Synergetic Air-Breathing Rocket Engine (SABRE) Programme Evaluation Report 2022

Published 11 January 2023

1. Synergetic Air-Breathing Rocket Engine (SABRE) Programme Evaluation Report 2022

AEROSPACE REPORT NO. ATR-2022-00387

Programme Evaluation Report 2022

December 19, 2022

Vera L. Scheidlinger - Programmatic Assessments and COE, Strategic Assessments and Studies Division

Kristopher Atkins - Economic and Market Analysis Center, Acquisition Analysis and Planning Subdivision

Dr. Torrey Radcliffe - Civil Systems Group, CSG Technology Office

Greg Meholic - Civil Systems Group, CSG Technology Office

John P. Mayberry - Capability Development and Transition, Developmental Prototypes and Projects

Shannon P. McCall - MSFC/KSC Programs, Human Exploration and Spaceflight Division

Prepared for:

Charles McCausland Head of Major Projects and Technology Development UK Space Agency Mob 07927 803674 Contract No. 010121

Authorised by: Civil Systems Group

APPROVED FOR PUBLIC RELEASE, DISTRIBUTION UNLIMITED.

1.1 Acknowledgements

The UK Space Agency would like to thank The Aerospace Corporation UK Ltd for their work on this evaluation and to Reaction Engines for their contribution. Special thanks go to Vera Scheidlinger, Kristopher Atkins, John Mayberry, Shannon McCall, Greg Meholic, Dr Torrey Radcliffe, and Riaz Musani from The Aerospace Corporation UK Ltd. Special thanks also go

to Carrie Lambert, Shaun Driscoll, and Oliver Nailard from Reaction Engines. Thanks also to the Government Internal Audit Agency for authorizing the publication of extracts from their report in this evaluation.

1.2 Final Report

The Aerospace Corporation UK Ltd

December 2022

Vera Scheidlinger

Kristopher Atkins

Dr Torrey Radcliffe

John Mayberry

Shannon McCall

Greg Meholic

1.3 Acknowledgements

The authors would like to thank Reaction Engines personnel for generously providing significant inputs to the evaluation. The information and evidence provided was extremely helpful and supported the success of the study. The authors would also like to thank the staff at the UK Space Agency for the information, insight, and guidance that they provided during the study.

2. Executive Summary

In 2015, the Secretary of State for Business, Innovation and Skills (BIS, now Business, Energy & Industrial Strategy (BEIS)), acting through the UK Space Agency, awarded Reaction Engines (RE) a UK Space Agency grant not exceeding £50,000,000 (fifty million pounds) for the development of a novel engine concept that combines air breathing and rocket technologies into a single engine system enabled by ground-breaking heat exchanger technology. This engine system is known as the Synergetic Air-Breathing Rocket Engine (SABRE) Programme. The purpose of this Grant Funding Agreement (GFA) was to advance the SABRE technology, stimulate growth in the UK space sector, increase the relevant skills and knowledge base in RE and the UK, and support the development of bilateral agreements between RE and UK and international partners.

The UK Space Agency commissioned The Aerospace Corporation UK Ltd to evaluate the SABRE Programme grant, and this report presents the findings of that evaluation.

2.1 The Evaluation

The objectives of the evaluation were to assess the benefit and impact of the grant funding, its value for money, and the processes by which the grant has been administered.

The study was undertaken between January and March 2022. The approach involved a review of available documentation and data as well as a series of interviews with relevant personnel within the UK Space Agency and RE.

2.2 The SABRE Programme

RE is a privately held company based in Oxfordshire, UK, that employs over 200 staff across its sites in the UK and US. Founded in 1989, RE’s primary objective was to develop technologies for their SABRE engine toward the goal of creating next-generation hypersonic flight and space access vehicles.

SABRE is a hybrid combined-cycle air-breathing/rocket engine that, if successful, may enable hypersonic travel within the atmosphere and could lead to reduced access-to-space costs. RE claims that the SABRE concept represents a major breakthrough in propulsion technology, which could enable the realization of a reusable, single-stage-to-orbit (SSTO) launch vehicle. The SABRE engine is designed to operate in air-breathing mode (using atmospheric air and on-board liquid hydrogen) up to velocities of Mach 5, then transition to a rocket mode (using onboard liquid oxygen and hydrogen) to enable exo-atmospheric flight and powered re-entry.

In order to further illustrate the performance capabilities of SABRE for space access, RE had also conceived a notional SSTO vehicle called SKYLON that used SABRE as its primary propulsion. Performance evaluations by RE of a SABRE-based SKYLON vehicle seemed to support the potential benefits of SABRE not only for SSTO systems, but for other launch vehicle architectures.

Funding for the SABRE and SSTO launch vehicle concept has largely been through private equity, supplemented by European Space Agency (ESA) contracts in recent years. However, SABRE gained ministerial attention, and the economic case for the UK Space Agency support for SABRE development began in 2012, with funding first ear-marked in 2013. The SABRE Programme was ultimately awarded a grant of £50M over 48 months in 2015 following a successful European Commission State Aid Decision [1]. This grant between RE and the UK Space Agency was, at the time, the largest value grant to a single entity in the Agency’s history.

Planned SABRE development is divided into four Phases. The focus of the grant awarded in 2015 was Phase 3 (Design and Demonstration), building on the successful development and demonstration of key technologies in the previous Phases 1 and 2 (Engine Technology Demonstration Programme). Phase 4 (Design and Development) is planned to evolve SABRE based on Phase 3 demonstration testing, complete the engine certification, and then lead to Phase 5 (Engine Production). As proposed in 2015, Phase 3 was divided into four tasks, two of which were to be funded in-part by the £50M UK Space Agency grant:

-

phase 3a – system definition and requirements (funded by ESA and RE, completed Q1 2017)

-

phase 3b – system preliminary definition (£10,317,760 from UK Space Agency)

-

phase 3c – system detailed definition (£39,682,240 from UK Space Agency GFA)

-

phase 3d – demonstration engine manufacture

Following completion of SABRE Engine Level System Requirements Review (SRR) in December 2016 through Q1 of 2017, RE and their various stakeholders and funding sources opted to realign the programme with a focus on advancing the design of the air-breathing engine technology demonstrator through a dedicated ground test initiative called DEMO-A in preparation for testing of the integrated DEMO-A Engine by the end of 2019. This realignment resulted in a modified grant agreement aimed at reducing future design risks and which was approved in 2017.

Due to delays in SABRE technical development and issues with test facility readiness, the DEMO-A test was not achieved in the time period covered by the SABRE Programme grant. Although not all the original project objectives were achieved, considerable progress has been made in the design and manufacture of components and facilities needed.

[1] https://ec.europa.eu/competition/elojade/isef/case_details.cfm?proc_code=3_SA_39457

2.3 Impact Evaluation

The overall purpose of this impact evaluation is to assess whether the grant met its objectives, and to determine what impact the grant funding had on RE, as well as on the wider UK space industry. The study team was able to identify several strong programme impacts, including:

Technological advancements – SABRE technology was advanced as a result of grant funding; however, due to the inherent challenges of technology development and maturation, many of the initial technical goals and milestones were not achieved. Notably, the heat exchanger technology development programme (HTX) achieved the goal of advancing through several critical design reviews as well as test. The successful test campaign, undertaken at the RE purpose built hypersonic ground test facility, enabled the precooler to be tested multiple times at Mach 5 conditions. This was a world first and represents a significant step forward in demonstrating and de-risking a critical element of the SABRE engine. The DEMO-A project achieved all of its key design maturity goals whilst also undertaking subscale testing of some subsystems, with focus given to the critical subsystems supplied by RE. While the realigned Phase 3 Programme goal of achieving test readiness for DEMO-A and the test facility was not achieved, the study team finds that accomplishments achieved to date do fall largely in line with the original 2015 GFA intent, which was to progress the demonstration engine through the Critical Design Key Point (CDKP) and Critical Design Review (CDR). It appears that there was some growth in ambition during the programme realignment that advanced the main objective from CDR to test readiness. Furthermore, the scaled subsystem testing undertaken within the programme together with the full-scale subsystem and coupled subsystem testing now underway, represents a significant step forward in validating the design. To successfully move into the next phase in SABRE development, further components and systems associated with DEMO-A need to be tested.

Positioning of RE as a “space” company – a space company is a company involved in the larger space economy, providing goods and services associated with space or space access. These goods and services could include but are not limited to research and development activities, manufactured hardware, and space-enabled services (such as telecom) provided to end-users. While RE considers itself a space company, the grant has improved RE’s position as a space company within the larger space economy and positively impacted RE’s ability to provide goods and services associated with space or space access. As a result of the grant funding, RE has developed new and strengthened relationships with international and domestic space agencies and companies and has made relevant technological and process advancements associated with space and space access

Employment and people development – RE has grown from 61 employees in 2014 to 204 permanent employees in 2020. The workforce is made up of highly skilled, diverse, and young employees from across the country, Europe, and throughout the world. RE recruits professional engineers across a broad range of engineering disciplines; most recruits have a university education, with many holding PhDs and being industry experts in their field. RE employees induce positive externalities through productivity and knowledge spill-overs, where knowledge generated within RE enhances the productivity of other organisations. RE also promotes continuous professional development and encourages its workforce to achieve professional accreditation through recognised bodies such as the Institute of Mechanical Engineering, Royal Aeronautical Society, and the Institute of Physics

Labour productivity gains – according to findings presented in the UK government’s recently published Size and Health of the UK Space Industry 2021 every direct RE employee, supported by the income they receive, should be viewed as a force multiplier, delivering 2.6-times greater return on investment to the UK economy over the average UK employee. Additionally, space industry employment has indirect and induced UK industrial base impacts, such that direct employment by RE supports an additional 367 UK jobs through indirect and induced efforts

Knowledge exchange and partnerships – RE has successfully generated tradable Intellectual property (IP) as a result of the SABRE Programme grant funding. Since 2015, RE has had 12 granted patents, registered in several countries, for an average rate of just under 2 grants per year. However, often RE chooses instead to protect its IP by retaining it as a non-public trade secret, of which they currently have 35 internally documented. In addition to protecting its IP, RE has also leveraged their IP to facilitate knowledge transfers in industry and form partnerships with other organisations. The technologies developed on the path toward SABRE have broad benefits beyond space-access and the mainstay SABRE Programme. In line with the conditions of initial UK Government investment, RE has pursued early commercialisation of SABRE technology in adjacent and alternative applications and industries such as ammonia heat exchange, battery cooling, green and sustainable applications, and high-speed flight. RE has won contracts for spin-out technologies in these areas with future opportunities expected to generate additional revenue. These spinouts have also allowed RE to industrialise its technology and processes to accommodate efficient higher yield output, a key step in the commercialisation of new technology. These spinouts also have the potential to generate positive spill-over effects in the larger economy

New and strengthened partnerships – the grant has significantly strengthened RE’s reputation and provided the opportunity to gain interest and, in many cases, work directly, with important government bodies and industry players. When the original 2015 grant was approved, RE had a relatively small number of industry relationships; RE now has 990 registered suppliers and 650 active suppliers. RE has also built new and strengthened partnerships with key government agencies such as ESA, the French National Centre for Space Studies (CNES), the Italian Space Agency (ASI), the German Aerospace Centre (DLR), and key UK Ministries and Departments

Technological and scientific inspiration and prestige – RE is a homegrown company that aims to rival incumbent launch providers, which could reduce the UK’s reliance on foreign launch service providers for access to space and provide more resilient launch alternatives. RE actively promotes their profile and company through a variety of communication avenues and participates in events designed to stimulate interest and excitement around space topics. The company attracts attention with their numerous publications, presentations, and accolades, which could result in attracting additional talent from other parts of the world. This benefits the UK space industry as a whole by creating a hotspot for big-name business leaders and companies.

2.4 Value for Money

The study determined that the SABRE grant could have had a very large impact on the UK economy. The company has achieved £96 million of follow-on investment, funding, and revenues since the initial grant funding. Using relevant spill-over multipliers, the study team estimated that RE could have generated as much as £233.3 million in spill-over economic impacts, for a total of £379.3 million in gross economic impact to the UK economy over the seven-year grant period (~£54 million per year).

Comparing the £50 million of grant received by RE in 2015 to the £379.3 million gross economic impact from the grant funding and RE’s research, contracts, and investment activities, it is suggested that for each £1 million in grants, RE’s activities could have generated a gross economic impact of as much as £6.3 million across the UK from 2015 to 2021. This is an upper-bound value and represents a maximum, best-case value, based on academic productivity multipliers.

2.5 Grant Administration

The study determined that the SABRE Programme grant was well administered, especially related to the amount of administrative overhead, flexibility to adjust to changing circumstances, process improvements seen over time, and the use of innovative solutions for technical assurance.

However, several notable weaknesses were also identified. The initial proposal was not evaluated against standardised criteria, and the government’s overall goals and objectives of the SABRE Programme grant were not clearly documented. Additionally, prior to awarding the grant, the UK Space Agency did not have a risk management process in place to actively address the risks identified in the initial proposal.

The study also captured specific lessons learnt, best practices, and recommendations for improvement associated with the administration of this and future grants. Many of these lessons learnt were related to continuing to formalize and mature existing processes and increase interactions between the Agency and grant recipients.

3. Introduction

3.1 The Evaluation

This document presents the final report from the evaluation of the SABRE Programme grant received by RE. The Aerospace Corporation UK Ltd has undertaken the evaluation on behalf of the UK Space Agency in 2022. Following the standard intervention evaluation process outlined by the Magenta Book, there were three main elements in this study:

-

impact evaluation – did the grant achieve its objectives? What was the impact of the grant on RE’s positioning as a “space” company? What were the other benefits and impacts of the grant funding?

-

value for money assessment – what were the direct and indirect economic impacts of the grant on the UK space industry? how do these impacts compare to the initial grant investment?

-

process evaluation – how effectively was the grant administered? what processes and practices worked well, and what areas could be improved upon?

Due to the challenging nature of technology development efforts, the as-executed SABRE Programme differed from the plan proposed in the original 2015 Grant Funding Agreement (GFA). All changes to the scope of the original grant were reviewed and approved by UK Space Agency. In order to capture the true impact of the grant, the scope of this evaluation includes both the original objectives and goals, as well as the objectives and goals of the realigned Programme.

3.2 The Approach

This study employed a mixed-method approach to this evaluation, organized around three main packages of work:

-

scoping – a short preliminary step to review initial programme documentation and relevant UK Space Agency guidance documents and develop an evaluation approach.

-

data gathering – the main phase of the study, including requesting additional data from the UK Space Agency and RE, performing open-source research, and conducting interviews with relevant personnel from the UK Space Agency and RE.

-

analysis – the final phase of the study, analysing the data collected throughout the study, and addressing the key evaluation elements.

-

reporting – weekly reporting occurred throughout this study to provide updates on progress. A draft of this report was provided to both RE and the UK Space Agency for review and comment. This Final Report represents the final deliverable.

Significant programme documentation and data were available to the study team, so the evaluation approach was primarily a table-top review by subject matter experts. The study also included a series of interviews with relevant personnel within the UK Space Agency and RE to gather additional primary data.

As stated previously, the SABRE Programme did experience challenges and setbacks during the execution of the grant resulting in non-trivial, agreed changes to the programme execution plan and milestone delivery schedule. The study team evaluated the impact of the grant against both the original objectives and goals, as well as the objectives and goals of the realigned Programme.

Further details on the study requirements, approach, and methods are provided in Appendix A.

3.3 The Report

The remainder of this Final Report is structured as follows:

-

section 4 – introduces RE and the SABRE Programme and presents a brief overview of the SABRE technology as well as a timeline of changes experienced over the course of the grant

-

section 5 – presents the results of the impact evaluation organized according to the objectives of the grant and the key areas of consideration

-

section 6 – presents the assessment of the grants’ direct and indirect impact on the UK economy

-

section 7 – presents findings associated with the administration of the grant including lessons learnt and areas of improvement for future UK Space Agency grants

-

section 8 – summarizes the main findings of the study

Needs: De-risk cutting edge SABRE engine technology across multiple component parts and subsystems to advance innovative access-to-space solution, and the need to stimulating growth in the UK space sector while increasing the relevant skills and knowledge base in the UK.

Objectives:

-

de-risk SABRE technology

-

stimulate growth in the UK space sector

-

increase the relevant skills set and knowledge base in the UK

-

support the developments of bilateral agreements between REL and UK International partners

Inputs:

-

provision of UK Space Agency grant funding (£50m)

-

provision of ESA general support technology programme (GSTP) funding (£10m)

-

private funding (e.g., investors)

-

access to ESA technical expertise and project management board (PMT) support

Activities:

-

SABRE technology development, improvement, and advancement

-

development of relationships with sub-contractors, international space agencies, and other key partners

-

creation of intellectual property (IP) for technology transfer and exploitation

Outputs:

-

advancement of SABRE technology to support future integration into a system-level design

-

REL positioned as a “space” company through new and strengthened partnerships and enhanced reputation

-

successful technology transfer and exploitation (revenue-generating technology “spin-offs”)

-

improved future competitiveness (improved knowledge, skills, and capabilities within REL and UK space industry)

Outcomes and Impacts:

-

SABRE technology de-risked for future public or private investment

-

growth in UK space sector: businesses, employees, skills & capabilities

-

increased visibility and reputation of REL capabilities among potential partners and investors

-

new and strengthen partnerships that continue beyond grant funding

-

spin-off of revenue-generating tech to offset long-duration space ROI

3.4 Programme Logic Model

As part of the Scoping activities, the study team developed a logic model for the SABRE Programme, based on the evidence obtained through independent research and discussions with the UK Space Agency (Figure 1). This model describes the logical sequence and relationships between the Objectives of the grant, the available resources (Inputs), the Activities undertaken as a result of the grant, and the anticipated results (Outputs) and changes (Outcomes and Impacts) that should address the initial Objectives.

4. The SABRE Programme

4.1 Background and context

RE is a privately held company based in Oxfordshire, UK, that employs over 200 staff across its sites in the UK and US. RE develops technologies for an advanced combined cycle air-breathing rocket engine called SABRE toward the goal of creating next generation hypersonic flight and space access vehicles.

RE was founded in 1989. RE has invested over 30 years in research into thermodynamics and heat exchanger technology and intends to develop the SABRE engine (see Table 1). SABRE is a hybrid combined-cycle air-breathing/rocket engine that, if successful, will enable hypersonic travel within the atmosphere and greatly reduce access-to-space costs. The SABRE concept represents a major breakthrough in propulsion technology, which could enable the realization of a reusable, SSTO launch vehicle (the SKYLON spaceplane). The SABRE is designed to operate in both air-breathing mode (using atmospheric air and on-board liquid hydrogen) and rocket mode (using onboard liquid oxygen and hydrogen).

4.2 Table 1: Fundamental Features of SABRE are [2]:

-

the integration of an air-breathing engine with a rocket engine whilst minimising the duplication of equipment

-

deep pre-cooling of the air used in the engine to enable the operation of a compressor at high Mach numbers

-

use of the energy absorbed from the air to power internal turbomachinery

-

use of the hydrogen fuel as a heatsink for the residual energy prior to combustion

Since its inception, the SABRE thermodynamic cycle has progressed through several iterations as RELs knowledge base and capabilities grew. The 2015 SABRE Programme grant proposal was for development of what was referred to as the “SABRE 4” engine concept. It improved on SABRE 3 with a better equivalence ratio (ratio of actual to stoichiometric fuel/air ratios) for potentially increased SKYLON performance. Unlike SABRE 3, the SABRE 4 separated the air-breathing and rocket combustion chambers, but they still share a common nozzle. This would also allow “clearly defined programmatic separation of the two technologies” (i.e., separate air-breather and rocket engine developments).

Two SABRE demonstration engines were planned and designated E1 and E2. They would likely consist mainly of the Air-Breathing Core; other sub-systems (e.g., Combustion System/air-breathing & rocket, Nacelle Structure, Intake System, etc.) would be introduced in later configurations.

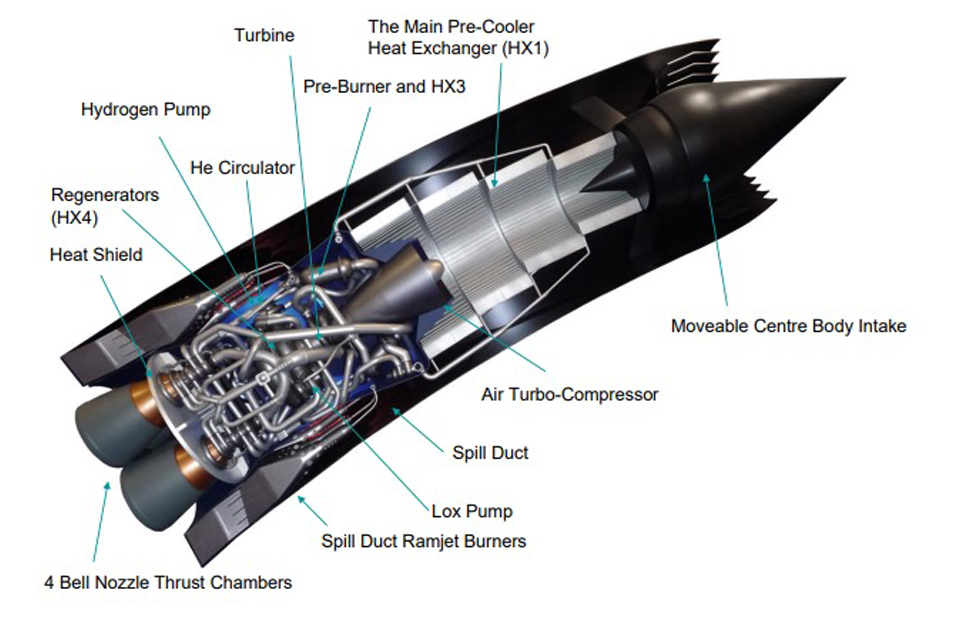

This is an image of a SABRE demonstration engine with a number of parts labelled.

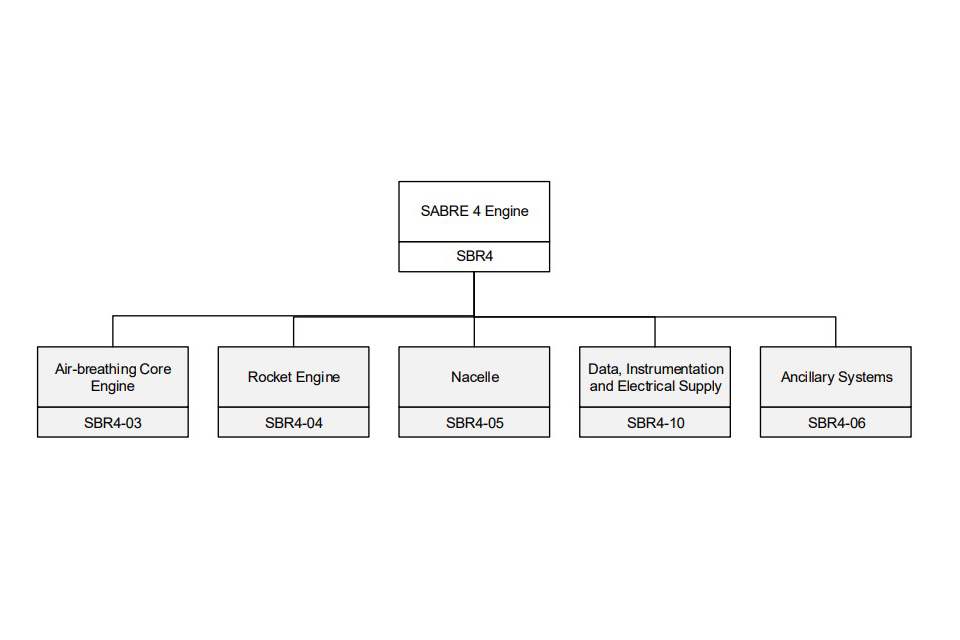

The SABRE engine itself consists of five major sub-systems: the air-breathing core engine sub-system; the rocket engine sub-system; the nacelle; the data instrumentation and electrical supply sub-system; and the ancillary sub-systems (see Figure 2). The air-breathing core engine and rocket engine are considered separate sub-systems and are further broken down into sub-system elements (see Figure 3).

This image shows a flow chart. There is one module on the upper level of the flow chart and five more modules on a level below.

RE’s original SABRE concept envisioned the rocket engine development in parallel with the nacelle and air-breathing core. It would be highly integrated with the air-breathing core and sub-contracted to an experienced rocket engine manufacturer.

However, RE’s most recent design separates the rocket engine development from the integrated whole. The rocket engine would be purchased or developed separately and assembled with the air breathing core during final integration and test. SKYLON is the original conceptual SSTO launch vehicle powered by SABRE to take advantage of SABRE’s dual-mode air breathing and rocket modes.

The SKYLON concept began in 1989 and has been advanced by internal RE study work since 2009. SKYLON would leave horizontally from runway in air breathing mode, like a traditional aircraft, climb in altitude and speed until it reached Mach 5, then transition to rocket mode into Low Earth Orbit (LEO). After delivery of its payload, SKYLON would re-enter Earth’s atmosphere and glide back to the runway for landing.

However, the SKYLON structure is quite complex and different from traditional aircraft or launch vehicles. It includes corrugated reinforced glass ceramic aeroshell, multilayer foil insulation, Titanium/Silicon Carbide (Ti/SiC) spaceframe primary structure with titanium nodes, and aluminium cryogenic tankage with foam insulation. These advanced manufacturing capabilities would need to be developed to make SKYLON a reality. (See Figure 4.) SKYLON development was not a major focus of the SABRE Programme grant.

This image is concept art of a SKYLON space plane. The image shows the underside of the place flying through the sky.

Funding for the SABRE and associated SKYLON Spaceplane concept has largely been through private equity, supplemented by ESA contracts in recent years. However, the SABRE gained ministerial attention, and the economic case for UK Space Agency support for SABRE development began in 2012, with funding first ear-marked in 2013. The SABRE Programme grant of £50M over 48 months was ultimately awarded in 2015 based on a successful European Commission State Aid Decision. [6] At the time of the award, this grant represented the largest grant to a single entity in the Agency’s history.

If successful, the grant would de-risk cutting-edge SABRE technology across multiple component parts and subsystems, advancing an innovative access-to-space solution. The grant would also stimulate growth in the UK space sector while increasing the relevant skills and knowledge base in the UK.

[2] Proposal, SABRE Development Programme, Ref SABRE-REL-OF-0022, Rev 03, 14 November 2017

[3] The SABRE Engine – Phase 3 Development Resource and Implementation Plan, Ref BSDEV-REL-OF-0018, Rev 08, 12 November 2015

[4] The SABRE Engine – Phase 3 Development Resource and Implementation Plan, Ref BSDEV-REL-OF-0018, Rev 08, 12 November 2015

[5] The SABRE Engine – Phase 3 Development Resource and Implementation Plan, Ref BSDEV-REL-OF-0018, Rev 08, 12 November 2015

[6] “Commission State Aid Decision” https://ec.europa.eu/competition/elojade/isef/case_details.cfm?proc_code=3_SA_39457

4.3 SABRE Programme Grant Timeline

Planned SABRE development is divided into four Phases. The focus of the grant awarded in 2015 was Phase 3 (Design and Demonstration), building on the successful development and demonstration of key technologies in the previous Phases 1 and 2 (Engine Technology

Demonstration Programme). Phase 4 (Design and Development) is planned to evolve SABRE based on Phase 3 demonstration testing, complete the engine certification, and then lead to Phase 5 (Engine Production). As proposed in 2015, Phase 3 was divided into four tasks, two of which were to be funded in-part by the £50M UK Space Agency grant, with the balance from RE match funding:

• phase 3a – system definition and requirements (funded by ESA and RE, completed Q1 2017)

• phase 3b – system preliminary definition (£10,317,760 from the UK Space Agency GFA)

• phase 3c – system detailed definition (£39,682,240 from the UK Space Agency GFA)

• phase 3d – demonstration engine manufacture

The SABRE Programme grant largely funded activities associated with Phases 3b and 3c. Phase 3a had been funded by RE (via a private equity fund) and ESA (£4M each). Major activities planned for Phase 3b included the completion of a successful Preliminary Design Review (PDR), and further technology development with emphasis on engine sub-systems development unit testing. Major activities planned for Phase 3c included advancing the SABRE flight design for the Block 1 demonstration engine, and the completion of a successful Critical Design Point Review (CDPR).

The major SABRE Programme milestones as proposed in 2015 are summarized in Table 2 below.

Table Two: Major Sabre Milestones (2015)

| Programme/Task | Purpose | Proposed Outcome | Proposed Start (CY) | Proposed Complete (CY) |

|---|---|---|---|---|

| Phase 3 | Demonstrate SABRE operation in a ground-based installation. | Demonstrate the technical viability of the SABRE design. Foundation for Phase 4. | Q1 2016 | Q4 2021 |

| Phase 3a System Definition and Requirements Phase | Advance SABRE system design together with the associated requirements definition. Culminate in a System Requirements Review (SRR) and provide input into Phase 3b. | Culminate in a System Requirements Review (SRR) and provide input into Phase 3b. | N/A (before grant) | Q2 2016 |

| Phase 3b System Preliminary Design | Continue engine design to completion of the preliminary design phase. | Culminate in the system Preliminary Design Review (PDR). | Q1 2016 (overlapping some with Phase 3a) | Q1/2 2018 |

| Phase 3c System Detailed Definition | Advance SABRE detailed design to a flight engine and complete the design of the associated Block 1 demonstration engine | End with the Block 1 demonstration engine Critical Design Key Point review (CDKP). | Q2 2018 | Q3/4 2019 (roughly end of 48-month grant period) |

| Phase 3d Demonstration Engine Manufacture | Manufacture and assemble the Block 1 demonstration engine and undertake the initial engine testing. | Culminate in the Critical Design Review (CDR) for the Block 1 engine. | Q4 2019 | Q4 2021 for Phase 1 Block 1 engine demo (beyond 48-monthgrant period) |

Following the SABRE Engine Level SRR (completed in December 2016 through Q1 of 2017), RE and their various stakeholders and funding sources decided to realign the programme with a focus on advancing the design of the air-breathing engine technology demonstrator (DEMO-A) in preparation for testing of the DEMO-A Engine by the end of 2019. Due to this realignment, a modified grant agreement focused on reducing future design risks was approved in 2017.

The programme as planned in 2017 was realigned into 19 projects within the following key elements:

-

SABRE integrated design

-

vehicle studies

-

technology demonstrators (at subsystem level) including test facilities

-

a series of technology development projects (enabling technologies)

Phase 3b was planned to be concluded at a SABRE Intermediate Key Point (IKP) review in mid-2018. Successful execution of the following activities was a stated pre-requisite for holding the IKP:

-

DEMO-A PDR conclusion

-

results of the test facility design review

-

results of heat exchanger technology development programme (HTX)

-

preliminary studies of the DEMO-N (design and develop a Nacelle demonstrator)

-

preliminary studies of the DEMO-R (design and develop a staged combustion rocket engine demonstrator)

-

continuation of the technology development programmes required for the SABRE engine

Schedule details for Phases 3c and 3d were not presented; Phase 3 was planned to culminate in the SABRE CDR in late 2026. Phase 4 was planned to consist of test integration, production readiness, and the beginning of engine production, completing in late 2033.

Due to delays in SABRE technical development and issues with test facility readiness, the DEMO-A test was not achieved in the time period covered by the SABRE Programme grant.

5. Impact Evaluation

This section addresses the assessment of the impact of the SABRE Programme grant. The overall purpose of this impact evaluation is to assess whether the grant met its objectives and to determine what impact the grant funding had on RE as well as on the wider UK space industry.

The material is structured around the main outputs and impacts that were expected to result from the SABRE Programme grant (see Figure 1 above). Significant programme documentation and data was available to the study team, so the results are largely based on a table-top review, supplemented as needed by data gathered through a series of interviews with relevant personnel within the UK Space Agency and RE [7].

[7] A significant portion of the information in this section was graciously provided by RE. The information was reviewed by the study team and is accepted as accurate and truthful.

5.1 Technological Advancements

One of the main objectives of the SABRE Programme grant was to advance the SABRE technology with a goal of maturing understanding of system performance through detailed design and demonstration. In order to determine whether the grant met its technical objectives, the study team:

-

reviewed technical progress of each component associated with SABRE 4.1 engine cycle

-

reviewed the summary of development of key technologies as provided by RE

-

reviewed the technical deliveries associated with the main activities in the realigned 2017 proposal, compared original cost vs actual as-invoiced cost, and the timeliness of the deliveries

It is important to note that the study team did not evaluate the “goodness” of the milestone accomplishments – only that the deliverables were submitted and accepted by the customers. The technical assurance of the milestones was completed by ESA as part of the GFA.

Significant technical progress was achieved during the period of the grant on all the elements that are both novel and critical to successful development of a SABRE engine. This progress (detailed in the next subsections) all feeds into the planned demonstration which will validate the SABRE concept. At the conclusion of the grant, RE had the capacity to produce all the needed elements for DEMO-A. Only after the DEMO-A goals have been achieved will there be enough confidence to pursue development of full engine.

5.2 Technical Progress of SABRE 4.1 engine cycle components

In the 2017 programme realignment proposal, the DEMO-A subsystems were intended to advance through the Critical Design Key Point (CDKP) gate review, then through CDR at the DEMO-A system level. Following the CDPK/CDR gates, the DEMO-A subsystems were intended to progress to the Manufacturing, Assembly, and Test phase, culminating in TRRs at the subsystem and DEMO-A system level. The rocket engine and nacelle elements of the SABRE system were to receive limited pre-PDR development during the Phase 3 realignment, but the content was eventually cancelled, and funds transferred to other milestones. The precooler (HX1) was not part of the DEMO-A project but developed separately as the HTX project. HTX was intended to progress through TRR and initial testing.

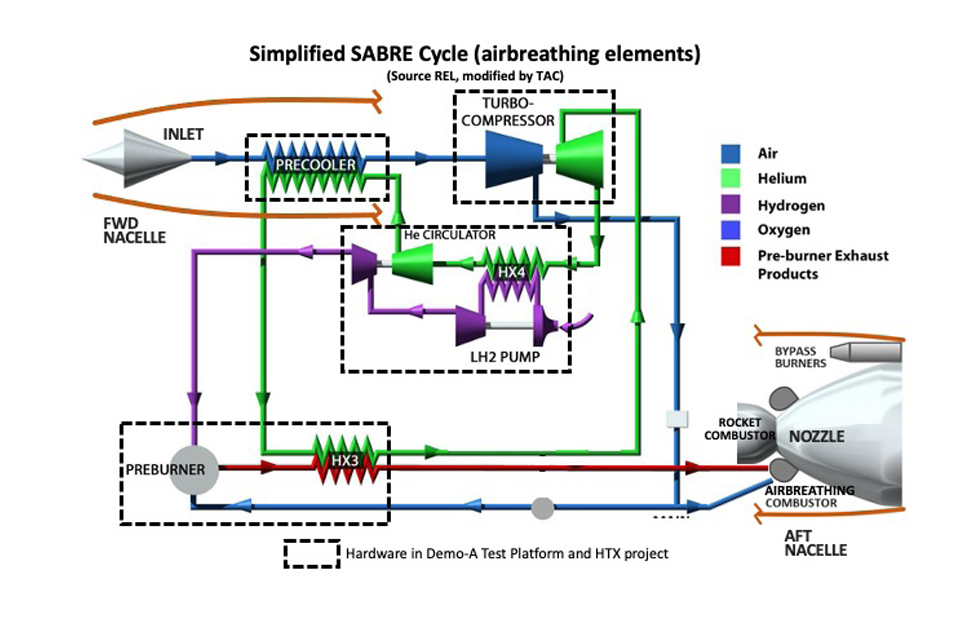

Shown below in Figure 5 is a schematic of the airbreathing elements of a simplified SABRE cycle with the hardware elements of the DEMO-A and HTX projects highlighted.

This image is a schematic of the airbreathing elements of a simplified SABRE cycle with the hardware elements of the DEMO-A and HTX projects highlighted.

Figure 6 below shows a “scorecard” of the design maturity and hardware status achieved during the Phase 3 grant period. The HTX project achieved the goal of advancing through CDR, TRR and test. The DEMO-A project achieved the CDKP/CDR design maturity goals but did not achieve the TRR goals. It should be noted that there was substantial testing and manufacturing trials at various scales during the design phase.

Figure 6: SABRE design maturity score card

| NACELLE | Design | Hardware/Test |

|---|---|---|

| Air Inlet | unknown | unknown |

| Precooler (HX1) | CDR | Test (Testing Achieved) |

| Nacelle Structure | unknown | unknown |

| Bypass Burners | unknown | unknown |

| AIR-BREATHING CORE | Design | Sub-Element | Integrated Test |

|---|---|---|---|

| Turbo Compressor (C1T1) | CDKP | Manafacturing capable | unknown |

| Preburner (PB1) | CDKP | Full scale testing | MRR (Manafacturing Readiness Review) |

| High Temp HX (HX3) | CDKP | Partial testing | unknown |

| LH2/He Regen (HX4) | CDKP | Manafacturing Demonstrated | unknown |

| He Circulator (C2T2) | CDKP | Manafacturing capable | MRR (Manafacturing Readiness Review) |

| LH2 Turbopump (P1T4) | CDKP | SOC (Supplier On-Contract) | SOC (Supplier On-Contract) |

| Airbreathing Combustor | unknown | unknown | unknown |

| Ancillary | CDKP | Partial Testing | FPS (First Parts in Stores) |

| DEMO-A System | CDKP | unknown | unknown |

| ROCKET | Design | Hardware/Test |

|---|---|---|

| Turbomachinery | unknown | unknown |

| Main Combustor | unknown | unknown |

| Nozzle | unknown | unknown |

5.3 Development of Key Technologies

Five major SABRE elements were advanced by RE using the UK Space Agency Grant: HX1 (precooler), C1T1 (helium turbine air compressor), PB1 (hydrogen-fuelled combustor), HX3 (microtube heat exchanger), and HX4 (microchannel heat exchanger).

RE has made significant strides in developing knowledge and capabilities to model and manufacture each of the five major elements. Integrated analytical models of varying fidelity were developed and cross validated. The models have been tuned and validated with experimental test results. RE has improved understanding of material properties at the extreme operational environments the systems will operate under. Design and manufacturing techniques were validated though fabrication and assembly of key components. The work performed under the grant has allowed for extensive understanding of the design and operational challenges of the complex heat exchangers and hydrogen combustor that enable SABRE.

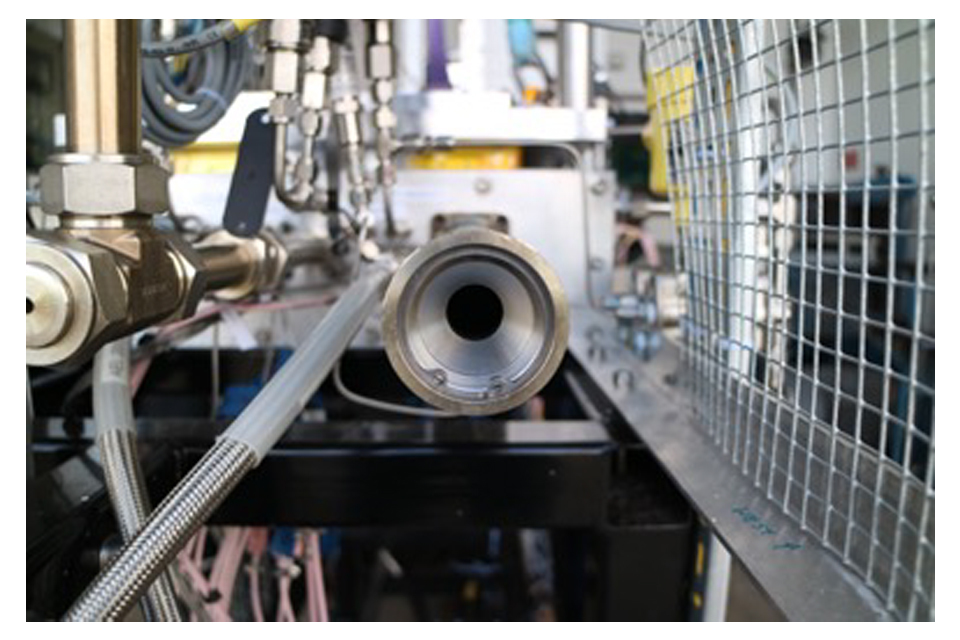

The grant funding enabled the full design, analysis, manufacture, and test of the precooler. This included taking the precooler successfully through a rigorous set of design, quality and safety review gates overseen by ESA and in some instances, supported by Reactions Engines’ strategic partner, BAE Systems. The project required a unique test set-up including newly designed, manufactured, and integrated test equipment (GSE) and a new bespoke test facility. After successful integration of the test article, GSE and control system within the test facility, the precooler was successfully tested multiple times at Mach 5 conditions. The results were analysed, and the performance models verified. All equipment was then transported back to the UK for disassembly and condition inspection. The test process for the precooler Mach 5 test is seen in Figure 7 below.

This image shows the test process for a Precooler Mach 5. The image shows air being pushed through machinery.

The DEMO-A Programme is a unique and complex engineering programme aimed at the development of all major subsystems within the air breathing core, the system level design and integration (e.g., controls, instrumentation) and ultimately a series of test demonstrations. The programme has taken the SABRE air breathing core from thermodynamic cycle diagrams and basic concept design to a fully designed system ready to be tested. This has involved multiple design iterations in order to update and simplify the design in accordance with learning achieved through the design and analysis of individual components and the system design/models. Ten major subsystems have been designed and analysed and taken through design gate reviews from concept to critical design (i.e., to the point of drawings produced and configuration ready for part manufacture). Suppliers have also been sourced for all hardware. This process also involved taking the overall system design through an equivalent set of rigorous design gates, from initial concept design to a fully analysed, detailed design (Critical Design Review). This included the testing of key system elements to demonstrate viability ahead of part manufacture (e.g., testing of key control system elements in a specially designed lab). Successful completion of both the subsystem and system design gates was achieved through approval from the project’s technical leadership team and ESA. Periodic review (approximately 6 monthly) of the programme’s technical progress was also undertaken by an independent Technical Advisory Board comprised of experienced individuals from the aerospace and space industry. Images of testing from the DEMO-A are seen in Figure 8 and Figure 9 below.

This image shows a number of people looking at a piece of machinery inside a hangar.

This image shows the nozzle of a HX3.

[6] Image provided by RE, and modified by TACUK

[8] Image provided by RE

[9] Image provided by RE

[10] Image provided by RE

5.4 Technical Deliveries

As discussed above, the SABRE Programme was realigned following the SABRE Engine Level System Requirements Review in 2017. The realigned programme was focused on advancing the design of the air-breathing engine technology demonstrator in preparation for testing of the DEMO-A Engine by the end of 2019.

The projects proposed in the 2017 programme realignment were as follows:

-

001 SABRE System Integration – Not included in GFA grant

-

Complete Interim Key Point (IKP) for the SABRE Engine

-

002 Vehicle Studies – Not included in GFA grant

-

003 DEMO-A Subscale airbreathing ground demonstration engine

-

004 DEMO-R Rocket engine demonstrator

-

005 DEMO-N Nacelle subsystems demonstrator

-

006 Test Facility for airbreathing core development engines (e.g. DEMO-A)

-

007 HTX Design, build and test of a high temperature precooler demonstrator

-

Technology Development Projects

-

008 Pre-Burner Test Rig

-

009 DEMO-A Microchannel HX Manufacture Development

-

010 Tubular HX Research

-

011 Advanced Nozzle Research

-

012 Intake & Bypass Burner Research

-

013 Nacelle Engineering

-

014 High Temperature Turbine Research

-

015 Hydrogen Embrittlement Research

-

016 Centrifugal Compressor Test Rig

-

017 SABRE Microchannel HX Manufacture Development

-

018 Rocket Design Study

-

019 Nacelle Base Drag Research

-

020 SABRE Rep-planning

The study team reviewed the technical deliveries associated with these activities and summarized the originally planned and as-invoiced costs and the timeliness of the deliveries [11].

[11] 18 review packages were invoiced under the 2015 milestone structure prior to the 2017 realignment. Those review packages are also referenced below.

5.5 003 DEMO-A

Project 003 DEMO-A Subscale airbreathing ground demonstration engine was the primary activity in the 2017 realigned grant, accounting for over 50% of the GFA funding value:

Original Re-alignment Amount: £25,615,863

As-Invoiced Amount: £27,852,767

The major DEMO-A milestones in order of delivery were:

Alternative Concept Key Point (ACKP) Reviews (July 2017)

-

10 review packages

-

total GFA value invoiced was £809,390

-

all packages were delivered on schedule

Baseline Design Review (BDR) Reviews (November 2017 to January 2018)

-

8 review packages

-

1 package removed from programme

-

total GFA value invoiced was £1,282,101

-

packages were delivered on average 30 days late

Preliminary Design Key Point (PDKP) Reviews (May 2018 to July 2020)

-

28 review packages

-

1 package determined to be Out of Scope and moved to the 007 HTX project

-

1 package removed from programme

-

total GFA value invoiced was £7,175,387

-

packages were delivered on average 201 days late

Mid-Design Review (MDR) Reviews (November 2018 to April 2020)

-

20 review packages

-

1 package determined to be Out of Scope and moved to the 007 HTX project

-

1 package removed from programme

-

total GFA value invoiced was £4,320,104

-

packages were delivered on average 270 days late

Critical Design Key Point (CDKP) Reviews (December 2018 to December 2020)

-

27 review packages

-

1 package moved to Post-PDR Close-out

-

1 package reduced to £0

-

1 package determined to be Out of Scope and moved to the 007 HTX project

-

1 package removed from programme

-

total GFA value invoiced was £5,491,223

-

packages were delivered on average 162 days late

18 review packages were invoiced under the 2015 milestone structure prior to the 2017 realignment.

Those review packages are also referenced below.

Preliminary Design Review (PDR) Reviews (March 2019 to May 2021)

-

11 review packages

-

total GFA value invoiced was £3,786,240

-

packages were delivered on average 29 days late

Critical Design Review (CDR) Reviews (March 2019 to November 2020)

-

16 review packages

-

total GFA value invoiced was £3,027,924

-

packages were delivered on average 20 days late

First Parts in Store (FPS) Reviews (August 2019 to November 2020)

-

5 review packages

-

total GFA value invoiced was £844,165

-

packages were delivered on average 16 days late

Manufacturing Readiness Review (MRR) Reviews (May 2021)

-

2 review packages

-

total GFA value invoiced was £283,803

-

packages were delivered on average 285 days late

An additional 7 review packages associated with 003 DEMO-A were invoiced under the 2015 milestone structure.

Additional details on these deliveries are detailed in Appendix A.3 Funding Milestone Details.

5.6 DEMO-R

Project 004 DEMO-R Rocket engine demonstrator project had three milestones: A Scoping Study, a Trade Study, and Concept Design & Requirements Definition. In December 2019 it was determined that DEMO-R was under-resourced due to the focus on HTX and DEMO-A. DEMO-R was declared Out of Scope and the funding transferred elsewhere.

Original Re-Alignment Amount: £898,722

As-Invoiced Amount: £0

5.7 005 DEMO-N

Project 005 DEMO-N Nacelle subsystems demonstrator has a single milestone for Bypass Burner Development. However, funding was transferred to 003 DEMO-A in July 2020.

Original Re-Alignment Amount: £1,520,825

As-Invoiced Amount: £0

5.8 006 Test Facility

Project 006 Test Facility for air breathing core development engines (DEMO-A) was originally planned and invoiced as follows:

Original Re-Alignment Amount: £8,216,070

As-Invoiced Amount: £4,924,876

A total of 27 Test Facility milestone packages were delivered. However, there were also 23 planned Test Facility milestone packages that were eliminated due to “Change of Scope-Not planned to be delivered.”

An additional 6 review packages associated with 006 test Facility were invoiced under the 2015 milestone structure.

Project 006 Test Facility should culminate in facility handover and test facility readiness review. Additional details on the delivered packages and eliminated packages are detailed in Appendix A.3 Funding Milestone Details.

5.9 007 HTX

Project 007 HTX Design, build and test of a high temperature precooler demonstrator, was originally planned and invoiced as follows:

Original Re-Alignment Amount: £6,154,957

As-Invoiced Amount: £9,644,627

A total of 25 HTX milestone packages were delivered. An additional 5 review packages associated with 007 HTX were invoiced under the 2015 milestone structure. The HTX project culminates in a post-test TRB.

5.10 008 Pre-Burner Test Rig

Project 008 Pre-Burner Test Rig was originally planned and invoiced as follows:

Original Re-Alignment Amount: £906,878

As-Invoiced Amount: £1,006,878

A total of 4 Pre-Burner Test Rig milestone packages were delivered.

5.11 009 DEMO-A Microchannel HX Manufacture Development

Project 009 DEMO-A Microchannel HX Manufacture Development was originally planned and

invoiced as follows:

Original Re-Alignment Amount: £292,526

As-Invoiced Amount: £654,993

A total of 7 milestones were delivered.

5.12 010 Tubular HX Research

Project 010 Tubular HX Research was originally planned and invoiced as follows:

Original Re-Alignment Amount: £202,197

As-Invoiced Amount: £215,045

A total of 2 milestone packages were delivered; a third milestone delivery planned but funding was transferred to 003 Demo A.

5.13 011 Advanced Nozzle Research

Project 011 Advanced Nozzle Research was originally planned and invoiced as follows:

Original Re-Alignment Amount: £227,856

As-Invoiced Amount: £63,928

A single milestone package was delivered on the Nozzle Architecture Study-Interim Report. Another milestone package on the Nozzle Architecture Study was originally planned but funding was transferred to 003 DEMO-A.

5.14 012 Intake & Bypass Burner Research

Project 012 Intake & Bypass Burner Research was originally planned and invoiced as follows:

Original Re-Alignment Amount: £129,426

As-Invoiced Amount: £129,426

A single milestone package was delivered for Demo-N planning.

5.15 013 Nacelle Engineering

Project 013 Nacelle Engineering was originally planned and invoiced as follows:

Original Re-Alignment Amount: £60,016

As-Invoiced Amount: £0

A single milestone package was originally planned for to achieve an Interim Key Point (IKP), but in December 2019 it was determined to be Out of Scope and the funding transferred elsewhere.

5.16 014 High Temperature Turbine Research

Project 014 High Temperature Turbine Research was originally planned and invoiced as follows:

Original Re-Alignment Amount: £28,675

As-Invoiced Amount: £0

A single milestone package was originally planned for Design & Analysis to IKP. However, this milestone was never delivered or paid.

5.17 015 Hydrogen Embrittlement Research

Project 015 Hydrogen Embrittlement Research was originally planned and invoiced as follows:

Original Re-Alignment Amount: £285,131

As-Invoiced Amount: £326,911

Two milestone reports were delivered.

5.18 016 Centrifugal Compressor Test Rig

Project 016 Centrifugal Compressor Test Rig was originally planned and invoiced as follows:

Original Re-Alignment Amount: £202,130

As-Invoiced Amount: £0

Milestone associated with the Centrifugal Compressor Test Rig project were never delivered or paid.

5.19 017 SABRE Microchannel HX Manufacture Development

Project 017 SABRE Microchannel HX Manufacture Development was originally planned and invoiced as follows:

Original Re-Alignment Amount: £110,006

As-Invoiced Amount: £51,703

One delivery was made on the Regenerator Module Manufacturing Process Report.

5.20 018 Rocket Design Study

Project 018 Rocket Design Study was originally planned and invoiced as follows:

Original Re-Alignment Amount: £56,261

As-Invoiced Amount: £100,000

One delivery was made on the Rocket Engine Design Report.

5.21 019 Nacelle Base Drag Research

Project 019 Nacelle Base Drag Research was originally planned and invoiced as follows:

Original Re-Alignment Amount: £51,147

As-Invoiced Amount: £0

Nacelle Base Drag Research was originally funded for three activities, but delivery delays promoted a transfer of its funding to 003 DEMO-1 in July 2020. Therefore, the GFA value delivered was £0.

5.22 020 SABRE Re-planning

Project 020 SABRE Re-planning was originally planned and invoiced as follows:

Original Re-Alignment Amount: £182,000

As-Invoiced Amount: £182,000

A single delivery was made on the SABRE Proposal & Milestones Table.

This study determined that there were numerous revisions to the payment milestones and associated work content that were approved by the customer. These changes included:

-

splitting and/or adding milestones

-

transferring amounts between existing and/or added milestones

-

changing milestone names and/or deliverables

-

relegating milestones to lower phases, e.g., originally subsystem Test Readiness Review (TRR) revised or moved to subsystem ARR (Assembly Readiness Review)

-

removing milestone and moving content and/or funding

Delays in deliveries may have also been driven by limited RE staffing; UK Space Agency personnel did note that the RE staffing ramp-up in the initial years of the grant was much slower than anticipated, which impacted the overall programme schedule.

A review of emails from ESA to RE regarding milestone deliveries found that ESA was very complementary of RE and noted “The team has achieved a high level of design definition, commensurate with the needs of a CDR, and all aspects of planning for manufacture, V+V planning and supply chain are in place.”

Near completion of the MDR, ESA stated “…a number of highly successful manufacturing trials have been evidenced to date. These provide confidence that the critical elements needed can be available in good time,” although they did note performance risks that would need to be retired by a module flow test ahead of CDR. ESA concluded the MDR “represents significant progress” and “largely confirms manufacturability and identifies critical areas.”

However, none of the original 24 DEMO-A subsystem and system-level TRR milestones were accomplished. Many were relegated to lower phase levels (TRR to ARR, MRR, FPS or even lower phases), sometimes over several revisions. Some were outright “removed from programme” and the funds distributed elsewhere. All CDR milestones were accomplished. Six subsystems have FPS, and two subsystems accomplished MRR milestones.

Facility readiness for the airbreathing core test facility was not achieved. Approximately 40% of the allocated GFA funding was moved to other projects. Much of the removed content was for contracted structures, components, subsystems, materials, and commodities.

The DEMO-R and DEMO-N content were eliminated, and the funding allocated to other projects’ milestones.

The HTX project invoiced 57% more than the originally allocated GFA amount. Test readiness was achieved (with additional scope and milestones added) and initial testing was conducted.

The as-invoiced distribution of the £50M GFA amount from the 2017 proposal is shown below:

• DEMO-A: £27,852,767 invoiced (vs £25,615,863 proposed)

• DEMO-R: No milestones accomplished (£898,722 moved to other milestones)

• DEMO-N: No milestones accomplished (£1,520,825 moved to other milestones)

• test facility: £4,924,876 invoiced (vs £8,216,070 proposed)

• HTX: £9,644,627 invoiced (vs £6,154,957 proposed)

• technology demonstration Projects: £2,734,884 invoiced (vs £2,746,716 proposed)

• previously invoiced before programme realignment, £4,846,846

While the realigned Phase 3 Programme goal of achieving test readiness for DEMO-A and the test facility was not achieved, the study team finds that accomplishments achieved to date do fall largely in line with the original 2015 GFA intent, which was to progress the demonstration engine through the CDKP and CDR. It appears that there was some growth in ambition during the programme realignment that advanced the main objective from CDR to test readiness.

5.23 Positioning of RE as a “space” company

The study team was specifically tasked with evaluating the impact of the SABRE Programme grant on RE’s positioning as a “space” company. The study team considers a space company to be a company involved in the larger space economy, providing goods and services associated with space or access to space. These good and services could include but are not limited to research and development activities, manufactured “flight hardware,” and space-enabled services (such as telecom) provided to end-users. In order to evaluate the impact of the grant on RE’s positioning as a space company, the study team took several elements into consideration including interviews with RE personnel, technical advancements, new and strengthened relationships, publications, prizes received, creation of IP, and technology transfer. While RE considers itself a space company, the study team found that the grant has improved RE’s position as a space company within the larger space economy and positively impacted RE’s ability to provide goods and services associated with space and access to space. As a result of the grant funding, RE has developed new and strengthened relationships with international and domestic space agencies and companies and has made relevant technological and process advancements.

5.24 Self-assessment: “RE is a “space” company”

RE’s self-assessment is that RE was a space company prior to receiving the SABRE Programme grant, but that the grant funding has allowed the company to progress and evolve in this role. According to information provided by RE, SABRE and SKYLON were in development for several years before the award of the SABRE Programme grant via private equity funding and ESA contracts. This demonstrates RE’s pre-existing focus on providing goods and services associated with access to space. While RE has always seen itself as a company with space ambition, RE personnel agreed that the grant has added a level of credibility to their position within the larger space economy, especially in dealings with the United States. RE personnel also agreed that the grant allowed the company to work with international space partners (state agencies and private industry) with a sense of confidence and credibility. Due in part to the SABRE Programme grant, RE now views itself as an integral part of the UK space economy.

5.25 Involvement in the Larger Space Economy

The study team concurs with RE’s self-assessment that the SABRE Programme grant improved their position as a space company within the larger space economy by allowing RE to build new and strengthened partnerships, and to increase their public recognition across the space economy. As summarized in Section 5.39 below, the SABRE Programme grant did have a significant impact on RE’s relationships throughout the domestic and international space community. The grant has significantly strengthened RE’s reputation and provided the opportunity to gain interest and, in many cases, work directly with important government bodies and industry players.

During interviews with the study team, RE personnel specifically highlighted the importance of having additional access to ESA through the SABRE Programme grant. While RE did have commercial relationships with ESA prior to the grant, RE feels that these relationships have been strengthened through its participation throughout the programme duration including technical oversight on the critical review gates (PDR, CDR, TRR, etc). In addition to simply having a relationship with ESA through the grant, RE has also been able to leverage that relationship for additional opportunities that wouldn’t have otherwise been available.

RE personnel also cited their role at the 2019 UK Space Conference and their membership in the International Astronautical Federation (IAF) as evidence of their maturing position as a space company. Additionally, as discussed in greater detail below, RE actively promotes their profile and company through a variety of communication avenues and participates in events designed to stimulate interest and excitement around space topics. The nature of the SABRE Programme has resulted in many publications and invitations to attend conference events within the space industry. Accolades can also be used as a means of determining the success of the SABRE Programme in provoking industry interest; RE has received several notable accolades from within the space industry in the past several years.

5.26 Providing Goods and Services Associated with Space

The study team determined that the SABRE Programme grant had a positive impact on RE’s ability to provide goods and services associated with space and access to space. As discussed in greater detail above, technical advancements were made over the course of the SABRE Programme grant, and the objectives associated with progressing the demonstration engine through the CDKPs and CDRs were met as well as the full testing objectives for the precooler system. In addition to advances in hardware design, there have been upgrades to physics and engineering models and tools.

RE has also conducted several integrated vehicle studies analysing how the SABRE engine would perform in an orbital vehicle. This emphasis on total system performance as opposed to just the technical aspect of the SABRE development indicates that RE is maturing as a space company focused on space access.

Additionally, RE has significantly matured its business and manufacturing processes over the life of the grant. These changes were driven by the complexity of the programme as well as increasing coordination with other members of the space industry. Actions that may have been more ad hoc previously now have command media. These processes range from requirements management and verification to interface control and resource management. Such Systems Engineering and Programme Management capabilities are crucial for space companies developing highly complex and interconnected systems.

The grant resources were also used for several manufacturing demonstrations which allowed RE to industrialize their manufacturing processes and achieve ISO9001 accreditation. As discussed in greater detail below, RE has also successfully generated tradeable IP as a result of the SABRE Programme. RE has leveraged their IP to facilitate knowledge transfers in various industries and form partnerships with other organisations.

The only direct space-related transfer that has resulted in a commercial contract to date is the rocket engine plume cooling for the test stand. However, there are multiple thermal management challenges within the space product market and RE is actively exploring further opportunities with industry players and agencies where it can play a future role.

RE personnel also emphasized that the purpose of their technology transfer and exploitation programme is to expand beyond space into a more diversified portfolio with short-term commercial gains. Space technology development projects require long-term investments with a great deal of capital required upfront. In order to fund SABRE, RE needs to realize earlier commercial gains through technology transfer to other industries with a shorter return on investment timeline, such as motorsport.

5.27 Employment and People Development

RE has grown to 204 permanent employees since 2015. The workforce is made up of highly skilled, diverse (currently at 19% women) and young (average employee age is 34) employees from across the country, Europe (28 European employees), and throughout the world (e.g., Australia, Canada). The company includes professionals in many sectors of the economy, from high-performance motorsport to the video gaming industry. Figure 10 below shows the actual recruitment profile of RE. Overall head count for 2021 is similar to 2020. The compound average growth rate of 24% per year has exceeded the planned profile from the 2014 Business Case. Note that this figure does not include subcontract personnel, of which there were approximately 30 during 2019.

Figure 10: RE Permanent Employees [12]

| Year | Permanent Employees |

|---|---|

| 2014 | 61 |

| 2015 | 71 |

| 2016 | 96 |

| 2017 | 132 |

| 2018 | 174 |

| 2019 | 200 |

| 2020 | 204 |

In the 2015 grant, RE identified staff retention and recruitment as a top-level risk associated with the programme stating that a workforce of up to 204 would be needed to complete the programme. According to Figure 10 above, the company has grown from 61 employees in 2014, to 204 employees in 2020, effectively reaching their risk mitigation goal. However, UK Space Agency personnel did note that the staffing ramp-up in the initial years of the grant was much slower than anticipated, which impacted the overall programme schedule.

RE recruits professional engineers across the design, manufacture, and testing phases and across a broad range of engineering disciplines such as those listed below.

-

heat exchanger thermodynamics

-

mechanical design

-

performance & aerodynamics

-

systems engineering

-

turbo-machinery

-

rockets & turbo-pumps

-

technical support

-

manufacturing

-

stress & structural analysis

-

control systems

-

safety and reliability

The company also recruits Operations, Programme Management, and Science and Technology professionals to support the main programme and a broad range of individuals into support functions that assist the main project activity. Most recruits will have a university education with many holding PhDs and being industry experts in their field (due to the specialist nature of the activity). As of early 2022, the company has 21 job openings on its website. A summary of the job types and locations is shown below in Table 3.

Table 3: Summary of RE Job Openings [13]

| Job Groups | |

|---|---|

| Applied Technologies | 5 |

| Chief Operations Office | 5 |

| Engineering | 6 |

| Programmes | 2 |

| Supply Chain & Production | 3 |

| Total Job Postings | 21 |

| Job Groups | |

|---|---|

| Littleton, CO (United States of America) | 1 |

| Culham Science Centre | 20 |

In addition to the direct impact of the research these employees perform, they also induce positive externalities through productivity and knowledge spill-overs where knowledge generated within RE enhances the productivity of other organisations. Employees also contribute to induced effect wage spending impacts supported by the organisation’s research, contract, and investment income. Employees spend their pay checks on goods and services in the economy. This, in turn, produces wage income for workers in the industries that produce these goods and services resulting in additional rounds of spending, i.e., a ripple effect throughout the UK economy.

RE promotes continuous professional development and encourages its workforce to achieve professional accreditation through recognised bodies (e.g., Institute of Mechanical Engineers, Institute of Physics, Royal Aeronautical Society, Association for Project Management). As part of its commitment to investing and developing people, the company supports both an engineering apprenticeship and engineering graduate programme, which has become an attractive opportunity for early career professionals. Thus far, 12 graduates and 8 apprentices have been through the programme. This attracts high-potential talent from top UK universities around the country. The representation of women has been high in these programmes and the retention of graduates and apprentices within the company after completing the programmes has been good.

There are numerous ways in which university research might have positive spill-over effects on the private sector. For example, spill-overs are enabled through direct Research & Development (R&D) collaborations between universities and firms, such as engineering apprenticeships and engineering graduate programmes, the publication and dissemination of research findings, or university graduates entering the labour market and passing on their knowledge to their employers.

RE is an employer of highly skilled and productive employees in the space industry with a high likelihood of being employed, as well as having enhanced earnings, and the company supports its core activities through significant expenditures throughout the UK economy. RE’s physical footprint also supports jobs and promotes economic growth throughout the UK economy. Section 6 summarizes the gross economic benefits of the direct and induced impacts of research, contracts, and investment supported by the employee base.

[12] Employee headcount provided by RE

[13] https://reactionengines.co.uk/careers/vacancies/

5.28 Labour Productivity Gains

The UK government’s recently published Size and Health of the UK Space Industry 2021 report cites employment of 46,995 in the UK space sector and estimates it is valued at £16.5 billion (both figures relate to 2019/20). Among the findings of the 2021 report was evidence of a productivity increase from employees of the UK space industry. While the total UK space industry income decreased from £16.8 billion in 2018/2019 to £16.5 billion in 2019/2020, income in the Space Manufacturing segment increased from £2.2 billion to £2.7 billion. The industry directly contributed £6.9 billion of Gross Value-Added (GVA) to UK economic output in 2019/20. That GVA divided across the 46,995 direct employee workforce results in a labour productivity ratio of £146,000 per employee, which is 2.6-times greater than the UK average labour productivity (£57,000 per employee). This high level of labour productivity reflects the UK space industry’s highly skilled workforce. This data can be seen in Figure 11 below [14].

5.29 Top statistics

Total space industry income: £16.5 billion. Percentage breakdown is:

- Space applications: 74%

- Space manufacturing: 14%

- Space operations: 9%

- Ancillary services: 3%

Direct Employees: 47,000

Income from exports: £5.3 billion

Global ranking in private space investments: 2nd

Space organisations identified: 1,293

R&D expenditure: £836 million

Employees with a bachelor’s degree or higher: 73%

5.30 Global exports

North America: 24%

Central and South America: 4%

Rest of Europe: 48%

Middle East and North Africa: 5%

Asia, Oceania and Sub-Saharan Africa: 19%

5.31 Regional Employment

London: 27%

South East: 21%

Scotland: 18%

Rest of UK: 34%

5.32 Further statistics

Direct contribution of the UK space industry to UK GDP: £6.9 billion

Organisations expecting income growth over the next three years: 4 in 5

UK space industry labour productivity vs. national average: 2.6x

[14] Bryce Tech. “Infographic: Size & Health of the UK Space Industry 2021”. UK Space Agency, April 2022. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1070143/Bryce_UK_S_H_Infographic_MASTER_v4.pdf

5.33 Credits

BryceTech

UK Space Agency

Note: Based on analysis of 1,293 UK-based space-related organisations in 2019/20. Source: BryceTech (2022), Size & Health of the UK Space Industry 2021.

Space industry employment also has indirect and induced supply chain impacts. It is estimated that the activity of 100 employees in the space industry supports 300 additional employees among suppliers and in other economic sectors (such as retail and services) [15]. Direct employment in RE (204 employees) could potentially support 612 additional UK jobs through indirect and induced effects. Therefore, the total UK-based employment supported by the activities of RE is estimated to be 816 employees. These quantified estimates appear reasonable when compared to the comprehensive supply chain RE has developed since 2015, which includes 990 registered suppliers and 650 active suppliers.

[15] Bryce Tech. “Size and Health of the UK Space Industry 2021”.

5.34 Intellectual Property and Partnerships

5.35 Patent Portfolio

Information from RE’s patent portfolio provides additional valuable insights into the company’s wider knowledge dissemination activities. A broad suite of technologies is in development for SABRE, at various levels of maturity, generating tradeable IP. Most mature, and pivotal, is the heat exchanger technology which has already demonstrated its spin-out potential and generated revenue in other applications. Most of the IP generated to date is around the heat exchangers, the whole system design and the turbomachinery required for the SABRE cycle. In some cases, RE has protected its IP with a series of patents. Since 2015, RE has had 12 granted patents, registered in several countries, for an average rate of just under 2 grants per year. However, often RE chooses instead to protect its IP by retaining it as a non-public trade secret, of which they currently have 35 internally documented. Table 4 shown below, provides a summarization of the technical areas where RE holds patents and the countries in which they have been granted patent protection.

Table 4: RE Patent Portfolio 2015 – 2021 [16]

| Inventions | Date Granted | UK | USA | AUS | CN | Japan | FR | Italy | DEN | Spain | UKR | RUS | KOR | CA | IL | Patent |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SABRE 3 Cycle | 7-Sep-16 | x | x | x | x | x | x | x | x | x | GB2519152B | |||||

| SABRE 4 Cycle | 12-Oct-16 | x | x | x | x | x | x | x | x | x | x | x | x | x | GB2519155B | |

| Helium - EP | 13-Sep-17 | x | x | x | x | x | x | x | x | x | EP3055511B1 | |||||

| Pre-Cooler Case 1: Thermal Expansion | 15-Apr-15 | x | x | x | x | x | x | x | x | x | x | x | x | GB2519147A | ||

| Pre-Cooler Case 2: Load Element | 4-Oct-17 | x | x | x | x | x | x | GB2519153B | ||||||||

| Pre-Cooler Case 3: Intermediate Header | 24-May-17 | x | GB2521113B | |||||||||||||

| Pre-Cooler Case 4: Frost Control | 24-May-17 | x | GB2521114B | |||||||||||||

| Pre-Cooler Case 5: Guide Vanes | 12-Aug-20 | x | GB2519148B | |||||||||||||

| Pre-Cooler Case 6: Drum Structure | 12-Aug-20 | x | GB2578262B | |||||||||||||

| Gas Turbine Improvements | 27-Oct-21 | GB2584331B | ||||||||||||||

| Multiple Fluid Spiral Module HX | 6-Oct-21 | GB2581840B | ||||||||||||||

| Internal Heat Dissipation for Battery Cells | 15-Dec-21 | GB2589149B |

In addition to those listed in Table 4, there is one further patent pending grant status (published in 2020) and another 6 patent applications (all published since 2018). RE also has 30-40 ideas that are currently underway in their internal patent process which will hopefully become patent applications in the future.

[16] Information provided by RE

5.36 Knowledge Exchange and Partnerships

In addition to protecting its IP, RE has also leveraged their IP to facilitate knowledge transfers in industry and form partnerships with other organisations. The eleven activities listed in Table 5 describe the impacts associated with Reaction Engines’ licensing of its IP to other organisations; the operations of spinout companies whose activities are based on RE IP; and the activities of partnerships with other companies.

SABRE is a technology concept that potentially has broader benefits beyond space access and the mainstay SABRE Programme. In line with the conditions of initial UK Government investment, RE has pursued early commercialisation of SABRE Technology in adjacent and alternative applications and industries. RE has won contracts for spin-out technology with future opportunities expected to generate additional revenue. These spinouts have also allowed RE to industrialise its technology and processes to accommodate efficient higher yield output, a key step in the commercialisation of new technology.

Table 5: RE Technology Transfer and Knowledge Exchange Activities [17]

| Activity | Description |

|---|---|