Local authority capital finance framework: planned improvements

Published 28 July 2021

Applies to England

1. Summary

1. The government recognises that capital investment is essential for enabling local authorities to deliver economic regeneration, housing and school improvements, and to support service transformation, and is used well by many authorities. However, the evidence is clear that the system is failing in some places and this document sets out planned actions to address this. The government will continue to monitor the sector for signs of significant improvement, and will make further changes to how the Prudential System works if problematic behaviour continues.

2. Introduction

2. The current system to regulate capital finance, in place since 2004, is based on the principle of local decision making and accountability. Local authorities are free to determine their own capital strategies and decide how they deliver services on the principle that they are best placed to make the decisions needed to support their local communities.

3. Prior to 2004, local authority borrowing for capital expenditure had always been tightly controlled. Under the system in force from 1990, the government annually issued each authority with a basic credit approval, which had the effect of setting a rigid upper limit to an authority’s use of borrowing and other long-term credit. The move to the current system, known as the Prudential Framework (the Framework), represented a significant change whereby local authorities now have wide freedoms to borrow and invest without the need to seek prior approval from the government.

4. The current system is permissive, but not without bounds. The Framework comprises underlying legislation, which local authorities must adhere to, and four statutory codes which they must have regard to. The intent of the Framework is to drive good decision-making to support local capital delivery in a way that is value-for-money, while constraining excessive risk to the sector.

5. The Framework is based on principles rather than being a prescriptive rules-based system. It has always placed a degree of reliance on local authorities to comply with the intent and spirit of the Framework and not to actively seek ways, whatever the motivation, to diverge from its principles of prudence, affordability and sustainability. It also relies on robust local decision-making and governance.

6. The Ministry of Housing, Communities and Local Government (MHCLG) has policy responsibility for the Framework. It also has overall responsibility for the local government finance system, which includes monitoring risk from changes in sector behaviour and ensuring the legislation and guidance remain fit for purpose. The wider capital system includes other actors and frameworks such as the financial reporting regulatory framework and local government audit.

7. This document sets out the government’s plans for strengthening the current system while protecting the principles of local decision making. It sets out plans for both improving our role as steward of the local government financial system, by ensuring we have the data to effectively monitor risks in a timely way, and to strengthen the current capital system so that it remains effective in driving good decision making and preventing excessive risk. It builds on some of the changes we have already seen, such as the recent changes to the operation of the Public Works Loan Board (PWLB), in place since November 2020, which are designed to stop local authorities from accessing PWLB borrowing if they are planning on undertaking investments primarily for yield.

3. Why we are making changes to the capital framework

8. The government recognises the importance of local government capital investment, including the important role it will play in recovery from the pandemic and in delivering priorities such as levelling up, regeneration and housing provision. Since the inception of the current system in 2004, the economic and regulatory landscape has changed significantly, and it is necessary to keep the Framework and capital system under review to ensure it adapts to reflect new risks and challenges, as well as being prepared for those which may emerge. Borrowing and investment decisions, if not undertaken and managed in a prudent way, may not deliver value for money and can place an authority’s financial sustainability at risk.

9. The risks associated with borrowing for commercial investments have received particular attention. Since 2016, there has been a significant increase in local authority borrowing correlated with an increase in commercial investment. The National Audit Office report Local Authority Investment in Commercial Property stated that the estimated local authority investment in commercial property from 2016-17 to 2018-19 was £6.6 billion and local authority commercial property acquisitions had risen by more than 14-fold in the period 2016-17 to 2018-19, compared with the preceding three years.

10. These trends are concerning as some authorities have taken on excessive debt in pursuit of commercial income and pursued investment strategies that place tax-payers’ money at undue risk. We updated our statutory guidance in 2018 with the aim of improving transparency and supporting sound decision-making. At the time of these changes, the government was clear that it would continue to monitor the trends and take further action if necessary.

11. Following the changes to our guidance, we conducted a post-implementation review of the impact in summer 2019. At the same time, the National Audit Office undertook its independent review of local authority commercial investment. Published in February 2020, the NAO’s report was the subject of an evidence session of the Committee of Public Accounts (PAC) in May 2020 and a subsequent report in July 2020. All of the reports were consistent in concluding that, while many authorities are compliant with the Framework, there remain some authorities that continue to engage in practices that push the bounds of compliance and expose themselves to excessive risk.

12. Further, although recent scrutiny has focussed on the risks associated with borrowing for commercial investments, it is clear that pursuit of commercial profit is not the only activity that creates risk to the system. government is aware of risky practices such as authorities taking on disproportionate levels of debt and pursuing novel investments for which they do not have the right skills and experience. Problems with governance and management of risk have been identified in recent cases of financial failure, as have issues arising with arms-length bodies such as local authority companies. The COVID-19 pandemic has exposed many of these fragilities in the capital system, which have likely existed for some time and must now be addressed.

13. The capital system also needs to be able to better constrain the risks associated with complex capital transactions. This includes credit arrangements, such as PFI deals or income strips, and financial derivatives. These types of arrangement can carry more risk than traditional forms of financing and require the right expertise to support effective decisions and risk management. As they are less well understood by non-experts, this can have the effect of decreasing transparency and reducing the scope for appropriate challenge.

14. All of this calls into question whether the capital system has kept pace with evolving sector risk. It is, therefore, timely for the government to review the system to identify and address its weaknesses.

4. Our plan

15. The capital system is complex, and it is unlikely that any single action by the government would successfully address all the issues that create excessive risk. Therefore, we are taking a number of actions across the system. These actions can be broadly considered on a scale from those that involve providing greater monitoring and scrutiny, to those that involve close working with local authorities to support and manage their commercial practices, to stricter actions that seek to prevent councils taking on undue risk.

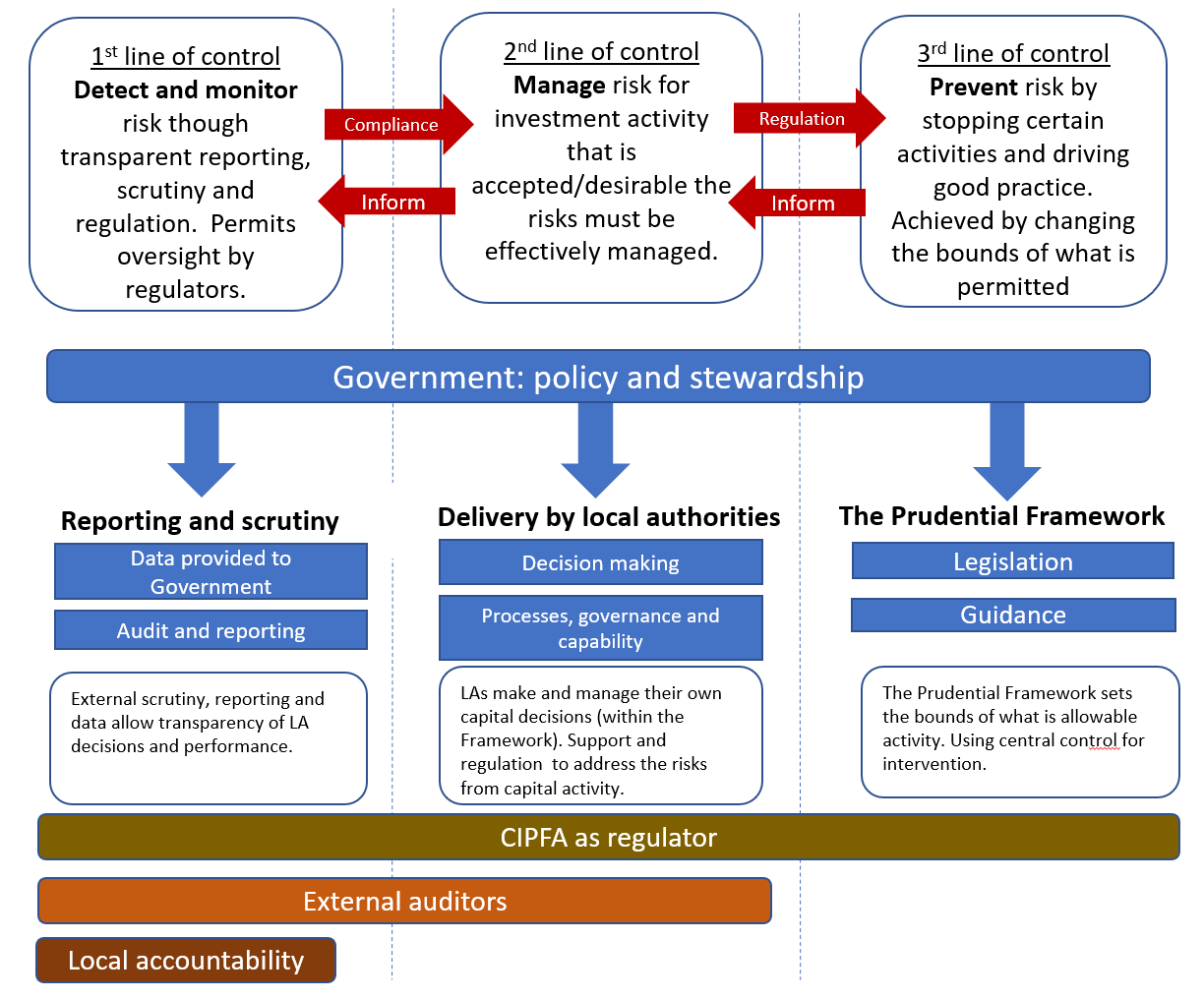

16. These actions can be considered using a ‘lines of control’ model:

i. The first line of control is the scrutiny of local authority activity, enabled by transparency and reporting. This includes effective monitoring by the government and others with a regulatory function, but also ensuring that there is sufficient transparency so that local authorities can be held to account locally.

ii. The second line of control is the system of controls within local authorities. At this level, government actions can directly address local mismanagement through direct engagement or support strengthening of local authority controls and capability to achieve better outcomes. This aims to strengthen local decision making and risk management by supporting improvements to capability and governance of investment decisions.

iii. The third line of control is the Prudential Framework itself. It uses the existing statutory powers for intervention, alongside opportunities to strengthen the Framework using secondary legislation to tighten what is allowable.

Figure 1: Three-lines of control model for strengthening the capital system

17. Our approach is to provide both universal oversight and a way of enabling targeted intervention where necessary. This seeks to put in place an approach which sets expectations for all, deters local authorities from excessively risky investment and borrowing practices, and provides the levers for directly addressing issues when appropriate.

18. We are developing options for a scaled approach to intervention, to ensure we can act on risk in a proportionate way. The interventions include light-touch measures of initial engagement and communication with the authority to understand the risk and clarify the government’s stance. They also include more intensive work such as involvement of auditors and, if needed and appropriate, escalation to interventions such as application of the statutory borrowing caps. The triggers for these interventions will be drawn from a range of data as part of our increased monitoring function. The work to assess risk and assign interventions will also use externally held tools, such as the CIPFA resilience index. This will expand on our existing approach for determining local authority risk, by addressing capital-specific concerns better.

5. Our objectives and planned actions

19. Our overall objective is to support effective, sound capital decisions that facilitate local objectives and government priorities. We will encourage capital expenditure and investment activities in line with these objectives but act to reduce excessive risks. We set out below the work we will undertake to achieve this.

Improving our role as an effective steward of the local government capital finance system (detect and manage)

To improve our stewardship of the local government capital system, we will ensure we have the appropriate data to monitor risks and provide targeted, proportionate intervention where necessary:

- We have completed our data survey designed to extract new data from local government and fill our identified information gaps. We are now working with the sector and stakeholders to update our regular data returns to ensure we continue to get the data we need. We will supplement this with deep dives to better understand the drivers and causes of certain behaviours.

- We are developing an analytical process to pre-emptively identify risks in the sector, including those local authorities that might be engaging in risky activity or non-compliance with the Framework. This involves better use of the quantitative data we collect, combined with intelligence gathered from sector engagement and monitoring. We will identify the early indicators of risk and build an ‘early warning system’ to permit timely intervention where needed.

- We are improving communication with local authorities about what is and is not acceptable. We are communicating earlier with local authorities when we become aware of certain activities.

Improving local practices and capability (detect and manage)

Devolved accountability places significant reliance on local processes, controls and governance being sufficiently robust to drive good decision making and risk management. We are aware that skills, capacity and practices vary from one council to another, and that more can be done to promulgate consistent good practice. We are committed to supporting improvements at a local level to achieve value for money while delivering local and government priorities:

- We are commissioning a review of the current governance and skills landscape for investment and borrowing within local authorities, to identify the systemic issues that prevent good practice.

- When the review is complete, it will form the evidence base for working with partners to develop training and guidance targeted at the identified issues.

Putting in place appropriate tools to intervene with local authorities where necessary (manage)

Government does not want to move to a system of central control, but it must have the levers to deal with instances of excessive risk and non-compliance with the Framework. Where authorities hold too much risk or demonstrate clear non-compliance with the principles of the Framework, we will consider direct measures:

- We are reviewing the statutory powers for capping borrowing and considering how and when we will apply these to protect local financial sustainability.

- We are developing a range of interventions to directly address risk. This starts with communications with individual local authorities but may also involve engaging local government auditors and other actors in the capital system. We recognise that actions need to be proportionate and appropriate.

- For the small number of authorities which have indicated a need or approached the government for support, and where the governance and management of that commercial investment has been a contributory factor, the government has provided support with the condition that the councils are subject to rigorous independent reviews that include the councils’ commercial activity and investments.

Ensuring that the Capital Framework is fit-for-purpose to constrain financial risk and drive sound decision-making (prevent)

We are reviewing the Prudential Framework and working with other actors in the capital system such as CIPFA and auditors to ensure the system remains effective in achieving its objectives:

- We are working closely with CIPFA as they update the Prudential and Treasury Management Codes. Following CIPFA’s updates, we will review our guidance to ensure they are consistent, complete and reinforcing.

- These plans are being taken forward alongside the implementation of the Redmond Review recommendations, recognising that audit and financial reporting are key mechanisms for scrutiny and transparency.

- Following the PWLB reforms designed to prevent debt-for-yield investments, we will review local authority capital plans for compliance with the PWLB lending terms, and will use the plans as a source of data to monitor system risks.

- We will further clarify the regulations and guidance relating to the Minimum Revenue Provision, so that all local authorities understand the need and value in ensuring revenue is setting aside annually in respect to all of their Capital Financing Requirement. This will in turn make sure borrowing is genuinely affordable and can be paid when it is due. We plan to launch the consultation in summer 2021.

6. Next steps

- We understand the wealth of knowledge that local authorities possess and their understanding of the practical implications of making changes to the capital system. We will engage with the sector and key stakeholders on our individual proposals as we take them forward.

- We will ensure that sector input is reflected in the development of the details of our proposals, through consultation where appropriate, to ensure that we are effective in achieving government’s objectives while avoiding unintended consequences.