Market Data Insights - September 2021

Published 15 October 2021

Economic summary

The end of September marked the end of the Coronavirus Job Retention Scheme, also known as furlough. This scheme had been in place since 20 March 2020 to protect employee jobs and incomes during the pandemic. In contrast, job vacancies rose to over 1 million this month, the first time since Office for National Statistics (ONS) records began.

This month’s economic news was dominated by fuel shortages and queues at petrol stations. This was due to the continued shortage of lorry drivers meaning that tankers were not delivering to petrol stations as usual.

Increases to wholesale energy prices have caused multiple energy firms to fold as they could no longer deliver on their promised prices for consumers. More than 1.7 million UK households, which bought their energy from firms which have now folded, have been transferred to new firms. Energy prices for consumers are expected to rise because of increased costs from suppliers and anticipated rises to the energy price cap.

The increasing wholesale energy prices have had knock-on effects on other industries. Most notably, it caused fertiliser factories to shut meaning reduced production of its CO2 by-product, leading to CO2 shortages. This resulted in government suspending competition laws for parts of the CO2 industry to ensure CO2 is supplied to UK businesses.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) inflation stayed above the 2% Bank of England target for the fourth consecutive month at 3.0%, the largest levels observed since 2012.

COVID-19 cases have remained largely stable over the past month as pupils return to schools and universities and many people begin to return to offices. The 7-day average number of cases stood at 34,172 as at 23 August which rose by 0.6% to 34,358 at 23 September.

Credit spreads as at 24 September 2021

| AAA | AA | A | BBB | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 24 bps | 48 bps | 85 bps | 127 bps | ||||||

| ▼ 1 bps MoM | ▼ 2 bps MoM | ▼ 2 bps MoM | ▼ 4 bps MoM |

(Source: UN10/20/30/40 ICE indices)

An asset’s ‘credit spread’ is the difference between its yield and that of a government-issued bond of similar maturity. It is an indicator of the perceived riskiness of the asset. It represents how much investors want to be rewarded for investing in it instead of a lower risk government bond.

Over the month up to 24 September, credit spreads held steady for most higher grades of bonds. However, the credit spreads on lower grade bonds fell. The lower the grade of bond, the deeper the decline tended to be.

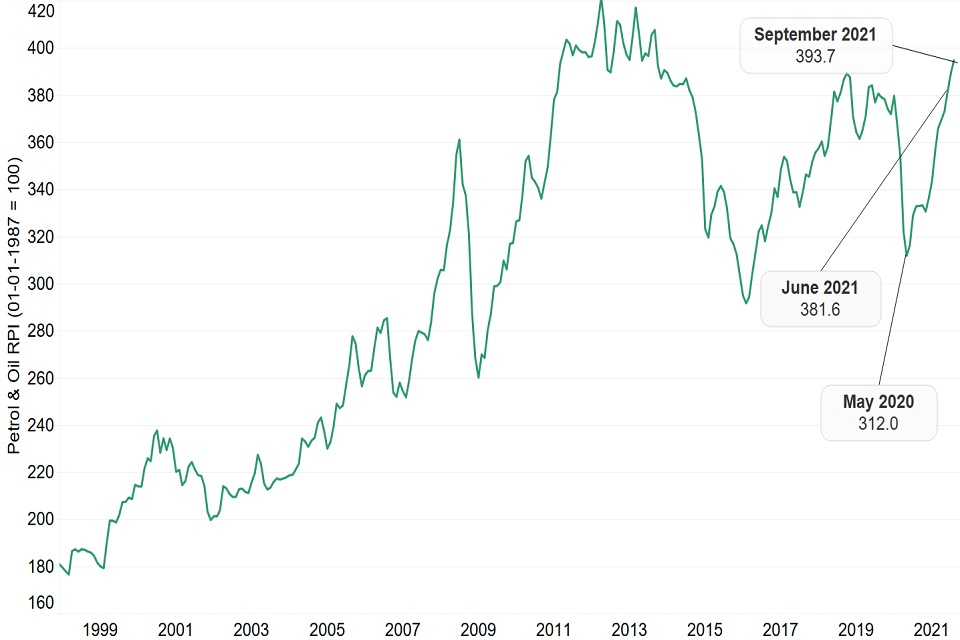

Petrol and Oil

(Source: ONS time series MM23)

As economies across the world continue to emerge from lockdown and consumer air travel increases, oil prices have increased sharply since their near 10-year low in May 2020. While petrol prices rise can be attributed to increased demand from individuals following lockdown easing, the price could also have been affected by the recent supply issues at petrol stations.

The graph above shows the ONS petrol and oil index and we can see that prices have now returned to pre-pandemic levels and these are now nearing the peak of April 2012.

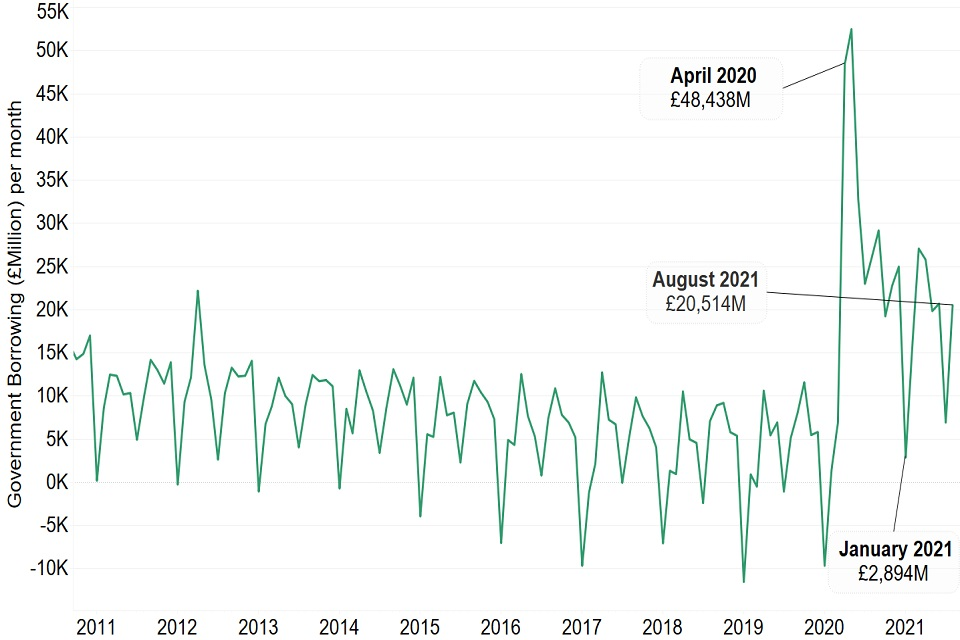

Government borrowing

(Source: ONS public sector finances time series)

As part of the government’s continuing efforts to recover from the economic effects of the pandemic, they are still borrowing at levels above what was observed over the past 10 years pre-pandemic.

On 30 September, the government closed the furlough scheme, which protected a cumulative total of 11.7 million jobs over its lifetime. Similarly, on 6 October 2021, the government withdrew the temporary £20 a week increase to universal credit that was introduced in response to the pandemic. The withdrawal of these benefits is expected to reduce the pressure on government borrowing.

Disclaimer

The information in this publication is not intended to provide specific advice. Please see our full disclaimer for details.

The Government Actuary’s Department is proud to be accredited under the Institute and Faculty of Actuaries’ Quality Assurance Scheme.