Scotland in the UK

Updated 21 August 2014

Union flag and saltire

Know the facts - introduction from Scottish Secretary Alistair Carmichael

On 18 September 2014, people in Scotland will take one of the most important decisions in our lifetime - to stay in the United Kingdom or leave it and become a separate independent state.

As Secretary of State for Scotland, I have been all over our country in recent months discussing the referendum with individuals, communities and a wide range of organisations. All over Scotland, people have asked me for clear, simple information that can help individuals, the organisations they work for and the people who use their services to understand the benefits to Scotland of being in the UK and the implications of leaving.

The UK Government has undertaken a major programme of analysis to explain the benefits of Scotland being part of the UK and to examine the implications of independence. This short booklet sets out the main conclusions so far. The detailed analysis - and much more information - can be found online.

The UK Government wants everyone in Scotland to be well informed before the referendum. So I would encourage organisations to make this information available to ensure everyone can understand the positive case for Scotland remaining in the United Kingdom.

Scotland in the UK today: the best of both worlds

Being part of the UK gives Scotland the best of both worlds.

At Holyrood we have a powerful Scottish Parliament that controls more than £27 billion of spending - around 60% of all public spending in Scotland. The Scottish Parliament has the power to make and change the law to meet Scottish needs and aspirations on childcare; education; training and skills; enterprise; health and social care; justice and policing; housing; the environment; agriculture, fisheries and rural affairs; and the arts, culture and sport.

At the same time we benefit from being part of the UK; with a UK Parliament that takes decisions on behalf of everyone in the UK on the economy, defence, national security and international affairs. We benefit from being part of a larger, more diverse and stable economy that allows us to pool benefits in the good times and share risks in the bad times.

And our devolution settlement is flexible. The Scotland Act 2012 extended the powers of the Scottish Parliament with the largest devolution of tax powers from Westminster in 300 years.

From April 2016, further devolution will give the Scottish Parliament additional tax powers, so it will be responsible for raising one-third of the money it spends in Scotland. These powers include a new Scottish Rate of Income Tax which will allow the Scottish Government to decide the rate of tax that people in Scotland pay. The UK Government has also announced powers to enable the Scottish Government to issue its own bonds and borrow for capital investment such as major transport projects, hospitals, schools and flood defences.

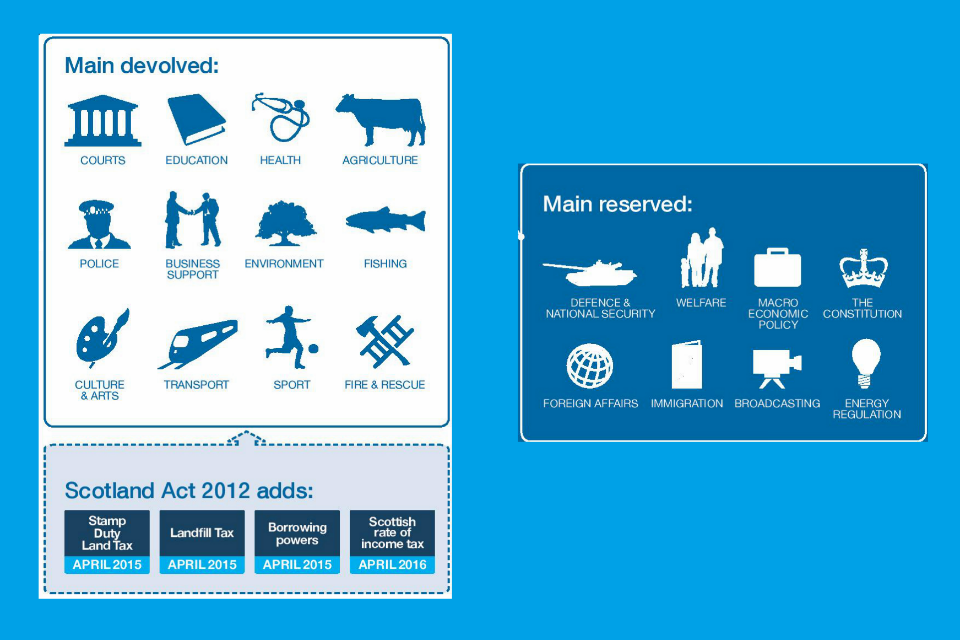

Main powers that are reserved and devolved:

Main powers that are reserved and devolved

The UK is four nations united and free of borders. Together we created the NHS and the BBC, fought for freedom in world wars, celebrated Olympic success and built the best and most enduring union of nations in the world.

Independence would mean Scotland leaving the UK to form a new state. The rest of the UK would continue. UK laws and institutions - like the Bank of England - would continue to operate in the continuing UK and the continuing UK would retain its membership of organisations like the EU, the UN, NATO and the G7.

An independent Scotland would need to apply to all international organisations it wished to join and establish its own domestic institutions. There are more than 200 UK public bodies that currently perform functions in Scotland - the government of an independent Scotland would need to decide how many of these would need to be replicated. Creating and running these institutions would have to be funded by Scottish taxpayers.

Our economic strength and security

As part of the UK, Scotland’s economy has performed strongly. Over the last 50 years, growth in economic output per person has been slightly stronger in Scotland than the UK average. This demonstrates that Scotland does well from being part of the UK, outperforming small independent countries. From 2000 to 2012 Scottish growth per head was higher than Denmark, Finland, Ireland, Luxembourg and Portugal.

Within the UK, we pool resources and share risks across Scotland, England, Wales and Northern Ireland. The size and diversity of the UK economy has helped protect us from economic shocks, like the 2008 banking crisis. The UK Government spent £45 billion recapitalising the Royal Bank of Scotland (RBS) in 2008, and the bank also received £275 billion of state guarantees and loans. In total this support would have been twice the size of the whole Scottish economy in that year, including North Sea oil.

Growth rates in GVA (Growth Value Added) per head

Sweden - 1.6%

Scotland - 1.2%

Austria - 1.2%

Finland - 1.1%

Ireland - 0.8%

Luxembourg - 0.8%

Portugal - 0.2%

Denmark - 0.1%

The UK Pound

The UK is one of the most successful monetary, fiscal and political unions in history, and the current arrangements bring significant benefits to Scotland. Taxation, spending, monetary policy and financial stability policy are co-ordinated across the whole of the UK to the benefit of all parts of the UK. Risks are pooled and the UK has a common insurance against uncertainty. If people in Scotland vote to leave the UK, we would also be voting to leave the UK pound. That is part of the choice that we are being asked to make.

The Scottish Government has proposed a currency union with the continuing UK. All three major UK political parties have ruled out a currency union because it would not be in the interests of the continuing UK or an independent Scotland. For an independent Scotland, a currency union would make it more difficult to adjust to economic challenges, as we have seen for European countries in the euro currency union. For the continuing UK, it would mean being exposed to much greater risk, with the possibility that UK taxpayers would be asked to bailout Scotland in the event of a fiscal or financial crisis.

Our single market

The UK’s large domestic market, with one currency and one set of rules, allows businesses to trade freely across the whole of the UK benefiting businesses, workers and consumers. In 2011, Scotland sold goods and services to the other parts of the UK worth over £45.5 billion. This is double the amount we export to the rest of the world and four times as much as to the rest of the European Union combined.

This trade is supported by a common business framework that is the basis for every stage of a business from hiring employees, to borrowing money, to getting goods to market either online or on the high street.

In the event of independence, the Scottish Government would have to choose between:

-

adopting the pound informally, in the way that Panama and Ecuador use the US dollar (so-called “sterlingisation”), meaning Scotland would have no control over its interest rates and no lender of last resort for its banks

-

joining the euro, which an independent Scotland could be obliged to do as part of joining the EU, and would mean the euro replacing the UK pound in circulation and Scottish interest rates set by the European Central Bank

-

creating a new Scottish currency, which would give the Scottish government full control over all economic policy, but would mean uncertainty about the value of savings and pensions, and huge costs to business.

Within the UK, we benefit from the strong UK pound, without any of these risks.

Regardless of the choice of currency, independence would put an end to all of this.

It would mean businesses that work across the UK having to deal with two sets of rules and regulations and two tax systems, all of which would increase costs and create uncertainty, making it harder to do business across the whole UK.

The UK Government’s analysis puts the potential cost per household in Scotland every year of putting a border between Scotland and the wider UK economy, and establishing different regulatory and other systems, at £2000.

Financial services

The size of the UK economy means that it can sustain and support a vibrant and secure financial sector. An independent Scotland would have a banking sector more than 12 times the size of its economy – far more than Ireland, Iceland and Cyprus when they got in to difficulties.

We benefit from the UK’s position as a global leader in financial services and the financial sector is one of the most important in the Scottish economy – it contributed £8.8 billion to the Scottish economy and supported 8% of total Scottish employment (nearly 200,000 jobs) in 2013.

The Scottish financial sector, and all these jobs, depend on customers in England, Wales and Northern Ireland – as well as those in Scotland. Our UK single market means that financial services firms in Scotland can sell their products to customers across the UK without any barriers. Nearly 90% of ISAs and 80% of mortgages sold by Scottish firms are sold to customers in other parts of the UK.

Banking sector assets as a proportion of GDP

Iceland - 880%

Scotland - 1254%

Ireland - 894%

United Kingdom - 492%

Cyprus - 700%

Independence would break up this domestic market. An independent Scotland would have to set up its own legal and regulatory framework for financial services, and its own tax system. This would mean that firms selling pensions, insurance and mortgages in an independent Scotland and in the continuing UK would face extra costs from operating in both markets - costs which could ultimately be borne by individuals (either as tax payers or customers).

There are also a number of UK-wide consumer protection and advice bodies - like the Financial Conduct Authority, the Financial Ombudsman Service and the Money Advice Service - which it would be costly to duplicate in an independent Scotland. The financial services industry estimates this would cost millions of pounds.

The UK also has well-funded arrangements which protect deposits in UK banks up to £85,000 if banks get into difficulties. If Scotland became independent, Scottish banks and their customers would no longer be covered by this protection.

An independent Scotland would have to establish its own deposit guarantee scheme under EU law. If one of the two large banks in Scotland were to fail, the costs for compensating depositors would fall almost entirely on the one remaining bank. If the scheme failed, an independent Scottish government could be required to step in. Currently, the deposits that would be covered by a Scottish scheme would be worth more than 100% of the Scottish economy.

Instead of risking these extra costs, firms could decide to focus on only one market. Companies like RBS and Bank of Scotland have spoken of the risks of higher costs in the event of Scottish independence. Others like Standard Life and Alliance Trust are considering how they might relocate parts of their business to England if there were to be a vote in favour of independence. Independence could lead to reduced choice and higher costs for financial products for people in Scotland, including for mortgages, insurance and pensions. On the basis of independent analysis, the UK Government has estimated that an average annual mortgage payment in Scotland could increase by £1,700.

Our shared United Kingdom

Sharing our resources across the UK supports public spending in Scotland now and in the future - spending in Scotland has been around 10% higher than the UK average since 1998. This was equivalent to £1,300 per person in 2012-13.

Wherever we live in the UK, people receive the same benefit payments, regardless of the peaks and troughs of local economies, or differences between local populations. The size and strength of the UK economy helps us to support people in times of need and to provide financial security in our old age.

In the event of independence, Scotland would receive a share of North Sea oil and gas revenues, which would have to be negotiated. However, oil receipts are one of the most volatile sources of revenue. Since devolution, Scotland’s geographical share of oil and gas receipts has fluctuated between £2 billion and £12 billion.

The Scottish Government’s figures show that in 2012-13, the geographical share of North Sea revenues fell by more than £4 billion – equivalent to more than half of Scotland’s education budget lost in one year. However, as part of the UK, the Scottish Government’s budget actually increased in 2012-13, benefiting from the strength and diversity of the UK’s economy.

Graph

Within the UK, the oil and gas sector, and the renewable energy sector, benefit from a single energy market of millions of customers. Scotland’s energy industry relies on unrestricted access to the 24 million electricity customers in England and Wales – 10 times as many as in Scotland. As part of the UK, we work together to maximise the potential of renewable energy, with Scotland’s dynamic renewables sector benefitting from the sharing of the costs by customers across the whole UK.

Innovative industries, like renewables, gain from the UK’s world-leading and thriving research community. Researchers across the UK benefit from access to infrastructure, like advanced computing and through UK membership of international facilities, such as the European Centre for Nuclear Research (CERN). Sharing these costs makes them more affordable. At the same time, researchers in Scotland directly benefit from UK-wide research funding. In 2012-13, Scotland secured over 13% of UK Research Council funding (£257 million) – better than Scotland’s GDP share (8%) or population share (8.4%). In addition to public funding, the UK’s charitable organisations fund significant amounts of research in Scotland; approximately 14% of funding raised by members of the Association of Medical Research Charities in 2011 was spent on research in Scotland.

The UK Research Councils are just some of over 200 UK-wide public bodies that serve people in Scotland today. They are underpinned by shared values and allow everyone in the UK to take advantage of economies of scale to minimise costs to taxpayers, to maximise the UK’s global reputation and to pool resources and risks where that makes sense. However, if Scotland left the United Kingdom, it would also leave all the institutions of the UK.

The Scottish Government has said that it would seek to continue to share many of these institutions in the event of independence. But these institutions are not shared with other separate states, and it is not clear why it would be in the continuing UK’s interests to change arrangements for UK institutions to enable them to serve two separate states in the future.

A new Scottish state would inevitably need to create a wide-ranging set of new public organisations. Establishing an entirely new set of institutions would be an enormous task requiring substantial up-front investment.

The institutions we share as part of the UK are deeply embedded into our daily lives. For instance, the National Lottery is played by millions of people across the UK, and the money it raises supports sport and culture across the whole of the UK, with over 50,000 individual good causes in Scotland receiving funding worth £2.5 billion in total since 1994. A new Scottish state would have no automatic right to continue being part of the UK National Lottery.

The BBC is one of the greatest of our shared institutions. It is admired across the globe and informs, educates and entertains millions of viewers and listeners at home. In the event of independence, public service broadcasters - including the BBC - would serve the public in the continuing UK.

As a new separate state, an independent Scotland would not automatically be entitled to a share of the BBC. Any bid to make use of existing BBC assets, or to show BBC programmes, would have to be negotiated.

Our place in the world

Together as the United Kingdom, we influence the world around us. The UK is at the top table of the EU, NATO, the G7, the Commonwealth and the UN Security Council - the only country in the world that is part of all these bodies. We shape the international decisions that affect Scotland and use our influence to promote democracy and human rights across the globe.

The UK’s diplomatic global network represents Scotland worldwide, employing over 14,000 people in 267 Embassies, High Commissions, Consulates and other offices in 154 countries and 12 Overseas Territories around the world. We use our networks to promote and protect the economic interests of businesses based in Scotland - for example defending Scotch whisky against counterfeits, discriminatory taxation and trade barriers.

Scottish businesses benefit from the active support of UK Trade & Investment’s (UKTI’s) 169 offices in over 100 countries. And, as part of the UK, we pool our resources to make a real difference with international aid, as the second largest aid donor in the world and as the first country in the G7 to hit the 0.7% GNI (Gross National Income) commitment. Our shared efforts allow the UK to work to end extreme poverty; ending the need for aid by creating jobs, unlocking the potential of girls and women and helping to save lives when humanitarian emergencies hit.

We all benefit from the UK’s strong voice in Europe, where we use our influence on issues that matter to people and businesses in Scotland, like budget contributions, fishing and agricultural subsidies. Everyone in the UK gains from the terms we have negotiated in the EU, including the opt-out of the euro and the Schengen area and our budget rebate, which is worth over £3 billion.

In the event of independence, an independent Scottish Government would need to apply to join international organisations, including the EU, which would need the agreement of all 28 member states. The Scottish Government’s expectations for the terms and timetable of EU membership are unprecedented, which is why the President of the EU Commission, the Prime Minister of Spain and others have raised concerns.

Instead of gaining from the UK’s EU budget rebate, an independent Scotland would actually have to pay towards the rebate of the continuing UK.

World's top 10 aid donors

As part of a United Kingdom, we also work together to defend ourselves at home. The UK’s integrated approach to defence protects all parts of the UK. Our security and intelligence agencies guard us from terrorism, espionage and cyber-crime.

The UK Armed Forces are the best in the world, keeping us safe in the UK, and contributing to conflict prevention and humanitarian operations overseas; sustained by an annual defence budget that is one of the largest in the world.

Our defence spending supports the defence industry in Scotland, which employs around 12,600 people. In the event of independence, companies based in Scotland would no longer be eligible for contracts that the UK chose to place domestically, for national security reasons.

Our UK border is also protected, with over 20,000 people and more than £2 billion spent to stop people and goods that could harm us from entering the UK. Within the UK, people and goods can move freely. Travel around the UK does not require identification documents. There are neither customs inspections nor administration associated with the movement of goods. 23 million vehicles cross in both directions each year between Scotland and England; 15 million tonnes of freight move in each direction; 7 million rail passenger journeys take place between Scotland and the other parts of the UK; and there are 800,000 air passenger journeys between Scotland and Northern Ireland.

In the event of independence, the current boundary between Scotland and the continuing UK would become an international border between separate states. Both a separate Scottish state and the continuing UK would have to make decisions about how to manage the flow of people and goods across that border. It is likely that over time, differences in tax and regulatory regimes would develop as the two different governments pursued different policies to suit their own circumstances. These differences could be exploited by criminals through smuggling. It is also possible that the governments would want to pursue different immigration policies. However, an independent Scotland could not pursue a much more open immigration policy and also seek to join the Common Travel Area with the UK and Ireland.

Conclusion

Scotland is an integral part of the UK. We all make a contribution and receive the benefits of being part of a family of nations.

As part of the United Kingdom, Scotland has influence at home and around the globe. Our industries are better protected and supported by the strength and diversity of the UK economy and we are able to have our voice heard on the world stage through UK membership of international organisations.

Our distinctive national culture; our churches, our education and our legal system are – and always have been – respected within the United Kingdom.

And with our own devolved Parliament at Holyrood we are able to take decisions on key issues that affect our day-to-day lives in relation to our health, our schools, our justice system and our environment.

For over 300 years, we have worked together with our friends and family in other parts of the UK. And by voting in September to stay in the United Kingdom we can continue to achieve more together than we would apart.