Sugar ATQ consultation (2020): information pack

Updated 16 December 2020

1. Introduction

As part of the new UK Global Tariff (UKGT) announced on the 19 May 2020, the government established an autonomous tariff rate quota (ATQ) to allow for a set volume of raw cane sugar to enter the UK tariff free. This was in effort to balance support for UK producers, processers, and consumers whilst maintaining preferential trade with developing countries and supporting the UK’s ambitious free trade agreement (FTA) trade agenda.

ATQs allow imports up to a given quantity of a good to come in at a lower or zero tariff for a specified period of time. Once imports exceed this given quantity, the UKGT rate will apply.

An ATQ of 260,000 tonnes for raw cane sugar was announced as part of the UKGT, to apply for 12 months from 1 January 2021, with an in-quota rate of 0%. Once the quota threshold is met, the out of quota tariff rate, the UKGT MFN rate of £28.00/100kg, will apply. ATQs are applied in line with the MFN principle as part of the UK’s applied tariff regime.

The Northern Ireland/Ireland Protocol in the Withdrawal Agreement provides for certain specific arrangements as regards Northern Ireland.

The government made clear at the time that this ATQ would be reviewed. The government has now launched a public consultation on the future of this sugar ATQ, which will form an integral part of the government’s review.

The consultation will provide the opportunity for participants to provide:

- specific feedback on the proposed sugar ATQ, including on the corresponding level

- information on interactions with the proposed sugar ATQ and the importance of this to their business and sector

The government will carefully consider all evidence when making a final decision on the proposed sugar ATQ. In making a final decision the government will have regard, alongside the consultation responses, to the principles set out in the Taxation (Cross-border Trade) Act 2018, namely the:

- interests of consumers in the United Kingdom

- interests of producers in the United Kingdom of the goods concerned

- desirability of maintaining and promoting the external trade of the United Kingdom

- desirability of maintaining and promoting productivity in the United Kingdom

- extent to which the goods concerned are subject to competition

The government will also seek to balance strategic trade objectives, such as the delivery of the UK’s trade ambitions and FTA trade agenda, with maintaining the government’s commitment to developing countries to reduce poverty through trade.

This review could result in an increase, maintenance, or reduction, of the volume of the ATQ, or the complete removal of the ATQ. Moreover, if the evidence suggests alternative courses of action the Government may need to consider other mechanisms as part of the review.

Throughout the consultation, respondents are encouraged to provide evidence to support their views, including the possible impacts (costs and benefits) of amending or not amending the proposed sugar ATQ on businesses, consumers and the economy.

Like all government policy, we remain open to hearing feedback from stakeholders on the UKGT, however the UKGT is not part of this consultation. The consultation will be open for 3 weeks from 14 September 2020 to 5 October 2020 until 11:59pm.

Please download the consultation questions and once completed please email them to: sugarreview@trade.gov.uk. Due to COVID-19, we are not able to provide a postal address to respond to this consultation.

The government will publish a summary of the public consultation responses it received as well as the policy once it has considered all the evidence. The points for consideration set out in the consultation do not represent a final policy position.

The government would encourage every interested party to take part in the consultation and help to shape this policy. For any further queries or questions on guidance or accessibility you can email: sugarreview@trade.gov.uk.

2. The UK sugar regime

2.1 The EU and UK sugar regimes pre 2017

The UK sugar market produces around 1.9Mt of refined white sugar per annum and is made up primarily of sugar cane refining, UK sugar beet refining and EU white sugar imports. Until recently sugar has been a highly regulated sector within the EU, with an annual production quota of 13.5 million tonnes of sugar beet divided between 20 Member States, including the UK. During this time EU sugar prices were high and generally above world prices; EU prices were as much as three times the level of world prices as recently as 2007. This gap was in large part due to very high external tariffs (Figure 1).

Figure 1 - Line graph showing comparison of EU white price, import price of raw cane from Organisation of African, Caribbean and Pacific States (ACP) countries and world white price

Sources: European Commission, ICE

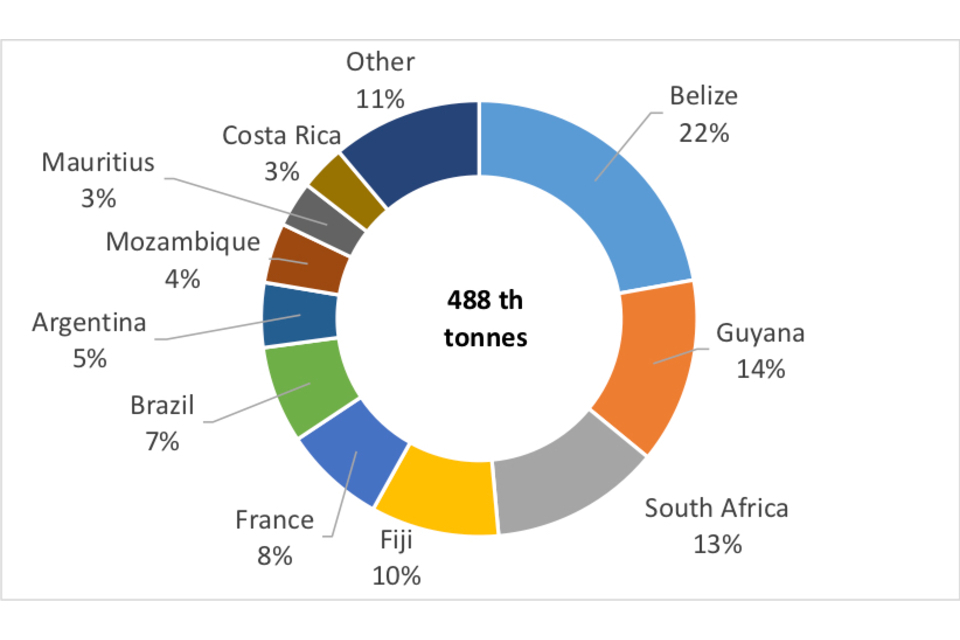

There is a UK cane refinery based in London, where raw cane sugar is imported and converted into white sugar and other products for human consumption. Most of this is imported from ACP and Less Developed Countries (LDCs), as well as cane producers like Brazil (Figure 2). Due to our commitment to support developing countries, the UK provides tariff-free entry for raw sugar from ACP producers (those that have an Economic Partnership Agreement in place) and LDC producers (through unilateral duty-free quota free access), although their average sugar prices are above world levels due to higher costs of production.

Figure 2 - Pie chart showing UK imports of raw cane sugar (HS code 170114, 17-19 average)

| Country | % |

|---|---|

| Belize | 22% |

| Guyana | 14% |

| South Africa | 13% |

| Fiji | 10% |

| France | 8% |

| Brazil | 7% |

| Argentina | 5% |

| Mozambique | 4% |

| Mauritius | 3% |

| Costa Rica | 3% |

| Other | 11% |

Source: HMRC overseas trade statistics

Table 1 – UK imports and exports of sugar (‘000 tonnes, refined basis, 2017-19)

| 2017 | 2018 | 2019 | |

|---|---|---|---|

| UK imports | |||

| - from the EU (mainly refined sugar) | 530 | 526 | 511 |

| - from RoW (mainly raw cane sugar for refining) | 458 | 422 | 430 |

| Exports | |||

| - to the EU | 157 | 236 | 197 |

| - to RoW | 46 | 125 | 68 |

| Net imports | 785 | 587 | 676 |

Source: Agriculture in the United Kingdom, 2019. Defra.

In addition, there are domestic beet growers based in the East Midlands and East Anglia with 4 factories situated in those areas at present. The UK is a structural net importer of sugar (Table 1). Until 2010, the UK raw sugar market was shared roughly 50-50 between the UK cane refining sector and the UK beet producing sector (Figure 4). Once this raw sugar has been refined into white sugar it is either consumed domestically or exported. White sugar refined from beet or cane sugar is very similar and substitutable.

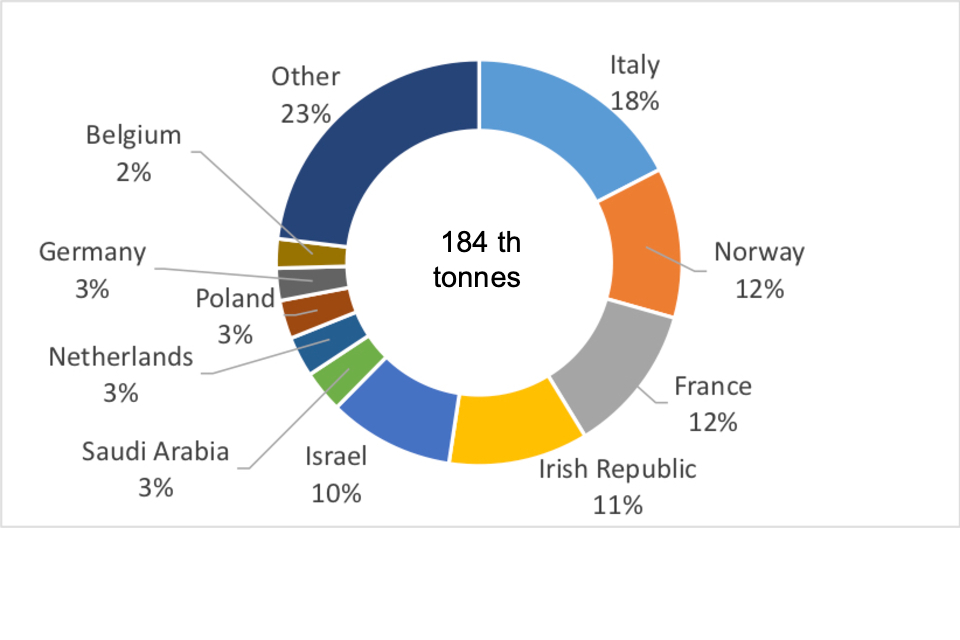

Figure 3 - Pie chart showing UK exports of white sugar (HS codes 170191 and 170199, 17-19 average)

| Country | % |

|---|---|

| Other | 23% |

| Italy | 18% |

| Norway | 12% |

| France | 12% |

| Irish Republic | 11% |

| Israel | 10% |

| Saudi Arabia | 3% |

| Netherlands | 3% |

| Poland | 3% |

| Germany | 3% |

| Belgium | 2% |

Source: HMRC overseas trade statistics

2.2 EU sugar sector reforms

Major reforms to the EU sugar regime commenced in 2006, which restructured the industry. This included the progressive reduction of support prices for beet and white sugar, as well as the phasing out of public intervention until 2008/2009, which started the erosion of the imported sugar cane’s share of the UK sugar market.

These reforms eventually culminated in the decision to remove sugar beet production quotas from 1 October 2017. The end of these sugar quotas meant there were no limits to production or to exports. From an EU perspective this allowed for production to better adjust to market demand, both within and outside the EU. The result was that sugar beet production grew in the EU, meaning EU prices have started to converge with white sugar world prices (Figure 1). The result is that the EU has now become a net exporter. This elimination of quotas effectively resulted in there being no cap on EU sugar production, but the tariffs on raw cane remained, meaning EU based refiners were not able to import raw cane at world prices.

2.3 The effect of 2017 reforms

The removal of sugar quotas in 2017 left UK beet sugar producers’ share of the UK market at around 55%. The increase in EU domestic production of beet sugar following quota abolition, combined with the consequent fall in the EU white sugar price without any commensurate reduction in the cane import duty, significantly reduced the quantity of raw cane sugar imports on the EU market.

The relatively low white sugar price in the EU results in little raw cane sugar entering the UK competitively due to high external tariffs. Consequently, imported cane sugar’s share of the UK market has gradually eroded each year since 2010, from 50% towards 15-20%, with the share of EU white sugar imports growing to 25-30%. (Figure 4).

Figure 4 - Line graph showing UK domestic beet sugar production and imports of sugar (refined basis)

Source: Agriculture in the UK, Defra - Imports from the EU are predominantly in the form of white sugar apart from imports from French overseas territories and re-exports from elsewhere; imports from the rest of the world are mainly in the form of raw cane sugar (98%).

While raw cane sugar continues to be imported from ACP countries tariff free, the higher costs of production mean it cannot compete against European beet growers, while some more competitive cane growers face (aside from a limited amount of trade at reduced tariffs under EU TRQs) high EU and in future UK MFN (UKGT) tariffs. The UK accounts for a considerable share of several ACP sugar producers’ exports, including Belize (88% dependence in the 2017-19 period) and Fiji (38%).

2.4 Post transition period

At the end of the transition period the UK will apply the UKGT and, without further intervention, this would mean that the UK sugar cane refining sector will continue to have duty-free access to raw cane sugar from ACP countries that the UK has signed continuity agreements with, and from LDC countries through the UK’s Generalised Scheme of Preferences. However, the price of raw cane sugar from ACP and LDC countries is relatively high compared to other sources due to higher costs of production, and the sector will face high tariffs on raw cane sugar from countries that do not have a trade agreement or preferential access. The inability of the cane refining sector in the UK to source competitively priced raw cane sugar could undermine its long-term viability and its role as a market for raw sugar cane exports from developing countries.

Competition in the UK between beet and cane processors could affect the prices paid by domestic consumers which may in turn have an impact on the wider economy. It is also beneficial to maintain a diversity of supply to the UK for food security reasons.

For as long as the UK is a structural net importer of sugar, domestic white sugar prices will continue to be driven by import parity from the most competitive source of imports (currently the EU, given the prevailing level of tariffs on white sugar). On 19 May 2020 an ATQ was announced that would apply to imports of raw cane sugar from 1 January 2021. An ATQ of the size proposed (260,000 tonnes of raw cane sugar with an in-quota rate of 0%) would not, according to our analysis, be expected to have a material impact on price incentives for UK beet producers. Rather it is the level of imports of raw cane sugar, and the quantity of white sugar imports required to meet the UK’s deficit in sugar, that would be expected to be in tension.

3. Glossary of terms

Applied Tariff Rate – tariffs applied at the border, the UK is free to set whatever tariffs it wants, as long as they are applied equally (in line with the MFN principle) and no higher than the bound tariff rate.

Free trade agreement (FTA) – is a preferential arrangement between two countries / customs unions, that seeks to remove or reduce barriers to trade such as tariffs.

Most Favoured Nation (MFN) – Is a World Trade Organisation principle which means that, when applied to tariffs, the same tariffs must be applied to all trading partners, unless an exception applies, for example, that a trade agreement or other preferential arrangement is in place.

Suspensions – Tariff suspensions are complete or partial reductions in a standard tariff rate. They allow unlimited quantities to be imported for a specific period of time, after which the rate applicable reverts to a standard tariff rate.

Tariff(s) – are taxes applied to imports when they enter the country (also known as ‘import duty’ or ‘customs duty’)

Taxation (Cross-Border Trade) Act 2018 – The Act that gives the necessary legal power for the Government to impose and regulate customs duties on goods that are imported into and exported from the UK once the UK has left the EU. As per section 8(5) of the Act, there are five key principles established in the Act that the UK’s trade policy must give due regard to.

World Customs Organisation (WCO) – An intergovernmental organisation (which the UK is a member of) that regulates customs administrations across World Trade Organisation members.

World Trade Organisation (WTO) – An intergovernmental organisation (which the UK is a member of) which sets out the global rules and regulations for trade for its members.

WTO Terms – The Most Favoured Nation (MFN) principle is sometimes referred to as the ‘WTO Terms’ which is the WTO principle which means that the same tariffs must be applied to any trading partner, unless an exception applies, such as a free trade agreement (FTA).