Review of simplification: Approach and interpretation

Published 18 July 2022

Foreword

The role of the Office of Tax Simplification (OTS) is to provide the government with independent advice on simplifying the UK tax system. Its statutory footing calls for the OTS “to provide advice to the Chancellor of the Exchequer…on the simplification of the UK tax system” including “improving the efficiency of the administration of relevant taxes”.

The 30 November 2021 HM Treasury five-yearly review of the OTS recommended that we “undertake a project to articulate [our] approach to, and interpretation of, ‘tax simplification’, including clarifying [our] aims as an organisation and the success measures for assessing its progress”.

The previous Chancellor and the Financial Secretary requested that the OTS undertake this work as a formal review, focusing on conclusions that can inform how the OTS and Government should prioritise simplification efforts over the next five years.

We are pleased to present the resulting report, which

-

sets out an analysis of tax complexity and its impact

-

recommends principles for officials to use in tax policy development

-

refreshes the OTS’s future aims and priorities, and measures of success

We are grateful to all those in industry who willingly gave time, ideas, challenge and support over the course of 36 meetings and five written submissions and to the members of the OTS Board for their helpful steers and insights.

We would like to thank John Hall, who project-managed the review, supported by Sally Campbell, Zoe Judd, Bethan Kay, Claire McEvoy, Patricia Mock, and Julia Neate; guided by OTS Heads of Office David Halsey and James Konya. We are also very grateful to officials in HM Treasury and HM Revenue & Customs for their time.

Kathryn Cearns OBE - OTS Chair

Bill Dodwell - OTS Tax Director

Executive summary

Chapter 1 explores complexity

- how tax simplification is not a policy objective in itself, but should be a core consideration for the government to support taxpayers through the design, implementation and administration of tax policy at every stage in the policy making process, and when measuring the success of a policy after implementation

- how lack of clarity on the purpose or outcome of the rules can impact productivity, growth and investment decisions; and unintended incentives create the potential for distortions

- how undue administrative burdens and unclear obligations can create costs for taxpayers, intermediaries, advisors, and government

Chapter 2 takes common themes from the challenges of complexity and identifies fundamental questions for tax policy makers, going on to derive principles from them for government to consider in tax design. These principles are reflected below in the recommendation.

Chapter 3 considers how these four fundamental questions then translate into assessment of existing tax rules, including how the OTS will use them in its approach to its own work.

Chapter 4 outlines that the OTS will continue its strategy of reviewing existing elements of the tax system, as well as looking forward, focusing in particular on technology, data and digitisation, and work that will help to support individuals and small businesses. We will consider the potential for future developments - including technology - to benefit taxpayers, their agents and HMRC. We will also seek to publish data to enhance understanding of the tax system and promote debate.

Chapter 5 looks at measuring the success of government in embedding simplification in policy design and administration, as well as the success of the OTS, through its reputation, relevance, and influence on government thinking, future policy development, and wider public debate.

Recommendation

This report recommends that the principle of simplification should be embedded in the general tax policy making process.

In the course of developing policy, officials and ministers may wish to consider the following four areas, including in considering mitigation strategies:

- Are the rules, their purpose and their consequences easy to understand and predict? Are the tax rules logical, with their purpose understood and the outcomes of choices clear and running with the grain of the lives and businesses they encompass? Do they add complexity when taken in aggregate with the immediate and wider existing rules?

- Are the rules and their administration taking advantage of modern developments, including technology? Can technology shoulder some of the administrative or process burden for taxpayers? Can technology help manage the complexity without undermining informed choice? Is this technology available and accessible for the majority, and how are the digitally excluded or challenged served? Are tax policies capable of being implemented in a digital manner?

- Is it easy enough to comply with the rules? As well as the core rules themselves, can taxpayers understand the administration, processes, and obligations? Whether they are in scope, what they need to do and when? Is the cost to taxpayers, intermediaries, advisers, and government proportionate?

- Can taxpayers be better supported? Are there ways that intermediaries can take some of the burden away from taxpayers in reporting or payment, or by directing taxpayers to HMRC guidance? Is the guidance fit for the audience? Are advisors enabled to help their clients manage their tax affairs, including through access to taxpayer data and HMRC systems?

Chapter 2 recognises that this should neither be as simple nor as rigid as a ‘checklist’ but considered proportionately and meaningfully.

1. Complexity

Introduction

The 2021 HM Treasury five-yearly review of the OTS analysed complexity by reference to policy, legislative, and operational factors, drawing on the OTS’s previous work on assessing complexity, which also distinguished between underlying complexity and the impact of complexity in practice.

During the present review the OTS has:

- heard and considered a variety of current perspectives on the nature and practical significance of different forms of complexity

- reflected on insights gained through its own recent work

- taken account of changes in the prevalence and capacity of technology

- considered the context in which the next stages of the OTS’s work will be conducted

Based on these considerations, this chapter explores complexity and the ways it impacts taxpayers, advisers, intermediaries, and government. The conclusion then draws some key themes which are taken forward by the rest of the report.

Complexity from competing factors

The primary purpose of taxation is to raise funds to support the provision of public services. Parliament may also have other objectives for a given tax policy, such as contributing to the UK’s international competitiveness, supporting growth and productivity, encouraging or discouraging certain behaviours, compensating for market failure, and redistribution.

Similarly, looking at the provision of information to HMRC, whilst it is clearly desirable for government to want to minimise such obligations, it may not be the best approach for taxpayers if it leaves HMRC without important information. For example, a lack of distinguishable, reliable, and up-to-date information identifying dividends from personal service companies limited the government’s scope to extend Covid support schemes to company directors, who depended on such dividends.

There are times when policy design will mean that simplification cannot be pursued to the fullest extent. For example, there is the question of equity: different rates, thresholds, and allowances all add to the complexity of the tax calculation, but they also ensure the burden of tax is felt less by those who can afford to pay it less.

Subject matter complexity

The UK economy is highly developed, international, and both mature and sophisticated across multiple specialist sectors, including financial services and technology. Many of these areas are constantly changing, including developments in law, regulation, and standards.

Tax policy and its practical operation must somehow accommodate this underlying complexity; encompassing and handling taxpayers, transactions, and situations that are specialist, often convoluted and subject to constant change. Some complexity in the tax system arises from these underlying factors.

Examples of this arise in rules that handle funds, financial services, and multi-national businesses. But day to day life can also be complex, with situations leading to multiple choices that the system needs to deal with. The OTS highlighted complexity such as this in its report on Inheritance Tax.

In these situations, it is still relevant to ask whether the complexity is proportionate to the context, and to the capabilities of those affected by it. For both complex businesses and day-to-day situations, thorough consultation to understand the ‘real life’ steps the business or person goes through can often help to minimise the burden of tax and ensure the rules do not distort decision making. Government should also consider ways that technology or support from intermediaries can help to ease the burden.

Poorly planned policy can lead to uncertainty, which can have an enormous negative impact on taxpayers’ ability to make investment and other business decisions, in turn stifling growth and productivity.

Policy complexity

An area that has grown in importance in the OTS’s work in recent years is the degree to which the tax system has a material effect on business or personal decision making.

Some policies are specifically intended to affect behaviour, such as those providing relief for pensions, or promoting investment. However, in some cases policies create unintended effects that can distort people’s decision making away from a course which could well have led to a better outcome for them, their business or family, and the wider economy. The OTS highlighted examples of this in our Inheritance Tax report and Capital Gains Tax report in relation to passing on assets when someone dies.

Unintended incentives or disincentives can also mean people get caught out or make choices that disadvantage them, because they had not realised there would be a counter-intuitive or unexpected tax result, or had not appreciated the associated non-tax outcome or burden. As an example, the OTS has raised questions about how well people understand both the tax and non-tax consequences from choosing to run their business as a company. This can stifle productivity and growth by leading to decisions that may be better for tax but are not good for the business.

While this risk can be mitigated through good guidance or professional advice, the need for help, or to know you need help, is itself a complication; particularly where it seems like the government is steering taxpayers toward a particular choice because the tax is lower.

Similarly, new policies do not always account for the complexity they add when taking into consideration the existing rules. An example is the various reliefs and allowances on savings income for individuals, where the interaction between them makes it hard to understand the outcome easily.

Here, as for subject matter complexity, officials should seek to thoroughly engage with stakeholders in the policy design stages to test for both intended and unintended consequences, and ensure all interactions are established in the experience of those impacted by the change. Both in that engagement and in legislation and guidance that follow, the intended objective of the policy should be crystal clear.

Legislative complexity

Policy is perhaps most fundamentally expressed in legislation, so it is not surprising that some have looked to judge complexity by reference to the number of pages of tax legislation, including the OTS in the past.

Whilst the addition of pages to the Taxes Acts can be a clear indicator of new rules to learn, with each page perhaps another facet to understand, shorter legislation is not always more accessible. While by no means a panacea, the Tax Law Re-write project and tax legislation since have aimed for clearer, better sign-posted legislation using modern English, at the inevitable expense of greater length.

The OTS’s engagement has shown us that the overwhelming majority of people rely on guidance and are unlikely to engage with the legislation. Guidance is also used extensively by tax advisers and HMRC officers to understand and supplement the legislation. Accordingly, the OTS does not consider the overall length of tax legislation to be a reliable indicator of complexity in practice.

Clarity

A recurrent theme in these complexities is the need for clarity. Legislation should be drafted with an eye to whether it or the guidance contains the details which provide clarity for the application in practice. It will be a case-by-case decision whether to explicitly set out in legislation the position in the most common situations, or to leave the legislation purposive and defer clarity to more detailed guidance.

One important area for clarity is the use of different defined terms to cover broadly similar subject matter, and of the same defined term used to mean slightly different things in different provisions. Naturally, differing policy intent will lead to multiple definitions; but having too many creates complexity and the opportunity for misunderstanding. The opportunity should always be taken to consider re-using an existing definition in its entirety.

The OTS sees HMRC’s Tax Administration Framework Review as an opportunity to consider clarity afresh for some of the most fundamental tax provisions; and to consider how well they deal with modern life, ways of working, and technological opportunities. The Taxes Management Act 1970, even though amended and supplemented substantially, is a well understood example of legislation that has fallen behind the times.

Stability and accommodating the pace of change

Stability is important to allow taxpayers to make effective business, investment, and personal decisions and ultimately to support growth.

Stability in terms of the tax system can be a matter for government, where the competing merits of desirable change and medium-term stability must be weighed. In some areas, governments have offered transitional relief which itself may bring additional complexity.

But stability is also a factor of the wider world: changes to the economy, society, technology. Tax cannot predict these but should look to be adaptable to change. That the Tax Administration Framework Review is a 10-year project is broadly encouraging, as fundamental change should never be rushed or hit people all at once, but it does mean that decisions made in these early stages will need to be flexible enough not to become quickly outdated.

Administrative complexity

Once policy is determined, and expressed in legislation, the intentions of ministers and officials become open to wider interpretation as the new rules take effect. This occurs not just in the specific changes in themselves, but in how they interact with wider tax rules and with business and family life.

Making the policy intent and the core legislative provisions clear can help to prevent deviation from intent. During those stages it is also key that the implementation and ongoing processes and obligations are thoroughly thought through as part of a holistic design to ensure that the system fits together in a way that is intelligible to the taxpayer, any intermediaries, advisers, and HMRC staff alike.

Effective, intelligible, and proportionate administration is also essential in reducing the ongoing costs and burdens on individuals and businesses. Here, the OTS sees good guidance and the appropriate use of technology and support as the lynchpins to reducing those costs and burdens.

A major part of this is how well HMRC systems join things up and work smoothly, making seamless use of third-party data and presenting this in a coherent way to taxpayers and their agents; for example through the Single Customer Account.

As the OTS has observed (for example, in the Third party data report), government needs to look to technology and processes to help collect, harness, and accurately use information that is readily available from an array of sources. And the OTS has also recognised (in our evaluation of the Single Customer Account) the importance of allowing intermediaries, taxpayers and agents to easily access up to date information from HMRC and interact with this digitally.

It is often hard for a taxpayer to understand their obligations, to know what to do about them, or how to do it, or to judge whether it has been done right. This is why HMRC’s commitment to improve its guidance remains crucial (see our guidance review update) and why the OTS has continued to stress the benefits of increasing tax awareness and education (for example, in our everyday tax evaluation).

In the context of guidance, there is a balance to be struck in ensuring it covers what people need or want to know and alerting taxpayers to less-common scenarios, whilst avoiding becoming too long or hard to navigate. There is a role for technology here in interactive guidance, which HMRC have used in some areas.

It is not always clear to what extent guidance can be relied upon, so that people have the necessary degree of certainty. Even more so than with legislation, there is merit in enabling people to get to a definitive answer easily, and if that is going to be hard to achieve then it is reasonable to ask whether the underlying policy is at fault.

Conclusion

Tax simplification is not a policy objective in itself, and the need for simplicity may find itself in contest with the broader objectives of government and with these drivers of complexity.

But it is the OTS’s position that simplification should act as a challenge for the government in relation to the design, implementation, and administration of tax policy at every stage in the tax policy making process and operational process, and when measuring the success of a policy after implementation.

As the counterpoint to the themes of complexity above, the OTS considers that a useful working summary of simplification is:

- making the way the tax system works easier to understand and predict with tax rules that facilitate, rather than distort, decision-making to enable taxpayers to understand and make better, more informed, business and family choices

- making the practicalities of tax compliance easier with straightforward design, administrative processes, technology and guidance; reducing taxpayer, intermediary, employer, and agent costs, and freeing up HMRC resources to invest

- ensuring that administrative processes and guidance are clear to enable tax compliance obligations to be understood and fulfilled with proportionate ease

- where things have to be complex, ensuring taxpayers are supported by other parties who can help taxpayers get it right

Chapter 2 takes these points to pose fundamental questions for policy design, which Chapter 3 then explores in application. Chapter 4 looks at how the themes can be applied to consider existing policy and how it can be improved.

2. Simplification principles for tax design

Introduction

This Chapter recommends a framework of principles for government and policy officials to consider in relation to their work on all potential tax policy proposals and changes.

Embedding simplification in HM Treasury and HMRC tax policy work

Simplification is not a policy objective in itself: ‘The problem is that to achieve successful and lasting simplification, proper account has to be taken of the other important aspects of taxation and simplification should be integrated into the tax policy process…’. (Simon James. ‘The Complexity of Tax Simplification’. Chapter 11 (2016) p.242)

The 2021 HM Treasury review noted at paragraph 2.18 that it would not be appropriate for the OTS to become involved ‘behind the curtain’ on policy development, given its independent status.

Accordingly, to enable the simplification agenda to have sustained traction, this Chapter sets out details on how the challenges to complexity outlined in Chapter 1 translate into principles for government to apply during the tax policy making process and concludes with a recommendation that an imperative for simplification should be embedded into that process.

Simplification principles for government

Building on the working summary of simplification in the conclusion to Chapter 1, the OTS proposes officials should ask four fundamental questions iteratively throughout the policy making process:

- Are the rules, their purpose, and their consequences easy to understand and predict?

- Are the rules and their administration taking advantage of modern developments, including technology?

- Is it easy enough to comply with the rules?

- Can taxpayers be better supported?

To provide context to these questions, this chapter provides eight considerations and principles in a summary table, and Annex A explores them in more detail.

Table 1: Are the rules, their purpose and their consequences easy to understand and predict?

| Consideration | Principle | |

|---|---|---|

| 1. |

Real life practicality Whether the policy fits naturally or intelligibly with other considerations affecting the taxpayers and others concerned. |

Clear policy design Ensuring tax policy design is clear and makes sense to people; fitting with the way life works, the way processes can be implemented or how people think about things generally. |

| 2. |

Distortion and predictability Whether tax rates, thresholds, reliefs or interactions between taxes distort behaviour, make it difficult to predict tax outcomes or cause practical difficulty, and how far the choices or elections available are helpful or cause disproportionate difficulty. |

Tax rules which facilitate decision making rather than distorting behaviour Develop tax policies which facilitate people’s understanding and decision-making and avoid distorting economic or personal behaviours in unintended ways. |

| 3. |

Clarity and consistency Whether legislation is direct in its structure and approach, with consistent definitions, sets out the position in common situations explicitly to give clarity and certainty, and whether there is frequent extensive policy change. |

Take account of the existing UK tax framework, minimise unnecessary changes and plan ahead Ensure tax policy development takes account of the longstanding framework of UK taxation, minimises unnecessary change (which itself brings complexity) and plans ahead (for example via use of Road Maps) to avoid confusion. |

Table 2: Are the rules and their administration taking advantage of modern developments, including technology?

| Consideration | Principle | |

|---|---|---|

| 4. |

Technological support HMRC systems and taxpayer interfaces work, are helpful, efficient and joined-up, with relevant information and third-party data available and appropriately used. Not everyone can access technology, so something is needed for those who cannot. |

Improve digitisation and system design Ensuring that new tax policy changes make the best use of digital systems and data, are integrated into HMRC’s ongoing plans for technological and systems reform, and that these receive appropriate investment and support. Is this technology available and accessible for the majority, and how are the digitally excluded or challenged served? |

| 5. |

International data Cross-border business and tax have always been considerations, but the explosive growth of the internet has brought new business models and allowed micro businesses to trade internationally. Increasingly data, platforms and intermediaries are based overseas. |

Work closely with international bodies Where an area has cross-border aspects, work with international bodies to adopt common frameworks for data collection and exchange, and potential tax collection. |

Table 3: Is it easy to comply with the rules?

| Consideration | Principle | |

|---|---|---|

| 6. |

Administration The administration of new policies is properly integrated into the system from the outset with full consideration given to the necessary mechanisms required to support the delivery of compliance. |

Processes which make it easy for taxpayers to handle straightforward matters themselves Minimising administrative burdens and costs. |

| 7. |

Understanding and awareness Taxpayers understand their obligations, are informed to make decisions and are clear on what they and others need to do, and when, giving certainty and confidence. |

Ensure the fullest external engagement and understanding at all stages With appropriate proactive communications to manage expectations. |

Table 4: Can taxpayers be better supported?

| Consideration | Principle | |

|---|---|---|

| 8. |

Intermediary support Taxpayers, employers, other intermediaries and agents can easily access relevant HMRC information and services, and their potential to support taxpayers is harnessed. |

Utilise intermediaries to best support and contribute to the tax system Including through providing information to taxpayers or to HMRC, or through a greater role in tax collection, in a way which minimises the administrative costs involved. |

There are detailed narratives on these principles in Annex A.

Recommendation

This report recommends that the principle of simplification should be embedded in the general tax policy making process.

In the course of developing policy, officials and ministers may wish to consider the following four areas, including in considering mitigation strategies:

- Are the rules, their purpose and their consequences easy to understand and predict? Are the tax rules logical, with their purpose understood and the outcomes of choices clear and running with the grain of the lives and businesses they encompass? Do they add complexity when taken in aggregate with the immediate and wider existing rules?

- Are the rules and their administration taking advantage of modern developments, including technology? Can technology shoulder some of the administrative or process burden for taxpayers? Can technology help manage the complexity without undermining informed choice? Is this technology available and accessible for the majority, and how are the digitally excluded or challenged served? Are tax policies capable of being implemented in a digital manner?

- Is it easy enough to comply with the rules? As well as the core rules themselves, can taxpayers understand the administration, processes, and obligations? Whether they are in scope, what they need to do and when? Is the cost to taxpayers, intermediaries, advisers, and government proportionate?

- Can taxpayers be better supported? Are there ways that intermediaries can take some of the burden away from taxpayers in reporting or payment, or by directing taxpayers to HMRC guidance? Is the guidance fit for the audience? Are advisors enabled to help their clients manage their tax affairs, including through access to taxpayer data and HMRC systems?

This should neither be as simple nor as rigid as a ‘checklist’ but considered proportionately and meaningfully. In implementing this recommendation, officials may wish to consider, in particular:

-

Embedding simplification and these principles in training for policy officials

-

Ensuring that consultations always look to explicitly explore practical implementation of the policy

-

Ensuring new policy is considered in the schema of the immediate tax system surrounding it

-

Reflecting to ministers where choices, including the core policy objective itself, will drive significant complexity

-

Looking to make sure the guidance is clear and accessible, and does more than repeat the legislation

There may already be work ongoing in some of these areas, and the OTS would be keen to work with officials on this to the extent this is possible and appropriate.

3. The approach of the OTS

Introduction

This Chapter sets out the approach of the OTS in relation to the reviews it undertakes into the simplification of various aspects of the UK tax system.

The OTS is independent from government and precluded from direct involvement in developing new tax policy, and so our ongoing review work focuses on the “stock” of existing tax rules, rather than the “flow” of tax rules resulting from the new policy process.

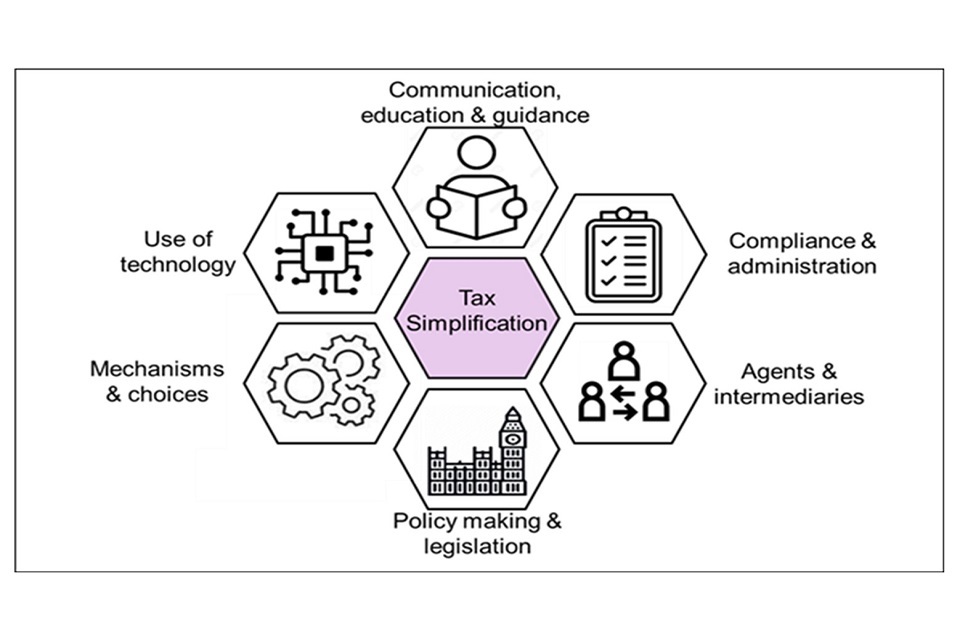

OTS framework

In conducting its reviews, the OTS has adopted a framework which looks to consider six separate aspects (or “lenses”) of simplification as it explores and consults with stakeholders, recognising that different lenses will be more significant in some contexts than others.

The OTS’s approach under each of the six lenses is summarised below. As in the case of the simplification principles recommended for government in Chapter 2, each lens links directly to one of the four fundamental simplification questions posed for consideration:

- Are the rules, their purpose, and their consequences easy to understand and predict?

- Are the rules and their administration taking advantage of modern developments, including technology?

- Is it easy enough to comply with the rules?

- Can taxpayers be better supported?

Are the rules, their purpose and their consequences easy to understand and predict?

Policy making and legislation

The OTS will consider

- the extent to which the policy and legislation fits naturally with regulatory or other relevant legal, business or personal considerations for the taxpayers concerned

- whether the policy makes sense, or is intuitive, to those affected by it

- whether the structural approach adopted in the legislation, operational systems and guidance is the simplest way to frame things

- whether there are overlapping or interacting provisions, and how easy it is to see how things fit together in particular cases

- whether the rules or process have been subject to successive frequent changes or disproportionate numbers of disputes, and the reasons for this

- whether the complexity of the policy is proportionate to the context

Mechanisms and choices

The OTS will consider

- whether policy mechanisms, such as rates, thresholds or reliefs disproportionately distort behaviour in ways that run counter to the government’s policy objectives

- whether interactions between taxes, eligibility for reliefs, boundaries or the mechanics of particular calculations, cause practical difficulty

- whether any choices or elections provided for are helpful, or whether a default or some other approach would be better

- what insights may be gained from international comparisons and academic work, while recognising that countries differ in their nature and context

Are the rules and their administration taking advantage of modern developments including technology?

Use of technology

The OTS will consider

- to what extent HMRC systems and taxpayer interfaces work are helpful, efficient, joined-up and continually improving

- whether the technology or processes involved appropriately collect, harness and use all the information and data that is or could be available

- whether simplification from the taxpayer and intermediaries’ perspective receives appropriate attention in HMRC programmes of work such as the Tax Administration Framework and the Single Customer Account

Is it easy enough to comply with the rules?

Compliance and administration

The OTS will consider

- whether it is sufficiently straightforward for people to handle the simpler or more common scenarios that arise, and the level of HMRC contact needed

- whether it is clear in practice what to do or pay when, to fulfil one’s compliance obligations, including in relation to forms, record-keeping and online activity

- whether the rules or process have been subject to successive frequent changes or disproportionate numbers of disputes, and the reasons for this

Communication, education and guidance

The OTS will consider

- whether a taxpayer can readily understand what to do, how to do it, and to know that it has been done it right

- whether the relevant HMRC guidance is readily accessible, and strikes a good balance in covering what is needed while remaining easy to navigate, and the extent to which it can be relied on

- whether it is easy to get to a definitive answer in the most common 80% of cases, and how easy it is to get help from HMRC where needed in other cases

- whether there is adequate general awareness of the area in question among those affected or who could benefit

Can taxpayers be better supported?

Agents and intermediaries

The OTS will consider

- whether taxpayers or their agents can easily access relevant up to date information from HMRC, and interact with this digitally

- whether the way HMRC’s agent service or other intermediary services handle the area in question is effective, appropriate and straightforward for the context

- to what extent there may be greater scope for intermediaries to inform taxpayers about their obligations and assist them in complying

4. The OTS’s aims and priorities

Introduction

The role of the Office of Tax Simplification is to provide the government with independent advice on simplifying the UK tax system. Its statutory footing calls for the OTS “to provide advice to the Chancellor of the Exchequer…on the simplification of the UK tax system” including “improving the efficiency of the administration of relevant taxes”.

Since 2018 the OTS has worked to a simplification strategy made up of three interconnected principles, under which we have published work which has:

- provided information, data, and policy analysis to shape debate about significant or difficult areas or long-standing issues in the tax system (tackling difficult areas)

- reviewed tax areas or operational processes within the tax system in a holistic way, generally focusing on individuals or smaller businesses (greatest numbers affected)

- highlighted specific practical issues (’quick wins’)

The OTS is taking the opportunity presented by this review to refresh this strategy, to ensure that it informs and directs its work in the most effective and fruitful way, as anticipated in the OTS’s evidence to HM Treasury’s 2021 review.

OTS aims

As noted in the conclusion to Chapter 1, the OTS considers that a useful working summary of simplification is:

- making the way the tax system works easier to understand and predict with tax rules that facilitate, rather than distort, decision-making to enable taxpayers to understand and make better, more informed, business and family choices

- making the practicalities of tax compliance easier with straightforward design, administrative processes, technology and guidance; reducing taxpayer, intermediary, employer, and agent costs, and freeing up HMRC resources to invest

- ensuring that administrative processes and guidance are clear to enable tax compliance obligations to be understood and fulfilled with proportionate ease

- where things have to be complex, ensuring taxpayers are supported by other parties who can help taxpayers get it right

Our aim is to promote that agenda, through our publications and formal advice to government, through informal influence in discussions with policy makers, stakeholders and the media, and through events we organise or participate in.

OTS priorities and strategy

The OTS’s core role is as advisor to the government, and we will continue to prioritise work which is commissioned by the Chancellor. Also in that role, and given our obligation to reflect the views of taxpayers, advisors, and intermediaries, we will be responsive in our own initiative work to the emerging priorities of the economy and society.

In the OTS’s evidence to the 2021 HM Treasury review we reflected areas of priority where we believe the OTS could add value to the current tax complexity challenges facing the UK. Our intention is to continue to focus in particular on technology, data and digitisation, and work that will help to support individuals and small businesses.

Wider principles of selection

As general principles, the OTS will seek to prioritise work which:

- has the greatest potential to make a difference to the largest number taxpayers or businesses; this will often mean looking at individuals and smaller businesses

- has the capacity to move debate forward in relation to major areas of policy, systems, or the framework of tax administration; this will often mean choosing areas that are relevant to the wider taxpayer and advisory community

- has the potential to lead to practical changes improving the experience of taxpayers or their advisors in handling everyday tax matters; this will often mean looking at modern technology or other methods of streamlining processes

To help maximise its impact, the OTS will:

- make clear the relative significance or priority it attaches to recommendations, supported by relevant data and analysis of impacts

- continue its recent practice of revisiting selected previous reports to provide an evaluation and update on progress

5. OTS impact and measures of success

Adoption of OTS recommendations

As an advisor, a clear measure of the impact and success of the OTS is when the government follows our advice. The OTS publishes reviews of whether recommendations have been adopted through evaluation and update notes, such as those on everyday tax and life events.

However, as this report recognises, multiple competing factors will influence the government’s decisions on whether policy change should be adopted. The HM Treasury 2021 five-year review recognised that this cannot be a metric for the success of the OTS:

…the OTS is an advisor not a policy maker. It is for government to consider the OTS’s recommendations and their potential impact in the round, determine whether unavoidable trade-offs are acceptable, or if the existing complexity is necessary to achieve other policy objectives. The importance of tax simplification does not alter the fact that it is for the government alone to make decisions on tax policy.

Similarly, recent research concerning the Law Commissions noted that “Although implementation cannot be ignored, it is misguided and dangerous to equate it with success”, and that implementation was only one way to influence the wider debate and impact of the law. (See Shona Wilson Stark. ‘The Work of the British Law Commissions, 2017’. Hart Publishing. p.9. The paper lists three reasons: that implementation is uncertain for a variety of reasons, that being measured on implementation may drive ‘pandering’ and a lack of independence, and that implementation itself is no indicator that the recommendation was good.)

Though it is important to recognise where OTS recommendations have been adopted, such as extending the filing deadline for CGT land disposals, the wider considerations mean this should not be a metric for the success of the OTS.

Wider influence over government and public debate

Whether recommendations are pursued or not, they can still influence government thinking, future policy development, and wider public debate. Given the OTS’s aims as outlined in chapter 4, ensuring our relevance is a clear metric of our success.

The OTS has historically measured its success by gauging its relevance and reputation in the tax policy community, the media, and in recognition by government of the work of the OTS. The annual reports have, and will continue to, demonstrate this (for example, the OTS’s 2019 to 20 Annual Report).

HM Treasury 2021 review recommendations

The HM Treasury 2021 five-year review made two specific recommendations which the OTS should implement to better serve the public and government:

- Expose their reasoning behind their recommendations, particularly where there are trade-offs between simplification and other policy objectives that government must consider; and

- More clearly prioritise those recommendations which the OTS considers of most value to taxpayers.

The OTS will carefully ensure that these have been reflected in future reports.

Annexes

Annex A: Narrative for principles for tax design

This Annex provides detailed narrative for the principles outlined in Chapter 2.

Are the rules, their purpose and their consequences easy to understand and predict?

| Consideration | Principle | |

|---|---|---|

| 1. |

Real life practicality Whether the policy fits naturally or intelligibly with other considerations affecting the taxpayers and others concerned. |

Clear policy design Ensuring tax policy design is clear and makes sense to people; fitting with the way life works, the way processes can be implemented or how people think about things generally. |

| 2. |

Distortion and predictability Whether tax rates, thresholds, reliefs or interactions between taxes distort behaviour, make it difficult to predict tax outcomes or cause practical difficulty, and how far the choices or elections available are helpful or cause disproportionate difficulty. |

Tax rules which facilitate decision making rather than distorting behaviour Develop tax policies which facilitate people’s understanding and decision-making and avoid distorting economic or personal behaviours in unintended ways. |

| 3. |

Clarity and consistency Whether legislation is direct in its structure and approach, with consistent definitions, sets out the position in common situations explicitly to give clarity and certainty, and whether there is frequent extensive policy change. |

Take account of the existing UK tax framework, minimise unnecessary changes and plan ahead Ensure tax policy development takes account of the longstanding framework of UK taxation, minimises unnecessary change (which itself brings complexity) and plans ahead (for example via use of Road Maps) to avoid confusion. |

1. Real-life practicality: Clear policy design

-

When considering a new tax policy, or a change to tax policy, the OTS considers that simplification is more likely, and complexity avoided, if the policy’s purpose is clearly stated.

-

This enables those concerned or involved to evaluate and test whether the approach proposed is as simple as is proportionate to the objective in view.

-

It is then very helpful for the policy to fit with the way that other things work that those affected will need or are likely to be considering, so that it makes intuitive sense to people.

-

In particular, it is valuable to avoid requiring people to develop a distinct way of understanding, thinking about, or doing things, that is only relevant for tax purposes, or to have a policy which is likely to trigger a response that runs counter to other business or personal imperatives.

-

The OTS recognises that it is not always possible to achieve this ideal. The point however is to ensure that the position has been understood and considered from the taxpayer’s perspective, alternative approaches considered and tested, and the trade-offs between different policy objectives appropriately evaluated.

-

For example, having specific tax rules for capital allowances that differ from accounting depreciation is undoubtedly tax specific, and more complex than just using depreciation. However, there are also a range of other policy objectives involved, and the OTS’s report on capital allowances found that making a change - even if desired – was likely to be disproportionately expensive and disruptive.

-

On the other hand, it is not clear that Capital Gains Tax needs to work in such a way that one may well not know how much tax will be due when one is obliged to pay it, such as in relation to the capital gains tax to be paid within (now) 60 days of a UK residential disposal.

| Back to table 1 | Back to Chapter 2 |

2. Distortion & predictability: Tax rules which facilitate decision making, rather than distorting behaviour

-

Alongside the idea of policy design making sense to people, the OTS also considers there is value in tax rules that facilitate people’s decision-making rather than distorting behaviour.

-

There are range of issues in the tax system which illustrate this. One example, described earlier, relates to the IHT and Capital Gains Tax rules about passing on assets when someone dies, which, as a result of the so-called ‘lock in’ effect, can cause people to hold onto assets until they die, mainly for tax reasons, which may well not lead to the best outcome in other respects.

-

Another area capable of distorting behaviour is the deeply rooted differential treatment of income from employment and self-employment for tax and national insurance purposes, which places considerable pressure on the boundary between employment and self-employment.

-

Clearly there are very significant employment rights differences in this area (there are three categories for employment law, but two for tax), the tax boundary broadly aligning with one of the two employment rights boundaries.

-

There has been an extensive range of behavioural responses in this area (such as increased use of one-person companies and umbrella companies) and governments have introduced, and changed, specific tax rules to manage and police this boundary (such as IR35 and in relation to disguised remuneration more generally). This shows that the boundary is complex to deal with.

-

So, at the very least, finding ways to simplify people’s experience of how this boundary works in practice would be very worthwhile. Possible approaches would be to explore the potential for creating a statutory employment test, offering clearer outcomes better attuned to the modern economy than it is possible to achieve through developments in case law, or to look again at different ways of taxing small one-person companies (see the OTS’s evaluation note on taxing small companies).

| Back to table 1 | Back to Chapter 2 |

3. Clarity & consistency: Taking account of the existing framework of the UK tax system, minimising unnecessary change and planning ahead to avoid confusion

-

As well as fitting well with other features of the legal context, business procedures or personal life, it is also important that tax policy development takes account of the longstanding historical framework of UK taxation.

-

Working with the grain where possible will assist in minimise disruptive change or upheaval - which brings uncertainty and complexity for taxpayers, intermediaries, agents and HMRC.

-

It is sometimes the case that policy change does not appear to take account of existing rules within the tax system that operate within the same area. An example would be the interaction of reliefs and allowances on savings income for individuals, where layering application make it hard to understand how the rules interact and establish what one’s liability is.

-

While there will always be some occasions where external events (such as the Covid-19 pandemic) mean that government has to act quickly or without the usual level of consultation, there are important simplification benefits of adequate planning ahead and avoiding confusion.

-

Partly this is about ensuring adequate tax policy consultation, which - for example - was a concern of some in relation to the government’s 2021 consultation on basis period reform, where a range of changes were later made, including a year’s delay. It can also sometimes be about continuing to make use of appropriate informal pre-consultation soundings with a range of informed stakeholders, on occasion including the OTS secretariat.

-

There is however a broader point about forward planning, in particular the value of developing and publishing indicative roadmaps for the way government envisages taking forward major areas of tax policy development.

-

Such roadmaps help manage expectations, draw in constructive engagement and ensure that unanticipated hazards are identified at an early stage. This can greatly assist the government in its objectives and help to make things simpler than they otherwise could be - because they will then be more likely to run as smoothly as they can for everyone (see the OTS’s March 2022 note on the Single Customer Account).

Case study: UK tax year end date

One major potential change to address simplification and broader compliance objectives where planning ahead would be important, is the UK’s continued use of a tax year end date that is rooted in the Renaissance. Pope Gregory XIII introduced the Gregorian calendar in 1582. It was adopted in the UK in 1752 and the tax year end changed to 5 April in 1800.

The OTS 2021 report on this subject noted the significant transitional costs of adopting a more rational tax year and recommended no moves to adopt a different year be taken until HMRC and other government departments had modernised important technology platforms and launched new products, such as the Single Customer Account and Making Tax Digital for Income Tax.

The report recognised the broad agreement that a tax year aligned with the calendar year, or at least a month end, would deliver considerable benefits over time. In view of the continuing growth in international exchange of information, a tax year ending on 31 December would bring real compliance and understanding benefits to taxpayers and the HMRC. Changing the tax year would require significant planning, over several years, so there is a benefit in giving consideration to the project soon.

| Back to table 1 | Back to Chapter 2 |

Are the rules and their administration taking advantage of modern developments, including technology?

| Consideration | Principle | |

|---|---|---|

| 4. |

Technological support HMRC systems and taxpayer interfaces work, are helpful, efficient and joined-up, with relevant information and third-party data available and appropriately used. Not everyone can access technology, so something is needed for those who cannot. |

Improve digitisation and system design Ensuring that new tax policy changes make the best use of digital systems and data, are integrated into HMRC’s ongoing plans for technological and systems reform, and that these receive appropriate investment and support. Is this technology available and accessible for the majority, and how are the digitally excluded or challenged served? |

| 5. |

International data Cross-border business and tax have always been considerations, but the explosive growth of the internet has brought new business models and allowed micro businesses to trade internationally. Increasingly data, platforms and intermediaries are based overseas. |

Work closely with international bodies Where an area has cross-border aspects, work with international bodies to adopt common frameworks for data collection and exchange, and potential tax collection. |

4. Technological support: improving digitisation and system design

-

In many situations the dominant concern is how easily the policy can be operated and administered, and the effectiveness of the digital systems involved.

-

HMRC is currently taking forward major programmes of work in relation to the Tax Administration Framework and the Single Customer Account, which have huge potential to improve things in these areas over the medium to long term, as would significant investment in improving the practical data gathering and operation of the PAYE system. See the OTS’s report on the Single Customer Account, and evaluation note on improving PAYE.

-

The significant nature of HMRC’s multi-year programme of IT transformation from legacy systems to modern enterprise platforms also brings challenges: it can displace or lessen the capacity for other, potential build, and possibly defer long-term implementation to after the larger build.

-

In addition, there is great potential to make better use of other kinds of third-party data so that instead of millions of individuals having to give HMRC details of income and gains on their savings and investments, or contributions to pension schemes, this data could instead be directly transferred to HMRC by banks and other financial organisations, and reflected in taxpayers’ Single Customer Account, tax code, or Self Assessment return. See the OTS report on use of third-party data.

-

Equally, millions of people make claims and elections every year, in particular relation to employee expenses, where the OTS has for example recommended a streamlining of the number of different levels of flat rate relief. It is interesting to note that New Zealand chose to abolish entirely tax relief for employee-borne expenses.

-

In addition, the lack of up-to-date information about self-employed people’s income, or the level of dividends from personal service companies, materially limited the range of people for whom the government was able to design Covid support schemes.

-

As well as making the most of the work HMRC currently has in hand on tax administration, it is important when making tax policy changes to give full and early attention to the operational implications. So, for example new features like the Capital Gains Tax UK residential property return need to be joined up with and embedded as part of existing systems, rather than new free-standing services being created with their own authentication protocols and without relevant access for taxation agents.

| Back to table 2 | Back to Chapter 2 |

5. International data: Working closely with international bodies

- Where an area has cross-border implications, work actively with relevant international bodies to adopt a common framework for data collection, data exchange and potential tax collection. A very recent example is the release by the OECD of the Model Reporting Rules for digital platforms to support exchange of information, which the OTS is glad to see the UK has committed to adopting.

| Back to table 2 | Back to Chapter 2 |

Is it easy to comply with the rules?

| Consideration | Principle | |

|---|---|---|

| 6. |

Administration The administration of new policies is properly integrated into the system from the outset with full consideration given to the necessary mechanisms required to support the delivery of compliance. |

Processes which make it easy for taxpayers to handle straightforward matters themselves Minimising administrative burdens and costs. |

| 7. |

Understanding and awareness Taxpayers understand their obligations, are informed to make decisions and are clear on what they and others need to do, and when, giving certainty and confidence. |

Ensure the fullest external engagement and understanding at all stages With appropriate proactive communications to manage expectations. |

6. Administration: Processes which make it easy for taxpayers to handle straightforward matters themselves

- An integral element in the successful delivery of new tax policy is in ensuring that full consideration is given to the underlying administrative processes, mechanisms and systems which must necessarily be put in place to facilitate delivery of the policy and its associated compliance requirements. These administrative processes, mechanisms and systems should be properly designed and integrated into the tax system from the outset and should make it simple for the majority of taxpayers to easily comply with their compliance obligations, minimising associated costs as a result.

| Back to table 3 | Back to Chapter 2 |

7. Understanding and awareness: Ensure the fullest external engagement and undertaking at all stages

-

Alongside good systems, there is a need for greater taxpayer awareness, and clear, accessible, up to date guidance and practical processes such as online forms, both for taxpayers and their agents. HMRC has a clear focus on guidance generally, but there remains plenty of scope to improve things for the agents and other intermediaries who facilitate the operation of the tax system and to improve tax awareness and education generally. See the OTS’s report on guidance, evaluation note on issues affecting agents and other intermediaries, and Chapter 2 of our evaluation note on everyday tax.

-

In considering future tax policy changes, it’s highly desirable to focus initially on the (80%) majority of situations, which probably concern the smaller businesses or less wealthy individuals and ensure that how things work in those cases is as clear and explicit as possible.

-

While this cannot extend to the more complex cases or situations where the rules themselves have to be more complex, it is helpful if that material does not get in the way of identifying what to do in the generality of simpler situations.

-

It is vital to make sure that advisors, who support many who would otherwise need to rely on HMRC’s time, are provided with the information, guidance and access to data they require; and likewise that other intermediaries are able to get what they need to give the taxpayer the right support.

-

It is also important that wherever possible things are simple enough for the majority of taxpayers to feel confident about handling their own tax affairs.

| Back to table 3 | Back to Chapter 2 |

Can taxpayers be better supported?

| Consideration | Principle | |

|---|---|---|

| 8. |

Intermediary support Taxpayers, employers, other intermediaries and agents can easily access relevant HMRC information and services, and their potential to support taxpayers is harnessed. |

Utilise intermediaries to best support and contribute to the tax system Including through providing information to taxpayers or to HMRC, or through a greater role in tax collection, in a way which minimises the administrative costs involved. |

8. Intermediary support: Utilising intermediaries to best support and contribute to the tax system

-

Another key area is to consider how intermediaries can best contribute to the tax system.

-

These include, or could include, employers, banks, letting agents, conveyancing solicitors, labour and property rental platforms.

-

Their existing and potential future roles include through providing information to taxpayers or to HMRC, or taking a greater role in tax withholding, in a way which minimises the administrative costs involved across the system as a whole.

| Back to table 4 | Back to Chapter 2 |

Annex B: Scoping note

Annex C: Organisations consulted

The OTS has listed below the wide range of organisations who gave their time to provide evidence to this review. The OTS is grateful to these organisations and to the large number of individuals who gave their time to provide evidence either in writing or in meetings. Individual’s names have not been published here.

- Association of Accounting Technicians

- Association of Independent Professionals and the Self Employed

- Association of Taxation Technicians

- Aviva

- BDO UK

- Charity Tax Group

- Chartered Institute of Taxation

- Confederation of British Industry

- Deloitte

- Edinburgh Law School

- Federation of Small Businesses

- HMRC

- HM Treasury

- Institute of Chartered Accountants of England and Wales

- Institute of Chartered Accountants of Ireland

- Institute of Chartered Accountants of Scotland

- Institute for Family Business

- Institute for Government

- Intergenerational Foundation

- London School of Economics

- Low Incomes Tax Reform Group

- Resolution Foundation

- Scottish Government

- Society of Trust and Estate Practitioners

- Stevens and Bolton LLP

- Tax Aid and Tax Help for Older People

- Tax Justice UK

- UK 200 Group of Agents

- University of Exeter

- University of Cambridge, Faculty of Law

- University of Canterbury, New Zealand

Annex D: Selected bibliography

Books

Tax Simplification, Editors: Chris Evans, Richard Krever, Peter Mellor pub. Wolters Kluwer (2015)

The Complexity of Tax Simplification, Editors: Simon James, Adrian Sawyer, Tamer Budak pub. Palgrave Macmillan (2016)

The Work of the British Law Commissions: Law Reform…Now?, Shona Wilson Stark (Hart / Bloomsbury Publishing, 2017)

Papers and articles

Themes and Issues in Tax Simplification, Graeme Cooper, Australian Tax Forum Vol 10 (1993)

Optimal Tax Simplification: Toward a framework for analysis, Joel Slemrod (1994)

Tax Simplification: Issues and Options, William Gale Tax Notes, based on testimony presented in Congress 17 July 2001 (2001)

Tax Simplification is not a simple issue: the reasons for difficulty and a possible strategy, Simon James (2007)

Tax simplification: A review of initiatives in Australia, New Zealand and the United Kingdom, Simon James, Adrian Sawyer, Ian Wallschutzky (2015)