Annual compliance report 2020

Published 17 September 2020

1. Executive Summary

This report presents a summary of the compliance and review work undertaken by the SSRO during 2019/20 in line with our 2017 compliance methodology (the methodology). We considered how contractors were complying with their reporting obligations, used the reports to better understand how the Act and the Regulations were operating, and sought to improve the timeliness and quality of submitted data. We were guided by our data strategy and our vision for reported data to be fully utilised in procurement decisions, contract management and development of the regulatory framework to deliver value for money and fair and reasonable prices.

Timeliness of reports

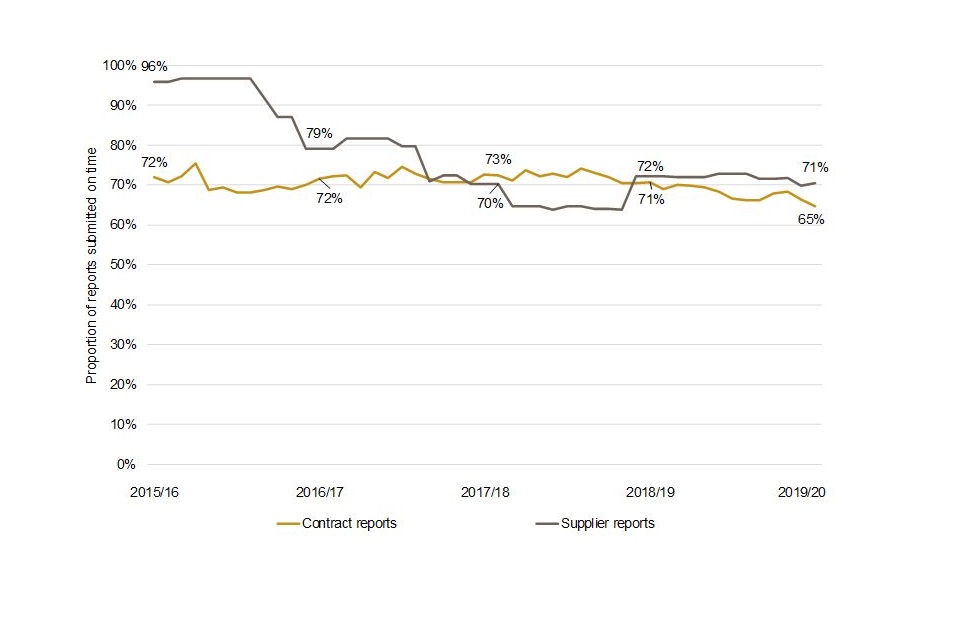

We found that 65 per cent of contract reports and 71 per cent of supplier report submissions were submitted in accordance with the due dates set by the Regulations. This is below the target set by the SSRO of 75 per cent.

Performance was mixed across the different report types. The reports with the highest proportion of delays were the initial contract reports (53 per cent on time), the completion reports (13 per cent of Contract Completion Reports and 18 per cent of Contract Cost Statements on time) and the strategic supplier reports (37 per cent of Strategic Industry Capacity Reports and 42 per cent of Small and Medium Enterprise Reports on time).

Most late reports are eventually submitted, but we are concerned that the average delay for late reports is increasing. More of the late report submissions were being made within 90 days of the reporting deadlines in 2019/20, compared to within 30 days as in previous years. The average delay was 396 days for contract reports and 514 days for supplier reports. As at 30 June 2020, 68 contract reports and 82 supplier reports had been outstanding for more than six months. A total of 18 of the 68 outstanding contract reports relate to just two contracts with two separate contractors, which have been highlighted to the MOD.

The late submission of reports impacts data quality and reduces the usefulness of the data, for example for ‘real-time’ ongoing contract and supplier management, or for use in estimation. We identified several avoidable reasons for late submission, and we recommend the following action by the MOD, the SSRO, and contractors to improve timeliness:

- contractors ensure that adequate resources are allocated to understanding and meeting statutory reporting requirements;

- contracting parties communicate better between themselves and with the SSRO about when a contract is a QDC;

- contractors promptly notify difficulties in providing reports and engage in dialogue with the MOD and the SSRO to resolve issues;

- contractors do not delay submissions due to unresolved issues on previous reports;

- contractors and the MOD ensure that contract completion dates are updated in DefCARS through the submission of on-demand Contract Reporting Plans;

- the SSRO further reviews overhead reporting requirements;

- the SSRO seeks to better understand the MOD’s use of the strategic reports; and

- the MOD takes timely enforcement action in appropriate cases.

Quality of reports

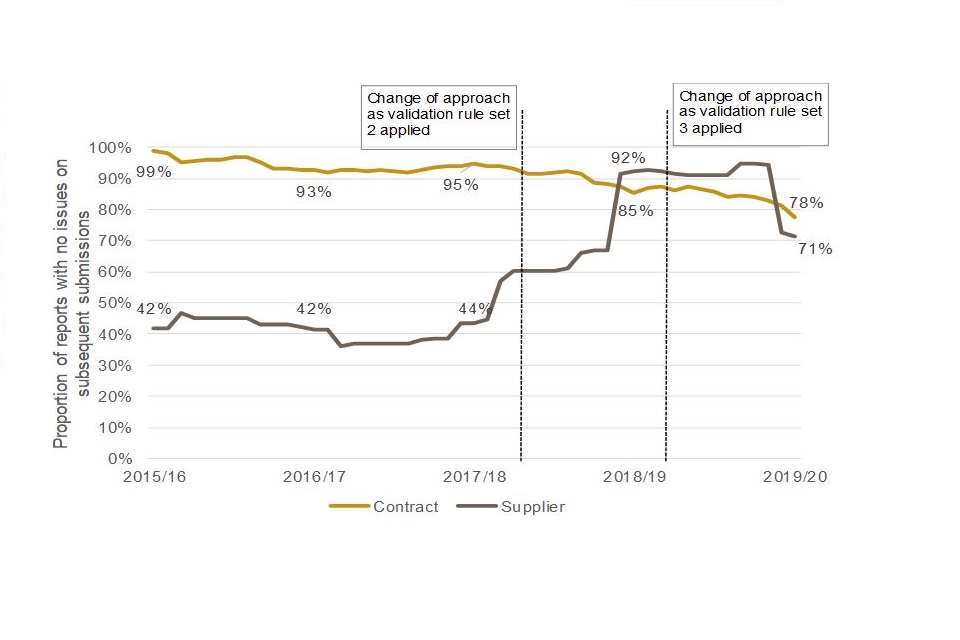

The percentage of reports submitted right first time exceeded the SSRO’s target of 25 per cent in 2019/20. 52 per cent of contract reports were submitted right first time and 51 per cent of supplier reports were right first time. Many of the issues raised by the SSRO with contractors after first submission were resolved and the reports resubmitted. The percentages of contract reports and supplier reports that were correct following resubmission were 78 and 71 per cent for 2019/20.

The quality of report submissions improved during 2019/20. The 52 per cent of contract reports submitted right first time compared with 38 per cent in 2018/19, and the average number of issues raised on both initial and update contract reports fell by around 50 per cent from 2018/19. We attribute the improvement to a combination of factors, including the introduction of a greater number of validation warnings within the system, contractors making better use of the automatic validation warnings within the system to get data right first time, a better understanding from contractors of submission requirements, and feedback from increased MOD reviews of submissions. There is more work to do and we intend to consider adopting a more stretching target in future.

We examined the common issues raised by the SSRO and the MOD on reports during 2019/20 and their potential impact on data quality and use of the data by the MOD. The most frequent issues on contract reports raised by the SSRO included:

- basic administration errors that affect the automation of data analysis;

- incorrect reporting dates that give a false impression of timeliness and impact on when information becomes available for use;

- the availability and consistency of price information, including recovery rates and volumes, profit rate calculations, and pre-amendments costs and profit, which will impede use of the data for contract management and estimation; and

- poor reporting of output metrics, linked to key contract deliverables, making it necessary to seek additional data sources for parametric estimating.

The most frequent issues raised by the SSRO on supplier reports concerned unexplained variances and inconsistencies across reports for business units within the overhead reports.

The MOD’s own review of submitted reports is key to ensuring their quality. The report examines the extent of the MOD’s reviews and the issues raised. We were pleased to see that the MOD reviewed more contract reports in 2019/20 than in previous years (25 per cent compared with 16 per cent in 2018/19). The MOD informed us that supplier report submissions were being considered and used, but our work revealed that only one of these reviews was recorded on the system itself.

Action is required by the MOD, the SSRO, and contractors if the quality of reported data is to improve. We recommend that:

- contractors take greater care when submitting reports to ensure that the data provided is correct and complete;

- the SSRO continues to support contractors to submit their reports through onboarding and other meetings, feedback on reports, and helpdesk responses;

- the MOD and contractors support the SSRO’s planned work on overheads, amendments and variances, and updates to the Reporting Guidance and DefCARS;

- the MOD continues to improve the extent to which it reviews the submitted reports and uses the data; and

- the MOD takes appropriate enforcement action when there are unaddressed issues with reported data.

Collaborative working with the MOD

We carried out targeted reviews of report submissions in 2019/20, which included speaking to MOD delivery teams to understand how they review reports and raise issues with contractors. We found that delivery teams successfully identified a range of reporting matters in contractor submissions but there were aspects of submissions where checks were less effective. To improve the review process and positively impact the quality of information reported by contractors, we recommended that the MOD:

- disseminates feedback from the targeted reviews to delivery teams;

- communicates developments in the SSRO’s reporting guidance and the MOD’s Commercial Toolkit to delivery teams;

- supports guidance updates with improved training to delivery teams;

- identifies ‘champions’ outside of the Single Source Advisory Team (SSAT) for delivery teams to refer to; and

- involves a wider range of skillsets in its reviews of submissions, including estimators.

We intend to continue to undertake targeted reviews and have started engagement with the MOD for a programme of reviews to be undertaken in 2020/21 which will include following up on these recommended actions.

Issues referred to the MOD

We continued to notify the MOD of late reports and issues with the quality of report submissions that could not be resolved with contractors. This is to enable feedback from the MOD to clarify whether there is an issue, the underlying causes, its relative importance, and how the issue can be addressed. It also supports action by the contractor and the MOD to resolve issues, and enforcement by the MOD in appropriate cases.

There are instances in which no action was taken by the MOD in response to issues raised by the SSRO. This includes the following matters which have now been outstanding for more than six months from the date of report submission:

- 150 outstanding reports (68 of which represent missing information from 23 contractors across 28 contracts, with a cumulative price of £1.379bn); and

- 399 issues raised by the SSRO on reports that have received no response.

No compliance or penalty notices were issued by the MOD in 2019/20. The length of delay on some late reports and outstanding issues means that the MOD is now unable to undertake enforcement action, exposing a potentially lasting impact on data quality where there are gaps in the data.

We continue to welcome feedback from the MOD but, given the delay, the SSRO proposes to close the referred issues that have been outstanding for more than six months. We will cease to actively seek feedback from the MOD, or cooperative action to resolve these issues and we do not intend to continue to chase responses or raise repeat issues on subsequent reports on the same contracts. In future where an issue has been outstanding on the system for six months or more from the due date of the submission, the SSRO will close the issue and mark it as impacting the overall quality of the report.

We recommend that the MOD considers whether any other action may be taken in respect of these late reports and outstanding issues. It may still be possible to get some of the reports submitted through direct negotiation with the contractor, or by requiring on-demand reports.

Compliance methodology

We reviewed our compliance methodology during 2019/20. We published our new 2020 methodology on 31 January 2020, for application from 1 April 2020, adopting a more efficient, risk based and proportionate approach to our compliance work.

2. Introduction

The 2020 Annual Compliance Report presents the findings from our review of statutory reports due for submission by 30 April 2020. Appendix 1 describes the types of report that may be required as part of the statutory reporting regime established by Part 2 of the Act and the Regulations, and separates these into contract reports and supplier reports.

The reports that we reviewed relate to qualifying defence contracts (QDCs) and qualifying sub-contracts (QSCs) entered into between 1 April 2015 and 31 March 2020. The SSRO was notified of 296 QDCs and QSCs in that period, placed across 85 Global Ultimate Owners (GUOs).[footnote 1] Contract reports had been submitted for 278 of the contracts by 30 April 2020. Further information on the data sources and methodology for inclusion of information in this report is detailed in Appendix 2.

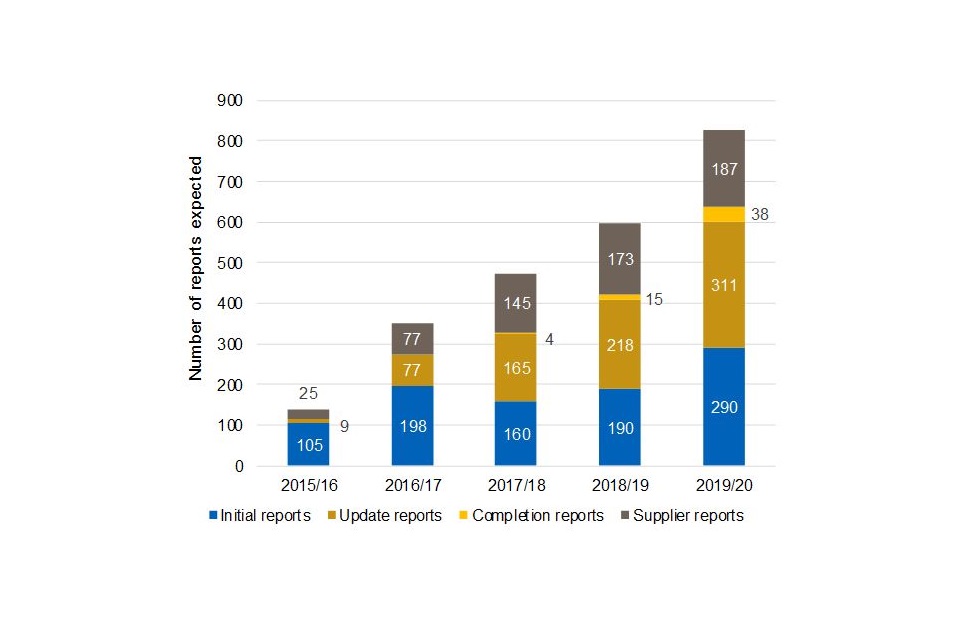

The number of reports expected each year has continued to grow, as shown in Figure 1, with 639 contract reports and 187 supplier reports expected in 2019/20. We attribute the growth in the number of expected contract reports in 2019/20 primarily to increasing numbers of qualifying contracts in the regime, and to the number of reports provided ‘on demand’. There were 70 new qualifying contracts in 2019/20, with prices totalling £8.9bn[footnote 2] and 61 reports were required ‘on-demand’, consisting of nine Contract Pricing Statements (CPS), 38 Contract Reporting Plans (CRP), one Interim Contract Report (ICR), and 13 Contract Cost Statement (CCS).

Figure 1: Total number of reports expected by year

Our review of report submissions was undertaken in line with our 2017 compliance methodology (the methodology), which was in force to 31 March 2020. We considered the extent to which contractors complied with their reporting obligations, focusing on the timeliness and quality of the submitted reports.

Our review of a submitted report may result in an issue raised in relation to whether the pricing requirements of the regulatory framework have been met. In such cases, the response from the contractor or the MOD may be used by the SSRO to inform its understanding of how the provision of the Act and the Regulations is operating.

We were guided by our data strategy when reviewing report submissions. The vision expressed in that strategy is for the data in statutory reports to be fully utilised in procurement decisions, contract management and development of the regulatory framework to deliver value for money and fair and reasonable prices. Achieving this vision depends on collecting good quality data, and to achieve this we have worked cooperatively with contractors and the MOD, and made efficient use of DefCARS and analysis to:

- identify and build a shared understanding of data quality issues in statutory reports;

- encourage prompt action to address data quality issues;

- refer appropriate issues to the MOD for enforcement; and

- inform updates to reporting guidance, DefCARS improvements and our review of the legislation.

The 2019/20 year has been exceptional due to the global impact of the Coronavirus (COVID-19) pandemic. Recognising the potential operational impact of the pandemic on contractors, the SSRO suspended the release of new compliance queries from the end of March through to the middle of June 2020. During this period, the SSRO continued to review submitted reports, and access to DefCARS remained uninterrupted. Contractors were encouraged to submit reports if they could, and most continued to do so.

3. Timeliness

The SSRO keeps under review whether statutory reports are submitted in accordance with deadlines set by the Regulations. Timely report submissions are key to achieving good quality data as defined in our data strategy, promoting relevance, comparability and reliability. If reports are not submitted on time, the MOD is less likely to be able to use the data effectively in support of its procurement decisions, or for contract management.

We assess the timeliness of reports against the following key performance indicator.

Proportion of contract reports submitted on time [Target 75%]

The target relates to contract reports, but we apply the same benchmark to supplier reports. The target of 75 per cent was set in 2017 and reflects the level of experience that contractors had with the regime at that time. We strive to provide a system and support that allows contractors to exceed the target, recognising the legislative expectation that all reports should be submitted on time.

The Regulations identify the circumstances in which reports are required and set the due dates for reports by reference to specified trigger events. Appendix 3 shows the how the due dates are calculated for each type of report. We identify whether reports are expected, and when they are due, using information submitted by contractors.

Analysis of the timeliness of submissions

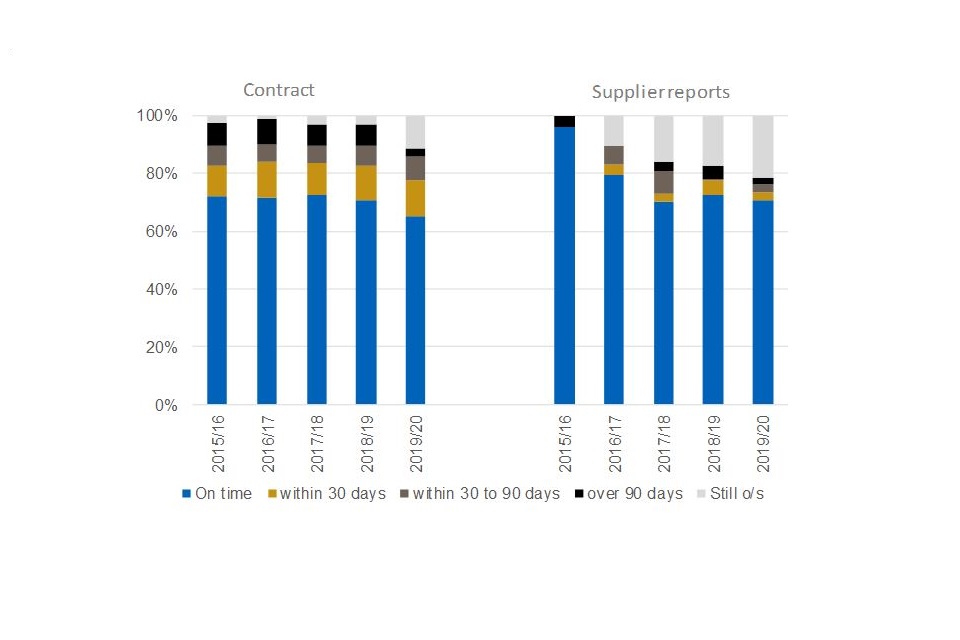

The percentage of reports received on time declined in 2019/20 and was below the SSRO’s target of 75 per cent. Figure 2 details the 12-month rolling average of report submission timeliness for contract and supplier reports. It shows that timeliness has remained below the SSRO’s target for several years and that contract reports dipped to 65 per cent on time at the end of 2019/20.

Figure 2: 12 month rolling average of report submission timeliness, by report type

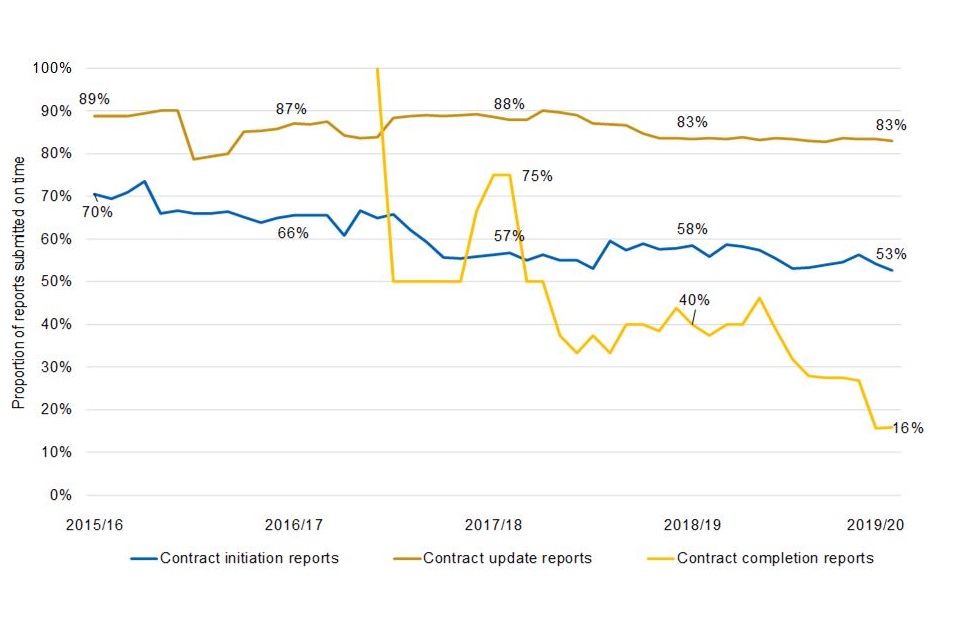

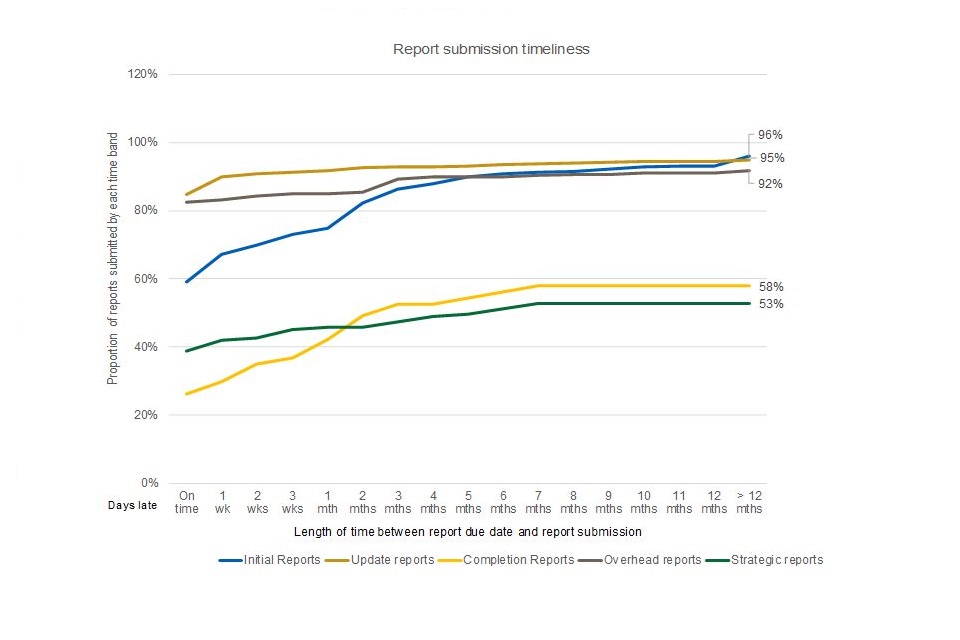

Performance was uneven across report types. Table 1 of Appendix 4 details the timeliness of contract reports expected during 2019/20, broken down by report type. Figure 3 shows the different levels of timeliness for contract reports, split into initial reports (the CPS, CRP and Contract Notification Report (CNR)), update reports (the Quarterly Contract Report (QCR) and ICR), and completion reports (the Contract Completion Report (CCR) and CCS). In summary:

- initial reports are significantly below target and timeliness continues to reduce year on year;

- interim reports are the timeliest, although within this 86 percent of QCRs are submitted on time and 75 per cent of ICRs are on time; and

- completion reports are, at 16 per cent, seldom submitted on time.

The timeliness for completion reports is volatile, given limited numbers of these reports have been submitted, as shown in the trend line in Figure 3. It is expected that in future years there will be a steadier average to report, as the number of completion reports increases.

Figure 3: 12 month rolling average of report submission timeliness for initial, update and completion reports

Table 2 of Appendix 4 details the timeliness of supplier reports, broken down by report type. Figure 4 shows the different levels of timeliness for the supplier reports, split into the overhead reports (Qualifying Business Unit Cost Analysis Report (QNUCAR), Estimated Rates Claim Report (ERCR), Actual Rates Claim Report (ARCR), Estimated Rates Agreement Pricing Statement (ERAPS), Rates Comparison Report (RCR)) and strategic reports (Strategic Industry Capacity Report (SICR) and Small and Medium Enterprise report (SME)). In summary:

- timeliness of the overhead reports was better than for strategic supplier reports;

- only the QBU cost analysis reports and the rates claim report exceeded the SSRO’s target; and

- timeliness of the strategic supplier reports was poor, with only 37 per cent of SICRs and 42 per cent of SMERs submitted on time.

Limited numbers of strategic supplier reports were expected. There is potential for low numbers of reports to significantly affect the trend line in Figure 4.

Figure 4: 12 month rolling average of report submission timeliness for overhead and strategic supplier reports

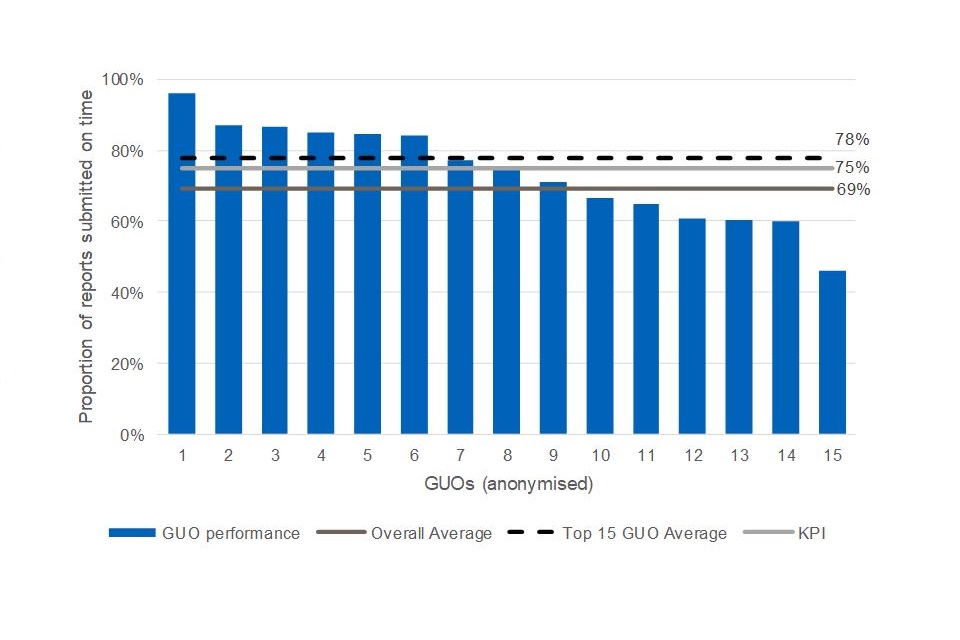

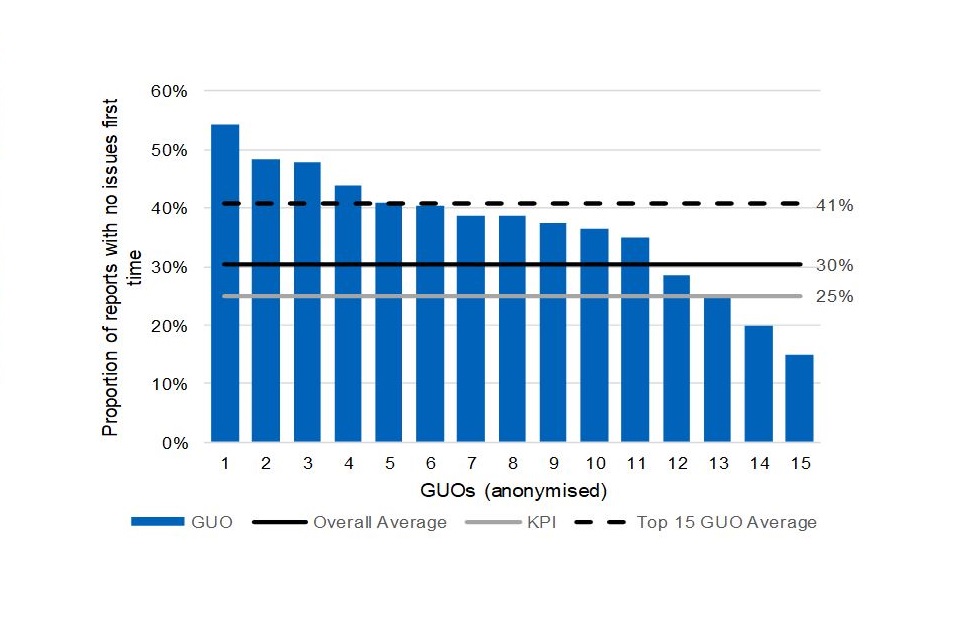

Fifteen GUOs were responsible for 77 per cent of all 1,780 expected contract reports. Each of these 15 were responsible for at least 20 individual contract report submissions.

Figure 5 details the timeliness of contract report submissions for these 15 GUOs in order of timeliness for contract report submissions, comparing them against the average timeliness across the regime for all years. Nine of the 15 were above the timeliness average for the regime.

Figure 5: Timeliness of contract report submissions by GU0O

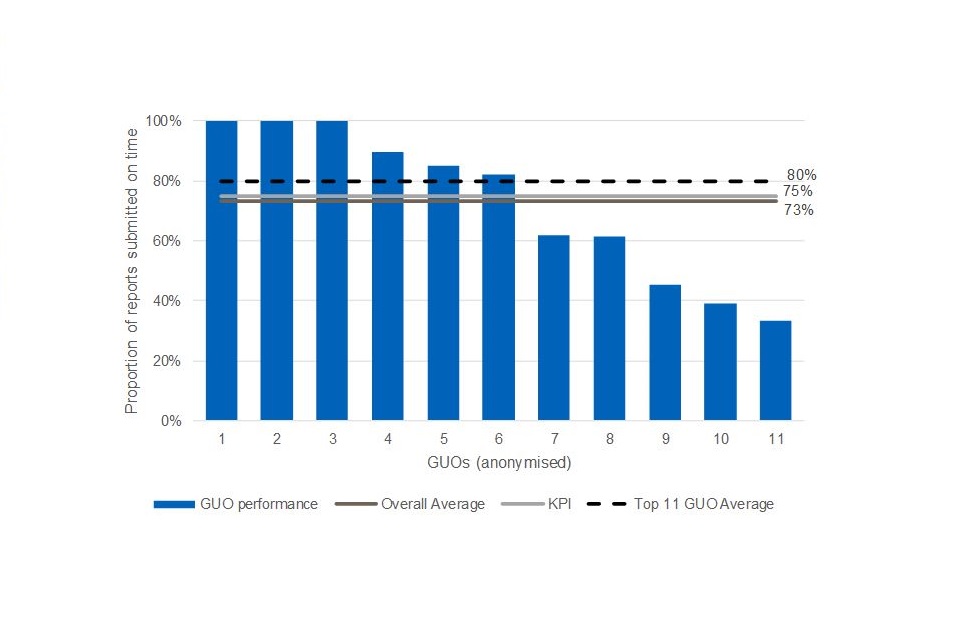

Eleven GUOs were responsible for 91 per cent of all 607 expected supplier reports. Each of these 11 were responsible for at least 10 individual supplier report submissions.

Figure 6 details the timeliness of supplier report submissions for these 11 GUOs in order of timeliness for supplier report submissions, comparing them against the average timeliness across the regime for all years. Six of the 11 were above the timeliness average for the regime.

Figure 6: Timeliness of supplier report submissions by GUO

Some of the MOD’s top suppliers of QDCs and QSCs are performing below expectation in terms of the timeliness of their report submissions. An improvement by the lower performing GUOs would help to increase the overall timeliness of submissions if they continue to submit a significant number of reports in future. The SSRO will contact these GUOs and seek to work with them to discuss their reporting arrangements and consider whether any improvements could be made to their processes for making timely submissions as required by the legislation.

The length of submissions delays

Many of the reports that are not submitted on time are subsequently submitted. For example, when late submissions are included, 89 per cent of the contract reports and 79 per cent of the supplier reports expected during 2019/20 were received by the cut-off date for this report of 30 June.

The SSRO has considered the extent of delay in the submission of the statutory reports. Figure 7 details the length of delay in submitting late contract and supplier reports across all years and Figure 8 shows how late reports are submitted over time.

Figure 7: Timeliness of contract and supplier report submissions by year

Figure 8: Analysis of the time taken to make late report submissions, by report type

There has been an increase in the time taken to submit late reports. Some key features of this growing delay are:

- the majority of late report submissions were made within 90 days of the reporting timeframes, compared to 30 days in previous years;

- the average delay across all submissions was 396 days for submitting late contract reports and 514 days for late supplier reports; and

- 68 contract reports and 82 supplier reports had been outstanding for more than six months, as at 30 June 2020. A total of 18 of the 68 outstanding contract reports relate to just two contracts with two separate contractors, which have been highlighted to the MOD.

Table 1 details the analysis of the delays by contract and supplier reports for all years. Further breakdowns by report type for both contract and supplier reports are set out in Tables 3 and 4 of Appendix 4.

Table 1: Analysis of delays by contract and supplier reports for all years

| Contract reports | Supplier reports | |

|---|---|---|

| Number of reports not received | 102 | 101 |

| Average number of days outstanding | 396 | 514 |

| Reports outstanding more than 6 months | 68 | 82 |

| % of reports outstanding more than 6 months against total expected | 4 | 14 |

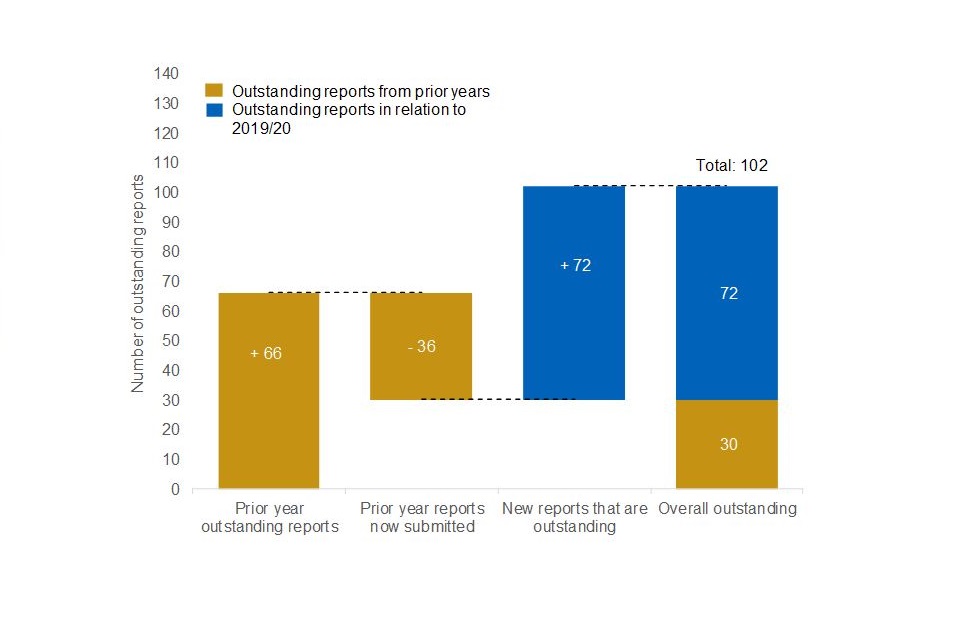

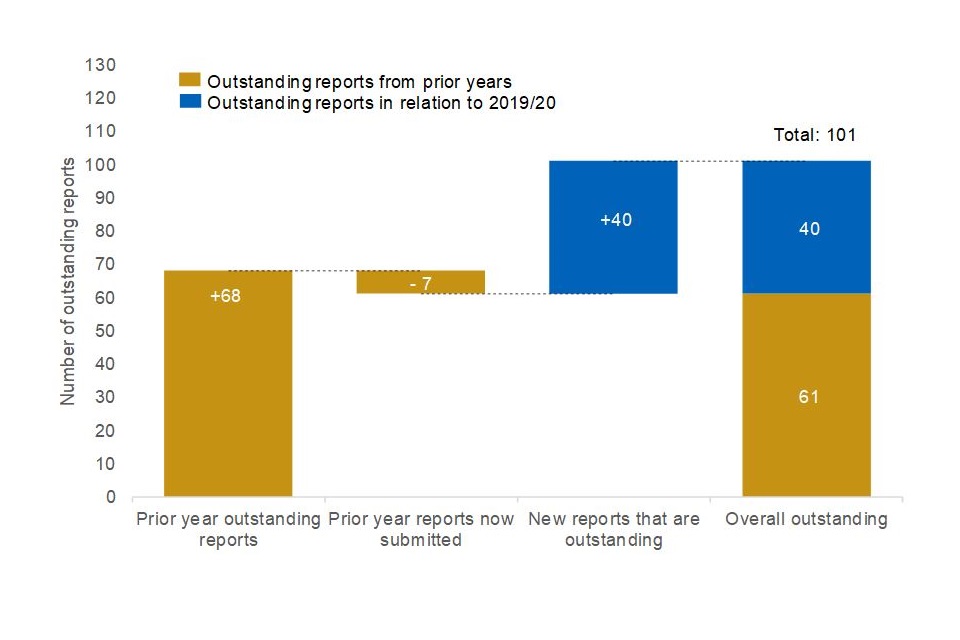

There is an increasing trend in the number of reports outstanding at the end of each year. Figures 9 and 10 compare the outstanding contract and supplier reports for 2019/20 against the previous year.

Figure 9: comparison of change to outstanding contract reports between 30 June 2019 and 30 June 2020

Figure 10: comparison of change to outstanding supplier reports between 30 June 2019 and 30 June 2020

The outstanding reports represent missing information in relation to a total of 6 per cent of all expected contract reports and 17 per cent of all expected supplier reports. Completion reports account for 24 per cent of the 102 outstanding contract reports, even though completion reports represent 3 per cent of the overall expected contract reports. SICRs and SMEs account for 61 per cent of the 101 outstanding supplier reports, even though these reports represent 22 per cent of the overall expected supplier reports.

There are 30 contract reports and 61 supplier reports that are outstanding from prior years and have therefore been delayed by at least one year. There is reason for concern as to whether these reports will ever be received, given the MOD has a deadline of six months from the due date of a report to issue an enforcement notice.

Late and failed submissions create gaps in the information available to the MOD. This risks impacting the effectiveness of the regulatory framework by reducing the information available to the MOD in DefCARS for:

- managing contracts and suppliers;

- analysing cost variances and outturn profit;

- preparing estimates for budgeting or to challenge contractor costs; and

- strategic planning.

The SSRO engaged with the MOD in 2019/20 about its use of the reported data on costs split by the defined pricing structure, amendments and variances, and overheads. We found limited use of this data, which in turn limited feedback on data quality. We will look for further feedback from the MOD about data quality and uses of the data in future.

Reasons for late submissions

The SSRO records the reasons given by contractors for submitting late reports and Table 2 summarises this information. The information is incomplete as we have been unable to contact some contractors, others have not responded when contacted, and there is no statutory requirement to report reasons for lateness. The response rates are particularly low in respect of supplier reports, as contractors have been less proactive in in providing information about these and the SSRO does not have contact details for all GUOs responsible for making submissions.

Table 2: Analysis of reasons for contract report submission delays

| Contract reports | Supplier reports | |

|---|---|---|

| Reason | Outstanding as at 30 June | Outstanding as at 30 June |

| Contractor needed additional time to gather relevant information. | 10 | 14 |

| Contract durations extended and so reports expected in line with original reporting plans, or additional reports that become due because of contract extensions, were not made. | 2 | 0 |

| Contractor unaware that the contract had been assessed as a QDC or QSC. | 3 | 0 |

| Operational issues caused by the COVID 19 pandemic. | 6 | 0 |

| Individuals with responsibility for making submissions had left organisations and the responsibility for making ongoing submissions was not passed on. | 7 | 0 |

| Contractors unclear about the reporting requirements. | 13 | 0 |

| Issues raised on previous submissions, either by the SSRO or the MOD, remained outstanding and the contractor’s wished to resolve these before making any further submissions. | 14 | 3 |

| Contractor either unable or unwilling to make the submissions. | 18 | 0 |

| Unknown | 29 | 84 |

| Total | 102 | 101 |

The 2019/20 year was exceptional due to the global impact of the Coronavirus (COVID-19) pandemic but we do not consider that the pandemic was a significant cause of the increase in outstanding reports and the growing delays to report submissions. We base this conclusion on the following information:

- access to DefCARS has remained uninterrupted during the pandemic and contractors continued to submit reports as required by the legislation;

- only four contractors notified the SSRO that submissions could not be made by 30 June due to operational difficulties associated with the pandemic, affecting one set of initial reports and three update reports; and

- three contractors notified the SSRO of operational difficulties that delayed submission of initial reports, but the delays were not significant and the reports were submitted before 30 June.

Improving the timeliness of submissions

Several reasons given by contractors for late submissions would appear to be avoidable. Action is required by the MOD, the SSRO, and contractors if the timeliness of reporting is to improve, including the following:

- contractors should familiarise themselves with reporting requirements, with support from the SSRO, and allocate staff to submitting reports;

- there must be better communication between contracting parties and between contracting parties and the SSRO about when a contract is a QDC;

- contractors should promptly notify difficulties in providing reports and engage in dialogue with the MOD and the SSRO to resolve issues;

- contractors should not delay report submissions due to unresolved issues on previous report submissions;

- contractors and the MOD should ensure that contract completion dates are updated in DefCARS through the submission of on-demand CRPs;

- the SSRO should further review overhead reporting requirements and seek to better understand the MOD’s use of the strategic reports; and

- the MOD should take appropriate enforcement action.

Contractors should take steps to familiarise themselves with the reporting requirements. The SSRO is committed to making the reporting process as easy and clear as possible and we offer support to contractors through our guidance, DefCARS improvements, our helpdesk, onboarding sessions and training:

- In 2019/20 we held 30 on-boarding sessions with contractors where a contract, or potential contract, notification was received by the SSRO that involved a new contractor or team with their first qualifying contract. This included both SME and non-UK based contractors.

- In 2019/20 we also delivered four MOD training sessions to improve stakeholders’ understanding of DefCARS and of reporting requirements but have seen a reduction in the appetite for joint industry training sessions with only one session delivered during 2019/20, as individual on-boarding sessions were favoured.

Some contractors need to take further steps to ensure that:

- the responsibility for making submissions is clearly allocated within the company; and

- there are appropriate handover arrangements to transfer responsibility for making submissions when staff members leave their employment.

Better communication is needed between contracting parties to improve the timeliness of report submissions. The MOD should provide the contractor with early notification that a contract will be a QDC and the contracting authority should promptly advise the sub-contractor of any assessment that a contract is a QSC. By communicating this information early in the contracting process, the contractor has time to become familiar with the reporting requirements.

Contractors should promptly inform the MOD and the SSRO when they experience difficulties in providing reports. When this occurs, there should be dialogue between the contractor, the MOD and the SSRO to determine the key reasons for non-compliance, and what actions may be taken to remedy this going forward.

Some contractors suggested that they had delayed report submissions to allow time for issues raised on previous submissions to be resolved. This practice is inconsistent with the legislative requirement to submit reports and should be discouraged. At the same time, contractors should work with the MOD (and sub-contractors with the prime contractor) to promptly resolve issues raised on reports so that they do not impact subsequent submissions.

Where contract completion dates change, contractors should update the contract reporting plan in DefCARS, so that compliance can be measured against the revised due dates for reports. The SSRO’s reporting guidance recommends that this is done by submitting an on-demand contract reporting plan. We have updated DefCARS so that contractors can identify the due date of report submissions by reference to the contract reporting plan. We have consulted on further changes to our reporting guidance on how to determine the contract completion date and how to update the CRP. Subject to consideration of feedback we expect to make those changes in late 2020.

Our work on the Review of the single source regulatory framework 2020 highlighted that the current arrangements for overhead report submissions prevent the MOD and the SSRO from confidently identifying when overhead reports are due and from bringing concerns to the attention of the MOD in time for enforcement action to be taken. This is evidenced by the fact that around half of the ‘unknown’ supplier report delays are in relation to the overhead reports. The other half are in relation to SICR and SME report submissions.

Our work to better enable supplier report compliance monitoring will be considered further as part of our review of statutory reporting requirements in support of the MOD’s consideration of overhead recovery. This work will not consider the submission on SICR and SME reports as this is subject to further discussion between the SSRO and the MOD to better understand why SICR and SME submissions are delayed, or not submitted at all, and the impact of this.

The SSRO supports contractors to comply with their reporting obligations. We also notify the MOD as soon as a delay has occurred and we provide monthly updates to the MOD, including any explanations provided by the contractor for the delay. This allows the MOD to consider if, and when, enforcement action may be appropriate.

4. Quality of submissions

Proportion of contract reports submitted that are complete and meet the requirements of the legislation at the first attempt [Target 25%]

The SSRO considers whether reports are complete and free from issues as these are more likely to contain good quality data. As indicated in our data strategy, the SSRO aims to see reported data fully utilised in support of the regulatory framework, and this is more likely if the data is relevant, comparable and reliable.

The SSRO’s KPI relates to contract reports, but we apply the same benchmark to supplier reports. The target is low as historically few reports were right first time. We propose to stretch this target in future and to add a KPI for the percentage of reports that are right by the second submission.

Analysis of the quality of submissions

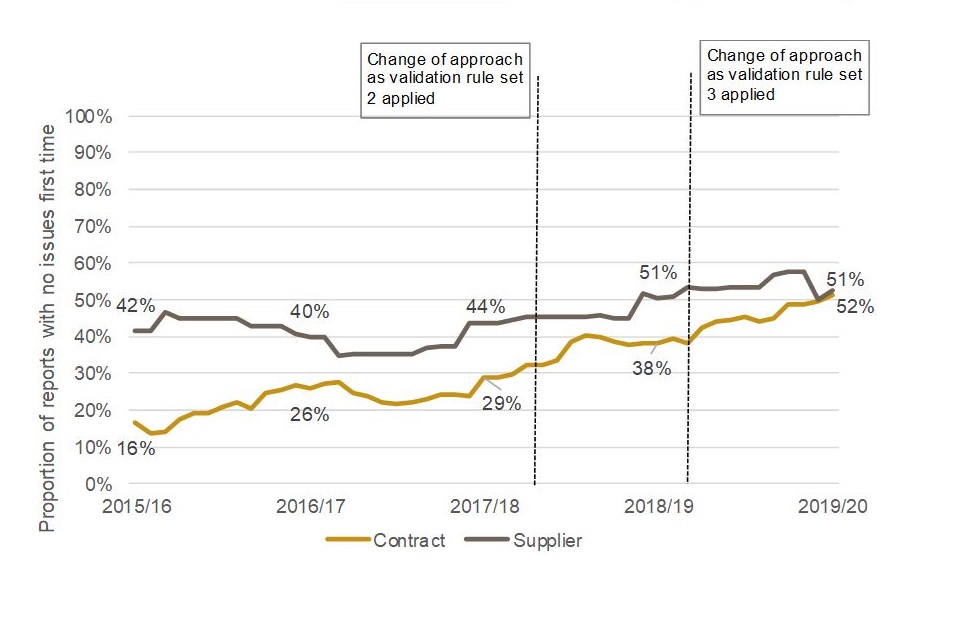

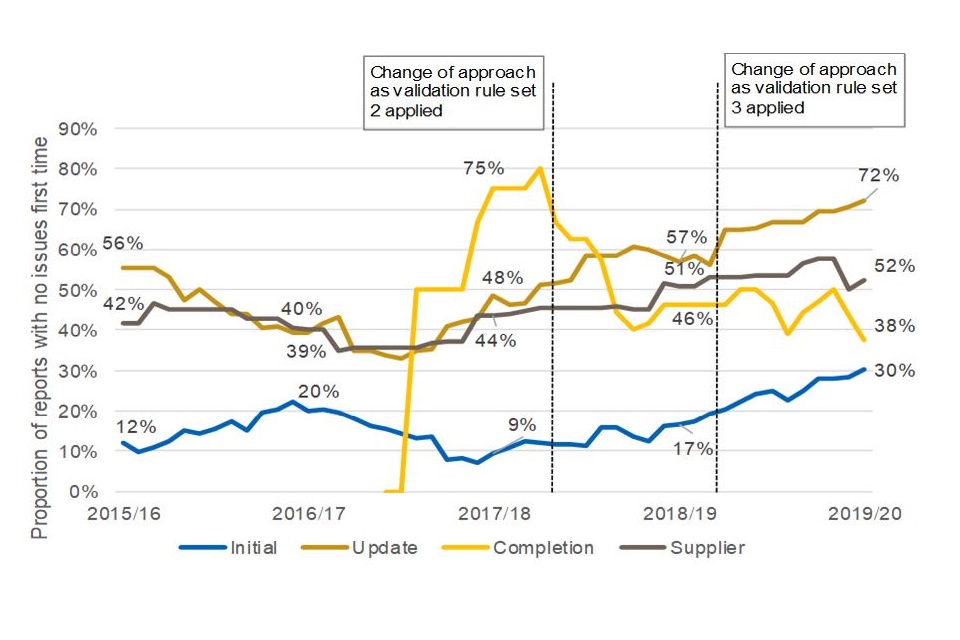

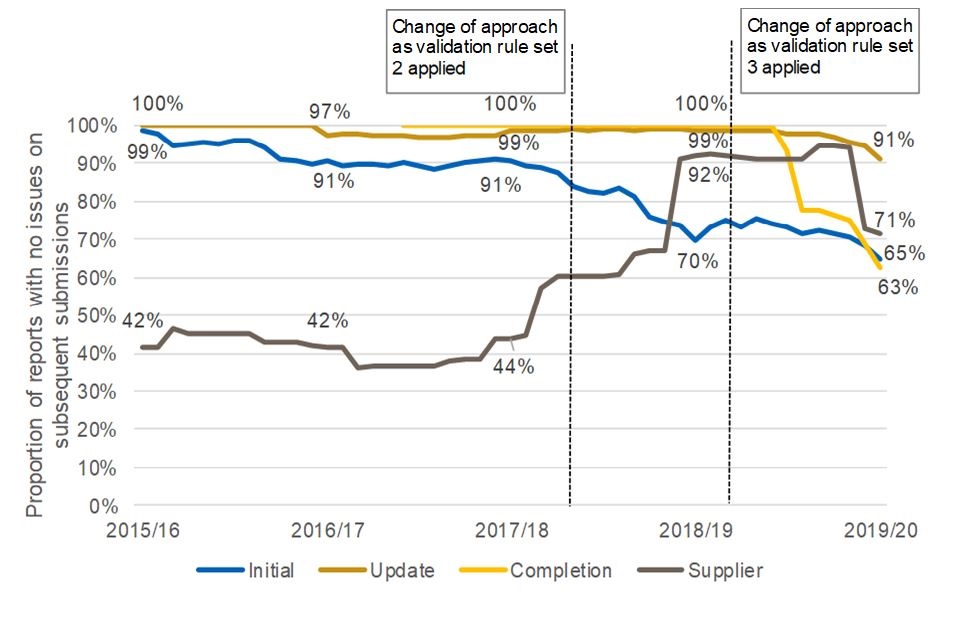

In 2019/20, the SSRO identified that 52 per cent of contract submissions were made ‘right first time’. This is an improvement on the 38 per cent that were right first time in 2018/19. The percentage of supplier reports that were right first time remained the same at 51 per cent, although this is based on the sample of reports reviewed by 30 June and may change once all supplier reports have been reviewed. Figure 11 details the proportion of contract and supplier reports submitted with no issues raised by the SSRO. Figure 12 provides a breakdown for different types of contract reports and shows that it was the initial and completion contract reports that had the most issues identified upon first submission.

Figure 11: 12 month rolling average proportion of contract and supplier report submissions correct first time, by submission date

Figure 12: 12 month rolling average proportion of contract and supplier report submissions correct first time, by report type and submission date

The SSRO’s performance indicator is based on a ‘pass or fail’ assessment of a report submission. We would like all reports to be right first time, but we also consider:

- whether contractors resubmit reports and get them right on subsequent submissions; and

- the number and type of issues raised on each report.

Figures 13 and 14 show the extent to which contractors submit correct reports on subsequent attempts, or where the MOD has responded to an issue raised with it by the SSRO that has resulted in the issues being marked as resolved. When considering the subsequent resolution of issues raised, the quality of the submissions increases significantly. We expect that over time, as contractors resubmit reports, the percentage of corrected reports for both contract and supplier report submissions initially made in 2019/20 will increase further.

Figure 13: 12 month rolling average proportion of contract and supplier report submissions correct in subsequent submissions, by submission date

Figure 14: 12 month rolling average proportion of contract and supplier report submissions correct in subsequent submissions, by report type and submission date

The SSRO identified fewer issues on reports submitted in 2019/20 than in previous years. Table 1 of Appendix 5 details the number of issues raised by year for both contract and supplier reports. We reviewed 574 contract report submissions and raised 534 issues with contractors, of which 347 have been resolved. We reviewed 84 supplier report submissions and raised 132 issues with contractors, of which 27 have been resolved.

The numbers of issues raised by the SSRO were affected by two key matters:

- We separately consider issues raised by the MOD on reports, which are increasing. Our updated compliance methodology refers to increased reliance on MOD reviews and we will consider how to reflect these in future publications of the compliance report.

- We suspended compliance queries on 30 March 2020 to allow for any operational issues faced by contractors in dealing with the COVID19 pandemic, and we did not restart issuing and chasing queries until 10 June 2020. This has had an impact on our supplier report reviews, where the majority of issues were released in June 2020 and contractors had not, at the date of drafting this report, had sufficient time to resolve them.

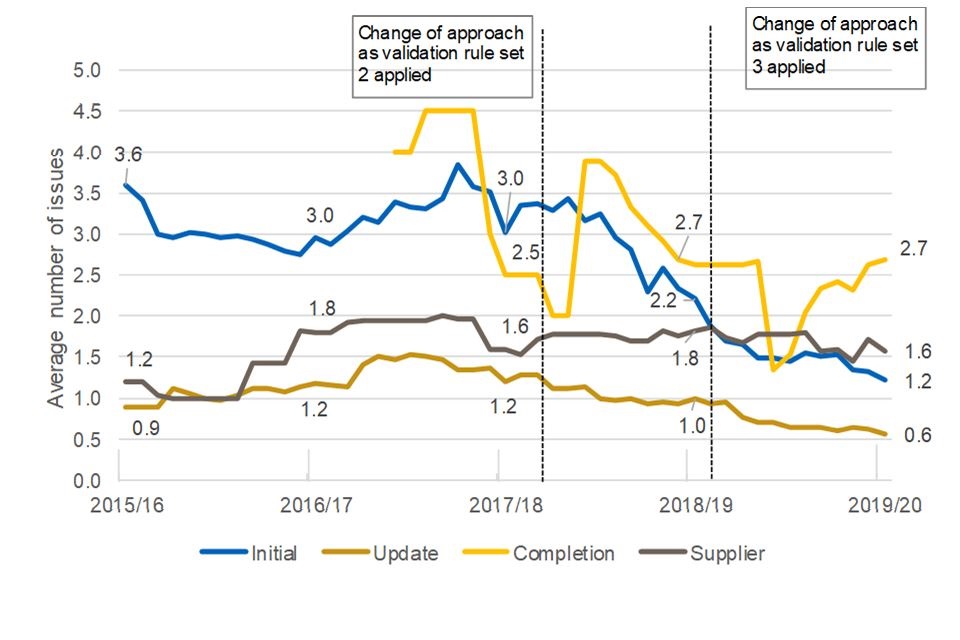

There was a decrease in the number of issues raised by the SSRO on each report. The decrease is particularly apparent in relation to initial and updated contract reports, where the average number of issues raised has halved since the prior year. Figure 15 details the 12-month rolling average number of issues per report type, by submission date, and shows that:

- issues per report have continued to fall for initial and update reports;

- issues are higher for completion reports, but there continue to be lower numbers of these reports and performance may improve as experience grows; and

- issues per supplier report appear static in 2019/20 compared to previous years.

Figure 15: 12 month rolling average number of issues per report type, by submission date

The reduction in the number of issues raised per report has been due to increased use of automatic validation warnings and a better understanding by contractors of submission requirements. The SSRO introduced validation rule sets 2 and 3 in June 2018 and May 2019, which have helped to reduce the number of issues on reports.

The top 15 GUOs (by number of report submissions) account for 79 per cent of all contract report submissions reviewed by the SSRO and the quality of their submissions impacts the overall quality indicator significantly. Figure 16 details the proportion of contract reports submitted with no issues raised for these 15 GUOs, in order of the quality of contract report submissions.

Figure 16: Proportion of contract report submissions with no issues raised, by GUO (only for GUOs with a minimum of 15 report submissions)

Some of the MOD’s top suppliers of QDCs and QSCs are performing below expectation in terms of the quality of their report submissions. An improvement by the lower performing GUOs would help to increase the overall quality of submissions if they continue to submit a significant number of reports in future. The SSRO will contact these GUOs and seek to work with them to discuss their reporting arrangements and consider whether any improvements could be made to their processes for making better quality submissions.

Themes arising from identified issues

The queries raised by the SSRO and the MOD on the statutory reports cover a wide range of issues, but some general themes can be identified. In 2019/20, around half of the SSRO’s queries on contract reports centred on ten themes, and 67 per cent of the supplier report queries centred on five themes. Tables 3 and 4 show the themes we have identified, and how they may impact on future use of the data.

Table 3: Analysis of the top ten themes from contract report issues raised by the SSRO in 2019/20

| Theme | % of issues | Common issues arising within theme | Potential impact on future use of data |

|---|---|---|---|

| Supplier Details | 7 | Incorrect or incomplete company, or parent company, details provided. | Basic errors in supplier data impacts the ease and automation of analysis and requires manual intervention to correct the data. |

| Report Submission Admin | 7 | Dates reported for when the report is due out of line with the legislation. | Incorrect reporting dates give a false impression of the timeliness of data and impact on the availability of information for contract management and analysis. |

| Contract Price | 5 | Reporting of price excludes contract costs before the contract became a QDC on amendment. Total contract price reported differs from price calculated using the pricing formula. |

If the reported data provides an incomplete or inaccurate understanding of the contract price, it may restrict the MOD’s use of the reports to manage its contracts or make estimates. If the price is not calculated in accordance with the formula, questions will remain as to whether it is value for money and fair and reasonable. |

| Recovery Volumes | 5 | Incomplete, or inconsistent, annual profiling of cost recovery rates and volumes across the years of the contract. | Use of reported recovery rates and volumes for estimation will be impeded if the data is incomplete or otherwise lacking in quality. |

| Output Metrics | 5 | Output metrics, or the value and units associated with output metrics, not reported. | Estimators will need to look elsewhere for the output metrics needed for parametric estimating, which may be less efficient. |

| Profile of Costs | 5 | Incomplete annual profiling of costs across the years of the contract. Inclusion of negative values as ‘costs’ within the annual profiling of costs across the years of the contract. |

Use of reported cost information for estimating purposes will be impeded if the data is incomplete or otherwise lacking in quality. The inclusion of ‘negative costs’ provides an inaccurate profile of costs across years. |

| Contract Profit | 5 | Incomplete annual profiling of costs across the years of the contract. Inconsistency in calculation of contract profit rate. |

Use of reported cost profiles and profit information for estimation and contract management will be impeded if the data is incomplete or otherwise lacking in quality. If the steps for determining the contract profit rate are out of line with the contract price, questions will remain as to whether the price is value for money and fair and reasonable. |

| Reporting Plan | 5 | Changes to contract completion dates that are not reflected in reporting plans. Contract ‘entered into’ date reflected as the date of amendment for contracts that have become qualifying contracts by amendment. |

Incorrect reporting dates give a false impression of the timeliness of data and impact on the availability of information for contract management and analysis purposes. The selection of the incorrect date that a contract is entered into means that pre-amendment costs and profits are not reported leading to an incomplete data set. |

| CSA | 4 | CSA calculator within DefCARS left incomplete. | If the CSA calculator is not completed, there is a lack of assurance that the CSA has been calculated in accordance with the Statutory Guidance. It also limits the data available for analysis, reducing understanding of how the regime is operating and our ability to make recommendations for legislative change or improvements to DefCARS. |

| Inconsistencies across reports | 4 | Changes in prices across reports without any corresponding pricing amendments reported. | Use of reported prices for estimation and contract management will be impeded if there are unexplained inconsistencies between reports. |

Some issues with basic administrative data are less prevalent than in previous years, such as supplier and business unit details that are incomplete or inconsistent between reports. DefCARS picks up most of such issues automatically and flags them, allowing the contractor to make an amendment to the data before submission. Some issues continue to occur, such as incorrect company details that are only identified by manual review.

Table 4: Analysis of the top five themes from supplier report issues raised by the SSRO in 2019/20

| Theme | % of issues | Common issues arising within theme | Potential impact on future use of data |

|---|---|---|---|

| Variances between Estimates and Actuals | 21 | No commentary provided to explain variances within submitted overhead reports. | Use of reported cost information for estimating purposes will be impeded if the data is incomplete or otherwise lacking in explanation. |

| Inconsistencies across reports | 14 | Cost analysis information reported on an inconsistent basis. | Use of reported cost analysis information for estimation purposes will be impeded if there are unexplained inconsistencies within reports. |

| Changes between Actuals and Future Estimates | 13 | Changes between prior year actuals and future estimates not explained. | Use of reported cost information for estimating purposes between prior years and future estimates will be impeded if the data is incomplete or otherwise lacking in explanation. |

| Relevant Financial Year | 11 | Incorrect relevant financial years referenced. | Basic errors in data impacts the ease and automation of analysis and requires manual intervention to correct the data. |

| Head Count for prior year | 8 | Unexplained changes in headcount data from prior year. | Use of reported head count information for estimating purposes between prior years and future estimates will be impeded if the data is incomplete or otherwise lacking in explanation. |

Overall, there are fewer issues identified with supplier reports than there are with contract reports. This is partly because the supplier reports are less structured in DefCARS than the contract reports and have fewer standard fields. This limits the SSRO’s ability to scrutinise the consistency of submitted data.

Our Review of the single source regulatory framework 2020 considered the overhead reports. We identified a need to better understand how the information is used by the MOD, particularly in relation to the rates programme. We intend to continue to consider recovery and reporting of overheads under our Corporate Plan 2020-2023, which may lead to changes in how we collect this data.

MOD reviews

The MOD reviewed 144 of the 2019/20 contract report submissions, which is a significant improvement on the 40 reports that were reviewed at the same point last year. MOD reviewers raised 287 issues across 20 report submissions covering 15 contracts. In line with the approach agreed with the MOD, the SSRO does not duplicate issues raised by the MOD as part of its own reviews.

Table 5 details the top five themes arising from the MOD’s review of contract report submissions in 2019/20. These themes account for more than 65 per cent of the issues raised by MOD reviewers.

Table 5: Analysis of the top five themes from contract reports raised by the MOD in 2019/20

| Theme | % of issues | Common issues arising within theme |

|---|---|---|

| Business Units | 20 | Cost recovery rate information not recognised. |

| Contract Information | 17 | Contract information such as descriptions, dates and price not as per contract. |

| List of Significant Individual Payments | 12 | Missing payment details or details that are inconsistent with contract information. |

| Subcontract Details | 7 | Subcontract details incomplete. |

| Contract Price | 6 | Incorrect total contract price reported. |

There is, however, the potential for the MOD’s reviews to expand and achieve more. In 2019/20 the MOD:

- reviewed 25 per cent of contract reports;

- categorised most reviewed reports as having no issues, when subsequent reviews by the SSRO disclosed there were issues;

- has raised duplicate issues within the system and in some instances has not followed up on issues raised to close the issue with the contractor; and

- has only documented on the system the completion of one supplier report submission review.

There also remains a lack of clarity as to how reported information is used by the MOD, particularly in relation to the rates programme.

The SSRO’s Targeted Reviews identified action that the MOD can take to improve its reviews of the statutory reports (see section 5). This includes highlighting to Delivery Teams the importance of reviewing reports and supporting them to carry out such reviews. The training offered to Delivery Teams could be further developed to better meet the needs of MOD users. There is training offered solely by the MOD to Delivery Teams, and joint training by the MOD and the SSRO, which could be adapted to increase focus on the operation of DefCARS, including practical use of system validation rules, and to help recognise the time required to review reports. The SSRO will continue to support MOD training sessions aimed at Delivery Teams.

Improving the quality of submissions

Action is required by the MOD, the SSRO, and contractors if the quality of reported data is to improve, including the following:

- Contractors should take greater care when submitting reports to ensure that the data provided is correct and complete, particularly where it is basic information about the supplier itself.

- The SSRO will continue to support contractors to submit their reports through onboarding and other meetings, providing feedback on reports, and responding to helpdesk queries.

- The MOD and contractors should support the SSRO to carry out planned work on overheads and amendments and variances, and to make updates to Reporting Guidance and DefCARS.

- The MOD should continue to improve the extent to which it reviews the submitted reports and uses the data.

- The MOD should take appropriate enforcement action when there are unaddressed issues with reported data.

The SSRO introduced new validation checks in December 2019. We have also updated our guidance and DefCARS during 2019/20 to:

- improve the way data is collected on DefCARS, for example to enable more copy and paste functionality, include additional ‘yes/no’ fields to make the completion of some pages within the system more intuitive, and introduced developments that allow contractors to link submitted reports directly back to their reporting plans;

- reflect changes to the Regulations, for example to enable the provision for further information about sub-contracts; and

- facilitate completion of on-demand reports.

At the time of drafting this report we were consulting on guidance on how to determine the contract completion date as well as other improvements to the CIR guidance, such as the reporting of the ‘price committed to pay’. This consultation started in 2019/20 but was extended due to the impact of the COVID-19 pandemic.

The highest number of issues raised on reports relate to matters that could be avoided by greater care on the part of contractors. On contract reports this includes provision of the supplier’s own details. On supplier reports the most frequent issue is with the explanation of variances within overhead reports, due to suppliers either not providing, or inadequately explaining, the differences between prior year actual costs and prior year estimated costs, or between prior year actual costs and current year estimated costs.

The SSRO will continue to support contractors to get reports right first time by:

- providing automatic validation checks in DefCARS and considering where additional validation would be suitable;

- holding on-boarding sessions with contractors;

- meeting contractors to consider compliance issues at a ‘companywide’ level;

- providing contract specific feedback by telephone or in meetings;

- improving our reporting guidance and DefCARS; and

- keeping the reporting requirements under review.

There are areas in which contractors continue to find difficulty in applying the regulatory requirements which we have identified as areas for potential improvement to the guidance. These include:

- reporting the contract price where a late reduction has been negotiated to address a continuous improvement challenge, sometimes leading to the reporting of negative costs;

- keeping up to date with reporting plans when on-demand submissions not requested by the MOD;

- providing metrics information if no suitable metrics apply to the contract, or the contract has not stipulated any metrics;

- the requirement and ability to report ‘sunk’ costs when a contract is brought within the regime following an amendment, which has proved to be problematic for some contractors; and

- the reporting of amendments to contracts.

We will be considering the reporting of sunk price and negative costs as part of our version 10 reporting guidance update, for publication in the spring of 2021.

Our review of the single source regulatory framework 2020 considered the reporting of amendments and variances, and overheads. We identified a need to continue to explore these areas and make improvements. We have programmed work under our Corporate Plan 2020-2023 and plan to:

- introduce better categorisation of the causes of cost growth reported as variances;

- clarify how to report the impact of a material pricing amendment;

- simplify the on-demand report capability within DefCARS, making capture of amendment information in an on-demand CPS easier; and

- review the recovery and reporting of overheads.

The strategic reports will not be considered as part of the multi-year programme of work in relation to overheads, but this is an area that the SSRO will consider further with the MOD.

5. Collaborative working with the MOD

Between December 2019 and March 2020, while being supported by the MOD, the SSRO carried out Targeted Reviews of six initial report submissions and issued a report to the MOD on this work in June 2020.

The key objectives of the Targeted Reviews were to:

- supplement routine compliance monitoring with more detailed checks of a small number of individual reports, in line with the SSRO’s compliance methodology;

- gather intelligence as to how routine compliance monitoring is operating, including automatic validations in DefCARS and Delivery Team reviews;

- gather intelligence as to how the provisions of the regulatory framework are being applied in practice; and

- help inform the MOD of how well the its internal processes are working in practice.

The approach undertaken for the reviews included:

- the initial SSRO and MOD compliance checks being carried out in DefCARS for all six contracts as part of the normal review process;

- a desk-based review of each submission by the SSRO against a detailed compliance checklist, considering validation matters which should have been automatically highlighted by the system prior to submission;

- the review of any issues identified as part of the MOD review;

- consideration of any comments and attachments provided by contractor; and

- discussion with the MOD’s Delivery Teams for each of these six contracts, focusing on issues arising from the desk-based review as well as on the processes in place for Delivery Team review of submissions.

The Targeted Reviews found that Delivery Teams had, following the Commercial Toolkit Guidance, identified aspects of the initial reports that were incorrectly completed by contractors, with respect to:

- the reporting of contract price information, with submissions not reflecting agreed Allowable Costs or pricing amendments;

- the recording of dates, with incorrect or incomplete contract and reporting dates reflected in submissions;

- incomplete cost recovery rates, along with some volumes of recovery rates not being recognised by the MOD; and

- incorrect basic administrative data, where issues were identified with inaccurate reporting of the contract title and contract reference, incomplete parent company details as well as the incorrect contract type.

The issues raised by the Delivery Teams have improved the quality of data held in DefCARS and provided a better understanding of contract pricing. The SSRO, however, identified additional issues affecting the data quality of the submissions, which included:

- basic administrative issues such as incorrect company number information;

- incomplete information on the assumptions applicable to the pricing of contracts, payment details and reconciliations of costs within submissions; and

- incomplete supporting comments on the adjustments that were made to the baseline profit rate, particularly with respect the Cost Risk Adjustment, the Profit on Cost Once adjustment and the Capital Servicing Adjustment.

To improve the quality of reported information, we recommended in the report that:

- feedback on areas for improvement is provided to individual contractors periodically;

- the SSRO’s reporting guidance continues to be improved and changes are made to incorporate priorities identified through SSRO and Delivery Team reviews; and

- guidance continues to be supported through on-boarding and periodic training offered to industry DefCARS users.

While Delivery Teams successfully identified a range of reporting matters in contractor submissions, there were aspects of submissions where checks of contractor reporting were less effective. In these cases, there was not enough evidence available from the work of the Delivery Teams to determine whether reported information was in line with the requirements of the regulatory framework with respect to reporting and pricing.

Findings on how the MOD’s review processes were working in practice identified:

- a good level of awareness of the existence of the Commercial Toolkit guidance with all reviews carried out within the 15-day target, but low awareness of the practical application of the guidance resulting in a lack of clarity on what should be considered when undertaking a review;

- the MOD’s stated objective to use the data recorded in DefCARS to support contract management on an ongoing basis was not being met as Delivery Teams considered information provided by contractors outside of DefCARS to be more useful;

- the review process largely involved commercial staff, rather than the wider Delivery Team, resulting in reviews focused on contract price elements of submissions; and

- the depth and consistency of reviews varied across the Delivery Teams with some issues raised by the SSRO not having been identified by the Teams and some queries in DefCARS remaining unresolved, risking residual data quality issues.

Three key factors were cited by Delivery Teams as contributing to the finding on how MOD reviews were working in practice. The key factors were to do with other work priorities; training; and skillsets within teams.

To improve the operation of the MOD’s review process and positively impact the quality of information reported by contractors, we recommended that:

- summary feedback on key themes identified from the Targeted Reviews should be disseminated to Delivery Teams to raise awareness and improve review focus;

- any developments to the SSRO’s reporting guidance and to the Commercial Toolkit should be communicated to Delivery Teams to promote the awareness and benefits of review work outcomes;

- any guidance is supported by improved training provided to Delivery Teams, including a focus on action lists and the identification of ‘champions’; and

- that the MOD involves a wider range of skillsets in its reviews, including estimators and both commercial and other Delivery Team members.

We intend to continue to undertake Targeted Reviews and have started engagement with the MOD for a programme of reviews to be undertaken in 2020/21 which will include following up on the recommended actions.

6. Issues referred to the MOD

The SSRO works with contractors to encourage timely and good quality submissions. In some cases, issues with reports are not resolved and we promptly raise such concerns with the MOD so that action can be taken to address them. We notify the MOD of:

- late reports submissions and provide monthly updates (timeliness issues); and

- issues raised with contractors on submitted reports if the contractor does not respond to an issue or provides a response that appears inconsistent with the legislation or statutory guidance (quality issues).

Raising issues with the MOD enables:

- feedback from the MOD to inform the SSRO’s understanding;

- resolution of the issue in cooperation with the contractor and the MOD; and

- enforcement action by the MOD if it considers it appropriate.

The MOD’s feedback is an important part of compliance reviews, as it helps the SSRO to understand whether reporting requirements are being met and how the regulatory framework is being applied. We use this feedback to clarify whether there is an issue, the underlying causes, its relative importance, and how the issue can be addressed.

The Secretary of State is empowered to take enforcement action if a contractor fails to meet its reporting obligations, which may, for example, be in relation to a missing submission or in relation to a submission that is in contravention of the reporting requirements that are set out in the legislation. Enforcement may consist of a compliance notice under section 31 of the Act requiring a contractor to take action, or a penalty notice under section 32 of the Act imposing a fine. The time limit for issuing a compliance or penalty notice in these circumstances is six months after the date the report is due.

Enforcement action in 2019/20

The MOD has not advised the SSRO of any compliance or penalty notices issued in 2019/20. This is in line with the trend from 2018/19, when no enforcement action was taken.

Action on late reports

The timeliness of reports was lower in 2019/20, as set out in section 3. We consider that it may assist to improve timeliness if the MOD made greater use of its enforcement powers than it does at present.

The MOD should be mindful of the six-month limitation when considering action on late reports. We draw attention to the following in this context:

- On 30 June 2020, there were a total of 68 individual contract reports that had been outstanding for longer than six months.

- These 68 reports represent missing information from 23 contractors across 28 contracts, with a cumulative price of £1.379bn.

- Two of the contracts with a price over £50m have not submitted their initial reports, nor any QCRs or ICRs which may subsequently have become due.

We recommend that the MOD considers whether any other action may be taken in respect of these late reports. It may still be possible to ensure the reports are submitted through direct negotiation with the contractor, or by requiring on-demand reports.

Action on issues raised with the MOD

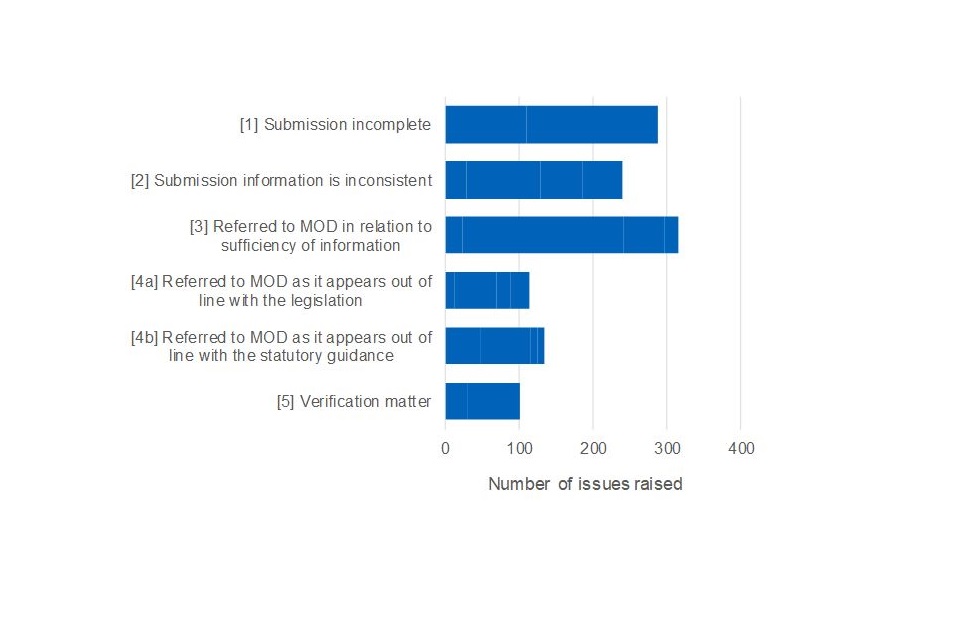

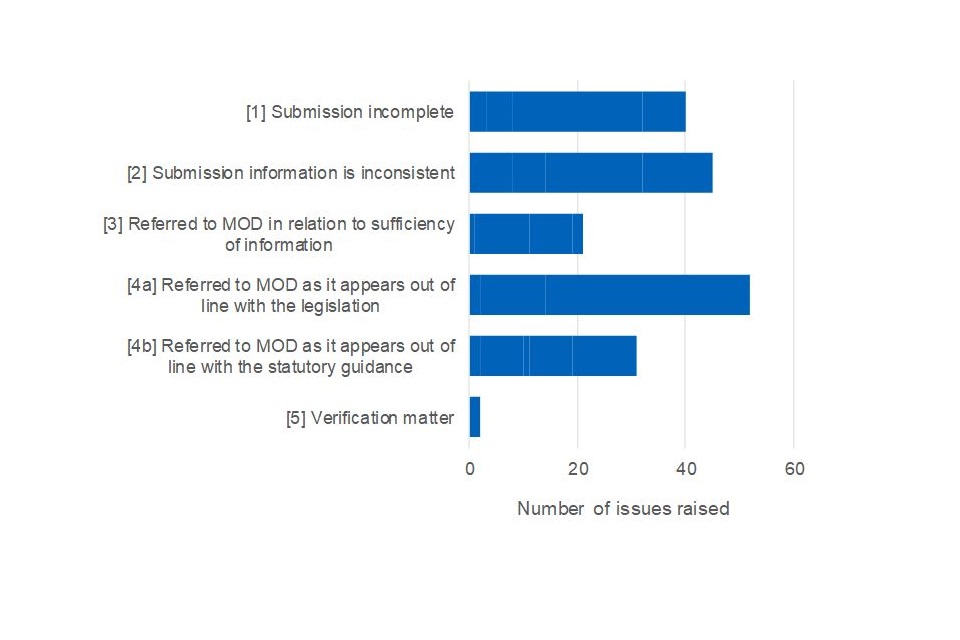

The SSRO raised a total of 1268 issues with the MOD from 2015/16 to 2019/20, relating to submitted reports. Figure 17 provides a breakdown of the issues into the categories used by the SSRO when referring matters to the MOD.

Figure 17: Analysis of the categories of issues referred to the MOD, 2015/16 to 2019/20

The issues referred to the MOD have typically been addressed by the contractor taking action to resolve the SSRO’s concern, or by the MOD providing feedback. Tables 6 and 7 shows the number of issues addressed by contractor action or MOD response and the number in respect of which there has been no response.

Table 6: Number of issues referred to the MOD on contract report submissions, by year the report was submitted

| Year | Issues referred | Issues addressed | Issues in progress |

|---|---|---|---|

| 2015/16 | 161 | 150 | 11 |

| 2016/17 | 608 | 575 | 33 |

| 2017/18 | 244 | 222 | 22 |

| 2018/19 | 181 | 108 | 73 |

| 2019/20 | 74 | 21 | 53 |

| Total | 1,268 | 1,076 | 192 |

Table 7: Number of issues referred to the MOD on supplier report submissions, by year the report was submitted

| Year | Issues referred | Issues addressed | Issues in progress |

|---|---|---|---|

| 2015/16 | 27 | 2 | 5 |

| 2016/17 | 77 | 0 | 77 |

| 2017/18 | 48 | 0 | 48 |

| 2018/19 | 58 | 0 | 58 |

| 2019/20 | 0 | 0 | 0 |

| Total | 210 | 2 | 208 |

There are 399 issues that the SSRO has referred to the MOD which have received no response and are now older than six months from the report submission date. These issues consist of:

- 191 issues on contract reports; and

- 208 issues on supplier reports (of which 141 related to SICRs).

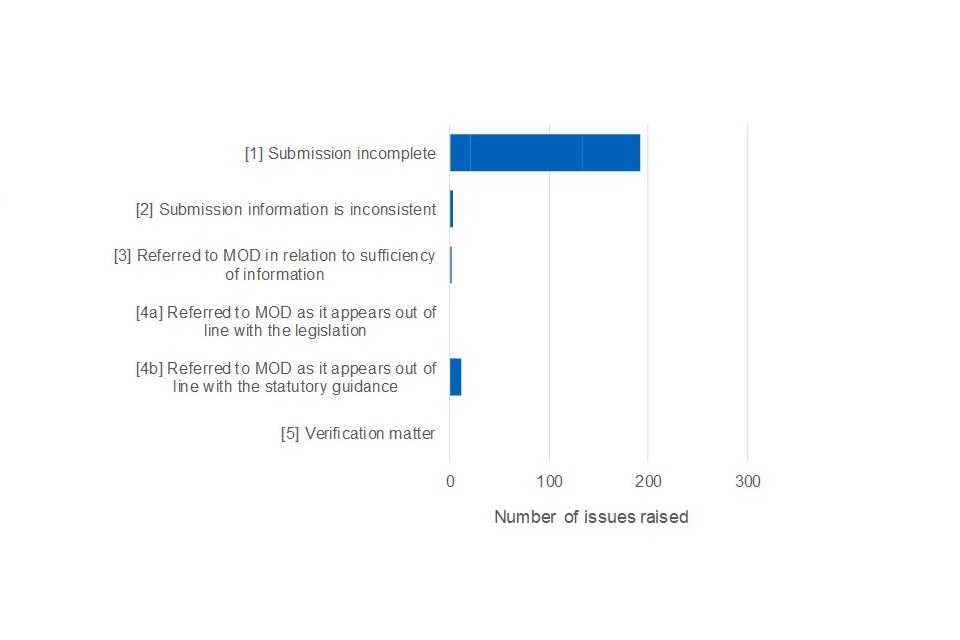

Figures 18 and 19 breakdown the 191 contract report issues and 208 supplier report issues that are older than six months into the categories used by the SSRO when referring matters to the MOD.

Figure 18: Analysis of the categories of contract report issues referred to the MOD where the submission date is older than six months

Figure 19: Analysis of the categories of supplier report issues referred to the MOD where the submission date is older than six months

Most outstanding issues on supplier reports in Figure 19 relate to the SICR (141 of 208 issues) and raise concerns about the completeness of the submitted reports. The SICR is intended to provide an overview of key suppliers’ capacity and overheads, relevant to the MOD’s current and future requirements. We have not received responses from the MOD to the issues raised on the SICRs and it is unclear whether the reports are being used by the MOD (e.g. to manage its relationships with key suppliers), or whether the SSRO’s work has positively impacted on use of the reports. As such, we have not raised similar issues with GUOs relating to the completeness of SICRs submitted during 2019/20. The SSRO will engage further with the MOD about its use of the SICR and will consider undertaking a thematic compliance review if the MOD supports this approach.

The SSRO proposes to close the issues referred to in Figures 18 and 19, as the MOD is now unable to issue a compliance or penalty notice to address them. We will cease to actively seek feedback from the MOD, or cooperative action to resolve the issues. Where the issue relates to a reporting requirement, as opposed to an issue in relation to a pricing matter, the SSRO will mark the issue as impacting on the overall quality of the submission but take no further action in any subsequent submissions for the same contract where the same issue arises. This means that there may be data quality issues in existing or future submissions that impact on analysis, or contract management. Where an issue relates to a pricing matter, the SSRO will be limited in its ability to fully consider its impact on the regime or to understand the underlying causes behind the issue and how it may be addressed in future.

The SSRO will continue to refer matters to the MOD as appropriate. As part of our updated compliance methodology we will seek to categorise these as ‘high, medium, or low’ priority to assist the MOD in knowing where to focus its efforts. The priority assigned to an issue by the SSRO will be based on its potential impact on operation of the regulatory framework. In future where an issue has been outstanding on the system for six months or more from the due date of the submission, the SSRO will close the issue and mark it as impacting the overall quality of the report.

7. Development of the methodology

The SSRO reviewed its compliance methodology in 2019/20 in consultation with stakeholders. We identified that updates should be made to the methodology to address the following matters:

- a clearer reflection of the SSRO’s review role within the regime with respect to reporting compliance, alongside that of contractors and the MOD;

- developments in technology, approach and consideration of stakeholder feedback received since the existing methodology was published in early 2017. In particular, the development of the web-based version of DefCARS, the introduction of automatic validations within the DefCARS; and the provision of a facility to correspond and log issues directly within the system which have provided for a more secure, transparent and efficient way of raising and resolving issues;

- our work with the MOD to develop processes and procedures for reviewing report submissions and to ensure that there has been a greater shared understanding of the issues encountered in contractor submissions. This is led to greater reliance being placed by the SSRO on the MOD’s reviews, leading to a development in the way that we calculate our quality indicator;

- acknowledgement that the ‘right first time’ reflection of performance needed to take into account action taken by contractors to rectify any issues arising, which had led to the development of the quality indicator;

- the developments in the way we have supported contractors to improve the timeliness and quality of submissions, including updating our standard on-boarding process for contractors with new qualifying contracts; implemented a training environment on DefCARS; enabled contractors to gain early access to DefCARS via the ‘potential QDC / QSC’ functionality; and meeting with contractors to discuss any issues arising from submissions; and

- the introduction of our work on the ‘Targeted Reviews’ of submissions which have involved detailed discussion with MOD Delivery Teams.

The updated compliance methodology was published in January 2020 for implementation from April 2020. Our next compliance report will be based on this methodology.

-

For the purposes of this report, one company that has made its own supplier report submissions has been classified as a GUO separate to its ultimate parent undertaking. ↩

-

SSRO Qualifying Defence Contract Statistics 2019/20, https://www.gov.uk/government/collections/ssro-qualifying-defence-contract-statistics ↩