Sellafield Ltd Annual Report and Financial Statements 2021/22

Published 15 July 2022

1. Company Information

Directors

Mrs L I Baldry (Chair) (resigned 2 May 2021)

Mr A J M Meggs (Chair) (appointed 2 May 2021)

Mr M J Chown (Chief Executive Officer)

Mr J M Seddon (Finance Director)

Mr A D Cumming (Shareholder Representative Director)

Mr J Baxter (Non-Executive Director)

Dr A F J Choho (Non-Executive Director)

Mr D G Vineall (Shareholder Representative Director)

Mrs C L Hall (Non-Executive Director)

Mr J P Simcock (Non-Executive Director)

Mrs R McLean (Non-Executive Director) (appointed 1 Oct 2021)

Secretary

Mr A M Carr (resigned 5 January 2022)

Miss K Smith (Appointed 5 May 2022)

Auditors

Mazars LLP

One St Peter’s Square

Manchester

M2 3DE

Bankers

National Westminster Bank plc

3rd Floor

250 Bishopsgate

London

EC2M 4AA

Registered Offiice

Hinton House

Risley

Warrington

Cheshire

WA3 6GR

2. Strategic report

The directors present their strategic report for the year ended 31 March 2022.

Principal activities and future developments

These financial statements contain certain forward-looking statements with respect to the financial condition and business of Sellafield Limited (the company). Statements or forecasts relating to events in the future necessarily involve risk and uncertainty and are made by the company in good faith based on the information available at the date of signing this report.

The company undertakes no obligation to update these forward-looking statements. Nothing in these financial statements should be construed as a profit forecast nor should past performances be relied upon as a guide to future performance.

The principal role of the company is to operate nuclear sites under the site licence and a services agreement between itself and the Nuclear Decommissioning Authority (NDA) in a safe, secure, efficient and cost-effective manner and in accordance with its corporate Plan and operating Plan.

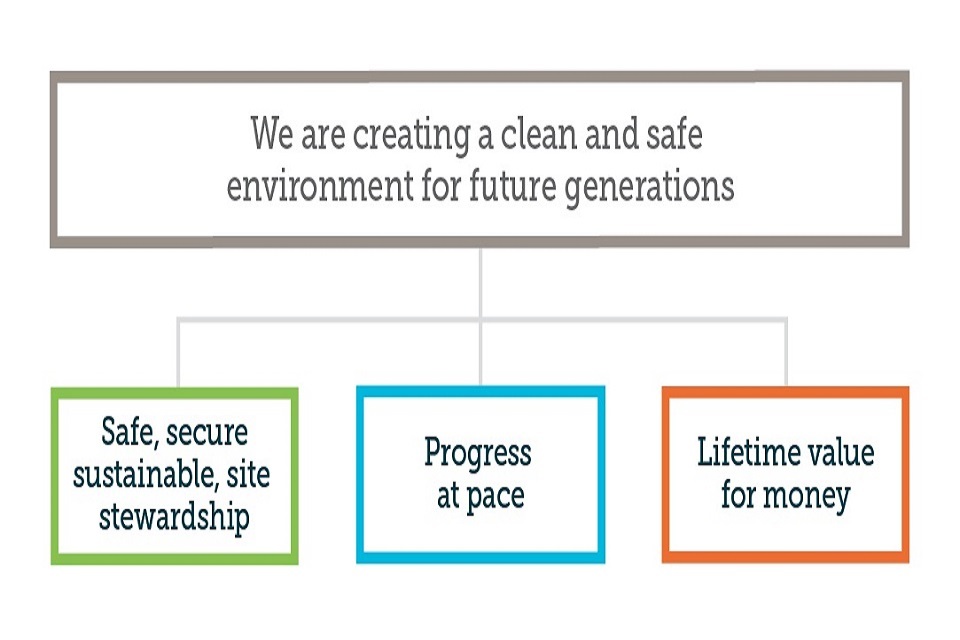

Seventy-five years ago, the company helped to create the nation’s nuclear deterrent. Today, it is using its unrivalled knowledge of nuclear to create a clean and safe environment for future generations.

The company is responsible for the safe, secure and sustainable stewardship of the Sellafield site and the nuclear materials, fuel and wastes stored there, for making progress in the clean-up of redundant facilities that pose a threat to the environment, and for delivering lifetime value for money through the investment made in the nuclear site.

The company operates under the services agreement between the company and NDA, as a wholly owned subsidiary of NDA. In accordance with the Energy Act 2004, NDA has tasked the company with carrying out activities set out in the NDA Designation of Sellafield.

The company’s primary site is the Sellafield nuclear site in West Cumbria. The company also has an engineering, design and functional support capability at its Risley office, near Warrington, and several offices in the West Cumbrian community.

In the year ended 31 March 2022, all costs incurred by the company in the performance of the services agreement are directly recoverable from the NDA (2021: same).

In 2021/22, the company continued to focus on creating a safe and clean environment for future generations.

This is at the forefront of the company’s strategy, and will be executed by safe, secure and sustainable site stewardship, progress at pace, and creating lifetime value for money.

The section on page 23 provides more information on the impact of the COVID-19 pandemic on activities during 2021/22 and future developments.

Review of the business

During the year the company incurred operating costs of £2,352 million (2021: £2,070 million). This expenditure is recoverable from the NDA under the services agreement and represents the operational costs of the Sellafield site including expenditure on:

- carrying out the environmental clean-up of the UK’s most complex and hazardous nuclear site, Sellafield

- decommissioning nuclear facilities

- receiving, reprocessing and storing used nuclear fuel

- managing the UK’s special nuclear materials

- delivering capital projects to support the mission, and asset care and maintenance – some of the facilities at Sellafield are more than 70 years old so significant investment is required to ensure that they remain operational and in a safe state prior to decommissioning

- the safe treatment of low level, intermediate level and high-level waste

Despite the impact of the COVID-19 pandemic on the company’s operations, during 2021/22 the company has made progress in meeting its targets and milestones set by the NDA, including high hazard reduction, nuclear operations and safe secure stewardship.

Progress this year includes:

- successfully progressed work on major projects alongside supply chain partners

- made important progress in creating a clean and safe environment for future generations

- performed with passion, pride and pace and embraced the other themes in our manifesto

Progress at pace

- making progress towards the end of reprocessing operations in the Magnox plant

- processed the final batch of plutonium arising from Thorp reprocessing operations, signalling the end of Finishing Line 6 operations

- successfully completed a test run to move 3m3 boxes of nuclear waste into The Box Encapsulation Plant Product Store Direct Import Facility

- continued work on construction delivery, including installation of a 750-tonne crane next to the Box Encapsulation Plant, ready for retrievals from the Magnox Swarf Storage Silo

- in the Magnox Swarf Storage Silo, progressed installation of the second Silo Emptying Plant machine and moved the first Silo Emptying Plant machine into position to start retrievals.

- moved the 175-tonne waste retrievals module which will be getting nuclear waste out of the Pile Fuel Cladding Silo sideways for the first time

- delivered the first ready-to-use Self Shielded Box to site, ready to store nuclear waste from legacy ponds in the new Interim Storage Facility.

- started retrieving solid waste from the Redundant Settling Tank

Safe, secure sustainable, site stewardship

- successful repatriation of intermediate-level waste to Australia

- removed the Windscale Pile 1 chimney diffuser, removing the seismic risk associated with the chimney from the Sellafield site

- took delivery of 2 new hybrid trains, replacing older and less environmentally friendly engines, part of the company’s plan to replace solely diesel locomotives with smaller all electric 40-tonne versions

- issued updated Enterprise Risk Assessments in response to government guidance and brought to a close the on-site test and trace facility, which had its last day of operations on 31 March.

- confirmed that all the containers which hold vitrified high-level waste are now ready for return overseas as they have been filled, cleaned, weighed and checked (known as pre-attribution).

Lifetime value for money

- £1.3 million investment under the Sellafield Ltd Social impact, multiplied (SiX) programme towards the development and creation of the Industrial Solutions Hub entity, working with Copeland Borough Council and Programme and Project Partners

- launched the West Cumbria Mental Health Partnership, part of £1.8 million investment under the Sellafield Ltd Social impact, multiplied (SiX) programme Transforming West Cumbria programme, led by Cumbria Community Foundation

- opened the Engineering and Maintenance Facility at Leconfield, Cleator Moor and the first Robotics and Artificial Intelligence Collaboration hub in Whitehaven (RAICo1)

- recruited 200 apprentices across 20 career pathways

- launched diversity and inclusion training to help all employees understand the company’s commitment to diversity and inclusion, and to understand the law in this area. Continued to grow employee networks and invested in training aligned to a range of initiatives including promotion of mental health champions.

Safety performance

The company is committed to safety, and keeping its workforce, supply chain partners, local communities, facilities and environment safe.

Nuclear safety is our overriding priority at Sellafield because of the potential significant consequences from a nuclear safety event however we focus on all aspects of safety as they are interconnected.

Performance against the nuclear safety performance indicator was good over the year. On radiological and environmental safety, there was strong performance during 2021/22 in both areas and a low level of events against company targets.

Performance against company conventional safety targets deteriorated when compared to 2020/21. The company’s accident-related safety metrics exceeded the corporate targets which are purposefully set high to encourage everyone at Sellafield to raise the bar. Performance remained high compared with the wider sector.

The majority of events are things like slips, trips and falls associated with routine work, rather than large high-risk tasks. Further detail will be shared in our annual review of performance, due for publication summer 2022.

In line with the company’s aim for all people working at Sellafield to go home safely every day, we are focused on improving our conventional and nuclear safety performance.

The company measures its safety performance against industry best practice at a national and international level, aided through its membership of the World Association of Nuclear Operators (WANO), and through various Key Performance Indicators.

It has a safety performance improvement process to identify gaps, analyse for (and prioritise) resolution and close the gaps. This approach aligns the behaviours inherent to a learning organisation and a healthy nuclear safety culture.

The programme comprises 3 work streams:

- corrective action programme – risk-based approach to progressing condition reports, for the reporting, screening (sentencing), investigating and correcting of issues

- trending programme – routine trending and analysis of condition report data in order to identify underlying weaknesses and prioritise opportunities to close gaps, make improvements, and establish sustainable solutions for the business

- operating experience programme – learning from internal and external issues is shared and used to prevent or minimise similar causes occurring and avoid making similar mistakes

Key learning opportunities are escalated to the Sellafield Ltd Executive, to ensure significant issues impacting safety, reliability and performance across the site are addressed.

This involves periodic reviews by the Nuclear Independent Oversight and Nuclear Safety team to identify enterprise issues – including significant events, adverse trends, long-standing cross-functional issues, to enable informed executive decisions on prioritised actions and improvement activities required to address key learning opportunities and focus the staff on resolving long-standing enterprise issues.

As well as this, the Sellafield Ltd Board is fully informed, engaged and involved with safety performance at Sellafield Ltd.

Changing the way that we work with our supply chain

Our supply chain plays an intrinsic role in the delivery of our mission, accounting for almost two thirds of our annual spend; supporting us with the necessary capacity and capability to allow us to deliver the operating plan.

With a network of over 900 companies engaged on Sellafield business, it is important that effective relationships are maintained with our current and future supply chain partners in order to provide sustainable value for money and improve efficiency and resilience.

Our long-term alliance frameworks are delivering great benefit in decommissioning, design and infrastructure, building upon learning from our other key supply chain partnerships and industry best practice.

These principles of best practice will help guide the development of the next generation of supply chain arrangements, helping to shape the new overarching acquisition strategy.

To successfully deliver our mission and execute the scope of work for the future, we will continue to be heavily reliant on having access to a sustainable supply chain with the necessary capability and capacity to deliver our planned work.

It is therefore important to the site mission that we develop and maintain a viable, robust and motivated supply chain to meet our requirements.

As part of our ongoing commitment to establishing greater economic resilience continue to promote supply chain inclusivity and in particular improve and increase the opportunities for small and medium-sized enterprises (SMEs), in financial year 2021/22 the outturn was of c.33% of direct and indirect spend with SMEs.

The continued use of Liaise, Innovate, Network and Collaborate (LINC) to encourage SMEs at local and national level to collaborate and deliver innovative solutions to the mission at Sellafield remains a commitment within our strategy for defined packages of work.

We continue to place greater emphasis on social value in the construct of our procurement opportunities and in our tenders, which will help drive improved social outcomes and impacts, meaning our communities can benefit from a greater return for taxpayers’ money.

This aligns with increased Her Majesty’s Government focus, as reflected in Procurement Policy Note (06/20).

Sustainability

Over the last few years there’s been a global change in how we think about everything we do, and society has developed a common understanding – we must look after our planet for future generations.

The single biggest contribution that the company will make to the environment is removing the risks associated with the oldest nuclear facilities at Sellafield.

Progress in delivering this task, along with details of its environmental, nuclear, radiological and conventional safety performance, and social impact work in 2021/22 is published on the company’s website in an annual review of performance.

The annual review of performance highlights the intent to take a holistic approach, looking at how work at Sellafield can be delivered in a sustainable way. It also includes the company’s ambition to be part of a sustainable local economy and a sustainable nuclear industry, including working with the supply chain and local stakeholders to help create diversification in our local economies and helping to create thriving communities are at the heart of our social impact strategy.

During 2021/22 the company has been socialising the SiX – Social, impact multiplied relaunch of the strategy. This has been well received and when the supply chain is referring to Sellafield Social Impact, they are calling it SiX.

An update of the Oxford economics report was carried out to understand any change in the impact that Sellafield Ltd has on its local communities, this will be published in the summer.

Public Procurement Notice (PPN06/20); taking account of social value in the award of central government contracts, has resulted in a greater focus in commercial to ensure social impact is included in the tender process.

This is continuing to be developed with processes being put in place to embed and capture the commitments made through our supply chain.

Some of the Investments during 2021/22 included:

- Western Excellence in Learning and Leadership – £1.3 million, this is year 3 of a multi-year programme developed with the NDA, Cumbria County Council and made possible with the commitment of schools across West Cumbria to improve educational attainment.

- Industrial Solutions Hub – £1.3 million towards the development and creation of the ISH entity, working with Copeland Borough Council and Programme and Project Partners to create ‘cluster building’ and diversify the economy beyond nuclear. This is the beginning of a larger project.

- Barclays Eagle Lab - £0.4 million for year 2 of the Eagle Lab, within the first 12 months the facility has attracting 19 new and small businesses looking to grow.

- Lead and change sustainability challenge - c £0.1 million funding for secondary schools in West Cumbria to take part in a sustainability challenge, an educational task to develop their own sustainability projects.

- Community projects – £0.9 million has been awarded to 24 individual third sector organisations delivering projects that help to address social needs in our local communities.

- Transforming West Cumbria Bedrock - £0.5 million to continue the bedrock programme enabling more organisations to benefit from the fund that is designed to increase the resilience and capability of the third sector.

The work the team has been doing working with partners to lead and drive social impact has been awarded recognition as highly commended in the national social value awards.

The redevelopment of the Bus Station and introduction of the Eagle Lab has won the NDA awards for best socio-economic project.

Financial performance

During the year the company incurred operating costs of £2,352 million (2021: £2,070 million). Under the Services Agreement between the company and NDA, the company must control its expenditure within agreed funding limits and operate the Sellafield site safely and securely whilst meeting targets and milestones agreed with its shareholder, NDA.

Management and employee incentivisation schemes are linked to their achievement. In the year the company spent 105% of the funds available (2021: 96%).

The company’s challenge is to deliver more hazard and risk reduction by becoming more efficient. This means reducing the cost of work at Sellafield, diverting money from overheads to front line decommissioning, retraining and reskilling people into priority work, and continuing to improve the way we work with the supply chain.

Under the services agreement, revenue represents the reimbursement of operating costs incurred under the services agreement in accordance with the principal activity of the company.

In 2021/22 the operating profit before taxation, depreciation, interest and research and development tax credits was £5 million (2021: £6 million).

The result for the year, after interest and taxation, amounted to £nil (2021: £nil).

During the year the company employed, including executive directors, an average of 10,843 employees (2021: 10,851) at a total cost of £787 million (2021: £788 million) after taxes and pension costs.

The company’s work on the Sellafield site also supports a significant number of supply chain and agency workers.

During the year, there was an average 680 agency staff (31 March 2021: 533).

The company is tackling unique challenges, in particular the safe clean up and decommissioning of the Legacy Ponds and Silos buildings. In the year the company invested £72 million on research and development (R&D) (2021: £79 million), with the majority of the R&D directly supporting the clean-up of the legacy facilities, reprocessing and fuel fabrication plants, waste management facilities and the infrastructure of the site. R&D costs are directly recoverable from the NDA under the services agreement.

In 2021/22 the operating costs of £2,352 million (2021: £2,070 million) includes external spend on donations in relation to socio-economic expenditure of £7.4 million (2021: £9.7 million), of which £7.4 million was paid in 2021/22 (2021: £9.7 million) and £nil is committed and will be paid during 2022/23 (2021: £nil).

In 2021/22 under the terms of the services agreement this socio-economic expenditure was recoverable from NDA. Under the services agreement, the company agrees in advance the level of socio-economic expenditure with its shareholder, NDA, and all such expenditure is recoverable by the company.

At 31 March 2022, the company’s statement of financial position includes £595 million (2021: £770 million) in respect of the deficit on the Sellafield section of the Combined Nuclear Pension Plan (CNPP), which is a defined benefit pension scheme.

The deficit has been calculated by the scheme actuary, who has performed an actuarial valuation at 31 March 2021 in accordance with International Accounting Standard 19 (R) (IAS 19 (R)). Further disclosures are available in note 16.

The NDA is the principal employer of the CNPP and is ultimately responsible for funding any pension fund deficits for the defined benefit sections of the CNPP. The level of employer contributions paid by the company is determined by the CNPP Trustees based on the latest triennial actuarial valuations.

Under the services agreement between the company and NDA, the employer contributions paid by the company are included in operating costs and are reimbursed by the NDA. As a result, the statement of financial position includes an NDA debtor for the full value of the deficit.

In addition, the statement of financial position includes trade and other receivables (note 10) of £478 million at 31 March 2022 (2021: £388 million) which includes monies due from NDA under the terms of the services agreement and monies due from HM Revenue and Customs in respect of R&D tax credits.

At 31 March 2022 the company had current liabilities (note 12) of £488 million (2021: £397 million) including lease liabilities, accruals, trade creditors, employee creditors, VAT and payroll taxes, which principally relate to the costs being managed under the services agreement and the operation of the Sellafield site.

Section 172 Statement

The company is licensed under the Nuclear Installations Act 1965 (as amended) and is the holder of the Nuclear Site Licence for the Sellafield site (incorporating the former Windscale site) i.e., the Site Licence Company (SLC).

It is the legal entity responsible for this site, which is owned by the NDA. As the SLC, the company, through its board, is directly accountable to the relevant regulators for compliance with the conditions of the nuclear site licence, environmental permits for Radioactive Waste Management and with all other applicable law and regulatory requirements, including compliance with the Companies Act 2006.

The company is responsible for ensuring that the activities on its sites are carried out in the long-term interests of the company, its employees, the local community, and business partners, and for doing so safely, securely, sustainably and with due regard to the environment.

The board of directors of Sellafield Ltd consider, both individually and together, that they have acted in the way they consider, in good faith, would be most likely to promote the success of the company for the benefit of its shareholder (having regard to the stakeholders and the matters set out in s172(1) a-f of the Act) in the decisions taken in the year ended 31 March 2022.

Our obligations

In addition to fulfilling the standard requirements of a limited company in the United Kingdom, Sellafield Ltd is required to fulfil a range of obligations to several government bodies.

These exist because of the company’s status as an ‘arm’s length’ body of the UK Government, requirements of the nuclear sector (domestic and international), the legacy of past missions on the Sellafield site, and the scale and scope of our current missions.

Our key obligations can be categorised as ‘direct’, where the company has a formal relationship with another government body (and is held to account on specific criteria), and broader relationships, such as those where obligations are held by the NDA (as the sole shareholder), which require significant input and support from Sellafield Ltd to discharge them.

‘Direct’ obligations

NDA: The company is a wholly owned subsidiary of the NDA and exists, at their discretion, to realise NDA’s strategic objectives for the Sellafield site.

The company is held to account by the NDA for safe and secure management of the Sellafield site, demonstrable progress, and return on investment. Consequently, we work closely with the NDA on matters pertaining to strategy and planning, major investments, commercial contracts, and performance management.

We are also obliged to fulfil NDA requests for independent reporting for assurance purposes. A specification of the company’s obligations to the NDA is set out in the services agreement between the NDA and Sellafield Ltd, and inter-NDA estate contracts.

Employees: The company employs more than 10,000 employees. Its primary obligation to those employees is to help them understand the Sellafield mission, our enterprise strategy, and their role in delivering that mission safely.

As discussed further in the directors’ report on page 25, the company regularly engages with our employees directly and through their union representatives. Our measures for performance in this area includes regular employee surveys.

Environment Agency (EA): The company’s primary obligation to the EA is to meet environmental regulation for Sellafield Ltd, which is primarily focused on site discharges and radioactive waste disposals.

Office for Nuclear Regulation (ONR): The company’s obligations to ONR are focused on ensuring Sellafield Ltd can operate as a nuclear Site License Company (as described in the ONR’s License Condition Handbook).

ONR has a broad remit, within the framework of the Nuclear Site Licence Conditions (NSLCs), to regulate what is required of Sellafield Ltd to preserve safety and security. ONR must also ensure that the company is compliant with the new UK safeguards regulations.

In particular, ONR will check that Sellafield’s material is present in the quantities, form and locations we’ve declared and that it is not being diverted to other uses.

Department for Business, Energy and Industrial Strategy (BEIS): Although Sellafield Ltd’s relationship with BEIS is formally through the NDA, with regards to communications and public affairs events (that are likely to elicit media interest), we are required to provide input and information directly to BEIS (informing the NDA in parallel).

International Atomic Energy Association (IAEA): Certain areas of the Sellafield site are also subject to inspections from IAEA and the company cooperates with these as required.

Planning Authorities: The company’s obligations to our local planning authorities is to bring planning applications forward in line with the requirements of planning regulations.

Local Authorities: The company has a close working relationship with the local authorities close to our site, in particular under the Radiation Emergency Preparedness and Public Information Regulations.

These relationships are a key component in ensuring our social license to operate. They also facilitate stakeholder input into our work and our understanding of community needs that help shape our social impact programme.

Health and Safety regulators: In addition to their nuclear regulatory duties ONR acts as the health and safety regulator. The Health and Safety at Work Act 1974 and associated regulations such as the Management of Health and Safety at Work Regulations 1999 require that we establish, implement and control an operating model, which is proportionate upon the risk and complexity of our activities.

This operating model includes our purpose and mandates, the overarching frameworks we use to pursue them, and the key activities we undertake day to day.

Finally, the company holds a number of standard certifications (e.g., ISO 9001) and works with various assurance and certification organisations to maintain these.

Broader relationships

The company also has key relationships with a broader range of government bodies, primarily associated with governance of business management, and other stakeholders.

Her Majesty’s Treasury (HMT): Sellafield Ltd is funded by the state, and consequently liaises with HMT with respect to forecast spending requirements (including the liabilities related to the Sellafield site). While this activity is led by the NDA, Sellafield Ltd is closely involved.

UK Government Investments (UKGI): As the NDA is responsible for discharging significant amounts of public funds to private sector organisations, it receives broad advisory support, challenge, and validation from UKGI. In particular, UKGI provides advice and challenge with respect to formal governance arrangements.

Sellafield Ltd provides support in any way required by UKGI to fulfil its governance mandate for arm’s-length government bodies.

Independent Projects Authority (IPA): The NDA also has responsibility for the delivery of major projects at Sellafield Ltd , which are subject to oversight by the IPA.

The NDA is therefore required to engage in project assurance processes with the IPA and can call upon Sellafield Ltd resources and expertise to support review processes and action recommendations.

World Association of Nuclear Operators (WANO): Sellafield Ltd is a member of WANO, an industry body dedicated to improving the safety and reliability of nuclear operations. The company participates in peer reviews and other programmes to enhance nuclear safety both at Sellafield Ltd and in other nuclear facilities worldwide.

Local Community: Sellafield Ltd has a broad range of obligations to the local community, partly stemming from our role as one of the region’s largest employers.

Through a series of public meetings, we routinely report on work underway at Sellafield and invite questions and dialogue from stakeholders and members of the public.

Supply Chain: Sellafield Ltd spends in excess of £1 billion per annum with its suppliers and sections within the Strategic report ‘Changing the way that we work with our supply chain’ and ‘Sustainability’ discuss how the company engages with its suppliers.

Governance

As discussed in more detail in the corporate governance section below, the company has corporate governance arrangements in place which are aligned with the 2018 UK Corporate Governance Code and fulfils the obligations set by our stakeholders.

The structure enables direction and control of Sellafield Ltd in a legally compliant, effective, and efficient manner. The key mechanisms which comprise Sellafield Ltd’s corporate governance are discussed below.

Sellafield Ltd Board

The Sellafield Ltd Board sets the strategic framework and direction for Sellafield Ltd’s operations, in alignment with the NDA’s strategy for the Sellafield site.

Amongst other obligations, it is responsible for agreeing plans by which company performance is measured, holding the executive team to account, setting corporate policies and overarching risk management and controls.

The board delegates day-to-day management of the organisation, and select authorities, to the Sellafield Ltd Executive. The board operates through several sub-committees. The Chair of the board is appointed by the NDA.

The Chief Executive Officer (CEO) is accountable to the Sellafield Ltd Board for all aspects of operating the Sellafield site and delivers this through delegation of accountabilities to the executive team.

The executive team is collectively accountable for managing Sellafield Ltd, which includes (but is not limited to):

- maximising value for the enterprise in a sustainable manner by making trade-offs around resource allocation to balance near-term and longer-term delivery objectives

- taking and overseeing the implementation of medium to long-term strategic decisions for the business

- providing assurance to the Sellafield Ltd Board that the business is being managed in accordance with the board’s requirements and delegations

- fostering a positive environmental protection, safety, and security culture across the Enterprise

- creating alignment with our owner on business priorities

There are several executive committees which enable the executive to carry out their activities as a collective and which form part of the company’s governance structure.

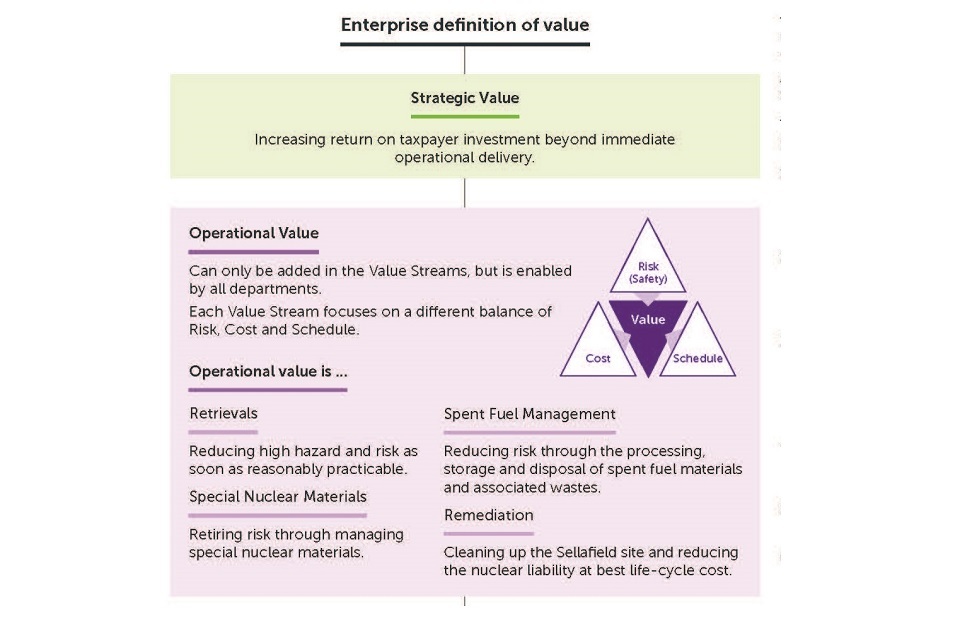

There are 3 components of value for Sellafield Ltd: ‘strategic’, ‘operational’, and ‘right to operate’ All 3 components are essential for Sellafield Ltd.

Enterprise Definition of Value

The overall sustainability challenges for the NDA, as set out in NDA Strategy 4, are:

- Decommissioning and remediating the UK’s legacy nuclear portfolio in the most effective, efficient and sustainable way.

- Maximising the socio-economic benefits derived from the mission to encourage economic diversity and social inclusivity.

- Retaining public trust, coupled with the necessary infrastructure and business environment to support the next planned use of released land and wider prosperity.

- Maintaining a suitable, sufficient and enduring decommissioning and waste management capability for the UK.

- Climate Change and decarbonisation of both the NDA estate and its mission.

- Maintaining the optimum strategic make-buy position, incentivising good practices in procured goods and services and a fuller engagement in the circular economy.

- Realising sustainable, and where possible, net gain end states and biodiversity.

Given constrained resources, the company must prioritise and justify the work it does and the way in which it does it.

The diagram below illustrates the idea that lifetime value for money is a combination of different types of value. It also provides a core concept for prioritisation or weighting of the value drivers in order to inform decision-making.

These judgements are inherently at least partially subjective, and the company needs to be able to consider all these factors in its choices and justify its choices in an open and transparent manner.

Sellafield Ltd cannot possibly meet all the expectations of all its stakeholders, but it must engage openly to explain its reasoning. This honesty is critical to meeting the NDA Strategy 4 commitment to deliver ‘safe, sustainable and publicly acceptable solutions’ and to maintaining the trust that the company depends on.

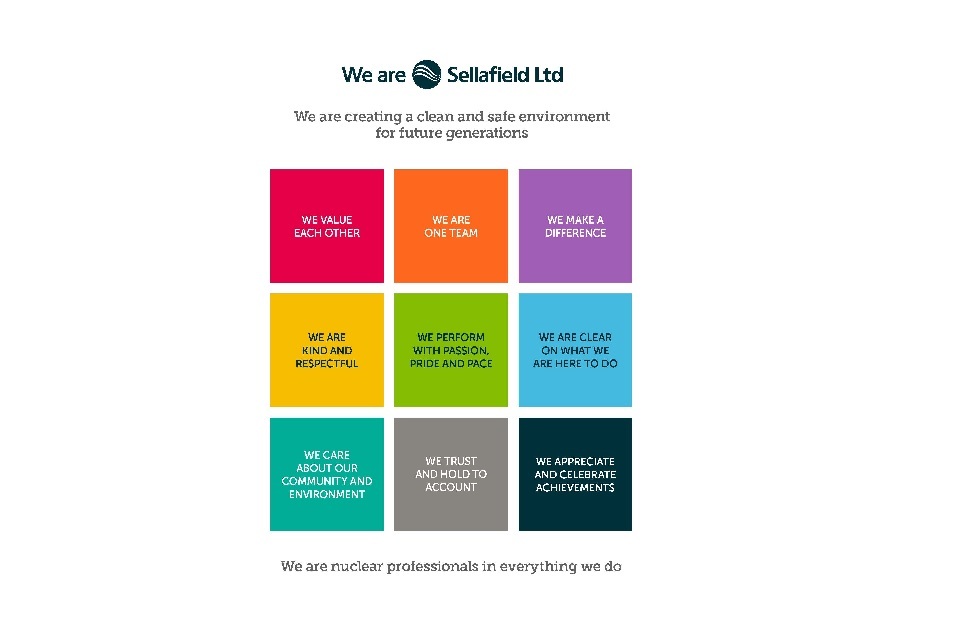

Behavioural

2021/22 fiscal year saw the manifesto gain momentum as a team of over 250 change makers have worked together to role model and spread the message of the manifesto.

The year saw us introducing strategic partners to enable a programmatic approach to embedding our manifesto across our organisation.

As we move to a purpose led organisation, we are working hard to ensure every decision we make is against our purpose of creating a clean and safe environment for future generations.

The year also saw us hold a Manifesto stand up when over a 24-hour period through the day and night our executive held manifesto sessions to share their journey with the manifesto, and teams across our organisation held local meeting to look at what more they could do to truly embrace and embed the manifesto into their everyday work.

We also ran a cultural enquiry where we spoke to 400 people throughout the organisation to identify how we were performing and where we needed to make improvements in role modelling and embedding our manifesto.

As well as the manifesto, Sellafield Ltd has behavioural frameworks which set out the expectations for how its staff and partners should act when working on behalf of the company.

They are fully aligned with UK and international standards, including WANO and IAEA requirements.

The company uses a range of frameworks and mechanisms to communicate and reinforce desired behaviours.

These include, for example, the Code of Responsible Business Conduct, which states the minimum standards expected, and the Nuclear Professionalism and Expectations booklet which sets out behaviours expected from our staff and contractors regarding nuclear safety and are aligned to WANO’s standards.

Diversity and inclusivity

The company is committed to embracing diversity and progressing a culture of respect and inclusion.

Sellafield Ltd has a number of employee-led diversity networks and employee groups, which exist to support its employees and help them to perform at their best. The company also links into NDA group-wide networks.

Each of the networks has an agreed set of terms of reference and works with the Diversity Council to ensure their work is coordinated and consistent with the company’s policies, way of working and aspirations, as outlined in our Manifesto.

The company’s strategic approach to diversity and inclusion is aligned to the people strategy and, includes annual improvement plans for gender balance, race, LGBT and mental health; company-wide training and communications activity; development and evolution of our internal employee led networks and survey and focus group work, with the ethos of being kind and respectful central to everything we do.

Plan – How we set direction and priorities

Sellafield Ltd develops plans and engages and aligns with the NDA on the direction the business is taking, pace of delivery of the core mission, and resource requirements.

Plans are developed across the short- (i.e., 1 to 3 years), medium- (i.e., 10 to 20 years) and long- (i.e., 100+ years) term.

Enterprise Strategy

The Enterprise Strategy flows from the company’s purpose of creating a clean and safe environment for future generations.

Sellafield is an important part of the NDA Group, working collaboratively with others in the group to deliver part of the NDA mission. Like our Manifesto, our strategy outlines the type of organisation Sellafield wants to be.

The strategy details a timeline up to the 2040s, whilst clearly setting out the 2020-2025 objectives.

In particular, the Enterprise Strategy sets out 14 enterprise level objectives against three strategic focus areas:

- Safe Secure Sustainable Site Stewardship

- Progress at Pace

- Lifetime Value for Money.

For each enterprise level objective, the company sets out statements of intent and a timeline which focuses on goals for the next 3-5 years.

The strategy also includes principles to provide guidance to our leadership in setting delivery priorities and making choices.

These principles include key elements of value; our people, sustainability, carbon reduction, technology and innovation and other topics.

The objectives and principles defined in the Enterprise Strategy describe how the company will deliver its purpose and maximise public value.

Safe, secure, sustainable site stewardship

As one of the most hazardous nuclear sites in the world, the potential consequences of a nuclear safety or security event on the site are extremely significant, for the local area, the UK and the international nuclear industry.

This is why safety, security and sustainability are at the heart of what the company does and why it’s key to its mission.

Our purpose emphasises the importance of the legacy we leave for future generations. We will continue to take steps on our journey towards our purpose by dealing with hazardous materials safely and securely.

The expectations of the public are evolving quickly as we learn more about the challenges and impacts of climate change. Commitments at international, national and regional levels mean all organisations have to play their part.

We will embed all aspects of sustainability (environment, economic, societal) in the delivery of our purpose. We aim to be recognised for exemplary environmental leadership and be a leader in low-carbon infrastructure project delivery. All steps we take will contribute towards a more sustainable future.

Progress at pace

Over recent years we have taken some significant steps in moving from design and build, to installation and operation of our legacy ponds and silos, completing some major projects, and commencing more.

As we have established these foundations for delivery across the site, the focus is to build on these at an appropriate pace with appropriate urgency.

In support of our purpose, we utilise our unique capabilities to support a range of other government policies and NDA commercial obligations.

Our progress at pace will particularly focus on the control and repackaging of special nuclear materials, emptying legacy ponds and silos, creating quality waste products, remediating the site towards agreed end states and leading the UK in predictable project delivery.

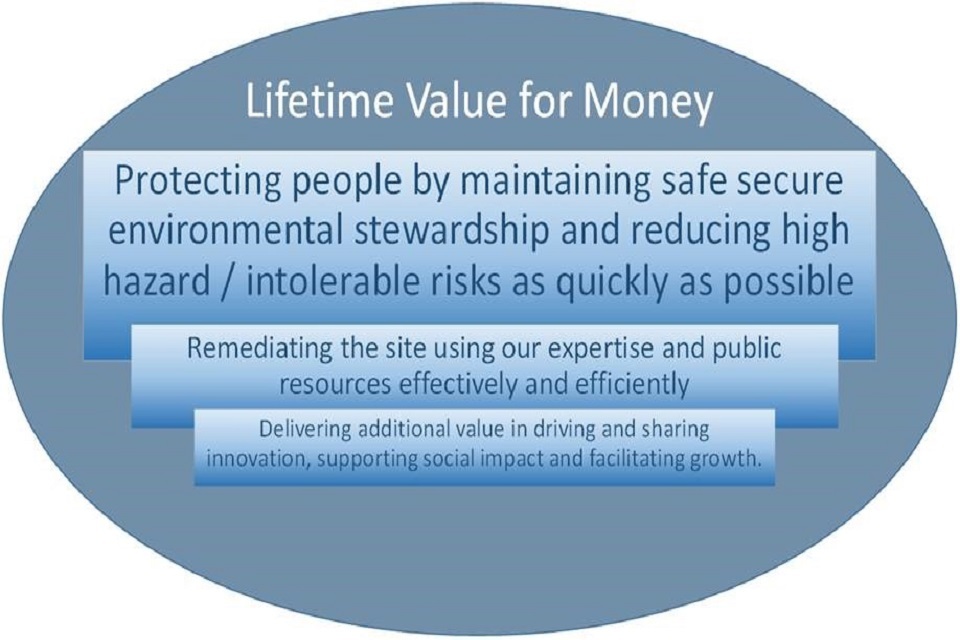

Lifetime value for money

We are cleaning up a legacy site and by doing so, reducing the government’s long-term liabilities. In the process, we can create value by leaving a positive legacy for the environment, our workforce and its communities.

This could include improvements in biodiversity, to improved public health or sustainable local business.

Throughout all it’s essential we maintain our ‘social licence to operate’. The continued existence and development of Sellafield Ltd is completely dependent on our stakeholders and whether they have the confidence in us to deliver the commitments and implement our purpose.

Creating lifetime value for money is about keeping that strong relationship with our stakeholders to continue operations at Sellafield Ltd which we plan to do by unlocking the potential of our people, driving innovative solutions for the future, minimising liability for future generations, maximising public value and return on investment and demonstrating we are a supportive employer, neighbour and industrial partner.

Planning

We set the direction and codify how we will deliver the strategy in corporate, operating, and baseline plans. These guide our activities and enable monitoring of our performance.

The Enterprise Strategy is translated into a high-level plan by our corporate planning team. The corporate plan is developed with key external stakeholder input and approved by the Sellafield Ltd Executive and Board, with endorsement by the NDA where appropriate.

Our Enterprise Portfolio Office uses the enterprise strategy and corporate plan to develop key targets and milestones, supported by detailed planning work carried out by the corporate planning and finance departments, with input from the portfolio offices in organisational units across the enterprise.

The Baseline Plan is a 100+ year plan setting out the total estimated costs for the Sellafield Ltd mission (detailed costs for in-years; modelled for outer years). It is used for performance monitoring and informing the site licence annual site funding limit, as well as the annual report and accounts, and the site liability estimate.

The baseline plan is subject to additional change controls to reflect the best estimate. The plan is developed by Sellafield Ltd in conjunction with the NDA.

The corporate plan is a 20-year view of the business deliverables and milestones and is effectively an implementation roadmap for our enterprise strategy.

It details the environment in which the business will operate as well as referencing the wider business context. The corporate plan identifies key risks, uncertainties and opportunities in the planning period.

The document is reviewed and updated every 5 years. The corporate plan is developed by Sellafield Ltd with input from the NDA.

The operating plan is a 3-year view of key deliverables and costs from the baseline and in-year targets agreed between the NDA and Sellafield Ltd. It sets out how funding will be allocated across different organisational units (and programmes where applicable).

Resources – How we acquire, deploy, and manage capital, capability and assets

Portfolio and programme management

We design and manage portfolios and programmes at different levels of the organisation to maximise value.

- Enterprise Portfolio Management refers to the prioritisation and balancing of the enterprise investment mix in terms of macro resource allocation and constraint management; this activity falls under the remit of the Enterprise Portfolio Office.

- Portfolio Management refers to Portfolio hubs within the value streams and other departments which are responsible for more detailed resource allocation and performance management across a collection of activities.

- Programme Management refers to the coordinated management of a collection of projects directed at a specific business outcome within a department or value stream (e.g., AGROP).

Spatial planning

Sellafield is a heavily congested site and sits within a defined nuclear licensed footprint. The nature of our mission means that we need to build new facilities in order to empty our highest hazard legacy facilities. Our spatial planning team ensures the best use of land for these facilities and their supporting infrastructure.

Enterprise-wide prioritisation

The Enterprise Portfolio Office works with the NDA and other Her Majesty’s Government stakeholders to agree Sellafield Ltd’s delivery targets and annual spending requirements.

Through this process, the Enterprise Portfolio Office establishes the prioritization and allocation of these and communicates corresponding targets to portfolio hubs throughout the organisation.

Within these constraints, directorates have discretion on the allocation of funding within their portfolios. A key exception is when proposed investments breach Delegations of Authority, in which case an investment proposal must be submitted to the Investment Review Panel (IRP – which is a cross-organisational committee chaired by the Finance Director) for sanctioning approval.

The Enterprise Portfolio Office reviews resource prioritisation on an on-going basis to ensure that it is maximising value for the enterprise and recommends in-year adjustments to the executive as appropriate.

This portfolio approach enables the right focus, decision making, and allocation of scarce resources where needed.

Budgeting and cash management

Finance is responsible for collating all inputs relating to budgeting, including funding limits and enterprise resource requirements, and developing an annual budget for the enterprise.

In accordance with the constraints set by the Enterprise Portfolio Office, finance is responsible for the mobilisation of funding across the enterprise.

The budget is actively managed at all levels throughout the enterprise, with financial controllers responsible for each key area of the business. As deemed necessary, additional Finance resources are deployed into the business to ensure effective financial governance.

Capability deployment

The specific accountability for capability development and deployment sits within a network of enterprise leads and heads of profession in partnership with their executive member.

They have a formal relationship with the people function resources to support enterprise-wide capability planning and development for their area.

In cases where, temporarily, enterprise demand for profession staff exceeds immediate supply, the people function will determine the appropriate allocation.

The company has implemented a capability planning process that has clear alignment to budget and the scope of work.

Corporate governance

It is the company’s stated position that it seeks to apply the underlying principles of the 2018 UK Corporate Governance Code (the Code) to the maximum extent to which it is applicable, without formally adopting the Code.

The first 2 exceptions, detailed below, are features of the Department for Business Energy and Industrial Strategy (BEIS) operating model for the NDA and Sellafield Ltd, whereby the NDA is the sole shareholder and as such determines the appointment of the Chair.

The company follows the principles of the Code with the following exceptions:

- The company is wholly owned by NDA, so principles and provisions related to multiple shareholders are not applicable

- the company does not follow all the principles in respect of board appointments. In particular, under the Articles of Association and Services Agreement, Sellafield Ltd’s Non-Executive Chairman is selected by the NDA, NDA also selects shareholder representative directors, and NDA must approve all appointments to (or removals from) the Sellafield Ltd Board. Also due to the long-term nature of the company’s business, non-executive directors are generally appointed for 3 to 4 years rather than re-elected annually.

- the company has an Audit and Risk Assurance Committee (A&RAC) that follows the principles of the Code, but the company does not present a report on the work of the A&RAC within its financial statements

The company has comprehensive risk management and risk reporting processes to manage all nuclear, business, safety, security, operational and financial risks related to the Sellafield site.

The code adopts a principles-based approach to provide guidance on good corporate governance. It places greater emphasis on relationships between companies, shareholders and stakeholders.

It also promotes the importance of establishing a corporate culture that is aligned with the company purpose, business strategy, promotes integrity and values diversity.

The company follows the 5 principles of board leadership and company purpose, which are:

- A successful company is led by an effective and entrepreneurial board, whose role is to promote the long-term sustainable success of the company, generating value for shareholders and contributing to wider society

- The board should establish the company’s purpose, values and strategy, and satisfy itself that these and its culture are aligned. All directors must act with integrity, lead by example and promote the desired culture

- The board should ensure that the necessary resources are in place for the company to meet its objectives and measure performance against them. The board should also establish a framework of prudent and effective controls, which enable risk to be assessed and managed

- In order for the company to meet its responsibilities to shareholders and stakeholders, the board should ensure effective engagement with, and encourage participation from, these parties

- The board should ensure that workforce policies and practices are consistent with the company’s values and support its long-term sustainable success. The workforce should be able to raise any matters of concern.

Accountability for the day-to-day management of the business is held by the Chief Executive Officer (CEO), supported by the executive team.

The directors have considered the disclosures included within the annual report and financial statements and are satisfied that the annual report and financial statements as a whole are fair, balanced and understandable, and provide the information necessary for the shareholder to assess the company’s position, performance, business model and strategy.

Board and committee structure

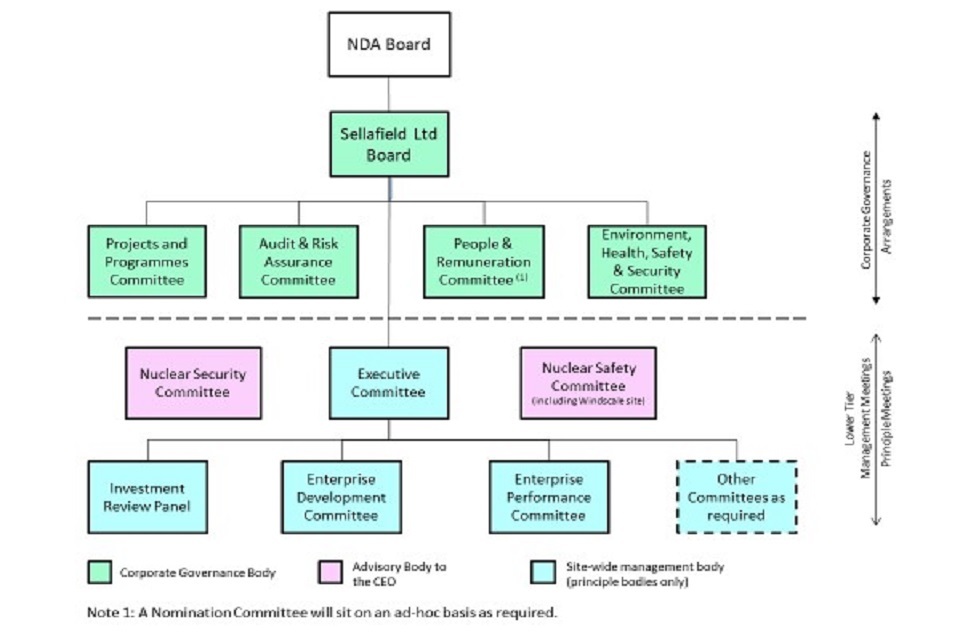

The corporate governance structure for the company is shown below.

As shown above, the structure comprises 4 formally constituted sub-committees of the company’s board, each of which is central to assisting the board in maintaining good governance and assurance/oversight.

Although other committees will support the work of these committees, final accountability and responsibility for the operation and management of the company rests directly with the board.

Decisions may be taken by these committees in line with their delegated authority as set out in their terms of reference (otherwise it is their responsibility to make recommendations to the board).

The board of directors of the company: The board has the sole decision-making authority, except where the board delegates its authority to the CEO or to board committees, in each case in accordance with the terms of the corporate governance documents and, where appropriate, the services agreement.

In such instances the board remains accountable to the shareholder for those decisions and as such requires oversight and assurance of the systems put in place to deliver day-to-day management of the organisation.

The Audit and Risk Assurance Committee (A&RAC): Its purpose is to ensure effective oversight of the company’s statutory reporting, corporate governance, risk management process and internal control. The committee also has oversight of the internal audit function of the company and the external auditor on behalf of the board.

The Environment, Health, Safety and Security Committee (EHSS): Its purpose is to provide the board with assurance in respect of policy implementation, statutory and regulatory requirements, internal controls (including environmental matters such as discharges and disposals, the Internal Regulator and EHSS Assurance) and risk mitigation.

The Projects and Programmes Committee (P&PC): Its purpose is to update and inform the board on the activities being undertaken by the company to deliver projects and programmes to schedule and within sanction, and to advise the board of any issues or concerns that it has regarding the performance of those projects and programmes, including but not limited to the confidence in meeting the desired outcomes.

The People and Remuneration Committee (P&RC): Its purpose is to consider, oversee, evaluate, and provide guidance to the board on the strategy and implementation plans adopted by the company in relation to its workforce and people.

The committee provides the means by which the voice of employees is heard by the board and the Chair of the committee ensures that the board takes into account the interests of employees when making its decisions.

The committee has delegated authority, subject to the remuneration framework, for setting the remuneration of all executive directors, including pension rights and any additional payments or bonuses, and for considering the overall effectiveness of the remuneration strategy within the company.

The company also has nominations committee (NomCo) which meets on an ad hoc basis as required.

Advisory Bodies:

The Nuclear Safety Committee: Whilst each director and executive committee member has responsibility for nuclear safety, there is also a nuclear safety committee constituted in accordance with the nuclear site licence requirements.

The committee includes the company’s chief nuclear officer as well as members external to the company. It reports directly to the CEO and through him provides advice to the licensee ensuring that matters of nuclear safety are given the highest visibility across the business.

Any advice given by the committee but not accepted by the CEO must be reported to ONR under Nuclear Site Licence Condition 13.

The Nuclear Security Committee: Whilst each director and executive committee member has responsibility for nuclear security, there is also a nuclear security committee. The committee includes the company’s chief nuclear officer as well as members external to the company.

It reports directly to the CEO and through him provides advice to the licensee ensuring that matters of nuclear security are given the highest visibility across the business.

Supporting Management Committees: The management committees are not decision-making bodies; they are the committees called by the accountable executive or senior manager to support them in the delivery of their personal accountability or in their duty to advise and inform the governance committees.

The Executive Committee: The CEO is accountable to the board for all aspects of running the business.

The CEO delegates certain of these controls and responsibilities to the members of the executive committee. The CEO as executive director with delegated authority to manage the business leads the executive committee which is the principal management committee for the company and, through the accountability of its members, frames the strategic recommendations to the Board, oversees the implementation and delivery of short to medium-term strategic decisions for the business and reviews corporate risk.

The executive committee focus is on decision making which directly impacts the business direction based upon recommendation(s) that have been tested through the appropriate sub-committee(s).

The study of proposals supported by subject matter experts is conducted within the remit of supporting committees enabling the executive committee to consider the strategic and business impacts without having to re-evaluate the principles and options.

The work of the sub-committees is guided by the executive committee framing the business requirements and direction.

The CEO provides assurance to the board that the business is being managed in accordance with the board’s requirements and authorities.

The executive committee provides a forum for executives to give advice as a collective to the CEO in support of the CEO delivering the accountabilities to the enterprise and its board and shareholder.

Executive committee membership comprises the executive directors and the general counsel and company secretary.

Each member is authorised by the CEO to undertake activities and manage their accountabilities within their respective areas of accountability.

They are individually accountable for delivery of the corporate plan and the safe, secure execution of the operating plan, including consideration of nuclear safety, security and the environment in all their activities, as well as achieving work and efficiency targets.

The Investment Review Panel (IRP): The chair of this panel exercises the delegated authority of the CEO to oversee the financial investment decisions of the company acting directly on behalf of the CEO.

The IRP takes formal decisions regarding the merits of investment, value for money, acquisition strategy and the financial case for placing of and/or amending significant contracts, including justification for increased sanction.

The IRP is also the primary body tasked with considering the procurement risks associated with an acquisition strategy or contract variation and for sole source awards and high value agreements, for onward submission to NDA/HM Government.

Where a matter is outside of the authority delegated to the panel chair, the chair provides advice and/or recommendations to the CEO. It reports on its business through the executive committee and upwards to the board.

Some significant investment decisions may, at the request of the CEO or IRP chair, be taken by the executive committee itself. Where matters are being presented to NDA for approval, the board will receive a summary of the sanction position as approved by the IRP/executive committee but, to the extent delegated, will not reconsider the merits or specifics of recommendations.

The IRP is supported in its work by the enterprise development committee which will evaluate and determine the strategic case for investment.

The enterprise development committee chair provides advice to the CEO and executive in support of enterprise strategic decisions and takes such decisions where so authorised within the delegated authority.

The remit of the committee is to ensure the effective development and implementation of the site strategic specification, both in the operational area (“technical”) strategies and the enabling functional (“enterprise”) strategies.

It acts as the key conduit for strategic information between the NDA and the company and between the corporate centre and the value streams/functions.

It supports the Enterprise Portfolio Office in developing the corporate plan and decision calendar and is the forum for senior level discussion on the development of such plans.

This Committee also serves as the primary governance committee for the development and oversight of transformation and social impact activities and is the route for recommendations to the board and executive in these areas.

The enterprise performance committee is the principal meeting to enable senior level oversight and assurance of, including reporting on, the performance outcomes of the business.

This includes the delivery of operational performance requirements in accordance with the operating plan. It is the opportunity to challenge, support and create meaningful debate on site performance, holding the responsible executive and/or value stream leads to account for performance in their area.

Attendance may include individuals from the NDA owners representative team by invitation, and therefore in addition it may provide a forum for NDA and the company executives jointly to discuss and challenge delivery outcomes.

All other committees, whether formally appointed or not, are advisory unless either the board or the executive committee elects to further delegate any of its decision-making authority.

The work of the executive, enterprise development and enterprise performance committees is supported by the work of the Enterprise Portfolio Office (EPO).

The EPO operates under Executive management with responsibility for prioritising the allocation of resources (finance, labour, facilities) to maximise benefits in alignment with the strategy.

Under the overall control of the enterprise director the corporate centre maintains a suite of tools to manage the business, including strategic decision calendars.

The company complies with the 2018 Code by means of an annual self-assessment of the board and board committees (facilitated by an independent party such as internal audit) and a 3 yearly independent external review of effectiveness.

Role of the company board

The board provides leadership to the company within a framework of prudent and effective controls which enable risk to be assessed and managed.

It is accountable to the shareholder and regulators for compliance with the conditions of the nuclear site licence, environmental permits and other applicable l;aw and regulatory requirements.

Its authority is derived from the Articles of Association and the Scheme of Delegations and is subject to the conditions within the remuneration framework.

The board meets at least 6 times each calendar year.

The Companies Act 2006

The Companies Act 2006 sets out the duties of a director as follows:

- a duty to act in accordance with the company’s constitution and only exercise powers for the purposes for which they are conferred

- a duty to act in the way the director considers, in good faith, would be most likely to promote the success of the company for the benefit of its members as a whole and in doing so have regard to various matters

a) the likely consequences of the decision in the long term

b) the interests of the company’s employees

c) the need to foster the company’s business relationships with suppliers, customers and others

d) the impact of the company’s operations on the community and the environment

e) the desirability of the company maintaining a reputation for high standards of business conduct

f) the need to act fairly as between members of the company, although this is not relevant as the company only has one shareholder, being NDA.

- a duty to exercise independent judgment

- a duty to exercise reasonable care, skill and diligence

- a duty to avoid a situation in which the director has, or can have, a direct or indirect interest that conflicts, or possibly may conflict, with the interests of the company

- a duty to not accept a benefit from a third party conferred by reason of the director being a director, or their doing (or not doing) anything as director

- a duty for the director to declare if he is in any way, directly or indirectly, interested in a proposed transaction or arrangement with the company, and the nature and extent of that interest, to the other directors

The role of a director is separate and distinct from the role of an executive or senior manager, even if (as is the case of certain directors who are also members of the executive committee) the roles are held by the same person.

Each executive director’s role is to put aside the interests they may have in an executive capacity and act in a way which meets the duties of a director.

Non-executive directors are recognised as playing a key part in good governance in terms of independent oversight of board decision making.

Non-executive directors’ roles are developed to ensure that they provide the appropriate level of oversight and challenge to the decisions of the board and they are provided with suitable and sufficient information and briefings to enable them to fulfil this role in full.

In line with UK best practice, the overall effectiveness of the board is reviewed on an annual basis or other such period as determined by the board.

It is for these reasons that Sellafield Ltd requires its directors to undertake formal training with regards to the role of a director, either through the Institute of directors or other equivalent body.

Roles of the board members

The board membership is comprised of:

- Non-Executive Chair, selected by NDA

- Chief Executive Officer (Executive Director)

- Up to 3 other Executive Directors (including the Finance Director or equivalent)

- Up to 2 Shareholder Representative Directors

- Up to 6 independent Non-Executive Directors

COVID-19

The COVID-19 pandemic created a global challenge and Sellafield Ltd responded quickly to maintain control whilst developing an understanding of the impact of COVID-19, transmission factors and mitigation.

Strong relationships were formed with external agencies, and information from these were used to generate company and stakeholder briefings, scenarios, and inform decisions.

The company developed a plan in the early days of the pandemic that considered what would be its Best Available Technique and as Low as Reasonably Practicable approach as a result of the new risks and constraints.

The plan defined 4 phases to be tolerant to whatever the evolution of the pandemic. The company has followed this plan throughout, updating the Nuclear Safety Committee, Sellafield Ltd Board and NDA colleagues and wider stakeholders regularly. In parallel, the company undertook scenario analysis of the longer-term impact on its risks and mission delivery.

Despite the challenge of the emergence of new variants and associated waves of infection Sellafield Ltd has progressed to phase 4 of the response plan and has put in place effective controls to live with the residual impact and manage through normal arrangements.

The Omicron variant resulted in the highest absences in January 2022 at any time during the pandemic, but effective prior planning enabled us to maintain nuclear safety, retain workforce confidence, and to minimise the impact on delivery.

The new capabilities (e.g., Sellafield Ltd test and trace) put in place to mitigate the impact of COVID-19 have been demobilised but options to enable a rapid response should the external environment necessitate have been made and learning to improve resilience to future challenges captured.

Other considerations

It is very difficult to quantify the full impact from the war in Ukraine. What we can say is that it is a significant factor contributing to the volatility and uncertainty in the external environment and is a factor in the high rates of inflation we are now experiencing.

Although not entirely attributable to the war (other issues include the pandemic and Brexit) we are now experiencing inflation at a rate not seen for 30 years and well in excess of the 2% assumed by Treasury for our funding settlement.

Principal risks and uncertainties

As previously stated, the company operates the Sellafield nuclear site under the site licence and a services agreement between itself and the NDA, and this includes managing some of the most significant nuclear risks in Europe.

As discussed above, the company seeks to apply the underlying principles of the Financial Reporting Council’s 2018 UK Corporate Governance Code. The company has comprehensive risk management and risk reporting processes to manage all nuclear, business, safety, security, operational and financial risks related to the Sellafield site.

As discussed in note 2.2l, if required the company uses forward foreign currency contracts and currency options to reduce foreign exchange rate exposure on certain assets, liabilities and firm commitments.

During the year the company did not engage in such activities (2021: same). The company does not engage in speculative treasury arrangements, and all its activities are designed to support underlying business activities. All treasury activities are carried out under policies approved by the Board.

The company’s maximum exposure to credit risk is the carrying value of the company’s financial assets as reported in the statement of financial position. Trade and other receivables principally include company operating costs recoverable from the NDA, which as discussed in note 10 are considered to be contract assets under IFRS15 and recoverable under the terms of the services agreement. Therefore, the directors consider the risk of financial loss to be remote.

The company’s liquidity risk is managed via the working capital arrangements described in note 11. Exposure to price and cash flow risks are not significant to the results and affairs of the company.

The company does not have major working capital requirements because all expenditure incurred by the company is reimbursed by the NDA under defined contract terms within the services agreement, and the company’s working capital requirements are provided by NDA.

In particular the majority of the company’s payments to suppliers, employees and third parties are funded through a cash drawdown agreement with the NDA, and the NDA also provides the company with a working capital facility of £2.5 million so that the company’s other liabilities can be met as they fall due.

Under the Energy Act 2004, the NDA has a statutory obligation to provide adequate funding to enable the company to manage risks and keep the Sellafield site safe and secure.

The company does not have significant supplier or credit risks (2021: same).

As discussed above, the nuclear industry is regulated by bodies such as the Environment Agency and the Office for Nuclear Regulation, and the company has detailed processes, procedures and controls to ensure that it complies with all aspects of this regulatory environment.

Any fines arising as a result of the company’s non-compliance are reimbursable costs under the services agreement with the NDA.

By order of the board

Miss K Smith

Secretary

Date: 6th July 2022

Registered Company Number: 01002607

Hinton House

Risley

Warrington

Cheshire

WA3 6GR

3. Directors’ report

The directors present their Directors’ report for the year ended 31 March 2022.

Directors

The directors who held office during the year and to the date of this report were as follows:

Mrs L I Baldry (Chair) (resigned 2 May 2021)

Mr A J M Meggs (Chair) (appointed 2 May 2021)

Mr M J Chown (Chief Executive Officer)

Mr J M Seddon (Finance Director)

Mr A D Cumming (Shareholder Representative Director)

Mr J Baxter (Non-Executive Director)

Dr A F J Choho (Non-Executive Director)

Mr D G Vineall (Shareholder Representative Director)

Mrs C L Hall (Non-Executive Director)

Mr J P Simcock (Non-Executive Director)

Mrs R McLean (Non-Executive Director)

Secretary

Mr A M Carr (resigned 5 January 2022)

Miss K Smith (appointed 5 May 2022)

None of the directors who held office at the end of the financial year had any disclosable interest in the shares of the Company (2021: same).

According to the register of directors’ interests, no rights to subscribe for shares in or debentures of the company were granted to any of the directors or their immediate families, or exercised by them, during the financial year (2021: same).

Directors’ and officers’ liability insurance

Directors’ and officers’ liability insurance is provided, covering inter alia the defence costs of civil legal proceedings and the damages resulting from the unsuccessful defence of such proceedings except, in each case, to the extent that a director or officer acted fraudulently or dishonestly (2021: same).

Directors’ indemnities

As at the date of this report, the company entered Deeds of Indemnity with certain of the directors (2021: same). These indemnities are qualifying third party indemnity provisions for the purposes of the Companies Act 2006 (UK).

Policy and practice on payment of creditors

The company has continued its commitment to the Prompt Payers Code of Practice drawn up by the Confederation of British Industry (CBI), with rigorous monitoring of payment performance.

Copies of the Code are available from CBI, Centre Point, 103 New Oxford Street, London, WC1A 1DU. Over the year 99% (2021: 99%) of invoices submitted against the standard payment terms were paid on time.

Employees and employee engagement

The company attaches importance to the involvement of its employees in the company’s development and has continued its previous practice of keeping them informed on matters affecting them as employees and on various factors affecting the performance of the company.

Employee representatives are consulted regularly on a wide range of matters affecting the current and future interests of the employees.

Employee involvement in the performance of the company is encouraged through various bonus and remuneration schemes.

The company is committed to a policy of equal opportunities for all employees. Great care is exercised in our recruitment and selection procedures to ensure that there is no discrimination, and that training is given to meet individual needs.

Applications by people with disabilities are given full and fair consideration and wherever practical, provision is made for their special needs. The same criteria for training and promotion apply to people with disabilities as to any other employee. If an employee becomes disabled, every effort is made to ensure their continued employment.

As discussed in the Strategic report within the section on corporate governance, the Sellafield Ltd Board has a People and Remuneration Sub-Committee (P&RC) whose purpose is to consider, oversee, evaluate and provide guidance to the board on the strategy and implementation plans adopted by the company in relation to its workforce and people.

The committee provides the means by which the voice of employees is heard by the board and the chair of the committee ensures that the Board takes into account the interests of employees when making its decisions.

The company regularly consults with the unions (GMB, Prospect and Unite), and consults with employees directly through surveys, discussion forums, and briefs.

Customer and supplier engagement and interests

In the Strategic report the section 172 Statement discusses how the company works with the NDA, which is its customer and shareholder, and other stakeholders.

The strategic report also discusses how the company works with its suppliers, principally within the sections ‘Changing the way that we work with our supply chain’ and ‘Sustainability’.

Going concern

As discussed in the strategic report on page 24, under the Energy Act 2004, the NDA has a statutory obligation to provide adequate funding to enable the company to manage risks and keep the Sellafield site safe and secure.

The company does not have major working capital requirements because all expenditure incurred by the company is reimbursed by the NDA under defined contract terms within the services agreement, and the company’s working capital requirements are provided by NDA.

In particular the majority of the company’s payments to suppliers, employees and third parties are funded through a cash drawdown agreement with the NDA, and the NDA also provides the company with a working capital facility of £2.5 million so that the company’s other liabilities can be met as they fall due.

Agreed funding levels are set annually by NDA. It is anticipated that high inflation and increase in energy costs could result in the company’s spend to be higher than the agreed funding levels in the forthcoming year.

As in previous years, Sellafield will work collaboratively with NDA to resolve any funding issue. All costs incurred by the company will be reimbursed by NDA

Having reviewed the cash flow forecasts against agreed funding levels, and working capital availability form the NDA, the directors have concluded that the use of the going concern basis of accounting is appropriate and that there are no material uncertainties related to events or conditions that may cast doubt about the ability of the company to continue as a going concern.

Streamlined energy and carbon reporting

Greenhouse gas (GHG) emissions and energy usage data for the period 1 April 2021 to 31 March 2022 is as follows:

| Current reporting year 21/22 | Comparison reporting year 20/21 | |

|---|---|---|

| Energy consumption used to calculate emissions: kWh total (000 kWh) | 1,037,000 | 1,183,000* |

Breakdown by fuel: kWh

| Electricity (000 kWh | 137,000 | 139,000 |

| Natural Gas (000 kWh) | 888,000 | 1,036,00 |

| Other fuels (000 kWh) | 8,000 | 5,000 |

| Transport (000 kWh) | 4,000 | 3,000 |

Scope 1

| Emissions from combustion of gas (Scope 1): tCO2(e) | 161,000 | 190,000 |

| Emissions from combustion of fuel oils (Scope 1): tCO2(e) | 2,000 | 1,000 |

| Emissions from combustion of fuel for transport (Scope 1): tCO2(e) | 700 | 700 |

Scope 2

| Emissions from purchased electricity (Scope 2): tCO2(e) | 29,000 | 32,000 |

Scope 3

| Emissions from business travel: hire or employee-owned vehicles where company is responsible for fuel (Scope 3): tCO2(e) | 400 | 100 |

| Total gross CO2(e) based on above: tCO2(e) total | 193,100 | 223,800 |

| Intensity ratio: tCO2(e)/ £1 million | 82 | 108 |