Summary of consultation responses

Updated 3 October 2019

1. Introduction

Background

1.1 Section 19(2) of the Defence Reform Act 2014 (the Act) requires that the Single Source Regulations Office (SSRO) provides the Secretary of State with its assessment of the appropriate baseline profit rate, capital servicing rates, and SSRO funding adjustment (“rates”) by 31 January each year for the purpose of assisting the Secretary of State in determining what those rates are for the subsequent financial year.

1.2 The SSRO’s approach to calculating its assessment is set out in its Single Source Baseline Profit Rate, Capital Servicing Rates and Funding Adjustment Methodology (“the methodology”). . 1.3 Following engagement with key stakeholders during summer 2018, the SSRO conducted an eight-week public consultation[footnote 1]on proposed changes to the methodology in three areas to:

a. remove ‘small’ companies from the result by introducing a more sophisticated companysize criteria, aligned to those used by other organisations, to further improve stability of the comparator group and to enhance the objectivity of that aspect of the methodology;

b. calibrate the automatic filters that identify a company’s activities to further reduce the need for manual intervention; and

c. clarify or codify existing practice in the activity characterisations to provide additional transparency and give further assurance that the methodology is applied in a consistent way.

Consultation summary

1.4 During the consultation period, the SSRO:

a. held group and individual discussions with members of the SSRO’s Operational Working Group[footnote 2] (OWG) and other interested parties;

b. received 8 responses to the consultation.

1.5 The SSRO would like to take this opportunity to thank those who responded to the consultation for sharing their views with us. 5 respondents gave permission for their responses to be published and these are available in SSRO (2019) Single source baseline profit rate methodology: Consultation Responses.

1.6 Overall, consultation respondents welcomed the opportunity to engage with the SSRO on the methodology. Most respondents expressed some support that the proposed changes improve the methodology; however, in all cases, industry respondents consider that the changes do not adequately address the topic areas, and some challenged the validity of the methodology in its entirety. These positions are largely based on arguments that have previously been put to the SSRO and that we have responded to. Having taken into account the representations made, the SSRO are of the view that the methodology is appropriate and the only changes at this time should be those that were consulted on.

1.7 We acknowledge that industry respondents have raised specific feedback on some technical aspects of the methodology that were outside the scope of the consultation and these are set out in Section 3. The SSRO is always open to constructive discussion on incremental improvement to the way in which it applies transfer pricing principles upon which the methodology is based. We will put any such matters forward for consideration in future work programmes.

1.8 As a result of feedback, we will alter the description of the geography search criteria for clarity, but this does not alter the substance of the change to the methodology. The other changes that were consulted on will be implemented as proposed.

1.9 The following sections of this paper summarise the views and evidence provided by consultation respondents, together with the SSRO’s commentary on how these responses have informed the final methodology in the areas on which we consulted.

1.10 The methodology will be applied by the SSRO in assessing the rates it will recommend to the Secretary of State that should apply from 1 April 2020.

2. Search criteria and activity characterisations

2.1 The MOD supported the proposed changes; we have set out below a summary of the key points made by other respondents with regards to the proposed changes to the methodology relating to the search criteria and activity characterisations.

2.2 Most respondents also gave comments on other aspects of the methodology or on other matters out of scope of the methodology and these are discussed in Section 3

Geography criteria

2.3 One respondent sought clarity on the meaning of the term ‘overseas territories’ in paragraph 3.30 of the consultation, since certain UK overseas interests are determined to be British Overseas Territories.

2.4 The exclusion of overseas territories means that only the part of the political definition of a country that is geographically located in Western Europe and North America would be included. For example, French Guiana would not be included as part of “France” for the purposes of the search. We accept this could be better phrased and propose to alter the text consulted on as follows:

9.11 Companies located in the following geographical regions, not including overseas territories, are included in the search: - Western Europe - North America

Company size criteria

General views on proposed changes

2.5 Four industry respondents considered that the proposed changes improve the methodology; however, they also consider that there are wider issues with the methodology that need to be addressed to ensure it meets its objectives (see section 3). This view is shared with three other respondents to the consultation.

2.6 SSRO response: We will implement the proposed changes to the methodology. Comments and feedback on further changes will be logged and put forward for consideration in future work programmes.

Comparison with single source MOD contractors

2.7 Some industry respondents proposed a more extensive consideration of comparability. They considered that companies performing QDCs and QSCs perform additional economic activities associated with integrating sophisticated equipment into complex systems that were absent in comparator group companies.

2.8 Some respondents considered that the economic activities performed by MOD’s contractors were generally to higher or more complex standards than those performed by comparator group companies. They argued that the work performed under QDCs/QSCs is usually more specialised, complex and risky.

2.9 Five industry respondents were of the view that it would not be typical for a company with a turnover £10.2 million and total assets of £5 million and/or 50 employees to possess the required resources to prequalify for any MOD tender and a typical company the MOD engages with is much larger and is capable of managing greater complexity than the existing, or proposed size thresholds. They pointed to the SSRO’s own analysis presented in the consultation document that showed most QDC contractors to be “Large” or “Very Large” and one respondent noted that the SSRO’s 2018/19 Annual Statistics shows that there were only 11 out of 201 contracts that were contracted to SMEs. One respondent suggested that the turnover threshold should be set at the level of not less than £50 million, to match the threshold that gives the same availability of data as in the US. One respondent noted it had gathered information that the comparator group did consist of companies whose economic activities were included in whole or in part in the activity types that contribute to the delivery of QDCs and QSCs, but that some relevant activities were absent.

2.10 SSRO’s response: We have considered the matters raised by respondents, but do not agree these undermine the validity of the comparator group. The definition of comparability that the SSRO applies is that a company must undertake economic activities that are included in whole or in part in the activity types that contribute to the delivery of QDCs and QSCs. We consider that this definition reflects a robust and operable application of the OECD transfer pricing guidelines. We welcome the acknowledgement that the comparator companies meet the requirements of the definition. Given the representation in the comparator group of the MOD’s major single source contractors and of the defence industry more broadly, it is not the case that certain relevant activities are absent from comparator companies, although clearly not all comparators (or all QDC holders) would be capable of performing the entirety of the largest or most complex QDCs. Whether activities are contracted for on a basis that would meet the legal threshold for classification as a QDC or QSC or the MOD’s contracting policies is not in our view a categorical determinant of whether a company undertakes comparable activities.

Relationship between turnover and profitability

2.11 One industry respondent noted that their own analysis showed a relationship between turnover and profitability. Another told us that the data produced by the Government Profit Formula process (Yellow Book) always showed a relationship.

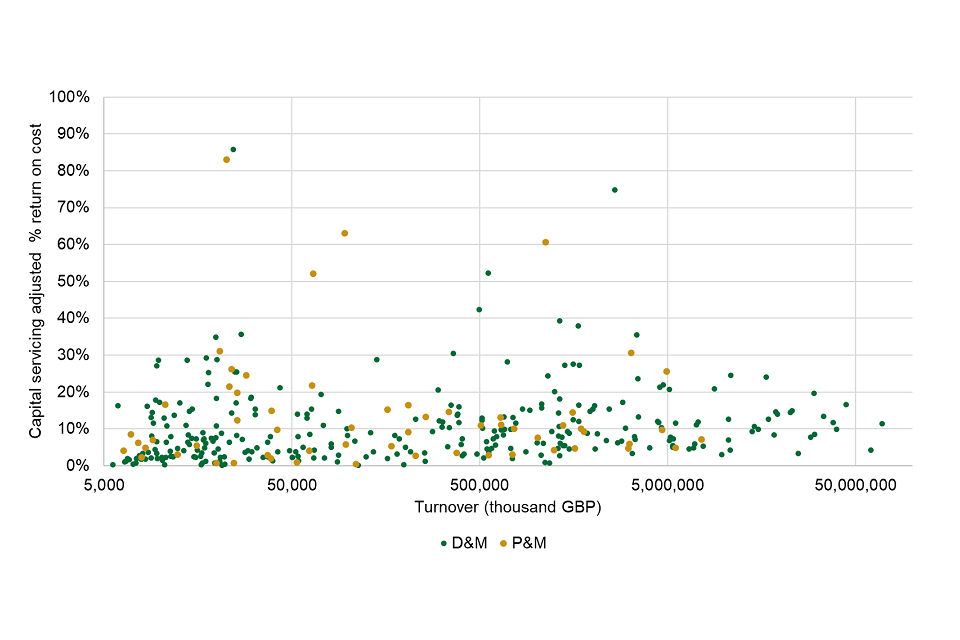

2.12 SSRO response: The SSRO’s own analysis on the actual comparator companies used to assess the baseline profit rate do not show a systematic relationship between return on cost of production and turnover (see chart 1 and chart 2). The SSRO has reviewed the analysis referred to by industry that has been made available, and does not believe it demonstrates otherwise. In particular, the analysis did not reflect important improvements the SSRO has made to the methodology in response to industry feedback. We can see no clear economic rationale as to why in a competitive market a company’s profit rate would be systematically determined by its size and such a relationship is not borne out in the data.

Chart 1: relationship between profit and turnover BPR comparator group 2019/20

Scatter chart showing relationship between profit and turnover BPR comparator group 2019/20

Availability of data for assessing impact of criteria changes

2.13 One industry respondent did not believe that sufficient data was made available to make an assessment on changing the criteria for the threshold. They identified the key missing data to be that which would enable the assessment of the affect the proposed changes would have on the baseline profit in previous years.

2.14 SSRO response: The SSRO considers it has provided appropriate transparency of data in both written form and at workshops to enable an informed assessment of the merits or otherwise of changing the criteria. Developments in the SSRO’s methodology are intended to incrementally improve the way in which it applies the OECD transfer pricing guidance and are not designed with a specific numerical outcome in mind. We consider that changes should be made on their own merits rather than on the outcome they might deliver.

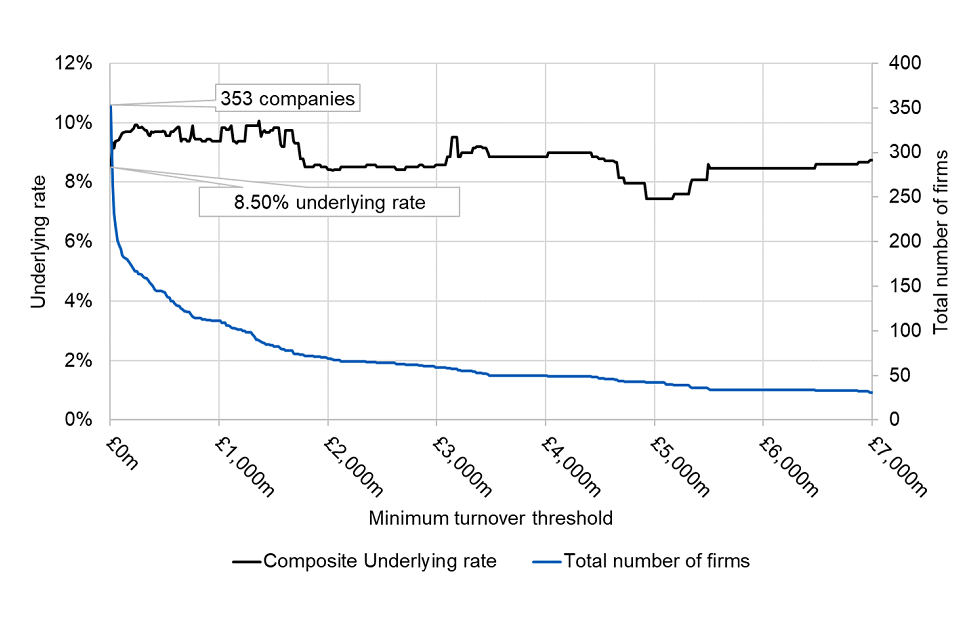

2.15 The BPR is set with reference to actual returns generated by profitable comparator companies and is therefore responsive to changes in the underlying performance of those comparator companies and could increase, decrease or stay constant. However, had the new company size criteria been applied for the 2019/20 rates assessment and all other considerations remained unchanged, the result of the methodology would have been a BPR of 7.86% (compared to 7.63%).

2.16 For completeness we include the underlying comparator group profit rates for the full range of turnover criteria as presented to the Operational Working Group.

Chart 2: impact of increasing the turnover threshold on the underlying rate of the 2019/20 comparator group

Scatter chart showing impact of increasing the turnover threshold on the underlying rate of the 2019/20 comparator group

Financial criteria

2.17 Two industry respondents commented on the proposed tangible fixed asset criteria. One proposed that the criteria should also consider intangible fixed assets and assets that are not recognised on the balance sheet, and those that have been fully written down and old book values. The second suggested the measure should be limited to UK based fixed assets so that it ensures that tangible fixed assets are held within the relevant economy.

2.18 SSRO response: The SSRO uses data that is published and collated in Orbis and therefore cannot filter based on assets not recognised in the balance sheet. The SSRO considered using the existence of “intangible assets” as a search criteria but found that some companies carry out comparable activities despite not having intangible assets on their balance sheet. As noted by respondents, intangible assets are often not recognised on a company’s balance sheet. Further analysis would need to be undertaken in order to persuade the SSRO that this is a reliable criteria to apply.

Activity type NACE Rev 2 codes and text search terms

2.19 One industry respondent said that they do not believe that industry have agreed the NACE codes currently utilised in the selection of the comparator set. They suggested that the current NACE codes do not identify enough companies that undertake prime contracting of complex platforms and integration of many complex systems and that this results in a comparator group comprising of equipment suppliers and not prime contractors.

2.20 SSRO response: The defence industry as well as other complex systems integrators are well represented in the comparator group. We welcome submissions of specific companies, not present in the comparator groups, for assessment against the criteria for inclusion. In 2016, the SSRO consulted on its methodology and NACE codes were a subject of that consultation. This consultation also considered the NACE codes used and updated them based on the responses received. We remain open to future suggestions of particular codes we should consider for inclusion or removal.

Specific queries about detailed aspects of the proposals

2.21 Responses to the consultations included some specific queries or comments about aspects of the proposals. These are set out in the table below with references to the paragraphs in question in the original consultation document.

Table 1: Specific issues identified by consultation respondents

| Comments | Response |

|---|---|

| Para 3.10: One respondent thought the consideration of criteria applicable to R&D tax credits may be irrelevant as it is the MOD’s declared policy to reclaim R&D credits regardless of their purpose. | The SSRO did not intend to make any comment on the extent to which R&D tax credits are an Allowable Cost. |

| Para 3.14: Two industry respondents questioned the relevance of including the ex-hire sector. One found that the proposed new words confusing, and the other proposes that they should not be incorporated into the description because they consider that the nature of hire businesses and the services they provide has no comparison with many companies that perform single source contracts. | The SSRO consider that hiring and leasing of assets is an activity that it is relevant to include to the activity characterisations. |

| Para 3.25: One industry respondent disagreed with the proposal to exclude high value services with high margins (i.e. professional services like accountancy and legal advice) from the comparator group. They argued that such exclusion would set an artificial limit which does not reflect the real market. | The Ancillary Services activity group, which is the subject of these comments, is not incorporated into the baseline profit rate assessment. It is produced for information and is specifically intended to exclude higher value-adding services. The SSRO is open to considering entirely new, or modified versions of existing comparator groups which may include such activities. |

| Para 3.26-3.27: One respondent proposed the methodology should consider how global companies which generate significant revenues outside of Western Europe/North America, particularly in the Middle East are treated. | The SSRO considers that the methodology is clear that the comparable activities of the business are expected to meet the relevant activity characterisation and be undertaken in comparable geographic areas. These comparable geographic areas would typically include Western Europe and North America. |

| One industry respondent agreed with the proposed change to delete text referring to pumps, actuators and motors (para 3.9) because they are not sufficiently complex to be included in the comparator group. | The SSRO will implement the proposed change. |

| Para 3.30-31: One respondent sought clarity on whether the proposal aims to eliminate the overseas subsidiaries of UK based GUO as well. | No, the data used is consolidated financial data of the Global ultimate owner (GUO) of a corporate group, as reported by the company. |

| Para. 3.30-31: One respondent sought clarity on whether the criteria has consideration of companies that register outside of Western Europe and North America for tax purposes, but predominantly operate in those areas. | The criteria requires that companies are registered in North America or Western Europe, and therefore excludes companies incorporated outside of those jurisdiction. |

| Para. 3.32-34: One respondent questioned why “Retail” and “Wholesale” companies only tend to be excluded rather than be excluded in all cases. | The SSRO would expect all such companies to be rejected, however we consider it good practice to validate any such decision as correct as a company may have been inappropriately classified. |

| Para 3.38: One industry respondent sought clarity on what “or similar” meant in the phrase “the word military (or similar)”. | For clarity, using an asterisk in the search term “militar*” means that it will include all words starting with those letters, for example “military” “militarised”, militarized”, etc. |

| One industry respondent sought assurance that subsidiary undertakings were excluded from the comparator groups. | The exclusion of subsidiary undertakings is covered by 9.8 to 9.10 of the current methodology and we are not proposing to alter this. |

3. Other changes and future review

Other feedback from the consultation

3.1 The respondents were asked to identify any material issues in the topic areas covered in the consultation that they believed have not been adequately addressed in the proposed changes. We also invited respondents to identify whether there were any aspects of the SSRO’s methodology that we should prioritise for review in the future.

3.2 The feedback is summarised in the table below, alongside the SSRO’s responses. We will be engaging with stakeholders on topics to take forward as priorities for a future corporate plan in the coming months.

Detailed responses

The consultation set out three specific “yes/no/don’t know” questions for respondents on the proposed change, to which only five of the eight respondents provided answers. The low response rate has limited our ability to provide meaningful numerical analysis of the results. However, the responses provided tended to reflect the views put forward by industry respondents that there were aspects of the methodology they remain dissatisfied with. This feedback is captured in the table below.

Table 2: Issues identified we will consider for future review

| Topic | Comments | Response |

|---|---|---|

| Comparability – return on capital | One industry respondent considered there is potential to set a profit rate that appears generous, but because it falls short of the weighted average cost of capital (WACC) the contract is in effect loss making, when considering returns on capital. | The SSRO’s profit Q&A document considers the matter of different measures of profitability and WACC (question 7). The SSRO has been engaging with OWG on profit principles and this discussion has included consideration of principles relating to returns to investors. The SSRO is engaging further on these. |

| Activity groups – additional activity groups | Two industry respondents suggested the inclusion of Information and Telecommunications companies, which they consider are currently underrepresented. They argued that many single source contracts have substantial work in this area and this should be reflected in the comparator group. | Most MOD single source suppliers are already present in the comparator group. However, the SSRO is open to considering the construction of new activity types, such as Information and Telecommunications, alongside the four existing ones. The SSRO will keep the matter under review, and will consider further work in relation to this as a potential regulatory priority for a future corporate plan. |

| Additional adjustments | Four industry respondents noted that the methodology does not adjust for some accounting and cost issues that they consider are becoming increasing more significant as part of “disallowed” costs. These include: a) imputed interest charges in relation to IFRS 16 Leases; b) selling and marketing costs; and c) amortisation and impairment of intangible assets acquired in a business combination They argued that this results in a distorted comparison which disadvantages contractors who as a result does not receive a ‘fair and reasonable price’. | The SSRO’s profit Q&A document sets out why the methodology does not make adjustments other than for the CSA. Analysing these matters is a significant and complex piece of work. The SSRO will consider further work in relation to this as a potential regulatory priority for a future corporate plan. |

| Value for money | One respondent proposed the need to define the term ‘good value for money’. | The SSRO has been engaging with OWG on profit principles and this discussion has included consideration of principles relating value for money. |

| Incentive fee | One industry respondent proposed a review of the incentive fee, and on how it can be applied to provide more flexibility to reward contractors for better-than-contracted performance across all delivery aspects within a contract. | The incentive adjustment was considered this year as a potential priority under the review of contract profit rates, but there was not sufficient support to prioritise it ahead of other areas. It remains a potential area for a future corporate plan. |

| Comparability – defence representation | One respondent acknowledged that focusing purely on defence companies would bias the outcome to a narrow sample that is not representative of the wider industrial base; others disagreed with the SSRO’s statement that a comparator group based on MOD single source suppliers would be a measure of profit in a non-competitive market on the basis that those suppliers also operate in many other markets, with only a small number having significant volumes of non-competitive work. In general, industry respondents consider that the comparator group contains too many companies that are not similar enough to defence contractors, or that the comparator group should give additional weight to defence companies. | It is not the SSRO’s intention that the comparator groups contain only companies from the defence industry. The MOD’s single source suppliers and the defence industry in general is well represented in the comparator groups. The methodology identifies companies whose economic activities are of the type which contribute in whole or in part to the delivery of QDCs and QSCs, which feedback from this consultation supports as being the case. The result of the process is a robust comparator group that is relevant to the activities which contribute in whole or in part to the delivery of QDCs and QSCs. |

| Comparability – OECD Transfer Pricing Guidelines | One industry respondent disagreed with the way the SSRO applies the OECD’s Transfer Pricing Guidelines and believes its use should be confined to routine transactions, for example commodities. | Transfer pricing is employed extensively by multinational enterprises and tax authorities globally. The OECD’s Transfer pricing guidelines have broad application and we consider them to be appropriate for these purposes. |

| Comparability - geography | Two respondents noted that the majority of MOD’s budget is spent with UK- or US-based companies. They consider comparator companies should reflect where MOD money is being spent and that this is not currently achieved. Another respondent considered the criterion to be too narrow on the basis that a number of other countries that have world class manufacturing capabilities, particularly in aerospace and defence (eg Japan, South Korea, Mexico, etc.) should also be included. | The OECD Transfer pricing guidelines note that “for a number of industries, large regional markets encompassing more than one country may prove to be reasonably homogenous, while for others the differences among domestic markets are very significant”. The SSRO considers Western Europe and North America to be consistent with this guidance. Narrowing the search would exclude a large number of valid comparators. Widening the search would include economies that are economically dislocated from the UK, Western Europe and North America. |

| Comparability – capital structure | One industry respondent suggested that the methodology should consider the comparability of capital structure. They consider the group as a whole is different to defence contractors on the basis that the current baseline profit rate assessment incorporates a Capital servicing adjustment (CSA) nearly twice the median of QDC/QSC contracts. | There is not one particular capital structure applicable to single source contracting and step 6 exists as the mechanism to consider and adjust for any differences. Given the wide range of capital structures present in the defence industry and the operation of step 6, the SSRO does not consider the differences highlighted to be problematic. |

| Comparability – monitoring comparator groups year on year | One respondent suggested that a comparator group that remains unchanged over time might be considered. This would enable consistency year on year to measure the movement of profit in a like-for-like comparison. | The comparator group changes every year due to company specific market dynamics (for example the removal of loss-making companies) although the majority of the group has historically been consistent year-on-year. The SSRO publishes analysis annually (slide 14) to allow consistent year-on-year comparison. |

| Comparability – company hurdle rates | One respondent noted that global companies will choose where to make investment and that lower profit rates make the UK less attractive. They suggested that a better comparison would be against potential returns on offer elsewhere. | The SSRO understands that internal company investment decisions are normally not made public. There are many factors that determine where companies invest money. The comparator group already includes companies operating in a range of jurisdictions and so is not solely dependent on reported UK profits. |

| Activity groups – ‘Develop and make’ and ‘Provide and maintain’ | Two stakeholders suggested altering how the P&M and D&M activity groups are used. One proposed merging the two groups on the grounds that the nature of defence contracting means that it is often difficult to separate them. Another proposed monitoring the level of expenditure MOD makes in each activity type to enable the development of a weighted average rate that better represents the market, rather than the existing simple average. | The SSRO set out the factors it considered in deciding the way in which it combines the D&M and P&M activity types Profit 2017/18 Q&A question 19. We remain of the view the current approach is appropriate and see limited benefit adding additional complexity to this process. |

| Activity groups – ‘Ancillary services’ and ‘Construction’ | Most industry stakeholders queried the continued reporting of the ‘Construction’ and ‘Ancillary Services’ benchmarks. They argued that these activities would be competed or single source by exception because there is a vibrant competitive market for them. | The SSRO considers that these benchmarks provide valuable contextual analysis that supports the BPR recommendation to the Secretary of State. They are not used in the calculation of the baseline profit rate. |

| Activity groups – amending ‘Provide and maintain’ | One respondent considered the P&M activity type does not reflect the fact that single source contracts are for ‘maintain’ and ‘assure a capability’, but do not ‘provide equipment’. | This is already reflected in the P&M characterisation. Companies included in the P&M comparator group are required to ensure availability of an asset either through repair and servicing to third party equipment, or through hire or lease arrangements that include associated upkeep and maintenance. |

| Median Vs Mean | Four industry respondents disagreed with the use of the median, which they believe skews the results towards smaller companies. | The SSRO has published the transparency data on the distortions that would be caused by the use of the mean and weighted mean on its website (slide 33 of supporting analysis). Question 13 of the Q&A explains why the SSRO uses the median rather than the mean or weighted mean and also explains the cause of skewness in the data. |