Oxfordshire Local Industrial Strategy

Published 19 July 2019

Diamond Light Source, Harwell Science and Innovation Campus (credit: OxLEP)

Foreword

When Howard Florey came to Oxford in 1935 as the newly appointed Professor of Pathology, he arrived to state of the art but largely empty labs in the new Sir William Dunn School.

He soon set about recruiting a research team and – by the early war years – Florey, Ernst, Chain and others had turned over the department to making penicillin and demonstrating how effective it could be against bacterial infections. Penicillin then seemed nothing short of miraculous, banishing many infectious diseases that were some of the leading killers of the time. Indeed, the work of the Oxford team ushered in the modern age of antibiotics.

Nearly 85 years on, Oxfordshire is today a global centre of research and innovation. It is home to a number of world-leading science and technology companies which are located across leading business clusters and hubs that form a hive of knowledge intensive economic activity and anchor the area’s strengths in breakthrough sectors.

Oxfordshire is the UK’s engine for innovation: ground breaking R&D is driving the creation of new, dynamic businesses hungry to grow and scale up; cutting edge products and services are solving the challenges in healthcare, mobility, energy and communications; and commercialisation of these new ideas is delivering manufacturing and supply chain opportunities across the length and breadth of our country.

Oxfordshire’s success, therefore, is critical to the success of the UK.

This Oxfordshire Local Industrial Strategy sets out an ambitious plan to build on Oxfordshire’s strong foundations and world-leading assets. It will deliver transformative growth and prosperity for all communities across the county, supporting the objectives of the national Industrial Strategy. This Strategy looks to build on these strengths and assets to drive R&D and innovation across the region as a pioneering contributor to the Industrial Strategy’s target for national R&D spending to reach 2.4% of GDP by 2027 and 3% in the longer term. In doing so, it will drive Oxfordshire’s ambition to become 1 of the top 3 global innovation ecosystems by 2040.

Achieving this bold and ambitious target will require collaborative working between all partners across Oxfordshire and government. We will need to develop the physical, digital, financial and knowledge infrastructure of Oxfordshire to foster a successful innovation ecosystem that is focused on competing at a global level against our rival international hubs.

This will be supplemented by a thriving business environment which makes Oxfordshire the playground for innovators and entrepreneurs to translate big ideas into commercially successful products and services.

Oxfordshire wants to be a pioneer for clean and sustainable growth, known as the location which harnesses the dynamic potential of its science and technological innovation for the benefit of local residents, business and improved public services which is an exemplar for contemporary living and design, and delivers sustainable and flourishing communities.

Most critical of all, Oxfordshire will be relentless in maximising the full potential of each and every person who lives and works in the county, ensuring that they are equipped with the very best skills which can provide them with the capability to secure the new employment opportunities generated across the innovation ecosystem. The Oxfordshire Social Contract will be central to the ambition to drive social mobility and ensure local residents benefit from the dynamic location which is their home.

This Local Industrial Strategy, therefore, presents a long-term framework against which private and public sector investment decisions can be assessed, grouped around the 5 foundations of productivity. We will use Ideas to establish a globally connected and competitive innovation economy; our People will benefit from a more responsive skills ecosystem creating better opportunities for all; Infrastructure will enable greater connectivity especially across key growth locations; the Business Environment will enable Oxfordshire to become a powerhouse for commercialising transformative technologies; and finally, we will develop Oxfordshire as a living laboratory to help solve the UK’s Grand Challenges for all Places.

Everyone has a role to play in making Oxfordshire’s Local Industrial Strategy successful, real and relevant – communities, investors, educators, entrepreneurs, innovators and more.

We invite you to join us in this exciting journey and seize the opportunities which lie ahead of us.

Rt Hon Greg Clark MP

Secretary of State for Business, Energy and Industrial Strategy

Jeremy Long

Chair of the Oxfordshire Local Enterprise Partnership

Executive summary

Oxfordshire has been at the centre of innovation in the UK for centuries. National and local investments have built up a network of science parks and innovative firms across the county, and now wider investments in the region offer the opportunity to cement the area’s reputation as one of the best locations in the world to innovate.

This Local Industrial Strategy sets out an ambitious plan to build on Oxfordshire’s strong foundations and world-leading assets, to deliver transformative growth which is clean and sustainable and delivers prosperity for all communities across the county. It will deliver the aims of the national Industrial Strategy, government’s long term plan to boost productivity, by backing businesses and investing in skills, industries and infrastructure.

This growth will be driven by innovation and higher productivity - both in those emerging sectors which will harness transformative technologies, and in sectors that have historically driven the economy. It will be inclusive, place sensitive and sustainable, responding to increasing concerns around climate change, and will enhance the natural environment and the quality of life for everyone in Oxfordshire.

Building a global innovation ecosystem: Oxfordshire in 2040

This Local Industrial Strategy is framed by Oxfordshire’s ambition to be a top 3 global innovation ecosystem by 2040.

Oxfordshire will achieve this through developing the 5 foundations of productivity, as set out in the national Industrial Strategy, and by building on the county’s world-leading science and technology clusters.

This will knit together the existing strengths of the county – in the historic academic assets in the City of Oxford, within dynamic and creative residential communities, and across its science and technology parks throughout Oxfordshire – into a coherent network, able to exploit the latest technologies.

As well as supporting ‘breakthrough’ firms, this will enable growth in the ‘cornerstone’ local businesses that form the backbone of the Oxfordshire economy, providing jobs, essential services and supply chains across the innovation ecosystem and delivering growth in the UK as a whole.

Oxfordshire in 2019

Oxfordshire has one of the strongest economies in the UK, contributing £23 billion Gross Value Added (GVA) to the UK exchequer in 2017. It is also rapidly growing at an average of 3.9% growth year-on-year since 2006

The county has significant assets in research and development (‘R&D’) being home to the top performing university in the world, the University of Oxford, as well as Oxford Brookes, a leading university in the UK for teaching and research. These anchor institutions support an international brand that draws talent and investment to both the City of Oxford and across Oxfordshire in the number of science, innovation,technology and business parks located in the county. The Oxfordshire knowledge-led economy generates the highest number of university spin-out companies in the UK, underlining its importance to the national economy.

However, despite Oxfordshire’s many strengths, it has low productivity relative to many peers. Whilst the region’s productivity per hour worked is above average for England, in recent years it has fallen below the south east. Moreover, as Oxfordshire’s economy grows there is an increased strain on the county’s infrastructure. Housing is becoming increasingly unaffordable and rail, road and energy infrastructure are not sufficient to meet rising demand.

This also places it at an increasing disadvantage to its international competitor locations in attracting foreign investors, talent and business investment.

This Local Industrial Strategy recognises these challenges to the Oxfordshire economy and sets out the opportunity to ensure that this growth is coordinated county-wide. It sits alongside the Oxfordshire Housing and Growth Deal, agreed with government in 2017, which sets out the commitment to deliver 100,000 new homes across the county before 2031 as well as improvements in necessary accompanying infrastructure. This strategy looks to integrate the county’s leading R&D and innovation assets into future housing and infrastructure. This will provide pioneering solutions to deliver transformative and sustainable neighbourhoods that prepare communities for the future and make Oxfordshire a clean and prosperous place to live and work.

Ideas

Oxfordshire is a global centre of research and innovation. The county is home to 2 renowned universities – the University of Oxford and Oxford Brookes – and a number of world-leading science, innovation, technology and business parks. This hive of knowledgeintensive economic activity attracts international talent and investment and encourages the highest intensity of university spin-outs in the UK.

This engine of innovation in Oxfordshire also benefits the wider UK and is key in building innovation excellence across the country and competing globally for investment and talent.

This Local Industrial Strategy looks to build on these strengths and assets to drive R&D and innovation across the region as a pioneering contributor to the Industrial Strategy’s target for national R&D spending to reach 2.4% of GDP by 2027, and 3% in the longer term.

For Oxfordshire to reach this ambition, this Local Industrial Strategy recognises that the county needs to develop its physical, digital, financial, knowledge and social infrastructure to foster a successful innovation ecosystem that competes at a global level. This means ensuring that there is a sufficient pool of leadership talent, funding and business premises to support growing businesses. Oxfordshire will therefore support the transformation of science and technology parks, and the potential creation of a new Global Business District as part of the Oxford Station quarter. Additionally, it prioritises local investment in the breakthrough technologies set out in the Oxfordshire Science and Innovation Audit and this Local Industrial Strategy to accommodate fast-growing businesses. The county will also set out a distinctive global brand to raise Oxfordshire, and the Oxford – Cambridge Arc’s, international profile for innovation and R&D to attract more investors and talent.

This will include the launch of the ‘Connecting Globally’ platform, a digital platform to showcase success across the region and facilitate collaboration with other global innovation ecosystems.

People

Oxfordshire has a highly skilled workforce, with 51% of the working age population educated to degree level or above. The county’s unemployment rate is over 50% lower than the UK average, at 1.3% compared to 2.7% nationally. However, the county has pockets of significant deprivation and wage disparity.

The priority in this Local Industrial Strategy is to build a skills system that better responds to local demand, which provides a range of opportunities for all across the county. This will help develop a more responsive skills ecosystem to support our innovation ambitions. Oxfordshire will take forward a series of measures to support business engagement with the skills system through the development of an Oxfordshire Social Contract, including:

- establishing a Skills Advisory Panel for Oxfordshire

- championing T levels locally, so that they map to the county’s technology sectors and support local employers to deliver industry placements and develop new apprenticeships

- establishing an Oxfordshire Entrepreneurship Hub to support students and young people across the county to develop business propositions and develop connections across the innovation ecosystem

- working with the Careers and Enterprise Company, local colleges and Oxfordshire County Council, to improve social mobility for young people by ensuring they will have greater access to career pathways within Oxfordshire

- developing OxLife, a targeted programme to reskill and upskill older workers and armed forces personnel, returning to the Oxfordshire workforce, so that they can actively engage in the new innovation economy

- driving growth in apprenticeships and maximise local take up of the apprenticeship levy through working with local employers to maximise their usage of their levy allocation

- working through the Oxfordshire Growth Board to convene local leaders, academic experts, businesses and community organisations to form an Inclusive Growth Commission. This will consider how Oxfordshire can ensure that the benefits of a world leading innovation ecosystem can be equitably shared and reach all communities, learning from other global ecosystems

Infrastructure

Oxfordshire has strong transport links along the Bristol-Birmingham-London corridors and enjoys close proximity to Heathrow and Birmingham airports. The county is committed to improving links across the Oxford-Cambridge Arc with the development of the East-West Rail scheme. However, a growing economy and population is putting strain on rail and road infrastructure, as well as the energy sector. Housing also faces rising demand and affordability pressures. In order for Oxfordshire to deliver on the vision to be a world-leading innovation ecosystem, it must continue to work with government to develop resilient infrastructure that can respond to future demands and is sustainable for the environment.

Oxfordshire will do this by:

- identifying opportunities to progress the ambitions in the Oxfordshire Infrastructure Strategy, supporting local plans to improve rail and roads across the area and make space for sustainable, multi-modal transport

- working to realise the ambitions of the Oxfordshire Energy Strategy using local funding streams, to harness the opportunities of clean growth and put in place a low carbon energy grid that supports business growth and leads to the development of pioneering new models of energy management and the application of ground breaking battery technologies

- developing an ambitious Digital Investment Plan to provide world leading digital coverage

Government is supporting these initiatives through investment in East-West Rail and the Expressway and by offering policy support on the development of the Oxfordshire Digital Investment Plan.

Business environment

Oxfordshire is home to thousands of great businesses and is one of the strongest engines for growth in the UK. With over 31,000 VAT registered businesses across a broad range of sectors. Oxfordshire has a well-balanced, resilient economy which has been instrumental to its track record of continued growth.

However, many firms continue to struggle to grow to scale and do not translate ideas into business growth as well as some other competitor locations.

This Local Industrial Strategy looks to address identified challenges (including access to premises and finance) to ensure the region can maximise its commercial and innovative potential. Oxfordshire will enhance its business support offer through the Growth Hub to develop a world class ‘Scale Up’ programme that provides a single, coordinated and collaborative service that delivers dedicated support for high growth potential breakthrough businesses. Oxfordshire Local Enterprise Partnership will establish an ‘Oxfordshire Finance Hub’ as part of the Growth Hub, to help firms access finance, and will seek further opportunities to attract institutional investors such as Sovereign Wealth Funds into the area.

Government will support this by working closely with Oxfordshire to develop an Internationalisation Delivery Plan to expand on the county’s global brand and attract trade and investment opportunities to support business growth.

Places

Oxfordshire has a wealth of assets in research, innovation, natural capital and cultural heritage.

Towns and villages across the county are vibrant and distinct, driving a strong and growing tourism industry attracting over 30 million visitors a year to Oxfordshire. The county is also an increasingly attractive place to live and work, but this success, however, is putting strain on the county’s infrastructure – compounded by flooding and environmental issues that limit housing developments.

The vision set out in this Local Industrial Strategy, therefore, is designed to help the county retain its distinctive character, while seizing the opportunities of the 21st century. It provides Oxfordshire with the opportunity to innovate in place-making, building healthy and sustainable communities that are technology-enabled, improve quality of life, and utilise innovative solutions to the challenges of modern living and respond to the increasing concerns around climate change.

Oxfordshire’s communities themselves have the opportunity to become exemplars of contemporary living - preparing for technological and environmental change, whilst retaining natural landscape and a high-quality living experience.

This will be based on developing new technologies with private sector partners, coordinated by multidisciplinary teams to respond to the Grand Challenges as set out in the Industrial Strategy.

In addition, government will work in partnership with Oxfordshire to support the delivery of these new housing communities, not least through the Oxfordshire Housing and Growth Deal, and through other initiatives such as the Local Growth Fund and the Housing Infrastructure Fund. Government also recognises the importance of natural capital assets across the county, including its 3 Areas of Outstanding Natural Beauty and 7 Special Areas of Conservation.

Working across the Oxford-Cambridge Arc

This strategy is 1 of a family of 4 linked strategies covering the Oxford-Cambridge Arc (‘the Arc’), with the other strategies covering, Buckinghamshire, Cambridgeshire and Peterborough and the South East Midlands. It therefore includes a summary of the wider economic context and identifies those priorities within each Local Industrial Strategy which can be developed at scale across the Arc, complementing the specific Oxfordshire strategic objectives which sit at the heart of this strategy. This includes:

- working together collaboratively across all of the foundations of productivity to ensure that the implementation of the 4 Local Industrial Strategies maximises the economic potential of the wider Arc region

- harnessing the collective strength of the Arc’s research base – driving greater collaboration on science and research; and growing the role of the Arc as a global research and innovation hub

- bringing employers and skills providers together to understand the current and future skills needs, and planning provision to meet them

- maximising the economic benefits of new transport, energy and digital infrastructure within the Arc

- developing an improved business support and finance programme for high growth companies, a shared approach to commercial premises and an Internationalisation Delivery Plan to encourage greater trade and inward investment in the Arc

- embodying government’s 25 year Environment Plan and contributing to the Clean Growth Grand Challenge Mission to halve the energy use of new buildings by 2030

Together, the strategies reflect the close collaboration and partnership working between Local Enterprise Partnerships (LEPs) across the region.

Introduction

Oxfordshire is one of Britain’s success stories.

It has one of the highest concentrations of innovation assets in the world with universities and science, technology and business parks which are at the forefront of global innovation in transformative technologies and sectors such as fusion technology, autonomous vehicles, quantum computing, cryogenics, space, life sciences and digital health.

The economy is high-skilled, knowledgeled and dynamic. The county is one of the most popular places in the country to live, visit, and pioneer new industries; the markets for these technologies are increasingly global and are set for rapid growth between now and 2040. Oxfordshire has already created a number of high-tech companies that have been valued at over US$1billion, which is testament to the ability of the innovation ecosystem to nurture and spin out companies. This success is not limited to the City of Oxford: the region also has some of the highest levels of productivity for agriculture, and an increasingly mature network of business hubs throughout the county.

Oxfordshire can leverage these strengths to become 1 of the top 3 innovation ecosystems globally by 2040. That means ensuring research strengths are developed and deepened further; that they accelerate the translation into business innovation and rising productivity outside the gates of science parks; and that this is delivered while enhancing, rather than compromising, cultural, social and environmental assets.

This Local Industrial Strategy recognises and responds to the challenges facing Oxfordshire: its relative wealth and success disguises lower productivity than elsewhere in the south east, due to longer hours worked; a stagnating or declining working age population; and housing affordability in the region which is among the worst in the country, driving deprivation in some areas. The fact that housing affordability varies across the region suggests simply building more homes won’t be enough: they need to be in the right areas, and with advanced transport links to ensure residents can make the most of the economic opportunities the region offers.

Potentially transformative change is taking place in Oxfordshire. The Oxfordshire Housing and Growth Deal, agreed with government in 2017, committed up to £215 million of national government investment into the county for infrastructure and affordable homes to assist in achieving the ambition of planning and delivering up to 100,000 new homes in the county by 2031.

Alongside this a Joint Statutory Spatial Plan, coordinating all local authorities to ensure a county-wide, integrated, sustainable planning framework to 2050 is being prepared for submission in 2021. Taken together, this also offers the catalyst for significant transformation across the wider Oxford-Cambridge Arc.

This Local Industrial Strategy is based on a partnership between representatives of Oxfordshire’s businesses, universities, education bodies, local authorities and the government. It presents a longterm framework against which private and public sector investment decisions can be assessed, grouped around the 5 foundations of productivity:

- Ideas: Establish a globally connected and competitive innovation economy

- People: Develop a more responsive skills ecosystem creating better opportunities for all

- Infrastructure: Enable greater connectivity and accessibility especially across key growth locations

- Business environment: Become a powerhouse for commercialising transformative technologies

- Places: Develop Oxfordshire as a living laboratory to help solve the UK’s Grand Challenges

Figure 1: Foundations of Productivity

Figure showing the 5 foundations of productivity: Ideas, People, Infrastructure, Business environment and Places.

Ideas

Establish a globally connected innovation economy:

- drive up R&D investment

- support transformation of science and technology parks and develop new hubs

- establish a ‘Connecting Globally’ Platform to facilitate collaboration with other global innovation ecosystems

- progressing Oxfordshire Internationalisation Plan

People

Develop a more responsive skill system creating better opportunities for all:

- establish a Skills Advisory panel

- champion T Levels

- maximise use of Apprenticeship Levy

- establish an Oxfordshire Entrepreneurship Hub to support development of business propositions

- create pathways and social mobility for young people

- support reskilling through OxLife

- form an Inclusive Growth Commission

Infrastructure

Enable greater connectivity and accessibility especially across key growth locations:

- identify opportunities to progress the ambitions of the Oxfordshire Infrastructure Strategy

- develop an ambitious Digital Investment Plan, working closely with the Department for Digital, Culture, Media and Sport and national and regional partners

- realise ambitions set out in the Oxfordshire Energy Strategy

Business environment

Become a powerhouse for commercialising transformative technologies:

- enhance the Oxfordshire Growth Hub

- establish a scale up programme to support high growth businesses to expand rapidly

- establish an Oxfordshire Finance Hub to support access to finance

- establish an investment case to attract Wealth Fund investment

Places

Develop Oxfordshire as a living laboratory to help solve the UK’s Grand Challenges:

- establish a Clean Growth Living Lab

- establish a Data and Mobility Living Lab

- establish a Health and Wellbeing Living Lab

Oxford-Cambridge Arc: economic context

Oxfordshire and the Oxford-Cambridge Arc

This Local Industrial Strategy for Oxfordshire articulates government and local partners’ shared ambitions for the area at a sub-regional level, outlining how specific interventions in the local area will drive future growth in Oxfordshire and across the Arc more widely.

These local ambitions sit alongside a range of work which will be progressed collectively at an Arc level.

Each of the Local Industrial Strategies across the Arc should be read as ‘local chapters’ of the national Industrial Strategy - outlining not only the ambitions for the local areas, but also how their strengths and assets will contribute to national objectives.

The economic opportunity presented by the Arc is significant. But it will not happen by itself. It will take concerted and coordinated work by both government and the local areas to ensure that the Arc remains an economic asset of international standing over the coming decades. This Local Industrial Strategy for Oxfordshire published alongside those for Buckinghamshire, Cambridgeshire and Peterborough and the South East Midlands, shows how this will be done.

Introduction to the Arc

The Oxford-Cambridge Arc is a world leading economic area, underpinned by a high-quality environment, which has the potential to deliver transformational growth that will create jobs and boost local and regional economies for the benefit of existing and future communities. It currently has 3.7 million residents and over 2 million jobs, contributing £111 billion GVA annually to the UK economy[footnote 1] and the transformative economic potential to contribute around £191.5 billion by 2050. It is a highly productive and prosperous region with global strengths in science, technology and high-value manufacturing.

The Arc covers the ceremonial counties of Oxfordshire, Buckinghamshire, Northamptonshire, Bedfordshire and Cambridgeshire. The economic landscape is covered by the Oxfordshire, Buckinghamshire and South East Midlands Local Enterprise Partnerships and the Cambridgeshire and Peterborough Mayoral Combined Authority’s Business Board.

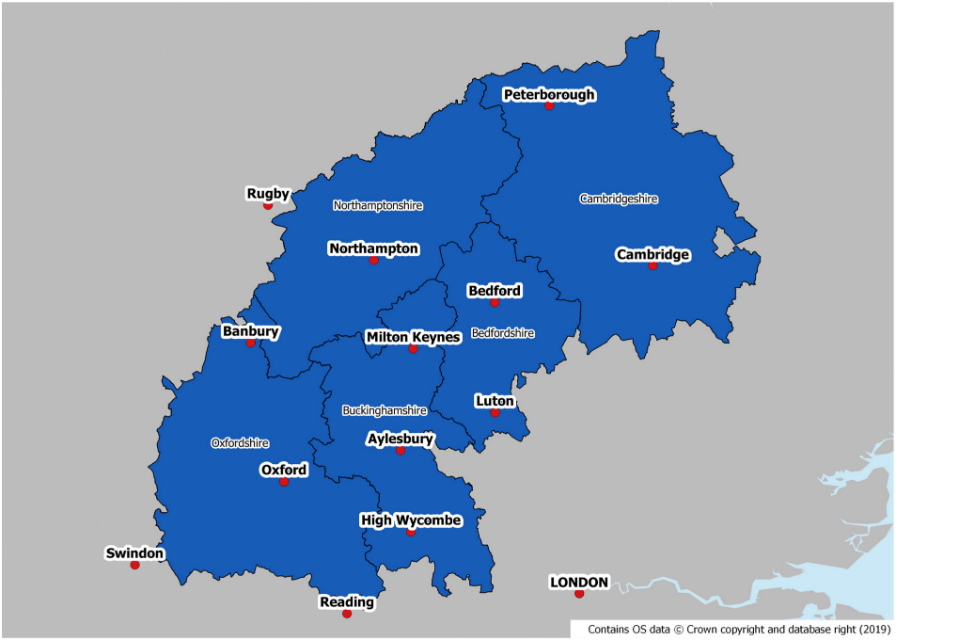

Figure 2: Map of the Oxford-Cambridge Arc

Map of Oxford-Cambridge Arc, showing the area’s ceremonial counties: Cambridgeshire, Bedfordshire, Buckinghamshire, Oxfordshire and Northamptonshire

View a larger version of figure 2.

The Arc as a whole is a strongly knowledge-intensive economy. It contains 10 diverse universities[footnote 2], including the Universities of Oxford and Cambridge, 2 of the world’s greatest and most internationally recognisable centres of learning, and a network of cutting-edge science parks, research institutions, businesses and incubators.

The Arc is home to world-leading R&D and is already renowned as a place of global firsts – pioneering cures for disease, forging breakthroughs in engine technology, innovation in future energy and transport systems, and developing world-leading strengths in technologies that are shaping the twenty-first century. But it has the ambition and ability to go further. Its continued success will be critical if the UK is to meet its target of 2.4% of GDP being spent on R&D by 2027 and its knowledge and innovation assets enable the area to be world-leading in industries that have rapidly growing global markets.

The Arc today: Key growth sectors

Transformational growth of the scale envisaged across the Arc will need to build on the breadth of existing assets and strengths found across the local area.

The Arc is home to 2 globally renowned life sciences clusters in Oxford and Cambridge – the most productive life sciences clusters in Europe, which already compete internationally with the global leaders in San Francisco and Boston, Massachusetts. These clusters feature prominently in the UK’s Life Science Sector Deals, published in 2017 and 2018. The Cambridge life sciences cluster alone is home to over 400 companies, with 15,500 employees and contributing around £2.9 billion annually to the UK economy[footnote 3]. Oxfordshire is home to a world-leading bioscience cluster, with an estimated 180 R&D companies and over 150 companies in associated industries. It has world-class R&D facilities, with 4 new innovation centres at the Oxford BioEscalator, the Begbroke Accelerator, Harwell Science and Innovation Campus and Culham Science Centre. Buckinghamshire is also home to a growing med-tech sector and the county also houses national facilities such as the spinal centre in Stoke Mandeville.

The Arc has significant strengths in the space and satellite sector. The Harwell Science and Innovation Campus in Oxfordshire comprises over 90 space organisations employing nearly 1,000 people and is the largest space cluster in Europe incorporating the European Space Agency, the Space Applications Catapult and the National Satellite Testing Facility. This is complemented by Westcott Venture Park in Aylesbury Vale with a growing space cluster with particular strengths in upstream space, and also home to the National UK Propulsion Test Facility. In aerospace, Central Bedfordshire’s Cranfield University, which is home to the Aerospace Integration Research Centre and the UK’s Aerospace Technology Institute, is building a Digital Aviation Research and Technology Centre that will spearhead the UK’s research into digital aviation technology.

The Arc is a world leader in advanced manufacturing, with particular specialisms in high-performance technology and motorsport engineering. Silverstone is home to 40 advanced manufacturing companies, testing facilities for materials and vehicles and the iconic F1 Circuit. More widely, there are over 4,000 businesses operating in ‘Motorsport Valley’[footnote 4] , which extends from Northamptonshire into Oxfordshire and beyond – a £6 billion global cluster of automotive, motorsport and advanced manufacturing companies.

The Future of Mobility features heavily across the Arc as a whole, specifically in the research, development and commercialisation of Connected and Autonomous vehicles (CAV). Key assets include the RACE Centre at Culham Science Centre, which is a UK centre of excellence in robotics and autonomous systems, Millbrook Proving Ground in Central Bedfordshire and, at Milton Keynes, a hub of the Connected Places Catapult and the UK Autodrive project.

There are several leading creative and digital clusters within the Arc. In Buckinghamshire, Pinewood Studios and the National Film and Television School comprise 2 globally renowned state-of-the-art facilities. Milton Keynes, Peterborough, Cambridge, Luton, Northampton, Oxford, High Wycombe, South Bucks and Aylesbury all have highly concentrated creative and digital clusters with diverse specialisations. Oxfordshire is home to a range of strengths including computer games, software development, cybersecurity, high performance computing as well as film and TV including the new £78 million studio facilities at Didcot opened by Rebellion. In Cambridge, the information and digital technologies cluster is highly concentrated, with a strong track record of establishing and growing globally significant companies. This high concentration of modern, creative, industries, have led to Arc businesses featuring heavily in the UK’s Creative Industries Sector Deal.

Policy context

Recognising the importance of the area and the opportunity it provides for the UK, the government has already made significant investment to support local growth and productivity in the Arc over recent years. This has included:

- committing over £400 million of Local Growth Funding to the LEPs in the Arc from 2015/16 to 2020/21, to fund growth enabling projects

- agreeing over £800 million of funding for economic growth, transport and skills through the Cambridgeshire and Peterborough Devolution Deal

- continuing to invest in the 4 LEPs’ Growth Hubs to provide business support across the Arc and investment in the Greater South East Energy Hub

- supporting the accelerated development of key sites through our Enterprise Zone programme, including in Science Vale, Northampton Waterside, Aylesbury Vale and Alconbury Weald

- investing, through Innovate UK, £670 million in 1000 businesses in the Arc since 2010 to help them develop and innovate new products and services

It was part of recognising the national importance of the Arc that, in 2016, the government commissioned the National Infrastructure Commission (NIC) to undertake a study to strengthen our collective understanding of the area’s economic growth potential. The NIC published its report[footnote 5] – Partnering for Prosperity: A new deal for the Cambridge–Milton Keynes– Oxford Arc – in 2017, concluding that, with the right interventions, the Arc could harbour transformational growth, even against its existing levels of output. It explained that meeting this long-term potential would require both significantly more homes to be built and improvements in east-west transport connectivity.

In its response to the NIC report[footnote 6], published in 2018, the government designated the Arc as a key economic priority, outlining a breadth of actions to seize the opportunity for growth identified in the NIC’s report. The government also affirmed its ambition to deliver more homes in the Arc, supported by measures such as the £215 million Oxfordshire Housing and Growth Deal and the recent confirmation of £445 million Housing Infrastructure Funding for the Arc. The government has committed to deliver transformational infrastructure projects to improve eastwest connectivity across the Arc, most notably by completing the £1 billion East West Rail scheme and the Expressway. Government is also working with partners to identify what utilities, digital and environmental infrastructure, planning and investment is required. Importantly, the government’s response to the NIC recognised that delivering ambitious growth on this scale had to go hand in hand with environmental enhancement to maximise the benefits to local people, leaving the environment in a better state for future generations.

Since then, the government and local leaders have been working in partnership across the Arc to match the level of ambition for the area. This includes working collaboratively to realise the area’s potential through 4 inter-related policy pillars:

- Productivity – ensuring businesses are supported to maximise the Arc’s economic prosperity, including the skills needed to enable communities to benefit from the jobs created

- Place-making – creating places valued by local communities, through the delivery of sufficient, affordable and high-quality homes, to increase affordability and support growth in the Arc, as well as wider services including health and education

- Connectivity – delivering the infrastructure communities need, including transport and digital connectivity, as well as utilities; and

- Environment – investing in environmental infrastructure and ensuring growth leaves the environment in a better state for future generations.

Oxfordshire in 2019

Oxfordshire is a unique economy in its own right and a core part of the Oxford Cambridge Arc. This chapter sets out further context on the opportunities and challenges facing the county’s economy, and the policy framework under which they are being addressed.

Oxfordshire Local Enterprise Partnership (OxLEP) has produced 2 detailed reports setting out the current state of the Oxfordshire economy and future growth potential. These reports sit alongside and inform the approach outlined in this Local Industrial Strategy. They are:

- The Baseline Economic Review, exploring how Oxfordshire has performed relative to the UK as a whole, as well as the relative performance of each district authority and different types of businesses[footnote 7] and sectors within the county

- The Future State Assessment which sets out what Oxfordshire has the potential to achieve and what being a ‘top 3 global innovation ecosystem’ could mean for the County, as well as detail on the key industries in which Oxfordshire can be globally competitive. It details an ambitious economic growth agenda for Oxfordshire, along with a spatial vision to ensure that growth in the County is achievable and sustainable.

An Investment Prospectus to underpin the Oxfordshire Local Industrial Strategy, allowing both public and private investors to understand how they can invest in Oxfordshire to enable the region to achieve its growth potential, will be developed during 2019/20.

Oxfordshire’s economic strength

Oxfordshire has one of the strongest economies in the UK. It is a net contributor to the UK exchequer, contributing £23 billion GVA in real terms in 2017. It is also rapidly growing, with an average growth of 3.9% growth year-on-year in nominal terms since 2006. Oxfordshire is home to around 678,000 people and 31,000 VAT registered businesses, including a high concentration of technology-based businesses that are at the forefront of global innovation. The region is home to the University of Oxford, the top performing university in the world, as well as Oxford Brookes, one of the leading young universities in the UK for teaching and research.

Oxfordshire has the highest intensity of university spin out companies in the country. The University of Oxford continues to generate more spin-outs than any other university nationally. Between 2014 and 2015, a total of 136 spin-out companies generated approximately £147 million of GVA, supporting 2,421 jobs in the Oxfordshire economy. On a per-head basis, the output of local workers is in the top 20% of English regions, and Oxfordshire is leading the way in the UK for ‘good growth’ – Oxford is the highest ranking city in the UK in PwC’s 2018 Good Growth for Cities report, which measures the performance of cities against key economic and wellbeing indicators, such as employment, health, income and skills.

This impressive track record of growth has been delivered through close partnership working between government, local authorities, business leaders and universities. Over £600 million worth of government and European funds have been secured through Growth Deals, a City Deal, European Structural Investment Funds and Infrastructure Funds – all part of an overall investment programme in Oxfordshire worth £2.2 billion.

Figure 3: Overview of the Oxfordshire Economy

Map of the UK showing Oxfordshire.

Economy

£23bn GVA generated in real terms each year

3.9% GVA growth in nominal term year-on-year since 2006

1 of 3 County areas which are net contributors to the UK exchequer

Population

51% of working age population educated to degree level or above

1.3% unemployment rate in the working age population

The Baseline Economic Review

The Baseline Economic Review sets out the macro-economy of Oxfordshire:

- The Oxfordshire economy supports 417,000 jobs and 31,000 VAT registered businesses

- 160,000 people live in Oxford

- Employment is very high across Oxfordshire with the participation rate being is 82%, compared to 75% for UK and 79% for south east

- Output growth has continued to be strong since the financial crisis (3.9% per annum since 2007), well above national averages. Even during the last recession Oxfordshire continued to grow. Total output per worker is 20% above the UK average.

Strengths

1st Oxford University rank in Times Higher Education global rankings 2018

£600m largest fund for university spin outs in Europe: Oxford Sciences Innovation

$1bn track record of growing businesses with market values of over US$1bn

30m visitors to Oxfordshire each year, many of them international

50,000 new jobs created since 2011/12

Challenges

50% higher median house prices than the English average

7% full fibre rollout, well behind many international competitors

3% annual growth in apprenticeships, well below the UK average of 12.5%

55% increase in population aged over 85 by 2031

- Wage growth tracked UK and South East averages from 2007, but has accelerated above the national averages since 2014, rising at twice the rate of the UK. This is true even adjusting for house prices

- Despite this, productivity in Oxfordshire is slightly below the south east average. Oxford itself has the lowest productivity rate (measured as value add per hour worked) of the 5 authorities. South and West Oxfordshire perform well (at 47th and 48th of 379 local authorities). Oxfordshire’s high incomes therefore imply that its residents are working longer hours than others elsewhere

- With the exception of the Vale of White Horse, Oxfordshire’s population has been roughly stable or in decline since 2014 – the Vale of White Horse has seen substantial growth. Oxfordshire is already ‘older’ than the UK average and will continue to age at comparable rates

Oxfordshire is rightly ambitious to be a leading economic region not just in the UK, but globally. However, future growth is being put at risk by a number of critical challenges that need to be addressed. Physical and digital connectivity lags behind global competitors, and housing affordability and the rising cost of living is detracting from Oxfordshire’s quality of life. The economy is dependent on a highly skilled workforce that is at risk as the population changes – requiring more action to nurture, attract and retain talent aligned to business needs. Oxfordshire has pockets of both urban and rural deprivation, and inequality. This Local Industrial Strategy aims to respond to this challenge and to address inclusive growth opportunities for all of our residents and businesses across the county.

To maximise the potential of the region, investors need to be encouraged to look beyond the university system to the breadth of world-class assets and knowledge-based strengths that Oxfordshire is home to - for example, Culham Science Centre, Harwell Campus and other world-leading assets and locations in the region.

Finally, despite its many strengths, Oxfordshire has its own ‘productivity puzzle’, underperforming relative to many peer regions. The ultimate objective of this Local Industrial Strategy is to raise productivity, and the 5 chapters dedicated to the foundations of productivity below set out further analysis and opportunities to solve that puzzle.

Figure 4: Oxfordshire’s Local Industrial Strategy

| UK Industrial Strategy | Oxfordshire Housing and Growth Deal |

|---|---|

| The UK Industrial Strategy is a region-led approach to growth. It seeks to boost Britain’s productivity and raise living standards by: - Strengthening the foundations of productivity - Building long term strategic partnerships between industry and government through sector deals - Inviting business, academia and civil society to tackle the Grand Challenges, to ensure the UK takes advantage of global trends and industries of the future |

The recent Housing and Growth Deal has secured an initial £215 million of investment over the next 5 years to build the infrastructure and homes we need to thrive. As part of the deal we have committed to: - plan for and support the delivery of 100,000 homes by 2031 - develop a Joint Statutory Spatial Plan - unlock enabling infrastructure - produce the Oxfordshire Local Industrial Strategy as a headline commitment under the productivity strand of the Deal |

| Oxfordshire Local Industrial Strategy | Existing and emerging strategies |

| This Oxfordshire Industrial Strategy is one of the first Local Industrial Strategies to be developed and sets out how we can take forward these ambitions. Foundations of productivity: - Ideas: to be the world’s most innovative economy - People: to promote a diverse and inclusive economy with good jobs and greater earning power for all - Infrastructure: a major upgrade to the UK’s infrastructure - Business environment: to be the best place to start and grow a business Places: to have prosperous communities across the UK Grand Challenges: - Growing the artificial intelligence and data driven economy - Shifting towards clean growth - Shaping the future of mobility - Meeting the needs of an ageing society |

The Oxfordshire Local Industrial Strategy will align to and build on a number of existing and emerging strategies. These include: - 2016 Strategic Economic Plan and sister strategies e.g. Skills, Innovation and Creative, Culture, Heritage and Tourism. - Oxfordshire Plan 2050 (Joint Statutory Spatial Plan) - Oxfordshire Infrastructure Strategy (and NIC First Mile/Last Mile 2050 plan) - 2017 Science and Innovation Audit - Oxfordshire’s Local Transport Plan 5 - Oxfordshire Rail Connectivity Study - The Local Plans for housing and development for each District - Oxfordshire Energy Strategy ,br>- Oxford – Cambridge Arc Economic Vision - Oxfordshire Joint Health & Wellbeing Strategy |

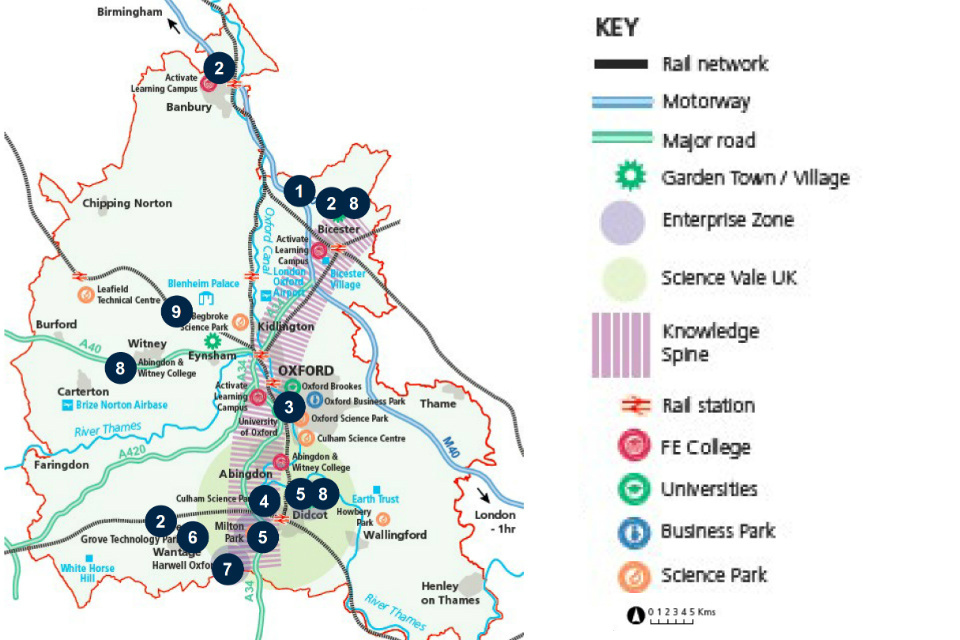

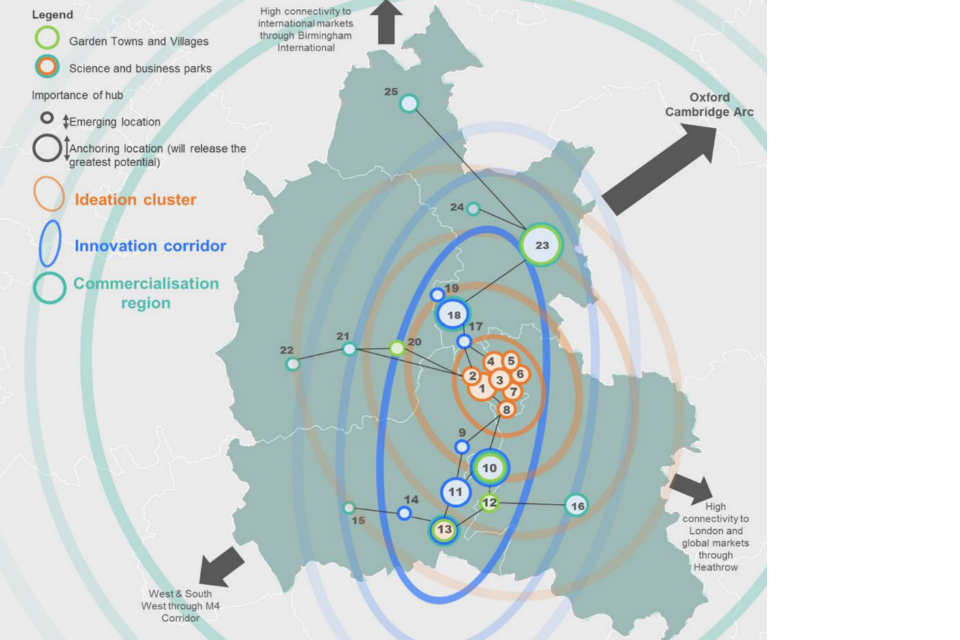

Figure 5: Oxfordshire’s critical economic sectors, assets and growth opportunities within the innovation ecosystem

Map showing Oxfordshire’s critical economic sectors, assets and growth opportunities.

View a larger version of figure 5

-

Upper Heyford Creative City key sectors: creative industries inc proposed 130 acres international film & tv studio complex

-

Motorsport Valley key sectors: advanced engineering, battery technology, high performance motorsport technologies

-

Oxford City Science Area key sectors: Life Sciences, AI Technologies, Digital Health, Quantum Computing, Global CBD

- Oxford BioEscalator

- Old Road Campus Medical Research Centre

- John Radcliffe, Nuffield & Churchill Hospitals Quarter

- Centre for Applied Semi-Conductivity

- Oxford Science Park

- Osney Innovation District

- Oxford Northern Gateway

- Oxford Station Quarter and Global Central Business District

- Centre for Fusion Energy and Supply Chain Cluster

- Remote Applications in Challenging Environment Centre (RACE) -

Culham Science Park key sectors: Fusion Energy, Robotics & Autonomous Systems

- Over 2000+world leading scientists on site working with UK strategic assets

- Centre for Fusion Energy and Supply Chain Cluster

- Remote Applications in Challenging Environment Centre (RACE)

- 3500 homes proposed at adjacent Culham Smart Village providing testbed for new mobility solutions (linking with Harwell and Culham), digital health and smart technologies to deliver improved public service outcomes -

Milton Park / Didcot Garden Town key sectors: Life Sciences, Creative Industries

- 250+ high technology companies employing 9000+ people, encompassing leading life sciences cluster

- EZ1 package of 9 separate development sites totalling 21ha

- Adjacent to EZ2 Didcot Growth Accelerator offering grow on space across 102ha of land

- Testing of new forms of mobility via Autonomous Vehicles pilot linked to Didcot Garden Town

- International Film & TV Studios Hub anchored around Rebellion Studios development -

Williams Innovation & Technology Campus key sectors: advanced engineering inc new high-performance technology campus cluster

-

Harwell Campus key sectors: Health Sciences (MedTech, life sciences, digital health), Space Applications, Energy:

- 200+ world leading research and technology companies on site employing c6000 people

- designated UK Space Agency gateway with Europe’s largest space cluster of 90 companies

- location of critical UK strategic assets including Diamond Light Synchrotron, Medical Research Council, Public Health England

- EZ1 development site of 93ha

- proposed 1000 new homes as part of Harwell Innovation Village to pioneer solutions for grand challenges focused on clean growth and mobility -

Living Labs Testbed Undertake smart living pilots at scale using emerging technologies integrated into major housing development to tackle Grand Challenges:

- Bicester Garden Town 13,000 homes (inc healthy town and EcoTown)

- Didcot Garden Town 15,000 homes

- Oxfordshire Cotswolds Garden Village 2200 homes -

Begbroke Science Park key sectors: advanced engineering, medical tech:

- 60+ world leading research and technology companies employing 900+ staff

- Begbroke Innovation Escalator spin out hub

- Proposed 4000 homes as part of wider A44 corridor vision to double capacity at Begbroke including new station and linking to Oxford Airport and Oxford Parkway

Building a global innovation ecosystem: Oxfordshire in 2040

Oxfordshire’s Vision Statement

To position Oxfordshire as 1 of the top 3 global innovation ecosystems by 2040, building on the region’s world leading science and technology clusters to be a pioneer for the UK in emerging transformative technologies and sectors.

An ‘innovation ecosystem’ describes the large and diverse nature of participants and resources that are necessary for innovation. Typically, innovation ecosystems comprise a flourishing environment for innovation and business creation; world-leading experts in knowledge and technology development; and a dynamic, agile and skilled workforce.

Oxfordshire already has many of the ingredients for success. The University of Oxford is considered the best in the world, topping the Times’ Global University Rankings since 2016. Oxford Brookes University is a top performing young university in the UK for teaching and research.

This provides a ready stream of globally-competitive graduates, post-graduates and researchers in world-leading science, technology and humanities. The region is internationally connected through swift rail links to international airports. Quality of life is already very high.

The Future State Assessment compares Oxfordshire to similar areas in other countries – from Silicon Valley in the USA, Helsinki in Finland and Tel Aviv in Israel to Pangyo Techno Valley in South Korea and the Zhongguancun Science Park in Beijing, China.

Innovation ecosystems have different trajectories of growth and have succeeded with different combinations of qualities and strengths, but they share a number of common characteristics (see figure 6). Innovation ecosystems also rely on a distinction between ‘Cornerstones Businesses’ – forming the backbone of the ecosystem, providing jobs and critical services to high-technology businesses – and ‘Breakthrough Businesses’. The following chapters set out how Oxfordshire will develop these characteristics in the county.

Figure 6: Building a world-leading innovation ecosystem

Figure showing how Oxfordshire will build a world-leading innovation ecosystem (detail below).

Iconic Brand It is essential for a globally-leading innovation ecosystem to have a distinctive proposition and a strong vision that differentiates itself from other ecosystems, around which citizens, businesses, leaders and investors can unite.

Liveable Place To attract people, business and investment, an innovation ecosystem needs to have thriving communities. These must be healthy, sustainable, provide a high quality of life, and support both urban and rural living. They must be affordable, well connected, and have a vibrant community and cultural offer.

Strong Financing Availability of finance is essential to creating and commercialising innovation, scaling spin-outs and investing in the talent and infrastructure necessary for innovation to flourish. Investment can come from a number of sources.

Commercial Culture A strong commercial culture is an environment in which entrepreneurship, investment and innovation thrives. It covers broad factors such as regulation and competition, as well as cultures of collaboration and knowledge exchange that encourage innovation and commercialisation.

Keystone Assets An innovation ecosystem must be anchored by national or international keystone assets – these can range from education institutes, national research facilities, world-class industry clusters and knowledge-intensive assets.

Talent Proposition Talent is integral to the innovation ecosystem. A strong innovation ecosystem must have the ability to attract and retain world-class talent, as well as nurture the talent and skills of its own citizens, developing skills aligned to business need and across a number of sectors.

Oxfordshire’s breakthrough sectors

Oxfordshire thinks globally. This level of ambition stems from national and international leadership in transformative industries. These industries are shaping the twenty first century and expect rapid growth in the coming decades. As well as providing a home for these industries, Oxfordshire’s research strengths give it global leadership on many underpinning technologies – ensuring the county is well-placed to capitalise on future industries too.

The 2017 Oxfordshire Science and Innovation Audit and the Future State Assessment sets out 8 emerging sectors where Oxfordshire has particular research and industrial strengths.

These emerging industries will provide jobs for generations, providing a sustainable economic base for Oxfordshire and the country through the twenty first century.

In addition – as set out in the business environment chapter below – Oxfordshire is already demonstrating increasing success in turning ideas into businesses, helping them grow quickly, and retaining their talent locally rather than losing them to international competitors.

Case Study: Oxford Nanopore

Oxford Nanopore Technologies was originally spun out of the University of Oxford Chemistry department as Oxford Nanolabs, in 2005 and since its foundation it has established IP collaborations with twenty institutions including Harvard, Boston and the University of California. The company has developed and commercialises novel and highly disruptive DNA / RNA sequencing technology.

Unique in this rapidly-growing market, only Oxford Nanopore provides devices that are scalable from pocket size to providing population-scale sequencing, providing ‘long reads’ (conferring substantial biological benefits), real-time data streaming (for rapid, dynamic workflows), and interrogate the DNA or RNA molecules directly using electronics rather than light.

The current and potential applications of this technology are broad and potentially transformative. Following the launch of the MinION sequencer, nanopore sequencing is now being used for rapid cancer characterization, infectious disease diagnostics, food safety testing, population-scale genomics and myriad other uses.

To date, Oxford Nanopore has raised £451 million in funding from international investors and selling its technology into more than 80 countries. It is opening a new high-tech manufacturing facility at Harwell in 2019.

Factors in the ecosystem that have enabled growth:

- Proximity to world leading assets: Oxford Nanopore has grown to more than 450 employees worldwide, with its HQ at Oxford Science Park. The company has taken advantage of cutting-edge facilities available on Begbroke and the Oxford Science Park, as well as world class facilities suitable for manufacturing at Rutherford Appleton at Harwell Campus

- Acess to talent: Oxford is an attractive location for the most senior employees to the newest wave of talent who may be considering their first role or a transition from academia. The reputation as an intellectual centre of excellence, along with entertainment, schooling, culture and leisure facilities, supports the recruitment and retention of the best employees

Factors in the ecosystem that are constraining growth:

- Cost of living: With property and other expenses rising inexorably, Oxfordshire has an increasing affordability challenge which can make it more difficult to recruit, especially more junior staff

- Infrastructure: The A34 and other key routes are severely congested making access to key science parks and hubs increasingly challenging across Oxfordshire

Success in Oxfordshire will help the UK, as a whole, meet Industrial Strategy ambitions: leading on emerging technologies, raising the share of output that goes into R&D, and helping us all to respond to the Grand Challenges: an Ageing Society; Clean Growth; the Future of Mobility; and Artificial Intelligence (AI) and Data. The close links between Oxfordshire and other regions – the Arc, London, the West Midlands, West of England, and the M4 Corridor – will generate spill-over effects and supply chain opportunities across the UK.

Life sciences

Oxfordshire has one of the strongest life sciences clusters in Europe and is a global hub for life sciences entrepreneurship and business. The region hosts a broad range of strengths including med-tech, pharma, diagnostics, digital health and biomedical engineering, and is shaping the future of the industry using technologies such as artificial intelligence and machine learning. Oxfordshire is home to numerous national assets including the Rosalind Franklin Institute, the Big Data Institute and the Structural Genomics Consortium.

There are also clear strengths in commercialising life sciences innovation, with 3 companies that have previously been valued at over $1 billion: Oxford Nanopore; Immunocore; and Adaptimmune, and manufacturing opportunities demonstrated by the new Vaccines Manufacturing Innovation Centre announced in the UK Life Sciences Sector Deal.

World leading businesses are supported by strong academic leadership and connections across the UK from Birmingham and Cambridge to Dundee as well as the Medicines Discovery Catapult in Alderly Park. Oxfordshire can help the UK compete with areas such as the Boston Metropolitan Area and the Research Triangle in North Carolina that uses its research capabilities to power biological and digital health breakthroughs.

Quantum computing

Oxfordshire is leading the way for the world in quantum readiness. Oxford University is leading a consortium of 9 UK universities to build the first Q20:20 Quantum Computer Demonstrator by 2020, gaining significant international advantages. Quantum businesses are being created locally, underpinned by technologies such as cryogenics and artificial intelligence that are in turn attracting top talent from across the world to Oxfordshire. Research will provide an opportunity for rapidly increasing links with the Birmingham- based Quantum Hub in Sensors and Metrology and Quantum Enhanced Imaging (QuantIC) Hub at Glasgow.

The UK has a strong global position in the race to develop quantum technologies, competing with the likes of Quantum Valley in Canada, Hefei in China, key tech firms, such as Google and IBM and start-ups such as Rigetti. Oxfordshire needs to continue to innovate in quantum technologies in partnership with other areas in the UK, if the country is to continue to compete internationally and attract global investment in these technologies and linked industries.

Space-led data applications

Harwell Campus is the heart of the UK’s space industry and the largest space cluster in Europe. It hosts over 90 organisations including the European Space Agency (ESA) Centre for Satellite Applications and Telecoms; the ESA Business Incubation Centre; the Science and Technology Facilities Council’s RAL Space Centre; and the Satellite Applications Catapult. The sector currently employs around a thousand people, primarily in high- value, knowledge-intensive roles.

By 2021 Oxfordshire will also be home to the UK National Satellite Test Facility. Oxfordshire organisations are involved in a wide range of space activities, from designing and building components and satellites to go into space, to developing end-user applications that utilise space data for a wide variety of sectors.

Space organisations in Oxfordshire are working closely with new space opportunities across Cornwall, Glasgow and the East Midlands and is integral to upstream satellite innovation from Airbus, Surrey Satellite Technologies Ltd, the National Physical Laboratory and the Universities of Surrey and Southampton, with complementary satellite data analytical capability from the University of Portsmouth.

These assets are essential if the UK is to remain at the forefront of global competition and compete with the likes of Silicon Valley, which is home to the NASA-Ames Research Centre, and clusters in France, Germany and Beijing.

Development of Oxfordshire’s space sector is critical if the UK is to achieve its target market share of 10% of the global space market by 2030.

Robotics and Autonomous Systems (RAS)

Oxfordshire is at the heart of RAS activity in the UK, with RACE at Culham Science Centre a key UK centre of excellence. Connected and Autonomous Vehicles (CAV) are a vanguard application of RAS and will show us how robots can move people and goods more efficiently with far- reaching implications across industries.

Oxfordshire is at the forefront of CAV development: the Oxford Robotics Institute kick-started the UK’s CAV programme in 2010; their spin-out Oxbotica is leading a UK consortium to launch a fleet of driverless vehicles to drive from Oxford to London; and RACE is 1 of the 4 national CAV testbeds. Other companies in the CAV ecosystem include Zeta, Amev, Nominet, Latent Logic, Williams, Arrival, StreetDrone and FiveAI. Public sector innovation in CAV has been mirrored with Oxfordshire County Council being the first UK local authority to include CAVs in the local transport strategy and to have a dedicated CAV team, currently the largest in the UK.

Oxfordshire is at the centre of the @UK CAV testing area, with London and Birmingham at each end. The area includes public testing environments including the 5G innovation centre, and autonomous vehicles trials of Nissan (Cranfield), Oxbotica (Culham), Jaguar Land Rover (Coventry) and Volvo (Drive Me London).

RAS is predicted to impact 15% of UK GVA worth £266 billion to the UK economy by 2035.

Developing Oxfordshire’s RAS industry is essential to growth and to remaining globally significant, competing with areas such as Silicon Valley, where Uber, Google and Tesla are developing CAVs.

Cryogenics

Oxfordshire is the global leader in cryogenics – the production and behaviour of materials at very low temperatures. The blend of academic, research and industrial expertise makes Oxfordshire home to the most powerful concentration of cryogenic expertise in the world. Cryogenics is a critical enabling technology with sub-sectors such as cryocoolers, instrumentation and superconducting magnets. Cryogenic technologies underpins around 17% of the UK economy, including many of our high-growth sectors, particularly space, life sciences, energy and quantum computing.

Oxfordshire is responsible for the majority of the UK cryogenic sector which includes: the world-leading Rutherford Appleton Laboratory at Harwell Campus, which pioneered the development of a multifilament superconducting cable known as the ‘Rutherford Cable’; companies such as Innovative Cryogenic Engineering in Witney and Thames Cryogenics in Didcot, a world-leader in the manufacture and supply of cryogenic piping; and the University Technical College in Didcot, the first school globally to install a cryogenics lab.

Cryogenic technologies developed in Oxfordshire are manufactured across the UK in areas such as the north east of England, creating high value jobs.

Oxfordshire is world-leading in the sector but faces competition from a number of markets including the USA, Japan and France where governments are investing heavily in cryogenic sub-sectors, recognising the strategic importance of this technology.

Energy

Oxfordshire is at the forefront of innovation in energy technologies and systems of the future. The region has strengths in areas such as novel batteries; battery management systems; and data analytics through its wealth of energy businesses pioneering clean growth, including the Culham Centre for Fusion Energy (CCFE) and the Faraday Institution at Harwell Campus, which is home to 30 industry, academic and public organisations.

This is complemented by leading innovation in local grid systems in the county through Project LEO and the Energy SuperHub which are delivering pioneering smart energy management solutions, battery storage technologies and new low carbon ground source heating to residential and commercial properties.

The UK Atomic Energy Authority (UKAEA) is a lead participant in the co-ordinated EU fusion programme managed by EUROfusion and operates the largest fusion device in the world, JET. By hosting JET, UKAEA has developed globally unique fusion capability, which is creating high value jobs and exports across the country.

For example, the robotics capability at Culham has enabled major contracts worth more than £200 million to be won around the UK in the last few years, including supporting hundreds of jobs in the north west and north east. Oxfordshire is also home to Tokamak Energy and First Light Fusion, 2 of the leading fusion start-up companies in the world.

Despite increasing competition from Japan and Canada, Oxfordshire’s unique assets and strengths have the capability to push the UK to the forefront of innovation.

Digital and creative

Over 3,000 digital and creative businesses are based in Oxfordshire generating £1.4 billion to the UK economy each year. Oxfordshire has strengths in a range of digital technologies, such as cyber security and data analytics – these transferable strengths enable the County to be world- leading across other industries from space to bio-tech and quantum.

Creative strengths range from animation and digital gaming to digital publishing and media. This has produced a number of spin-outs, notably Natural Motion which was recently acquired for US$500 million, and Rebellion which has recently announced a £78 million new film complex in Didcot creating 500 new jobs.

Oxfordshire collaborates within the UK across the Golden Triangle and with other areas such as Bristol where there are strong creative and digital entrepreneurial communities. Oxford Innovation has recently opened an innovation centre in West Belfast, Innovation Factory, to boost start-up development in the region.

The UK has a number of global competitors in this sector, particularly in the USA where tech and social media giants have disrupted the sector, as Alibaba has done in China. Helsinki is another key competitor, with strengths in digital and gaming, along with a strong start-up culture.

Motorsport

Oxfordshire is a critical part of the UK’s iconic ‘Motorsport Valley’, a £6 billion automotive global cluster of high- performance technology, motorsport and advanced engineering companies. Oxfordshire is home to a number of world-renowned motorsport names including Williams F1 in Grove, Renault Sport F1 in Chipping Norton and Prodrive and Haas in Banbury, as well as global supply chain companies such as SS Tube Technology and Lentus, and the iconic BMW MINI manufacturing plant.

Oxford’s universities are also world- leading centres for education in motorsport engineering, with Oxford Brookes providing race engineers for all the major Formula 1 teams. Oxfordshire has a number of research strengths, including in advanced engines and battery technology, where companies like Williams and Prodrive have been driving Oxfordshire to the forefront of global competition for over a decade. Williams is also responsible for the IP and research and development for HyperBat Joint Venture battery manufacturing which is based in Coventry, showing how our energy cluster generates additional growth across the UK.

Oxfordshire competes and collaborates globally in this industry, as an integral part of the UK’s dynamic motorsport cluster. There are over 4,000 businesses operating in ‘Motorsport Valley’, which extends from Oxfordshire and into Northamptonshire and beyond.

The 5 foundations of productivity

Ideas

Oxfordshire is a global centre of research and innovation. The region brings together the dense networks of excellent research, knowledge-intensive businesses and skilled workers that are essential to a successful innovation ecosystem.

The Oxfordshire Local Industrial Strategy affirms the area’s ambition to work with government as a pioneering contributor to the Industrial Strategy’s target for national R&D spending to reach 2.4% of GDP by 2027 and 3% in the longer term.

This chapter sets out Oxfordshire’s approach to driving up R&D and innovation across the region and beyond. It prioritises:

- supporting universities, local authorities, investors and developers to deliver world-class science and innovation hubs throughout the county, to deepen collaboration and accelerate the commercialisation of new ideas. This will complement the wider Oxford-Cambridge Arc economy

- driving local R&D investment and growth in the area’s breakthrough sectors and technologies

- in ternationalising Oxfordshire, connecting the region’s innovation to world-wide opportunities and ecosystems and broadening the established ‘brand’ of Oxford

Summary of ‘Ideas’ strengths and challenges

- Oxfordshire has long been a worldleading centre for research and innovation across a wide range of technologies and sectors

- It contains the University of Oxford, ranked number one in Europe for both research and commercialisation, significant national government investments (more £2 billion in internationally leading scientific facilities and assets) especially at Harwell and Culham, leading industry clusters in life sciences, scientific instrumentation and motorsport, and the largest investment fund for university spin-outs globally

- Oxfordshire local authorities collaborate closely with universities and local business to use local innovation to improve public service delivery. This provides a base for integrated approaches to address the Grand Challenges

- Many of the science and business parks are at capacity and lack sufficient commercial and innovation space. Innovative industries and businesses are world-leading but face significant competition from established global hubs and other challenger regions

- Oxfordshire’s brand currently centres on the university system and needs to be expanded to encompass the entirety and breadth of opportunities across the whole innovation ecosystem

- 1 of the top 2 barriers to growth for businesses in Oxfordshire is access to markets and customers internationally

World-leading assets

Oxfordshire combines the ingredients of a successful innovation ecosystem in a single place – exemplified by the breakthrough sectors and technologies set out in the ‘Building an Innovation Ecosystem’ chapter, above.

The region has a world leading research base. This includes 2 renowned universities – the University of Oxford and Oxford Brookes – and high levels of R&D undertaken by the private sector. Ongoing investment from UK Research and Innovation (UKRI) continues to support the area’s strengths. Oxfordshire’s business R&D spending is high, at £1,600 per capita (compared to £360 in London). This is the seventh highest rate of 42 uppertier authorities. Recent research by the Enterprise Research Centre has also put Oxfordshire as having the highest percentage of firms undertaking R&D activity of any local economic area.

The diversity of Oxfordshire’s business base, coupled with its ability to generate ‘unicorn’ firms (businesses achieving market valuation of US$1billion) at a rapid rate suggests this investment by the private sector in R&D is broad based, rather than depending on a small number of major firms, which predominates in other regions.

This is underpinned by excellent R&D and innovation infrastructure where Oxfordshire is home to a number of world-leading science, innovation, technology and business parks that form a hive of knowledge intensive economic activity and anchor the area’s strengths in breakthrough sectors. These include Begbroke Science Park in Cherwell, Milton Park, Oxford Science Park, and national labs in Culham Science Centre in South Oxfordshire, the Harwell Campus in Vale of the White Horse and the University Science Area in Oxford City. Public and private investment into Oxfordshire in recent years is bolstering innovation capability. The City Deal Programme and Local Growth Fund resulted in 4 new innovation centres: the BioEscalator at the Old Road Campus in Oxford, the Begbroke Accelerator, the Remote Applications in Challenging Environments (RACE) Centre at Culham Science Centre and the Innovation Centre at Harwell Campus. Each of which are now at capacity, underlining the huge demand for innovation space across the ecosystem. Oxfordshire has also received investment into 2 Enterprise Zones, which sit across Milton Park, Didcot and Harwell.

Government has also recognised the strategic importance of worldclass assets within Oxfordshire, having invested in key sectors to drive the UK’s leadership in new and emerging technologies through the national Industrial Strategy:

- £100 million for the Rosalind Franklin research institute at Harwell Campus to improve health through physical science innovation

- £65 million for the Faraday Institution at Harwell Campus, charged withtackling the global energy and battery storage challenge

- £99 million for a National Satellite Testing Facility at RAL Space at Harwell Campus

- £86 million for a National Fusion Technology Platform at Culham Science Centre

- £68.3 million for the Satellite Applications Catapult at Harwell Campus

Finally, Oxfordshire combines this research strength with the highest intensity of university spin-out companies in the country. The University of Oxford continues to generate more spin-outs than any other University in the country. There are currently 149 active start-ups and spin-outs from the University, with local ambition to accelerate this in coming years. Between 2014 and 2015, a total of 136 spin-out companies generated approximately £147 million of GVA, supporting 2,421 jobs in the Oxfordshire economy.

The county also has capacity to grow businesses to values of over US$1billion, such as Oxford Nanopore. It has significant research strengths to support future spin-outs, as set out in the breakthrough sectors section above.

These strengths do not just benefit the immediate county. Oxfordshire’s innovation ecosystem is a national asset that drives growth across the UK. Ideas that are born here do not stay in the county, and the collaborations between universities and businesses in Oxfordshire with those in other regions are key to building innovation excellence across the country. For example, R&D and innovation activity developed by the Space Cluster at Harwell is central to the development of manufacturing and supply chain opportunities in the South West, East Midlands and Scotland and are playing crucial roles in delivering new opportunities around spaceport and in-orbit launch services which will revolutionise satellite technologies. The success of Oxfordshire is key to attracting international talent and investment to the UK, as well as achieving the Industrial Strategy’s aim for the UK to be the world’s most innovative economy and driving up R&D investment.

Whilst these strengths provide a powerful engine to drive UK growth, Oxfordshire is aiming to compete with its global peers. To play its full role as a global innovation hub and to help meet the UK’s 2.4% R&D target, Oxfordshire must continue to be at the forefront for commercialising the ideas that it generates.

Case Study: Evox Therapeutics

Evox Therapeutics is a privately held, Oxford-based biotechnology company. It focuses on harnessing and engineering the natural delivery capabilities of exosomes to develop an entirely new class of therapeutics for the treatment of various severe diseases. Evox was founded in 2016 based on work coming out in part from Oxford University and received £10 million in seed funding from Oxford Sciences Innovation (OSI). This funding allowed Evox to lease laboratory space in Oxford Science Park, advance R&D, and grow the team from 1 person to 30 over 18 months. In autumn 2018, Evox raised an additional £35 million funding from internationally-known venture capital investors, and re-investment from the University of Oxford and OSI. Evox anticipates future significant capital raises and further expansion of the team to over 100 employees as it continues to compete internationally.

Factors in the Oxfordshire ecosystem that have enabled growth: