Cambridgeshire and Peterborough Local Industrial Strategy

Published 19 July 2019

Aerial view of Cambridge Biomedical Campus (credit: Charlie Abbott)

Foreword

Cambridge is the UK’s driving force for human discovery.

From Francis Crick’s role in the discovery of the structure of DNA, Fred Sanger’s work to understand how to sequence it, and ultimately to the Sanger Institute’s role in sequencing one-third of the human genome, as part of the International Human Genome Project, Cambridge has led our understanding of the nature of humanity itself. Cambridge still produces more patents than the nearest 4 UK cities put together, and its University’s academics and alumni have produced more Nobel laureates than any other institution globally. It is the combination of Cambridge’s global leadership in academic discovery, and sectors such as life sciences and digital, together with Peterborough’s rich heritage in manufacturing, and The Fens’ potential for agri-tech, that provide the building blocks to make Cambridgeshire and Peterborough the UK’s fastest growing and most innovative economy outside London.

Cambridgeshire and Peterborough is an international hub of innovative business. It is leading in research in fields as diverse as artificial intelligence and agri-tech. It generates £23.7 billion of national output[footnote 1] and has seen employment levels growing by 3.3% over the last 6 years[footnote 2].

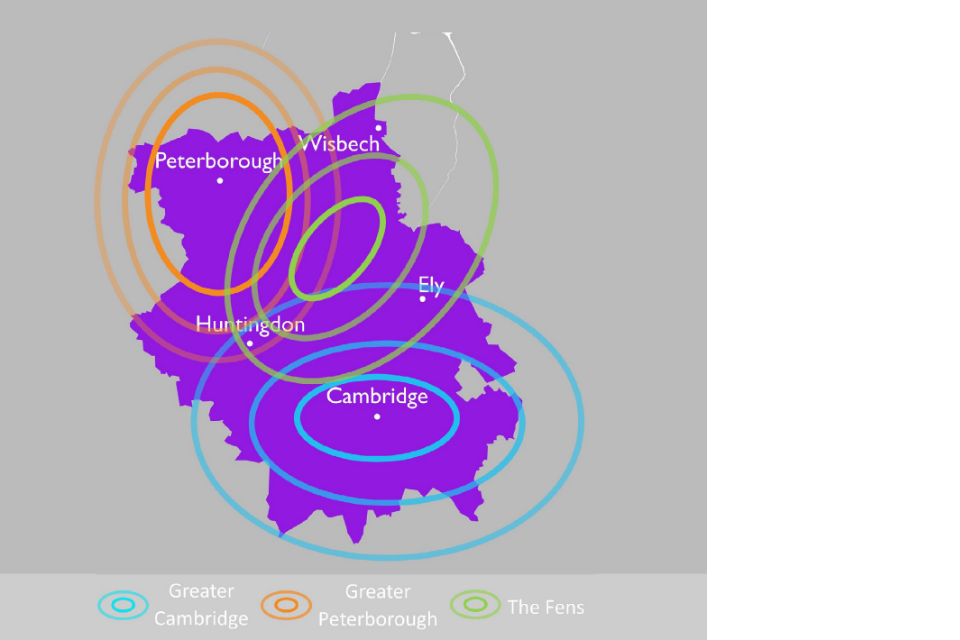

Cambridgeshire and Peterborough is comprised of 3 different sub-economies - Greater Cambridge, Greater Peterborough and The Fens. Each is unique, facing its own opportunities and challenges. Success for business in each will take a different form, while the overall goal – an inclusive, prosperous, and productive economy – is the same. To achieve this, many different sectors will need to flourish, creating opportunities for entrepreneurs and employees.

The success of the Oxford-Cambridge Arc is also dependent on an economy in Cambridgeshire and Peterborough which continues to grow, creating further demand for employment and housing. Partners across the Arc are collaborating to ensure the Arc delivers on its transformative economic potential for the UK as a whole.

The mandate to deliver all of this is set out in the Devolution Deal signed between central government and local partners. Through the establishment of a Combined Authority with devolved powers, local partners set out a commitment that ‘Cambridgeshire and Peterborough will enhance its position as a global leader in knowledge and innovation, further developing its key sectors including life sciences, information and communication technologies, creative and digital industries, clean tech, high-value engineering and agri-business’[footnote 3].

This Local Industrial Strategy sets out an evidence-based plan to support industry across the area in delivering these goals. The foundation for it is the Cambridgeshire and Peterborough Independent Economic Review – a thorough review of all the available economic evidence for the area chaired by an experienced and expert panel, bringing in new research on business clusters and growth. This review set out a series of key recommendations, many of which are reiterated and developed upon in this document.

By creating the conditions for business to thrive, Cambridgeshire and Peterborough can achieve its goals of doubling economic output and building an inclusive economy. This strategy combines bold ambition with clear actions that will directly support firms to grow, become more productive, and increase their international reach.

Rt Hon Greg Clark MP

Secretary of State for Business, Energy and Industrial Strategy

James Palmer

Mayor of Cambridgeshire & Peterborough

Prof Aamir Khalid

Chairman of The Business Board

Executive summary

Cambridgeshire and Peterborough are determined to make their economy work for all of the area’s communities.

The full economic potential of the region can only be realised by identifying diverse strengths – from Peterborough’s rapid growth, Cambridge’s global research strengths, and The Fens’ innovative micro and agricultural businesses and working to tie them together.

This Local Industrial Strategy sets out how Cambridgeshire and Peterborough will maximise the economy’s strengths and remove barriers that remain to ensure the economy is fit for tomorrow’s world. It supports the aims of the National Industrial Strategy by boosting productivity in Cambridgeshire and Peterborough. The interventions within are based on a highly credible, independent evidence base, and are specifically and carefully designed to achieve growth.

This strategy is 1 of a family of 4 linked strategies covering the Oxford- Cambridge Arc (‘the Arc’), with the other strategies covering Oxfordshire, Buckinghamshire and the South East Midlands. It therefore includes a summary of the wider economic context and identifies those priorities within each Local Industrial Strategy which can be developed at scale across the Arc, complementing the specific Cambridgeshire and Peterborough strategic objectives which sit at the heart of this strategy. This includes:

- working together collaboratively across all of the foundations of productivity to ensure that the implementation of the 4 Local Industrial Strategies maximises the economic potential of the wider Arc region

- harnessing the collective strength of the Arc’s research base – driving greater collaboration on science and research; developing a network of ‘living labs’ to trial and commercialise new technologies; and growing the role of the Arc as a global research and innovation hub

- bringing employers and skills providers together to understand the current and future skills needs, and planning provision to meet them

- maximising the economic benefits of new transport, energy and digital infrastructure within the Arc

- developing an improved business support and finance programme for high growth companies, a shared approach to commercial premises and an Internationalisation Delivery Plan to encourage greater trade and inward investment in the Arc

- taking a Natural Capital Planning approach to development within the Arc, embodying government’s 25 Year Environment Plan and contributing to the Clean Growth Grand Challenge Mission to halve the energy use of new buildings by 2030

Together, the strategies reflect the close collaboration and partnership working between Local Enterprise Partnerships (LEPs) across the region.

Today’s picture

The Cambridgeshire and Peterborough economy is thriving, contributing £22 billion to the UK. The economy has outperformed the UK in overall growth since 2009, and growth in employment has significantly outpaced official figures. The area is an internationally recognised centre for artificial intelligence, life sciences, food production and advanced manufacturing. Cambridge is a global leader in innovation and the commercialisation of new ideas. Local partners’ ambition is to continue to build an industrial ecosystem that is globally known for tackling the biggest challenges facing society, and in so doing to nearly double gross value added (GVA) over 25 years.

In the short-term, the Combined Authority will work to raise productivity per hour to above the UK average by 2024. Through applying a natural capital and ecosystem services approach local partners will ensure this is matched by a world-class natural environment.

As the Cambridgeshire and Peterborough Independent Economic Review (CPIER) established, it is really 3 sub-economies. The largest and most international is Greater Cambridge, characterised by high levels of output and skills, a rich mix of biomedical, pharmaceutical, artificial intelligence and other technology companies underpinned by 2 leading universities, one of which is amongst the greatest in the world. In the north, Greater Peterborough is important both as the largest city and, consistently over the last decade, one of the fastest growing in the country. It is an area with an important manufacturing history and existing base. It is also home to a growing range of service, financial and professional companies which – with a new 38 minute rail connection to London – are set to expand further through government and corporate relocations out of the capital. The Fens, a largely rural area, has a diverse range of market towns; much of the best farmland in the UK; and world-class agricultural production.

It is a rural economy but one which is also home to highly successful, niche manufacturing and service companies. This Local Industrial Strategy will tailor and mix interventions to the needs of each of these specific sub-economies.

Major opportunities exist in the area. The opportunity is to grow further, to benefit the whole area, building on Cambridge’s world-class assets. Devolution, and the creation of a Mayoral Combined Authority has also given Cambridgeshire and Peterborough a key advantage with more local powers and funding to deliver the ambitions of this Local Industrial Strategy.

In addition to making the most of opportunities, challenges must also be recognised and overcome. The key challenge relates to the underlying need to broaden the base of economic growth whilst securing the continued success of Greater Cambridge, raising productivity across the wider economy. This will ensure that the whole of Cambridgeshire and Peterborough grows more high-quality jobs, improving business output and providing better opportunities and outcomes for people.

Ambitions for tomorrow

This Local Industrial Strategy sets out 3 priorities for the Cambridgeshire and Peterborough economy:

- improve the long-term capacity for growth in Greater Cambridge by supporting the foundations of productivity. This will support the expansion of the region’s innovation powerhouse. Crucially, this will also reduce the risk of any stalling in the long-term high growth rates that have been enjoyed in the city region for several decades. This will be done by: investing heavily in housing; supporting supply chain development; delivering transformational transport and infrastructure; whilst leveraging the strengths and better connecting the Cambridge cluster – all for the greater benefit of the other 2 economies and the UK. There also needs to be continued efforts to support the Cambridge innovation ecosystem and to continue to attract international firms to the region;

- increase sustainability and broaden the base of local economic growth, by identifying opportunities for high growth companies to accelerate growth where there is greater absorptive capacity, addressing the current bottlenecks to growth in Greater Cambridge; and Sector Deal, local partners in Cambridgeshire and Peterborough will continue to deepen the connectivity between research and industry, with a specific focus on addressing the Ageing Society Grand Challenge. This will include the creation of an Innovation Launchpad, partnering with a global player to help start-ups and scale-ups get access to customers and markets world-wide. A Life Sciences Accelerator Scheme and key infrastructure improvements – such as the A505 and Cambridge South Station – are particularly crucial for this sector.

- expand and build upon the clusters and networks that have enabled Cambridge to become a global leader in innovative growth. The Local Industrial Strategy sets out how business leaders, sectors, and places will join together to build an economy-wide business support eco-system.Thiseco-systemwillpromote

- Agri-tech: Cambridgeshire and business growth; greater productivity; innovation commercialisation; greater global market access; and more effective skills development. This will complement the above to deliver a more inclusive and resilient economy

The CPIER has identified the area’s sectoral strengths and specialisms, which this Local Industrial Strategy will seek to make the most of. These include:

- life sciences: Greater Cambridge is a global centre of life sciences that will increasingly grow across Huntingdonshire and be connected to a wider cluster operating across the Arc. As part of the Life Sciences Sector Deal, local partners in Cambridgeshire and Peterborough will continue to deepen the connectivity between research and industry, with a specific focus on addressing the Ageing Society Grand Challenge. This will include the creation of an Innovation Launchpad, partnering with a global player to help start-ups and scale-ups get access to customers and markets world-wide. A Life Sciences Accelerator Scheme and key infrastructure improvements – such as the A505 and Cambridge South Station – are particularly crucial for this sector.

- agri-tech:Cambridgeshire and Peterborough’s ambition is to support further growth in pioneering research and development (‘R&D’) in plant science and precision agriculture, as part of a regional offer. The innovative ecosystem will be further strengthened, and the Combined Authority will develop and fund an Innovation Launchpad facility, or facilities, which offer new locations to support the development of innovation ecosystems. Agri-tech is one of the area’s strategic growth sectors which does not yet have central agglomerations which will be a key ingredient in its future success.

- digital and information technologies (including artificial intelligence): the opportunity is to establish Greater Cambridge and the Arc as the preferred global base for firms from across the world to create and adopt the technologies of tomorrow. As part of this, the Combined Authority will host a global artificial intelligence conference in Greater Cambridge. This represents a significant opportunity to increase the sector’s growth both within the local economy and across the Arc and the UK.

- advanced manufacturing and materials: Drawing on existing skills and capabilities, the Combined Authority can provide impetus to development of advanced manufacturing across the region. A specific opportunity lies in scale-up, developing facilities closely coupled to local universities where technologies can be developed and taken through the early stages of commercialisation.

This Local Industrial Strategy also recognises 5 supporting sectors, which are also strengths of the Cambridgeshire and Peterborough economy. These are;

- logistics

- health and social care

- education

- visitor economy and business tourism

- construction

There are opportunities in these sectors to create business growth. This Local Industrial Strategy also considers how these could be maximised.

Enhancing the foundations of productivity

Ideas

This Local Industrial Strategy will ensure that the area’s economic base grows by harnessing innovation. Actions to support this include:

- the creation of new launchpads will be the focal points for innovation cluster development. The creation of at least 4 new Innovation Launchpads will be the focal points for innovation cluster development. Focusing on product development to support key growth sectors – bringing together established firms with training, R&D, and incubation facilities. The creation of new launchpads will be focused on key sectors such as agri-tech, artificial intelligence and advanced manufacturing innovation

- consider options to develop a Mayoral Innovation and Growth Investment Fund. Providing equity and loan investment to firms already accessing growth coaching and support to break into global markets and transform their productivity through innovation.

- establish the Innovate 2 Grow Network, bringing together leading entrepreneurs, innovators, mentors and coaches with growing firms to strengthen linkages across the area

Places

The People chapter sets out how education and training levels will be improved to ensure business has the supply of skills it needs, and that people are provided with more and better opportunities to fulfil their potential, including digital skills. Key skills initiatives include:

- implement changes to the devolved Adult Education budget to change how it is invested and the related outcomes for individual opportunity and business needs

- look at scope to create a new university in Peterborough, that will attract highly skilled, productive individuals to the city, and develop the skills of the local population

- create a Skills, Talent and Apprenticeship Hub: connecting employers, providers, and learners

Infrastructure

The views of businesses surveyed and engaged in the development of place and sector strategies is that poor infrastructure is hampering growth and is set to increase as a problem over the next decade.

Sustaining and de-risking the area’s full potential for economic growth relies on transforming the transport, housing and infrastructure capacity in Greater Cambridge and improving the transport system for market towns. Improving connectivity is vital if recent growth is not to stall and will contribute to addressing the Future of Mobility Grand Challenge. Local partners will:

- progress key infrastructure priorities, for example, establishing in-principle viability of a Cambridgeshire Autonomous Metro (CAM), which could support sustainable growth in and beyond Cambridge City

- complete the Cambridgeshire and Peterborough Strategic Bus Review, on the basis of which a Bus Task Force is being established to examine opportunities for an improved future service

- work with government to develop a shared evidence base for the current and future energy needs of the Arc, including through the identification of opportunities to test new energy policies or approaches within the Arc

Business environment

The Combined Authority’s aim is to increase the number of start-ups and scale-ups to drive growth and productivity. The Combined Authority will:

- create a new Global Growth Service targeted at the places and firms that will have the most impact – operational from 2020 and working with 250 firms per year. This will be delivered through a new Cambridgeshire and Peterborough Growth Company, an arms-length and commercially sustainable, not- for-profit business to bring together the Growth Hub, Signpost2Grow and the new Global Growth Service

- introduce a new ‘Trade & Investment Service’ featuring an integrated and customer-focused approach to coordinating the Global Growth Grants and Loans with the support offered by the Department for International Trade and Buyer Credit (financing overseas customers to buy British goods) and other products from UK Export Finance

- establish a Global Investor Service focused on landing new firms into Peterborough and Greater Cambridge

Places

This Local Industrial Strategy aims to tailor and customise intervention to meet the distinctive needs of the 3 different areas of the local economy – Greater Cambridge, Greater Peterborough and The Fens. This will include supporting market towns as key players.

Responding to the Grand Challenges

This strategy will make a globally significant contribution to the societal and economic Grand Challenges that the government sets out in the National Industrial Strategy, building on the sector strengths of Cambridgeshire and Peterborough, notably:

- life science discoveries that transform ageing well

- artificial intelligence and data technologies transforming commercial and public life

- energy and circular economy practices that pioneer clean growth

- advances in sustainable and healthy food production brought about by agri-tech

Priorities for Cambridgeshire and Peterborough

This Local Industrial Strategy sets out an industrial blueprint to deliver Cambridgeshire and Peterborough’s vision of being a leading place in the world to live, learn, work, and do business.

The actions in this strategy will help deliver the aims of the national Industrial Strategy in the region; the Cambridgeshire and Peterborough Devolution Deal; and the recommendations of the Cambridgeshire and Peterborough Independent Economic Review (CPIER).

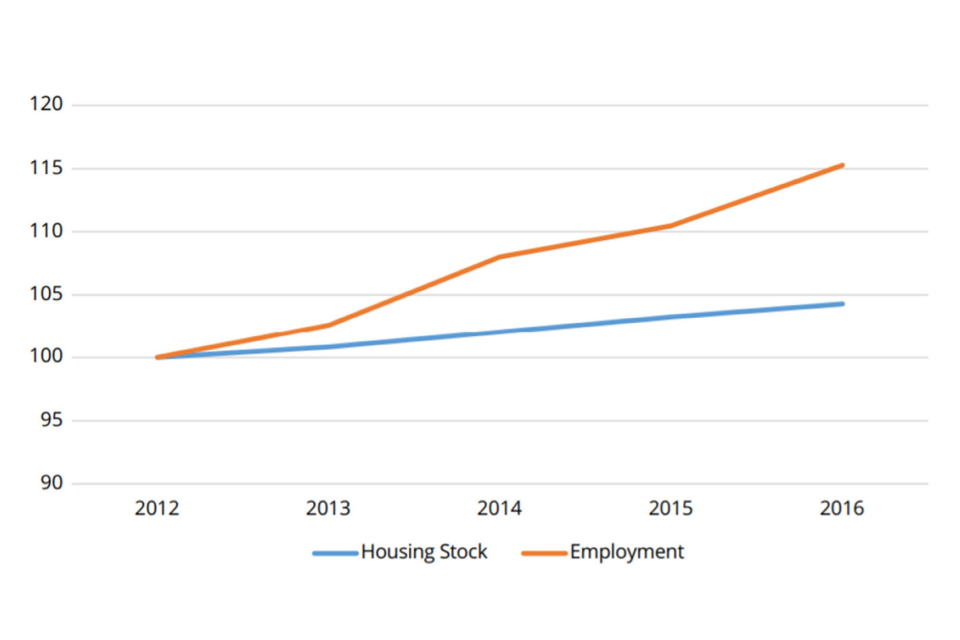

The Cambridgeshire and Peterborough Devolution Deal has set out a clear ambition to nearly double output in 25 years, and independent analysis has shown that this can only be achieved by strong increases in productivity. Whilst overall output growth has outperformed the UK, the area – taken as a whole - has become less productive, relative to the UK, over the last 5 years. As is the case elsewhere in the Arc, output growth has been sustained by additional employment rather than rising productivity. In 2012, productivity per hour worked was 98.9% of the UK average. By 2017, that had fallen to 94.9%, the biggest 5-year fall for any Combined Authority area[footnote 4]. Cambridgeshire and Peterborough has therefore set itself a 5-year target to reverse this trend, aiming to catch up with the national average for productivity per hour worked by 2024.

To achieve this, current patterns of growth must change. At the moment, Greater Cambridge has a global intellectual and market reach, but its economic and societal impact remains local. Businesses in The Fens are strong at bringing cutting-edge research to market, but tend to do so in relative isolation. Peterborough is one of the fastest growing cities in the UK, but has not translated its industrial heritage and recent growth into shared prosperity. Therefore, economic successes are highly place-specific. Within a few miles of Cambridge there are many businesses which are not sharing in its success, let alone those much further away. Too many of the people working in Cambridge have commutes that are difficult, long and growing: not out of choice, but necessity due to high housing costs. In isolated hamlets and in the biggest cities, the challenge of ageing means isolation and ill health. Businesses face increasing risks from a changing climate and other environmental pressures. The practical role of this Local Industrial Strategy must be to apply new approaches to solving these problems. Doing so will deliver the growth needed and ensure this is done in the right way.

Figure 1: the sub-economies and Cambridgeshire and Peterborough

Map showing the sub-economies and Cambridgeshire and Peterborough.

View a larger version of figure 1

This Local Industrial Strategy is not a dash for growth at any price. Cambridgeshire and Peterborough Combined Authority will work to ensure growth is sustainable and has a positive effect on all communities and the environment, to ensure the long-term health of the area – social, environmental and economic. The Combined Authority’s productivity- growth target is supported by 3 priorities, driven by the distinctive features of the local economy:

- improve the long-term capacity for growth in Greater Cambridge. Greater Cambridge is a magnet to companies from across the globe and the home of world-leading digital (including artificial intelligence) and life science clusters. Its labour supply and research and innovation reputation are of the highest order. But there are signs that constraints are starting to bite. Modelling shows that housing, energy capacity and transport issues will significantly reduce the success of Greater Cambridge if not dealt with. Local partners will act, with government’s support, to reduce the risk of any stalling in the long-term high growth rates that Cambridge has enjoyed for several decades. This will be achieved by the Combined Authority and local government investing heavily in housing, transport and infrastructure, whilst supporting efforts to increase inward investment and to develop the infrastructure and skills needed to enable firm scale-up. Keeping Cambridge strong is crucial to leveraging the strengths of this globally-important and hugely successful cluster for the greater benefit of the other 2 economies and the UK as a whole

- increase the sustainability and broaden the base of economic growth. Growth has not been balanced across the local area, and growth in high value companies has been very unevenly spread. The interaction between the 3 economies of Greater Cambridge, The Fens and Peterborough is a potential strength. Each economy has its own specialisms, allowing the area as a whole to lead the UK on multiple fronts. However, disconnects between the different economies present a missed opportunity. By enabling them to work together more closely, this Local Industrial Strategy will look to widen the benefits of high growth in some areas, most notably in Cambridge, to others. The business support networks and skills provision across the area will be better connected to ensure that all areas benefit from the wealth of expertise that exists

- expand and build on the clusters and networks that have enabled Cambridge to become a global leader. The benefits of the global success of Greater Cambridge have, for the most part, remained localised. Whilst there are signs some non-knowledge intensive businesses are moving out of Cambridge to the wider area, work will take place to ensure all parts of Cambridgeshire and Peterborough can thrive. This means building on places’ existing industrial strengths and developing a distinctive offer to help the firms with greatest potential in these places to achieve their full growth potential. Specifically, local partners will target improved productivity and access to international markets by identifying opportunities for high-growth companies to accelerate business growth where there is greater capacity. And innovative growth will be supported by encouraging individual business leaders, sectors, and places to join together to build an economy-wide business support eco-system. This eco-system will promote business growth, greater productivity, better commercialised innovation, greater global market access and more effective skills development – in support of a more inclusive and resilient economy

These priorities will be delivered by the actions set out against each of the foundations of productivity in the subsequent sections.

Realising this ambition will require a change in how the 3 sub-economies work. Greater Cambridge is a hotspot. There are other patches of excellence in Peterborough, in Huntingdonshire, and in The Fens – but these hotspots are generally isolated. This means some of the conditions that have made Cambridge so globally successful must be replicated – dense business networks, the right balance of competition and collaboration, access to finance, and the provision of high- quality business growth, productivity, innovation and global market access support, as well as partnerships with key anchor institutions. This will ensure that the emerging technologies and industries are being applied and will make Cambridgeshire and Peterborough a better place in which to live as well as work and do business.

At the same time, the success of Greater Cambridge cannot be taken for granted. There are serious risks that without investment in housing, transport and infrastructure that the area needs, the global businesses there may take flight to more attractive global centres of innovation-based growth and it will make it harder to achieve the national 2.4% R&D target.

Avoiding long-term risks to the productivity and growth of the local and national economy requires a focus on these issues in Greater Cambridge and its business base.

This Local Industrial Strategy therefore is underpinned by the fifth Industrial Strategy foundation of productivity: Places. The approach taken recognises the needs of the different places, across one of the largest Combined Authority areas in the UK. Greater Cambridge, Greater Peterborough, and The Fens each present different opportunities and challenges. This Local Industrial Strategy responds to these, tailoring the application and mix of the interventions to the very specific needs of each sub-economy.

This means higher levels of transport and innovation spend in Greater Cambridge, with more focus on business growth eco-system development, skills and education in The Fens and Greater Peterborough, including exploring scope to deliver a new university and Innovation Launchpads in the north and east of the area, to stimulate the level of growth from innovation, leading to higher productivity and prosperity there. These could be closely modelled upon what is working well in Cambridge.

Oxford-Cambridge Arc: Economic Context

This Local Industrial Strategy for Cambridgeshire and Peterborough articulates government and local partners’ shared ambitions for the area at a sub-regional level, outlining how specific interventions in the local area will drive future growth in Cambridgeshire and Peterborough and across the Arc more widely.

These local ambitions sit alongside a range of work which will be progressed collectively at an Arc level.

Each of the Local Industrial Strategies across the Arc should be read as ‘local chapters’ of the national Industrial Strategy[footnote 5] - outlining not only the ambitions for the local areas, but also how their strengths and assets will contribute to national objectives.

The economic opportunity presented by the Arc is significant. But it will not happen by itself. It will take concerted and coordinated work by both government and the local areas to ensure that the Arc remains an economic asset of international standing over the coming decades. This Local Industrial Strategy for Cambridgeshire and Peterborough, published alongside those for Buckinghamshire, Oxfordshire and the South East Midlands, shows how this will be done.

Introduction to the Arc

The Arc is a world-leading economic area, underpinned by a high-quality environment, which has the potential to deliver transformational growth that will create jobs and boost local and regional economies for the benefit of existing and future communities. It contains almost 4 million residents and over 2 million jobs, contributing £111 billion of Gross Value Added to the UK economy per year[footnote 6] and the transformative economic potential to contribute around £191.5 billion by 2050. It is a highly productive and prosperous region with global strengths in science, technology and high-value manufacturing.

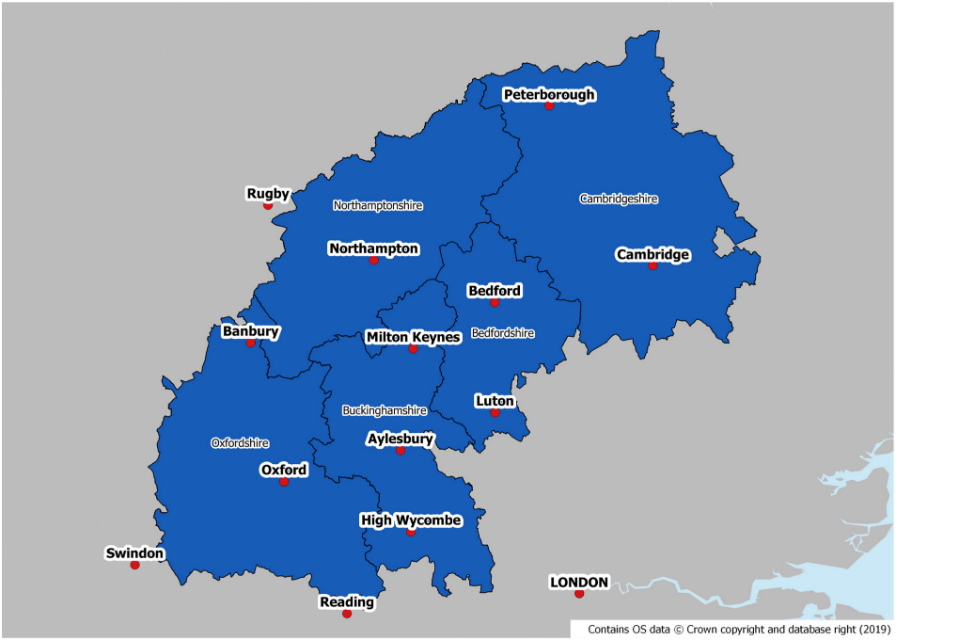

The Arc covers the ceremonial counties of Oxfordshire, Buckinghamshire, Northamptonshire, Bedfordshire and Cambridgeshire. The economic landscape is covered by the Oxfordshire, Buckinghamshire and South East Midlands Local Enterprise Partnerships and the Cambridgeshire and Peterborough Mayoral Combined Authority’s Business Board.

Figure 2: Map of the Oxford-Cambridge Arc

Map of Oxford-Cambridge Arc, showing the area’s ceremonial counties: Cambridgeshire, Bedfordshire, Buckinghamshire, Oxfordshire and Northamptonshire

View a larger version of figure 2

The Arc as a whole is a strongly knowledge-intensive economy. It contains 10 diverse universities[footnote 7], including the Universities of Oxford and Cambridge, 2 of the world’s greatest and most internationally-recognisable centres of learning, and a network of cutting-edge science parks, research institutions, businesses and incubators.

The Arc is home to world-leading R&D and is already renowned as a place of global firsts – pioneering cures for disease, forging breakthroughs in engine technology, innovation in future energy and transport systems, and developing world-leading strengths in technologies that are shaping the 21st century. But it has the ambition and ability to go further.

Its continued success will be critical if the UK is to meet its target of 2.4% of GDP being spent on R&D by 2027 and its knowledge and innovation assets enable the area to be world-leading in industries that have rapidly growing, global markets.

The Arc today: Key growth sectors

Transformational growth of the scale envisaged across the Arc will need to build on the breadth of existing assets and strengths found across the local area. The Arc is home to 2 globally renowned life sciences clusters in Oxford and Cambridge – the most productive life sciences clusters in Europe, which already compete internationally with the global leaders in San Francisco and Boston, Massachusetts. These clusters feature prominently in the UK’s Life Science Sector Deals, published in 2017 and 2018. The Cambridge life sciences cluster alone is home to over 400 companies, with 15,500 employees and contributing around £2.9 billion annually to the UK economy[footnote 8]. Oxfordshire is home to a world-leading bioscience cluster, with an estimated 180 R&D companies and over 150 companies in associated industries. It has world-class R&D facilities, with 4 new innovation centres at the Oxford BioEscalator, the Begbroke Accelerator, Harwell Science and Innovation Campus and Culham Science Centre. Buckinghamshire is also home to a growing med-tech sector and the county also houses national facilities such as the spinal centre in Stoke Mandeville.

The Arc has significant strengths in the space and satellite sector. The Harwell Science and Innovation Campus in Oxfordshire comprises over 90 space organisations employing nearly 1,000 people and is the largest space cluster in Europe incorporating the European Space Agency, the Space Applications Catapult and the National Satellite Testing Facility.

In aerospace, Central Bedfordshire’s Cranfield University, which is home to the Aerospace Integration Research Centre and the UK’s Aerospace Technology Institute, is building a Digital Aviation Research and Technology Centre that will spearhead the UK’s research into digital aviation technology.

The Arc is a world leader in advanced manufacturing, with particular specialisms in high-performance technology and motorsport engineering. Silverstone is home to 40 advanced manufacturing companies, testing facilities for materials and vehicles and the iconic F1 Circuit. More widely, there are over 4,000 businesses operating in ‘Motorsport Valley’[footnote 9], which extends from Northamptonshire into Oxfordshire and beyond – a £6 billion global cluster of automotive, motorsport and advanced manufacturing companies.

The Future of Mobility features heavily across the Arc as a whole, specifically in the research, development and commercialisation of connected and autonomous vehicles. Key assets include the RACE Centre at Culham Science Centre, which is a UK centre of excellence of robotics and autonomous systems, Millbrook Proving Ground in Central Bedfordshire and, at Milton Keynes, a hub of the Connected Places Catapult and the UK Autodrive project.

There are several leading creative and digital clusters within the Arc. In Buckinghamshire, Pinewood Studios and the National Film and Television Schoolcomprisetwogloballyrenowned state-of-the-art facilities. Milton Keynes, Peterborough, Cambridge, Luton, Northampton, Oxford, High Wycombe, South Bucks and Aylesbury all have highly concentrated creative and digital clusters with diverse specialisations. Oxfordshire is home to a range of strengths including computer games, software development, cybersecurity, high performance computing as well as film and TV including the new £78 million studio facilities at Didcot opened by Rebellion. In Cambridge, the information technology and digital technology cluster is highly concentrated, with a strong track record of establishing and growing globally significant companies. This high concentration of modern, creative, industries, have led to Arc businesses featuring heavily in the UK’s Creative Industries Sector Deal.

Policy context

Recognising the importance of the area and the opportunity it provides for the UK, the government has already made significant investment to support local growth and productivity in the Arc over recent years. This has included:

- committing over £400 million of Local Growth Funding to the LEPs in the Arc from 2015 to 2016 to 2020 to 2021, to fund growth enabling projects

- agreeing over £800 million of funding for economic growth, transport and skills through the Cambridgeshire and Peterborough Devolution Deal

- continuing to invest in the 4 LEPs’ Growth Hubs to provide business support across the Arc and investment in the Greater South East Energy Hub;

- supporting the accelerated development of key sites through an Enterprise Zone programme, including in Science Vale, Northampton Waterside, Aylesbury Vale and Alconbury Weald

- investing, through Innovate UK, £670 million in 1000 businesses in the Arc since 2010 to help them develop and innovate new products and services

It was part of recognising the national importance that in 2016 the government commissioned the National Infrastructure Commission (NIC) to undertake a study to strengthen collective understanding of the area’s economic growth potential. The NIC published its report[footnote 10] – Partnering for Prosperity: A new deal for the Cambridge–Milton Keynes– Oxford Arc – in 2017, concluding that, with the right interventions, the Arc could harbour transformational growth, even against its existing levels of output. It explained that meeting this long-term potential would require both significantly more homes to be built and significantly improved east-west transport connectivity.

In its response to the NIC report[footnote 11], published in 2018, the government designated the Arc as a key economic priority, outlining a breadth of actions to seize the opportunity for growth identified in the NIC’s report. The government also affirmed its ambition to deliver more homes in the Arc, supported by measures such as the £215 million Oxfordshire Housing and Growth Deal and the recent confirmation of £445 million Housing and Investment Funding for the Arc. The government has committed to deliver transformational infrastructure projects to improve east-west connectivity across the Arc, most notably by completing the £1 billion East West Rail scheme and the Expressway. Government is also working with partners to identify what utilities, digital and environmental infrastructure, planning and investment is required.

Importantly, the government’s response to the NIC recognised that delivering ambitious growth on this scale had to go hand in hand with environmental enhancement to maximise the benefits to local people and leave the environment in a better state for future generations.

Since then, the government and local leaders have been working in partnership across the Arc to match the level of ambition for the area. This includes working collaboratively to realise the area’s potential through 4 inter-related policy pillars:

- Productivity – ensuring businesses are supported to maximise the Arc’s economic prosperity, including the skills needed to enable communities to benefit from the jobs created

- Place-making – creating places valued by local communities, through the delivery of sufficient, affordable and high-quality homes, to increase affordability and support growth in the Arc, as well as wider services including health and education

- Connectivity – delivering the infrastructure communities need, including transport and digital connectivity, as well as utilities

- Environment – investing in environmental infrastructure and ensuring growth leaves the environment in a better state for future generations

The 4 Arc Local Industrial Strategies set out a shared response to the productivity pillar.

Figure 3: Cambridge and Peterborough in regional context

Map showing Cambridge and Peterborough in regional context

View a larger version of figure 3

Other key strategic corridors

In addition to the Arc, Cambridgeshire and Peterborough is also the central nexus for many other important corridors and national connections, which will play an active role in future growth.

London-Stansted-Cambridge Corridor: This corridor, also known as the UK’s Innovation Corridor, connects the area to the capital, via the research centres of Hertfordshire and Essex, and the international airport at Stansted. Key assets include GSK, Harlow Enterprise Zone, and the London universities. This area has the potential to generate 400,000 new jobs, half of which would be in technological jobs[footnote 12], by 2036. This Corridor plays a significant role in the growth of the Life Sciences sector across the wider region. The Cambridgeshire and Peterborough Business Board continues to invest in connectivity across this crucial corridor, including recent investment into the upgrade of the M11.

Cambridge–Norwich Eastern Agriculture and Tech Corridor: The local area shares many common business interests and sectors with Norfolk, most notably around agri-tech and food sciences, where the University of East Anglia is a world-leading research centre. This Corridor presents opportunities to work together, cementing the East of England as a global centre of excellence.

Connections to the midlands and the north: Just as important as links south to London and east to Norwich, are links to the midlands and the north. These regional powerhouses are leading the UK in many areas of innovation and progress – by connecting into them through key transport links like the East Coast Mainline and A1 the local area stands to benefit from, and contribute to, their productivity growth.

Links to international ports: The east coast ports, most notably Felixstowe, connect to the world, and are a key outlet for exports. As local partners look to grow the area’s export contribution to GDP, and thrive in the post-Brexit world, these links to the global marketplace put Cambridgeshire and Peterborough in a strong position to trade.

Evidence summary

A detailed understanding of the economy of Cambridgeshire and Peterborough is the keystone of this Local Industrial Strategy.

This is found in the Cambridgeshire and Peterborough Independent Economic Review (CPIER). This was developed to inform the Combined Authority of the nature of the economy, developing trends, and issues to be addressed. To ensure this was impartial, an independent commission was set up to chair it, led by economist Dame Kate Barker. Others on the Commission included business people and academics with specialist expertise relevant to the work. Much of the detail that sits behind the key economic features identified here can be found in the review (which is also informing the delivery of other key local plans like the Combined Authority’s Local Transport Plan and the Non-Statutory Strategic Spatial Framework).

Base engine - strong business performance

Businesses in the area are performing strongly. Employment growth has been strong, and, as revealed by independent analysis of all registered businesses in the area, significantly outpacing official sample-based figures, by as much as 1% per annum. This is true not only of the urban hotspots of Greater Cambridge and Peterborough, but right across Cambridgeshire and Peterborough.

This has translated into strong growth in output, as measured by GVA. Strikingly, the region has bucked the wider regional trend of the east of England, to outperform the UK.

Figure 4: Real Gross Value Added (GVA) – index – 2001=100

Chart showing the real GVA – index – 2001=100

View a larger version of figure 4

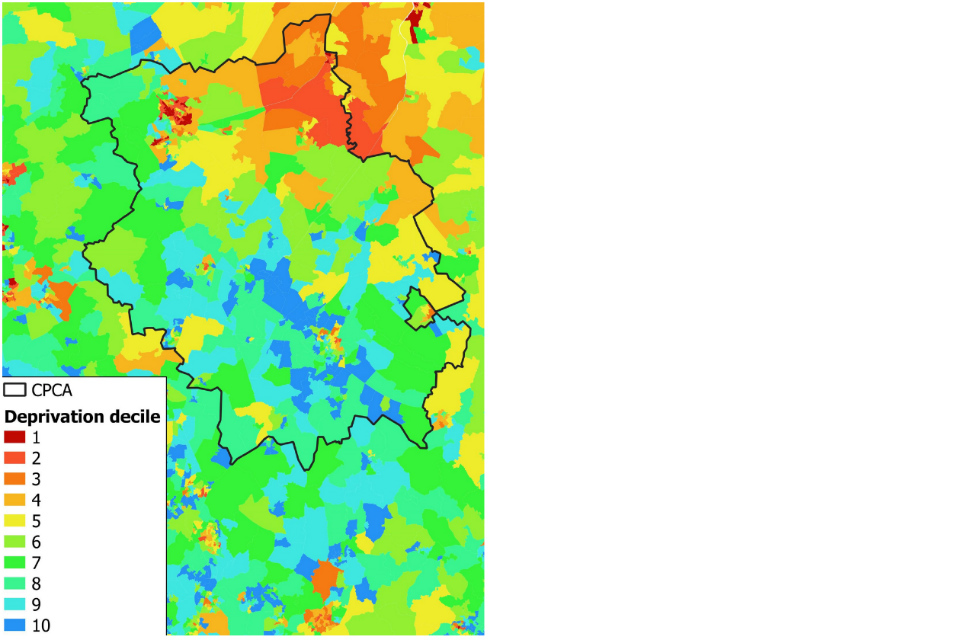

An inclusive growth challenge

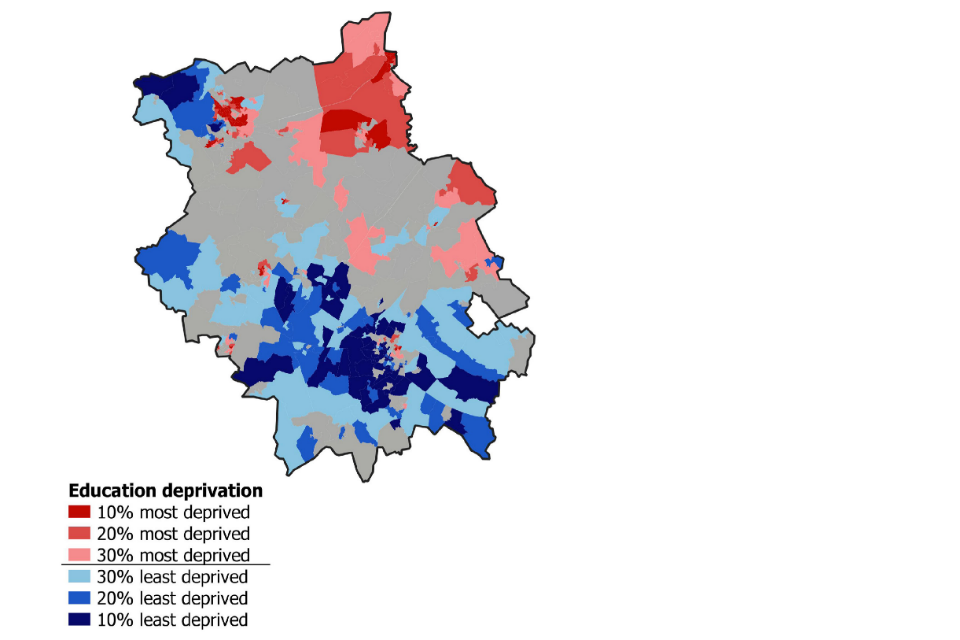

Despite business growth having been strong everywhere recently, the benefits have not been felt across the whole region in the same way. The economy of Greater Cambridge has been performing the most strongly. The positive effects of this have been felt in parts of the Greater Cambridge ecosystem, with market towns such as Ely and St Ives benefiting. However, further north the effects are not being felt. Wages are notably lower in the northern districts of Peterborough and Fenland than the southern districts of Cambridge and South Cambridgeshire. There are related challenges of poorer health and education outcomes, with healthy life expectancy falling below the retirement age in some parts of the north of the Combined Authority.

This can be seen clearly through the Indexes of Multiple Deprivation with strong contrasts within and across the county between areas ranked amongst the best (blue) and the worst (red) in the country[footnote 13].

In many ways, the area is a microcosm of the UK as a whole. It has a prosperous south, based around one principal city, which receives the majority of foreign investment and attracts high value companies and talent from across the world. International evidence increasingly shows that this concentration of growth leads to both high living standards and significant inequality. Further north, there is much industry and innovation, but while there are many success stories, business investment, skill levels and wages are lower.

Figure 5: Index of multiple deprivation

Heat map showing the index of multiple deprivation for Cambridgeshire and Peterborough.

View a larger version of figure 5

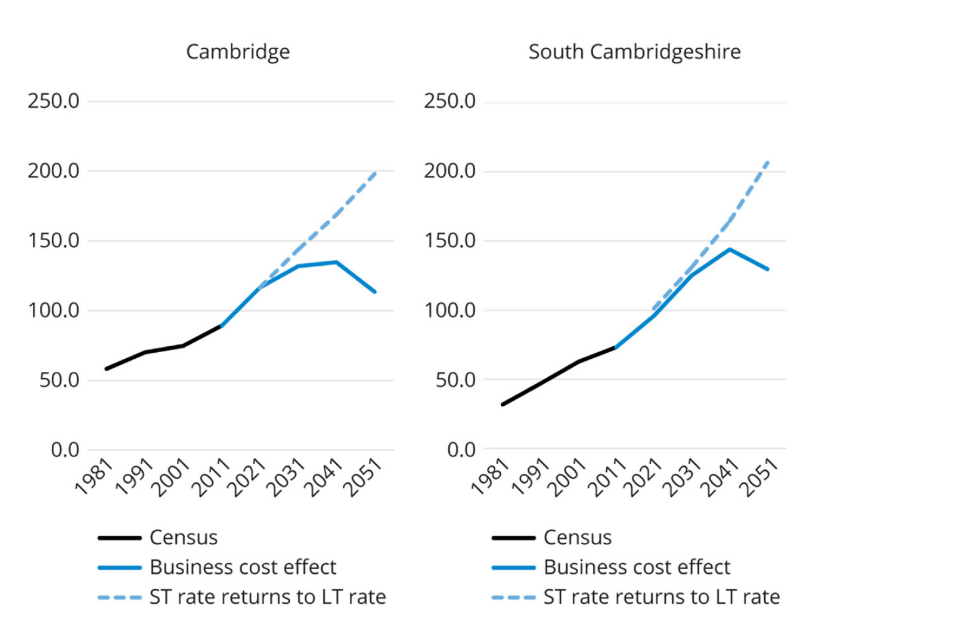

Risks to UK industrial success

The CPIER also identified a significant risk to the national economy if transport infrastructure and housing issues were not tackled in the Greater Cambridge area. The report also recognises the ongoing impacts of climate change, coupled with future growth and a rising population across the area will add further stress to the area’s environmental infrastructure and natural environment. Advanced land use and transport modelling from the University of Cambridge (similar to that carried out for some of London’s bigger transport projects) has shown that, on current rates of transport infrastructure development and housing delivery, the growth of the economy will slow, before eventually going into reverse within 10 to 15 years.

This leads the CPIER to make its seventh key recommendation, that ‘[a] package of transport and other infrastructure projects to alleviate the growing pains of Greater Cambridge should be considered the single most important infrastructure priority facing the Combined Authority in the short-to medium-term’. Energy infrastructure is also at capacity around Cambridge, hampering the ability to build new science facilities. Securing its future success will ensure Greater Cambridge can remain a global leader in innovation and the commercialisation of new ideas and an internationally recognised centre for artificial intelligence, life sciences, food production and advanced manufacturing.

Figure 6: University of Cambridge modelling: employment growth set to stall in the medium-term, and go into reverse in the long-term

Chart showing employment growth is set to stall in the medium-term, and go into reverse in the long-term.

View a larger version of figure 6

Sectoral strengths and specialisms

The detailed evidence base created for the CPIER shows that Cambridgeshire and Peterborough have specialisms in high-productivity, high value added, sectors.

The area is strong in sectors which directly contribute towards the UK’s Grand Challenges and are important global growth markets. Based on a combination of existing strength and future growth opportunities, 4 strategic growth sectors have been identified:

- life sciences

- digital and information technologies (including artificial intelligence)

- advanced manufacturing and materials

- agri-tech

These have been used as a basis for recruitment of industry leaders to the new Business Board, and for each a sector growth strategy will be co-produced between businesses and the Combined Authority. These will sit as part of the Local Industrial Strategy framework and will make recommendations for the consideration of the public sector and businesses alike.

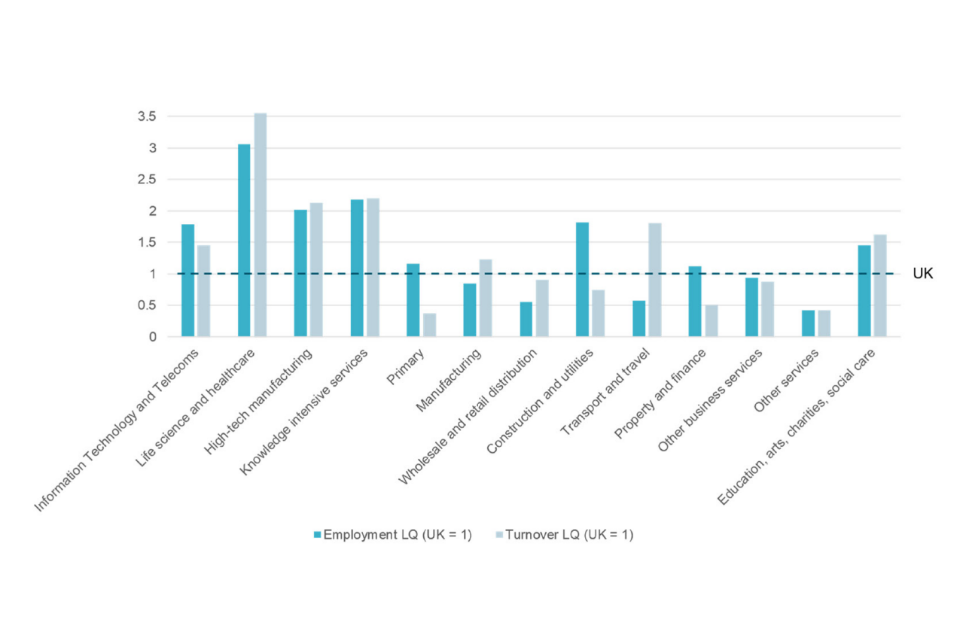

The diagram below shows local specialisations in terms of employment and total turnover compared to the UK in a range of business sectors.

Figure 7. Location Quotients for employment and turnover in businesses in Cambridgeshire and Peterborough

Chart showing Location Quotients for employment and turnover in businesses in Cambridgeshire and Peterborough.

View a larger version of figure 7

Life sciences

As demonstrated through the Life Sciences Sector Deals, life sciences is one of the UK’s greatest business strengths, and the reach of the biomedical industry in Greater Cambridge, and increasingly Huntingdon, is international. This cluster is worth around £3 billion annually to the UK economy, encompassing over 430 companies and employing over 15,000 people. The growth of Greater Cambridge is therefore intrinsically linked to the future success of this cluster. Government announced £45 million investment for cloud computing software at the European Bioinformatics Institute in Cambridge, in the Spring Statement[footnote 14], in support of this.

The Greater Cambridge cluster is the global HQ of AstraZeneca and also has the presence of other global industry leaders such as GlaxoSmithKline and Envigo. World-leading genomics firm Illumina has recently completed a £150 million new facility at Granta Park.

The sector covers a wide variety of interrelated fields, including pharmaceuticals, genomics, and biodata. Local industry generates numerous spin-outs with innovative products, including Abcam (which offers research tools into proteins and other chemicals), Crescendo Biologics (therapeutics in oncology) and Kymab (developing antibody technologies).

The Science Industry Partnership, which brings employers together with government to provide vocational skills needed for the science industry, is launching its first local programme in Cambridgeshire. Apprenticeship standards for the bioinformatics sector and other key sectors are being developed.

Case Study: Cambridge Centre for Ageing and Neuroscience (Cam-CAN)

The Cambridge Centre for Ageing and Neuroscience (Cam-CAN) is a large-scale collaborative research project, launched in October 2010, with substantial funding from the Biotechnology and Biological Sciences Research Council (BBSRC).

The Cam-CAN project is using epidemiological, behavioural, and neuroimaging data to understand how individuals can best retain cognitive abilities into old age.

Case Study: Positive Ageing Research Institute (Anglia Ruskin University)

The Positive Ageing Research Institute (PARI), is a cross-faculty multidisciplinary institute involving over 130 academics from across Anglia Ruskin University.

The institute brings together a multi-disciplinary team representing diverse disciplines. Common interests in ageing unites the Institute with practitioners, local authorities, industry, and voluntary organisations.

Through innovations local partners aim to bring greater sustainability to technology-enabled health services, in order to create business opportunities and economic growth.

Life science opportunities

Greater Cambridge is a global centre of life sciences that will increasingly grow across Huntingdonshire and be connected to a wider cluster operating across the Arc. Local partners in Cambridgeshire and Peterborough will continue to deepen the connectivity between research, industry, and the public sector (especially the hospitals), with a specific focus on addressing the Ageing Society Grand Challenge. This will include the creation of an Innovation Launchpad, based on pioneering business scale-up approaches already proven in California, partnering with a global player to help start-ups and scale-ups get access to customers and markets world-wide. It will pioneer new approaches in digital health, using the local area as a testbed for innovation. A Life Sciences Accelerator Scheme and key infrastructure improvements – such as the A505 and Cambridge South Station – are particularly crucial for this sector.

Agri-tech

The Cambridgeshire and Peterborough area (and the wider east of England) is one of the most fertile soils regions in the UK and is home to many progressive and innovative farmers, ground-breaking technologists and innovative companies across the food and drink value chain as well as centres of world-leading research. The management of and confidence in key data, including the associated analysis and interpretation for aiding reliable decision making will become ever more important. There are untapped potential opportunities in The Fens and across the local area for growing and strengthening this sector specialism, and by creating better connections with local clusters in clean growth, advanced manufacturing, artificial intelligence and machine learning – collectively tackling other key policy agendas in the UK and on a global stage such as healthy ageing, nutrition and wellbeing. A big opportunity within this is to develop new career opportunities as part of the devolved local skills system.

Agri-tech in this region is increasingly operating as a successful innovation ecosystem. An example of this is Agri-Tech East, which brings closer collaboration between the scientific and research community and the businesses (including farmers and growers), operating across the supply chain. The Cambridgeshire and Peterborough Combined Authority has also recently established a venture capital fund Cambridge Agri-tech to support businesses to grow. There is now a need to build on existing partnerships with other geographical areas.

38,000 people are currently employed in the agri-tech sector in the local economy, generating approximately £4 billion of economic value per annum. Agri-tech opportunities were highlighted by the CPIER and the sector is forecast to grow by over 10% over the next 10 years. The local agri-tech cluster has internationally significant research and development in both agriculture and food. This research base is also a significant provider of postgraduate training with a global reputation and creates a significant market for those with higher level skills and qualifications.

The strength and breadth of the research base is built on a highly skilled, international workforce, attracted to Cambridgeshire by the reputation of centres such as NIAB and the University of Cambridge. Firms in the economy have expertise in sensors, robotics, genomics and communications and are at the forefront of ideas and commercial applications that are shaping the food production in the UK and globally.

Automation provides opportunities for economies of scale to increase the efficiency with which food and drink is produced, and new career opportunities are developing in engineering; robotics; software development and producing algorithms.

Agri-tech opportunities

The ambition is to support further growth in pioneering R&D in plant science and precision agriculture, including crop bioscience, engineering, robotics and information technologybased systems. This will be achieved as part of a regional offer, including New Anglia (through an expansion of the joint Eastern Agri-tech Growth Initiative), the Oxford-Cambridge Arc, Greater Lincolnshire LEP and other partners.

Innovative ecosystem will be further strengthened, including by working with networks like Agri-Tech East, developing new skills provision and building upon the emerging local presence of venture capital and investment funds.

The Combined Authority will develop and fund an The area’s innovation Launchpad facility, or facilities, which offer new locations for businesses, research institutes, incubators and other key players to co-locate to support the development of innovation ecosystems. Agri-tech is one of the area’s strategic growth sectors which does not yet have central agglomerations which will be a key ingredient in its future success.

Case Study: NIAB Innovation Hub @ Soham

The Innovation Hub is a purposebuilt facility in the heart of The Fens, facilitated by funding from the Eastern Agri-tech Growth Initiative (Local Growth Fund). This unique centre managed by NIAB has a particular focus on fresh produce. Welcoming farmers and growers, food businesses, and other users wishing to engage in applied research work to reduce or reuse all forms of waste in the food supply chain and improve resource use efficiency in its production. Research and trial activity includes:

- waste reduction — healthy soils, crop production, field and post-harvest storage

- waste management — packing, processing and alternative uses and markets

- increase value or application potential for new products from waste streams

- identifying opportunities to recycle waste or generate energy and co-products

- target total and marketable field losses, due to weather, pests and diseases or other damage

- reduce loss of quality or specification in store due to crop physiology, disease or storage conditions

Digital, information technologies and artificial intelligence

The vibrancy and technological expertise of the Cambridgeshire andPeterborough area digital sector is a significant reason for the area’s international attractiveness. The sector delivers almost 9% of the area’s revenue and 8% of employment. Furthermore, it is the fastest growing knowledge intensive sector, increasing 10.4% over the last 3 years (compared to 6.6% for KI as a whole). Foreign direct investment (FDI) into the area and sector is strong and, when these projects occur, they generate twice the proportion of jobs than information technologies FDI more generally across the UK.

A well-known example, ARM, was started in Cambridge with fewer than 20 employees and has grown into a global player valued at £24 billion in 2016. This is one reason why Greater Cambridge is an internationally recognised centre for artificial intelligence and digital technology innovation, with Cambridge University among the top 5 globally in this area.

Academic and home-grown success has led to major private investment too. Microsoft established their first non-US research centre in Cambridge in 1997, followed by Apple, Amazon, Samsung and others.

As demonstrated in the artificial intelligence sector deal, Cambridge is a key part of the £1 billion invested in UK artificial intelligence start-ups. Venture funding of £170 million was invested in Darktrace, £140 million in BenevolentAI, and £50 million in Featurespace, and the number of spinouts from the University continues to rise with starts ups such as PROWLER.io, Cytora, AudioTelligence and Intelligens, and many other companies choosing Cambridge for their international headquarters. Cambridge has recently secured a major expansion by Bristol-based Graphcore, which designs chips used for artificial intelligence. More widely, firms are supported in innovative growth by numerous technological assets, key amongst which is the new artificial intelligence supercomputer which is being used to support artificial intelligence companies in developing next generation solutions.

The inter-relationship between digital and the other Local Industrial Strategy strategic growth sectors can be neatly demonstrated by the 2018 decision of one of Europe’s biggest artificial intelligence firms – BenevolentAI – to acquire a drug discovery and development facility at the Babraham Research Campus in Greater Cambridge, to dramatically speed up drug discovery.

Digital and information technologies opportunities

The opportunity is to establish Greater Cambridge and the Arc as the preferred global base for firms from across the world to create and adopt the technologies of tomorrow, offering businesses exceptional talent at all levels and a highly networked ecosystem that has global impact. As part of this, the Combined Authority will host a global artificial intelligence conference in Greater Cambridge. This represents a significant opportunity to increase the sector’s growth both within the local economy and across the Arc and the UK. It will not be just the digital sector that benefits from this growth, but all vertical markets who can increase efficiency and deliver advanced benefits to customers through the adoption of cutting-edge technology products and services such as big data, artificial intelligence, robotics and nextgeneration connectivity solutions.

Advanced manufacturing and materials

Specialisms and strengths in this sector exist across all of the 3 economies of Cambridgeshire and Peterborough, with an overall strength of this region being the practical application of innovation in cutting-edge commercial products. Peterborough has a strong manufacturing history, large firms such as Caterpillar have engineering bases there as well as a number of cutting-edge smaller firms, such as Radical Sports Cars.

20% of business turnover generated in Peterborough comes from high-tech manufacturing (with a further 6% stemming from other manufacturing).

Prototype fabrications for the first magnetic resonance imaging (MRI) machines were built at Chatteris in The Fens, and Stainless Metalcraft continues to produce high-end scientific products, such as cryostats, chambers that can maintain very low temperatures. Composites are a particular strength in the west of the area, with Forward Composites, Paxford Composites and Codem Composites based in and around Huntingdon, producing alternatives to steel and aluminium for aerospace, motorsport and other industries. Greater Cambridge is home to leading firms such as Marshalls Aerospace and Hexcel Composites, as well as major industry research institutions such as TWI (The Welding Institute), the Cambridge Graphene Centre, and the Institute for Manufacturing operating across the whole country as well as with firms locally. Greater Cambridge also acts as a successful spin out engine to the rest of the UK, with innovations such as metalysis created there and scaled elsewhere.

Hubs of manufacturing also exist within Cambridgeshire’s Market Towns, such as St Neots. The St Neots Masterplan for Growth identifies how the manufacturing base – which includes firms such as Sealed Air – can act as a contributor to the growth of the sector within the Arc, making use of new connectivity brought about by East-West Rail and the A428 Upgrade.

Advanced manufacturing opportunities

Advanced manufacturing and materials is a broad sector that contains many subsets and will play a myriad of roles across the future growth of the Cambridgeshire and Peterborough economy. The East of England Science and Innovation Audit of 2017 found this sector to be ‘of foundational importance to the other themes’ (namely life sciences, agri-tech and information technologies). But alongside its ‘foundational’ importance, it has institutions and features which bond it together as a sector in its own right, and which this Local Industrial Strategy will support specifically to grow.

This opportunity covers the whole of Cambridgeshire and Peterborough, where the existing base engine of firms can be supported to grow into bigger clusters and eco-systems with interventions such as a new Innovation Launchpad, the Growth Service, the scoping work for a proposed new university in Peterborough, and the development of a Fens Business Network. Drawing on skills and capabilities that already exist in some hotspots, the Combined Authority can provide impetus to development of advanced manufacturing across the region. A specific opportunity lies in scale-up, developing facilities closely coupled to local universities where technologies can be developed and taken through the early stages of commercialisation.

There is scope to pilot this idea on the West Cambridge site, in collaboration with the Institute for Manufacturing and the wider Engineering Department. There is also an opportunity to collaborate with other centres of excellence in advanced materials – such as Greater Manchester and CPI in Tees Valley – to grow the UK’s strengths in this technology. As part of the Growth Service the Combined Authority will seek to create Scale-Up Engines to support early stage commercialisation.

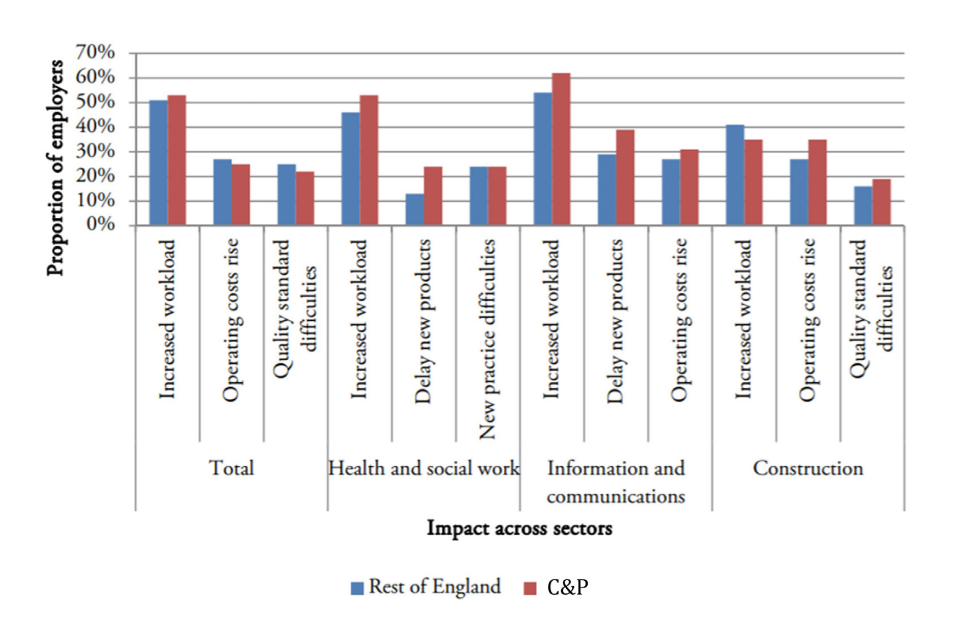

Key supporting sectors

Five supporting sectors have been identified where local strengths exist and where local partners can build upon the strong market position to create business growth and increase the sustainability of the local economy further:

- Logistics: The connectedness of parts of Cambridgeshire and Peterborough to the UK transport network means it plays a significant part in the UK logistics sector. In particular, Peterborough has a base on the A1, which has attracted many firms to establish distribution centres there, including Amazon. Due to the expansion of online shopping, this industry is likely to both grow and change in future as new methods of transport and distribution become available. However, to ensure the city continues to be attractive and to capture the growth in this sector suitable sites need to be allocated and developed offering both good motorway connections and access to the local labour force. Local partners will consider options to provide more and better logistics commercial space on the A1 West (Haddon) at Peterborough, where additional, contiguous housing is being developed around the Ortons, as this could provide a significant opportunity for improving the city’s GVA performance

- Health and social care: With almost 30,000 staff working in health and social care in Cambridgeshire and Peterborough, the sector is a significant part of the economy, with long-term potential for growth and productivity gains through the adoption of new technologies and techniques. Working with existing organisations, such as Cambridge University Health Partners, we can develop closer local links between R&D and early stage product and therapy development in life sciences and the local health and care system, opportunities exist to drive commercial and health benefits locally as well as globally. The impact of the local health and social care sector on the wider inclusion and growth goals is also crucial. It benefits everyone to keep staff well, and there is good evidence that there are opportunities for better using employee assistance schemes and occupational health schemes to keep people in work and reduce pressure on the care system

- Education: Education is a key UK export. Recent Department for Education statistics[footnote 15] found the value of UK education-related exports to be £18.8 billion in 2014. This figure grew by 18% between 2010 and 2015. The University of Cambridge’s reputation attracts many students from abroad – when these spend money in the UK, it registers as an export contribution to the national economy. The region is home to other key higher and further education institutions including Anglia Ruskin University, and the College of West Anglia. Due to the prestige of Cambridge, there are numerous language schools, and colleges offering preparatory courses, which attract students from around the world;

- Visitor economy and business tourism: The area is home to key visitor attractions such as Ely Cathedral and the city of Cambridge which make a significant contribution to the local economy and natural assets including Wicken Fen and the Great Fen Project are increasingly important to the visitor offer. However, Cambridge struggles with the weight of tourist attraction at times, and like many world cities, ‘over-tourism’ is a risk. Many of the market towns and villages surrounding Cambridge have rich visitor opportunities, which if developed into a more coordinated offer can bring in revenue and create real economic opportunities. Business tourism is very important as well and has an important impact on the growth and productivity of other sectors in the economy, especially in knowledge intensive industries. In Greater Cambridge a lack of large conference facilities hampers potential growth here, as international enquires are turned away due to the lack of sufficient capacity; and

- Construction: Much of the development in Cambridgeshire and Peterborough is fuelling strong growth in the construction sector. This gives an important opportunity to drive productivity and growth across the sector, adopting new techniques and technologies. The local area has numerous examples of good building quality, such as the University of Cambridge’s development at Eddington, which reuses surface level water, reducing wastage and minimising flood risk. Government has also invested in the Centre for Digital Built Britain at Cambridge University, a core partner in the Construction Innovation Hub designed to support the transformation of the construction sector, and the Construction Industry Training Board (CITB) is relocating to Peterborough.

The subsequent sections of this strategy set out the actions that will be taken against each of the foundations of productivity to support further business growth and productivity gains, building on local existing strengths and emerging trends. These actions will support all sectors.

The 5 foundations of productivity

Ideas

Deliver an economy-wide, place-based innovation and growth eco-system.

Cambridgeshire and Peterborough is a global centre of highly diverse and successful innovation, representing one of the UK’s greatest assets for idea generation and commercialisation. R&D funding by UK Research and Innovation (UKRI) in the UK is the highest outside of London within Cambridgeshire and Peterborough[footnote 16]. Its future success is key to the UK achieving the commitment set out in the Industrial Strategy of 2.4% of GDP invested in R&D by 2027, and 3% in the longer term.

The priorities and interventions of this Local Industrial Strategy are collectively intended to maximise the potential of some of this area’s greatest assets, through enabling the future success of the local centres of innovation – most notably Greater Cambridge – whilst also actively working to spread innovation across more of the economy, moving firms and sectors up the value-chain.

To achieve this, the evidence and recommendations from the CPIER and the 2017 East of England Science and Innovation Audit have been considered and interventions have been tailored in ways that will support clusters of innovation to grow and that are bespoke to places and sectors.

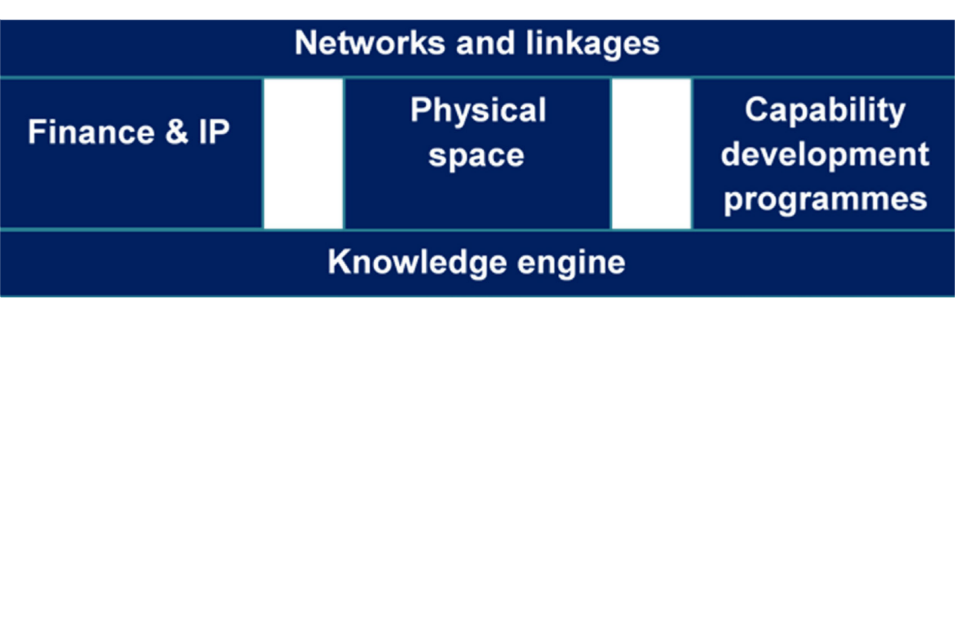

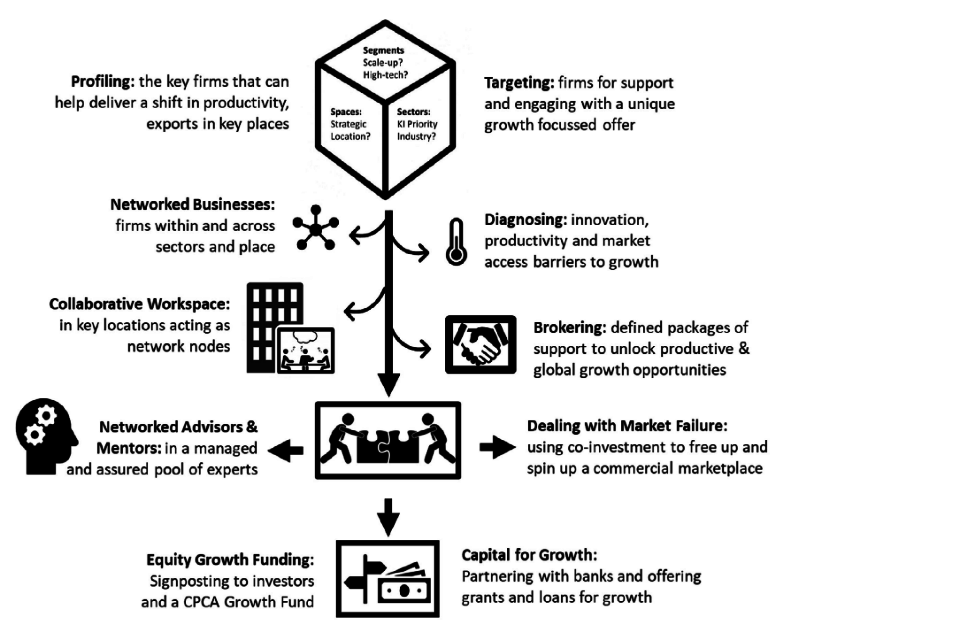

Figure 8 The Innovation Ecosystem model as developed through the CPIER

Figure showing the Innovation Ecosystem model as developed through the CPIER.

Evidence and barriers

Productivity growth is heavily dependent on the introduction of innovative new products and services and the ideas and the circumstances which give rise to them. Whilst much process innovation happens in situ in offices and laboratories in companies wherever they are, the nature of innovation is changing more generally in a way that is becoming more context sensitive. If the major innovations of the motor age happened in a handful of places and a small number of large companies, the model of today is more complex, diverse and more broadly based. So, place matters intrinsically for innovation.

Greater Cambridge is one of the world’s most effective and diverse innovation systems. Innovation ecosystems need knowledge engines that drive development. These include research institutions like universities at the high end, and education providers at an earlier point in the system. It also includes the businesses, professional service advisors, and supply chains which generate clusters of specialisms that draw in interest and expertise.

Across Cambridgeshire and Peterborough this knowledge engine operates to the highest of levels within Greater Cambridge. The University of Cambridge provides one of the best research institutions in the world, and a pivotal anchor for innovation in the city and beyond.

Combined with the area’s private R&D labs and public sector research establishments such as the Medical Research Council Laboratory of Molecular Biology, this provides the region with a formidable research base.

Knowledge institutions can be found in other clusters in various stages of maturity, such as the recent Agri-tech Innovation Hub, sponsored by the National Institute of Agricultural Botany (NIAB), which was brought forward with Local Enterprise Partnership investment. The Combined Authority proposals to make the case for creating a new university in Peterborough which could, over time, become the knowledge engine in the north of the region.

This model of innovation sees the knowledge engine as the foundation for 3 pillars of policy, namely finance and intellectual property, physical space and capability development programmes.

The picture on availability of, and access to, finance and intellectual property is mixed. Cambridge has a deep pool of early stage finance through the likes of Cambridge Angels and Cambridge Capital Group, but even here firms report low levels of access to scale up capital and growth strategy support.

The University is seeking to address this market failure by supporting Cambridge Innovation Capital and private sector investors – such as Amadeus and Ahren – are important players, but elsewhere there is a lack both of seed finance and an absence of the collaborative approach to innovation which seems to be so important a part of Cambridge’s success.

The requirements for physical space, like finance, have stages. What a business needs in its start-up phase is different to its needs as it matures and grows. It is vital, if an innovation ecosystem is to be effective for there to be variety and availability at every stage.There is evidence that Greater Cambridge could benefit from more start up and particularly scale up space, which are less likely to attract private sector funding given the risk profile and need for more commercially focussed wet labs for product development and testing. The Combined Authority and Greater Cambridge Partnership are working to support this. Peterborough has a significant shortage of business space and especially incubator space, important to encourage entrepreneurs to set up and locate. The Fens lack suitable move-on space and also the tailored innovative spaces that can link to specific sectors and can support wider start up and innovation activity in market towns.

In terms of capability development, both the finance and property offers in Greater Cambridge are more developed than those elsewhere. In Peterborough there is need which could be met linked to the proposed new university and growth support proposed through the Mayor’s Endowment for Global Growth (EGG). The Fens are similarly in need – focused on sectors including agri-tech and advanced manufacturing. One key reason for the differential development of the areas which reflects the strength of the innovation and growth eco-systems in each area is the strength of networks and linkages in each area. Cambridge has highly effective networks: the links between incubators, venture capital, mentors and entrepreneurs are essential to the ‘Cambridge Phenomenon’. In Peterborough there is greater a need to establish the sort of functional mentoring, advisory, coaching and supply chain networks that have made Cambridge so successful. The Fens needs to encourage firms who compete to collaborate and build knowledge.

Interventions

Ambition:

To deliver an economy wide place-based innovation and growth eco-system.

Actions:

To drive progress towards achieving this priority, Cambridgeshire and Peterborough will:

- improve networking and linkages:

- establish the Innovate 2 Grow Network, bringing together leading entrepreneurs, innovators, mentors and coaches with growing firms to strengthen linkages across the area;

- establish new networks and strengthen existing networks in specific towns and cities;

- support businesses, universities and other partners to collaborate to maximise public and private investment, including R&D funding in the 4 major growth opportunities identified above and to support the supply chain innovation which will be needed across many sectors

- establishing a Fens Business Network

- improve funding for Intellectual Property exploitation:

- Consider options to develop a Mayoral Innovation and Growth Investment Fund, targeted at growth firms to fill gaps in the equity and loan market to break into new markets and support innovation and productivity gains. Particularly in places where access to finance is more difficult. This will provide equity and loan investment to firms already accessing growth coaching and support to break into global markets and transform their productivity through innovation;

- expansion of the Eastern Agritech Research, Development and Prototyping Growth Initiative, enabling direct funding support to more firms

- establishing an SME Innovate 2 Grow Fund to promote R&D, innovation and commercialisation of ideas – offering match funding to SMEs to write bids to access R&D and innovation grants

- improve the amount of physical space for businesses to set up and grow, including:

- continue to work to develop at least 4 new Innovation Launchpads. These will be the focal point for innovation cluster development. Focussing on product development to support key growth sectors – bringing together established firms with training, R&D, and incubation facilities. These will be focused on key sectors such as agri-tech, artificial intelligence and advanced manufacturing innovation

- supporting new start up, incubation, and scale-up space where market failures are identified

- introduce new programmes of support for businesses:

- developing a CPCA-wide innovation and growth support eco-system, harnessing the growth, innovation and productivity expertise within the Knowledge Engine of Cambridge to create 1,000 Global Growth Champions

- establishing Micro Innovation Systems in market towns, in specific locations to be identified by the Market Town Strategies, that integrate the improved business networking infrastructure local partners propose to create, with the Global Growth Champion support services, the proposed growth investment funding into specific new market town business growth space

Working with local partners across the Arc Cambridgeshire and Peterborough will also:

- harness the collective strength of the Arc’s research base will be essential. The new Arc Universities Group will act as the focal point from cross-Arc collaboration on science and research, identifying and delivering joint R&D projects and providing a pipeline of talent to knowledge-intensive businesses

- strengthen its ability for businesses to commercialise ideas coming out of its universities and others. Key to this will be a network of ‘Living Laboratories’ that both trial technologies linked to new developments across the Arc and help address the Grand Challenges. Arc partners will also use assets such as Harwell, Silverstone and Cranfield to establish new networks that support the convergence of technologies across sectors and seek to develop emerging districts such as West Cambridge