SSRO determination on the extent to which labour costs in a qualifying defence contract are Allowable

Published 25 January 2019

Executive summary

1. Background

1.1 The SSRO was asked by the Secretary of State for Defence to determine the extent to which the labour costs in a qualifying defence contract were allowable. The SSRO received the referral on 20 April 2018 and accepted the referral on 9 May 2018, having conducted due diligence in line with its guidance.

1.2 The SSRO issued a provisional determination to the parties on 28 August 2018. The parties made further representations, which the SSRO considered before issuing its final determination on 30 October 2018.

1.3 The contract in question concerned support and maintenance of equipment. The labour costs formed part of a target price for the contract and were estimated by multiplying labour rates for the contractor’s business by the labour hours estimated for the contract.

1.4 The estimated labour hours were not contested, and the determination focused on the labour rates forecast for the contract. The key issue was whether the contractor’s approach to estimating the labour rates would result in allowable costs, having regard to the test of whether the costs are appropriate, attributable to the contract and reasonable in the circumstances (the AAR test).

1.5 The labour rates were estimated in circumstances where there was a degree of uncertainty about the labour required from the contractor’s business over the life of the contract. The contractor had previously done similar work for the MOD, but to some extent the scope of work for the contract was expected to depend on survey, inspection and testing and there were, additionally, two elements of the specification that were new. There were also revisions being made to the MOD’s work programmes that would be likely to impact on labour required from the contractor.

1.6 The contractor took a top-down approach to estimating the labour rates, which involved taking the rates for a baseline year and rolling them forward for the contract (a period of between four and five years). The SSRO’s determination considers, first, whether the contractor’s top-down approach was suitable in the circumstances that applied at the time of entering into the contract and, secondly, whether appropriate adjustments were made to the baseline rates when applying them to the contract.

1.7 This document sets out an anonymised version of the SSRO’s determination, which is intended to aid understanding of how the regulatory framework is being applied without disclosing sensitive information. The process of anonymisation has involved removing some of the detailed facts relied upon in making the determination. As the determination was made having regard to the circumstances of the subject contract, care needs to be taken when applying the findings to another contract.

2. Determination summary

2.1 The SSRO accepted that the approach of applying forecast labour rates for the business to estimated labour hours for the contract could produce an estimate of labour costs that satisfies the AAR test. There was no dispute between the parties on this point.

2.2 The Guidance identifies a series of factors to be considered when determining whether a cost satisfies the AAR test. If the contractor correctly applies a suitable methodology when estimating the contract labour hours and labour rates for the business, then the resulting labour costs should satisfy the majority of the factors and, consequently, the AAR test.

2.3 The choice of the most suitable methodology to deploy should be based on its characteristics and the contract in question, giving due consideration to the strengths and weaknesses of each approach. The top down approach adopted by the contractor is capable of providing a reasonable estimate of the labour rates, provided that relevant adjustments are made to the baseline to address differences from the contract period.

2.4 For this contract, the uncertainty in the MOD’s programmes made it unlikely that a bottom up approach would be more accurate. This does not mean that a top down approach will always be most appropriate, nor that a bottom up approach will never be appropriate.

2.5 Forecast load was an input to the contractor’s calculation of its labour rates estimate, which it determined based on the MOD’s work programmes at a point in time. No evidence was provided that a different programme would have been more appropriate, and the contractor’s general approach seems reasonable given the volatility that was identified.

2.6 It was reasonable to use the Baseline year, subject to relevant adjustments and provided that any costs that were not Allowable were removed. It provided the most recent actual data and the parties agreed it was an appropriate year to use.

2.7 The assessment of whether the Baseline year included costs that would not be Allowable under the contract, and the comparison of the baseline with the previous year, helped the parties to understand how representative the baseline was and what adjustments were required. Details of the actual performance achieved through labour management in the Baseline year, such as labour utilisation, workforce capacity and the mix of hired and permanent staff in the cost centres, may have provided greater transparency as to the baseline.

2.8 The adjustments that the contractor made to the labour rates for the Baseline year appear reasonable. It is possible that additional adjustments to the baseline may have been reasonable, for example, in relation to matters of workforce management. The SSRO was not provided with evidence that would enable it to make such a determination, but it considered that there is information available to the parties that would enable them to consider whether any additional adjustments are required, such as the contractor’s forecast of load and information held by the contractor about performance in the Baseline year. A bottom up model or use of the MOD’s Form 19, or similar spreadsheet, is not required for this purpose, given its conclusion that due to volatility such an approach is not likely to be more accurate than a top down approach. Any adjustments to the baseline should not double count the planned productivity reductions in the contract hours.

The Referral

3. The question to be determined

3.1 The referral concerned a contract entered into between the Secretary of State for Defence (the Authority) and the contractor. The contract is a qualifying defence contract (QDC) within the meaning of the Defence Reform Act 2014 (the Act).

3.2 The SSRO was asked by the Authority on 20 April 2018 to determine “the extent to which the claimed Labour Rates deliver Allowable Costs” under the contract. The application was made on behalf of the Authority by an official of the Ministry of Defence (the MOD) and references to the MOD and the Authority are used interchangeably in this document. The referral was submitted under section 20(5) of the Act, which enables the SSRO to determine the extent to which a cost is an allowable cost under a QDC if the Secretary of State or the primary contractor applies to the SSRO for such a determination.

3.3 The estimated labour costs for the contract were calculated by multiplying estimated contract labour hours by estimated labour rates for the contractor’s business. Having regard to this methodology, the SSRO considered it may accept a referral to determine the extent to which the labour costs in the contract are allowable, focusing on the labour rates element of the labour cost calculation. The SSRO accepted the referral on this basis on 9 May 2018 and notified the MOD and the contractor of this acceptance on the same date.

4. Process followed, and matters considered

4.1 Prior to accepting the referral, the SSRO considered whether the preconditions had been met for an application by the Authority under section 20(5) of the Act.[footnote 1] The MOD gave a notice to the contractor, requiring it to show that the labour costs are appropriate, attributable to the contract and reasonable in the circumstances, and stating that it would refer the matter to the SSRO if the contractor did not provide satisfactory evidence in support of its claim within 30 working days. The contractor responded but the MOD was not satisfied with the response.

4.2 The SSRO also considered whether the referral was made in time, as an application for a determination under section 20(5) of the Act must not be made more than two years after the contract completion date.[footnote 2] This was not an issue, as the completion date for the contract falls in the future.

4.3 The SSRO informed the parties on 23 May 2018 that the target date to issue a final determination was 13 November 2018. The timeframe was set having regard to the nature and complexity of the referral, in line with the SSRO’s published guidance on referrals.

4.4 After accepting the referral, the SSRO appointed a committee to make the determination, in accordance with paragraphs 10 and 11 of Schedule 4 to the Act. The members of the committee were Terence Jagger and Marta Phillips, both non-executive board members of the SSRO, and Christine Fraser, an independent. The committee was supported by a case team.

4.5 The MOD and the contractor actively participated in the referral, responding to requests from the SSRO for information and further explanations. They are referred to together in this determination as “the parties” or “the contracting parties”.

4.6 The MOD submitted information to the SSRO prior to the formal application for a determination. The SSRO issued further requests for information to the parties on the dates set out in Table 1 below.

Table 1: Dates of information requests and responses

| Request | Response | |

|---|---|---|

| MOD | 17 May 2018 | 30 May 2018 |

| Contractor | 17 May 2018 | 22 May 2018; and 1 June 2018 |

| Contractor | 15 June 2018 | 20 June 2018 |

| Contractor | 20 June 2018 | 28 June 2018; and 3 July 2018 |

4.7 The SSRO invited each party to comment on material submitted by the other party and further submissions were made by both parties in response. These opportunities were provided progressively throughout the referral.

4.8 One party submitted some of its information on the basis that the information may not be shared with the other party to the referral. The SSRO respected this request but for reasons of fairness the SSRO did not rely on any information submitted on a confidential basis in making its determination. This position was made known to the parties both at the oral hearing and in writing.

4.9 With the exception of the confidential material, the SSRO considered all representations received from the parties as required by the Regulations.[footnote 3] References to the representations have been removed from this summary of the determination.

4.10 A site visit was conducted at the contractor’s business on 2 July 2018. The purpose of the site visit was to provide general background for the SSRO in relation to the work that is the subject of the contract and the site at which it is being carried out. The site visit was attended by representatives of both parties.

4.11 An oral hearing was held at the SSRO offices on 5 July 2018, with both parties being represented. The oral hearing provided an opportunity for both parties to make representations to the SSRO and to answer questions. The hearing was recorded, and a transcript made available to both parties on 26 July 2018.

4.12 The SSRO issued a provisional determination to the parties on 28 August 2018. The representations made by the contractor and the MOD in response to the provisional determination have been considered and reflected in this determination where appropriate.

4.13 In making its determination, the SSRO was required to consider legislation and guidance in force at the time when the contract was agreed.[footnote 4] The relevant provisions are set out in this document, primarily in sections 5 and 6, and were considered when making the determination.

4.14 Consideration was given to previous decisions of the SSRO, in response to other referrals, but these did not provide significant assistance with this determination.[footnote 5] An earlier opinion issued by the SSRO looked at the reasonableness of the costs estimate for a target cost contract but the specific issues in that opinion differed to those in this determination.[footnote 6]

Legislation and guidance

5. Referral and pricing provisions

5.1 Section 20(5) of the Act empowers the SSRO to determine the extent to which a cost is an Allowable Cost under a QDC, if the Secretary of State or the primary contractor applies for such a determination. Pursuant to section 20(6), the SSRO may determine that the contract price of the QDC is to be adjusted in consequence of a determination made under section 20(5) as to the extent to which a cost in the contract is to be treated as Allowable.

5.2 The price of a QDC is subject to controls imposed by the Act and the Single Source Contract Regulations 2014 (the Regulations). Regulation 10(1) requires the price payable under a QDC to be determined in accordance with the formula:

(CPR x AC) + AC

5.3 For the purposes of the pricing formula, “CPR” is the contract profit rate for the contract, determined in accordance with regulation 11. “AC” means the primary contractor’s allowable costs (the Allowable Costs) and regulation 10(1) refers expressly to section 20 of the Act for the concept of what an allowable cost is. Regulation 10(1) also provides that the Allowable Costs in the pricing formula are to be determined in accordance with one of the six regulated pricing methods described in paragraphs (4) to (11) of regulation 10.

Allowable Costs

5.4 Section 20(2) of the Act provides that in determining whether a cost is an Allowable Cost under a QDC, the Secretary of State and the primary contractor must be satisfied that the cost is:

- appropriate;

- attributable to the contract; and

- reasonable in the circumstances (the AAR test).[footnote 7]

5.5 The Secretary of State may at any time require the primary contractor to show that the requirements of the AAR test are met in relation to a cost under a QDC.[footnote 8] This power does not remove the obligation on both parties to be satisfied that the AAR test is met in relation to each cost.

Statutory Guidance on Allowable Costs

5.6 In determining whether the AAR test is satisfied in relation to a particular cost, the parties must have regard to statutory guidance issued by the SSRO.[footnote 9] The SSRO issued guidance about determining whether costs are Allowable Costs under QDCs on 26 January 2015 (the Guidance),[footnote 10] which was the current guidance at the time the contract was entered into. Section 9 of the Guidance assists with what is meant by the terms appropriate, attributable and reasonable used in the AAR test.

Appropriate

5.7 The Guidance provides that a cost is appropriate if, by its character and nature, it represents a cost that is expected to be incurred in the conduct of delivering a contract such as the QDC or QSC in question.[footnote 11] Appropriate costs are those which should be able to withstand public scrutiny, and which can be supported by sufficient justification. In order to help assess whether a cost is appropriate, the Guidance provides the following checklist:

- Is it a cost that would be expected to be incurred in the delivery of the QDC?

- Is the cost suitable for the purpose of the QDC or QSC?

- Would the inclusion of the cost withstand public scrutiny?

- Is inclusion of the cost fair and equitable?

Attributable

5.8 The Guidance provides that a cost is attributable if it is incurred directly or indirectly for the fulfilment of the QDC in question and it is necessary to fulfil the requirements of that contract.[footnote 12] All costs must have been (or will be) incurred by the contractor and applied to the QDC or QSC on a basis that is consistent with the contracting company’s overarching cost accounting practices, while having not been, or planned to be, recovered in any way from existing or future contracts. In order to help assess whether a cost is attributable, the Guidance provides the following checklist:

- Is the treatment of the cost consistent with normal business practices?

- Is it consistent with the firm’s normal accounting practices?

- Is the cost borne by the contractor?

- Is there causality of the cost to the contract?

- Is the cost identifiable?

- Is the cost incurred in fulfilling the specification of the QDC?

- Can it be evidenced that the cost has not been recovered elsewhere?

Reasonable

5.9 The Guidance provides that a cost is reasonable if by its nature it does not exceed what might be expected to be incurred in the normal delivery of a contract such as the QDC or QSC in question, whether under competitive tendering conditions or as a single source contract.[footnote 13] Indicators of whether costs are reasonable include, but are not limited to, the level of competitiveness and/or market testing undertaken in the supply chain, the expected benefits provided and any alternative options available, for example, to justify decisions as to whether to sub-contract or undertake work ‘in-house’. In assessing whether costs are reasonable, consideration should be given to:

- any particular specification and performance requirements;

- any uncertainty involved;

- the economic environment; and

- the statutory provisions in place at the time of contracting.

5.10 In order to help assess whether a cost is reasonable, the Guidance provides the following checklist:

- Is it congruent with meeting the contract performance requirements?

- Would the cost withstand public scrutiny?

- Are cost estimates based on empirical evidence, where this is possible?

- Is the cost consistent with sector/ market benchmarks?

- Is the quantum of the cost consistent with good business practice?

- Do the costs deliver value for money to the UK taxpayer?

Target pricing

5.11 Regulation 10(1) specifies that the Allowable Costs must be determined in accordance with one of six regulated pricing methods. Regulation 10 names each method in paragraphs (4) to (11) and specifies whether each method is based on estimated costs, actual costs or a combination of both. It further nominates the time at which the costs are to be determined. Regulation 10(3) provides that, if the parties to a QDC agree, different regulated pricing methods may be used for defined components of the contract.

5.12 The labour costs under the contract are priced according to the target pricing method. Regulation 10(11) provides that under the target pricing method, the Allowable Costs are the Allowable Costs as estimated at the time of agreement.

5.13 As the target price is based on estimated Allowable Costs, these may differ from the actual or outturn Allowable Costs at contract completion. Section 16 of the Act provides that the parties may agree that the total price payable can be adjusted by reference to any difference between the amount of the estimated and actual Allowable Costs under the contract. The amount of the adjustment must be determined by agreement between the Secretary of State or an authorised person and the contractor, or by the SSRO if the matter has been referred to it.

6. Matters required to be considered in the determination

6.1 In carrying out its functions under Part 2 of the Act, the SSRO must aim to ensure:

- that good value for money is obtained in government expenditure on QDCs; and

- that persons (other than the Secretary of State) who are parties to QDCs are paid a fair and reasonable price under those contracts.

6.2 The SSRO seeks to achieve these aims when determining the extent to which a cost meets the AAR test.

6.3 Regulation 19 provides that in making a determination under section 20(5) of the Act, the SSRO must have regard to:

a. the information that was available to each party at the time of agreement;

b. the statutory guidance in place at the time of agreement;

c. in the case of a contract which contains provision of the kind described in regulation 15 (TCIF adjustment), those provisions; and

d. whether the parties disclosed, in a timely manner, the facts and assumptions they used to determine the Allowable Costs or the contract profit rate.

6.4 Additionally, regulation 54 provides that in making any determination under the Act or the Regulations, the SSRO must have regard to:

a. any regulations or statutory guidance made under Part 2 of the Act which were in force at any time material to the matters under consideration;

b. the extent to which any relevant statutory guidance has been followed (and any justification advanced for not following it);

c. the extent to which any person has fulfilled its responsibilities under Part 2 of the Act and these Regulations;

d. any relevant previous decisions of the SSRO; and

e. representations made by the parties to the contract (or the persons who would be parties to the proposed contract), and (where not such a party or person) by the Secretary of State.

6.5 The SSRO took the above matters into account when making the determination.

Summary of relevant facts

7. The contract and associated arrangements

7.1 The determination concerned a QDC which, in the broadest sense, was for the support and maintenance of equipment (the contract).

7.2 The scope of the support and maintenance work under the contract involved survey and reporting to determine the methodology that would be followed. This meant that the full extent of work required would be known only when surveys, inspections and tests were completed.

7.3 The contractor had previously carried out support and maintenance for the Authority. A significant amount of the work required under the contract is similar to work carried out previously by the contractor, but with two key differences. It was estimated that 68 per cent of the specification was the same, 20 per cent was similar but increased in scope, and 12 per cent was new work.

7.4 The contract was priced partly in accordance with the target pricing method and partly in accordance with the costplus pricing method. The determination was concerned with the target price component of the contract price. The Regulations provide that, under the target pricing method, the Allowable Costs are the Allowable Costs as estimated at the time of agreement.[footnote 14]

7.5 The contract specified a provisional target price and a provisional maximum price. The contract provided for the parties to split any difference between the actual costs and the estimated costs in the target and maximum prices, by reference to a specified sharing arrangement. One of the reasons the contract price was described as provisional was that the estimated labour costs were calculated on the basis of provisional rates.

8. The labour costs

8.1 The methodology used for calculating the estimated labour cost of the contract involved taking the product of two other estimates:

- The labour hours required to carry out the contract.

- The labour rates.

8.2 The contractor’s workforce is divided into a number of cost centres for accounting purposes and labour rates are estimated at the level of each cost centre. The labour costs for the contract are arrived at by summing the products of labour hours and rates for each relevant cost centre.

8.3 The provisional rates used in pricing the contract were calculated using actual costs and rates from a previous year as the baseline. The contract provides for revised labour rates based on actual costs in the financial year immediately preceding the date of entry into the contract (the Baseline year) to replace the provisional rates, upon the parties reaching agreement on labour rates calculated from that baseline. In that event, the contract price shall be recalculated as though the revised labour rates applied from the contract start date.

8.4 The labour costs for the contract were calculated using an estimate of hours required to deliver the Contract. The contractor derived a baseline number of hours from a previous contract, which was then adjusted to arrive at the estimated hours for the contract. The adjustments included a reduction for expected efficiencies. The parties agreed the estimated number of hours required for the contract.

8.5 The contractor estimated the labour rates from the Baseline year’s actual costs and workload (load). The contractor’s model, which applied its estimation methodology, was submitted to the MOD after the date of entry into contract and was considered by the SSRO as part of the determination.

8.6 The labour rates reflected the variable labour and overheads for the production areas of the contractor’s business, referred to in this document as variable cost centres. The fixed overheads were to be recovered primarily through another contract.

8.7 The forecast load was an input to the contractor’s model and was derived from work programmes issued by the MOD. The contractor reviewed the programmes and relevant contract specifications and translated them into workload hours. The load was presented in the contractor’s model which set out load by year, by variable cost centre and by type of work.

8.8 The other key input to the contractor’s model was the total direct costs (labour and overhead) for the variable cost centres and the total costs associated with support and corporate functions. The contractor used the actual costs incurred in the Baseline year and estimated the costs forward.

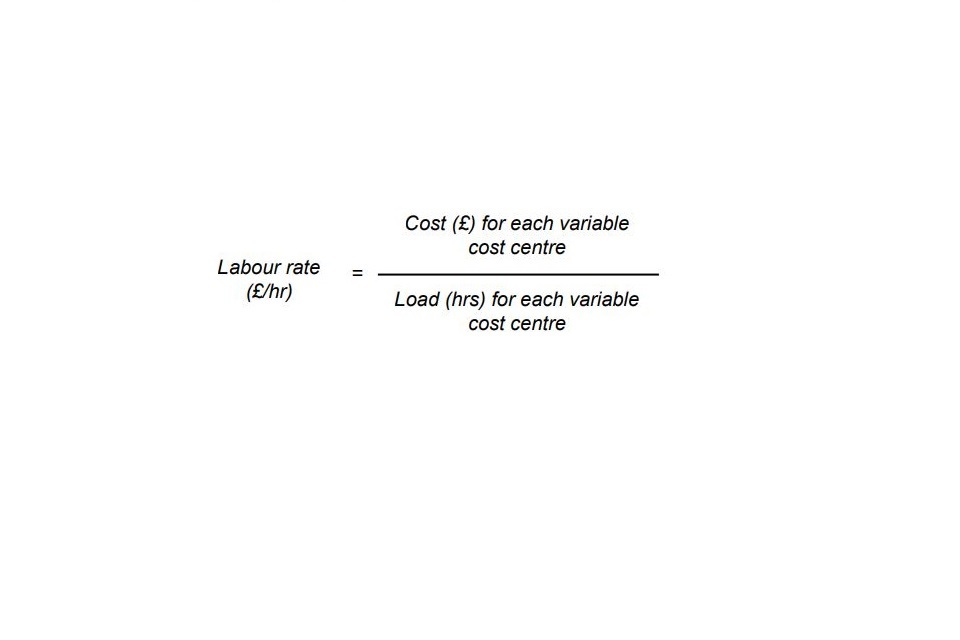

8.9 For each of the variable cost centres, the labour rate was calculated using the forecast load and estimated costs for the Contractor’s business. The equation for calculating the labour rate for each cost centre is shown in Figure 1.

Figure 1: Labour rates equation

Labour rate (£/hr) = Cost (£) for each variable cost centre divided by Load (hrs) for each variable cost centre

8.10 The contractor’s model assumed a fixed relationship between load and costs, such that the labour rate does not change due to forecast changes in the load. For example, if load is 10 per cent higher than in the Baseline year, then total direct labour and overhead costs are assumed to be 10 per cent higher. The rate does change due to other adjustments, such as for inflation.

8.11 The Authority did not accept the contractor’s labour rates claim. It considered that the estimating arrangements were inconsistent with the pricing principles introduced by the Act and the Regulations, and that insufficient evidence had been provided to come to a view that the labour costs are Allowable.

Determination

9. Introduction

9.1 The SSRO accepted a referral to determine the extent to which the labour costs in the contract are allowable. In proceeding with this determination, the SSRO considered the extent to which the labour costs are appropriate, attributable to the contract and reasonable in the circumstances, namely the AAR test.

9.2 The labour costs are included in the target price component of the contract. As explained in paragraph 5.12 above, when using the target pricing method, the Allowable Costs are the estimated Allowable Costs at the time of agreement. This determination is concerned with whether the estimated labour costs were Allowable.

9.3 The Guidance identifies a series of factors that should be considered when determining whether a cost is appropriate, attributable to the contract and reasonable in the circumstances, and these are set out in paragraphs 5.7 to 5.10 above. If the contractor correctly applies a suitable estimating methodology, then the resulting labour costs should satisfy the following factors and, consequently, the AAR test:

- the factors at paragraph 5.7 (appropriate);

- the first six factors at paragraph 5.8 (attributable); and

- the factors listed at paragraph 5.10, except the fourth (reasonable).

9.4 The basic methodology employed by the contractor to estimate the labour costs is summarised in section 8 above. It involves estimating the labour hours required for the contract and applying estimated labour rates to those hours to produce an estimate of the labour costs. The parties took no issue with this general approach and the SSRO accepts that it is capable of producing an estimate that satisfies the AAR test.

9.5 As the hours used in the estimation method were agreed, the parties raise no issue in the referral concerning that element of the labour costs equation. The SSRO was satisfied that the approach to estimating the labour hours is reasonable and has not set out a detailed examination of the labour hours.

9.6 The primary issue in the determination was whether the labour rates may produce an estimate of the labour costs that is Allowable. The SSRO was asked to make its determination in relation to the contractor’s model.

9.7 The SSRO approached the determination by considering how the contractor calculated the estimated labour rates, rather than seeking to determine what the labour rates should be. This approach was communicated at the oral hearing and was consistent with the referred question.

9.8 The SSRO first considered the suitability of the contractor’s rates model and whether it was reasonable to extrapolate the labour rates from an historic baseline. This is set out in section 10.

9.9 Consideration was given to the contractor’s application of its methodology, which involved looking at:

- The choice of programme to determine the load (section 11).

- The choice of the Baseline year and the steps taken to understand whether it was a good starting point (section 12).

- Whether adjustments were made to reflect differences between the Baseline year and the contract years (section 13).

9.10 Each of sections 10 to 13 set out the relevant background, an assessment of relevant material and a determination. The overall determination is summarised in section 14.

10. Cost modelling approach

Background

10.1 The contractor’s methodology for estimating the labour rates is outlined in section 8 above. It takes the actual rates for the business in the Baseline year and rolls them forward for the contract, subject to some adjustments. This approach was referred to in the referral as a top down methodology.

10.2 The MOD considered that the contractor’s methodology for estimating labour rates was not consistent with the AAR test and would not result in Allowable labour costs. It expressed concern that the contractor’s rates methodology does not show the effects of changes in labour utilisation, headcount, overtime or shift patterns on the labour rates. The MOD explained that the contractor’s top down approach assumes the labour mix does not change going forward. The percentage split between permanent staff, contractors and hired labour is maintained at the levels assumed in the Baseline year.

10.3 The MOD’s position was alternatively that:

- A more granular approach is required to be satisfied that costs are Allowable. It considered that the contractor should take all known factors, including the forecast labour requirements based on the MOD’s programmes, and build them into a rate. This approach may be referred to as a bottom up methodology. The MOD recommended use of its Form 19 (DEFFORM 860), which requires contractors to project forward in-house labour requirements and add hired labour.

- A top down approach could be used, provided that appropriate changes were made to the baseline. The MOD described the changes that should be made to the baseline in a variety of ways but, in summary, this involved modifying the baseline to address changes in load and consequent impacts on costs that may be predicted with sufficient certainty from what is known about future programmes. The MOD was not explicit about how such changes should be predicted.

10.4 The MOD considered that its power under section 20(4) of the Act to require the contractor to show that a cost satisfies the AAR test may be undermined by a top down approach. The MOD added that it was seeking evidence that the contractor had taken a holistic view of its business and had made reasonable adjustments and felt it was not reasonable to claim a cost but not provide the evidence that supports it.

10.5 The contractor stated at the oral hearing that it did not know what adjustments the MOD would like it to make. The contractor stated that the MOD had recommended areas in which its approach should be changed, such as labour utilisation, but that these were undefined in terms of value. The MOD had provided the contractor with its own estimate of the labour rates, had identified areas in which it had taken a different approach and requested that the contractor provide its position and supporting evidence.

10.6 In the contractor’s view, modelling on estimates as urged by the MOD would produce spurious accuracy. The contractor said that in delivering its work it has a high level of dependency on the MOD, as the MOD controls the work programmes (described in paragraph 8.7 above). The contractor stated that the work programmes are constantly changing due to the MOD’s regular revisions and any estimate would be quickly out of date. It considered that uncertainty affects its business and creates challenges in predicting load for future years. In light of such uncertainty, the contractor found it difficult to develop a bottom up model based on a volatile load and expressed the view that using the latest set of actuals is as good an approximation for going forward as any other. The contractor stated that it uses the same approach for other work.

10.7 The contractor provided the following evidence to support its contention that work programmes are subject to such a level of change as to mean that further efforts to model load would be unlikely to improve accuracy:

a. The survey and report approach to the work means that the full extent of the requirement is known only when surveys, inspections and tests are completed.

b. Two elements of the work had not been carried out previously.

c. About two thirds of the work was expected to be the same as it had done previously and, consequently, about one third would be different.

d. There had been 49 separate changes in the MOD’s programme within a 33-month period.

e. The forecast outturn hours for the contract were significantly higher than the hours estimated when entering into the contract.

f. A comparison of estimated and actual load for the business showed increasing divergence, with actual load becoming significantly greater than estimated. The contractor stated that the total variances get larger the further forward the estimates go, with a range of 9 per cent in the first year rising to 62 per cent in the fifth year.

10.8 The MOD argued that the significant increase in load under the contract (see 10.7(e) above) was partly expected and partly due to the contractor’s own actions. The MOD referred to delay in submitting a QDC compliant tender at the time of pricing, other delays attributable to the contractor, and changes within the specification as a result of, but not exclusive to, these delays.

Assessment

10.9 The Act and the Regulations do not specify that any particular estimating methodology should be used to produce a cost estimate. The Guidance also does not recommend use of a particular pricing methodology to produce a cost estimate.

10.10 The contractor applied a top down approach to estimating the labour costs, as summarised above. Such an approach is sometimes referred to as ‘the analogy estimating method’. The methodology uses actual costs from a similar situation and applies normalisation adjustments to account for differences between the analogy and the required estimate.

10.11 The MOD relied on section 20(4) of the Act to support its position that a bottom-up approach was required. That provision enables the Secretary of State to require the contractor to show that a cost satisfies the AAR test, but it does not specify what information may be sufficient to satisfy that requirement. In determining the extent to which the labour costs are allowable, the SSRO has considered whether the information provided by the contractor, including its approach to estimating the labour costs, shows that the labour costs in the contract satisfy the AAR test.

10.12 It is difficult to accept that a top down approach could never produce costs that satisfy the AAR test. There are strengths and weaknesses associated with both top down and bottom up methodologies, as indeed there are with other cost estimation methods. The choice of the most suitable methodology to deploy should be based on its characteristics and the contract in question, giving due consideration to the strengths and weaknesses of each approach.

10.13 By deriving rates from a baseline year, the contractor could avoid the need to rely on detailed resourcing forecasts that may then prove inaccurate due to programme changes or changes in the scope of work. The top down approach has the advantage that it is based on actual data for the Baseline year, which was the most recent set of complete data at the time of entry into the contract. The link between what was done in the business in that year and the contract can be readily understood. The approach can be applied before detailed programme requirements are known. The estimate can be developed more quickly and at a lower cost, because the methodology is less complex and less information is required about future work.

10.14 The contractor raised volatility as a key factor relevant to its choice of estimating methodology. The MOD indicated that some of the changes in the labour hours required for the contract were either expected, or due to the contractor’s actions. Notwithstanding that submission, there is evidence of significant uncertainty at the time of estimating the labour costs. The SSRO accepts that there was uncertainty involved in understanding the requirements and scoping the work at the time of estimating the labour costs (paragraph 10.7(a)- (c)). There was also uncertainty due to frequent changes in programming and those changes continued (paragraph 10.7(d)). The uncertainty would normally result in substantial changes or volatility in the load for the business (paragraph 10.7(e)-(f)) and impact on individual cost centres.

10.15 The suitability of the top down approach could be displaced if there were reasons to think that a bottom up methodology would produce a more accurate estimate. In this context, it is worth noting that the gainshare arrangements that form part of the target pricing method will work best where the estimated costs are as accurate as possible.

10.16 A bottom-up approach would have provided greater transparency through clearly modelling labour assumptions based on estimates of utilisation and the mix of permanent and hired staff. It would have suffered, however, from the volatility in the load for the business, because the survey and repair approach and the changes to the programmes affecting the business result in original estimates becoming increasingly unreliable as the contract progresses. In these circumstances, the SSRO was not persuaded that an estimate based on a more detailed bottom-up approach would produce greater accuracy. The proportionality of the approach also needs to be considered, balancing the costs of such an exercise against the expected benefits.

Determination

10.17 The choice of the most suitable methodology to deploy should be based on its characteristics and the contract in question, giving due consideration to the strengths and weaknesses of each approach. The top down approach is capable of providing a reasonable estimate of the labour rates used to calculate the estimated labour costs for the contract and produce labour costs that satisfy the AAR test.

10.18 The evidence provided to the SSRO did not support the conclusion that a bottom up approach would have provided a more accurate estimate of the labour rates. This is due to uncertainty in the programme for the business and in the work required for the contract.

10.19 The top down approach is relatively cost effective compared with the costs of preparing a bottom up model. Given there was no evidence that a bottom up methodology would have provided greater accuracy, it was not clear that this would have been proportionate.

10.20 The application of a top down approach depends on the cost base being sufficiently representative of future activity and the associated cost. It may require applying cost adjustments to achieve an accurate estimate, and judgment is required as to the appropriate adjustments to be made. Having established that the use of a top down approach may be reasonable in the circumstances of the contract, the contractor’s application of the top down approach is considered in the following sections of this determination.

11. Workload for the contractor’s business

Background

11.1 The contractor’s model used forecast load as an input, as explained in section 8 above. The contractor’s top down model assumes, however, a fixed relationship between load and costs.

11.2 The contractor translated MOD work programmes to estimate the load for each of the claimed rates. The MOD contended that the programmes used were not the latest available but did not demonstrate which other work programme or specification would be more suitable.

Assessment

11.3 The contractor used known work programmes to calculate load, making an estimate at a known point in time. The SSRO accepted there was uncertainty in the work programmes when the contractor was preparing its labour rates estimate. On that basis, it does not have evidence that different programmes would have been more appropriate for the purposes of calculating load than those used by the contractor.

Determination

11.4 It was reasonable for the contractor to estimate load by using work programmes at a point in time. There was no evidence that different programmes would have been more appropriate, given the volatility that was identified.

12. Baseline costs

Background

12.1 The parties jointly agreed to use the actual costs for the Baseline year for the contract. Minor changes were made to the baseline after the submission of the contractor’s model. The contractor considered that the actual costs provided evidence of performance which was more reliable than forecasting, given the volatility in the hours for the business. The baseline was adjusted by the contractor to remove costs that were not considered Allowable Costs under the Act and Regulations.

12.2 The contractor undertook a review of actual costs in the Baseline year against the previous year. The focus of the review was not to establish that the Baseline year was a representative year but was undertaken at the request of the MOD to demonstrate the impact of load. The review focused on two cost centres, rather than all cost centres across the business. The review further analysed the labour in eight production groups within the two cost centres. It examined variances in the hourly rate for the eight production groups where the variance was greater than £1 per hour between the two years. In focusing on variances in the hourly rates, the review did not address whether any adjustments may be relevant in other production groups, for example in production groups where the largest number of hours were incurred. The contractor relied on its review to justify that adjustments were required in respect of two types of workers and one of its production groups.

12.3 The MOD interpreted the Regulations as requiring that the latest information available should be used as a baseline. After reviewing the baseline resulting from the contractor’s adjustments, the MOD considered there were still costs included in the Baseline year which were not Allowable Costs, but did not provide details of these.

Assessment

12.4 At the time the contractor prepared its rates claim, the Baseline year represented the most recent complete year. The legislation and guidance do not expressly require the use of the latest data when estimating costs. The parties took the view that one should always use the most recent data for the purposes of estimation, and the SSRO accepted that this was a reasonable approach for the contract.

12.5 The contractor’s review of the Baseline year against the previous year provided some evidence of how representative the Baseline year was. The comparison could have covered all cost centres and could have considered the number of hours applicable to the production groups rather than just the hourly rate variance, however, the groups reviewed accounted for over 85 per cent of the labour costs for the contract and provided relevant information about representativeness.

12.6 It may have assisted in demonstrating how representative the Baseline year was if a comparison had been made with several earlier years, rather than just the previous year. There were impediments to such a comparison. The previous year and other earlier years were prior to the introduction of the Act and the Regulations. To ensure comparability, consideration would have had to be given to adjusting the actual costs in prior years to remove costs viewed as not Allowable. The entry into an arrangement for directing fixed costs to another contract, changed the basis of the labour costs recovery from full cost recovery, i.e. fixed and variable costs, to variable only. For these reasons, a review of comparative performance was less feasible in relation to earlier years.

12.7 The MOD indicated that there remain costs which, in their view, are not Allowable, within the Baseline year. The MOD did not specify these costs, and consequently, the SSRO was unable to make an assessment regarding this view. The contractor’s general approach is reasonable but, if the rates are to produce labour costs that satisfy the AAR test, any baseline used to estimate the rates should not include costs that would not be Allowable Costs under the contract.

12.8 The contractor did not evidence to the SSRO the performance levels achieved through labour management, such as labour utilisation, surplus capacity and hired labour versus permanent staff levels which formed the basis of the Baseline year costs. Without this information, the SSRO found it difficult to fully assess the extent to which the baseline is representative and, corresponding to this, the extent to which adjustments may be required to the Baseline year. It has been noted that the parties agreed an adjustment to the estimated contract labour hours to achieve efficiency savings, and the SSRO would not expect this to be double counted.

Determination

12.9 The choice of a baseline is important in the context of a top down approach to cost estimating. In rolling-forward a baseline, historic performance levels, such as the levels of surplus capacity and utilisation rates within the workforce and use of contract labour, are carried forward into future estimated rates. An understanding is required of how representative the baseline year is, when compared with likely future performance, so that any necessary adaptations can be made.

12.10 It was reasonable to use the Baseline year, subject to relevant adjustments. The Baseline year provided the most recent actual data and the parties agreed it was an appropriate year to use.

12.11 The assessment of whether the Baseline year included costs that would not be Allowable under the contract, and the comparison of the baseline with the previous year, helped the parties to understand how representative the baseline was and what adjustments were required. Details of the actual performance achieved through labour management in the Baseline year, such as labour utilisation, workforce capacity and the mix of hired and permanent staff in the cost centres, may have provided greater transparency as to the baseline.

13. Adjustments to the baseline

Background

13.1 The baseline for variable cost centres at the contractor’s business reflected the costs associated with the direct hours of work completed. The opening position of the model reflected the Baseline year costs and the load performed in the year. It includes the workforce structure, i.e. the balance of trades, the mix of staff and hired labour, the amount of overtime and other shift premiums, as well as the level of workforce capacity and utilisation.

13.2 Adjustments are required to reflect the workload differences between the business load in each year of the estimate period compared to the baseline. The contractor adjusted the Baseline year cost base to cover legislative, inflation and apportionment changes, and workload volume and skills requirements.

13.3 The MOD took no issue with the adjustments in respect of legislative changes. The MOD reviewed the inflation indices and concluded that the contractor had applied prudent assumptions in this area of their estimate. The apportionment adjustments have no impact on variable rates for the business and are not considered relevant to this referral.

13.4 Additional costs were included in the model to reflect categories of resource which were not considered to be adequately represented in the workforce. The contractor identified changes to costs in relation to two types of workers (A and B) and one of its production groups (C). The load and rates comparison undertaken by the contractor illustrated that the Baseline year cost base excluded certain activities that would be required under the contract.

13.5 The MOD and the contractor agreed that additional costs needed to be included in the price to reflect the need for category A workers to carry out these activities under the contract.

13.6 The comparison between Baseline year and the previous year undertaken by the contractor showed that the hired labour rate for category B workers dropped significantly from the earlier year, when hired workers were used, to the Baseline year, when this resource was not needed. The contractor added additional hired labour costs to the cost base over two years to reflect the need for additional welders. The MOD contended that additional costs should not be included in the estimate as these were already adequately addressed in the rates for the Baseline year. In addition, the MOD stated that the contractor should, more appropriately, have considered upskilling its core workforce rather than bringing in hired labour to undertake the work. In response to the provisional determination, the contractor noted that investment in upskilling of workers is made more difficult when there is uncertainty of scope in future projects.

13.7 The contractor completed an analysis of production group C which showed that the Baseline year load was 41 per cent higher than the load in the previous year, and that the rate had reduced by around 6 per cent due to higher utilisation. The contractor considered that this higher utilisation could not be sustained over the contract period as load is forecast to fall by between 34 per cent and 59 per cent compared to Baseline year. On this basis, the costs were adjusted so that the rates were more closely aligned to the level in the year preceding the Baseline year (pre-inflation) and costs were included over the contract period.

13.8 The MOD raised two challenges to the appropriateness of this additional cost. Firstly, that production group C surplus capacity should be dealt with under the separate contract where most of the fixed costs were placed, as waiting time is dealt with there, and, therefore, no adjustment is required in respect of production group C under the contract. Secondly, that as surplus capacity was the underlying cause of the issue, it could be dealt with through labour transfers.

13.9 The MOD considered that the review of the load and rates between the Baseline year and the previous year would have provided additional opportunities for the contractor to adjust other aspects of the estimate by addressing, for example, utilisation improvements, the impact of staff transfers between types of work and the better management of surplus capacity. It was the MOD’s view that the inclusion of adjustments in these areas would have improved the quality and completeness of the model outputs. However, the contractor considered that it was unreasonable to make adjustments of this nature to the estimate given the volatile and unpredictable nature of the load.

13.10 As summarised above, the MOD submitted that it was not opposed to a top down approach in the sense of setting a baseline and applying changes to it. It argued that changes should be made to the baseline to address changes in load for the business and consequent impacts on workload that may be predicted with sufficient certainty from what is known about future programmes. The MOD was not explicit about how such changes should be predicted.

13.11 The MOD considered that the production of a granular capacity-based estimate would allow the contractor to demonstrate the management of workforce utilisation, as well as the make-up of the workforce into permanent staff, contractor or hired labour. In so doing, the MOD believed, the model would more appropriately show how the workforce could be managed by, for example, assigning surplus manpower in one area to areas where there is a labour shortage. The MOD accepted that load volatility is an unavoidable feature of the work undertaken at the business but considered that the programmes (which at the time of issue were used to develop the most current view of load, and mix) should be fully incorporated into the rates estimate prepared by the contractor.

Assessment

13.12 In relation to the contractor’s argument for inclusion of additional costs associated with category B workers, the SSRO accepts that workforce upskilling may serve to mitigate the extent of the premiums incurred. However, upskilling may also be associated with skill-based pay premiums for the staff with this new capability. While there appears to be a case for inclusion of the premiums, the level of adjustment requires a consideration of which of the options i.e. upskilling or outsourcing is the most efficient outcome in the circumstances.

13.13 The contractor put forward supporting information for its production group C cost calculation. Looking at areas that are different or exceptional in the baseline year and making appropriate adjustments is the correct approach when applying a top down methodology. The MOD challenged whether this adjustment was necessary. The contractor put forward a respectable theory, but the SSRO was not in a position to say whether there is a sufficient causal link between the lower rate in a year of high load, and the quantified increase to the rate in future years when load is forecast to decrease.

13.14 There remains a question of whether other adjustments should be made to the Baseline year rates for the purposes of the contract. It is consistent with the contractor’s top down model that adjustments should be made where necessary to account for differences in the baseline and the required estimate.

13.15 The MOD’s contention is that changes should be made connected with workforce management, if these could be predicted with sufficient certainty from what is known about future programmes. The SSRO has already accepted that there was sufficient volatility in the programmes provided by the MOD to support the contractor’s choice of a top down approach. To the extent that the MOD’s contention about adjustments would require a bottom-up estimate to be carried out, relying upon loads developed from its changing programmes, then that raises the same concerns as were considered in section 10 above.

13.16 The SSRO has not been provided with evidence that would enable it to determine whether further adjustments are required to the contractor’s model. The contractor’s forecast of load, and information that it holds about actual performance in the Baseline year (identified in paragraph 12.11 above), may provide a basis on which the parties may consider whether further adjustments are required. There may also be other means of considering appropriate adjustments to the baseline. The consideration of potential adjustments does not require completion of a bottom up model.

Determination

13.17 The Baseline year rates should be adjusted to account for differences between the baseline and the required estimate of rates for the contract. The three adjustments that the contractor made to the Baseline year rates, i.e. category A and B workers and production group C, appear reasonable, with the possible exception of the group C adjustment. The SSRO did not have sufficient evidence to enable it to reach a conclusion in relation to the group C adjustment. This accounts for a small proportion of the overall labour costs, i.e. 1.3 per cent.

13.18 It is possible that additional adjustments to the baseline may be reasonable, for example, in relation to matters of workforce management. Any such adjustments should not double count the planned productivity reductions in the contract hours referred to in paragraph 8.4. The SSRO was not provided with evidence that would enable it to make such a determination. There is information available to the parties that would enable them to consider whether any additional adjustments are required, such as the contractor’s forecast of load and information held by the contractor about performance in the Baseline year. The SSRO does not, however, consider that a bottom up model or use of the MOD’s Form 19 or a similar spreadsheet is required for this purpose, given its conclusion that due to volatility such an approach is not likely to be more accurate than a top down approach.

14. Conclusions

14.1 The SSRO accepted that the approach of applying forecast labour rates for the business to estimated labour hours for the contract could produce an estimate of labour costs that satisfies the AAR test. There was no dispute between the parties on this point.

14.2 The Guidance identifies a series of factors to be considered when determining whether a cost satisfies the AAR test. If the contractor correctly applies a suitable methodology when estimating the contract labour hours and labour rates for the business, then the resulting labour costs should satisfy the majority of the factors and, consequently, the AAR test.

14.3 The choice of the most suitable methodology to deploy should be based on its characteristics and the contract in question, giving due consideration to the strengths and weaknesses of each approach. The top down approach adopted by the contractor is capable of providing a reasonable estimate of the labour rates, provided that relevant adjustments are made to the baseline to address differences from the contract period.

14.4 For this contract, the uncertainty in the MOD’s programmes made it unlikely that a bottom up approach would be more accurate. This does not mean that a top down approach will always be most appropriate, nor that a bottom up approach will never be appropriate.

14.5 Forecast load was an input to the contractor’s calculation of its labour rates estimate, which it determined based on the MOD’s work programmes at a point in time. No evidence was provided that a different programme would have been more appropriate, and the contractor’s general approach seems reasonable given the volatility that was identified.

14.6 It was reasonable to use the Baseline year, subject to relevant adjustments and provided that any costs that were not Allowable were removed. It provided the most recent actual data and the parties agreed it was an appropriate year to use.

14.7 The assessment of whether the Baseline year included costs that would not be Allowable under the contract, and the comparison of the baseline with previous year, helped the parties to understand how representative the baseline was and what adjustments were required. Details of the actual performance achieved through labour management in the Baseline year, such as labour utilisation, workforce capacity and the mix of hired and permanent staff in the cost centres, may have provided greater transparency as to the baseline.

14.8 The adjustments that the contractor made to the labour rates for the Baseline year appear reasonable. It is possible that additional adjustments to the baseline may have been reasonable, for example, in relation to matters of workforce management. The SSRO was not provided with evidence that would enable it to make such a determination, but it considered that there is information available to the parties that would enable them to consider whether any additional adjustments are required, such as the contractor’s forecast of load and information held by the contractor about performance in the Baseline year. A bottom up model or use of the MOD’s Form 19, or similar spreadsheet, is not required for this purpose, given its conclusion that due to volatility such an approach is not likely to be more accurate than a top down approach. Any adjustments to the baseline should not double count the planned productivity reductions in the contract hours.

Status of the determination and costs

15. Effect of the determination

15.1 The final determination is binding on both parties.

15.2 The SSRO is empowered under the Act to determine that the price payable under the contract is to be adjusted by an amount specified by the SSRO. For the purposes of this referral, the SSRO has not determined any specific amount of an adjustment of the contract price. However, the SSRO recognises that this question has the potential to be the subject of a future referral by either party. 15 Defence Reform Act 2014, section 35(4). 16 Defence Reform Act 2014, section 19(3)(d); Single Source Contract Regulations 2014, regulation 16(9).

16. Costs

16.1 In making a determination, the SSRO has the power to require the payment of such costs as the SSRO considers appropriate by one party to the other.[footnote 15] In exercising this power, the SSRO is required to have regard to whether the parties disclosed, in a timely manner, the facts and assumptions they used to determine the Allowable Costs.[footnote 16]

16.2 The negotiations between the parties reached an impasse which led to the current referral. The disagreement about the choice of methodology for estimating the labour rates was a significant contributor to that impasse. In the absence of any specific representations about the conduct of one of the parties relevant to costs, for example in relation to disclosure, the SSRO does not propose to require either party to make a payment of costs in relation to this referral.

-

Single Source Contract Regulations 2014, regulation 19. ↩

-

Single Source Contract Regulations 2014, regulation 19(2). ↩

-

Single Source Contract Regulations 2014, regulation 54(e). ↩

-

Single Source Contract Regulations 2014, regulations 19(3)(b) and 54(a) and (c). ↩

-

Single Source Contract Regulations 2014, regulation 54(d). ↩

-

https://www.gov.uk/government/publications/ssro-anonymised-summary-of-first-formal-opinion-on-aqualifying-defence-contract ↩

-

Defence Reform Act 2014, section 20(2). ↩

-

Defence Reform Act 2014, section 20(4). ↩

-

Defence Reform Act 2014, section 20(3). ↩

-

Single Source Cost Standards: statutory guidance on Allowable Costs January 2015 published on 26 January 2015 ↩

-

‘Single Source Cost Standards: statutory guidance on Allowable Costs January 2015’ published on 26 January 2015, paragraph 9.2. ↩

-

‘Single Source Cost Standards: statutory guidance on Allowable Costs January 2015’ published on 26 January 2015, paragraphs 9.3 and 9.4. ↩

-

‘Single Source Cost Standards: statutory guidance on Allowable Costs January 2015’ published on 26 January 2015, paragraphs 9.3 and 9.4. ↩

-

Defence Reform Act 2014, section 35(4). ↩

-

Defence Reform Act 2014, section 35(4). ↩

-

Defence Reform Act 2014, section 19(3)(d); Single Source Contract Regulations 2014, regulation 16(9). ↩