Local authority financial reporting and external audit: Spring update

Published 19 May 2021

Applies to England

1. In December, the Department delivered its response to the Redmond Review. That report set out the planned response to the 23 recommendations made by Sir Tony and grouped them under 5 themes:

- Action to support immediate market stability

- Consideration of system leadership options

- Enhancing the functioning of local audit, and the governance for responding to its findings

- Improving transparency of local authorities’ accounts to the public

- Action to further consider the functioning of local audit for smaller bodies

2. The December response set out proposed actions to implement the majority of those recommendations and also made a commitment to provide a full response in the Spring on the options for systems leadership, after further consideration.

3. This report fulfils that commitment, details the actions already taken to implement the Redmond Review recommendations, and also sets out our thinking on the recommendations relating to systems leadership.

4. We will work closely with all stakeholders, including local bodies and audit firms, to refine the proposals, set out in this report, before publishing a public consultation exercise ahead of summer recess.

Action taken to address immediate market instability

5. Our December response acknowledged the Redmond Review’s findings about the fragility of the local audit market and agreed that urgent action was needed. Despite the extension of the audited accounts publication deadline to 30 November for all local authority bodies, over 260 (55%) principal authorities’ accounts remained open on 1 December 2020, in part reflecting the special challenges posed for both auditors and local bodies by the Covid-19 pandemic. The actions we have taken to date will help to alleviate the immediate funding and timing pressures facing both audit firms and local authorities.

6. In January 2021, we consulted on amendments to the Accounts and Audit Regulations 2015 to implement recommendation 10, which we partially accepted, to extend the deadline for publishing audited local authority accounts to 30 September from 31 July. In our response, we said that we would extend the deadline for two years from 2020/21 and to review at that point whether there is a continued need to have an extended deadline. These regulations came into force on 31 March 2021.

7. The Redmond Review also looked at the fee structures surrounding the audit contracts administered by Public Sector Audit Appointments Ltd (PSAA) (the appointing body for 98% of principal local authority audits) noting that the fee setting and variation process was insufficiently flexible and that local audit fees had reduced by 40% when compared against a 20% rise in central government and FTSE100 audit fees.

8. To that end we are providing £15million to principal bodies, both to help support affected bodies to meet the anticipated increase in audit fee costs in 21/22 and to support with new burdens relating to implementing Redmond’s recommendations. We are currently seeking views via public consultation on the methodology for distributing this funding in the fairest way and our intention is to confirm individual allocations as soon as possible after the consultation closes on 18 May.

9. On fees, Redmond recommended that the current fee structure for local audit be revised to ensure that adequate resources are deployed to meet the full extent of local audit requirements. In response, we are currently consulting on proposals to make amendments to The Local Audit (Appointing Person) Regulations 2015 that will, subject to stakeholders’ views, provide PSAA (the bulk audit services procurement body) with more flexibility to agree fees that more closely match the actual costs of audit.

10. While the picture on outstanding audits has improved, there remained 116 2019/20 audit opinions outstanding as of 31 March 2021 – four months beyond the extended deadline. It is our expectation that the measures set out above should help to mitigate the knock-on impacts in 21/22 for completion of 20/21 audits, as well as helping ameliorate outstanding delays.

11. Progress implementing these commitments, as well as our action in response to all of the other Redmond recommendations, is set out in the table at annex A.

Consideration of system leader options

12. MHCLG’s priorities for local audit are: a strong and coordinated quality framework, a buoyant local audit market, and improved transparency and governance. In the current local audit framework, there are different organisations responsible for procurement and contract management of local audit contracts (PSAA), determining the Code of Local Audit Practice (National Audit Office (NAO)), regulating the local audit sector (the Financial Reporting Council (FRC)), and monitoring and review of local audit performance (the FRC and the Institute of Chartered Accountants in England and Wales (ICAEW)).

13. Sir Tony Redmond identified a lack of coherence and join up across the current local audit framework, as none of the existing organisations in the system “had a statutory responsibility, either to act as a systems leader or to make sure that the framework operates in a joined-up and coherent manner”.

14. To address this, the Review recommended that all these functions should be transferred to a single organisation – with a new independent body, the Office of Local Audit and Regulation (OLAR), responsible for procurement, contract management, regulation, and oversight of local audit. This new body would liaise with the FRC with regard to its role in setting auditing standards.

15. We agree that a lack of leadership across the current system has hampered both a coherent response to challenges arising and a nimble response to changing imperatives. We also agree that differing views on ‘what local audit is for’ has contributed to a disjuncture between organisations within the system.

16. In our December response to the Redmond Review, we said that we were not currently persuaded of the need for a new arms-length body and that we wanted to explore the full range of options as to how best to deliver Sir Tony’s findings about a lack of system leadership, including whether to establish a new body. Since then, we have been working closely with stakeholders across Government and the local audit sector to think through exactly what would be required from a new system leader.

17. In March 2021 the government published a White Paper setting out its plans to reform corporate audit, reporting and governance. The White Paper set out details of how the government proposes to establish a new regulator, the Audit, Reporting and Governance Authority (ARGA), to replace the FRC. It also set out government plans to create a new audit profession that is distinct from the accountancy profession, and to encourage competition in the market for audit of large listed companies. We have looked at options for local audit in the context of these wider reforms.

Functions of a system leader

18. As set out above, we agree that there is a lack of coherence between different functions within the existing local audit system. We also agree that a clearly accountable system leader is needed, with overarching responsibility for the local audit framework, including the Code of Audit Practice and the monitoring and review of local audit performance.

19. However, we do not accept that the same organisation also needs to be responsible for the procurement and management of local audit contracts, and note that this is not a typical role for an independent regulator to have. As the Local Government Association (LGA) highlighted in their response to the Redmond Review, there could be a conflict of interest, for example, if auditors defend poor performance by criticising the contract.

20. Notwithstanding this, it will be important to ensure that there is alignment between the objectives of the procurement and the broader framework, for example, to ensure that the former reflects an appropriate balance between price and quality.

21. Furthermore, we think that it is important that the system leader has an overarching responsibility for encouraging effective competition in the local audit market. While this goes beyond the recommendations of the Redmond Review, we think it is important as Sir Tony highlighted “evidence of market stress in the supply of appropriately experienced and qualified local authority auditors”, and this is not something that can just be resolved by changes to the procurement.

Options for delivering system leadership

22. In considering the full range of options for delivering this system leader role, it remains our view that it is not necessary, or desirable, to establish a new arms-length body with responsibility for local audit.

23. We do not wish to re-create the costly, bureaucratic and over-centralised Audit Commission. While we accept that this was not the intention of Sir Tony’s recommendation, we need to be mindful of the risk that, once a new body is created, costs can spiral over time, and it is our responsibility to safeguard the interests of our taxpayers.

24. Rather than re-creating the Audit Commission, we want to build on the benefits of the 2014 Local Audit and Accountability Act. This includes the reduction in the cost to local authorities and government of local audit, delivering estimated savings of £1.35 billion over 10 years. The Act also gave local bodies more flexibility around their audit services and required authorities to publish certain information set out in transparency codes which, for the very smallest authorities, replaced external audit in most cases.

25. We also need to be mindful of how local audit fits into the broader audit landscape. While a new body with responsibility for procurement, regulation and oversight of local audit would align some functions, it would also create new interfaces, for example with the FRC who has broader regulatory responsibility.

26. There are clear interdependencies with health audit, and there is a risk that a new local audit-focused body would lead to greater divergence with health audit, at a time when the government’s NHS White Paper Working Together to improve health and social care for all is driving greater integration between health and local government services. The downsides of potential divergence between local and health audit emerged clearly from our engagement with audit firms.

27. We also think it would be wrong to extract local audit from the broader audit framework. While there are distinct elements to local audit – as outlined later in this report – the fundamentals, and many of the issues facing the sector, including the long-term supply of auditors, are the same. It is notable that part of the aims of the government’s broader reforms to corporate audit is to improve transparency and strengthen governance arrangements with a clear public interest focus, similar to MHCLG’s ambition’s for local audit.

28. We have worked with stakeholders to consider a number of alternatives to OLAR, including whether existing organisations, or MHCLG, could take on this system leader role. Our view is that it would be inappropriate for central government to act as a regulator of local government audit and we remain committed to the principles of a locally-led audit regime, as embodied in the 2014 Act. It is preferable to have a regulator who can both act independently, and have the confidence of stakeholders and local bodies that they are acting independently.

29. Of the existing organisations in the local audit system, we note Sir Tony’s finding that none of these six entities (NAO, FRC, PSAA, ICAEW, the Chartered Institute of Public Finance and Accountancy (CIPFA), and the LGA) has a statutory responsibility, either to act as a system leader or to make sure that the framework operates in a joined-up and coherent manner, and also that a number of these organisations do not have the local authority sector as their main focus.

30. Consequently, it will be necessary to ensure that we give the system leader the statutory responsibilities and powers to ensure that they are able to function appropriately, and also to ensure that they have sufficient focus on the issues specific to public audit. We recognise that this will require primary legislation to establish.

Preferred system leader

31. In this context, it is our view that ARGA, the new regulator being established to replace the FRC, would be best placed to take on the local audit system leader role. The FRC is the only organisation that currently undertakes the full range of core functions relating to the quality framework we think it necessary for a single responsible body to have, albeit with some of these, such as code setting responsibilities, currently only relating to corporate audit.

32. As we have outlined above, we think that it is crucial that a new system leader has a core focus on ensuring competition on the market, and this will build on the proposals to introduce “promoting effective competition in the market for statutory audit work” as a core objective for ARGA currently being consulted on as part of the government’s corporate audit consultation Restoring trust in audit and corporate governance.

33. Sir Tony noted the risk that the reforms being undertaken in response to the Kingman and Brydon Reviews created a risk of greater divergence between corporate and local audit. However, we think that by establishing ARGA as the body responsible for local audit, we can harness the impact of these broader reforms on improving competition in the local audit market too.

34. The Department for Business, Energy and Industrial Strategy (BEIS) is also consulting on proposals to establish a new professional body for corporate audit, and as we develop our proposals, we will work with BEIS to consider how this should relate to local audit.

35. Taking this approach, and transferring the Code of Local Audit Practice to ARGA, will also help to ensure that the focus of local audit and health audit continue to remain aligned.

Governance to deliver an ARGA local audit system leader

36. We note that Sir Tony’s rationale for discounting the FRC as a possible system leader was that its “main focus is corporate sector external audit, and to be fully effective the system leader for local public audit will need to demonstrate detailed expertise and a clear focus on that sector.”

37. We agree that this expertise and focus are requisite for a system leader, and we are confident it will be possible for ARGA to develop them. While the exact arrangements for a new ARGA local audit system leader will be subject to further work with BEIS and FRC, we have agreed a number of high-level principles to provide reassurance on this point.

38. These include aligning ARGA’s proposed statutory objectives, principles and functions to explicitly include local audit, the specific needs of the sector and the additional responsibilities relating to system leadership. Also, the establishment of a new department within ARGA to take on responsibility for local audit-related work, including oversight and inspection.

39. Beyond this, there are a number of governance mechanisms that BEIS is currently consulting on to ensure that the government has the information it needs to shape the regulatory framework according to ARGA’s experience on the ground and that ARGA has clarity on the government’s strategic priorities, while being clear to maintain ARGA’s legal and operational independence.

40. The mechanisms include BEIS’s Secretary of State having responsibility for the appointment of non-executive board members of the ARGA Board and sending a statutory remit letter at least once a Parliament setting out those matters which the regulator should consider when exercising its policy-making functions. The regulator should be required to respond publicly to that letter. While the final details will be subject to consultation, it is our intention that these measures will also be used to ensure alignment with local audit.

41. Sir Tony also recommended the establishment of a new Liaison Committee comprising key stakeholders and chaired by the Ministry of Housing, Communities and Local Government (MHCLG), to receive reports from the new regulator on the development of local audit. We agree that this would be an important forum, however, it is our view that this should be chaired by ARGA, as the system leader. The exact membership of this will be subject to further consideration, but we envisage representation from organisations including CIPFA, PSAA, LGA, NAO, ICAEW, MHCLG, the Department of Health and Social Care (DHSC), NHS England, BEIS and the Treasury (HMT). It is our intention that, in the interim, as ARGA is established, MHCLG would chair this forum.

42. As well as this engagement with stakeholder organisations, it will also be crucial that ARGA has forums for engaging directly with both local bodies and audit firms to ensure that local audits are focused on areas of most risk to local bodies, and that firms have a clear understanding of priorities for the sector, and are able to escalate issues and concerns where necessary. We will work with the FRC to consider what the best mechanisms will be for achieving this.

43. Sir Tony also recommended that a system leader have responsibility for producing annual reports summarising the state of local audit. We strongly agree with this recommendation.

44. We note that the report previously prepared by PSAA included detail on the number of audits completed by the statutory deadline and the number of qualified financial audit and value for money opinions, with the latter categorised by theme. It also listed all Public Interest Reports, Statutory Recommendations and Advisory Notices issued in the preceding year. The exact content of the report would be subject to further work, but we see this as an important mechanism for ARGA to report on progress to MHCLG, as well as to inform MHCLG’s stewardship of the local government accountability framework.

45. Following today’s announcement, we will undertake further engagement with stakeholders, including local bodies and audit firms, to refine our thinking on how a new ARGA local audit system leader should operate, before launching a public consultation on the details of the proposals ahead of summer recess. It will be important that this is consistent with the proposals currently being consulted on as part of the government’s wider corporate audit reforms.

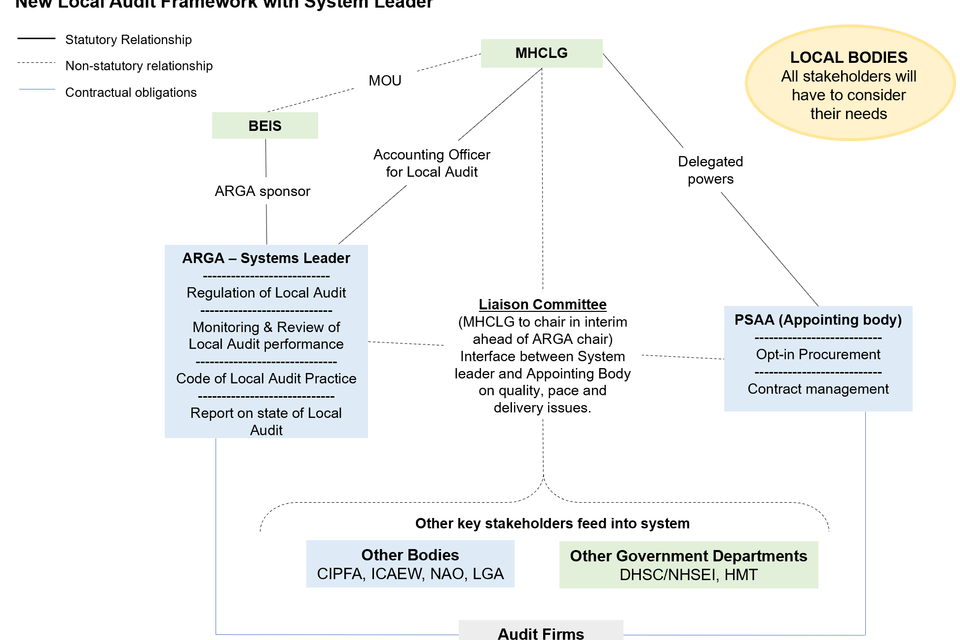

Diagram showing the different organisations in the new local audit system and the interactions between them, as described in the wider report.

Focus of local audit

46. Sir Tony highlighted the ‘expectation gap’ between what auditors are required to do, and what local authorities and taxpayers expect, when auditors are assessing the financial resilience of local authorities. This has also been a consistent theme raised by stakeholders, who have emphasised the need for the government to clearly set out its expectations of local audit.

47. Local audit comprises two elements. It includes an opinion that the statutory financial accounts, produced in accordance with CIPFA’s Code of Practice on Local Authority Accounting, are true and fair, in accordance with statutory duties. The audit of the financial statements is a requirement that is consistent with private companies (unless exempt) and central government bodies. In the UK, external audit is undertaken under the International Standards on Auditing (ISA) (UK), set by the FRC, and audited accounts are then consolidated into the Whole of Government Accounts. The NAO’s Code of Audit Practice (the ‘Code’) sets out that auditors of local bodies should conduct the audit of the financial statement in accordance with the ‘current auditing standards’ as issued by the FRC.

48. As well as the financial audit, legislation also requires a further, value for money opinion from public audit, which includes an assessment on whether the auditor is satisfied that the Authority has made proper arrangements for securing economy, efficiency and effectiveness in its use of resources, including consideration of financial sustainability and governance arrangements. The ISAs do not apply to value for money audits. The Audit Code requires the auditor to form a judgement on the nature and amount of work required to support the audit opinion.

49. The additional value for money audit requirements reflect the government’s view that expectations of public audits should be higher than for company audits, in recognition of the fact that taxpayers cannot divest in their local body, in the way that a private investor in a company can. This is also reflected in the additional powers and duties that public auditors have to make Public Interest Reports and Statutory Recommendations, which perform a crucial role in bringing concerns into the public domain.

50. In undertaking the value for money audit, the auditor is only required to review whether proper practices were in place, rather than form a view on whether a local authority has delivered value for money.

51. Until recently, the Code required auditors to give a binary opinion on whether the proper arrangements were in place. However, this was revised in the recent update to the Code, which now requires auditors to provide a narrative statement on the arrangements in place. The department welcomes this change, as it is our view that the binary value for money judgement required under the previous Code did not provide sufficient information for taxpayers or local bodies, particularly in a context where the complexity and commercialisation of local authority finances has increased.

52. The new value for money requirements in the updated Code including a new commentary on governance, arrangements for achieving financial sustainability, and improving economy, efficiency and effectiveness - should help to address this. However, we agree with Sir Tony’s recommendation that a new system leader should undertake a post implementation review to assess whether these changes have led to more effective external audit consideration of financial resilience and value for money matters, as Sir Tony Redmond recommended.

53. We recognise that this new requirement will increase the cost of local audit. We have provided £15m to help meet the increased cost of audit in 21/22, including the new Code of Audit Practice requirements, and we will ensure that the New Burdens Doctrine will apply to any future increases in requirements.

54. This may also have capacity implications for audit firms, at a time when there are issues relating to delays in the completion of audits and more broadly relating to the future pipeline of auditors. It is our expectation that the steps that the government is taking should provide clear reassurance as to the future viability of the local audit market, and give audit firms the confidence to invest sufficiently in their local audit teams.

55. To support this, we welcome the work that has been undertaken by the NAO and the FRC to make amendments to guidance, including Auditor Guidance Notes 03 and 07, as well as the guidance note on going concern, that should help assist in the delivery of 20/21 audits. However, in recognition of the significance of the delays facing the sector, we will work with stakeholders to consider whether there are other steps that could be taken to assist in the timely delivery of 21/22 audits.

56. More broadly, we also want the new system leader, as well as existing stakeholders, to look at whether there are opportunities to reduce some of the accounting and audit requirements where these relate to areas of less risk to local bodies. The intention would be to ensure that local authority accounts and the statutory audit are proportionate, noting that they need to be consolidated into the Whole of Government Accounts, prepared in accordance with International Financial reporting Standards, and meeting the necessary standards of reporting and scrutiny.

57. As there will inevitably be a period of transition while new arrangements are put in place, in the interim we will work with the CIPFA, CIPFA/LASAAC, the FRC, NAO, HMT, the Financial Reporting Advisory Board and others to look at opportunities to address these issues around accounting and audit requirements at pace, including through modifications to the Accounting Code.

Procurement/ appointing person arrangements

58. In our December publication, we said that we would consider what, if any, further action may be necessary to support the future appointing person to ensure that the next procurement enables market sustainability. We highlighted the finding that 88% of local authorities who responded to the Review’s Call for Views thought the current procurement process does not drive the right balance between cost reduction, quality of work, volume of external auditors and mix of staff undertaking the work.

59. There is a balance to be struck between cost and quality. Historically, there were concerns that fees were too high and it was right that real savings were delivered for the taxpayer following the abolition of the Audit Commission. However, the context has changed since 2014, including the structure of the market, plus new obligations and the complexity of the work.

60. It is striking that local audit scale fees reduced by 40% between 2014/15 and 2018/19, while central government and FTSE100 fees have increased by 20%. We have been working closely with PSAA in recent months to develop our plans for allowing greater flexibility to reflect additional costs in audit fees, and are allocating £15m to local bodies to help with this and the additional requirements associated with implementing Redmond’s recommendations.

61. These measures will help to address the immediate market fragility issues, as well as ensure that, in the longer-term, there is a mechanism to reflect additional costs more quickly if new audit requirements are introduced during the course of an appointing period, thereby removing the financial risk from the audit firms.

62. While Sir Tony recommended that a new system leader should take on responsibility for procurement, as we have outlined above, we do not consider this to be appropriate given the need for independence between the procurement and quality oversight functions.

63. Based on our engagement, it remains our view that PSAA is the organisation best placed to act as the appointing body, including overseeing the next procurement, due to their strong technical expertise and the proactive work they have done to help identify improvements that can be made to the process. This will also help to provide continuity, given the proximity of the next procurement exercise.

64. However, it is clear that the procurement of local audit contracts is a vital element of the broader framework, and objectives need to be aligned across this system, including through consultation with the FRC and other stakeholders.

65. As the Redmond Review highlighted, with only three firms covering over 80% of local audit, a withdrawal by one could create a very challenging gap to fill. Looking ahead to procurement for the next round of contracts that will commence from 2023/24, a priority needs to be expanding the number of firms engaged in the market. Our engagement with the audit firms who currently hold local audit contracts indicates that this is a view that they share.

66. Alongside confirming PSAA as the appointing body, we will agree an updated Memorandum of Understanding between MHCLG and PSAA. To support the delivery of a positive outcome at the next procurement, it will be important to ensure that objectives are aligned across the system, and that all partners are playing their role in supporting the appointing person. To achieve this, the Liaison Committee will provide a forum to consider the procurement strategy at key stages in its development.

67. However, PSAA will remain responsible and accountable for the appointment of auditors and setting scales of fees for relevant principal authorities that have chosen to opt into its national scheme, as specified by the Secretary of State for Housing Communities and Local Government under the provisions of the Local Audit and Accountability Act 2014 and the Local Audit (Appointing Person) Regulations 2015.

68. The updated MOU will also reflect the expectation that the next procurement exercise includes a strong focus on market development, to support the long-term competitiveness and sustainability of the market. MHCLG will be providing additional support to PSAA to help with this. We will expect PSAA to work closely with local bodies and audit firms to deliver a positive outcome for all parties.

69. The appointing person ‘opt-in’ arrangements currently only apply to local bodies, with health bodies responsible for appointing their own auditors. We have engaged with colleagues in DHSC and NHS England to discuss whether changes should be made to the procurement arrangements for health audit, but it is our shared view that existing arrangements should remain in place.

70. The Secretary of State for Housing, Communities and Local Government retains the delegation powers, and MHCLG will continue to keep all arrangements under review in future to ensure that they are delivering quality and value for money for local bodies and taxpayers.

Progress implementing other recommendations relating to auditor training and qualifications, the functioning of local audit, and governance, the transparency of local authorities’ accounts and the audit of smaller bodies

71. Alongside action on addressing market instability and considerations around systems leadership, we have also been working with key stakeholders to consider how we implement the broader commitments we made in our response to the Redmond Review. In recognition of the importance of delivering collaboratively with stakeholders, we have established a number of working groups led by sector representatives, with membership drawn from other stakeholder organisations, to make recommendations to MHCLG as to how the commitments should be implemented.

72. In relation to the recommendations around auditor capacity, skills, training and experience, we are working closely with the FRC, ICAEW and CIPFA to review the current guidance on entry requirements for Key Audit Partners in local audit - and to consider what else is possible to ensure that firms with the capacity, skills and experience are not excluded from bidding on local audit work.

73. We have also been engaging with the LGA, CIPFA and others to consider the recommendations around audit committees, their status and membership, with a view to developing new guidance endorsed by all stakeholders.

74. We are working with CIPFA to develop the new Standardised Statements of accounts, and consideration is also being given to making further amendments to the Accounts and Audit Regulations – subject to consultation – to require the development and auditing of the new Standardised Statement. New burdens for local bodies resulting from these new requirements will be met from part of the additional £15m provided to local bodies for 2021/22.

75. We are also working with smaller bodies stakeholders, including the National Association of Local Councils (NALC), Society of Local Council Clerks (SLCC), and the Small Authorities Audit Appointments (SAAA) to consider changes to current auditor guidance notes and what additional audit work might be appropriate for ‘larger’ small bodies. This also includes considering what further action might be possible to assist a small number of parish councils in relation to vexatious complainants.

Next steps

76. Following today’s publication, we will work closely with stakeholders, including local bodies and audit firms, to refine our proposals for implementing our commitments around system leadership, as well the range of other commitments we have made in response to the Redmond Review, ahead of publishing a public consultation on the proposals in advance of summer recess.

77. Some of these changes would require primary legislation, and so the government would look to introduce them, subject to public consultation, as part of broader draft legislation with BEIS to implement the government’s broader corporate audit reforms when Parliamentary time allows. We will continue to work closely with the FRC, PSAA, NAO and others in the intervening period to consider how we can make more immediate changes that do not require primary legislation.

Annex A: Table of recommendations outlining our response and our progress implementing them

Action to support immediate market stability (recommendations 5, 6, 8, 10, 11)

| Recommendation | December MHCLG Response | Progress update |

|---|---|---|

| 5. All auditors engaged in local audit be provided with the requisite skills and training to audit a local authority irrespective of seniority. | Accept; we will work with the ICAEW, CIPFA and FRC to deliver this recommendation |

In progress. • We committed to working with stakeholders, including the ICAEW, CIPFA and FRC, to deliver this recommendation. We have established a working group to deliver this recommendation, which is currently considering proposals to deliver it and we will provide an update ahead of summer recess. |

| 6. The current fee structure for local audit be revised to ensure that adequate resources are deployed to meet the full extent of local audit requirements. | Accept |

In progress. • We are currently consulting on proposals to make amendments to The Local Audit (Appointing Person) Regulations 2015 that will, subject to stakeholders’ views, provide Public Sector Audit Appointments Ltd (PSAA) (the bulk audit services procurement body) with more flexibility to agree fees that more closely match the actual costs of audit. • We are providing £15 million to principal bodies, both to help support affected bodies to meet the anticipated increase in audit fee costs in 21/22 and to support with new burdens relating to implementing Redmond’s recommendations. We are currently seeking views via public consultation on the methodology for distributing this funding in the fairest way and our intention is to confirm individual allocations as soon as possible after the consultation closes on 18 May. • We have reconfirmed PSAA Ltd as the appointing body ahead of the next procurement, and will work closely with them, as well as other stakeholders, to ensure alignment in objectives between the procurement and the wider local audit system. |

| 8. Statute be revised so that audit firms with the requisite capacity, skills and experience are not excluded from bidding for local audit work. | Part accept; we will work with the FRC and ICAEW to deliver this recommendation, including whether changes to statute are required |

In progress. • We committed to working with stakeholders, including the ICAEW and FRC, to deliver this recommendation. We have established a working group to deliver this recommendation, which is currently considering proposals to deliver it and we will provide an update ahead of summer recess. • This includes reviewing guidance relating to the entry criteria for key audit partners (KAPs). |

| 10. The deadline for publishing audited local authority accounts be revisited with a view to extending it to 30 September from 31 July each year. | Part accept; we will look to extend the deadline to 30 September for publishing audited local authority accounts for two years, and then review |

Delivered. • Regulations extending the audit publication deadline to 30 September for 2 years came into force on 31 March 2021. • At the end of this period we will review whether there is a continued need to have an extended deadline. |

| 11. The revised deadline for publication of audited local authority accounts be considered in consultation with NHSE/I and DHSC, given that audit firms use the same auditors on both Local Government and Health final accounts work. | Accept |

Delivered. • Regulations extending the audit publication deadline to 30 September for 2 years came into force on 31 March 2021. • At the end of this period we will review whether there is a continued need to have an extended deadline. |

Consideration of system leadership options (recommendations 1, 2, 3, 7, 13, 17)

| Recommendation | December MHCLG Response | Progress update |

|---|---|---|

|

1. A new body, the Office of Local Audit and Regulation (OLAR), be created to manage, oversee and regulate local audit with the following key responsibilities: • procurement of local audit contracts; • producing annual reports summarising the state of local audit; • management of local audit contracts; • monitoring and review of local audit performance; • determining the code of local audit practice; and • regulating the local audit sector. 2. The current roles and responsibilities relating to local audit discharged by the: • Public Sector Audit Appointments (PSAA); • Institute of Chartered Accountants in England and Wales (ICAEW); • FRC/ARGA; and • The Comptroller and Auditor General (C&AG) to be transferred to the OLAR. |

We are considering these recommendations further and will make a full response by spring 2021 |

Part accept; • We accept the need for a single organisation to have responsibility for leadership of the local audit system, including oversight of the quality framework and encouraging competition in the local audit market. • We accept that this requires a single body to have responsibility for: o Producing annual reports summarising the state of local audit; o Monitoring and review of local audit performance; o Determining the code of local audit practice; and o Regulating the local audit sector. • We do not accept that a new body needs to be created to undertake these functions, and think that these functions, as well as an overarching responsibility for system leadership and encouraging competition in the local audit market, should be undertaken by the Audit, Reporting and Governance Authority (ARGA), set to be established to replace the Financial Reporting Council. • We do not accept that this body should also have responsibility for procurement and management of local audit contracts, and think that these should functions should continue to be undertaken by PSAA. • We will work with stakeholders to refine these proposals ahead of a public consultation before summer recess. |

| 3. A Liaison Committee be established comprising key stakeholders and chaired by MHCLG, to receive reports from the new regulator on the development of local audit. | We are considering these recommendations further and will make a full response by spring 2021 | Part accept; we will establish this new Liaison Committee, but think that this should be chaired by ARGA as the ‘system leader’ once the new arrangements our established. MHCLG will chair this in the intervening period. |

| 7. That quality be consistent with the highest standards of audit within the revised fee structure. In cases where there are serious or persistent breaches of expected quality standards, OLAR has the scope to apply proportionate sanctions. | We are considering these recommendations further and will make a full response by spring 2021 | Part accept; we will work with stakeholders to consider whether additional sanction powers beyond the audit enforcement procedures that ARGA will already have are necessary. |

| 13. The changes implemented in the 2020 Audit Code of Practice are endorsed; OLAR to undertake a post implementation review to assess whether these changes have led to more effective external audit consideration of financial resilience and value for money matters. | We are considering these recommendations further and will make a full response by spring 2021 | Accept; we have endorsed the changes to the 2020 Audit Code of Practice, and will look to ARGA to undertake a post implementation review to assess whether these changes have led to more effective external audit consideration of financial resilience and value for money matters in due course. |

| 17. MHCLG reviews its current framework for seeking assurance that financial sustainability in each local authority in England is maintained. | We are considering these recommendations further and will make a full response by spring 2021 | Accept; MHCLG carries out a range of assurance activity, drawing on local authority data and financial metrics and soft intelligence from engagement with the sector. The Department has undertaken additional data collection in 2020-21 to provide government with robust data on local financial pressures in the context of the Covid-19 pandemic, and has also implemented a consistent process to engage with local authorities facing financial challenges and, where appropriate, provide exceptional financial support. |

Enhancing the functioning of local audit, and the governance for responding to its findings (recommendations 4, 9, 12, 18)

| Recommendation | December MHCLG Response | Progress update |

|---|---|---|

|

4. The governance arrangements within local authorities be reviewed by local councils with the purpose of: • an annual report being submitted to Full Council by the external auditor; • consideration being given to the appointment of at least one independent member, suitably qualified, to the Audit Committee; and • formalising the facility for the CEO, Monitoring Officer and Chief Financial Officer (CFO) to meet with the Key Audit Partner at least annually. |

Accept; we will work with the LGA, NAO and CIPFA to deliver this recommendation |

In progress. • We committed to working with stakeholders, including the LGA, NAO and CIPFA, to deliver this recommendation. We have established a working group to deliver this recommendation, which is currently considering proposals to deliver it and we will provide an update ahead of summer recess. • This includes consideration of new guidance developed with the stakeholders listed above, as well as the ICAEW and PSAA Ltd, and local bodies and audit firms. |

| 9. External Audit recognises that Internal Audit work can be a key support in appropriate circumstances where consistent with the Code of Audit Practice. | Accept; we will work with the NAO and CIPFA to deliver this recommendation |

In progress. • We committed to working with stakeholders, including the LGA, NAO and CIPFA, to deliver this recommendation. We have established a working group to deliver this recommendation, which is currently considering proposals to deliver it and we will provide an update ahead of summer recess. • This includes consideration of new guidance developed with the stakeholders listed above, as well as the ICAEW and PSAA Ltd, and local bodies and audit firms. |

| 12. The external auditor be required to present an Annual Audit Report to the first Full Council meeting after 30 September each year, irrespective of whether the accounts have been certified; OLAR to decide the framework for this report. | Accept; we will work with the LGA, NAO and CIPFA to deliver this recommendation, including whether changes to statute are required |

In progress. • We committed to working with stakeholders, including the LGA, NAO and CIPFA, to deliver this recommendation. We have established a working group to deliver this recommendation, which is currently considering proposals to deliver it and we will provide an update ahead of summer recess. • This includes consideration of new guidance developed with the stakeholders listed above, as well as the ICAEW and PSAA Ltd, and local bodies and audit firms. |

| 18. Key concerns relating to service and financial viability be shared between Local Auditors and Inspectorates including Ofsted, Care Quality Commission and HMICFRS prior to completion of the external auditor’s Annual Report. | Accept; we will work with other departments and the NAO to deliver this recommendation |

In progress. • We committed to working with stakeholders, including the LGA, NAO and CIPFA, to deliver this recommendation. We have established a working group to deliver this recommendation, which is currently considering proposals to deliver it and we will provide an update ahead of summer recess. • This includes consideration of new guidance developed with the stakeholders listed above, as well as the ICAEW and PSAA Ltd, and local bodies and audit firms. |

Improving transparency of local authorities’ accounts to the public (recommendations 19, 20, 21, 22)

| Recommendation | December MHCLG Response | Progress update |

|---|---|---|

| 19. A standardised statement of service information and costs be prepared by each authority and be compared with the budget agreed to support the council tax/precept/levy and presented alongside the statutory accounts. | Accept; we will work with CIPFA to deliver this recommendation | In progress. • We are currently working with CIPFA to deliver this recommendation. We are taking time to consider how it should work, as it is important that it is of value for taxpayers. |

| 20. The standardised statement should be subject to external audit. | Accept; we will work with CIPFA and the NAO to deliver this recommendation | In progress. • We are currently working with CIPFA to deliver this recommendation. We are taking time to consider how it should work, as it is important that it is of value for taxpayers. |

| 21. The optimum means of communicating such information to council taxpayers/service users be considered by each local authority to ensure access for all sections of the communities. | Accept; we will work with the LGA and CIPFA to deliver this recommendation | In progress. • We are currently working with CIPFA to deliver this recommendation. We are taking time to consider how it should work, as it is important that it is of value for taxpayers. |

| 22. CIPFA/LASAAC be required to review the statutory accounts, in the light of the new requirement to prepare the standardised statement, to determine whether there is scope to simplify the presentation of local authority accounts by removing disclosures that may no longer be considered to be necessary. | Accept; we will look to CIPFA to deliver this recommendation |

In progress. • CIPFA/LASAAC has agreed a new Strategic Implementation Plan that includes delivery of this recommendation. |

Action to further consider the functioning of local audit for smaller bodies (recommendations 14, 15, 16, 23)

| Recommendation | December MHCLG Response | Progress update |

|---|---|---|

| 14. SAAA considers whether the current level of external audit work commissioned for Parish Councils, Parish Meetings and Internal Drainage Boards (IDBs) and Other Smaller Authorities is proportionate to the nature and size of such organisations. | Accept; we will look to SAAA to deliver this recommendation | In progress • We committed to working with stakeholders, including SAAA and JPAG, to deliver these recommendations. We have established a working group to deliver this recommendation, which is currently considering proposals to deliver it and we will provide an update ahead of summer recess. • This includes changes to current auditor guidance notes and what additional audit work might be appropriate for ‘larger’ small bodies. |

| 16. SAAA reviews the current arrangements, with auditors, for managing the resource implications for persistent and vexatious complaints against Parish Councils. | Accept; we will look to SAAA to deliver this recommendation | In progress • We committed to working with stakeholders, including SAAA and JPAG, to deliver these recommendations. We have established a working group to deliver this recommendation, which is currently considering proposals to deliver it and we will provide an update ahead of summer recess. • This includes changes to current auditor guidance notes and what additional audit work might be appropriate for ‘larger’ small bodies. |

|

23. JPAG be required to review the Annual Governance and Accountability Return (AGAR) prepared by smaller authorities to see if it can be made more transparent to readers. In doing so the following principles should be considered: • Whether “Section 2 – the Accounting Statements” should be moved to the first page of the AGAR so that it is more prominent to readers; • Whether budgetary information along with the variance between outturn and budget should be included in the Accounting Statements; and • Whether the explanation of variances provided by the authority to the auditor should be disclosed in the AGAR as part of the Accounting Statements. |

Accept; we will work to JPAG to deliver this recommendation | In progress • We committed to working with stakeholders, including SAAA and JPAG, to deliver these recommendations. We have established a working group to deliver this recommendation, which is currently considering proposals to deliver it and we will provide an update ahead of summer recess. • This includes changes to current auditor guidance notes and what additional audit work might be appropriate for ‘larger’ small bodies. |