Civil Service Pensions 2015 Remedy ('McCloud') consultation – Equality Impact Assessment

Updated 7 August 2023

1. Introduction

1.1 Purpose of Equality Impact Assessment

1.1 This document records the analysis undertaken by the Cabinet Office as Scheme Manager of the Civil Service Pension Schemes (CSPS), for the proposed secondary legislation. The proposed legislation will enable the implementation phase of the retrospective elements of the McCloud remedy.

1.2 This analysis is provided in addition to the full Equality Impact Assessment [footnote 1] undertaken by Her Majesty’s Treasury (HMT) in respect of the Public Service Pensions and Judicial Offices Act 2022 (PSPJO Act), the primary legislation that sets out the remedy requirements for all public service pension schemes. This equality impact assessment enables the Minister to fulfil the requirements placed on them by the Public Sector Equality Duty (PSED) as set out in section 149 of the Equality Act 2010.

1.3 The principles of the PSED requires the Scheme Manager to have due regard to the need to:

- eliminate unlawful discrimination - direct discrimination, indirect discrimination, discrimination arising from disability, and harassment, victimisation and any other conduct prohibited by the Act;

- advance equality of opportunity between people who share a protected characteristic and people who do not share it; and

- foster good relations between people who share a protected characteristic and those who do not share it.

1.4 In relation to the first limb of the PSED, the conduct prohibited by the Act includes the following.

- Direct discrimination – this means less favourable treatment “because of” a protected characteristic. This includes discrimination by association (being treated less favourably because of a protected characteristic e.g. of a friend, spouse, partner, parent or another person with whom they are associated) and discrimination by perception (because of a perceived protected characteristic which an individual may not, in fact, possess).

- Indirect discrimination – this is concerned with acts, decisions or policies which are not intended to treat anyone less favourably, but which in practice have the effect of disadvantaging a group of people with a particular protected characteristic. Where such a policy disadvantages an individual with that characteristic, it will amount to indirect discrimination unless it can be objectively justified.

- Harassment – this is unwanted conduct related to a relevant protected characteristic which has the purpose or effect of either violating a person’s dignity, or creating an intimidating, hostile, degrading, humiliating or offensive environment.

- Victimisation - this occurs where a person subjects another person to a detriment because either they have done a protected act or it is believed they may do a protected act.

The protected characteristics as set out in the Equality Act 2010, to be considered are:

- age

- disability

- sex

- gender reassignment

- marriage or civil partnership

- pregnancy and maternity

- race

- religion or belief

- sexual orientation.

In addition, under the Equality Act 2010 it is unlawful to discriminate against a carer either because of their own protected characteristic, or because of a protected characteristic of the individual(s) they care for. For example, if a carer is looking after somebody who is elderly or disabled, it would be unlawful to discriminate against the carer because of their responsibilities associated with the age or disability of the person who they care for. The 2019 Civil Service people survey informed us that 27% of people who responded to the survey said they had caring responsibilities. A breakdown of carers by some protected characteristics is contained in the ‘Building a Carer Inclusive Civil Service’[footnote 2].

1.5 This EQIA is a tool to demonstrate that due regard has been given to the PSED principles in developing these scheme regulations and the policy behind the regulations. Specific due regard considerations include:

- Think about equality in the early stages of planning, to remove any perceived barriers and improve implementation.

- Make sure that no one is excluded from the delivery of services or implementation of policies.

- To help to anticipate and understand the consequences of our actions and the effects of decisions on different communities, individuals or groups.

- Identify whether a policy is likely to affect groups of people in different ways.

- Provide an opportunity to involve different groups of people in decision making.

- Evidence that decision-making includes a consideration of the actions that would help to avoid or mitigate any negative impacts on particular protected groups.

- Provide positive opportunity to advance equality within all areas of work including projects, policies and procedures.

- Make decisions based on analysis and evidence with consideration of the actions that would help to avoid or mitigate any negative impacts on particular protected groups.

- Help us meet our Equality Act 2010 Public Sector Equality Duty.

1.2 Scope of Use

1.6 This Equality Impact Assessment (EQIA) has been drafted to accompany the proposed secondary legislation that will implement the retrospective changes of the McCloud remedy (the remediable service remedy), as set out in Part 1, Chapter 1 of the PSPJO Act, to end the discrimination identified by the Court of Appeal in 2018.

1.7 The number of Civil Service Pension Scheme members impacted by the retrospective remedy is about 420,000 (as at 30 June 2022). The three areas that the remediable service remedy proposed scheme regulations will bring into force are;

- scheme regulations to manage the consequences of the ‘rollback’ provisions of the PSPJO Act. The Act has the effect of treating unprotected and taper protected alpha pension scheme members as if they had never left the PCSPS legacy schemes for the remedy period 1 April 2015 to 31 March 2022

- scheme regulations to give members who have retired or died before 1 October 2023 an immediate choice election for new scheme benefits in relation to their remediable service

- scheme regulations to give a deferred choice underpin (DCU) to active and deferred members. These members will receive a remediable service statement of their benefit options for the remedy period closer to their retirement date and will be able to make a benefit election at that point.

2. Background

2.1 McCloud Judgment

2.1 In April 2015 public service pension schemes were reformed; the cost of the legacy schemes had significantly increased over the previous decades, with most of those costs falling to the taxpayer. To protect against unsustainable increases in costs, new schemes were introduced with career average revalued earnings design and increased Normal Pension Ages, alongside the introduction of a cost control mechanism. They were also progressive, providing greater benefits to some lower paid workers.

2.2 In December 2018, the Court of Appeal ruled that the protection offered to some members of the judges’ and firefighters’ schemes, as part of the 2015 public sector pension reforms, gave rise to unlawful age discrimination and also were indirectly discriminatory on the grounds of sex and race. This is referred to as the McCloud judgement and the courts required that this unlawful discrimination be remedied by the government.

2.3 The reforms included a policy of transitional protection. This meant members closest to retirement stayed in their unreformed legacy scheme as they had the least amount of time to prepare for the changes. The transitional protection provided as part of the reforms applied to those within ten years of their normal pension age as at 31 March 2012 and they were not required to move to the new scheme on 1 April 2015.

2.4 It was the transitional protection element of the 2015 reformed schemes that was found to be discriminatory and not the reformed schemes themselves.

2.5 There was also a limited protection category included in the reforms, this applied to members who were within 3.5 years of qualifying for transitional protection, as of 1 April 2012. This allowed for a staged transfer to alpha, according to age. This was known as tapered protection and meant members in this group would be moved to the new scheme at some point between 1 April 2015 and 31 March 2022.

2.6 Following the 2018 judgement the Chief Secretary to the Treasury confirmed the requirement for a legal remedy across all reformed public service pension schemes.

2.7 The Government consulted on how it should remedy, put right the discrimination identified and consequently published its consultation response in February 2021. It confirmed that:

- affected members would be given a choice of which pension benefits to receive

- the remedy period, for the choice of benefits, would be 1 April 2015 to 31 March 2022

- the pre 2015 legacy schemes would close on 31 March 2022

- the choice of benefits would be given either at the time they become payable (referred to as the ‘deferred choice underpin’) or, for members already in receipt of pension benefits, the choice will be given as soon as possible after necessary changes to the schemes are implemented

- there will not be an option to have a combination of benefits in the legacy scheme and the reformed scheme over the ‘Remedy Period’

2.8 The Public Service Pensions and Judicial Offices Act 2022 provides the legislative framework for all public service schemes to address the discrimination identified by the Courts. Further scheme specific secondary legislation is required for each scheme in order to achieve the government’s remedy policy to remove the discrimination resulting from the changes made in 2015.

2.9 The first stage of the remedy was applied by new scheme regulations introduced across the public service schemes on 1 April 2022. This moved any members still in the older public service schemes to the appropriate reformed schemes from 1 April 2022 - for members of the Civil Service pension arrangements, this is the alpha pension scheme.

2.10 The next phase of the remedy programme will seek to correct as far as possible the age discrimination identified by the Court of Appeal in 2018 and will generally apply to members with ‘remediable service’ (i.e. those service in the scheme between 1 April 2015 and 31 March 2015), with some limited exceptions. Schemes must have implemented this second phase by 1 October 2023 at the latest.

2.11 For all unfunded schemes, other than the judicial schemes, the government is implementing the Deferred Choice Underpin (DCU) remedy option along with an immediate choice mechanism.

2.12 The immediate choice option will be for members who have benefits in payment before 1 October 2023. The DCU option applies to eligible members who will bring benefits into payment after 1 October 2023. Both options give eligible members the opportunity to make a choice as to whether to take legacy or reformed scheme benefits for the remedy period.

2.13 The DCU option will be given to members when their pension benefits become payable. For pensions already in payment the option will be given as soon as practicable once the scheme regulations are in force.

2.14 The DCU option for members to make a choice about their remedy benefits close to retirement was supported by the majority of respondents to HM Treasury’s consultation. This option is the preferred approach as it provides members with greater transparency in making their remedy decision. It avoids the need for members to make assumptions about matters such as their future career progression and retirement age, which would increase the risk of members, particularly younger members, making decisions that may not be in their best interest.

2.15 Royal Assent for the PSPJO Act was granted on 10 March 2022, after which the Civil Service Pension Scheme regulation amendments were laid. The Public Service (Civil Servants and Others) Pensions (Amendment) Regulations 2022 (SI 2022 No 330) allowed for all protected Civil Service Pension Scheme members to be moved to alpha, from 1 April 2022. The legacy schemes (with sections classic, classic plus, premium and nuvos) were closed on 1 April 2022, meaning members could not build up further service in these schemes on or beyond that date. This date marks the end of the remedy period and places all pension scheme members in the same scheme going forward.

The reformed Civil Service scheme (alpha) is not discriminatory, and the government wants to make sure that all members are treated in the same way for pension benefit provision after the discrimination has been addressed.

3. Scheme-specific Legislation Equality

3.1 Impact Assessment

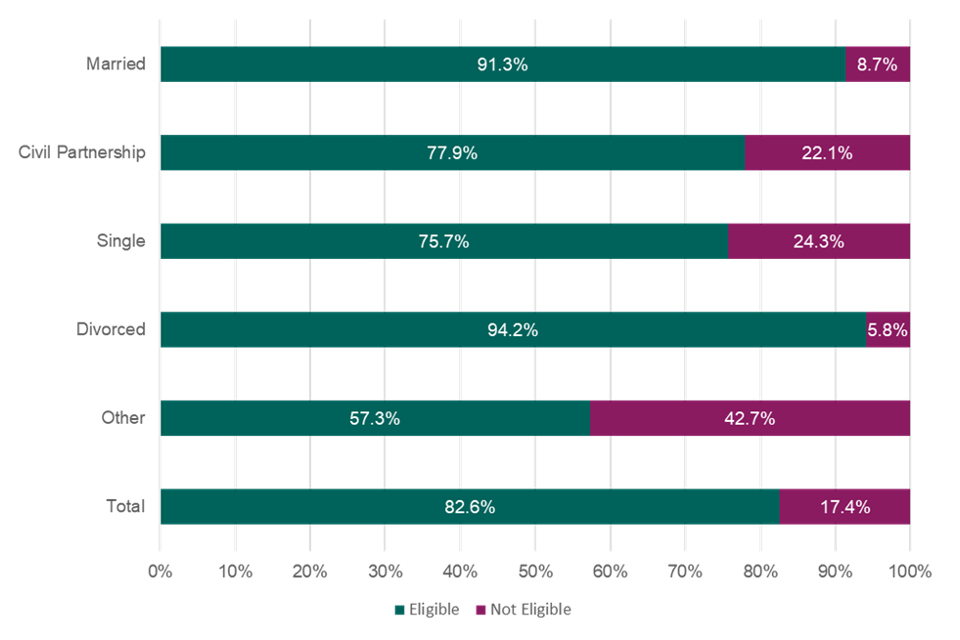

3.1 This Equality Impact Assessment will look at the impact of the proposed scheme regulations and will consider whether there are any significant impacts on the ‘protected’ groups by gender, disability, ethnic minority and age. These equality impacts have been explored, in line with the government’s duty to have due regard to the need to eliminate discrimination, advance equality of opportunity, and foster good relations. The Equality Impact Assessment initially considered all the “protected” groups, but determined it was disproportionate to conduct detailed analysis in respect of religion or belief, sexual orientation, gender reassignment, marriage and civil partnership and pregnancy and maternity. This was due to the limited data available for Civil Service Pension Scheme members in respect of these protected characteristics.

3.2 This conclusion was justifiable because the Remediable Service Remedy will be applied to all in-scope members irrespective of any protected characteristics. The processes to implement the Remediable Service Remedy have been developed with due regard to all protected characteristics. For this impact assessment the Government Actuary’s Department has used data provided by the scheme administrator to carry out some equalities impact analysis for the Scheme Manager.

3.2 Approach / Data

3.3 This EQIA assesses the impact of the proposed secondary legislation implementing the remediable service remedy against the appropriate protected characteristics as outlined above. The Scheme Manager engaged the Government Actuary’s Department (GAD) to provide scheme data analysis to support this equalities impact assessment. The data analysis provided in the Annexes to this document have been provided by GAD, other sources are listed where appropriate.

3.4 Under the Data Protection Act 2018 and General Data Protection Regulations (as it applies to the UK) (‘UK GDPR’), the Scheme Manager is the ‘data controller’ for scheme member data. The UK GDPR principles and requirements for data controllers is detailed in the Scheme Manager’s Data Management Policy. This Policy states; ‘The personal data we hold shall be adequate, relevant and limited to what is necessary for processing purposes’.

3.5 This means that scheme member data collected is limited to what is necessary for pension scheme administration purposes. Data relating to a number of the protected characteristics specified in the 2010 Equality Act is not held by the scheme. We have looked at the Civil Service Diversity and Inclusion Dashboard [footnote 3] for analysis purposes to understand and compare with the data held by the scheme. Pension scheme membership data would generally include; age, gender, marriage and civil partnership status (this information is limited to the date it is captured).

3.6 In addition to this impact assessment, HM Treasury carried out an equality impact assessment for the primary legislation (PSPJO Act 2022) which contains powers for all public service pension schemes to implement the remediable service remedy. Our scheme specific analysis is similar to their findings. A link to HM Treasury’s equalities impact assessment is shown earlier in this document.

3.3 Policy Proposals

3.7 This impact assessment has been carried out to look at the impact of the policy design provided by the Public Service (Civil Servants and Others) Pensions Remediable Service Regulations. In addition to the PSPJO Act these regulations are necessary to remove the transitional protection that was applied to Civil Service Pension Scheme members as part of the 2015 public service pension reforms. This legislation will come into force no later than 1 October 2023. This assessment will not consider the policy underpinning the PSPJO Act 2022.

3.4 Remedy design

3.8 All members eligible for the remediable service remedy will be given a choice between receiving legacy scheme or reformed scheme equivalent benefits, for the remediable service period. (Eligibility is defined in the PSPJO Act).

3.9 The first phase of the remediable service remedy is to return eligible members in the reformed scheme, alpha, to the respective legacy scheme they were in prior to 1 April 2015. This phase is referred to as ‘rollback’. This will take place when the new scheme regulations come into force and be no later than 1 October 2023. This also applies to members with new scheme benefits in payment, but section 6(4)(a) of the PSPJO Act 2022 means that members won’t see a change to their benefits unless they choose to receive legacy scheme benefits instead.

3.10 This will put all members in the same position for the remedy period. There will be remediable action for some members as a result of being moved from one scheme to another. The policies for these changes are explained in the consultation document. The remedy is designed to remove the discrimination identified and provide fairness to all Civil Service Pension Scheme members. The PSPJO Act 2022 directs that public service pension schemes must address the discrimination; the underlying principle being that the changes are necessary and justifiable using proportionate means to achieve a legitimate aim. The government has committed to treating all public service pension scheme members equally from 1 April 2022 and for the remediable service period. The remedy will have many aspects and each member is unique and will have the right to choose the remedy solutions that best suit them.

3.5 Giving members a choice: analysis

3.11 After 1 October 2023, members with remediable service will have the option to choose between legacy scheme pension benefits or benefits equivalent to those available under the reformed pension scheme, for the remedy period, 1 April 2015 to 31 March 2022.

3.12 All eligible members, no matter what protected characteristic group, could be viewed as ‘benefiting’ from being offered a choice of benefits for remediable service as they are being offered a choice that was not previously available and will be able to choose benefits that were not previously available.

3.13 It could also be viewed that members who choose different benefits to the benefits which they had already built up prior to the Remediable Service Remedy, could be seen as having ‘benefited’ from being offered a choice of benefits for the Remedy Period.

3.6 Immediate choice decision

3.14 The PSPJO Act 2022 directs scheme regulations must be made to allow a member who is a pensioner or the beneficiary of a deceased member immediately before 1 April 2022 to make an immediate election to receive alternative benefits in respect of their remediable service. If no election is made within a prescribed period, they will continue to receive the benefits already in payment. Except for members in receipt of mixed benefits, where they are receiving part alpha and part legacy scheme benefits, this is not permitted and a choice must be made.

3.15 Members with pension benefits in payment or who died before 1 October 2023 will be given an immediate choice to receive alternative benefits for any remediable service. There are about 116,000 members in this category, the highest proportion, 85%, are members who have taken benefits from the legacy scheme, through retirement or death. The choice will be given by issuing a remediable service statement showing the benefits available from both the legacy and new scheme equivalent benefits. This will make clear not only the monetary value of the benefits but also any adjustments that would apply should alternative scheme benefits be chosen.

3.16 The Scheme Manager does not make the assumption that everyone would benefit from receiving benefits from their legacy scheme for the remedy period. Therefore, the scheme regulations have been drafted so as to give effect to the policy of allowing members the choice of benefits they want to receive for their remediable service, giving them control over the pension benefits they receive for the remedy period.

3.17 The immediate choice decision is addressing the direct age discrimination and the indirect sex and race discrimination introduced by the 2015 public service pension scheme reforms. This policy primarily affects older members who have retired or died. It allows members or, where the member is deceased an appropriate representative, to choose the benefits they wish to receive for the remedy period. The immediate choice group represents about a third of the remedy population.

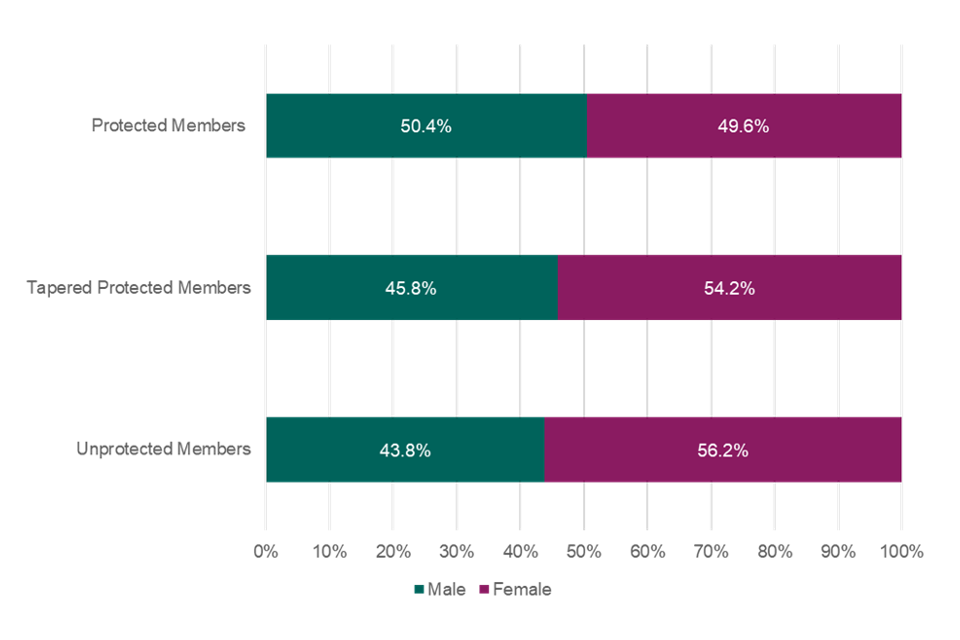

3.18 The analysis shown in this document breaks down the remedy population by age, sex and remedy status. This gives a good indication of the membership represented in the immediate choice group. This analysis shows that although males account for less than half (45.9%) of all eligible members, the majority of protected members are male at 50.4%. Females account for a greater proportion of unprotected members at 56.2%. 10% of this group is made up of members who have retired due to ill health or died before 1 October 2023. It is possible that some members who retired due to ill health may have a disability.

3.19 The 2015 Remedy Programme engaged with behavioural scientists to review all member communication materials, with full details at Annex H. This is to make sure all member communications are written in plain English, contain minimum complexity, and have clear calls to action. The aim of this engagement was to make information as clear as possible for all members, particularly when they are being asked to make a choice. This engagement demonstrates due regard to members and members representatives who may have reduced information processing ability which could be due to age or disability.

3.20 Taper protected members will not be able to keep the benefits in payment, in the same way as members in the protected and unprotected groups can. This is because they will have benefits in payment from both the legacy and new schemes and this cannot continue. All members are to be treated in the same way and will have the choice of legacy or new scheme equivalent benefits, not a mixture of both. Any advantages of receiving benefits from both schemes due to this protection will be lost. The taper protection category makes up 12% of the overall remedy population and females represent almost 55% of this group. It is felt this treatment can be justified as the taper protected group were treated differently due to age on the introduction of the pension reforms. This policy is considered as a proportionate means of achieving a legitimate aim and introducing fair correction of former discrimination. However, where members are disproportionately affected by adjustments to benefits in payment due to mixed service, for example where an overpayment of benefits has happened, no member will be subject to an unreasonable individual burden or would suffer significant prejudice.

3.21 No other specific equality impacts have been identified with this policy although we do not have specific data relating to all the other protected characteristic groups for this remedy population. The policy design and implementation is inclusive and will be communicated in a clear and accessible way. The input from behavioural scientists in forming the communication strategy and products for this group is particularly important in dealing with deceased members’ families and those who have retired due to ill health. Where a member has any difficulties with the information given or complying with the requirements there will be signposting to further guidance and support. In addition, the provision of a default election means benefits will not be lost if an election is not made by a member or their representative.

3.7 Proposed scheme policy for the Scheme Manager to make decisions in the absence of member elections

3.22 Where a member does not respond to communications offering an election of alternative scheme benefits, the scheme regulations will provide for the scheme to make a choice for the member. It will be assumed that the member does not want to receive alternative scheme benefits for the remedy period and the benefits that are in payment will continue. This does not apply where the member had tapered protection and is receiving benefits from both legacy and reformed schemes. In these cases, the Scheme Manager will make an election to pay the highest value benefits from either the legacy or new scheme equivalent benefits. The highest value will be determined in consultation with the scheme actuary.

3.23 This approach is viewed as giving the member a fair outcome should they choose not to respond or are unable to respond and make an election. This default position will be clearly shown in the remediable service statement (RSS) that will be sent. No impacts that would negatively affect any protected characteristics have been identified in defining this policy.

3.8 Deferred choice decision

3.24 Members who have not taken benefits will be offered the choice between taking legacy or reformed scheme equivalent benefits for remediable service, at the point at which the benefits become due.

3.25 As the choice will be offered to all members irrespective of any of the protected characteristics, and this policy is designed to correct direct and indirect discrimination it is not considered that this raises any cause for concern for any of the protected characteristic groups.

3.26 The deferred choice underpin is the option that will apply to about 300,000 remediable service members which is about 70% of the remedy population. These are likely to be unprotected members aged under 50 at the date the 2016 valuation data was collected. This remedy solution will be in place for a number of years until all remediable service members have made their choice. This policy allows members to choose between legacy or new scheme equivalent benefits at the time benefits are brought into payment. This means they will be able to make the decision at the appropriate time with relevant information based on their circumstances at that time.

3.27 This policy applies to all remediable service members and the scheme manger does not consider that any of the protected characteristic groups will be subject to different treatment or impacted in a negative way. Where a member has any difficulties with the information given or complying with the requirements there will be signposting to further guidance and support and default options will be in place and explained.

3.28 Where a difference in treatment on the basis of age will occur is for members with mixed benefits, because they will not be able to keep the benefits already in payment. These members fall into the taper protected category which makes up 12% of the overall remedy population and females represent almost 55% of this group. It is felt this difference in treatment can be justified as the taper protected group were subject to different treatment on the introduction of the 2015 scheme. These members were allowed to defer moving to the new scheme due to age related conditions. Consideration has been given to the potential for members to be disproportionately affected by adjustments to benefits in payment. If an overpayment of benefits happens due to the removal of mixed service benefits, no member will be subject to an unreasonable individual burden or would suffer significant prejudice. The Scheme Manager determines this policy to be a proportionate means of achieving a legitimate aim in putting right previous discrimination.

3.9 The Remediable Service Statement

3.29 Members will receive a remediable service statement, RSS that sets out:

- the benefits available to them for the remediable service from the legacy scheme and new scheme equivalent

- how to respond to make a choice

- where to find out more information

- the deadline for making an option

- what happens if no immediate choice election is made

This is the key information that will be provided, the RSS will contain more information

3.30 The policy design and implementation is inclusive and will be communicated in a clear and accessible way. The RSS will be in paper format and posted out to members, there will be different options available for how a response can be made, paper or electronic communication. The input from behavioural scientists in forming the communication strategy and products for this group is particularly important in dealing with deceased members’ beneficiaries and those who have retired due to ill health.

3.31 A decision was taken to engage with behavioural scientists early on in the development process, this was seen as essential to shape and inform the communications strategy and products. It was acknowledged that communication would be critical for engaging effectively with members about the remedy due to the potentially complex nature of some of the choices members may face. Members will be asked to make an active and informed decision between different pension arrangements that may be unfamiliar to them. This early engagement informed that disabilities and old age could impact people’s ability to process complex information and may impact their ability to make informed decisions. This reinforced the need to make the remedy information, processes and engagement with members clear, inclusive, supported, wide reaching and accessible. The RSS can be issued in Braille or a language other than English on request.

3.32 The RSS will provide the appropriate options to members at the appropriate time. The RSS was developed with the help of behavioural scientists. Testing of several versions of the RSS was carried out by the behavioural scientist through one to one interviews, firstly with a number of retired members. Each example RSS was shared with the pensioner members and they were asked to comment on the presentation of the information and which they preferred and why. The feedback gathered from the interviews informed the final version of the basic RSS to be used.

3.33 The 2015 Remedy communication strategy has 15 guiding principles:

- To put members at the heart of all communications & engagement approaches

- To understand the needs of our employers when asking them to support us in communicating with members

- To make sure our communications are accessible to all by providing multiple media channels

- Deliver communications in ‘plain English’

- Be mindful of the diverse nature of our audience

- Deliver communications in a way which brings about the right response and action from our stakeholders

- Do what is right for our members and employers, not just what is easy

- Apply the right level of empathy and sensitivity to support members in difficult scenarios, for example, bereaved next of kin or those suffering with ill health

- Make sure that all communications are accurate, timely, concise, and targeted

- Use a joined up and full approach that manages the range of stakeholder needs

- Be mindful of maintaining engagement with members, without saturating them with unnecessary information

- Work to adapt and modify existing messaging and channels to ensure that it is right for our stakeholders

- Use Cabinet Office protocols regarding external communications

- Establish clear outcomes and targets, measure against these and adjust our approach as necessary

- Seek to deliver value for money in the delivery of our communications and engagement activities.

3.10 Decisions about the treatment of remediable service

Opted-out service elections and the Partnership Pension Arrangements

3.34 The PSPJO Act 2022 states scheme regulations for legacy schemes must allow that members can elect to reinstate opt out service in the remediable service period, if they can show that they opted out as a result of the introduction of the reformed schemes.

3.35 The scheme regulations will set out the application process for members to apply for opted out service to be reinstated including the conditions that must be met for the application to be successful. These regulations will also cover circumstances where an application would be unsuccessful. Where a member had joined the Partnership Pension arrangements on opting out, the impact of the reinstatement of service to the legacy scheme will be explained.

3.36 The member will be provided with a Remediable Benefit Statement containing full information on the impact to their potential pension benefits before they will be able to make a reinstatement election. As well as containing the benefit options this document will set out the requirements and conditions for making such an election.

3.37 Potentially, members with any of the protected characteristics could be impacted but this would be in the same way as for other members. For members who have opted out there is no data available to determine that members of any particular protected characteristic group opted out of the scheme in the remedy period. The main driver identified for opting out has been identified as financial, as statistical information indicates those earning between £20k and £30k represent the highest proportion of opt outs. The male female split of members opting out is consistent as the table below shows and opt out rates have generally decreased year on year from 2012.

| Members opted out | Total | Female | % | Male | % |

|---|---|---|---|---|---|

| 2012 | 6921 | 3535 | 51 | 3386 | 49 |

| 2013 | 4577 | 2307 | 50 | 2270 | 50 |

| 2014 | 3905 | 1865 | 48 | 2040 | 52 |

| 2015 | 3582 | 1754 | 49 | 1828 | 51 |

| 2016 | 3720 | 1791 | 48 | 1929 | 52 |

Table data provided by MyCSP

3.38 No evidence of impact to any protected characteristic groups has been identified with this policy. The remedy population in this category is small and could apply to unprotected and taper protected members. Of opted out members who have Partnership Pension accounts, the figure is around 10,000 but we do not have a breakdown of members eligible for remedy within this number. The policy is a proportionate means of achieving a legitimate aim following the introduction of primary legislation.

3.11 Member Voluntary contributions

Added pension

3.39 Where members have paid contributions to purchase new scheme added pension in the remediable service period. Potentially, members with any of the protected characteristics could be impacted but this would be in the same way as for other members.

3.40 Unprotected members with alpha added pension purchase represent just over 1% of the unprotected remedy population, around 4,500 members. Members will have a choice under Section 20 of the PSPJO Act 2022 on how to treat the added pension purchase when they are returned to the legacy scheme. The options will be;

-

New scheme added pension removed and equivalent added pension benefits applied to the legacy scheme; or

-

Rights extinguished in new scheme and equivalent benefit provision in the legacy scheme if the same benefit type does not exist in legacy scheme; or

-

New scheme added pension contributions are refunded adjusted for any tax relief received, the added pension rights are removed.

3.41 For members who purchase added pension there is no data available to determine whether members with any protected characteristics have purchased added pension in the remedy period. The remedy population in this category is very small and there is no evidence to suggest any negative impacts to any protected characteristic group will result due to this policy. The policy gives the member the choice of how to deal with any added pension purchase and is a proportionate means of achieving a legitimate aim following the introduction of primary legislation.

Effective Pension Age and Enhanced Effective Pension Age

3.42 Where members have paid contributions to the new scheme for effective pension age or enhanced effective pension in the remediable service period. Potentially, members with any of the protected characteristics could be impacted but this would be in the same way as for other members.

3.43 Unprotected members who have contributed to effective pension age (EPA) or enhanced effective pension age (EEPA) make up about 1,600 members, 0.40%, of the unprotected remedy population. The number of members affected is very small and there is no data available about protected characteristics for these members. There is no evidence to suggest any negative impacts to any protected characteristic group will result due to this policy. The policy gives members the choice of how they want to treat EPA or EEPA contributions made in the new scheme. They will be able to convert the contributions to legacy scheme added pension or receive a refund of contributions paid. This is a proportionate means of achieving a legitimate aim following the coming into force of primary legislation.

3.44 Where the member decides they do not want to convert the rights for the EPA or EEPA to the equivalent added pension in the legacy scheme or take the contributions paid in the form of compensation. This may be because they intend to elect for new scheme benefits when they make their section 10 election. There will be an option available for members to reduce or waive the amount of contributions repayable by the scheme. This will be made by a formal agreement between the member and the Scheme Manager. The agreement will provide that the rights are immediately extinguished and set out the options available when the member comes to make their remedy choice through the section 10 election. As part of the section 10 the member may;

(i) opt to receive the refund of the liability owed by the scheme, or (ii) opt for rights in the scheme equivalent to the value of the rights extinguished at the date of the agreement

3.12 Pension Sharing on divorce

3.45 Protected, unprotected and taper protected members with pension sharing orders in the remedy period make up about 1,120 members, 0.3%, of the remedy population. Recalculation of the value of the pension using a cash equivalent transfer value for the remediable service will be needed to determine the value as if the member had always been a member of the legacy scheme. Where a member has mixed service two calculations are needed to determine the highest value benefits, in consultation with the scheme Actuary. Two cash equivalent transfer values will need to be calculated using the relevant remediable service, one based on legacy scheme benefits and one based on new scheme benefits.

3.46 For pension debit members an adjustment only applies where the alternative CETV calculation gives a higher amount. But in the case of mixed benefit members an adjustment is always necessary and could be higher or lower. This is because the CETV to be used is determined as the higher of new scheme or legacy scheme benefits based on remediable service. Mixed benefits cannot remain in any form under the remedy legislation, as this could be viewed as providing more favourable treatment to this group of members.

3.47 Pension credit members will be awarded a remediable credit adjustment where the recalculations determine the alternative scheme provides cash equivalent benefits of higher value, as determined by the scheme Actuary. The credit adjustment will be added to the existing pension credit member record. Where a pension credit member has a pension credit in both the legacy and new scheme, due to the pension debit member having mixed service, or as directed by the PSO they must select one scheme for the pension credit rights.

3.48 The number of members affected is very small and there is no data available on protected characteristics for these members. Potentially, members with any of the protected characteristics could be impacted but this would be in the same way as for other members. There is no evidence to suggest any negative impacts to any protected characteristic group will result due to this policy.

3.13 Transfers

3.49 Where a member transfers remediable service in from one public service pension scheme to another public service pension scheme on the Club terms, the policy is that they will continue to receive a choice of whether to receive legacy scheme benefits or new scheme benefits in the receiving scheme at retirement. Potentially, members with any of the protected characteristics could be impacted but this would be in the same way as for other members.

3.50 Transfers out of the scheme are uncommon and there are only about 1,000 cases that will need to be reviewed for the remedy.

3.51 Where a protected, unprotected or taper protected member has transferred out of the Civil Service pension arrangements including remediable service, recalculation of the transfer value under the alternative pension scheme arrangements will be carried out. This is to determine the higher value cash equivalent transfer value that is available from the legacy or new scheme. Any additional amount would be offered to the scheme that received the member’s transfer. Where the scheme is unable to accept the additional amount the member may be offered a compensatory payment instead. Where a lower value is determined, which may happen for members with mixed service, the scheme will make provision to waive any recovery of the transfer paid. Potentially, members with any of the protected characteristics could be impacted but this would be in the same way as for other members.

3.14 Partial Retirement

3.52 To eliminate any discrimination that may have resulted from members who partially retired during the remedy period, the Scheme Manager is proposing to follow the policy set out below. About 27,500 members, 6.5%, of the remedy population are affected in this category.

3.53 Members who partially retired during the remedy period will be treated as immediate choice members and will be offered an immediate choice as to which benefits they wish to take for the remedy period. The RSS containing the information setting out the benefits and options available will be provided within 18 months of 1 October 2023. No further choice will be given at final retirement in respect of remediable service.

3.54 Active members who partially retired before or after the remedy period (so before 1 April 2015 or after 31 March 2022) and have not fully retired by 1 October 2023, will not be treated as immediate choice members. These members will fall into the deferred choice category and get their remedy choice when they fully retire.

3.55 There is no protected characteristic data collected for members who partially retire. Partially retired members by definition will be older and aged over 50, but potentially could have other protected characteristics. There is no differential treatment identifiable for protected characteristic groups in this policy. Ill health retirement

3.56 To eliminate any discrimination that may have resulted from members who retired on the grounds of ill health in the remedy period and mitigate any further discrimination through the remedy, the Scheme Manager is proposing to review all ill health retirement cases for members who retired on the grounds of ill health during the remedy period (1 April 2015 to 31 March 2022). In addition, for those who applied for ill health retirement on or before 31 March 2022 but were not successful. These reviews will be carried out, as far as possible, before 1 October 2023.

3.57 The immediate choice section of the remedy population are to be contacted with their remedy choice as soon as is practicable once the scheme regulations come into force and the Scheme Manager will be dealing with the immediate choice for ill health retirement cases as high priority.

3.15 Immediate choice options

a) Eligible protected pensioner members in receipt of PCSPS ill health benefits fall within the definition of ‘pensioner member’ in the PSPJO Act and will be offered an immediate choice election to receive new scheme equivalent benefits, under section 6 of the PSPJO Act 2022.

b) Eligible unprotected pensioner members in receipt of alpha ill health benefits fall within the definition of ‘pensioner member’ in the PSPJO Act and will be offered an immediate choice election to receive PCSPS benefits under section 6 the PSPJO Act 2022.

3.58 Before the choices set out in a) and b) above can be offered to members the Scheme Manager has to determine if the member would have met the relevant ill health retirement criteria in the other scheme. This means for the members in a) (about 3,500 members) the scheme medical adviser, who determines if a member meets the ill health retirement criteria will need to review the medical information originally provided under the criteria for alpha ill health retirement.

3.59 The Scheme Manager has concluded, following advice from the scheme medical adviser, that for the members in b) it will generally not be necessary to carry out a further review of the medical information as the criteria for ill health retirement in alpha is such that the ill health criteria in the PCSPS would be met (save for some exceptions).

3.60 There is no protected characteristic data collected for members who retire on the grounds of ill health. Potentially, members with any of the protected characteristics could be impacted but this would be in the same way as for other members.

4. Specific Equality Act Legislation

This section summarises the Scheme Manager’s assessment of whether the principles of the PSED have been met.

4.1 Direct discrimination

4.1 The PSPJO Act corrects the direct age discrimination and indirect sex and race discrimination identified by the Courts in 2018. The remedy policy does not include any provisions that would be applied differently to members of any of the protected characteristic groups. It is designed to provide the scheme with the powers to correct the discrimination. Firstly, by treating all active members in the same way from 1 April 2022 by moving them to the reformed scheme. When these regulations come into force, all active and deferred members with remediable service will be deemed to have been in the PCSPS for the period 1 April 2015 to 31 March 2022, meaning all members are treated the same for this period. In acknowledging that the reformed scheme may have been preferential to some of those who were moved into it on or after 1 April 2015, the remedy allows all members with remediable service (including ‘protected’ members) to elect to receive reformed scheme benefits for the remedy period. Pensioner and deceased members will make their election as soon as possible after 1 October 2023.

4.2 Indirect discrimination

4.2 The remedy policy does not include any provisions that would be applied differently to members of any of the protected characteristic groups.

4.3 The Scheme Manager is aware that the remedy measures could impact differently on certain members who may share a protected characteristic. However, where this is the case, it is considered that this can be justified in achieving the overall remedy objective as set by the core principles of the PSPJO Act 2022.

4.4 It has been determined through this analysis that certain scheme flexibilities may impact some groups more than others. This is not unexpected due to the nature of transitional protection policy of the 2015 pension reforms and because the remedy is putting right the direct age discrimination introduced. In addition, the policies give all members control of the benefits they wish to receive and do not just impose one solution. For example, the inclusion of a default option for members with benefits in payment means the Scheme Manager can record the option taken as no alternative scheme benefits election received and continue to pay benefits as awarded. This policy is designed to prevent indirect discrimination to those who may be unable to respond meaning there will be no loss of benefits or other negative outcomes linked to the remedy.

4.5 The Scheme Manager has recognised that parts of the remedy are very technical in particular for members rolled back to the PCSPS. Any pension rights for the remedy period will need to be reviewed as a result of the roll-back, members will need to be made aware of the impact of this and will be offered options by providing clear, inclusive, accessible communications. Some members may need further support when making these final benefit choices. The Scheme Manager has engaged with behavioural scientists to make sure that all these factors are taken into account in all the communication and support channels used.

4.3 Harassment and victimisation

Harassment – this is unwanted conduct related to a relevant protected characteristic which has the purpose or effect of either violating a person’s dignity, or creating an intimidating, hostile, degrading, humiliating or offensive environment.

Victimisation - this occurs where a person subjects another person to a detriment because either they have done a protected act or it is believed they may do a protected act.

4.6 The Scheme Manager does not consider there would be a risk of harassment or victimisation to members with any of the protected characteristics as a result of any of the measures in the proposed legislation.

4.4 Advancing of equality of opportunity

4.7 The Scheme Manager has considered how all the measures in the proposed retrospective remedy scheme legislation might impact on the advancement of equality of opportunity. The measures in the proposed legislation will supplement the primary legislation with the ultimate effect of correcting the age discrimination identified. It will apply equally to all eligible members, irrespective of their protected characteristics. Therefore, the Scheme Manager does not consider any of these measures would negatively affect equality of opportunity or actively advance equality of opportunity.

4.5 Eliminating unlawful discrimination in relation to disability and the duty to make reasonable adjustments

4.8 The Scheme Manager has very limited evidence to assess whether any of the measures in the proposed legislation are likely to directly or indirectly discriminate against people with disabilities. However, due regard has been applied to this protected characteristic, in particular the engagement with behavioural scientists has been used to assist and inform the Remedy communications in terms of content, method and style. It is considered that the measures in the proposed legislation will not unlawfully discriminate in relation to disability and reasonable adjustments to access information and support will be available as required.

4.6 Fostering good relations

4.9 The Scheme Manager does not consider that the measures in the proposed legislation will actively foster good relations between those who share a protected characteristic and those who do not. However, the need to foster good relations was acknowledged when formulating the proposals for these measures so that they are not incompatible with this aim.

4.10 Further, in line with the government’s analysis for the PSPJO Act, the Scheme Manager believes that all the measures in the proposed remedy legislation, offer all scheme members, irrespective of any protected characteristics, equal opportunities. In turn this would respect the fostering good relations principle, as it will not create differences in treatment and affords all members the opportunity to choose the scheme benefits they receive for any remediable service. As such, the Scheme Manager does not determine that the proposed legislation will damage relations between groups.

4.7 Summary/Conclusion:

4.11 Based on the analysis in this report and because the scheme regulations are needed to support legislation to address direct age discrimination and indirect race and sex discrimination, the Scheme Manager has not identified any evidence to indicate that any of the protected characteristic groups will be negatively impacted.

4.12 In terms of the Public Sector Equality Duty aims, the Scheme Manager is of the opinion limb 1, to eliminate unlawful discrimination and other prohibited conduct, is met by the introduction of these policies and scheme regulations. Careful consideration has been given to the new policies to prevent further indirect discrimination being introduced.

4.13 In respect of limb 2, to advance equality of opportunity between persons who share a relevant protected characteristic and persons who do not share it, the Scheme Manager has sought to advance equality of opportunity by being as inclusive as possible throughout the design and implementation processes of the policy, by:

- developing an extensive member engagement programme

- seeking advice from behavioural scientists in formulating member communications

- developing interactive digital tools to assist members to understand what the remedy means for them

- early engagement with members, use of focus groups and collecting feedback through the Civil Service pensions website and webinars

- early engagement with Unions and employers

- demonstrating through the extensive communication strategy that the policy offers all eligible members the same opportunities and choices (where relevant) irrespective of any of the protected characteristics

4.14 In respect of limb 3, foster good relations between persons who share a relevant protected characteristic and persons who do not share it, the Scheme Manager does not consider this policy subject matter touches on tackling prejudice or promoting understanding between people from different protected characteristic groups. This policy does not involve treating some people more favourably than others to advance this aim. As such, the Scheme Manager does not determine that the proposed legislation will damage relations between groups.

5. Limitations

5.1 It should be acknowledged that all the data used in this EQIA is collected at a specific point in time that and may not be the same as when the legislation comes into force.

5.2 This report is produced for the purposes of analysing the potential impact of the Remediable Service Remedy.

6. Monitoring

6.1 Measures to monitor stakeholder interaction with the policy;

Before the regulations come into force:

- The public consultation to be carried out will provide a record of any initial concerns raised that we can consider.

- Review opinions and concerns raised by the consultation process.

After the regulations come into force:

- Monitor of telephone enquiries or complaints from the scheme administrators helpline.

- Monitor member complaints from various sources, administrator, IDR, Ministerial correspondence and FOI requests.

7. Annex A

7.1 Active membership analysis

Members eligible for remedy

Members are eligible for the Remediable Service Remedy (that is, eligible to choose between either legacy or reformed scheme benefits in the Remedy Period), if they meet the following criteria:

-

Date of Joining scheme before 1 April 2012, or

-

Protected or Taper Protected Status

For the purposes of this analysis, we have identified eligible members using membership data provided to the Government Actuary’s Department (GAD) by MyCSP Ltd for the purposes of the 2016 actuarial scheme valuation.

The following analysis has been carried out on the active membership population as at 31 March 2016. It is acknowledged that by only analysing the active membership data it may mean certain eligible members may not be included in the analysis (e.g. those who left the Scheme or retired after 1 April 2015 and before 31 March 2016). It was considered that including these members would not make a material difference to the outcomes of the analysis.

7.2 Table 1 – Eligibility for the Transitional Protection Remedy and Protection status

| Eligible for Transitional Protection Remedy | Number of active members as at 31 March 2016 | Proportion of active membership as at 31 March 2016 |

|---|---|---|

| Unprotected members | 222,463 | 48% |

| Taper protected members | 54,807 | 12% |

| Protected members | 105,876 | 23% |

| Total | 383,146 | 83% |

| Not eligible for transitional protection | 80,856 | 17% |

| Total active membership as at 31 March 2016 | 464,002 | 100% |

7.3 Table 1.2 – Members eligible for the Transitional Protection Remedy by Protection status and Legacy scheme

| Classic | Classic Plus | Premium | Nuvos | Total | |

|---|---|---|---|---|---|

| Unprotected members | 104,890 | 4,831 | 66,358 | 46,384 | 222,463 |

| Tapered Protected members | 39,279 | 1,555 | 10,702 | 3,271 | 54,807 |

| Protected members | 76,138 | 2,392 | 23,359 | 3,987 | 105,876 |

| Total | 220,307 | 8,778 | 100,419 | 53,642 | 383,146 |

The majority (58%) of members who are eligible to choose between legacy and reformed scheme benefits, have built up benefits in the classic section of the PCSPS. The second largest group is those with benefits built up in premium at 26%, with smaller proportions having built up benefits in nuvos at 14% or classic plus at 2%.

Eligible members who built up benefits in premium and nuvos are mostly unprotected members at 66% and 86% of the eligible membership of those schemes respectively.

Of the eligible members who built up benefits in classic and classic plus, the proportion who are taper protected or protected and the proportion who are unprotected members is broadly similar.

The report provided by GAD analysed the protected characteristics, where the data available allowed, of all members eligible to choose between either legacy or reformed scheme equivalent benefits for the Remedy Period.

8. Annex B – Equality Impact Analysis: Age

As previously outlined, the Courts determined that the transitional protection element of the 2015 public service pension scheme reforms treated those members who were closest to retirement more favourably than younger members, and this amounted to direct age discrimination.

This section of the EQIA sets out the impact of the secondary legislation that will implement the retrospective transitional protection remedy against the protected characteristic, age, as identified in the Equality Act 2010. This is in line with the Government’s duty to have due regard to the need to eliminate discrimination, advance equality of opportunity, and foster good relations. Civil Service statistics for 2021 show that the median age of civil servants is 45 years, down from 46 in 2020. The proposed remedy provides equal treatment in terms of pension provision across the total Civil Service Pension Scheme membership, irrespective of age at any point in time.

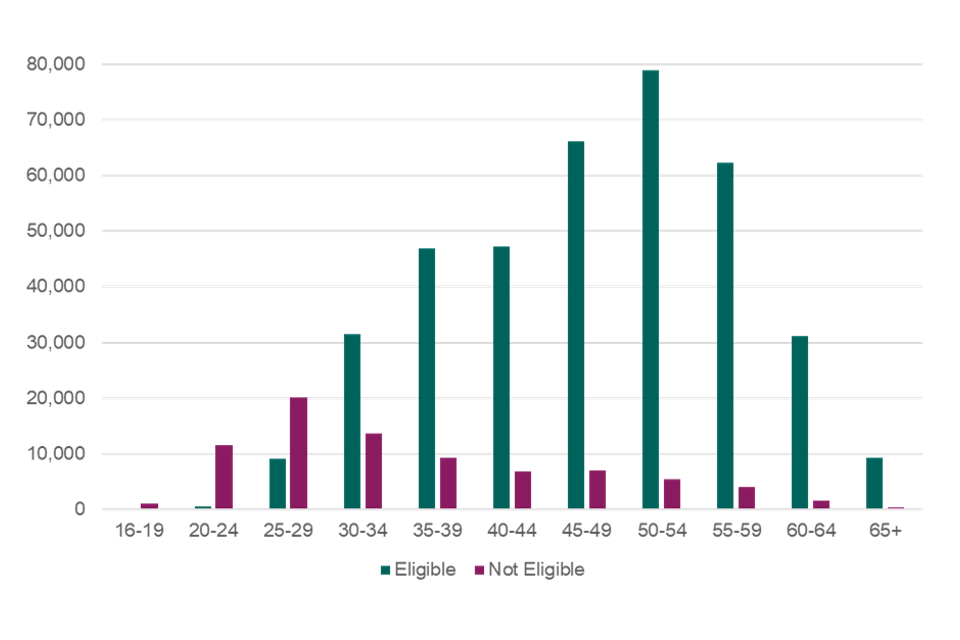

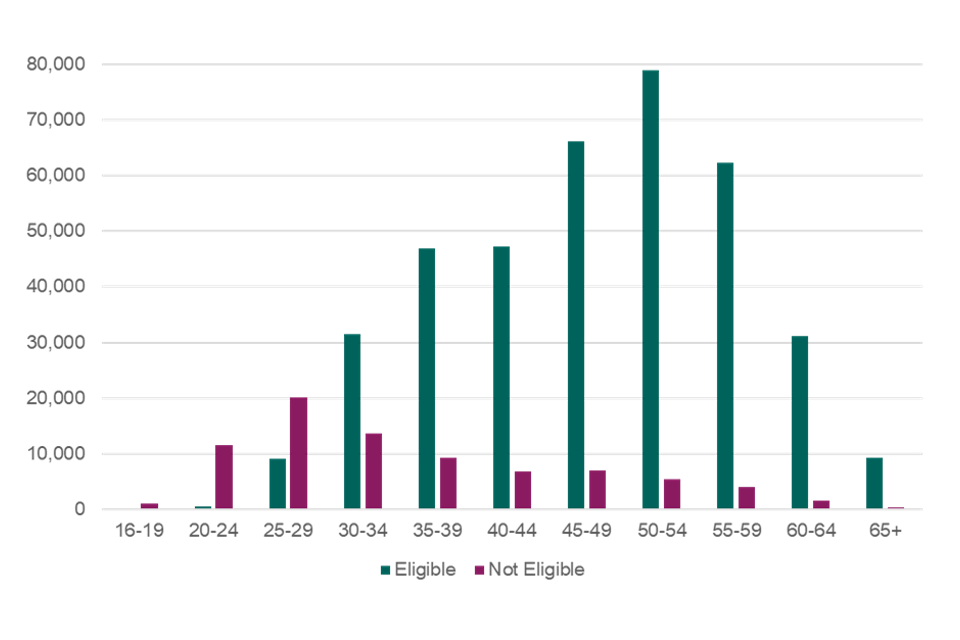

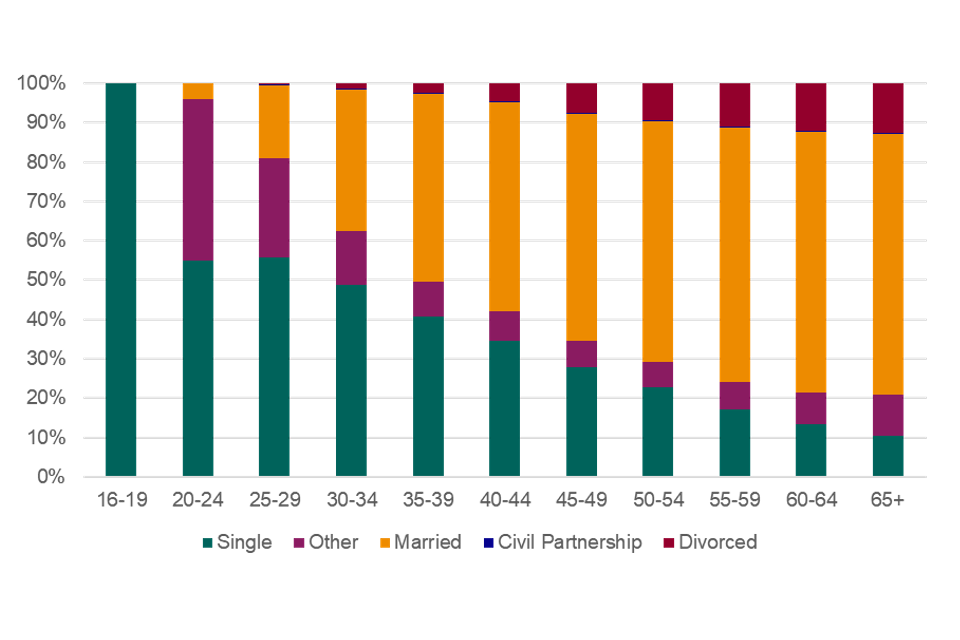

Typically, members who have joined the scheme since 1 April 2015 are likely to be younger than those members in the transitional protection group. The breakdown in membership by age and members who were eligible for protection is demonstrated in Chart 1 and Table 2 below.

The fact that those with transitional protection will be over a certain age reflects the discriminatory nature of the transitional protection, and the Government does not consider the removal of that unjustified discrimination to be discriminatory.

The analysis carried out indicates that 48% of the active membership are unprotected members, these members will be impacted by being rolled back to their legacy schemes for the remedy period. 17% of the membership are not eligible for any remedy. This indicates a different treatment by age for 17% of the active membership but this is justified and not seen to present a negative impact on the protected characteristic of age. This policy is a proportionate means to achieve the legitimate aim to remove the age discrimination introduced by treating members differently according to their age in 2012.

The UK Government’s policy decision to provide all eligible members with a choice of legacy scheme or reformed scheme equivalent benefits in the remedy period is one aspect of the approach to address the age discrimination identified.

The analysis below shows the split by age of Civil Service Pension Scheme members eligible to choose between legacy and reformed scheme equivalent benefits in the remedy period.

8.1 Analysis: Age

GAD analysed the split by age of members eligible to choose between legacy and reformed scheme equivalent benefits in the remedy period.

Table 2 and chart 1 sets out the age profile of all active members in the Civil Service Pension Scheme as at 31 March 2016, as well as the age profile of the active members eligible to choose between legacy and reformed scheme equivalent benefits in the remedy period, together with the age profile of those members who are not eligible for the remedy.

Table 2- Eligibility for the Transitional Protection Remedy by Age

| Age as at 31 March 2016 | All Active Members | Active Members Eligible for Remedy | Active Members NOT Eligible for Remedy |

|---|---|---|---|

| 16-19 | 1,007 | 1 | 1,006 |

| 20-24 | 12,014 | 504 | 11,510 |

| 25-29 | 29,301 | 9,134 | 20,167 |

| 30-34 | 45,117 | 31,485 | 13,632 |

| 35-39 | 56,161 | 46,883 | 9,278 |

| 40-44 | 54,213 | 47,306 | 6,907 |

| 45-49 | 73,059 | 66,141 | 6,918 |

| 50-54 | 84,430 | 78,972 | 5,458 |

| 55-59 | 66,324 | 62,294 | 4,030 |

| 60-64 | 32,790 | 31,170 | 1,620 |

| 65+ | 9,586 | 9,256 | 330 |

| Total | 464,002 | 383,146 | 80,856 |

8.2 Chart 1 Eligibility for the Transitional Protection Remedy by Age

Chart 1 Eligibility for the Transitional Protection Remedy by Age

8.3 Table 3- Eligibility for the Transitional Protection Remedy by Age and protection status

Age profile of the members eligible to choose between legacy and reformed scheme benefits, split by protection status.

| Age as at 31 March 2016 | Unprotected Members | Tapered Protected Members | Protected Members | Total |

|---|---|---|---|---|

| 16-19 | 1 | 1 | ||

| 20-24 | 504 | 504 | ||

| 25-29 | 9,134 | 9,134 | ||

| 30-34 | 31,485 | 31,485 | ||

| 35-39 | 46,883 | 46,883 | ||

| 40-44 | 47,306 | 47,306 | ||

| 45-49 | 66,141 | 66,141 | ||

| 50-54 | 19,817 | 51,536 | 7,619 | 78,972 |

| 55-59 | 1,139 | 3,271 | 57,884 | 62,294 |

| 60-64 | 32 | 31,138 | 31,170 | |

| 65+ | 21 | 9,235 | 9,256 | |

| Total | 222,463 | 54,807 | 105,876 | 383,146 |

This analysis shows that the age profile of the members for each protection status is as expected based on the protection status criteria (e.g. protected members are closest to retirement, and taper protected members are closer to retirement than unprotected members).

Table 3.1 sets out the age profile of the members eligible to choose benefits in the remedy period split by legacy scheme.

| Age as at 31 March 2016 | Classic | Classic Plus | Premium | Nuvos | Total |

|---|---|---|---|---|---|

| 16-19 | 0 | 0 | 0 | 1 | 1 |

| 20-24 | 6 | 0 | 6 | 492 | 504 |

| 25-29 | 37 | 1 | 2,054 | 7,042 | 9,134 |

| 30-34 | 4,171 | 57 | 14,405 | 12,852 | 31,485 |

| 35-39 | 18,992 | 699 | 19,394 | 7,798 | 46,883 |

| 40-44 | 26,533 | 1,442 | 13,623 | 5,708 | 47,306 |

| 45-49 | 44,181 | 2,113 | 14,003 | 5,844 | 66,141 |

| 50-54 | 56,118 | 2,289 | 15,022 | 5,543 | 78,972 |

| 55-59 | 43,754 | 1,543 | 12,256 | 4,741 | 62,294 |

| 60-64 | 20,579 | 540 | 7,193 | 2,858 | 31,170 |

| 65+ | 5,936 | 94 | 2,463 | 763 | 9,256 |

| Total | 220,307 | 8,778 | 100,419 | 53,642 | 383,146 |

This analysis identifies that:

-

At ages 20 to 29, the majority of members eligible to be offered a choice of benefits in the remedy period, have built up benefits in nuvos.

-

At ages 30 to 39, the majority of members eligible to be offered a choice of benefits in the remedy period, have built up benefits in premium.

-

At ages 40 to 65+, the majority of members eligible to be offered a choice of benefits in the remedy period, have built up benefits in classic or classic plus.

8.4 Chart 2 graphic sets out the age profile of the members eligible to choose benefits in the remedy period split by legacy scheme

Graphic showing age profile of the members eligible to choose benefits in the remedy period split by legacy scheme.

9. Annex C – Equality Impact Analysis: Sex

This section sets out the analysis of the equality impacts of the policy decision to provide eligible members with a choice of either legacy scheme or reformed scheme benefits in the Remedy Period, on the protected characteristic of sex, as identified in the Equality Act 2010. In line with the Government’s duty to have due regard to the need to eliminate discrimination, advance equality of opportunity, and foster good relations.

In determining that the transitional protection arrangements discriminated on the grounds of age, the Courts also concluded that if older members in a scheme were more likely to be male, providing older members with preferential terms also amounted to indirect sex discrimination.

The UK Government’s policy decision to provide all eligible members with a choice of legacy scheme or reformed scheme benefits in the remedy period is one aspect of the approach that is to be taken to address the age discrimination identified, and in turn, the indirect sex discrimination where it applies.

GAD analysed membership of the Civil Service Pension Scheme by sex, by sex and age, and by sex and working pattern as, in the UK, women fill more part-time jobs than men.

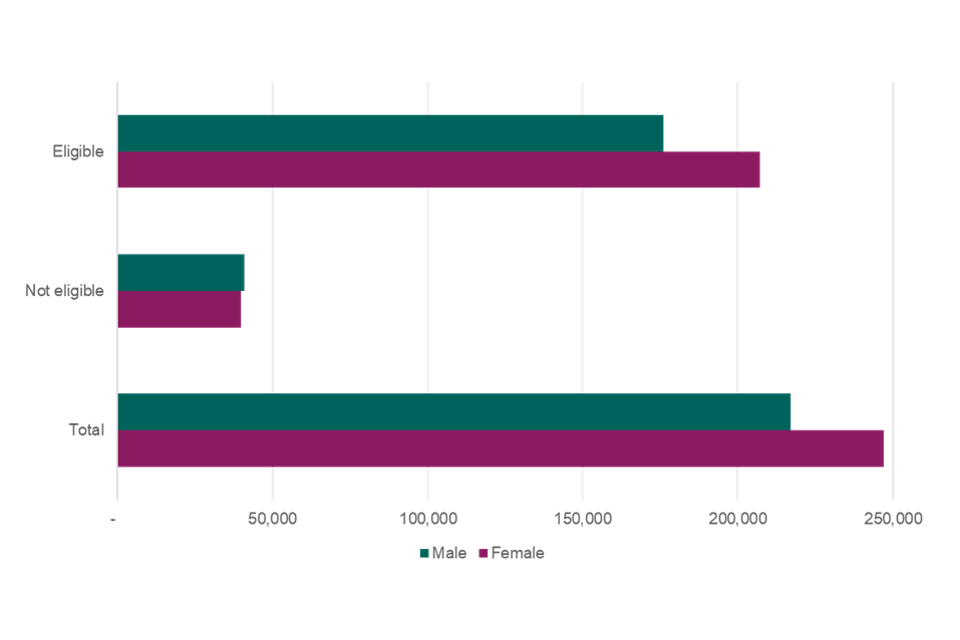

Table 4 sets out the split by sex of all active members in the CSPS as at 31 March 2016, as well as the split by sex of the active members eligible to choose between legacy and reformed scheme equivalent benefits, together with the sex split of those members who are not eligible for the remedy.

Table 4 – Eligibility for Transitional Protection Remedy by Sex

| Active Membership as at 31 March 2016 | Active members as at 31 March 2016 eligible for Remedy | Active members as at 31 March 2016 NOT eligible for Remedy | |

|---|---|---|---|

| Males | 216,985 | 175,994 | 40,991 |

| Females | 247,017 | 207,152 | 39,865 |

| Total | 464,002 | 383,146 | 80,856 |

9.1 Chart 3 – Eligibility for Transitional Protection Remedy by Sex

Bar chart showing Eligibility for Transitional Protection Remedy by Sex

This analysis shows that females account for just over half (53.2%) of the overall active membership of the scheme as at 31 March 2016 and that the eligibility split is quite consistent between males and females, with females accounting for 54.1% of those eligible to choose between reformed and legacy scheme benefits.

Table 4.1 and chart 4 set out details of the sex split of eligible members by protection status.

Table 4.1

| Active Membership as at 31 March 2016 | Active members as at 31 March 2016 eligible for Remedy | Active members as at 31 March 2016 NOT eligible for Remedy | ||

|---|---|---|---|---|

| Males | 216,985 | 175,994 | 40,991 | |

| Females | 247,017 | 207,152 | 39,865 | |

| Total | 464,002 | 383,146 | 80,856 |

9.2 Chart 4 – set out details of the sex split of eligible members by protection status.

Bar chart showing sex split of eligible members by protection status.

This analysis shows that although males account for less than half (45.9%) of all eligible members, the majority of protected members are male at 50.4%. Correspondingly, females account for a greater proportion of unprotected members at 56%.

Table 4.2 shows members eligible for Transitional Protection Remedy split by Sex and Legacy Scheme

| Classic | Classic Plus | Premium | Nuvos | Total | |

|---|---|---|---|---|---|

| Males | 97,958 | 4,099 | 47,681 | 26,256 | 175,994 |

| Females | 122,349 | 4,679 | 52,738 | 27,386 | 207,152 |

| Total | 220,307 | 8,778 | 100,419 | 53,642 | 383,146 |

This analysis shows that the splits of eligible members with accrued benefits in each of the legacy schemes is similar for males and females. For example, the legacy scheme is Classic for 59% of females and 56% for males. The corresponding percentages for the Premium scheme is 25% for females and 27% for males, and for the Nuvos scheme they are 13% for females and 15% for males.

10. Equality Impact Analysis: Sex and Age

Table 4.3 Age profile of active members in the CSPS who are eligible for Transitional Protection Remedy as at 31 March 2016 separately for males and females.

| Age as at 31 March 2016 | Active members as at 31 March 2016 eligible for Remedy | ||

|---|---|---|---|

| Males | Females | Total | |

| 16-19 | 0 | 1 | 1 |

| 20-24 | 259 | 245 | 504 |

| 25-29 | 4,026 | 5,108 | 9,134 |

| 30-34 | 13,402 | 18,083 | 31,485 |

| 35-39 | 19,938 | 26,945 | 46,883 |

| 40-44 | 20,510 | 26,796 | 47,306 |

| 45-49 | 29,808 | 36,333 | 66,141 |

| 50-54 | 35,962 | 43,010 | 78,972 |

| 55-59 | 29,805 | 32,489 | 62,294 |

| 60-64 | 16,649 | 14,521 | 31,170 |

| 65+ | 5,635 | 3,621 | 9,256 |

| Total | 175,994 | 207,152 | 383,146 |

This analysis shows the higher proportion of females eligible and the similarities in the age profiles of eligible males and females up to age 59. There are more males aged 60 and above.

10.1 Chart 4.1 shows the age profile of active members in the CSPS who are eligible for Transitional Protection Remedy as at 31 March 2016 separately for males and females.

Bar chart showing age ranges of active members in the CSPS who are eligible for Transitional Protection Remedy as at 31 March 2016 separately for males and females

10.2 Chart 4.2 shows the age profile and protection status of the members eligible to choose between legacy and reformed scheme benefits, separately for males and female.

Bar chart showing the age profile and protection status of the members eligible to choose between legacy and reformed scheme benefits, separately for males and female.

This analysis tells us the higher proportion of male members with protected status (as shown in Chart 4) is most likely a reflection of the age structure of the group eligible for the Transitional Protection Remedy, whereby there are more males aged 60 and above, who therefore met the criteria for protection.

10.3 Analysis: Sex and Working pattern

Further analysis has been carried out to look at any impact to members working part time. In the PSPJO Act 2022 equality impacts assessment (4.11) the Government recognised that women are more likely to take a career break and work part time than men, the reasons for this are likely to be linked to caring responsibilities or pregnancy and maternity. The remedy eligibility condition allowing qualifying breaks to count in the remedy period allows those who have taken career breaks, for example to care for young children or elderly relatives, to maintain consistency with their colleagues in respect of their pension rights.

10.4 Table 4.4 Transitional Protection Remedy full-time and part time split for males and females.

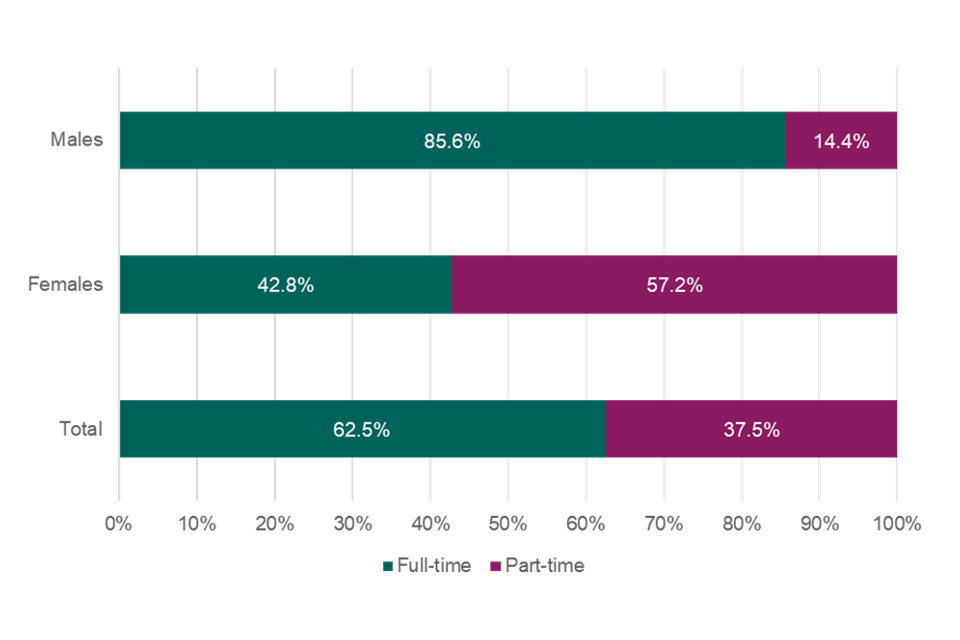

Split of the membership eligible for the Transitional Protection Remedy between those working full-time and those working part-time, separately for males and females.

| Working pattern | Full-time eligible members as at 31 March 2016 | Part-time eligible members as at 31 March 2016 | Total eligible members as at 31 March 2016 |

|---|---|---|---|

| Males | 150,718 | 25,276 | 175,994 |

| Females | 88,730 | 118,422 | 207,152 |

| Total | 239,448 | 143,698 | 383,146 |

Chart 4.3 shows Transitional Protection Remedy full-time and part time split for males and females.

Bar chart showing transitional Protection Remedy full-time and part time split for males and females.

10.5 Table 4.5 Eligible membership for the Transitional Protection Remedy between those working full-time and those working part-time by protection status.

| Working pattern | Full-time eligible members as at 31 March 2016 | Part-time eligible members as at 31 March 2016 | Total eligible members as at 31 March 2016 | |

|---|---|---|---|---|

| Males | 150,718 | 25,276 | 175,994 | |

| Females | 88,730 | 118,422 | 207,152 | |

| Total | 239,448 | 143,698 | 383,146 |

Chart 4.4 shows members eligible for Transitional Protection Remedy by Working Pattern and Protection status

Bar chart showing percentage of members eligible for Transitional Protection Remedy by Working Pattern and Protection status

This analysis shows that a larger proportion of part-time members have Protected status.

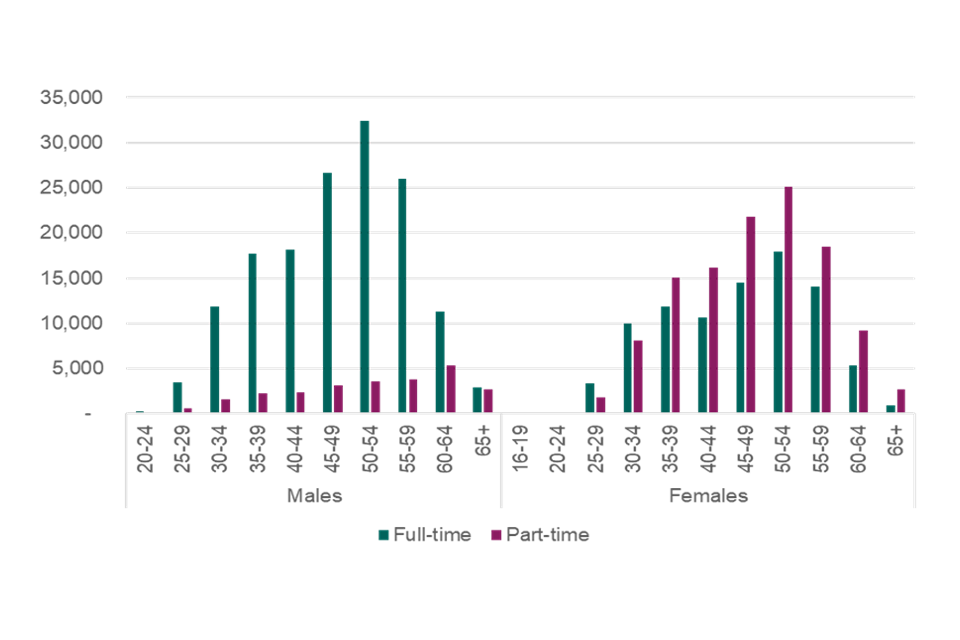

Chart 4.5 shows members eligible for Transitional Protection Remedy by working pattern and age, separately for males and females

Bar chart showing percentage of members eligible for Transitional Protection Remedy by working pattern and age, separately for males and females

This analysis shows that the higher proportion of part-time members with protected status (as shown in Chart 4.6) is a reflection of the age profile of part-time members, and the proportion of part-time members is highest at ages 60 and above, and therefore meeting the criteria for protected status. This analysis is also most likely to capture members with caring responsibilities as non-scheme specific data informs us that carers are more likely to work part time due to their caring responsibilities.

This analysis shows there is a higher proportion of females working part-time but a higher proportion of part-time members with protected status. This tells us the age profile of part-time members, who tend to be older, and the age and sex structure of the group eligible to choose benefits in the remedy period.

This data analysis breaks down the working population by age and sex and working pattern.

The statistical data used in this assessment analyses the active membership in the Civil Service as at 31 March 2016, by protection status. More recent data informs us that the Civil Service is becoming more diverse.

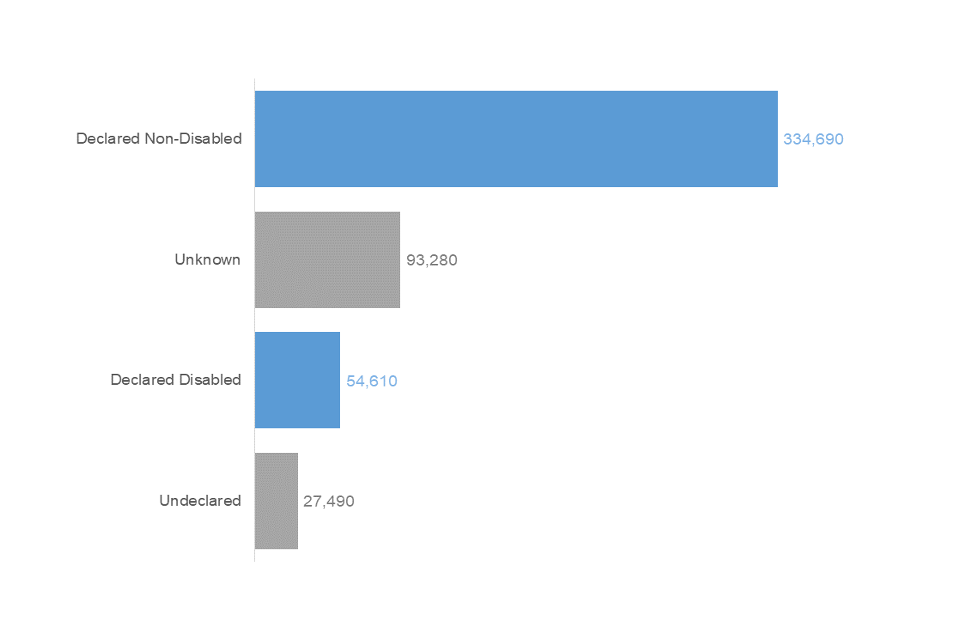

Latest figures show that 54.2% of civil servants are women, 14.3% are from ethnic minority backgrounds and 13.6% are disabled. The representation of ethnic minority staff is in line with the wider working population (13.6% of the UK’s working population were from ethnic minorities in July 2021) whilst disabled staff are still slightly underrepresented (14.7% of the UK’s working population were disabled as at March 2021)[footnote 3].

There is nothing in the remedy design to suggest any indirect discrimination will be extended or new indirect discrimination introduced to the protected characteristic of age or sex.

The proposed legislation being analysed in this EQIA, applies equally to all active and partially retired active, pensioner and deferred members who will be rolled back into their legacy scheme for the remedy period. From 1 April 2022 all active scheme members have been building up pension benefits in alpha.

Alpha is a career average revalued earnings (CARE) scheme, as opposed to the legacy schemes, which are final salary schemes. A CARE scheme is more likely to benefit those with lower salary growth more than higher earners. A larger proportion of males currently reach higher salary bands than females across the public service pension schemes, and it follows that they may be better off under legacy scheme (and final salary) arrangements. A higher proportion of women (and those of other protected characteristics) are likely to be better off under CARE schemes, which are broadly more beneficial for lower and some middle earners. The policy of allowing members to choose which scheme benefits they wish to receive allows members the freedom of choice to determine the benefits they receive and removes any discrimination in the remedy period.

11. Annex D – Race: Impact Assessment

This section assesses the equality impacts of the proposed secondary legislation on the protected characteristic of race as identified in the Equality Act 2010, in line with the Government’s duty to have due regard to the need to eliminate discrimination, advance equality of opportunity, and foster good relations.

The Court of Appeal’s findings in 2018 outlined that transitional protection provisions gave rise to indirect discrimination on the grounds of race.

In the Civil Service the proportion of employees from an ethnic minority group has increased between 2012 and 2020 by 3.9 percentage points (9.3% to 13.2%). This is slightly higher than the public sector average, and indicates that new starters in the Civil Service are more likely to be from an ethnic minority group.

As set out above, overall, a CARE scheme design may offer relatively fairer outcomes to ethnic minority groups who, like women, in some public sector workforces tend to experience lower salary progression.

As explained earlier the scheme does not hold specific data on race in relation to pension scheme membership or administration. Our analysis for this protected characteristic group is that as the remedy is to be applied to all members identified as eligible there will be no significant negative impact on the protected characteristic of race as a result of the proposed legislation. The policy of allowing members to choose which scheme benefits they wish to receive allows members the freedom of choice to determine the benefits they receive and removes any discrimination in the remedy period.

12. Annex E – Disability & Carers: Impact Assessment