Cross-Government Fraud Landscape Report 2021-2022 (HTML)

Published 21 March 2024

Introduction

Finding and reducing the impact of fraud is an essential part of government efficiency. In order for public bodies to understand and tackle public sector fraud, they must be able to find it.

This report sets out levels of detected, prevented and recovered fraud and error, as reported by departments and public bodies to the Government Counter Fraud Function’s Centre of Expertise [footnote 1]. Data in the report corresponds to the 2021-22 financial year, and includes fraud and error relating to business-as-usual activity [footnote 2] and COVID-19 support schemes.

We know that the public sector is a target for those who commit fraud, and we cannot mitigate every risk. However, government is taking action to ensure that as much taxpayers’ money as possible goes to delivering vital public services, rather than to criminals.

The government has a long-standing commitment to find more fraud in the public sector. We recognise that fraud is inherently a hidden crime and to fight it you have to find it. As such, the government sees an increase in detected fraud and error as a sign of progression. Detecting fraud requires a proactive effort to look for that which has been hidden.

The continued increase in detected fraud and error is an indication that good work is being undertaken to understand and identify the problem. The better the public sector detects fraud and error, the better it is able to both find and recover losses, and build stronger controls to prevent such losses in the future.

The report also provides an update on the “Scale of the Challenge”. This is the estimate for the overall level of fraud and error in central government [footnote 3] for 2021-22. This report also provides an update on the estimate of fraud and error loss in the COVID-19 support schemes as reported by government departments, which also refer to reporting on the 2020-21 financial year.

Since the start of the reporting period covered in this report, the government has invested over £1bn in taking action on fraud and error across government. Most of the investment has been into the Department for Work and Pensions (DWP) to increase action on the level of fraud and error in the benefits system.

The government also created the new Public Sector Fraud Authority (PSFA) to modernise the counter fraud activity in the public sector - taking into account the experiences of the pandemic.

The PSFA was launched in August 2022, and works to better understand and reduce the impact of fraud across the public sector. Its mandate, detailing what it will do and how it will work with its partners, was published in September 2022.

The PSFA, along with government departments, recognises that there is more to do to modernise the government’s approach to countering fraud. The PSFA is working with departments and public bodies to increase the ambition for tackling fraud, and to increase central government’s capability to take action. As a result of this work, 100% of the departments prioritised by the PSFA have now created counter fraud financial targets. We provide further detail on this in the final section of the report.

The PSFA was set a target to deliver £180m in audited benefits in 2022-2023. Working closely with departments and public bodies, the PSFA was able to exceed this target and delivered a total of £311m in audited counter fraud benefits.

Scope of the Data

The detected, prevented and recovered data in the report excludes fraud and error within welfare (including any impact of COVID-19 on fraud and error levels), tax and COVID-19 support schemes administered by HM Revenue & Customs (HMRC) and the Department for Work and Pensions (DWP). These figures are reported separately by HMRC and DWP [footnote 4].

It should be noted that in respect of recoveries, there is not always a direct alignment between the detection of fraudulent activity and the recovery of money. Recovery takes time and may be reported across multiple years.

In addition to the reported data, we have provided an update on the estimate of fraud and error within COVID-19 support schemes. This is based on post-event assurance [footnote 5] activity undertaken by departments. In contrast to the data on detected, recovered and prevented fraud and error, this data is provided over the two financial years, 2020-21 and 2021-22.

As part of this work, we considered measurement, where available, of COVID-19 support schemes operated by HMRC and DWP.

Facts & Figures

- 52% increase in detected fraud and error in 2021-22, compared to 2020-21

- £823m in detected fraud and error in 2021-2022, up from £541m in 2020-2021

- 45% COVID-related of detected fraud, 45% related to COVID-19, and 55% related to departments’ business-as-usual work, increased 389%

- Detected fraud associated with COVID-19 increased 389% from £54m to £264m between 2020-21 and 2021-22

- £190m fraud and error recovered in 2021-2022

- down 9% from £209m in 2020-2021

NB All figures from prior to the establishment of the PSFA. All figures contain outliers - exceptional instances that we do not expect to occur again in the future.

Detected, prevented and recovered fraud

The data presented here sets out the detected, prevented and recovered fraud and error that departments have reported to the Government Counter Fraud Function’s Centre of Expertise.

HMRC and DWP separately publish data on fraud and error relating to the tax and welfare systems, for example tax evasion and benefit fraud. Therefore, this data on detected, prevented and recovered fraud and error only includes HMRC and DWP’s internal fraud and error - that is, where it has been carried out by a government employee or contractor. It also does not include data from HMRC’s COVID-19 support schemes.

Government departments and public bodies report on both fraud and error. In this context, the difference between fraud and error is the intent of the individual or organisation involved in the incorrect payment. This intent is established on the balance of probabilities, in line with the government’s definition for reporting fraud. As such, there are elements of both subjectivity and uncertainty in the reporting, as it will be dependent on the extent to which a public body has evidence of intention, and their assessment of this evidence.

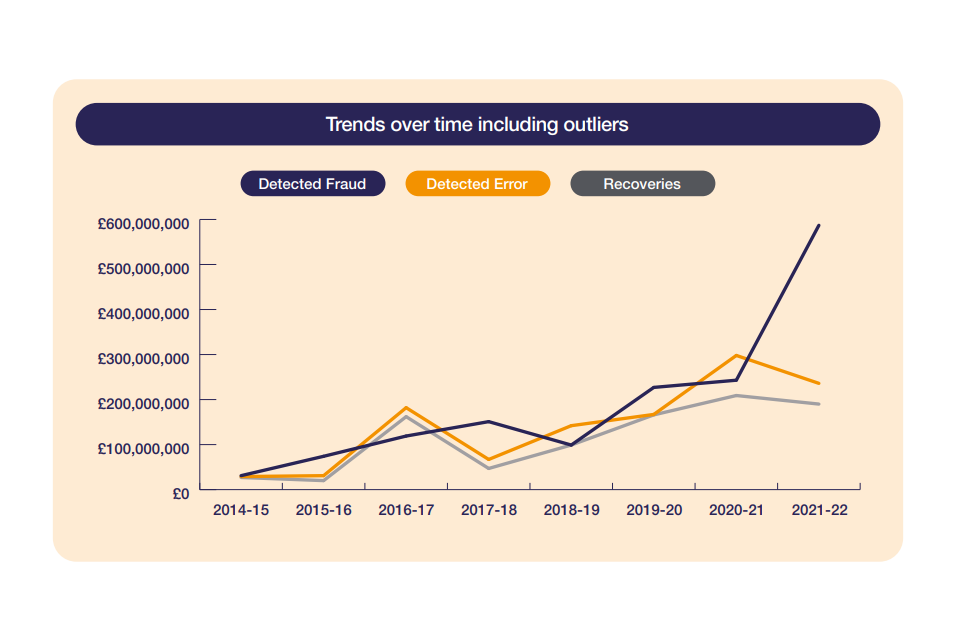

In 2021-22, reported levels of detected fraud and error increased by 52% from 2020-21, rising from £541m to £823m. This follows a general upward trend since reporting began in 2014-2015 (see fig. 1).

In 2021-22, fraud made up 71% of the total (including outliers [footnote 6]), with 29% classified as error. This is in contrast with the previous financial year, where fraud made up 45% of the total detected figure.

COVID-19 Reporting

From the start of the COVID-19 pandemic in January 2020, the government ran initiatives to support individuals and businesses. It created 393 schemes, and as of July 2023, [footnote 7] £358bn of public funding had been provided [footnote 8]. During this period, the government accepted that departments and public bodies would be operating in a riskier context than in non-emergency times, and that the level of fraud and error would be higher.

Fraud and error reported against COVID-19 consists of fraud and error within specific schemes that were introduced to support the public and businesses through the pandemic. As noted above, this excludes HMRC-administered schemes, which are reported separately.

Detected fraud and error relating to COVID-19 made up 43% (£356m) of the total reported in 2021-22 (£823m). This is an increase from 2020-21, both in proportion and value, when fraud and error relating to COVID-19 made up 38% (£205m) of the total reported level [footnote 9].

When the reported data from 2021-22 is combined with that reported in 2020-21, [footnote 10] the total detected fraud and error relating to non-HMRC COVID-19 schemes across the two years is £561m.

Government departments continue to work to find and recover fraud and error in COVID-19 schemes. The PSFA will continue to update the data on detected fraud and error in COVID-19 spending in future Fraud Landscape Reports.

Looking only at reported detected fraud in COVID-19 schemes, there was a near four-fold (389%) increase between 2020-21 and 2021-22, from £54m to £264m.

£235m (89%) of the detected fraud in COVID-19 schemes for 2021-22 was reported by the then Department for Business, Energy and Industrial Strategy [footnote 11] (BEIS). A further £28m (11%) was reported by the Department for Health and Social Care.

Fig. 1 Detected Fraud, Detected Error and Recoveries reported by government departments since 2014-15 [footnote 12]

Recovered Fraud and Error

Departments are required to report the amount of fraud and error they recover each year.

In 2021-22, government recovered £190m worth of fraud and error. Out of the 16 contributing departmental groups, the Department for Education (£47m), Department for Transport (£49m) and Department for Health and Social Care (£41m) contributed significant proportions of the recovery figure.

2021-22 recovery figures were down 9% from 2020-21, when departments reported recovering £209m overall. While this is an increase on pre-COVID-19 recovery levels, as a proportion of detected fraud and error, the recovery rate dropped from 39% in 2020-21 to 23% in 2021-22. However, it should be recognised that there can be a lag in reporting recovery of detected fraud and error, due to the timescales involved in recovering debt.

COVID-19 Reporting

Recoveries relating to COVID-19, excluding HMRC-administered schemes, decreased from £88m in 2020-21 to £29m in 2021-22.

Of the £88m fraud and error recovered in 2020-21, £69m of this can be attributed to error within COVID-19 support schemes, recovered by the then Department for Business, Energy and Industrial Strategy.

It is a government priority to recover money which has been lost to fraud and error. The government is committed to recovering fraud and error losses from COVID-19 schemes where it can.

Prevented Fraud and Error

In 2021-22, government prevented £334m in fraud and error, including both business-as-usual and COVID-19 reporting. This is a 60% decrease on £827m in 2020-21. Business-as-usual prevented fraud and error fell 43% from £559m in 2020-21 to £319m in 2021-22.

When considering the previous year’s data (2020-21), £174m of the £827m was considered as arising from outlier instances. These are exceptional reporting occurrences that we do not expect to occur again in the future, and therefore partly explain the significant drop between years.

COVID-19 Reporting

Reported prevented fraud in 2021-22 relating to COVID-19 schemes dropped 94% from £268m to £15m. This is in line with reduced expenditure on COVID-19 schemes in 2021-22, meaning there were fewer opportunities to prevent fraud than in 2020-21.

In 2021-22, there was a 66% decrease in government spending on COVID-19 related support measures, [footnote 13] compared with 2020-21. The Office for Budget Responsibility estimates that the government spent £229bn on COVID-19 support measures in 2020-21, and £78bn in 2021-22.

Estimates of fraud and error in COVID-19 support schemes

In response to the COVID-19 pandemic, the government launched support schemes for individuals and businesses. It created 393 schemes and, as of July 2023, their spending totalled £358bn.

The Coronavirus Job Retention Scheme (CJRS) was set up to support employers in retaining their employees through the COVID-19 pandemic, and the Self-Employment Income Support Scheme (SEISS) supported self-employed individuals (including members of partnerships) whose businesses were adversely affected by COVID-19. These employment support schemes achieved their primary aim of protecting jobs and businesses, with unemployment peaking at just 5.2%.

The Bounce Back Loan Scheme was introduced in May 2020 and provided over £46bn to 1.5 million businesses to support them with the finance they urgently needed to get through the COVID-19 pandemic.

In the creation of these schemes, and in response to the pandemic, the government accepted that there would be an increased risk of fraud and error.

While accepting the increased risk, departments were expected to understand that risk and to take action to prevent loss where possible. Fraud measurement was undertaken in the areas that departments identified as the highest risk. Departments were also expected to find and recover detected fraud and error, where it showed value for money.

HM Treasury required departments to make an evidence-based estimate in their 2021-22 Annual Reports and Accounts of the level of fraud and error in the COVID-19 support schemes that they administered.

The estimates published in Annual Reports and Accounts [footnote 14], and separate fraud and error publications [footnote 15], show a total estimated level of fraud and error in COVID-19 schemes of £10.34bn. This data has already been published separately by departments, but this is the first time we have published an aggregate figure.

Published departmental fraud and error estimates cover £171bn of the estimated £358bn of COVID-19 spending.

In wider post-event assurance work on COVID-19 support schemes, where departments sought to measure fraud and error levels, they reported estimates totalling a further £144m to the PSFA [footnote 16]. This additional reporting related to £6bn of spending, with measurement therefore carried out across £177bn (49%) of the estimated £358bn of COVID-19 spending.

The schemes which did not participate in measurement are likely to be lower risk and therefore experience lower levels of fraud and error. This aligns with the Global Fraud Risk Assessment, which the Counter Fraud Centre of Expertise established to build a deeper understanding of the fraud landscape across government during the pandemic.

The PSFA estimates that the level of fraud and error in government expenditure and income where no measurement has been conducted is between 0.5% and 5% [footnote 17]. However, this relates to non-emergency spending. Schemes delivered during emergency situations - such as the COVID-19 pandemic - contain an “inherently high risk of fraud” [footnote 18]. As such, it follows that this range may be exceeded in COVID-19 support schemes.

The £10.48bn estimated level of fraud and error in COVID-19 schemes equates to 5.9% of the £177bn spend covered by measurement exercises (published and unpublished). However, this does not all equate to a loss for the taxpayer. Significant work continues to go into recovering payments that have been made to the incorrect recipients, either through fraud or error.

As of the end of September 2023, HMRC had recovered £1.2bn [footnote 19] in fraud and error on their COVID-19 schemes. It also blocked over 67,000 claims, worth a total of £430m, via pre-payment checks. HMRC remains committed to tackling error and fraud in the COVID-19 support schemes where this is the most cost-effective use of resources.

In its 2022-23 Annual Report and Accounts, the Department for Business, Energy and Industrial Strategy forecast that of the 8.9% fraud level (£4.2bn) in the Bounce Back Loan Scheme, only 5.9% of loans with an estimated value of £1.7bn will go unrecovered. [footnote 20]

2021-2022 Scale of the challenge

Total estimated fraud and error (outside of COVID-19 schemes) is between £39.8bn and £58.5bn.

Fraud against public bodies takes money away from the vital public services that citizens rely on and can damage trust in government. The Public Sector Fraud Authority estimates that, in 2021-22, the level of fraud and error was between £39.8bn and £58.5bn [footnote 21], outside of COVID-19 specific schemes. This calculation includes tax and welfare and is based on established and published estimates where fraud and error measurement is undertaken to a high standard, along with an estimated range of 0.5%-5% [footnote 22] on the areas where high-quality measurement work has not been carried out.

In 2020-21, the PSFA estimated that the level of fraud and error per year was between £33.2bn and £58.8bn. The ‘floor’ of the estimate has risen slightly for 2021-22. This is due to higher fraud and error estimates in welfare and tax in 2021-22 compared to those in 2020-21. The ‘ceiling’ has remained broadly flat. The monetary value of fraud and error in the benefits system subsequently reduced in 2022-23.

Our fraud and error estimate relates to between 2.6% and 3.8% of overall government expenditure and income [footnote 23].

Counter fraud colleagues across government play a key role in finding, preventing and recovering this fraud, continuously striving to improve the methods used to reduce the impact of fraud against the public sector.

Whilst 2021-22 showed that progress has been made across government in relation to detecting fraud, there is still work required to better protect public funds.

Public Sector Fraud Authority

In the Spring Statement 2022, the Chancellor announced the creation of a new authority to counter fraud against the public sector.

The Public Sector Fraud Authority (PSFA) was launched on 3 August 2022 as an integrated partnership between the Cabinet Office (CO) and HM Treasury (HMT). The PSFA engages with government departments and public bodies to understand and reduce the impact of fraud.

Since its launch, the PSFA has worked hard to modernise how the public sector counters fraud, based on experiences and lessons learned in both the UK and internationally. This will help the government to better understand, prevent and take action on fraud - reducing the cost of public services and protecting the public sector.

Below we summarise just some of the PSFA’s achievements since launch. In Section 7, we provide further detail on the PSFA’s work with departments to set ambitious counter fraud targets.

£311m in audited counter fraud benefits delivered

The PSFA was set a target to deliver £180m in audited benefits in 2022-2023. Working closely with departments and public bodies, the PSFA was able to exceed this target and delivered a total of £311m in audited counter fraud benefits.

The £311m in audited counter fraud benefits represent prevented and recovered fraud and error as a result and is made up of a variety of data analytics projects, which include:

- the National Fraud Initiative, which is an exercise that works with more than 1,100 public bodies to compare sets of data against other records to identify discrepancies that may be evidence of fraud;

- the delivery of the COVID-19 Loan Schemes Fraud Analytics Programme, providing counter fraud flags to identify instances of potential fraud. These were then shared with accredited lenders to help them recover fraudulently obtained money.

Building a data platform with Quantexa

After a competitive tender, UK technology firm Quantexa was selected as the PSFA’s lead data analytics partner to deliver the Single Network Analytics Platform (SNAP).

This new platform uses artificial intelligence to connect millions of data points and provides a holistic view of risk involving UK-registered companies.

As part of this work, the PSFA has built several detection models to identify shell companies, suspect formations and sanctioned entities.

The SNAP makes it easier for fraud teams to look closely at UK-registered companies and to prevent public contracts, loans and grants from falling into criminal hands.

Government Counter Fraud Profession

The Government Counter Fraud Profession [footnote 24] (GCFP) was launched in October 2018 to develop a common structure for developing counter fraud capability across government

A key strategic aim for the Profession is to build deep counter fraud capability. As well as publishing standards and guidance, the Profession develops, delivers and signposts to, counter fraud training. The Profession aims to double the number of officers trained in Fraud Risk Assessment by March 2024 from 100, to 200.

In 2022-23, the Profession launched the bespoke Counter Fraud Leadership Programme, bringing together the first ever qualification for fraud leaders at Senior Civil Servant level. Having seen the first cohort of counter fraud leaders graduate, the Profession is already working to welcome the next cohort of senior leaders in January 2024, as well as year upon year.

The Centre of Learning for the Profession also recently collaborated with fraud subject matter experts and learning experts to reinvigorate the Fraud, Bribery & Corruption Awareness course, developed in partnership with Civil Service Learning. This all-staff course increases fraud awareness across the public sector and reminds participants that it is everyone’s responsibility to protect taxpayers’ money.

Engagement with international partners

The PSFA leads the International Public Sector Fraud Forum (IPSFF) of counter-fraud experts from the Five Eyes countries – America, Australia, Canada, New Zealand and the United Kingdom. The IPSFF has recently developed guidance on countering fraud in international aid (PDF, 3.8MB) and developing fraud control testing frameworks (PDF, 3.8MB).

In September 2023, the PSFA hosted 14 international delegates for a public sector fraud summit in London. The summit featured in-person strategic and technical discussions and workshops dedicated to improving our collective understanding of fraud and to share insights and best practice.

Target setting

As part of its work to modernise counter fraud activity, the government asked departments to set targets for their counter fraud work based on the financial impact they have. This forms part of the government’s wider drive to increase productivity and specific intent to increase its ambition in finding and dealing with fraud against the public sector.

Eighteen departments were prioritised into a tier-based system, based on their size and perceived level of risk, with a focus on ensuring departments in the top two tiers (15 departments - see fig. 2 below) set credible targets.

Tier 3 organisations (Cabinet Office, HMT, UK Export Finance) were seen as the smallest and had the lowest level of perceived risk of fraud and error. As such, these were not formally part of the target setting process. However, the Cabinet Office took the decision to still develop a target. The PSFA monitors these departments’ detected, prevented and recovered fraud and error through standard reporting.

A financial target for impact on fraud comprises prevented and recovered fraud and error. It was expected that targets would both show a positive return on investment and an uplift on previous performance. In cases where this was not possible, a clear rationale was expected.

In 2022-23, only two departments had set a financial impact target for their counter fraud work. For the 2023-24 financial year, 100% of Tier 1 and 2 departments created financial targets supported by the PSFA.

HMRC agrees its targets for activity on fraud and error in the tax system with HM Treasury Ministers.

DWP set a target to achieve savings in 2023-24 of at least £1.3bn from dedicated counter fraud and error resource. The target represents an increase on the savings achieved by these activities in 2022-23.

The other departments worked on targets directly with the PSFA. If met, the performance from the agreed targets would result in a 64% increase in counter fraud outcomes - a marked shift in ambition and committed outcomes across government.

The target setting process is developing. The government has clearly stated that its ambition is to continue to increase its impact from counter fraud activity.

Fig. 2 Departments broken down into tiers

Tier 1

- Department for Business and Trade

- Department for Education

- Department for Energy Security and Net Zero

- Department for Environment, Food and Rural Affairs

- Department for Health and Social Care

- Department for Transport

- Department for Work and Pensions*

- HM Revenue & Customs*

- Ministry of Defence

- Ministry of Justice

Tier 2

- Department for Culture, Media and Sport

- Department for Levelling Up, Housing and Communities

- Department for Science, Innovation and Technology

- Foreign, Commonwealth and Development Office

- Home Office

Tier 3

- Cabinet Office

- HM Treasury

- UK Export Finance

*HMRC and DWP are mature in their approach to counter fraud. HMRC agrees its targets for activity on fraud and error in the tax system with HM Treasury Ministers. DWP agreed its target with PSFA and HM Treasury.

Annex A: data tables

The tables below show the total amount of detected fraud and error reported by government departments and their arm’s length bodies in 2020-21 and 2021-22, both including and excluding COVID-19. This was reported to the Government Counter Fraud Function’s Centre of Expertise, prior to the establishment of the Public Sector Fraud Authority.

The reporting for DWP and HMRC is internal fraud and error only - that carried out by a government employee or contractor - and as such excludes welfare benefits, tax and HMRC-administered COVID-19 schemes.

Fig. 3 2021-22 Detected fraud and error by department, including outliers [footnote 25]

| Department | Total Detected Fraud and Error 20-21 | Total Detected Fraud and Error 21-22 |

|---|---|---|

| Department for Business, Energy & Industrial Strategy | £215.9m | £252.1m |

| Ministry of Defence | £148.9m | £225.2m |

| Department for Health & Social Care | £58.5m | £175.3m |

| Department for Education | £63.5m | £69.2m |

| Department for Transport | £12.3m | £53.7m |

| Department for Digital, Culture, Media & Sport | £0.9m | £12.4m |

| Home Office | £17.1m | £11.3m |

| Department for Environment Food & Rural Affairs | £16.3m | £11.2m |

| Foreign, Commonwealth and Development Office | £4.9m | £4.4m |

| Department for Levelling Up, Housing and Communities | £0.2m | £4.3m |

| HM Revenue & Customs* | £1.7m | £1.5m |

| Ministry of Justice | £0.5m | £0.6m |

| HM Treasury | £0.2m | £0.5m |

| Department for Work & Pensions* | £0.3m | £0.4m |

| Cabinet Office | £0.0m | £0.3m |

| Department for International Trade | £0.0m | £0.0m |

| Total [footnote 26] | £541.1m | £822.5m |

*Internal fraud only

| Department | Total Detected Fraud and Error 20-21 | Total Detected Fraud and Error 21-22 |

|---|---|---|

| Ministry of Defence | £148.9m | £225.2m |

| Department for Health & Social Care | £55.8m | £70.3m |

| Department for Education | £63.5m | £64.2m |

| Department for Transport | £12.3m | £53.0m |

| Department for Business, Energy & Industrial Strategy | £18.1m | £16.7m |

| Home Office | £17.1m | £11.3m |

| Department for Environment Food & Rural Affairs | £12.0m | £11.0m |

| Foreign, Commonwealth and Development Office | £4.9m | £4.4m |

| Department for Levelling Up, Housing and Communities | £0.2m | £4.3m |

| Department for Digital, Culture, Media & Sport | £0.9m | £3.3m |

| HM Revenue & Customs* | £1.7m | £1.5m |

| Ministry of Justice | £0.5m | £0.6m |

| HM Treasury | £0.2m | £0.5m |

| Department for Work & Pensions* | £0.3m | £0.4m |

| Cabinet Office | £0.0m | £0.3m |

| Department for International Trade | £0.0m | £0.0m |

| Total [footnote 27] | £336.2m | £467.0m |

-

The Government Counter Fraud Function’s Centre of Expertise was the predecessor to the Public Sector Fraud Authority. ↩

-

Business-as-Usual is defined as activity which was not reported as fraud and error relating to COVID-19 support schemes. The PSFA issued an updated consolidated data request process in November 2023, changing and improving the way in which departments report their fraud and error data. ↩

-

Ministerial departments and public bodies (excluding local government and the devolved administrations) ↩

-

The detected, prevented and recovered data in the report excludes fraud and error relating to COVID-19 within welfare. Error and fraud in the covid-19 schemes methodology and approach - an update for 2023; HMRC annual report and accounts 2021 to 2022; Fraud and error in the benefit system ↩

-

Activity after the release of funds on emergency schemes which is focussed on fraud measurement, detection and recovery. ↩

-

These are exceptional instances that we do not expect to occur again in the future. ↩

-

2023 HM Treasury COVID-19 Cost Tracker update (PDF, 194KB) ↩

-

Please note that the £358bn spend is the amount the government had spent on COVID-19 support measures so far (where data are available), as of 20 July 2023, and therefore includes spend from after the 2020-21 and 2021-22 financial years. ↩

-

This data only includes HMRC and DWP’s internal fraud and error. It does not include data from HMRC’s COVID-19 support schemes. ↩

-

The Department for Business, Energy and Industrial Strategy was subject to a machinery of government change in February 2023. ↩

-

Including fraud and error relating to COVID-19 support schemes. Excluding fraud and error within tax and welfare, as well as in HMRC’s COVID-19 schemes. ↩

-

Department for Business, Energy and Industry Strategy: Annual report and accounts 2021-22 (PDF, 12.3MB): and Department for Environment, Food and Rural Affairs: Annual Report and Accounts 2021–22 (PDF, 4.7MB) ↩

-

Error and fraud in the COVID-19 schemes methodology and approach: an update for 2023 ↩

-

A proportion of PPE Procurement, and a range of schemes operated by the Department for Culture, Media and Sport, including strands of the Cultural Recovery Fund; Tackling Inequalities; the Community Emergency Fund; and COVID-19 Emergency Response Funding. The PSFA is not able to place full assurance on the quality of these estimates. ↩

-

The range was informed by review of 48 loss measurement exercises (23 are judged to be high quality) by an independent expert panel. ↩

-

International Public Sector Fraud Forum Fraud in Emergency Management and Recovery: Principles for Effective Fraud Control (PDF, 6.8MB), p.6 ↩

-

Data provided to the PSFA by HMRC dated 13/12/23 ↩

-

Department for Business, Energy and Industry Strategy: Annual report and accounts 2022-23 (PDF, 9.2MB), p.157-158 ↩

-

Gross fraud and error. ↩

-

The most likely range for ‘unknown’ areas as determined by the Fraud Measurement Assurance programme oversight board, based on the evidence held by the programme and their collective professional experience. ↩

-

Based on information in the 20/21 Whole of Government Accounts (expenditure) and the 2021/22 HMRC annual report and accounts (income). ↩

-

These are exceptional instances that we do not expect to occur again in the future. Examples may include, for instance, unusually high value error within a time-limited government scheme, or a fraud carried out within a franchise arrangement. ↩

-

All department fraud and error figures are rounded up or down accordingly to the nearest £0.1m for this table. Therefore, due to this rounding, there may be small discrepancies with the overall total. ↩

-

All department fraud and error figures are rounded up or down accordingly to the nearest £0.1m for this table. Therefore, due to this rounding, there may be small discrepancies with the overall total. ↩