Market Data Insights: March 2021

Published 19 April 2021

Economic summary

The month of March saw several events which has impacted the UK’s economic outlook. The Chancellor of the Exchequer, Rishi Sunak, released his Budget to Parliament on 3 March. It contained his plans to protect and strengthen the economy, supporting a recovery with an investment-led approach.

The Budget contained extensions to the self-employment income support scheme and the business rates holiday. It also included future increases in corporation tax and proposals to set up special economic zones throughout the UK. This increases public sector borrowing in the short-term but the government hopes that this will help put the economy on the road to long-term recovery.

March also saw the UK take its first steps towards easing the national lockdown which will give the economy a much-needed boost. This brings an end to the ‘stay-at-home’ rule and allows outdoor sports facilities to reopen. Further restrictions are expected to be eased no earlier than 12 April. The actual date will be dependent on the effectiveness of the current measures to control COVID-19 cases.

Credit Spreads as at 28 February 2021

| AAA | AA | A | BBB | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 22 bps | 47 bps | 86 bps | 141 bps | ||||||

| ▼ 4bps MoM | ▼6 bps MoM | ▼5 bps MoM | ▼ 10 bps MoM |

An asset’s ‘credit spread’ is the difference between its yield and that of a government-issued bond of similar maturity. It is an indicator of the perceived riskiness of the asset. It represents how much investors want to be rewarded for investing in it instead of a lower risk government bond.

Over the month of February, credit spreads for investment grade bonds decreased by up to 10 basis points. Overall, this indicates there was a significant change in the market stability for credit.

Equities as at 28 February 2021

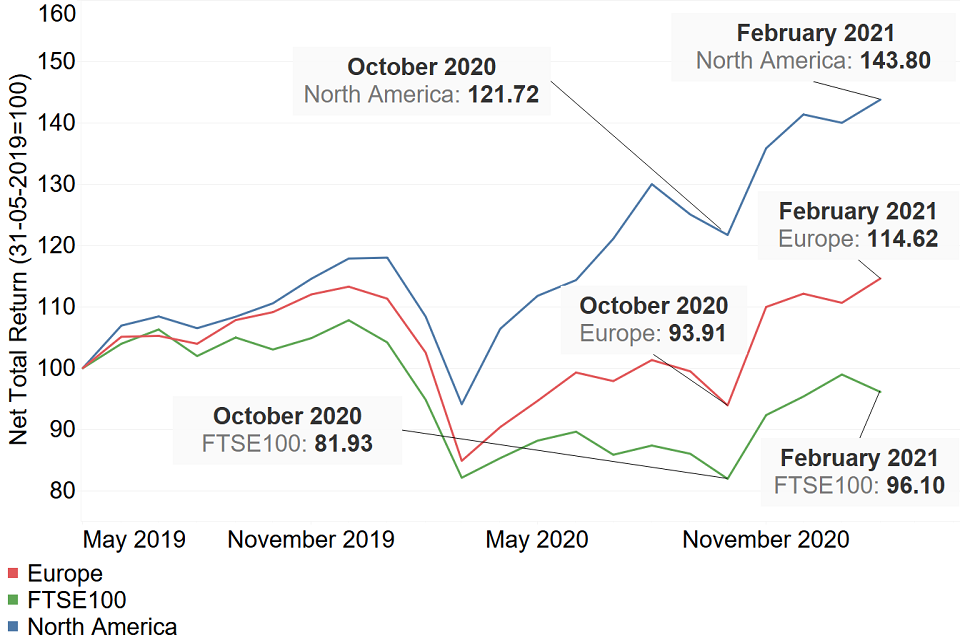

The graph below shows how the end-of-month positions have varied for the FTSE 100 between May 2019 and February 2021. The Financial Times Stock Exchange 100 Index (also referred to as the FTSE 100) is an index composed of the 100 largest companies listed on the London Stock Exchange.

The graph also compares against the North American and European MSCI indices which measures stock market performances in those areas. The graph is based on a base index of 100 for all 3 indices as at 31 May 2019.

The FTSE 100 has dropped in February 2021 after previously increasing for 2 successive months, compared to increases in the European and North American markets over the February period. This could be a small correction following the previous 2 months’ increases and the continuing effects of the national lockdown in the UK.

However, the FTSE 100 has not shown the same recovery from March 2020 as the other markets. The North American Market has grown considerably over the past 10 months and currently sits at a higher level than its pre-COVID peak. Given that all these regions have been affected by the pandemic to similar degrees, this could be explained by the composition of the FTSE 100. The FTSE is largely made up of banks, retailers and airlines; sectors which have been some of the hardest hit by the pandemic.

The long-term impact of Brexit and COVID-19 remain uncertain.

Foreign exchange

The foreign exchange rate represents the value of 1 currency in the price of another. For example, if the foreign exchange rate of the US dollar is said to be 0.50 GBP, then it costs 50p to purchase $1. Alternatively, it would cost $2 to purchase £1. This would be referred to as the exchange rate between the US dollar and the British pound.

Foreign exchange rates are an indicator for the economic health of the country. A strong currency allows the country to:

- buy goods and services from other countries for a smaller price. The process of buying goods and services from another country is referred to as imports.

- sell its goods and services to other countries for a higher price. The process of selling goods and services to another country is referred to as exports.

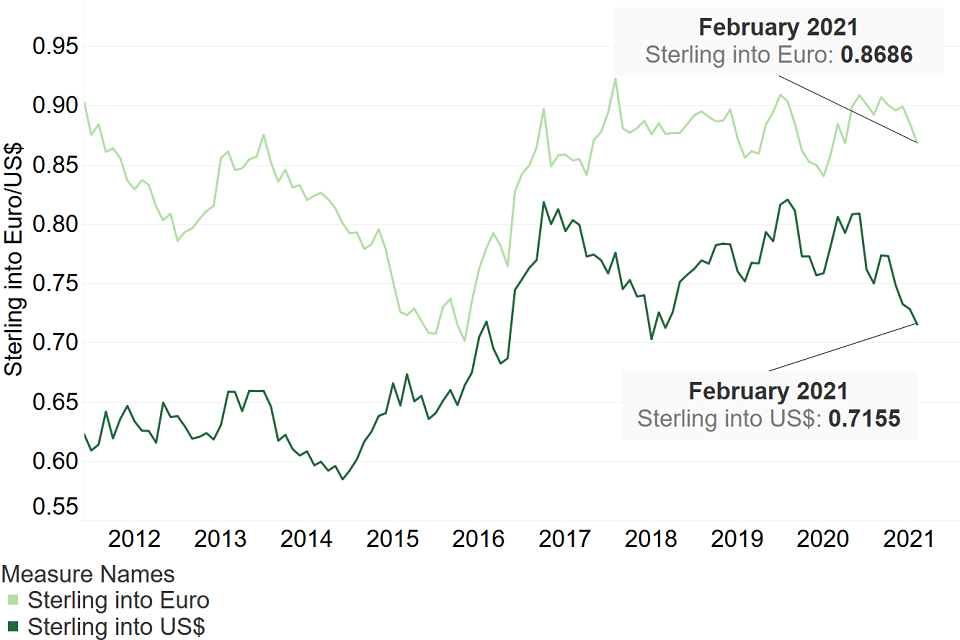

We focus on the exchange rate between the British pound and both the euro and the US dollar. The chart below shows how these rates have varied between January 2012 and February 2021.

The US dollar rate as at February 2021 is 0.7155 British pounds, which is the lowest it has been since March 2018. The euro as at February 2021 is 0.8686 British pounds, which is the lowest it has been since April 2020.

The weakening of the British pound against the dollar and the euro might reflect perceptions of post-Brexit trade and the on-going struggle over vaccine procurement.

Gold

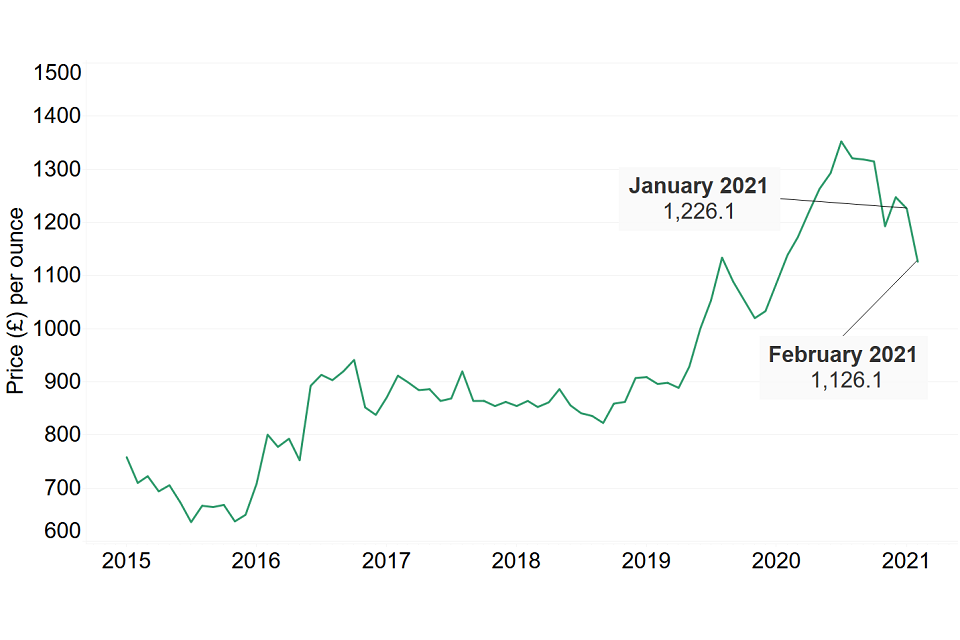

Gold is traditionally considered to be a key store of value. As the price of gold is typically independent of movements in the market, in uncertain economic times investors tend to flock to the commodity, leading to price rises.

Gold prices decreased for the second month in a row, falling to £1,126.10 per ounce. There is a decreasing trend over the past 7 months which continued over February. We can ascribe some of the decrease in value to a growing sense of certainty in the wider market.

The decreasing trend could be attributed to investors moving away from gold to gain higher investment returns as the world’s economies begin their route to recovery following the COVID-19 pandemic.

Any material or information in this document is based on sources believed to be reliable, however we cannot warrant accuracy, completeness or otherwise, or accept responsibility for any error, omission or other inaccuracy, or for any consequences arising from any reliance upon such information. The facts and data contained are not intended to be a substitute for commercial judgement or professional or legal advice, and you should not act in reliance upon any of the facts and data contained, without first obtaining professional advice relevant to your circumstances. Expressions of opinion do not necessarily represent the views of other government departments and may be subject to change without notice.

Quality Assurance Scheme

The Government Actuary’s Department is an accredited organisation of the Institute and Faculty of Actuaries’ Quality Assurance Scheme.