS guarantees eligible deposits up to £85,000. B, C, D - These capital instruments are referred to in points (a) to (c) of Article 48(1) of the BRRD.

The directive sets out that debt instruments must meet a set of conditions in order to be eligible for this non-preferred senior class of debt. The eligibility criteria are to enhance legal certainty. These conditions, as set out in article 2(2) of the Directive, are that the debt instruments:

- have an initial maturity of at least one year

- contain no embedded derivatives[footnote 9] and are not derivatives themselves

- the relevant contractual documentation explicitly refers to their lower ranking in the hierarchy

2.4 Implications for UK MREL requirements

In the UK, the Bank of England, as the resolution authority, is responsible for setting MRELs, including any subordination requirement. The Bank of England’s approach to MREL is set out in its Statement of Policy[footnote 10].

In light of the directive, the Bank of England has clarified that in relation to the subordination requirement they “expect UK resolution entities subject to a bail-in strategy to ensure that their MREL resources are subordinated to operating liabilities, using structural subordination except in the case of building societies which may use contractual subordination or statutory subordination.”[footnote 11]

3. The draft Banks and Building Societies (Priorities on Insolvency) Order 2018

3.1 Introduction

This chapter provides a summary explanation of the draft order, which is included at Annex A, and lists several consultation questions. The chapter is intended to assist interested parties in reviewing the government’s proposed approach to implementing the directive.

3.2 General approach

The directive requires the non-preferred senior class of debt to be provided for in normal insolvency proceedings[footnote 12]. In the UK, the 1986 Insolvency Act governs normal insolvency proceedings. For this reason, when the government transposed the original article 108 of the BRRD it made amendments to the 1986 Insolvency Act (alongside other insolvency proceedings, including modifications made by the Banking Act 2009).

As a general approach, the government proposes to make similar amendments as it did in the original transposition of article 108 of the BRRD. These amendments were made by the Banks and Building Societies (Depositor Preference and Priorities) Order 2014 (the 2014 Order).

The government’s proposed approach is to create, for the entities affected, a new provision for priority of non-preferential debt in relation to company winding up (Article 6, creating a new section 176AZA (non-preferential debts of financial institutions) in the Insolvency Act 1986). Non-preferential debt was not previously split into classes, so it is proposed that the new section 176AZA creates three new classes. The first is a class of “ordinary non-preferential debt” which corresponds to the non-preferential debt in the current regime. The second is secondary non-preferential debt, the new class required by the directive, which ranks below ordinary non-preferential debt as required by the updated Article 108(2) in the directive. This proposal ensures that the two new classes are both ranked under preferential debt and that ordinary non-preferential debt is ranked above secondary non-preferential debt. Finally, in accordance with Article 108(3), section 176AZA makes clear that the new class ranks ahead of additional Tier 1 and Tier 2 instruments and subordinated debt.

The approach described in the paragraph above is followed in the order of priority in relation to bankruptcy in section 328 where, for the entities affected, the currently unlabelled non-preferential debts are replaced with the new ordinary and secondary non-preferential debt classes (Regulation 8, amending section 328 of the Insolvency Act 1986), both above additional Tier 1 and Tier 2 instruments and subordinated debt.

In line with the approach taken previously with preferential debts provided for in Article 108 of the directive, it is proposed that the subordination of the new class of debt should apply to any voluntary arrangements under the Insolvency Act (Articles 5, 7 and 12) and any statement of proposals made by an administrator (Article 13). Definitions of the new classes are included after the definitions of the preferential classes created by the 2014 Order (Articles 10 and 11) and consequential changes are made in the Banking Act 2009 (Part 4 of the draft Order). Equivalent changes are made to the Insolvent Partnerships Order (Part 3 of the draft Order) and will be made (in the final Order) to the Insolvency (Northern Ireland) Order 1989, the Insolvent Partnerships Order (Northern Ireland) 1995 and the Bankruptcy (Scotland) Act 1985. Some further consequential amendments may need to be made before laying the Order.

It is intended that the draft regulations will be made under the powers in the European Communities Act 1972.

Question 1

Do you agreed with the general approach outlined above?

The government believes that the amendments provided for in the draft regulations are necessary to implement the directive. The government welcomes views from stakeholders on the following questions and on the effect of these draft regulations.

The government has taken the view in drafting the amendments to the 1986 Insolvency Act that the term “non-preferred senior” might cause confusion. The term is not used in the articles of the directive (it is used in the recitals only). The decision to use a different formulation than used in the recitals is primarily because the 1986 Insolvency Act does not use the concepts of “senior” and “junior” debt. The act also uses terms such as “preferential debts” so the use of “non-preferred senior” might suggest that that debts of this class have a higher ranking than the directive intends. To address this potential confusion, the draft in Annex A refers to debts of this new class as “secondary non-preferential debt” and the currently undefined ordinary unsecured debt which is not preferential debt (see the current section 328(3) of the act for example) as “ordinary non-preferential debt”. Additional Tier 1 and Tier 2 instruments and subordinated debt are referred to as “tertiary non-preferential debt”. The government would welcome views on the terminology used in the draft to ensure consistency with the 1986 Insolvency Act and the directive.

Question 2

Do you agree with the placement in the creditor hierarchy of this class of “secondary non-preferential debt” in accordance with section 176AZA of the Insolvency Act 1986 (as mirrored elsewhere in the Regulations)?

Question 3

Do you expect the approach taken to affect any existing debt instruments? Please provide details.

Question 4

What are your views on the protections given to creditors of this class of “secondary non-preferential debt”?

4. Impacts

As part of the government’s ongoing commitment to proportionate regulation, the government is conducting an impact assessment for the implementation of the directive. This consultation invites views from interested parties on the impact of the directive’s implementation on business and the UK market.

The government expects that building societies in particular will benefit most from the introduction of statutory subordination as, due to their legal structure, they do not have the option to structurally subordinate their MREL. The benefit of the directive is likely to be a lower cost of funding resulting from the expected pricing of secondary non-preferential debt instruments compared to the other subordinated debt instruments that building societies are able to issue.

The government also expects that there will be an initial one-off cost from legal and compliance work to understand the change in legislation and disseminate information to firms. This impact is expected to be in line with other similar changes in legislation.

4.1 Questions on the impacts of the Bank Creditor Hierarchy Directive’s implementation

Question 5

What is your assessment of the impact of these changes on the cost of funding? Please provide details on:

- the spread difference between Tier 2 issued debt and secondary non-preferential debt

- the expected issuance of secondary non-preferential debt, the expected maturity profile of the debt, and any other impacts

- the spread difference between Tier 2 issued debt and other contractually subordinated debt instruments

Question 6

HM Treasury assumes that other bondholders in the capital structure will not be affected by the introduction of secondary non-preferential debt (regardless of whether other bondholders are higher or lower in the hierarchy compared to secondary non-preferential debt holders). Please explain whether you agree and why.

Question 7

HM Treasury assumes that debt holders higher up and lower down the debt hierarchy compared to secondary non-preferential debt holders will not have their cost of funding affected. Please explain whether you agree and why.

Question 8

How many hours would firms’ compliance officers expect to spend understanding the change in legislation and disseminating information? Please include details on the number of compliance officers or other staff involved in this process.

Question 9

HM Treasury assumes that building societies that issue MREL above their capital requirements will take advantage of this legislation but that banks are unlikely to, as banks can already issue MREL-eligible debt through structural subordination. Please explain whether you agree and why.

5. How to respond

The government invites responses on the specific questions raised. The questions can be found throughout the document and are also listed in full below.

This consultation will close on 10 October 2018. The government cannot guarantee that responses received after this date will be considered.

Responses can be sent by email to: BankCreditorHierarchyDirectiveConsultation@hmtreasury.gov.uk

Alternatively, they can be posted to:

Bank Creditor Hierarchy Directive Consultation

Financial Stability

HM Treasury

1 Horse Guards Road

London

SW1A 2HQ

When responding please say if you are a business, individual or representative body. In the case of representative bodies, please provide information on the number and nature of individuals or firms that you represent.

5.1 Full list of questions

Question 1

Do you agreed with the general approach outlined above?

Question 2

Do you agree with the placement in the creditor hierarchy of this class of “secondary non-preferential debt” in accordance with section 176AZA of the Insolvency Act 1986 (as mirrored elsewhere in the Regulations)?

Question 3

Do you expect the approach taken to affect any existing debt instruments? Please provide details.

Question 4

What are your views on the protections given to creditors of this class of “secondary non-preferential debt”?

Question 5

What is your assessment of the impact of these changes on the cost of funding? Please provide details on:

- the spread difference between Tier 2 issued debt and secondary non-preferential debt

- the expected issuance of secondary non-preferential debt, the expected maturity profile of the debt, and any other impacts

- the spread difference between Tier 2 issued debt and other contractually subordinated debt instruments

Question 6

HM Treasury assumes that other bondholders in the capital structure will not be affected by the introduction of secondary non-preferential debt (regardless of whether other bondholders are higher or lower in the hierarchy compared to secondary non-preferential debt holders). Please explain whether you agree and why.

Question 7

HM Treasury assumes that debt holders higher up and lower down the debt hierarchy compared to secondary non-preferential debt holders will not have their cost of funding affected. Please explain whether you agree and why.

Question 8

How many hours would firms’ compliance officers expect to spend understanding the change in legislation and disseminating information? Please include details on the number of compliance officers or other staff involved in this process.

Question 9

HM Treasury assumes that building societies that issue MREL above their capital requirements will take advantage of this legislation but that banks are unlikely to, as banks can already issue MREL-eligible debt through structural subordination. Please explain whether you agree and why.

5.2 HMT consultations – processing of personal data

This notice sets out how we will use your personal data, and your rights under the Data Protection Act 2018 (DPA).

Your data (Data Subject Categories)

The personal information relates to members of the public, parliamentarians, and representatives of organisations or companies.

The data we collect (Data Categories)

Information may include the name, address, email address, job title, and employer of the correspondent, as well as their opinions.

It is possible that respondents will volunteer additional identifying information about themselves or third parties.

Purpose

The personal information is processed for the purpose of obtaining the opinions of members of the public and representatives of organisations and companies, about departmental policies, proposals, or generally to obtain public opinion data on an issue of public interest.

Legal basis of processing

The processing is necessary for the performance of a task carried out in the public interest or in the exercise of official authority vested in the HM Treasury. The task is consulting on departmental policies or proposals, or obtaining opinion data, in order to develop good effective policies.

Who we share your responses with (Recipients)

Information provided in response to a consultation may be published or disclosed in accordance with the access to information regimes. These are primarily the Freedom of Information Act 2000 (FOIA), the Data Protection Act 2018 (DPA) and the Environmental Information Regulations 2004 (EIR).

If you want the information that you provide to be treated as confidential, please be aware that, under the FOIA, there is a statutory Code of Practice with which public authorities must comply and which deals with, amongst other things, obligations of confidence. In view of this it would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information we will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on HM Treasury.

Where someone submits special category personal data or personal data about third parties, we will endeavour to delete that data before publication takes place.

Where information about respondents is not published, it may be shared with officials within other public bodies involved in this consultation process to assist us in developing the policies to which it relates.

As the personal information is stored on our IT infrastructure, it will be accessible to our IT contractor NTT. NTT will only process this data for our purposes and in fulfilment with the contractual obligations they have with us.

How long we will hold your data (Retention)

Personal information in responses to consultations will generally be published and therefore retained indefinitely as a historic record under the Public Records Act 1958.

Personal information in responses that is not published will be retained for three calendar years after the consultation has concluded.

Special data categories

Any of the categories of special category data may be processed if such data is volunteered by the respondent.

Basis for processing special category data

Where special category data is volunteered by you (the data subject), the legal basis relied upon for processing it is: The processing is necessary for reasons of substantial public interest for the exercise of a function of the Crown, a Minister of the Crown, or a government department.

This function is consulting on departmental policies or proposals, or obtaining opinion data, to develop good effective policies.

Your rights

- you have the right to request information about how your personal data are processed, and to request a copy of that personal data

- you have the right to request that any inaccuracies in your personal data are rectified without delay

- you have the right to request that your personal data are erased if there is no longer a justification for them to be processed

- you have the right in certain circumstances (for example, where accuracy is contested) to request that the processing of your personal data is restricted

- you have the right to object to the processing of your personal data where it is processed for direct marketing purposes

Complaints

If you have any concerns about the use of your personal data, please contact us via this mailbox: privacy@hmtreasury.gov.uk

If we are unable to address your concerns to your satisfaction, you can make a complaint to the Information Commissioner, who is an independent regulator. The Information Commissioner can be contacted at:

Information Commissioner’s Office

Wycliffe House

Water Lane

Wilmslow

Cheshire

SK9 5AF

0303 123 1113

Any complaint to the Information Commissioner is without prejudice to your right to seek redress through the courts.

Contact details

The data controller for your personal data is HM Treasury. The contact details for the data controller are:

HM Treasury

1 Horse Guards Road

London

SW1A 2HQ

020 7270 5000

public.enquiries@hmtreasury.gov.uk

The contact details for the data controller’s Data Protection Officer (DPO) are:

DPO

1 Horse Guards Road

London

SW1A 2HQ

London

5.3 Consultation principles

This consultation is being run in accordance with the government’s consultation principles. The government will be consulting for 4 weeks. This is in order to give stakeholders adequate time to respond while also ensuring that government is able to meet the transposition deadline of 29 December 2018.

-

Bank Creditor Hierarchy Directive’s full title is: Directive (EU) 2017/2399 of the European Parliament and of the Council of 12 December 2017 amending Directive 2014/59/EU as regards the ranking of unsecured debt instruments in insolvency hierarchy. ↩

-

Directive 2014/59/EU ↩

-

Proposal for a DIRECTIVE OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on amending Directive 2014/59/EU of the European Parliament and of the Council as regards the ranking of unsecured debt instruments in insolvency hierarchy ↩

-

http://www.consilium.europa.eu/en/press/press-releases/2018/05/25/banking-council-agreement-on-measures-to-reduce-risk ↩

-

OJ L 345, 27.12.2017, p. 96–101 ↩

-

Section 11 of Total Loss-absorbing Capacity (TLAC) Term Sheet, pages 15-17. ↩

-

The directive establishes that debt instruments with a variable interest rates derived from a broadly used benchmark or denominated in the domestic currency of the issuer will not be considered as having derivatives features. ↩

-

Statement of Policy on the Bank of England’s approach to setting a minimum requirement for own funds and eligible liabilities (MREL), 13 June 2018. ↩

-

Point 4.9, Statement of Policy on the Bank of England’s approach to setting a minimum requirement for own funds and eligible liabilities (MREL), 13 June 2018. ↩

-

The term “normal insolvency proceedings” is defined in BRRD article 2.1(47). ↩