UKHSA Advisory Board: income generation update

Updated 22 May 2023

Date: 24 May 2023

Sponsor: Andrew Sanderson

Presenter: Sarah Collins

Purpose of the paper

This paper updates the board on progress in developing a new framework for UKHSA’s income generation work, following the Advisory Board discussion in November 2022.

Recommendation

The Advisory Board is asked to note progress and next steps in developing a strategic approach to business development and income generation in UKHSA.

We intend to submit a detailed plan to the Executive Committee (ExCo) soon, following their approval of an outline approach in February 2023.

Business development and income generation in UKHSA

UKHSA benefits from an experienced and highly qualified Business Development function in the Commercial Directorate, which works with groups across UKHSA to drive innovation and generate income from business development partnerships and intellectual property. The Business Development team provides the framework strategy, governance and commercial expertise to support delivery across the organisation. Each Directorate General (DG) group is responsible for the delivery of opportunities and the Commercial Director and DG for Finance, Corporate and Commercial hold accountability at ExCo level for the overall framework. The surplus generated is retained by UKHSA, enabling the agency to undertake health security activities and maintain core capabilities beyond our core budget.

These activities generated £168 million in 2022 to 2023 (including a one-off financial adjustment relating to previous years). The main income streams are from:

- laboratory services (£77.5 million)

- intellectual property (£54.2 million - mainly Dysport royalties)

- Radiation, Chemical and Environmental services (£13.1 million)

- Data, Analytical and Surveillance (£4.5 million)

Partnerships with private sector organisations currently account for only a small proportion of income generated. Annexe A gives a full breakdown.

Effective governance ensures that Business Development opportunities align with UKHSA’s core mission, and we do not ‘chase the cash’ at the expense of the organisation’s core objectives. All opportunities are developed collaboratively between Business Development staff and colleagues across the organisation and undergo detailed development and scrutiny before assessment by the Opportunity Assessment Group (OAG). The OAG has members from Commercial, Finance, Legal, Science and Clinical and Public Health teams and scrutinises contracts for financial return, quality, ethics and legal compliance.

Strategic ambition and alignment

Following the Advisory Board steer in November 2022, we submitted to ExCo in February 2023 to clarify the strategic ambition of our income generation work and outline a proposed approach to maximise income from our assets.

ExCo agreed that the primary aim is to drive innovation and knowledge to support UKHSA’s core public health, science and growth objectives, including UK global leadership in public health and life sciences:

- prepare - generating knowledge to secure better health security outcomes, contributes to innovation and development to meet future health challenges, and helps maintain the UK as a science superpower

- respond - maintaining core capabilities, expertise and facilities, keeping stand-by assets ‘match fit’ to respond as needed

- build - building capability for the future, attracting and retaining leading scientists and health professionals to UKHSA by giving them a chance to use their know-how for public good, and supporting UK economic growth in key sectors by commercialising new products

While revenue is not the primary aim, the additional contribution it generates is significant. Revenue contributes to the overall funding of UKHSA core activities, allowing UKHSA to undertake activity it would otherwise be unable to fund and relieving pressure on our budget at a time of constrained public finances. Both board and ExCo have identified significant opportunity for UKHSA to monetise more of our activities and capabilities where this aligns with our strategic goals.

Business development partnerships contribute to UK economic growth by combining public and private knowledge, research, and funding to accelerate development of new capabilities. Matching small and medium-sized enterprises (SMEs) with much larger businesses, give smaller partners gateways to commercialise their products and processes, making their innovation accessible to a wider market.

Although not an income generating activity, our business development function also contributes to UKHSA’s ambition to provide health security leadership in both the UK and globally by partnering with UK and global actors to build health systems and pandemic preparedness in developing countries. These are funded by UK aid grants and undertaken in conjunction with the Department for Business and Trade and the Foreign, Commonwealth and Development Office.

A new strategic approach to income generation

Income has been consistent over the last 10 years, reflecting the strong relationships built with partners over that time (as demonstrated by repeat business from so many) and a balanced portfolio that gives UKHSA the financial headroom to manage variability in any one income stream. However, it is subject to market dynamics, and we now need to renew our portfolio to ensure it aligns with UKHSA’s strategic priorities, monetises our capabilities, maximises income and makes best use of resources by developing fewer, but deeper and longer-lasting partnerships.

ExCo has agreed building blocks for an income generation framework and delivery plan, that would target opportunities for:

-

new geographies, particularly countries that are looking to strengthen their public health strategy, capability and capacity. The UK’s response to the coronavirus (COVID-19) pandemic has strengthened the UK’s reputation as a centre of excellence for many areas of health-related innovation, creating greater opportunities for international work.

-

new markets - there is huge potential to realise opportunities in pathogen genomics and we expect to see significant growth in this area. There are also opportunities to develop our work in data analytics and surveillance, diagnostics and Radiation, Chemical and Environmental services.

-

new assets, including the Vaccine Development and Evaluation Centre (VDEC) and Diagnostics Accelerator. Income generation from knowledge and capability hubs will play an essential enabling role in the delivery of UKHSA’s mission into the future

These new opportunities will be enabled by an enhanced marketing capability and a review of our pricing models to ensure that UKHSA recovers full economic cost (FEC) where appropriate and generates surplus in line with market rates. We are already achieving better than FEC in many new projects and will continue to move progressively to economic value added (EVA) pricing. We will maximise the contribution to UKHSA by pricing on the basis of the de-risking services we can provide, as well as the excellence of our science.

Work in progress and next steps

We are now developing a detailed framework and delivery plan to implement the steer given by ExCo and Advisory Board. This will be a collaborative exercise, working closely with Science, Data, Analytics and Surveillance, and Strategy and other colleagues.

We are working with Strategy colleagues to ensure the framework is built into UKHSA’s corporate work to support UK economic growth and address Government Internal Audit Agency (GIAA) recommendations to ensure a clear line of sight from corporate objectives and strategy to income generation priorities. Strategy is also developing a strategic plan for key non-commercial stakeholders including NHS England, global health organisations and other government departments, and we will work with them to ensure alignment with the income generation plan.

We are working with Science colleagues on an income generation proposition for the VDEC and Diagnostics Accelerator.

We will work with Communications to develop a more structured, proactive approach to market UKHSA capabilities, including an enhanced e-presence and marketing programme.

We have agreed a management action plan to address recommendations from the GIAA audit of our income generation activities. These cover the integration of income generation priorities into the UKHSA business plan, corporate strategy and growth plan, development of detailed project plans, internal communications and engagement, knowledge asset management, and strengthening financial systems so that we can measure ‘profit’ from our activities, not just income. The actions will be integrated into the overarching income generation framework and plan submitted to ExCo.

We have secured funding from the Government Office for Technology Transfer (GOTT) to access support from Lexica, a specialist in business development. They will help us identify and access the best opportunities, reduce risk by supplying in-depth data and catalyse new industry relationships. We will also access the SME ecosystem through relevant associations, including the British In-Vitro Diagnostics Association and Bio-Industry Association.

The income generation framework and plan is a key part of the Commercial Partnerships Strategic Framework (CPSF), agreed by ExCo in January 2023. Income generation is 1 of 6 workstreams that will equip UKHSA with the commercial processes, tools and proportionate governance to create greater value for the organisation, encourage innovation and support growth.

A senior-level CPSF Programme Board, representing all groups in UKHSA, will provide oversight and challenge, drive implementation and ensure integration with other corporate workstreams. A first meeting in April agreed terms of reference and project initiation documents. The next meeting will prioritise workstreams and actions to match ambition with resource and capacity.

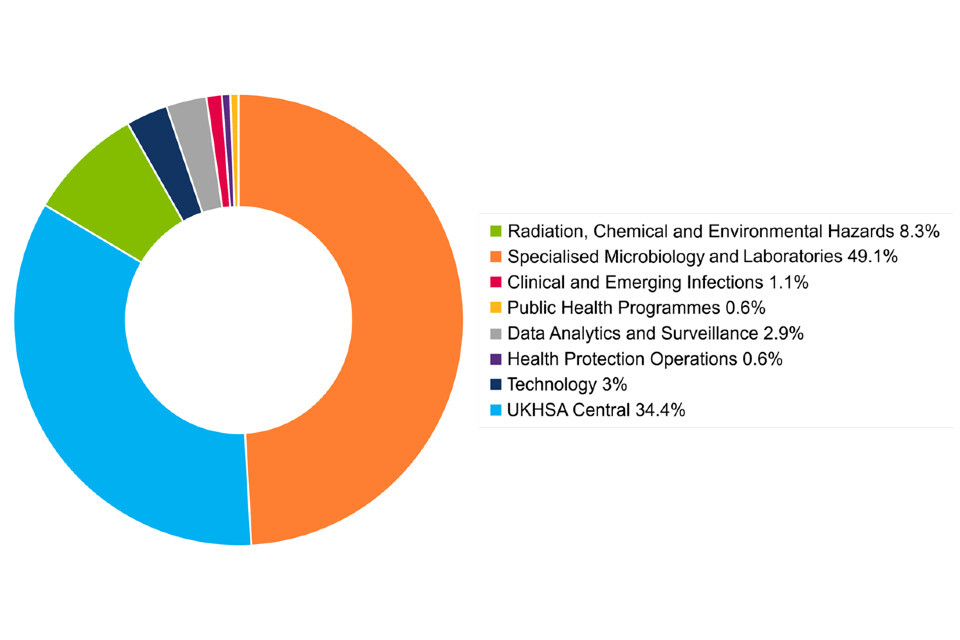

Annexe A: breakdown of UKHSA income 2022 to 2023

The breakdown of UKHSA income is as follows:

- specialised microbiology and laboratories 41.9%

- UKHSA central 34.4%

- radiation, chemical and environmental hazards 8.3%

- technology 3%

- data analytics and surveillance 2.9%

- clinical and emerging infections 1.1%

- health protection operations 0.6%

- public health programmes 0.6%

Note: income to UKHSA Central is largely royalties from Dysport.