CCS annual report and accounts 2024 to 2025: accessible version

Published 17 July 2025

Presented to Parliament pursuant to Section 4 (6A) (b) of the Government Trading Funds Act 1973 (as amended by the Government Trading Act 1990).

Ordered by the House of Commons to be printed on 17 July 2025.

HC1091

Welcome to Crown Commercial Service Annual Report and Accounts 2024 to 2025

In 2024/25 the Crown Commercial Service (CCS), as a Trading Fund and an Executive Agency of the Cabinet Office (CO), helped organisations across the entire public sector to save time and money on buying their everyday goods and services.

Who we are

The Crown Commercial Service is an Executive Agency and Trading Fund of the Cabinet Office and a key constituent of the Government Commercial Function.

Our purpose is tof help the UK public sector to better extract value from its commercial and procurement activity, with

- the commercial and procurement products and services that enable our customers to buy more efficiently and effectively and manage risk

- leverage the public sector’s combined demand so that each of our customers can better secure their quality, price, and wider policy, social and economic objectives

Our ambition is to increase the value the public sector gains from working with CCS year on year, through

- maximising our value and impact: making sure our products and services make effective procurement easier

- extending our coverage and influence to add value: making sure that we support customers to better extract value in those sectors and markets where we can have the biggest impact

- establishing a more effective and efficient organisation: making sure that we improve our leadership and management capability, enable our people’s development and deploy their skills to best effect, supporting them, buyers and suppliers with effective processes and technology

Our vision is to be a world class provider of commercial and procurement products and

services for the public sector. CCS will be customer focussed, trusted and admired by buyers and suppliers for our expertise and the quality of our offering.

We are committed to driving effective leadership through our organisation and we value our employees.

Our Values

Our values shape and drive everything we do. We listen, respect, collaborate and trust in order to deliver with confidence:

• we listen

• we respect

• we collaborate

• we trust

Performance highlights across the year

- £33 billion of public sector direct spend was channelled through our commercial agreements with an average commercial benefit rate of 10.49%

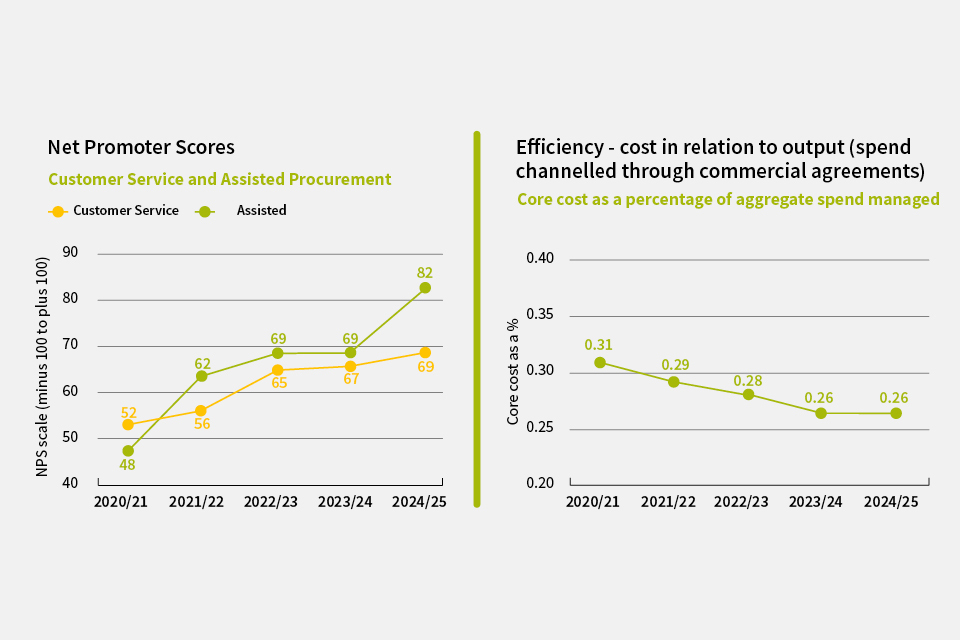

- Our Net Promoter Scores for customer satisfaction over the year were +69 for Customer Service and +82 for Assisted Procurement

- £2.3 billion (10%) of central government spend through our commercial agreements was directly with 1,468 SMEs

In line with government policy on prompt payment we paid 95% of undisputed supplier invoices within five days and 100% of undisputed payments due within 30 days

- April 2024: We celebrated our 10-year anniversary, following a decade of success and delivering value for our customers. Over the past 10 years we are proud to have gone from strength-to-strength, growing both our team and the commercial solutions we offer – and supporting more and more organisations across the public sector

- May 2024: We win an award at the National Go Awards for our collaboration with the Ministry of Defence (MoD) under our Network Services 3 agreement, which enabled the MoD to quickly procure tactical radios for urgent operations

- July 2024: Sam Ulyatt succeeded Simon Tse as Chief Executive of CCS. Previously serving as Chief Commercial Officer at the Home Office, Sam brings extensive experience in navigating and resolving complex commercial challenges. To learn more about her vision and priorities for CCS, please read her article in Civil Service World

- October 2024: We sign a new Memorandum of Understanding with Microsoft, offering access to enhanced value across Microsoft’s portfolio of products and services to eligible public sector organisations

- November 2024: We put in place a new, first of its kind, agreement that will help schools, local authorities, hospitals and other public sector organisations buy high-quality and sustainable food and drink at better value

- January 2025 : We launched a trial version of our Sustainable Solutions Finder, making it easier for buyers to identify the commercial agreements that help them meet their Carbon Net Zero goals

- February 2025: The Procurement Act 2023 went live, bringing significant changes to the regulations that govern UK procurement. We worked closely with the Cabinet Office to understand the new regulations and established a dedicated project team to help support public sector customers with implementing the new regime

- March 2025: Over 5,000 people have now attended our free of charge training sessions for CCS suppliers on how to create a Carbon Reduction Plan

Glossary

• ALB - Arm’s length body, an organisation that delivers a public service, is not a ministerial government department, and which operates to a greater or lesser extent at a distance from ministers

• CNZ - Carbon Net Zero. The target for the UK to bring all greenhouse gas emissions to net zero by 2050. Any emissions would be balanced by schemes to offset an equivalent amount of greenhouse gases from the atmosphere, such as planting trees or using technology like carbon capture and storage

• CCS - Crown Commercial Service

• CETV - Cash Equivalent Transfer Value

• CFBC - Counter Fraud, Bribery and Corruption

• CG&S - Common goods and services, products and services that multiple organisations need to purchase, from locum doctors and laptops, to police cars and electricity

• CG Central government, the ministerial departments

• CO - Cabinet Office

• Commercial benefits - The value that CCS drives for customers when purchasing through our commercial agreements. Our methodology allows for 2 routes for benefit calculations:

a. Spend benefits are based on sampling all spend through a commercial agreement and calculating average benefit for all the customer population using the agreement compared to current comparator market prices

b. Change benefits are a specific measure applicable to an individual customer usually as a result of a business change influenced by CCS and signed off accordingly by the customer

• Executive Committee - The Executive Committee manages the delivery of CCS’s strategic aims and provides leadership to the organisation. The Executive Committee is chaired by the Chief Executive and includes Director-level representation from the key directorates and functions in CCS

• FM - Facilities management

• FreM - The government Financial Reporting Manual, which is the technical accounting guide for the preparation of financial statements

• FTEs - Full time equivalent, the hours worked by one employee on a full-time basis

• GDPR - General Data Protection Regulation

• GGC - Greening Government Commitments

• GCF - Government Commercial Function

• GCO - Government Commercial Organisation

• GIAA - Government Internal Audit Agency

• GHG - Greenhouse gas

• GPA - Government Property Agency

• KPI - Key Performance Indicator

• ICT - Information and Communication Technology

• ISO - 14001 An internationally agreed standard that sets out the requirements for an environmental management system

• LGBTQ+ - Lesbian, Gay, Bisexual, Transgender, Queer communities

• MoU - Memorandum of Understanding, a type of agreement between two or more parties

• MPM - Managing Public Money, HM Treasury guidance for managing the spending of public funds

• MSAT - Modern Slavery Assessment Tool

• NAO - National Audit Office

• NHS FOM - NHS Future Operating Model, the programme to enhance procurement efficiency and effectiveness across the NHS

• NPS - Net Promoter Score, a measure of customer satisfaction

• PCSPS - Principal Civil Service Pension Scheme

• PES - Public Expenditure System

• ROCE - Return on Capital Employed

• SCS - Senior Civil Service

• Smarter Working - Smarter working empowers civil servants to make the right decisions about where, when and how they work; optimising the use of workplaces and technology, and realising savings for the taxpayer. It improves productivity through a focus on outputs and enables a better work life balance for all

• SMEs - Small and medium-sized enterprises (business of less than 250 employees)

• SOCNE - Statement of comprehensive net expenditure

• Social value - Social value legislation requires buyers of public sector services to consider whether there are related social, economic or environmental benefits that can be delivered through the contract, for example, creating more apprenticeships or reducing carbon emissions

• SOFP - Statement of financial position

• SRO - Senior Responsible Owner, the individual responsible for ensuring that a programme or project meets its objectives

• SSRB - Senior Salaries Review Body

• tCO₂e - Greenhouse gas emissions are referred to as tonnes of Carbon Dioxide equivalent. This is to ensure simplicity in reporting and consistency, and encapsulate a number of different gases such as Carbon Dioxide, Methane and Nitrous Oxides

• TOM - Target Operating Model

• VCSE - Voluntary Community and Social Enterprise

• WPS - Wider public sector, including local government, health and education, and third sector (charities

Performance report

Chair’s Statement

Peter George

It gives me great pleasure to write this Chair’s statement, having now spent my first full year as Chair of Crown Commercial Service. It’s been a year of a significant amount of change, but also a year where CCS has continued to grow and continued to deliver on the value that we can add to the public sector.

Last summer, our previous CEO Simon Tse retired after laying the 2023/24 Annual Report and Accounts in Parliament. We welcomed our new CEO, Sam Ulyatt, during the summer also, allowing for a comprehensive and smooth transition to new leadership. Sam has brought new energy to the leadership and organisation as a whole. The Board have no doubts that she will deliver on our goal of becoming a world class organisation.

On the day that Sam started in post, so did a new government. It was also the first full year of a new Permanent Secretary, with Cat Little leading Cabinet Office, our parent department. And in February, the new Procurement Act 2023 came into effect - and on the same day, a new Government Chief Commercial Officer, Andrew Forzani, took up his post and joined the CCS Board as a Non-Executive Director and CO Sponsor for CCS. As the financial year came to a close, it was also pleasing to be able to confirm Sean Golding in post as permanent Director of Finance, Planning and Performance after a year in the role as interim.

In addition to the above personnel changes, during the year the Office for National Statistics (ONS) also undertook a classification review of the sector classification of CCS of the statistical and financial reporting classification of public sector bodies in the National Accounts. The ONS concluded that CCS continues to meet the criteria to remain classified as a public corporation. Once Sam had a few months to settle into her role and the ONS classification review outcome was known, it was important that the Board and the Executive came together in November to reaffirm CCS’s strategic direction and purpose, as well as the vision for CCS to 2030. The organisation has also made significant progress developing its new brand strategy to really cement this and to ensure the organisation is focused on delivering value for the nation.

Because of all these factors, 2024/25 has been a huge year of significant changes in the Civil Service landscape for CCS, but as Chair of the Board, it has been reassuring that the organisation has been stable and continued to deliver through all of this, not least in part thanks to Sam’s and the Executive Committee’s leadership. CCS has once again delivered significant commercial benefits to our customers.

With the renewed strategy, Sam and the Executive Committee are now really focussing on a new customer strategy to crystallise the service offering for our 19,000 plus customers. Our ambition is to be a world class central commercial and procurement organisation and the preferred choice for customers and suppliers. We will be a customer focused organisation which is influential for, and with, the UK public sector. CCS needs to continue to focus on what only we can do to drive value for the nation, and ensuring that we are the best at what we do, and I am confident that the strategy, ambition, purpose and values that the organisation has committed to will help us to achieve this.

CCS is exceptionally well placed to deliver on the government’s missions, and to help the government deliver on the efficiency and productivity needed across the public sector. The new customer strategy and improved customer journeys will help CCS maximise the potential that is there and really ensure we are delivering value for the nation.

Peter George

Chair

Chief Executive’s introduction

Sam Ulyatt

It’s a pleasure to be publishing my first CCS Annual Report and Accounts as the Chief Executive and Accounting Officer, having completed 9 months in post. Having worked at CCS previously as a Commercial Director, I have always believed in the mission of, and further potential for, the organisation. It has been great to come back to CCS as CEO, and it is a privilege to lead this organisation that marked its 10 year anniversary in 2024.

My first day as CEO was also the first day of a new government, and it’s been a really exciting time as we’ve worked with colleagues across the Civil Service and Ministers to really demonstrate how we can contribute to the efficiency, productivity and reform ambitions of the government. As CEO, it’s been inspiring to see how colleagues are rising to the ambitions of both the government and our own strategy.

CCS continues to deliver efficiency and productivity for our customers. In 2024/25, I am delighted that we have provided value to our customers with commercial benefits averaging 10.49% against market comparators. As our product portfolio continues to mature and improve, we can drive even more value through our agreements, by further aggregating the buying power of the public sector, as well as saving our customers time and money through using our commercial agreements to call off. I am delighted that our success as an organisation enables us to continue to invest in commercial capability across the public sector. One such success has been the Contract Management Pioneer Programme, in collaboration with Government Commercial Function (GCF), Ministry of Housing, Communities and Local Government and Local Government Association, which has seen us invest £4 million over 3 years, with 75 councils participating in sharing knowledge and experience and over 400 learners benefitting from intensive training in contract management. In 2024/25, we also ran a customer payment initiative, successfully paying out over £33 million to our customers who have used our agreements, allowing them to reinvest in their own organisations.

As a leader, my biggest asset in this organisation is our people, and it’s personally important to me to be a values led CEO. The CCS values of Listen, Respect, Collaborate and Trust are as important now as they were when they were established. I was therefore very pleased with the 91% response rate to the 2024 Civil Service People Survey and the 5 percentage point increase in engagement scores to 67%. There are still areas for improvement and the 3 priorities agreed by the Executive Committee for 2025 are Leadership, Change Management and Talent Development.

Beyond the People Survey action plan priorities, we continue to ensure that we are doing all that we can to ensure that CCS is a great place to work, as it is vital to the success of the organisation. People do their best work when they are engaged and feel included and supported in their wellbeing. I was delighted therefore that CCS received another Gold Award from Mind in their Workplace Wellbeing Index. CCS is also now in the top 75 employers in the Social Mobility Employer Index, as well as achieving Level 2 ‘Accomplished’ status in the Carer Confident scheme. We’ve expanded our internship and placement opportunities, welcoming 7 interns through the Autism Exchange Internship Programme and the Leonard Cheshire Change 100 Programme, as well as working with DWP to support the Movement to Work Programme in Merseyside.

We have also been recognised for our professional expertise, with wins at the GCF Awards in the Collaboration and Partnerships category for our work with the NHS to transform how they buy energy. We also won another Collaborative Procurement Initiative Award - Central Government at the National GO Awards for our work with the MOD on the Defence Tactical Radio procurement programme. We were shortlisted for 5 nominations at the CIPS Excellence in Procurement and Supply Chain awards, as well as two nominations at the iNetwork Innovation Awards that celebrate innovation across the local public sector, but unfortunately were not winners on the night. It is always wonderful to see our people and our teams being celebrated for the value that they can bring to our customers.

In my time away from CCS, I myself have gained insight on the other side of the fence as a user, and I am keen to use this insight and experience to continue to drive the organisation forward. The review of CCS’s classification status and confirmation of continued public corporation status was important for me to be able to work with the Board and the Executive Committee to reaffirm our organisational strategy and our ambition, purpose and values as we look to where we want to be in 2030 so that we can truly deliver Value for the Nation. This also followed on the back of the NAO’s report on ‘Efficiency in government procurement of common goods and services’, which particularly looked at CCS and how we can best operate to support the public sector to extract maximum value from their procurement. The report acknowledged the progress we have made and our role, especially in aggregating purchasing, allowing the public sector to get the benefit from collective buying.

In January 2025, the National Audit Office (NAO) also published another report on ‘Government’s approach to technology suppliers: addressing the challenges’, which involved CCS. This report, as well as the publication of the Blueprint for Modern Digital Government report, have presented the opportunity for CCS, the GCF and Department for Science, Innovation and Technology to collaborate to address the challenges, and a Digital Commercial Centre of Excellence has been established to bring together the digital and commercial functions for digital procurement through: working with big technology suppliers; producing a digital sourcing strategy aligned to a jointly refreshed Digital, Data and Technology playbook, developing a reliable pipeline forecast for digital procurement, and supporting building more expertise in government. This is an exciting opportunity for new ways of working across functions, and is a model that could be replicated elsewhere if successful.

The opportunities to do things better across the public sector have also significantly shifted for the positive with the implementation of the new Procurement Act 2023 in February. CCS has been working closely with Cabinet Office colleagues for many years on the new regulations, ensuring that we are able to best exploit the new flexibilities and opportunities that the Regulations provide. Our Transforming Public Procurement project has successfully prepared us for the new Regulations and I am delighted to say that we had four agreements go out under the new regulations between go live of the Act and the financial year end. The appointment of Andrew Forzani as the new Government Chief Commercial Officer also presents the opportunity for CCS and the commercial function to collaborate even further, and I was pleased to welcome Andrew to the CCS Board as a Non-Executive Director and CCS’s Sponsor in CO.

With the implementation of the new Regulations came the new National Procurement Policy Statement, with the government setting out their policy priorities and how procurement can deliver on them. CCS has always enabled delivery of government policy through our commercial agreements, and will use the flexibilities of the new Act to continue to support our customers to achieve their Social Value, SME and Net Zero ambitions and deliver on the government’s missions.

In our work this year to reaffirm our strategy, purpose, ambition, vision and values, we have ensured that we are well positioned to maximise the opportunities that the new government, new Regulations and new ways of working across the public sector will bring. We have 9 ambitious strategic outcomes that will take us to 2030, and these underpin our annual business plan.

Optimising the value we provide for our customers and suppliers:

- customers save time and money by working with CCS

- CCS commercial agreements establish and maintain a capable and diverse supply chain that supports the UK economy and society

- the UK public sector chooses CCS digital solutions to transact a significant proportion of low value purchases

- CCS products and services are designed and deployed to support customers and achieve the best value

Maximising our impact by using our expertise and insight:

- the public sector recognises CCS as a key enabler of improved commercial outcomes through use of its relationships and unique position

- customers and suppliers recognise CCS as an authority in its markets through its expertise and scale

- CCS provides authoritative data and decision enhancing insight for the public sector

Building an effective and efficient organisation:

- our people are highly engaged and recognise CCS as a great place to work

- CCS is a well-run, resilient, and financially stable organisation

The government’s commitment to ensuring the efficiency and productivity of the public sector is something that we can help to drive by providing good quality commercial agreements that are easy for customers and suppliers to use, supporting small business and stimulating economic growth. We continue our digital and data transformation journey, ensuring that we are providing the right platforms, and turning the data that we have access to into actionable insights for our customers and suppliers across the commercial function and public sector. As well as our continued focus on our customer strategy and improving our customer journeys, just as vital is the work we do with suppliers. This year, we introduced a new Supplier Specifics series, to complement our Procurement Essentials series, a publication that will help educate suppliers, particularly SMEs, about a number of topics, to build confidence and result in better relationships, as well as encourage more suppliers to apply for places on our commercial agreements and successfully contract with the government.

With all these opportunities and ambitions to improve, I am conscious of the feedback from the People Survey about managing change, and that we are still sometimes trying to do too much in a way that is not coordinated or always aligned to our strategy. With that in mind, in the year ahead, I will be appointing a new Strategic Delivery Director to bring it all together and ensure we are moving forward in a coordinated, planned and cohesive way. There will continue to be challenges and we expect more reform of the Civil Service to come in the new year, not least from the ALB review, which we will participate in fully. Through all of these challenges, I look forward to working with my Board and Executive Committee as we lead the enterprise as one team, so that we can all collectively deliver value for the nation.

Sam Ulyatt Chief Executive and Accounting Officer

Statement of purpose, scope and strategy

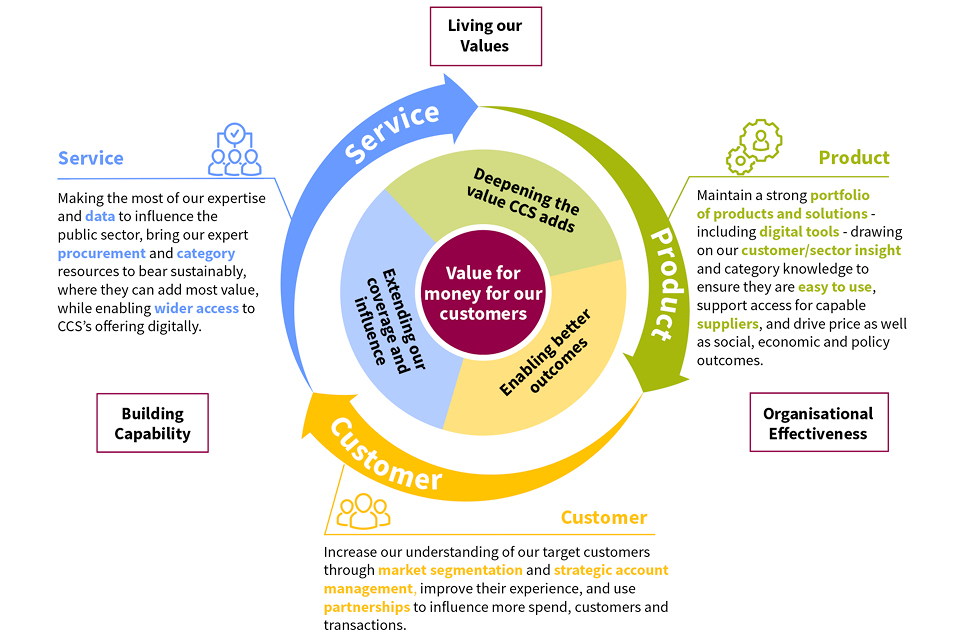

In 2024/25, CCS pursued three strategic priorities:

- maximising our value and impact

- extending our coverage and influence to add value

- establishing a more effective and efficient organisation

Our Business Strategy implements our strategic priorities by focusing on enhancing CCS’s key interventions - Customer, Service and Products - and developing and sustaining the critical enabling activity which will allow the organisation to operate effectively and sustainably at the greater scale. It is aligned to the Government Commercial Function strategy and supports the delivery of the Commercial Functional Plan.

Service: making the most of our expertise and data to influence the public sector, bring our expert procurement and category resources to bear sustainably, where they can add most value, while enabling wider access to CCS’s offering digitally.

Product: maintain a strong portfolio of products and solutions - including digital tools - drawing on our customer/sector insight and category knowledge to ensure they are easy to use, support access for capable suppliers, and drive price as well as social, economic and policy outcomes.

Customer: increase our understanding of our target customers through market segmentation and strategic account management, improve their experience, and use partnerships to influence more spend, customers and transactions.

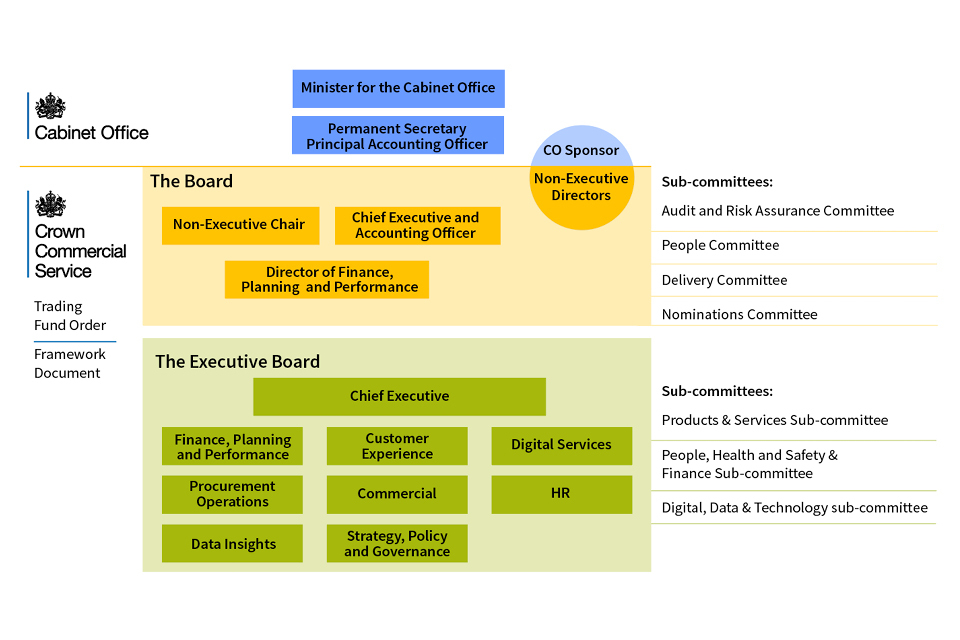

Organisational structure

Our organisational structure and governance arrangements are:

- Minister for the Cabinet Office

- Permanent Secretary and Principal Accounting Officer

- Cabinet Office Sponsor

- Trading Fund Order

- Framework Document

The Board:

- Non-Executive Chairman

- Chief Executive and Accounting Officer

- Director of Finance, Planning and Performance

- Non-Executive Directors

The Executive Committee:

- Chief Executive

- Finance, Planning and Performance

- Customer Experience

- Digital Services

- Procurement Operations

- Commercial

- Strategy, Policy and Governance

- HR

- Data Insights

Board sub-committees:

- Audit and Risk Assurance Committee

- People Committee

- Delivery Committee

- Nominations Committee

Executive Committee sub-committees:

- Products & Service Sub-committee

- People, Health and Safety & Finance Sub-committee

- Digital, Data & Technology sub-committee

Performance overview

The purpose of this section is to provide a summary of progress made against the three strategic priorities within our organisational strategy along with an overview of our financial performance. It also sets out the key strategic risks that have been and continue to be actively managed as we move forward.

1. Maximising our value and impact

To maximise value and impact, we enhanced our ability to assess the value delivered to customers, stakeholders and ourselves. A prototype Customer Value Scorecard was developed in October and successfully implemented across existing customer sector strategy groups, facilitating informed decision-making and strategic prioritisation.

We focused on enabling commercial benefits by improving our pricing performance against market comparators. In 2024/25, we partially achieved this objective, securing a commercial benefit rate of 10.49% and a spend-related commercial benefit value of £4.6 billion. These results show considerable progress in offering competitive pricing and delivering substantial stakeholder value.

Our efforts to enhance aggregation activities aimed at increased customer benefits include expanding beyond the Technology sector. While partially achieved in 2024/25, we continue to refine our approach as we move into 2025/26, acquiring better data to facilitate more effective aggregation and broader application. We fully achieved our goal of completing customer engagement pilots for 2024/25, underscoring our commitment to refining market strategies through active customer involvement to address priority areas and enhance stakeholder value.

In supplier assurance, while we completed pilots, the digitisation of supplier management is ongoing, leaving this objective partially achieved for 2024/25. Continued efforts are necessary to fully implement digitisation and enhance supplier risk assurance. With procurement reform enforced by new legislation, we concentrated on compliance risk mitigation and leveraging regime flexibility. The Act’s commencement in February facilitated a transition involving four agreements under the new legislation during 2024/25, ensuring our customers effectively adapt to mandated changes.

Our customer payment initiative was completed in 2024/25, with £33.1 million paid out to customers confirming payment arrangements, highlighting our commitment to providing significant financial benefits and robust support to our customers.

2. Extending our coverage and influence to add value

During 2024/25, we successfully achieved a key deliverable in the development of a refocussed brand strategy. We developed and signed off a clearly articulated brand value proposition, with the aim of embedding a renewed focus on CCS adding value to the public sector. This initiative aims to increase brand awareness, strengthen our position within the market and enable customers to see the value they can achieve in working with us. The brand strategy is now being embedded with plans for a gradual transition over the coming months, marking a significant step in our ongoing commitment to positioning CCS as a customer-led organisation.

In 2024/25, we made significant progress with our sector strategies initiative, aimed at enhancing support for public sector commercial and procurement activities. This deliverable seeks to create a coordinated and prioritised approach that maximises value for our stakeholders. While the sector strategies have been developed, the finalisation of delivery plans remains ongoing, indicating continuous effort to fully achieve this objective. Our focus remains on refining these strategies to ensure they provide optimal support and deliver substantial value in public sector engagements.

3. Establishing a more effective and efficient organisation

In 2024/25, we fully achieved our key deliverable of enhancing leadership capability by successfully implementing a leadership development programme. This initiative underscores our commitment to fostering effective leadership within the organisation.

We have made strides in improving the oversight and coordination of our portfolio’s projects and change initiatives. A prioritised view and approach to managing these projects have been developed, though the complete implementation of the change management framework remains a work in progress.

We have made headway towards defining and agreeing upon a target operating model, fostering a common understanding of the necessary changes for its implementation. The process included mapping our business architecture and evaluating the maturity of our systems, data, and processes, which will undergo further refinement in 2025/26.

Organisational development efforts have led to partial progress towards establishing a common understanding of optimal design and resource deployment. While workforce planning has been initiated, its advancement is currently constrained by the development of the operating model, necessitating continued focus and refinement.

The development of a new digital operating model is underway, aiming to enhance our digital products and services for customers while improving CCS’s overall efficiency and effectiveness. Following approval of the business case in October 2024, phased implementation has begun, including active recruitment efforts to support this transition.

The data strategy initiative has been fully achieved against the project plan to date, providing enhanced insights to inform decision-making, strengthening our value proposition to customers. Planned activity for 2024/25 has been successfully delivered, with the Executive Committee and the Board endorsing the Outline Business Case. Implementation of Phase 1 is currently underway alongside the development of a final business case.

Efforts to improve knowledge and information management, along with data governance are ongoing. While a data maturity assessment has yet to be performed, a project team is actively working to determine the requirements for migration, aiming to ensure effective management of our information assets and mitigate risks stemming from system changes.

Financial performance

We exceeded our financial targets in 2024/25. Total income was £222.7 million and expenditure was £107.5 million, delivering a surplus before other operating costs of £115.2 million (2023/24: £63.7m). Other operating costs of £27.9 million were also incurred relating to CCS Capability and Investment costs, Digital and Data Services and Procurement Capability. After interest and dividends, the retained deficit was £65.2 million (2023/24: deficit of £9.7m). The in-year deficit incorporated a dividend of £161.0 million to the Cabinet Office. Alongside this, CCS continues to expand the use of our commercial agreements with a focus on improving the value and commercial benefits arising to customers. We also continued to manage our cost base effectively with headcount in the organisation particularly closely managed.

The opening General Reserve of £167.9 million decreased to £102.7 million. Indexation of intangible assets resulted in an overall revaluation increase of £0.8 million. There was no change to Public Dividend Capital (£0.35m) meaning that the total of taxpayers’ equity in CCS decreased from £168.9 million to £104.5 million. More information is contained within the notes to the accounts on pages 82 to 98.

The Dividend payable to the Cabinet Office was £161.0 million in 2024/25 (2023/24: £71.0m) and is used to fund the expansion of commercial capability across government, including upskilling the commercial workforce, providing expertise on complex projects and managing relationships with strategic suppliers.

In 2024/25 CCS achieved a Return on Capital Employed of 64.1% (2023/24: 31.0%) which was significantly above the 5% target as set out in the Treasury Minute. The last six years of CCS’s income and costs are shown on page 100.

We continue to deliver commercial benefits and stimulate growth in customer spend through enhanced internal systems, digitised online access to our commercial agreements and focus on how we can add value through improved ways of working for both our customer users and suppliers.

We have continued our commitment to paying creditors in line with government policy on prompt payment. In 2024/25 CCS paid 95.3% (2023/24: 99%) of undisputed supplier invoices within 5 days and 100% (2023/24: 100%) of undisputed payments due within 30 days.

As a Trading Fund, CCS is expected to generate sufficient funds to meet its operating costs and prevent the need for recourse to the Cabinet Office or HM Treasury for financial support. Prudent financial management means that CCS ensures sufficient cash reserves are in place to mitigate against financial risk arising from any sudden reduction in customer demand, unexpected increases in expenditure or inability to collect income through systems failure. CCS will continue to adopt prudent cash and working capital management to ensure it is able to continue to operate as a going concern.

Key issues and risks that could affect CCS in achieving its objectives

We manage risk across all activities carried out by the business at a strategic and operational level, focusing on achievement of our Business Plan objectives. Risk management is coordinated across a network of risk management champions and business managers representing each team within the business.

Risk is appraised and managed in accordance with CCS risk management policy and practice. Our Strategic Risk Register is aligned to our business strategy and Business Plan and focuses on addressing the causes of each risk through a targeted set of mitigations. The causes are dynamic and are continually reviewed and updated to reflect any difficulties that the business foresees or experiences, including any arising from our analysis of the global and domestic political, economic and social context in which we operate. The Executive Committee and its sub-committees continue to have collective ownership of the risks and the Board sub-committees provide scrutiny on the effectiveness of mitigations to reduce risk in line with appetite and tolerances.

The Executive Committee and its sub-committees receive a risk insight report on a bi-monthly basis to enable a review of the effectiveness of mitigations. They also have access to the live Strategic Risk Register. The strategic risks are underpinned by a set of dynamic causes which are the focus of mitigating action. Those causes (typically more than 30 at any one time) change over the course of the year which impacts both the residual and inherent assessment scoring of risks. Additionally, there has been a wholesale review of risks and causes during Q4. This means that the risk assessment levels are not comparable to 2023/24.

Operational risks are reviewed by the Risk Assurance Group and a summary report is provided to the Executive Committee sub-committees on a bi-monthly basis.

The Audit and Risk Assurance Committee provides scrutiny of the overall system of governance, risk management and control.

The areas of strategic risk that had the potential for preventing the business from achieving its objectives in 2024/25 are set out in the following table. All of these risks are subject to continuous review.

Mitigations for the causes of each risk are documented and managed as part of the Strategic Risk Register.

| ID | Risk | ExCo owner | Failure to | Results in |

|---|---|---|---|---|

| 1 | Customer Value | David Skinner | Deepen our relationships with our customers across the public sector whilst delivering compelling value for the nation through the delivery of our expertise and services products / solutions (simpler, faster & better) | Negative customer perception of CCS products, services and solutions and reputational damage leading to a loss of customers to competitors |

| 2 | Supplier Management | Colin Morrow | Manage and actively develop our supply base effectively along with providing appropriate levels of assurance (financial and non financial) expected by customers | Supplier failure, an under utilised supply base and negative customer and supplier perception about the value of doing business with CCS |

| 3 | People Capability | Les Brewster | Develop and retain required capability and to deploy resources flexibly across the organisation to meet priority business needs and to sustain continued business growth and to meet customer need | Insufficient capability and capacity resulting in a workforce that is less agile or flexible to respond to customers needs and meet the needs of the business to achieve successful implementation of the Business Plan |

| 4 | Technology & Digital Capability | Stewart Hamilton | Deliver technology and digital solutions aligned to the business strategy which meets the needs of our business and our customers (buyers and suppliers) | Inability to grow or continue to support data driven business growth, loss of customers to competitors, inefficient technical implementations causing reputational damage/technical debt, and ineffectiveness in streamlining resources or sustaining workload |

| 5 | Organisational Effectiveness | Sean Golding | Continuously improve organisational efficiency, effectiveness and sustain business growth and meet customer needs whilst operating effectively within agreed resource levels | Loss of confidence from the Board (and other key stakeholders including customers) in the organisation and associated reputational damage |

| 6 | Change | George Last | Identify, define, prioritise and deliver improvements and change required to deliver our organisational and customer strategies | Failure to achieve our ambition and to implement our strategies efficiently, effectively and with engaged staff |

Performance analysis

How CCS measures its performance

Organisational performance has been measured on a monthly basis through a corporate dashboard, which tracks progress against Business Plan objectives and the Business Strategy and forms the basis of a formal monthly review at the Executive Board and its sub-committees. The Executive Board also performs a quarterly performance review with a focus on key risks and issues.

Organisational performance has been a standing agenda item at Board meetings. A summary performance report has been produced for this, drawing upon the corporate dashboard.

Key objectives in CCS Business Plan

Strategic Priority 1: Maximising our value and impact

| Key Deliverable | Headline Measure | 2024/25 Target | 2024/25 Result |

|---|---|---|---|

| 1. Measuring our Value | Enhanced ability to measure the value we provide for our customers in ways that are relevant to them, to stakeholders and to us and to use this management information to improve our offering and prioritise our effort |

A coherent suite of “value” performance measures with baselines and targets for each measure, where relevant by sector By December 2024 |

Fully achieved The prototype Customer Value Scorecard was developed in October and has been socialised and released to the existing customer sector strategy groups (Delivery Authorities) |

| 2. Enable Commercial Benefits | Demonstrably improved pricing compared to market comparators | Maintain and seek to improve percentage price benefit of using CCS commercial agreements compared to market comparators from 10.33% By March 2025 |

Partially achieved A commercial benefit rate of 10.49% was achieved Spend related commercial benefits value of £4.6 billion was achieved |

| Demonstrably improved pricing compared to market comparators | Achieve benefits of £4.8 billion by March 2025 |

||

| 3. Aggregation | Increased benefits for our customers from aggregation | Continue implementation of the strategy to increase aggregation benefits in priority categories. By October 2024 |

Partially achieved and ongoing Refinement of approach taking in wider application of aggregation activities beyond Technology Greater clarity on data required to enable more effective aggregation |

| 4. Strategic Category Management | More influential supply market strategies | Undertake customer engagement pilots for priority market strategies by December 2024 and commence rollout by March 2025 | Fully achieved Customer engagement pilots are complete |

| 5. Supplier Assurance | Enhanced supplier risk assurance for our customers | Complete implementation of the digitisation of supplier management Pilot implementation of agreed supplier assurance offering for customers By December 2024 |

Partially achieved and ongoing Pilots have been completed but digitised supplier management is not yet complete |

| 6. Procurement Reform | Provide customers with compliance risk mitigation and enable opportunities to take advantage of the flexibility and differences in new regime to create value | Complete a managed transition from PCR15 to the new regulations By March 2025 |

Fully achieved Legislation came into effect in February. 4 agreements were tendered under the new arrangements during 2024/25 |

| 7. Customer Payment Initiative | Tangible benefit returned to customers | Payments made to all intended recipients By December 2024 |

Fully achieved £33.1 million paid out to those customers that confirmed payment arrangements |

Strategic Priority 2: Extending our coverage and influence to add value

| Key Deliverable | Headline Measure | 2024/25 Target | 2024/25 Result |

|---|---|---|---|

| 8. CCS Brand | A clearly articulated brand value proposition with consistent internal and external understanding and appreciation for CCS’s core purpose and increased brand awareness |

Review CCS brand proposition with a view to establishing a revised and comprehensive approach to brand positioning, underpinned by marketing and communications By December 2024 |

Fully achieved The brand strategy has been agreed and signed off and will be rolled out internally and externally as part of a soft launch over the coming months |

| 9. Sector Strategies | A coordinated and prioritised approach to supporting public sector commercial and procurement activity that maximises value | Development and implementation of sector strategies for priority sectors By October 2024 |

Partially achieved and ongoing Sector strategies have been developed Delivery plans are still under development |

Strategic Priority 3: A more efficient and effective organisation

| Strategic Priority 3: A more efficient and effective organisation | |||

|---|---|---|---|

| Key Deliverable | Headline Measure | 2024/25 Target | 2024/25 Result |

| 10. Leadership | Improved leadership capability | Executive Committee and SCS Leadership Development Programme to focus on enterprise leadership and leading change |

Fully achieved Leadership development programme has been implemented |

| 11. Management of Change | More effective oversight and coordination of projects and change initiatives across our portfolio | Create a prioritised/sequenced enterprise view of change across CCS to enable clear alignment of change initiatives to business targets and better manage our resources Establish and implement a new change management framework to improve consistency of delivery, manage risk and impact of change on business By September 2024 |

Partially achieved and ongoing Prioritised view of change projects and initiatives has been established along with a prioritisation approach Change management framework is still to be fully implemented |

| 12. A defined and agreed target operating model | Common understanding of CCS’s target operating model and the change required to implement it | Fully map CCS’s current operating model By December 2024 |

Partially achieved and ongoing Process completed to mapping business architecture and assessing maturity of systems, data, and processes This analysis will be subject to further work in 2025/26 |

| 13. Organisational Development | A common understanding of optimal organisational design and resource deployment | Build a common understanding of the optimal organisational design and resource deployment alongside the operating model objective, making changes happen as appropriate. By March 2025 |

Partially achieved and ongoing Workforce planning has been carried out which is limited by the progress made on the operating model |

| 14. A new digital operating model | A more effective digital product and service offering to customers and a more efficient and effective CCS | Completion of final business case By October 2024 Implementation of phased digital target operating model From December 2024 |

Partially achieved and ongoing Business case signed in October 2024 Phased implementation is underway with recruitment being carried out |

| 15. Data Strategy | Better insight to inform decision making and strengthen our value proposition to customers | Deliver phase 1 of the enterprise data strategy, focusing on the customer By September 2024 |

Fully achieved Phase 1 has been delivered Outline Business Case for next phase endorsed by Executive Committee and the Board and implementation is underway |

| 16. Knowledge and Information Management and Data Governance | Effective management of our information assets and mitigation of risk from system changes | Significantly improve CCS Data Governance maturity assessment By March 2025 CCS establish project team to coordinate and deliver potential migration from Google to Microsoft in line with Cabinet Office requirements By March 2025 |

Partially achieved and ongoing Data maturity assessment has not been carried out Project team in place determining requirements for migration |

Strategic KPIs

| ID | KPIs | Measuring | Aim / trend | Base / target | Year end | % of target | |

|---|---|---|---|---|---|---|---|

| Customer | 1 | NPS assisted procurement | Customer advocacy | Increase | 55 | 82 | 149% |

| 2 | CSC (1st line) - % of calls resolved within 24 hours | Responsiveness | Increase | 81 | 96 | 119% | |

| 3 | Customer volume (reach) - LC&H (rolling baseline reflecting in month comparison v 2023/24) | Growth priority sector | Increase | 4,441 | 4,278 | 96% | |

| 4 | Customer volume (reach) - Health (rolling baseline reflecting in month comparison v 2023/24) | Growth priority sector | Increase | 2,275 | 2,170 | 95% | |

| 5 | Average price benefit rate (new customers) vs market % (Aggregate spend) | Price effectiveness | Increase | 10.33 | 10.49 | 102% | |

| Products & Services | 6 | At least 12 Market Strategies available through Kahootz to customers by March 2025 | Effectiveness | Achieve | 12 | 14 | 117% |

| 7 | New commercial agreements endorsed by the customer (forecast) | Customer advocacy | Achieve | 19 | 12 | 63% | |

| 8 | TPP: At least 8 procurements ready to be published to market, compliant with Procurement Act 2023 | TPP compliance | Target not used due to delay in legislation | ||||

| 9 | Supplier Certification rate % | Supplier compliance | Increase | 85 | 77 | 91% | |

| People & Capability | 10 | Maintain agreed staffing establishment | Headcount control | Achieve | 844 | 851 | 101% |

| 11 | Absence (Average Working Days Lost) | Productivity | Decrease | 6.3 | 8.4 | 133% | |

| 12 | Manager to employee ratio (spans of control) | Hierarchical structure | Increase | 2.6 | 3.0 | 115% | |

| 13 | % of Gov Functional Standards rated as at least "Better" | Functional capability | Increase | 45 | 45 | 100% | |

| Financial | 14 | Cost as a % of income | Organisational efficiency | Decrease | 48% | 46% | 105% |

| 15 | Trading Fund core operating surplus / deficit £m | Budget performance | Achieve | 127 | 118 | 93% | |

| 16 | Income for the Trading Fund £m | Budget performance | Increase | 236 | 220 | 93% | |

Key measures of success

Commercial benefits - the value that CCS drives for customers when purchasing through our commercial agreements. Our methodology allows for two routes for benefit calculations:

- ‘Spend Benefits’ are based on sampling all spend through a commercial agreement and calculating average benefit for all the customer population using the agreement, compared to current comparator market prices

- ‘Change Benefits’ are a specific measure applicable to an individual customer usually as a result of a business change influenced by CCS and signed off accordingly by the customer

Work is being carried in collaboration with customers to transition towards measuring customer savings in the future

Our aim is to continue to attract more business from both new and existing customers so that the public sector is able to realise increased commercial benefits in terms of benchmarked prices, as well as quality goods and services.

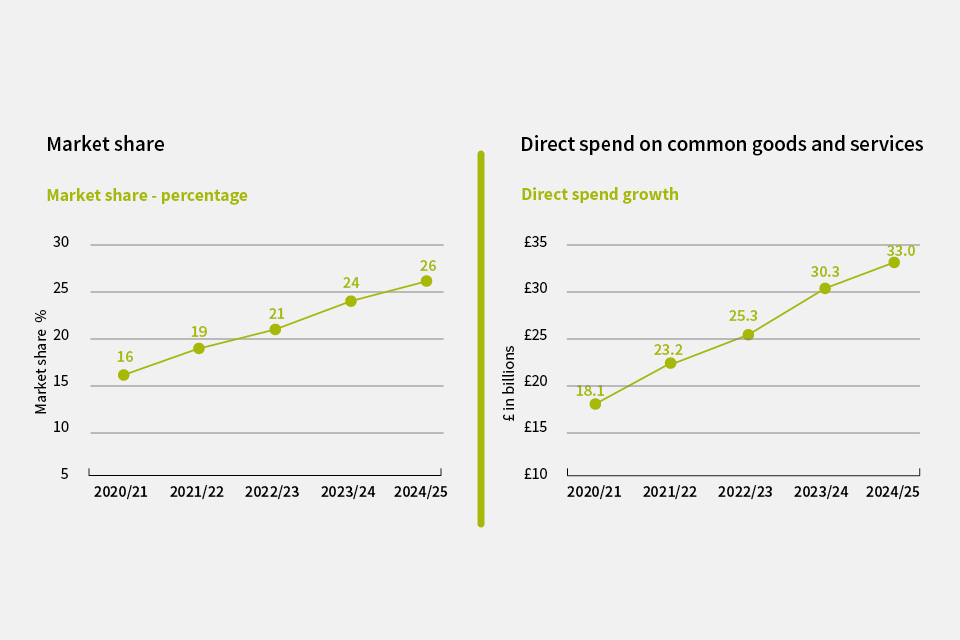

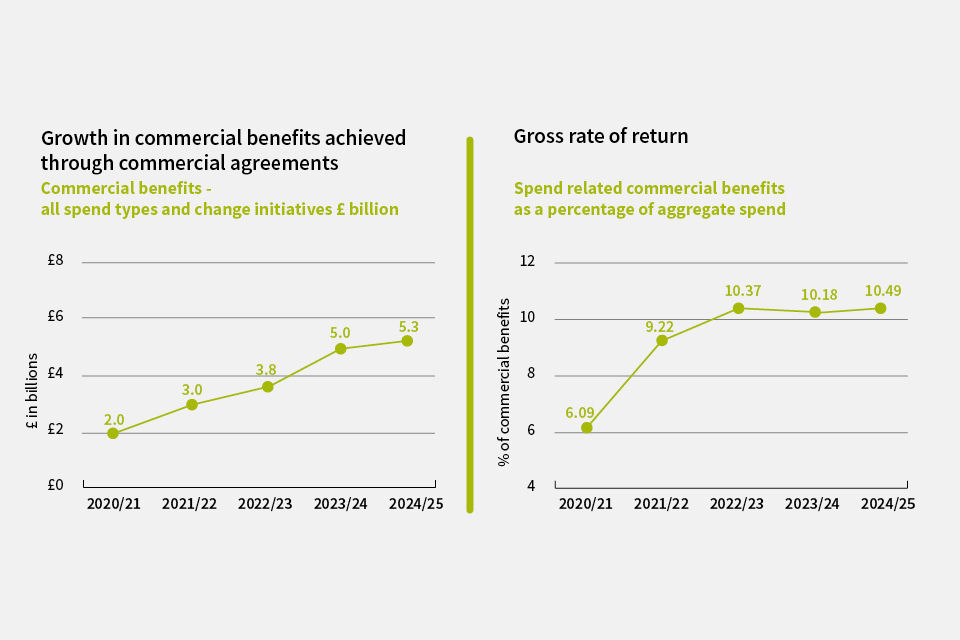

The graphs illustrate over the period 2020/21 to 2024/25 the following:

- growth in our market share

- growth in spend directly through our agreements

- growth in commercial benefits achieved through commercial agreements

- the gross rate of return - benefits as a percentage of spend

- the upward trend in our Net Promoter Scores for Assisted Procurement and Customer Service

- the downward trend in our core costs in relation to the output we manage (spend through the portfolio of commercial agreements)

Market share and direct spend growth

Direct spend on common goods and services increased from £18.1 billion in financial year 2020/21 to £33 billion in financial year 2024/25.

Growth in market share increased from 16 percent in financial year 2020/21 to 26 percent in financial year 2024/25.

Growth in commercial benefits achieved through commercial agreements and gross rate of return

The growth in commercial benefits achieved through commercial agreements, has increased from £2 billion in financial year 2020/21 to £5.3 billion in financial year 2024/25.

The growth in spend related commercial benefits as a percentage of aggregate spend, increased from 6.09 percent in financial year 2020/21 to 10.49 percent in financial year 2024/25.

Net Promoter Scores and efficiency - cost in relation to output (spend channelled through commercial agreements)

The net promoter scores have improved:

- the customer service score has increased from a score of 52 in financial year 2020/21 to 69 in financial year 2024/25

- the assisted procurement score has increased from a score of 48 in financial year 2020/21 to 82 in financial year 2024/25

The core cost as a percentage of aggregate spend managed, decreased from 0.31 percent in financial year 2020/21 to 0.26 percent in financial year 2024/25.

Sustainability report 2024/25

The UK government has made a commitment to be Carbon Net Zero (CNZ) by 2050. The Greening Government Commitments (GGCs) demonstrate how the government is working to improve the environmental performance of its estate and operations. As an executive agency and trading fund of the Cabinet Office, we are committed to supporting the GGCs in reducing our impact in these areas, to contribute towards meeting this target.

Our CCS estate is managed by the Government Property Agency (GPA) and its partners. We work closely with the GPA and our facilities management service partners to provide data that reflects our proportion of office space in our shared buildings, in order to accurately report on our performance. The greenhouse gas emission data published in our 2022/23 Annual Report and Accounts forms our baseline metrics for GGC reporting, against which future progress is measured.

GPA manages three of the properties CCS are based in (London, Birmingham and Norwich) and has recently achieved the ISO14001 certification. As the strategic leader in sustainability for the government’s office portfolio, the GPA is committed to minimising environmental impact through innovative programmes such as its CNZ and Lifecycle Replacement programme. These initiatives benefit CCS by creating a more sustainable working environment which potentially reduces operational costs and improves efficiency.

We continue to work closely with the GPA and our landlords in reducing the environmental impact of our estate to meet our CNZ targets.

The Greening Government Commitments

The GGCs set out the actions government departments and their partner organisations will take to reduce their impacts on the environment in the period 2021 to 2025.

The following GGC commitments are not applicable to CCS and are therefore excluded from this report:

- Nature recovery and biodiversity action planning – CCS does not have any significant natural capital, however our staff organise and participate in a number of nature recovery initiatives across the UK every year including beach cleans, gardening projects and parkland maintenance

- Travel car fleet – CCS do not own, lease or hire any fleet cars and therefore cannot report on this area. However, we are able to report on official business travel through other methods as detailed below

- ICT – Environmental impacts of ICT and paper usage will be reported by the Cabinet Office who provide CCS’s ICT equipment. CCS have moved all internally managed services on to public clouds and continues to benefit from the activities undertaken by those service providers with regards to the sustainability, carbon tracking and waste reduction associated with the services hosted with them, as well as the reporting they provide in support of those efforts

The table below shows the data gathered for the period 2024/25 on scope 1-3 emissions along with the baseline year for comparison (2022/23). For transparency, we have also included emissions data for 2023/24 again, which reflects a correction to the gas figure for our Liverpool office compared to last year’s report. This correction is due to a recently identified error in the meter readings at this site, which has now been resolved. This has taken our 2023/24 carbon footprint up by 9 tCO₂e to a total of 407 tCO₂e for 2023/24.

The data reported only includes those CCS offices in scope for reporting and has been extrapolated from full building data, showing figures based on space occupied. The offices reported on are:

- Birmingham: 23 Stephenson Street - 70m2 - 58 FTE

- Liverpool: The Capital Building - 1877m2 - 459 FTE

- London: 10 South Colonnade, Canary Wharf - 482m2 - 91 FTE

- Norwich: Rosebery Court, St Andrews Business Park - 1652m2 - 156 FTE

To avoid double counting, any data relating to our office at Concept House in Newport has been excluded as it is reported by the Intellectual Property Office.

Figures in italics indicate that the number reported for that line includes some estimates for part of the year. These estimates have been provided by the GPA and are based on the previous year’s data.

Below is an overview of CCS’s performance against each of the GGC commitments for the year 2024/25.

Scope 1

| Emission source/activity | Detail | Amount | tCO2e | Expenditure (£) | Base year 2022/23 (tCO2e) | % difference | 2023/24 tCO2e |

|---|---|---|---|---|---|---|---|

| Natural Gas (CCS Contribution) | London (kWh) | 1,518 | 0.28 | 174 | 0.50 | -44 | 0.67 |

| Liverpool (kWh) | 64,970 | 11.88 | - | 4.30 | 176 | 11.78 | |

| Norwich (kWh) | 337,850 | 61.79 | 28,123 | 28.00 | 121 | 52.15 | |

| Total gas | 404,338 | 73.95 | 28,297 | 32.80 | 125 | 64.60 | |

| Fugitive emissions | Birmingham (CO2e) | 1,931 | 1.93 | - | - | - | - |

| Total fugitive | 1,931 | 1.93 | - | - | - | - |

Scope 2

| Emission source/activity | Detail | Amount | tCO2e | Expenditure (£) | Base year 2022/23 (tCO2e) | % difference | 2023/24 tCO2e |

|---|---|---|---|---|---|---|---|

| Electricity generated (CCS contribution) | London (kWh) | 139,481 | 28.88 | 36,207 | 20.30 | 42 | 22.66 |

| Birmingham (kWh) | 22,395 | 4.64 | 7,791 | 3.10 | 50 | 4.02 | |

| Liverpool (kWh) | 558,640 | 115.67 | 224,000 | 122.00 | -5 | 127.20 | |

| Norwich (kWh) | 249,523 | 51.66 | 79,059 | 39.00 | 32 | 41.30 | |

| Total scope 2 | 970,039 | 200.85 | 347,057 | 184.40 | 9 | 195.18 |

Scope 3

| Emission source/activity | Detail | Amount | tCO2e | Expenditure (£) | Base year 2022/23 (tCO2e) | % difference | 2023/24 tCO2e |

|---|---|---|---|---|---|---|---|

| Upstream transportation and distribution | Transport of event equipment (miles) | 5,903 | 1.66 | - | 1.30 | 28 | 0.85 |

| Business travel* | Car (hire + grey fleet, miles) | 320,330 | 53.47 | 81,655 | 31.20 | 71 | 49.21 |

| Coach + mini bus (km) | - | 0.00 | - | 0.00 | 0 | 0.21 | |

| Rail travel (passenger.km) | 2,183,932 | 77.44 | 640,018 | 45.30 | 71 | 64.55 | |

| Air (passenger.km) | 15,330 | 4.18 | 3,306 | 0.00 | 100 | 2.93 | |

| Air (international, passenger.km) | 19,046 | 4.91 | 1,148 | 0.40 | 1127 | 0.49 | |

| Hotel stay | UK (room per night) | 2,260 | 23.50 | 216,416 | 13.50 | 74 | 18.53 |

| UK (London) (room per night) | 667 | 7.67 | 92,771 | 5.90 | 30 | 7.43 | |

| Waste disposal (CCS contribution) | Energy from waste (tonnes) | 8.42 | 0.05 | 4,190 | 0.10 | -46 | 0.14 |

| Landfill (tonnes) | 0.00 | 0.00 | 0.50 | -100 | 0.00 | ||

| Food waste (tonnes) | 0.99 | 0.01 | 0.00 | 0 | 0.01 | ||

| Recycling (tonnes) | 13.90 | 0.09 | 0.30 | -70 | 0.28 | ||

| Water** (CCS contribution) | Water supply and treatment (m3) | 3,753.70 | 1.27 | 2,394 | 0.60 | 112 | 2.18 |

| Downstream transportation and distribution | Miles | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0 |

| Total scope 3 | 174.25 | 1,041,898 | 99.10 | 76 | 146.81 | ||

| Annual tCO2e | Annual expenditure (£) | Baseline 2022/23 (tCO2e) | % difference | Revised tCO2e (2023/24) | |||

| Total emissions and expenditure | 450.75 | 1,417,252 | 316.30 | 43 | 407 | ||

*Business travel does not include GCO deployed staff as their travel is booked via Cabinet Office

**Expenditure for scope 1 and 3 excludes Liverpool as the data is currently unavailable

Scope 1 - direct emissions from owned or controlled sources

Scope 2 - indirect emissions from the purchase and use of electricity, steam, heating and cooling

Scope 3 - all other indirect emissions that occur in the upstream and downstream activities of an organisation

Below is an overview of CCS’s performance against each of the GGC commitments for the year 2024/25.

Mitigating climate change: working towards Net Zero by 2050

CCS’s overall GreenHouse Gas (GHG) emissions for 2024/25 are 451 tCO₂e, showing an increase of 43% on our baseline. Our direct GHG emissions (scope 1 gas) are 73.9 tCO₂e, up 125% from the baseline. Over the past year, CCS has assisted the GPA with upgrading the heating, ventilation, and air conditioning (HVAC) system at our Norwich office as part of the lifecycle replacement programme. Anticipated reductions in gas emissions have not yet materialised, as GPA needed to operate two systems simultaneously until the programme completed in early 2025. We expect to see improvements moving forwards. Additionally, the GPA has upgraded the London office hot water system to an Air Source Heat Pump (ASHP) this year removing the need for gas and making this an all-electric site. The GPA has also installed a Building Management System (BMS) to monitor and control key services, enhancing efficiency and sustainability, which should see future reduction in emissions at this site.

CCS’s GHG emission data continues to show that a significant proportion of our carbon footprint is from business travel (scope 3). The number of flights booked in 2024/25 rose slightly but is still at minimal levels. Our travel policy mandates considering lower carbon options, with rail travel as the preferred choice. CCS provides a travel booking tool that displays the CO₂ emissions for each train journey, flight, or hotel stay, helping employees make sustainable decisions.

To encourage greener commuting, CCS continues to offer a ‘Cycle to Work’ scheme to all employees and we continue to have 12 active members of the scheme. As part of our Carbon Reduction Plan CCS has begun exploring other ways we can encourage greener commuting.

Minimising waste and promoting resource efficiency

In 2024/25 CCS produced 23.3 tonnes of waste, equating to 0.15 tCO₂e.

Our waste bins are categorised and clearly labelled, enabling efficient waste management and output monitoring. All reported sites have now implemented recycling and waste-to-energy and as a result, CCS can continue to report zero waste to landfill across the four offices mentioned. In addition, our offices in Birmingham, Liverpool and London are also now sending food waste for composting/anaerobic digestion.

CCS has a strong focus on recycling with 13.9 tonnes of waste being recycled, which equates to 60% of our total annual waste. CCS sent 8.4 tonnes (36%) of waste for energy recovery and 1 tonne (4%) of food waste to composting/anaerobic digestion. CCS has minimal single use plastic across the organisation. All of our offices are equipped with ceramic mugs and glasses, stainless steel cutlery and ceramic plates for staff use.

Finite resource consumption: reducing water use

The amount of water consumed across the CCS estate in 2024/25 was 3,753.7 cubic metres, equating to 1.27 tCO₂e, which is an increase of 112% from our 2022/23 baseline of 0.6 tCO₂e. Despite this increase, this year’s figures show a 42% drop in consumption from last year’s report. Whilst water consumption has increased slightly from our baseline, CCS offices continue to benefit from the use of combined hot and cold taps which are an efficient system that only cools or heats what is required to avoid water waste. Additionally, CCS benefits from the use of dual flush toilets and sensor taps in the bathrooms which also reduce the amount of water being used across our sites.

Adapting to climate change

In 2024/25 CCS conducted an assessment of our estate and operations, identifying areas at risk of climate change and including the ways in which we can mitigate these risks. From this we developed CCS’s first adaptation action plan which sets out our approach to ensuring our offices remain safe working environments in a changing climate, allowing for continued business operations.

CCS’s Workplace Services team will continue to work closely with the GPA who are leading on the reduction of carbon emissions from their buildings via the Life Cycle Replacement and CNZ programmes. CCS will ensure that any future upgrade projects undertaken by the GPA across our estate are successfully delivered, contribute to the reduction in our carbon emissions, are adapting to a changing climate and will continue to maintain a safe working environment for our employees.

Procuring sustainable products and services

We remain committed to supporting the government’s 25 Year Environment Plan and the transition to a CNZ economy by 2050. We use relevant standards in contract specifications, and build in contractual levers such as social value provisions, enabling users of our agreements to meet their own sustainability goals.

In particular CCS is committed to the following sustainable procurement priorities:

- applying relevant and appropriate buying standards and best practice industry innovation to all our procurement activity

- implementing and monitoring the relevant and appropriate Procurement Policy Notices (PPNs) across our agreements and supply chain

- reducing carbon emissions through the procurement of energy across government and the public sector

- ensuring our procurements make a contribution towards reducing single use plastics in the supply of goods

- ensuring our procurements and wider activities make a contribution towards the government’s Net Zero target for 2050

- enabling the delivery of social value in public sector contracts through effective contract levers

- helping address the risks of modern day slavery in government’s supply chains

- supporting small and medium-sized enterprises through our procurements

Government buying standards

The Government Buying Standards (GBS) are a principal source of procurement guidance and set minimum mandatory buying standards for certain goods and services such as paper, office technology equipment, cleaning products, furniture and textiles, construction and fleet.

Where relevant and aligned with the timing of their procurement, these standards are explicitly referenced in CCS’s current commercial agreements. CCS also consults with policy experts in other departments, as well as relying on the considerable expertise of our category teams who will incorporate industry level best practice where relevant.

Carbon Net Zero projects

To support the UK Government’s commitment to achieving Net Zero by 2050, CCS has created a dedicated Carbon Net Zero team to implement sustainable commercial practices. The team has been involved in delivering public sector buyer advice, supplier training and support, sustainable policy implementation and supported cross-government working groups and industry bodies, to establish procurements as a vehicle to deliver tangible sustainability outcomes.

Funding CNZ projects is a big consideration when developing plans. To support our customers, we collate a list of open CNZ grants and funding opportunities from across government into a single place. The grants are mapped to appropriate routes to market offered by CCS, making it easy for customers to fund and operationalise CNZ initiatives.

Employee engagement and knowledge-building are central to our project’s success. We have continued to utilise Get Informed Know your Impact (Giki) this year to bring colleagues a personalised employee sustainability engagement programme and understand their personal impact. We have introduced sustainability champions to drive engagement and action, created tailored learning programmes, and encouraged participation through online interactive and engaging quizzes.

Carbon reduction plan

Commercial agreements are being created with sustainability built in from the start. For any contract over £5 million, PPN 06/21 applies, requiring bidders to provide a Carbon Reduction Plan (CRP), ensuring that agreement suppliers are committed to helping customers achieve CNZ by 2050.

In support of this, the Sustainability team has delivered virtual training sessions on the PPN to raise awareness of the policy and its requirements, helping suppliers understand how to create a compliant CRP. During 2024/25, CCS completed 16 virtual sessions, with 657 attendees. Since inception, the CRP training has been attended by 5,282 people across 83 events.

The CRP Compliance Team has been offering a free assessment to ensure the CRPs of suppliers on existing agreements are compliant. In November 2024 we started to link supplier CRPs to the CCS website when suppliers have provided their plan voluntarily, or as part of a tender requirement.

Social value

We continue to work with the Cabinet Office to fully embed Social Value PPNs 06/20 and 002, and follow best practice in social value. Our category strategies specifically address the opportunities to deliver social, economic and environmental sustainability in each market where we operate. Our agreements are designed to allow customers to create tangible benefits in towns and cities across the UK, including an evaluation of suppliers’ approaches during the procurement stage.

Our internal network of social value champions continues to peer review each procurement for social value inclusion and share best practice across the organisation. Every new agreement we have launched in the past year has included social value provisions, enabling customers to work towards their economic, social and environmental objectives through procurement.

Modern slavery prevention

We are committed to tackling modern slavery in global supply chains. Our agreements are designed to address modern slavery as part of our wider supplier due diligence. We continue to implement the key activities outlined in our Modern Slavery Statement, which sets out our approach to managing labour risks in our supply chains. The statement is available to view on our website.

We are working to ensure that there are appropriate measures in place to mitigate the risk of modern slavery throughout the whole commercial agreement lifecycle. All new commercial agreements are assessed for modern slavery risks and set out measures to prevent the occurrence of forced labour abuses in the supply chain if the risk level is high.

We continue to request annual Modern Slavery Assessment Tool (MSAT) reports from suppliers on higher-risk agreements, and conduct follow-up conversations with suppliers whose assessments have returned high risk scores. We have held follow-up reviews with numerous suppliers, resulting in improvements to their operations and risk management processes.

We understand how important access to information is in empowering our customers to buy responsibly. Our Modern Slavery web page provides guidance and information on how we enable sustainable procurement.

Small and medium-sized enterprises

We have seen continued good progress with our efforts to enable small and medium-sized enterprises to participate in our commercial agreements, with £2.33 billion (10%) of central government spend directly with 1,459 SMEs. This represents a reduction of £180 million in spend compared to 2023/24. We continue to design our commercial agreements so that SMEs are able to benefit and that is why 75% of the suppliers on CCS’s commercial agreements are micro (33%), small (28%) or medium (14%) sized enterprises.

Task Force on Climate Related Financial Disclosures

HM Treasury released guidance on the TCFD framework for the UK public sector to report on climate-related financial disclosures aligned with the private sector. CCS is an ALB of the Cabinet Office and falls within scope of reporting, consistent with the guidance available. CCS has complied with the TCFD recommendations and recommended disclosures around:

- governance (disclosures (a) and (b))

- metrics and targets (disclosure (a) to (c)).

- risk management (disclosure (a) to (c)).

This is in line with the central government’s TCFD-aligned disclosure implementation timetable which will take a phased approach to the reporting. CCS plans to make disclosures for Strategy disclosures (a) to (c) in future reporting periods in line with the central government implementation timetable.

Governance

Describe the Board’s oversight of climate-related issues.

We are in the process of developing a comprehensive sustainability strategy for 2025/26, which will be presented for the Board’s review. This strategy will ensure that a robust governance structure is established to effectively oversee

climate-related initiatives.

For 2024/25, our focus has been on fully understanding the requirements of the GGCs, alongside the creation of a climate change risk assessment and adaptation plan. Both of these documents have been reviewed and endorsed by our People and Finance Committee and Executive Board. The recommendations from the adaptation plan will be integrated into the implementation plan, which is set for delivery over the next five years, extending to 2030.

Management’s role in assessing and managing climate-related issues.

CCS remains committed to supporting delivery of the government’s Net Zero target and ensuring the UK maximises the benefits of the transition.

CCS helps customers generate long-term environmental benefits for their organisations, society and the economy. As part of our ambitions to maximise our value and impact, and establish a more effective and efficient organisation, CCS’s Board and committees will monitor and oversee progress against goals and targets for addressing climate-related issues moving forward.

CCS’s organisational structure can be found in detail on page 20 of this annual report.

Metrics and Targets

a) disclosure of the metrics used by the organisation to assess climate related risks and opportunities in line with its strategy and risk management process

CCS currently reports on GHG emissions as its key sustainability metric (as detailed in disclosure b). Other metrics for assessing climate related risks and opportunities are currently being reviewed as part of CCS’ strategic planning which will identify and embed appropriate metrics to measure climate related risks and opportunities in the future.

b) disclosure of Scope 1, 2 and, if appropriate Scope 3 greenhouse gas emissions and their related risks

CCS currently reports on its GHG emissions quarterly via the Cabinet Office as part of the GGC requirements. The CCS annual Sustainability Report aligns with this reporting framework for Scopes 1 and 2, and expands on Scope 3 to include data on hotel stays. A detailed breakdown of our GHG emissions data, including disclosure across Scopes 1, 2 and 3 can be found in the table on pages 32 to 33 of the Sustainability Report. This table includes 2022/23 emissions data reported which forms our baseline, allowing for transparency towards achieving the government target of CNZ by 2050.

As detailed in the Sustainability Report, CCS undertook a Climate Change Risk Assessment during 2024/25 for our estate and operations. The findings from that risk assessment were that there are no immediate high-risk actions required however there are a number of proactive measures which can be taken. These have been mapped into our implementation plan for 2025/26.

c) describe the targets used by the organisation to manage climate-related risks and opportunities and performance against targets

CCS is committed to climate risk management through the CRP, which sets out ambitious targets for the short (<4 years), medium (5-10 years) and long term (10 years+), working towards CNZ by 2050. CCS will continuously review carbon targets ensuring they align with our Sustainability Strategy and wider GGC targets. This approach will enable us to adapt to ongoing business changes and the impact of emerging technologies in the coming years.

Risk Management

a) describe the organisation’s processes for identifying and assessing climate-related risks

In December 2024, the People and Finance Committee approved CCS’s first ever climate change risk assessment and adaptation plan.

CCS used the Orange Book methodology to establish a systematic approach for identifying, assessing and mitigating climate-related risks aligned to the GGC framework. This involved integrating climate risk considerations into our existing risk management framework, ensuring that these risks are treated with the same rigour as other operational risks.

The recommendations and risks outlined in these documents have been incorporated into a draft implementation plan for 2025/26.

b) describe the organisation’s processes for managing climate-related risks

Any risks identified as part of the CCS climate change risk assessment will be mapped into short, medium and long-term risks aligned to the GGC framework as we draft our forthcoming Sustainability Strategy. Climate-related risks will be included in our risk register along with appropriate mitigation strategies. Any identified risks will be reviewed at intervals as set out in our strategy once finalised.

c) describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organisation’s overall risk management