Leasehold Reform (Ground Rent) Act 2022: Statutory guidance for enforcement authorities

Published 23 June 2022

Applies to England

1. Introduction

This document has been prepared as a guide for enforcement authorities in England to help them understand how to use their new powers to enforce the Leasehold Reform (Ground Rent) Act 2022 (the “Act”). There is separate guidance for enforcement in Wales.

The government wants to tackle unfair practices in the leasehold market and promote transparency and fairness for both leaseholders and landlords. This Act will mean that if any ground rent is demanded as part of a qualifying new long residential lease, it cannot be for more than one literal peppercorn per year. In effect, future most residential leaseholders will not be faced with financial demands for ground rent.

In England and Wales, the legal framework of the Act places a duty on local weights and measures authorities to tackle landlords that continue to require a payment of prohibited rent, where there is no legal exception. In England, district councils may also enforce, but do not have the duty to do so.

Other relevant legislation includes:

- Consumer Rights Act 2015

- Leasehold Reform Act 1967

- Landlord and Tenant Act 1987

- Schedule 2 of the Housing Act 1988

- Local Government and Housing Act 1989

- Leasehold Reform, Housing and Urban Development Act 1993

- Commonhold and Leasehold Reform Act 2002

2. Purpose and scope

2.1 What is the status of this guidance?

The Act requires that enforcement authorities who carry out enforcement activity under the Act, must have regard to the guidance issued by the Secretary of State, for leases of premises in England, and for leases of premises in Wales, Welsh Ministers.

This guidance should be read alongside the Act.

Where the word “must” is used, this means the guidance reflects a mandatory duty. Where the words “may” or “should” are used, this means that a course of action may reflect a requirement that is recommended or advised.

2.2 What does it cover?

This guidance covers the Act, changes to schedule 5 to the Consumer Rights Act 2015 (duties and powers to which Schedule 5 applies), changes to schedule 11 to the Commonhold and Leasehold Reform Act 2002 (administration charges), changes to section 24 of the Landlord and Tenant Act 1987 (appointment of manager by tribunal) and part 5 of the Housing Act 1985 (right to buy).

2.3 Who may enforce?

In the Act, “enforcement authority” means either a local weights and measures authority in England and Wales, or a district council in England that is not a local weights and measures authority. The enforcement roles include:

Local weights and measures authorities (“Trading Standards”) – in England and Wales must enforce section 3 in its area (Prohibited rent).

Local weights and measures authorities may enforce section 3 elsewhere in England or Wales.

A district council that is not a local weights and measures authority may enforce section 3 in England (both inside and outside the district).

2.4 When did the powers come into force?

The powers for enforcement authorities came into force with the relevant commencement date for the provisions of the Act.

For most new qualifying leases of dwellings (which includes flats, houses) granted on or after 30 June 2022, a landlord must not require a Leaseholder to make a payment of a prohibited rent.

There was a transition period that applied to qualifying leases of retirement homes. The measures came into force on 1 April 2023. A lease is a lease of a retirement home if it is a term of the lease that the premises may only be occupied by people aged 55 or over.

The measures do not apply to leases that were granted before commencement of the Act or to a lease granted after commencement but in accordance with a contract entered before commencement except regarding an option or right of first refusal (“pre-commencement leases”). There are special circumstances concerning replacement leases and non-statutory lease extensions (described later in this guidance).

2.5 What is ground rent?

A ground rent is a payment specified in a lease that the leaseholder is required to make to the landlord (directly or indirectly through an agent or representative) without obligation on the landlord (or person acting on behalf of the landlord) to provide a specific service in return to the leaseholder.

Leaseholders pay ground rent on top of their property purchase price and service charges. There is no obligation to charge a ground rent and there is no clear service provided in return for the payment. The market has seen high and escalating ground rents, which has caused real harm to leaseholders.

2.6 Who is a leaseholder?

A leaseholder is a tenant who owns a leasehold interest in property, granted by a person (the landlord) who holds the freehold interest or a superior leasehold interest in that property. This includes in most cases where a tenant has ceased to be a tenant and also a person acting on behalf of a tenant or a tenant’s guarantor.

3. Application

3.1 Qualifying leases

Generally, a lease qualifies as regulated by the Act where:

-

It is a long lease (exceeding 21 years) of a single dwelling (a building or part of a building, occupied or intended to be occupied as a separate dwelling, together with any yard, garden, outhouses, and appurtenances belonging to it or usually enjoyed with it).

-

It was granted for a premium (any pecuniary (monetary) consideration for the grant of the lease, other than rent.

-

No premium is required where there is a deemed surrender and regrant by virtue of the variation of a lease which is a regulated lease, or a lease granted before the relevant commencement day.

-

It was granted after the relevant commencement date and is not pursuant to a contract entered into before that date excepting options and rights of first refusal (e.g., most leases 30 June 2022 or for retirement homes 1 April 2023).

-

It is not an excepted lease.

3.2 Excepted leases

There are a limited number of leases that are excepted from the application of the Act.

3.2.1 Business Leases

A landlord may charge ground rent of more than ‘an annual rent of one peppercorn’ if the lease is a business lease. A business lease is where:

- the lease allows the premises to be used for business purposes (without needing further consent from the landlord for this use) and

- the use of the dwelling significantly contributes to this business purpose, for example a residential flat above a commercial shop which is where the shop keeper lives and that shopkeeper is also required to open the shop at certain times

- at or before the time the lease is granted the landlord and leaseholder exchange written notices confirming that the use of the premises is for the business purposes specified in the lease

What does the written notice confirming the use of the premises for business purposes need to contain?

The written notice must contain:

- the address (or an identifying description sufficient to identify the premises) for the lease in question, and statements to the effect that:

- the landlord or leaseholder (or prospective landlord or leaseholder) intends the premises demised by the lease to be used, and to continue to be used for purposes which are business purposes and this is expressly permitted by the lease (and no further consent is required from the landlord for such use);

- the nature of the business purposes permitted by the lease (or prospective lease) is such that the use of the premises demised by the lease as a dwelling significantly contributes to the business purposes;

- the lease (or prospective lease) is excepted from the Act and the lease can require the leaseholder to pay a rent which is more than a peppercorn rent;

- the name and signature of the landlord or leaseholder (or prospective landlord or leaseholder) giving the notice or the person authorised to give the notice on that person’s behalf.

The notice can be given by hand, left at the address, sent by post or via electronic communication. The notice must not form part of any instrument creating the lease.

For more information, please see the Leasehold Reform (Ground Rent) (Business Lease Notices) Regulations 2022.

3.2.2 Statutory lease extensions

Statutory lease extensions are excepted, whether of houses, under Part 1 of the Leasehold Reform Act 1967, or of flats, under Chapter 2 of Part 1 of the Leasehold Reform, Housing and Urban Development Act 1993.

3.2.3 Community housing leases

Where the landlord is a community land trust (as defined in section 79 of the Housing and Regeneration Act 2008), or it is a lease of a dwelling in a building controlled or managed by a co-operative society (as set out in paragraph 2B of Schedule 14 to the Housing Act 2004 disregarding subparagraph 3(b) of that paragraph).

For leases in England, the Secretary of State may make regulations specifying further conditions for such leases to meet the exception.

3.2.4. Home finance plans

Where a lease is granted pursuant to an arrangement which is a regulated home reversion plan under Chapter 15A of Part 2 of the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001, or a lease granted by a finance provider to a home buyer pursuant to a ‘rent to buy’ arrangement.

A ‘rent to buy’ arrangement is defined at section 2(10) and is generally where a person buys a freehold or leasehold interest in land (or an undivided share of such an interest) from a finance provider over a defined period by means of payment of a rent.

The Secretary of State may make regulations specifying further conditions for such leases to meet the exception.

4. Provisions of the Act

4.1 Meaning of rent

In its provisions, this Act does not refer to ‘ground rent’ which is an industry term and not defined in legislation and instead it uses the ‘rent’ which is in effect what a ground rent is. Rent is defined in section 22 (2) and ‘includes anything in the nature of rent, whatever it is called’. This is designed to reflect the complexity of how ground rent is defined and used in the market, but to also act as a deterrent to potential attempts by landlords to avoid the provisions of this Act.

Some leases may reserve, or in other words include certain sums within that lease’s definition of what ‘rent’ is i.e., £15 is for building insurance reserved as rent.

A sum that is payable in respect of rates, council tax, services, repairs, maintenance, insurance, or other ancillary matters is not rent for the purposes of this Act merely because it is reserved as rent in the lease. This is to avoid restricting legitimate charges that might be reserved as rent. However, this does mean something reserved as rent cannot be rent, and where something is reserved as rent in a lease, it is still open to challenge by enforcement authorities and the First-tier Tribunal to consider if it is in fact rent.

4.2 Payment of a prohibited rent and meaning of landlord and leaseholder

From the relevant commencement date, a landlord, or a person acting on their behalf, cannot require a leaseholder to make a payment of prohibited rent. A prohibited rent means any rent that exceeds what is permitted by sections 4 to 6 of the Act.

A landlord or person acting on the landlord’s behalf is prohibited from asking the leaseholder for a prohibited rent and must, if they receive a prohibited rent, refund it within 28 days beginning with the day after its receipt. Where the landlord breaches this duty, they may be subject to a penalty and a recovery order issued by the enforcement authority (see 5.2 Financial penalties and 5.3 Recovery of prohibited rent)

In relation to the payment of prohibited rent:

- a ‘landlord’ includes a person acting on their behalf, for instance an agent.

- a ‘landlord’ includes a person that has ceased to be a landlord. This applies to situations where, after the relevant commencement date, a leaseholder pays prohibited rent after which the freehold or superior lease is sold, or the landlord or agent changes.

- ‘leaseholder’ includes a person who has ceased to be a leaseholder where the lease is sold or assigned and also a person acting on behalf of a leaseholder or a leaseholder’s guarantor.

Enforcement authorities should note, “person” includes a body of persons corporate or unincorporate.

4.3 General rule: prohibited rent – ‘peppercorn’

For most qualifying leases, the landlord may not charge more than one peppercorn per year. In practice, it is not expected that a landlord will require the payment of a peppercorn.

There are different rules for shared ownership leases and replacement of pre-commencement leases (sections 5 and 6 of the Act and described below).

4.4 Permitted rent: shared ownership leases

There are special provisions for qualifying shared ownership leases. A shared ownership leaseholder may take an initial share of the property and increase their share up the equity ‘staircase’. As the leaseholder’s share in the equity increases, the percentage owned by the landlord will reduce.

This Act specifies that the rent that may be paid on the leaseholders’ share, may be no more than one peppercorn per year (e.g., If a leaseholder has a share of 60% the rent that may be paid on that share can be no more than one peppercorn per year. For the remaining 40% which is retained by the landlord “any rent” may be charged).

4.5 Permitted rent: leases replacing pre-commencement leases

There are specific provisions where a pre-commencement lease is ‘replaced’, which may be for example via a non-statutory lease extension by way of a deemed surrender and regrant of a lease. This applies to pre-commencement leases where the leaseholder is granted a new replacement lease (including shared ownership leases) that consist of or include some or all the premises demised by (or in other words, covered by) the pre-commencement lease.

The term of the new lease begins before the end of the pre-commencement lease (i.e., there is still time left on the old lease). The new replacement lease is a qualifying regulated lease.

This process will be encountered in two common situations: non-statutory (voluntary) lease extensions or where for some other reason there is a deemed surrender and regrant of a lease which will result in an existing remaining term, and a new replacement term.

A voluntary lease extension is one that falls outside of the statutory process that would be excepted from this Act.

A deemed surrender and regrant is the process whereby a lease by being varied is deemed to be surrendered and regranted. The two situations this occurs are when the term of a lease is extended, or the premises covered by the lease is increased. Either of these may result in a new replacement lease as defined in the Act being granted. An increase to the size of the property demised by (included in) the lease may occur, for instance, where the property demised by the lease is increased by adding the loft space above a top floor flat. Deemed surrender and regrant may also be used to correct an error in the lease.

Under the Act, in a replacement lease the landlord can:

- continue to charge rent for the remaining period on the existing term, however, the amount of rent is capped and cannot increase above the existing terms of the lease (termed the ‘maximum rent’)

- only charge a peppercorn per year for any new term

4.6 Administration charges for collecting peppercorn rents

The Act requires that no administration charge is payable in relation to the collection of any ground rent that is restricted to a peppercorn by this Act. It does this by amending relevant provisions in the Commonhold and Leasehold Reform Act 2002.

The leaseholder will be able to apply to the First-tier Tribunal for a determination under schedule 11 to the Commonhold and Leasehold Reform Act 2002 on whether an administration charge is payable or for an order varying the lease on the ground that such an administration charge is not payable.

The leaseholder may also apply (under section 24 of the Landlord and Tenant Act 1987) to the Tribunal to request that it makes an order appointing a manager where prohibited administration charges have been made. This will enable the Tribunal to take action where, for example, a landlord includes prohibited administration charges in leases on numerous occasions.

4.7 Summary of rent rules

Section 7 of the Act provides that a term reserving a prohibited rent is to be treated as reserving a permitted rent and sets out a table providing what the permitted rent should be in various cases.

Under Section 15, a leaseholder or landlord may make an application to the First-tier Tribunal, for a declaration about the effect of section 7 on the terms of a lease. The leaseholder or landlord may also apply to the Tribunal under schedule 11 of the Commonhold and Leasehold Reform Act 2002 which is amended by section 18 of the Act for a determination as to whether an administration charge for collecting a peppercorn rent is payable. Also, under section 24 of the Landlord and Tenant Act 1987 amended by section 18, the leaseholder may also apply to the Tribunal for an order appointing a manager where prohibited administration charges have been made, such as in leases on numerous occasions.

For the ease of enforcement authorities, below is a reference summary of the rent rules (N.B. this summary is not intended to be a replication of section 7):

Table 1: Reference summary of rent rules

| Rule | Rent permitted |

|---|---|

| General rule for all new regulated leases | One peppercorn per year |

| Shared ownership leases (leaseholder’s share of equity only) | One peppercorn per year |

| Shared ownership leases (landlord’s share of equity only) | Any rent |

| Replacement of pre-commencement leases (remaining term of existing lease only) | Maximum permitted rent; rent capped at existing level in pre-commencement lease |

| Replacement of pre-commencement leases (new term only) | One peppercorn per year |

| Administration charges for collecting a peppercorn rent | Nil |

5. Powers of enforcement authorities

5.1 Enforcing breaches of section 3

A breach of section 3 arises where a landlord requires a leaseholder to make a payment of a prohibited rent if they (or a person acting on their behalf) ask the leaseholder for payment or having received payment fail to refund it within 28 days.

Local weights and measures authorities in England and Wales have a duty to enforce a breach of section 3 in their areas. For the purposes of this duty, the breach occurs in the area in which the premises demised (or granted) by the lease are located. Where the premises are located in more than one area, the breaches are taken to have occurred in each of those areas.

District councils in England have the power, but not a duty, to enforce this section, and may do so both inside and outside their district.

Enforcement authorities may enforce section 3 elsewhere in England and Wales, but do not have the duty to do so. This may apply to situations where the enforcement authority makes an agreement with another authority to do so.

5.2 Financial penalties

The enforcement authority may impose a financial penalty on a person if the authority is satisfied beyond reasonable doubt that the person has breached section 3(1) by requiring a leaseholder to make a payment of a prohibited rent. Reference to a ‘person’ in this section means the landlord, or landlord at the time, who has since ceased to be so. The Act does not permit a penalty to be issued on a person acting on behalf of the landlord, such as an agent.

Before imposing a financial penalty, the enforcement authority must give the landlord a notice of their intention to do so, with a “notice of intent”. The notice of intent must be served within a period of 6 years beginning with the day the breach occurs, and the end of the period of 6 months beginning with the day on which evidence comes to the knowledge of the enforcement authority which the authority considers sufficient to justify serving the notice.

The amount of the financial penalty that may be issued is subject to the discretion of the enforcement authority, within the limits of a minimum of £500 and a maximum of £30,000.

A landlord who commits multiple breaches in relation to the same lease is generally only liable to one financial penalty. However, they will be liable for a further penalty if, having previously had a financial penalty imposed for an earlier breach, they then commit a further breach in relation to that lease.

Where a person has committed one or more breaches in relation to two or more leases, an enforcement authority may choose to impose a single financial penalty in respect of all those breaches. If a single penalty is imposed in respect of multiple breaches, the amount of a penalty must not be less than the total minimum amount that would have been imposed or exceed the total maximum amount that could have been imposed if each breach had been penalised separately. The amount of the penalty must also consider the requirements in relation to breaches to the same lease which require a single penalty as described in the above paragraph or if a further penalty is required for a breach beyond those for which a financial penalty has previously been imposed.

An enforcement authority must not impose a penalty on a person if another enforcement authority has already imposed a penalty on the person for the same breach. A person on whom a penalty has been imposed may appeal to the First-tier Tribunal.

Where an enforcement authority imposes a financial penalty, it may retain the proceeds of the penalty and use this money for the purposes of the costs and expenses incurred in or associated with carrying out its enforcement functions under this Act or otherwise in relation to residential leasehold property. Any excess must be paid to the Secretary of State where the penalty was imposed in relation to a lease premises in England.

5.3 Recovery of prohibited rent

If the enforcement authority is satisfied on the balance of probabilities that a leaseholder under a regulated lease has made a payment of a prohibited rent and all or part of that rent has not been refunded, the enforcement authority may order the repayment of the prohibited rent by any one of the following:

- the landlord at the time the prohibited rent was paid;

- the landlord at the time the enforcement authority makes the order; or

- a person acting on behalf of one of the above where the payment was paid to that person.

However, the above does not apply if the leaseholder (or person acting on behalf of the leaseholder) has made an application to the Tribunal to recover the prohibited rent under section 13 or an enforcement authority has previously made an order under section 10 in relation to the payment.

Where a leaseholder has made multiple payments of a prohibited rent under the same lease and these have not been refunded, the enforcement authority may make a single order for repayment for all the prohibited rent that has not been refunded.

Where an enforcement authority is ordering repayment of prohibited rent, they may also require interest on the outstanding amount to be paid.

Where the amount ordered to be repaid relates to a single payment of prohibited rent, the period for which interest may be charged is from the day on which the payment was made until the required amount is paid.

If the order relates to multiple payments of prohibited rent, the period for which interest may be charged on so much of the amount as relates to a particular payment from the date it was paid, until that part is paid.

The rate of interest must be that specified in section 17 of the Judgments Act 1838.

The total amount of interest paid must not exceed the amount of the rent ordered to be repaid.

6. What is the procedure for enforcing the Act?

6.1 Adopting an enforcement policy for this Act

Enforcement authorities should document and publish their own policy for undertaking enforcement action under this Act, including determining the appropriate level of financial penalties and/or need for a recovery order. Before adopting such a policy, enforcement authorities should consider the requirements of the local authority’s constitution and may wish to seek legal advice. Further advice on adopting a policy may be available from National Trading Standards.

The policy could include guiding principles, such as how to implement consistency of process, but not necessarily uniformity, as there should be due consideration for the merits of each case. It could also consider the proportionality of the action, compared with the severity of the breach.

Enforcement authorities could consider wider guidance related to sentencing when setting a policy in relation to determining the appropriate amount of a penalty, such as the Sentencing Council’s General guideline: overarching principles[footnote 1] although this will not be completely applicable to setting a civil penalty policy.

This Act will generally apply to landlords, which might be a corporate body (and so will apply to that corporate body, rather than the directors). Enforcement authorities may wish to consider wider sentencing guidelines on how to consider the turnover, or equivalent, of such bodies from the Sentencing Council, such as the guidance produced for pursuing breaches of fraud, food hygiene, or health and safety legislation[footnote 2].

6.2 Evidence gathering for issuing a penalty and/or recovery order

For the investigatory powers available to an enforcement authority for the purposes of enforcing this Act, see Schedule 5 to the Consumer Rights Act 2015.

It is the responsibility of enforcement authorities to assess and decide whether there is sufficient evidence to meet the standard of proof required to impose a financial penalty or to issue a recovery order. Enforcement authorities must ensure the correct standards of proof are considered when issuing a penalty or a recovery order, as these differ.

Enforcement authorities may wish to safeguard their decision with a review panel for example, but this is at the discretion of the enforcement authority. To prove an assertion, enforcement authorities should gather evidence. It is within the enforcement authority’s discretion as to what evidence to gather, however, enforcement authorities may wish to:

- identify who requested and received the payment of prohibited rent.

- check any relevant literature, such as the terms of a lease specifying the rent to be paid, or as it may be, if anything is reserved as rent.

- obtain evidence showing when the payment was made, to whom and that it was not refunded.

- evidence any recorded exchange between the parties, such as emails or text messages indicating the request for payment and lack of a refund.

- consult with its own records and those on the National Intelligence Database to establish whether previous action has been undertaken on this same breach, or there have been previous breaches.

This is not to be considered an exhaustive list and authorities may wish to seek further advice from NTS.

Evidence gathering must be conducted in line with the Regulation of Investigatory Powers Act 2000[footnote 3].

6.3 Determining whether to impose a penalty or issue a recovery order

Where it is satisfied beyond reasonable doubt that a landlord has breached section 3 of the Act, the enforcement authority may impose a financial penalty on a landlord. As detailed in 5.2 Financial penalties, there are limitations on when a penalty may be issued.

Where the enforcement authority is satisfied on the balance of probabilities that a leaseholder under a regulated lease has made a payment of a prohibited rent and all or part of that rent has not been refunded, the enforcement authority may order the repayment of the prohibited rent.

An enforcement authority is expected to utilise its enforcement policy in determining whether a penalty and/or recovery order should be issued. In all instances of such action, enforcement authorities must be fair, independent, and objective. They must not let any personal views about ethnic or national origin, gender, disability, age, religion or belief, political view, or sexual orientation of the parties involved influence their decisions. Neither must enforcement authorities be affected by improper or undue pressure from any source.

Enforcement authorities must apply the principles of the European Convention on Human Rights, in accordance with the Human Rights Act 1998, at each stage of a case.

Enforcement authorities must always act in the interest of justice. The government has been clear that the ability to retain the proceeds of financial penalties to recover the costs of enforcing this Act should not be used solely as a funding strategy for the local authority.

An enforcement authority should make a record of its decision, including its reasoning.

6.4 Determining the appropriate amount of the financial penalty

Enforcement authorities have discretion when determining the appropriate level of financial penalty within the limitations set out by the Act (see 5.2 Financial penalties).

An enforcement authority is expected to utilise its enforcement policy in determining the appropriate level of financial penalties. Enforcement authorities are expected to consider each breach on a case-by-case basis with the maximum penalty reserved for the worst offenders. The actual amount levied in any particular case should be fair and proportionate reflecting the severity of the breach and consider if the landlord has a previous record of non-compliance.

Enforcement authorities may wish to consult with NTS to ensure their policies are in line with the national approach to promote consistency, alongside local priorities.

Enforcement authorities should consider the following factors when deciding the level of a financial penalty for a particular case:

a) Severity of the breach. The more serious the breach, the higher the penalty should be. This should include considering:

Whether the breach relates to one lease, or multiple breaches in relation to two or more leases (note: a landlord who commits multiple breaches in relation to the same lease is generally only liable to one financial penalty, however, the number of breaches should affect the level of the penalty even if only one can be levied).

The culpability of the landlord in commissioning the breach. Where there is higher culpability, enforcement authorities should consider a higher financial penalty. Enforcement authorities may wish to consider to what degree evidence of a landlord’s complicity with the actions of a person acting on their behalf increase the level of culpability:

List showing culpability going from higher to lower culpability

Deliberate - intentional act or omission

Reckless - acted or failed to act regardless of the foreseeable risk

Negligent - failed to take steps to guard against the act or omission

Low/no culpability - act or omission with none of the above features

The harm caused to the leaseholder, whether direct or consequential. The greater the harm, the greater the amount should be when imposing a financial penalty.

b) Starting point and range. Obtaining financial information from the landlord may assist with considering what is an appropriate starting point and range, based upon the means of the landlord.

In the case of a corporate body, enforcement authorities may wish to consider any information available on its turnover or equivalent.

c) Aggravating and mitigating factors. The enforcement authority should consider what bearing any aggravating and/or mitigating factors have had in each case. Below is a non-exhaustive list of factors that enforcement authorities may consider depending on the circumstances and local priorities:

Aggravating factors may include:

- the landlord’s history of compliance

- whether the breach was motivated by financial gain

- if there has been any obstruction of justice

- any deliberate concealment of the activity or evidence

- if the leaseholder is vulnerable individual

Mitigating factors include:

- high level of co-operation with the investigation, beyond that which will always be expected

- evidence of voluntary steps to remedy the breach, including prompt repayment of prohibited rent

- evidence of health reasons preventing reasonable compliance (poor

- mental health, unforeseen health issues and/or emergency health concerns)

- no previous breaches

- good character and/or exemplary conduct

- the landlord is a vulnerable individual, where vulnerability is linked to the breach being committed

- acceptance of guilt

d) Fairness and proportionality. The final determination of any financial penalty should be considered alongside the general principle that a penalty should be fair and proportionate but, in all instances, act as a deterrent and remove any gain as a result of the breach.

Factors that could be considered include:

- any other relevant financial information available, such as profit margin for a corporate body or a landlord’s indebtedness. This should consider if the financial penalty would have a disproportionate impact on the landlord’s ability to comply with the law in future or other unintended consequences (e.g., a landlord at risk of losing their home).

- wider financial impact on third parties (e.g., impacting the employment of staff).

- totality principle: if issuing a financial penalty for more than one breach (relating to two or more leases), or where the landlord has already been issued with a penalty, consider whether the total financial penalties comply with the Act and are just and proportionate to the breaches.

A financial penalty covering multiple breaches must not exceed the minimum and maximum limits for a penalty, if each breach had been treated separately (see 5.2 Financial penalties).

The enforcement authority should record each decision and its reasoning.

6.5 Process for issuing a penalty and/or recovery order

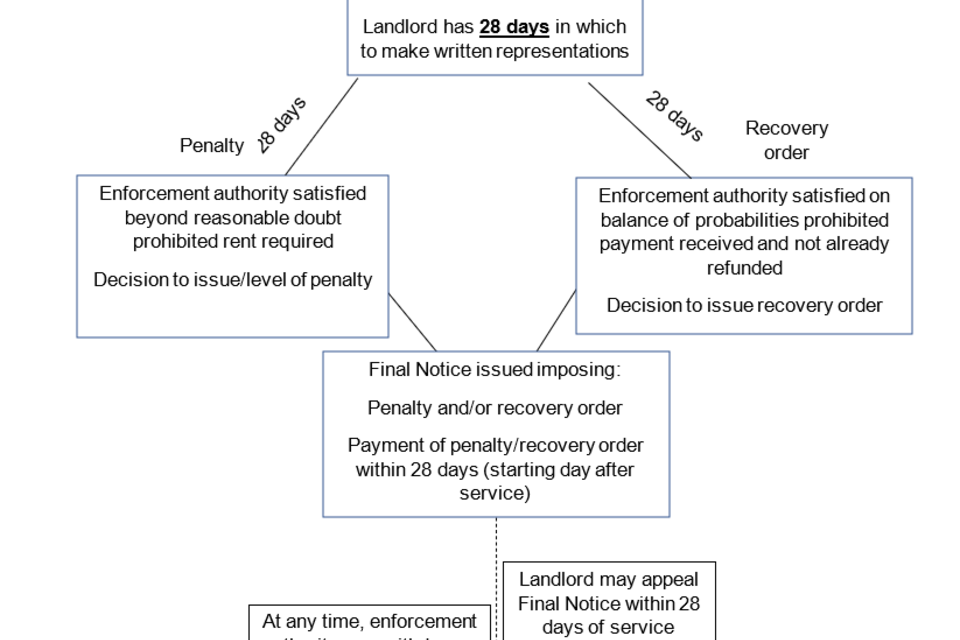

Before an enforcing authority may impose a financial penalty or issue a recovery order, it must follow a process detailed in the schedule to the Act. This includes the following steps, which are also shown in Figure 1:

Notice of intent

The enforcing authority must serve a notice of intent within six years of the day of the breach and the end of the period of six months beginning with the day on which evidence comes to the knowledge of the enforcement authority which the authority considers sufficient to justify serving the notice. Enforcement authorities should record details of the notice of intent on the National Intelligence Database.

A proforma is included in 11.2 Notice of Intent Pro forma. The notice of intent must set out:

- The date on which the notice of the intent is served

- The amount of the proposed financial penalty or the terms of a recovery order

- The reasons for imposing the penalty or making the order and

- Information about the right to make representations

Written representations

A person who receives a notice of intent may, within the period of 28 days beginning with the day on which the notice of intent was served, make written representations about the proposal.

Final Notice

After the end of the 28-day period for written representations the enforcement authority should decide whether it has sufficient evidence to issue a financial penalty (as well as the amount) and/or recovery order which may also require interest on the outstanding amount to be paid.

Where an enforcement authority decides to proceed with such action, it should issue a Final Notice on the person, which may cover both a financial penalty and a recovery order. A final notice imposing a penalty or making an order must require the penalty to be paid, or the order to be complied with before the end of the period of 28 days beginning with the day after that on which the final notice is served. Enforcement authorities should record details of the final notice on the National Intelligence Database.

A proforma is included in 11.3 Final Notice Pro forma. The final notice must set out:

- the date on which the final notice is served

- the amount of the penalty or the terms of the order

- the reasons for imposing the penalty or making the order

- information about how to pay the penalty or comply with the order

- information about rights of appeal and

- the consequences of failure to comply with the notice

Withdrawal or amendment

The enforcement authority may at any time withdraw or amend the notice of intent or final notice, including reduce an amount, the penalty or requirement for a recovery order. Where doing so, the enforcement authority must write to the person on whom the notice has been served.

6.6 Recovery of unpaid financial penalty or unpaid recovery order following Final Notice

If a landlord fails to pay all or part of a financial penalty, the enforcement authority may recover the outstanding amount on the order of the county court, as if it were payable under the order of that court.

Where a person fails to pay an amount under a recovery order (inclusive of rent and any interest), the enforcement authority may recover it on the order of the county court as if it were payable under an order of that court.

6.7 Proceeds of financial penalties

Where an enforcement authority imposes a financial penalty, it may retain the proceeds of the penalty and use this money for the purposes of meeting costs and expenses incurred in or associated with carrying out its enforcement functions in relation to residential leasehold property.

Any excess must be paid to the Secretary of State where the penalty was imposed in relation to a lease premises in England. Enforcement authorities may wish to consider setting a rationale for their costs, when adopting an enforcement policy for this Act (see 6.1 Adopting an enforcement policy for this Act).

Figure 1: Process for enforcement

Process for enforcement

Text version of process diagram above

Landlord or agent requires payment of the prohibited rent

Enforcement authority considers financial penalty

or:

Landlord does not repay the prohibited payment within 28 days of receipt

Enforcement authority considers recovery order

Next:

Enforcement authority serves notice of intent

Landlord has 28 days in which to make written representations

After 28 days

Either

Penalty

Enforcement authority satisfied beyond reasonable doubt prohibited rent required

Decision to issue/level of penalty

Or

Recovery order

Enforcement authority satisfied on balance of probabilities prohibited payment received and not already refunded

Decision to issue recovery order

Next

Final Notice issued imposing:

Penalty and/or recovery order

Payment of penalty/recovery order within 28 days (starting day after service)

Landlord may appeal Final Notice within 28 days of service

At any time, enforcement authority may withdraw or amend the Final Notice

Finally

County Court recovery where payment of penalty/recovery order not fully made within 28 days

7. Appeals of Final Notice

A Final Notice may be appealed at the First-tier Tribunal for a lease of a property in England. Appeals may be made against:

- the decision to impose the penalty or make the order

- the amount of the penalty

- the terms of the order

The person on whom the Final Notice was served must appeal within 28 days of the service of that notice beginning with the day after service of the notice. The notice will then be suspended until the appeal is finally determined, withdrawn, or abandoned.

An appeal will be a re-hearing of the enforcement authority’s decision and may be determined having regard to matters that the enforcement authority was unaware of.

The Tribunal may quash, confirm, or vary the notice. However, if varying the notice, the Tribunal cannot vary a notice to impose a financial penalty of less than the minimum or maximum amounts that could have been imposed in the final notice by the enforcement authority (less than £500 or more than £30,000).

8. Providing assistance to leaseholders

8.1 Assistance under the Act

Section 13 allows leaseholders (or person acting on behalf of a leaseholder) under a regulated lease who have paid prohibited rent that has not been refunded to apply to the First-tier Tribunal (Property Chamber) for a recovery order for leases of premises in England.

Section 15 allows either a leaseholder or landlord of a regulated lease to apply to the First-Tier Tribunal for a declaration as to the effect of section 7 on a term in the lease (or a contract relating to the lease). Following such an application, if the First-tier Tribunal is satisfied that the lease includes a prohibited rent, it must make a declaration as to the effect of section 7 on the terms of the lease (or related contract).

Section 16 of the Act allows the enforcement authority to assist leaseholders and in some cases their representatives, with these aspects of the Act. The help that an enforcement authority can provide under this section may include conducting proceedings or giving advice. The schedule to the Act also states an enforcement authority may help a person make an application for an order of the county court concerning unpaid amounts subject to a section 13 recovery order (one that the leaseholder or person acting on their behalf has pursued).

Leaseholders are unlikely to be eligible for state funded legal aid or assistance regarding the above applications. However, more information on this can be found in Get help paying court and tribunal fees

There are some restrictions on who may receive help, depending on the order which are below:

Table 2: Assistance for persons under the Act

| Type of application | Who can be apply for an order | Who the enforcement authority may assist under Section 16 and schedule |

|---|---|---|

| Section 13 application for a recovery order and county court order where amounts remain unpaid | Leaseholder, former leaseholder, person acting on behalf of such leaseholders, or a guarantor | Leaseholder, former leaseholder, person acting on behalf of such leaseholders, or a guarantor |

| Section 15 declaration as to terms of a lease or contract | Leaseholder, or someone acting on behalf of a leaseholder or landlord | Leaseholder, or someone acting on behalf of a leaseholder |

8.2 Consumer queries

It is foreseeable that enforcement authorities may receive queries and questions from leaseholders about ground rent, but also wider issues encountered with the leasehold system.

Where an authority is not best placed to answer such a query, they may wish to direct it to one of the organisations listed at the end of this document.

9. Release of information to the public, following enforcement action

Enforcement authorities have discretion about publicising a successful penalty for a breach of the legislation provided it has complied with relevant Data Protection Legislation. We would encourage enforcement authorities to publicise their work under this Act where this would have a beneficial effect on awareness of the legislation for the public.

We anticipate that enforcement authorities may receive requests from leaseholders about the enforcement action that has been undertaken in relation to this Act. At the least, there should be a process to notify the leaseholder that where relevant, a recovery order has been successful at recovering prohibited payments of rent and to establish mechanisms to repay this to the leaseholder.

It is also likely that some leaseholders will take an interest in whether a financial penalty was issued against a landlord. We encourage enforcement authorities to make information available on request by a leaseholder when enforcement authorities have successfully imposed a financial penalty against a landlord. Before doing so, enforcement authorities will need to consider their obligations under the Data Protection Act 2018.

Enforcement authorities should be aware that the Ministry of Justice has produced guidance that sets out the factors a local authority should consider when publicising sentencing outcomes[footnote 4]. This guidance states that it does not cover the release of personal information in relation to non-criminal penalties and where such information has not already been released into the public domain. Enforcement authorities should note that a financial penalty that may be issued under the Act, is a civil penalty. This means certain details about a financial penalty (including the personal details of the recipient, reason for the breach and amount) would not otherwise be a matter of public record.

Enforcement authorities must establish one of six valid lawful bases to process personal data. Each case will be different, and the authority should decide which basis is appropriate for the case’s circumstances. In the majority of cases under this Act, the lawful basis will be on the grounds of a public task when sharing a successful penalty by a landlord or managing agent. A public task may be relied upon when processing data in the exercise of official authority; this is the case when the enforcement authority is conducting a public function, power or performance of a specific task that is set out in law. Authorities do not need specific statutory power to process data, but the underlying task, function or power must have a clear basis in law. Authorities must be satisfied that processing is necessary for the performance of a task carried out in the public interest or in the exercise of official authority vested in the controller.

Further information and data protection principles are available on the Information Commissioner’s Office website. Enforcement authorities must be satisfied that their actions are compliant with the Data Protection Act 2018 when sharing personal data and should seek further advice where necessary. Enforcement authorities should also seek further legal advice in determining what information may be lawfully revealed to members of the public about the details of the penalty.

10. Glossary

Commencement date: the date on which the restrictions of the Act came into force, which is on or after 30 June 2022 for most new regulated leases and 1 April 2023 for new regulated leases of retirement homes.

Declaration: a formal decision by a Tribunal.

Deemed surrender and regrant: where a lease is varied in certain situations this results in a deemed surrender and regrant. This can occur in two situations; where the term of the lease is extended, or where the demise of the lease is increased. This may result in a new replacement lease as defined in the Act being granted.

Dwelling: a dwelling (a building or part of a building, occupied or intended to be occupied as a separate dwelling, together with any yard, garden, outhouses, and appurtenances belonging to it or usually enjoyed with it).

Enforcement authorities: a local weights and measures authority in England and Wales, namely Trading Standards and a district council in England that is not a local weights and measures authority.

Final Notice: a notice issued by an enforcement authority, requiring a penalty to be paid and/or the amount specified in a recovery order within 28 days of the date of the notice.

Financial penalty: under section 9, an enforcement authority may impose a penalty on the landlord where they have breached section 3 of the Act.

First-tier Tribunal (Property Chamber): a court that specialises in settling property disputes, including over leasehold charges and fees, enfranchisement and land registration. The First-tier Tribunal (Property Chamber) can issue repayment orders, fines and consider appeals.

Ground rent: although ground rent is not defined within the Act, it is a payment specified in a lease that the leaseholder is required to make to the landlord (directly or indirectly through an agent or representative) without obligation on the landlord (or person acting on behalf of the landlord) to provide a clear service in return to the leaseholder.

Landlord: In general, the person who the holds the freehold, or the superior lease to the tenant’s lease, or held it at the time when a breach of the Act took place.

Lease: the legal device (usually a written document) that grants a person a leasehold interest in a property and sets out the rights and responsibilities of the leaseholder and landlord.

Leaseholder: a tenant who owns a leasehold interest in property, granted by a person (the landlord) who holds the freehold interest or a superior leasehold interest in that property. This includes in most cases where a tenant has ceased to be a leaseholder and also a person acting on behalf of a leaseholder or a leaseholder’s guarantor.

Long lease: in this Act, a “long lease” means:

- a lease granted for a term certain exceeding 21 years, whether or not it is (or may become) terminable before the end of that term by notice given by or to the tenant or by re-entry or forfeiture or otherwise;

- a lease for a term fixed by law under a grant with a covenant or obligation for perpetual renewal, other than a lease by sub-demise from one which is not a long lease;

- a lease taking effect under section 149(6) of the Law of Property Act 1925 (leases terminable after a death, marriage or civil partnership).

Notice of Intent: before imposing a financial penalty the enforcement authority must give the landlord or agent notice of their intention to do so (“notice of intent”).

Peppercorn rent: one peppercorn per year.

Pre-commencement lease: a lease that was granted before the commencement date (30 June 2022 for most long leases, and 1 April 2023 for long leases of retirement homes). This also includes situations where a lease is granted according to a contract (except if this was an option or right of first refusal) that was signed before 30 June 2022 (or 1 April 2023 for retirement homes), but where the lease was granted after this date.

Premium: the sum a leaseholder must pay to the landlord for the grant of the lease. In the Act, it is defined as pecuniary (monetary) consideration for the grant of the lease, other than rent.

Recovery order: under section 10, an enforcement authority may order the repayment of the prohibited rent from a landlord (including a person acting on their behalf or a person who has ceased to be a landlord) where all or part of that rent has not been refunded.

Redress scheme: a free, independent service that helps leaseholders and landlords to address complaints where they haven’t been dealt with satisfactorily. By law, property agents are required to belong to one of two government-approved redress schemes.

Regulated lease: a lease which meets the criteria listed above (and as per section 1 of the Act), meaning it is covered by the Act and the peppercorn limit applies.

Rent: (as defined by s22 (2) of the Act) including anything in the nature of rent, whatever it is called.

Reserved as rent: Some leases may reserve, or in other words include certain sums within that lease’s definition of what ‘rent’ is i.e. £15 is for building insurance.

Retirement home lease:where it is a term of the lease that the premises demised by the lease must be occupied by persons who have obtained a minimum age of 55. These are regulated by the Act from 1 April 2023.

Right of first refusal: Lease options allow a leaseholder, renting a property, the opportunity of first refusal to buy a property. The agreement will set the terms for the purchase, including price and timescale for the offer, which typically includes a deadline of within 2 to 3 years of the lease being granted.

Statutory lease extension: a legal process through which a leaseholder can increase the number of years remaining on their lease. For a house, this will be under Part 1 of the Leasehold Reform Act 1967, or for a flat, under Chapter 2 of Part 1 of the Leasehold Reform, Housing and Urban Development Act 1993.

Voluntary (‘non-statutory’) lease extension: a process followed to increase the number of years remaining on a lease, without needing to follow the exact steps as set out in law (which result in a statutory lease extension).

Written representation: an opportunity for a landlord, or a person acting on their behalf, to respond in writing to a notice of intent that proposes a penalty and/or a recovery order.

11. Helpful links

As referred to in 8.2, where an authority is not best placed to answer a query, they may wish to direct the person to one of the organisations listed below.

-

General information about the Leasehold Reform (Ground Rent) Act 2022 legislation

-

The government’s Leasehold Reform (Ground Rent) Act: User guidance

-

An online version of the Leasehold Reform (Ground Rent) Act 2022

-

The government’s ‘How to lease’ guide

-

Citizens Advice Consumer Helpline or call 0808 223 1133

Other ‘How to’ guides:

- How to Buy a Home guide provides information to prospective home buyers

- How to Sell a Home guide provides information to those looking to sell their home

- How to Rent guide helps tenants and landlords in the private rented sector understand their rights and responsibilities.

- How to Let guide provides information for landlords and property agents about their rights and responsibilities when letting out property.

- How to Rent a Safe Home guide helps current and prospective tenants ensure that a rented property is safe to live in.

12. Pro forma notices

Notes on notices:

When drafting a notice, local enforcement authorities should consider the following and adapt the pro formas accordingly:

-

whether a single notice relates to both a financial penalty and a recovery order for a landlord

-

that a penalty may only be served on a landlord, but a recovery order may be served on a person acting on the landlord’s behalf. Separate notices may be required depending on the recipient and circumstances

-

whether a single notice is being issued for multiple breaches of two or more leases, that result in:

-

a single combined financial penalty, and/or;

-

a single recovery order covering all payments of prohibited rent.

-

Proforma are available to download:

-

Notice of Intent Pro forma (OpenDocument Text, 13KB)

-

Final Notice Pro forma (OpenDocument Text, 11KB)

-

Regarding turnover, or equivalent, see Corporate offenders: fraud, bribery and money laundering and, or, Health and safety offences, corporate manslaughter and food safety and hygiene offences: Definitive guideline. ↩

-

Publishing Sentencing Outcomes MoJ Guidance (PDF, 155KB). ↩