What Tied Pub Tenants Need to Know about Significant Increase in Price

Published 30 March 2022

Applies to England and Wales

How to use this factsheet:

This factsheet is for tied pub tenants who want to know more about provisions in the Pubs Code about significant increase in price.

It provides information to support tenant understanding. It is not a substitute for the Pubs Code legal framework.

Our website also contains other useful information about accessing your Pubs Code rights.

Terms and abbreviations

| Term/abbreviation | What it means |

|---|---|

| Code | The Pubs Code etc. Regulations 2016 |

| PCA | Pubs Code Adjudicator |

| POB | Pub-owning Business (often referred to as pub companies) |

| TPT | Tied Pub Tenant |

| MRO | Market Rent Only |

| MRO Option | The option for you to occupy the tied pub under a MRO-compliant tenancy and to pay a rent you have agreed with the POB in line with the MRO procedure or, failing such agreement, the market rent |

| Rent Assessment | An assessment of the rent you must pay in relation to an existing tenancy |

| RAP | Rent Assessment Proposal |

| Relevant Invoice | Invoice showing the price increase in the tied product or service (this invoice may also include other products or services) |

| Current Period | The 4-week period before the relevant invoice was issued (ending with the day on which the relevant invoice was issued) |

| Comparison Period | The 4-week period last year, which starts* with the day 12 months before the day the relevant invoice was issued (*if invoice was received before 1 April 2022, the 4-week comparison period ‘ends’ with the day 12 months before the day the relevant invoice was issued) |

| Relevant Product or Service | The tied product or service supplied to the tied pub tenant for which there is a significant increase in price |

1. When might there be a significant increase in price?

See Part 1 of the Pubs Code (Regulations 3 to 6)

If you have received an invoice showing an increase in the unit price of a tied product or service from the last time it was invoiced, it may be a significant increase in price under the Pubs Code.

When comparing unit prices, you must exclude VAT (Value Added Tax) and excise duty and disregard the effect of any discounts which the POB was not contractually required to give you.

The Pubs Code sets out the calculation to work out if the price increase is of the required level to be considered significant.

2. What does a significant increase in price allow me to do?

A significant increase in price under the Pubs Code gives you the right to ask your pub company for either or both of the following:

-

a rent assessment - which begins with a Rent Assessment Proposal (RAP) for a new tied rent

-

a Market Rent Only (MRO) option - to rent your pub on a free-of-tie basis

A significant increase in price is one of four gateways to request a MRO option - called ‘MRO events’. Note: it is not a MRO event if the price increase was reasonably foreseeable when the tenancy or licence was granted or when any last rent assessment was concluded.

There are strict time limits for sending a MRO notice or requesting a rent assessment.

The pub company must receive:

-

your request for a rent assessment within 14 days, starting the day you receive the invoice

-

your MRO notice within 21 days, starting the day after you receive the invoice

For more information about:

-

Rent Assessments, see factsheet What Tied Pub Tenants need to know about rent assessments and rent assessment proposals

-

The Market Rent Only Option, see factsheet What Tied Pub Tenants need to know about Market Rent Only (MRO) rights

3. How do I calculate if there has been a significant increase in price?

The Pubs Code sets out how to calculate whether a price increase in a tied product or service is a significant increase in price.

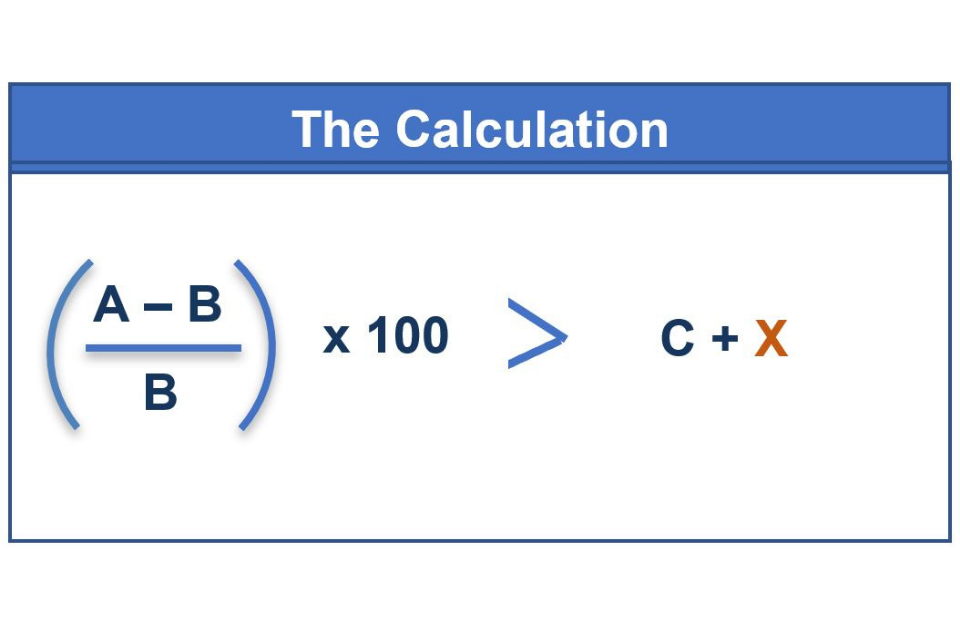

3.1 The Calculation

- A: The amount the products or service would have cost you last year in the comparison period if you had been invoiced at the current period prices

- B: The amount the products or service actually cost you in last year’s comparison period

- C: The relevant annual percentage change in the consumer price index (where that is negative, use zero)

- X: Set out in the Code and differs depending on the product or service type. Please see below.

4. Step by Step Guide to calculating if there has been a Significant Increase in Price

4.1 Step 1: Work out the ‘current period’ (this year)

Look at the invoice showing the price increase in the tied product or service. Work out the period four weeks before that invoice (ending with the day it was issued).

This four-week period is called the current period.

4.2 Step 2: Work out the ‘comparison period’ (last year)

Work out the four-week period last year, which starts with the day 12 months before the day the relevant invoice was issued.

This four-week period is called the comparison period.

If you received the relevant invoice before 1 April 2022:

The Pubs Code was amended from 1 April 2022, which included a change to the comparison period. If you received the relevant invoice before 1 April 2022, the four-week period last year ends with the day 12 months before the day the relevant invoice was issued.

There can only be a significant increase in price under the Pubs Code if you were invoiced for the same product or service in both the comparison period and the current period.

4.3 Step 3: Identify the product or service category

Identify which category the relevant tied product or service belongs to:

- Beer

- Alcoholic drink other than beer

- Products other than alcoholic drink

- Services

4.4 Step 4: Work out A and B in the calculation

List all the tied products or services within the same category identified at Step 3 that were invoiced in the comparison period. Then also note the quantities invoiced.

-

Only include the product or service if it’s supplied under a tie. For example, beer supplied under the tie and not all beer.

-

Consider products or services separately from each other within the same category where invoiced under different names or in different units (such as size or capacity) and/or in different packaging (such as bottles and cans).

-

Exclude from your list any product or service not invoiced in the current period under the same name and unit. For example, if a product has the same name but was invoiced in the current period in a different unit, you must exclude it.

Calculate A

- find the current period price for each item in the list by looking at the last time that product or service was invoiced during the current period

- note the price excluding VAT and excise duty and disregard the effect of any discounts which the POB was not contractually required to give you

- work out the amount that the relevant product or service would have cost you over the comparison period if invoiced at the current period price

Calculate B

- add up what the relevant product or service actually cost you over the comparison period

- when noting the prices, as with the current period price, you must exclude VAT and excise duty, and disregard the effect of any discounts which the POB was not contractually required to give you

Current Period - 4 weeks

| Tied Beer Category | Quantity | Current Period Price | Cost |

|---|---|---|---|

| Beer A | 5 | 102 | 510 |

| Beer B | 10 | 61.5 | 615 |

| Beer C | 15 | 41 | 615 |

| Total | 30 | 1740 |

Comparison Period - 4 weeks

| Tied Beer Category | Quantity | Comparison Period Price | Cost |

|---|---|---|---|

| Beer A | 5 | 100 | 500 |

| Beer B | 10 | 60 | 600 |

| Beer C | 15 | 40 | 600 |

| Total | 30 | 1700 |

4.5 Step 5: Work out the % increase between A and B

Work out the percentage price increase between A and B (calculate A minus B, divide the answer by B, then multiply the answer by 100).

Example:

1740 (A) – 1700 (B) = 40

40 ÷ 1700 (B) = 0.0235…

0.0235 x 100 = 2.35%

4.6 Step 6: Check the Consumer Price Index to find C in the calculation

Find out the annual percentage change in the consumer price index. This is published by the Office for National Statistics.

Take the change most recently published before the day the relevant invoice was issued. This % change is C in the calculation.

4.7 Step 7: Add C to X in the calculation

Add the % from Step 6 (C in the calculation) to the following % (X in the calculation) according to the product or service:

| Tied Product/Service | X = |

|---|---|

| Beer | 3% |

| Other Alcoholic Drinks | 8% |

| Non-alcoholic products or services | 20% |

Example:

If the % change in the consumer price index is 5% and the tied product is beer:

5% (C) + 3% (X) = 8%

4.8 Step 8: Check whether the % price increase reaches the required level

For a significant increase in price, the % price increase calculated at Step 5 needs to exceed the increase calculated at Step 7.

Example:

Step 5 = 2.35%

Step 7 = 8%

As 2.35% does not exceed 8%, in this example there is not a significant increase in price.

5. Questions about this factsheet

For general queries about the information in this factsheet, you may contact our enquiry service.

Please note, we can provide information about your rights, the Code and our processes. We cannot advise you about your case.

- Complete our online enquiry form

- Email: office@pubscodeadjudicator.gov.uk

- Call 0800 528 8080 to request a call back

This factsheet provides information to support tenant understanding. It is not a substitute for the Pubs Code framework.

You may find it helpful to take independent professional advice before making any decisions that may affect you and your business.

6. Find out more

- sign up to email alerts on our website

- follow the PCA on Twitter, Facebook and LinkedIn

- read the Pubs Code Adjudicator, Fiona Dickie’s, regular column in The Morning Advertiser

- access other PCA factsheets in the series: ‘What Tied Pub Tenants Need to Know’