The abolition of Class 2 National Insurance: Introducing a benefit test into Class 4 National Insurance for the self-employed

Updated 11 December 2018

Foreword

The 2015 Summer Budget confirmed the government’s intention to abolish Class 2 National Insurance contributions (NICs). This means that instead of paying two classes of NICs (Class 2 and Class 4), the self-employed will pay just one (Class 4) in the future. This follows the recommendations of the Office of Tax Simplification and will simplify the NICs system for millions of people.

Class 2 NICs currently provides the self-employed with access to a range of state benefits: the Basic State Pension, Bereavement Benefits, Maternity Allowance and contributory Employment and Support Allowance. To ensure that the self-employed can continue to access these benefits through the NICs system, this consultation considers how self-employed individuals could build entitlement through Class 4 NICs. It also identifies where alternative options will be considered for those who would be unable to maintain benefit entitlement under a Class 4 NICs entitlement test.

The government recognises that this is a complex area. Because of the importance of getting the detail right in this reform, no timetable has been set for the abolition of Class 2 and the reform of Class 4.

The government welcomes views on the potential approaches proposed and on alternative options.

David Gauke MP Financial Secretary to the Treasury

Lord Freud Minister for Welfare Reform

December 2015

1. Introduction

National Insurance contributions (NICs) are a charge on earnings and are paid by employees, employers and the self-employed. NICs are used to fund the State Pension and other contributory benefits via the National Insurance Fund, as well as the National Health Service.

The government is committed to simplifying the tax and NICs system. The independent Office for Tax Simplification (OTS) was established in 2010 to offer advice to the government on how this could best be done.

In its 2011 review of small business taxation, the OTS described how the system of NICs for the self-employed was particularly burdensome, and asked the government to look at this specific area.

Self-employed National Insurance

The self-employed are a major part of the UK economy – the 4.5 million self-employed people in the UK currently make up 1 in 7 of all employment.

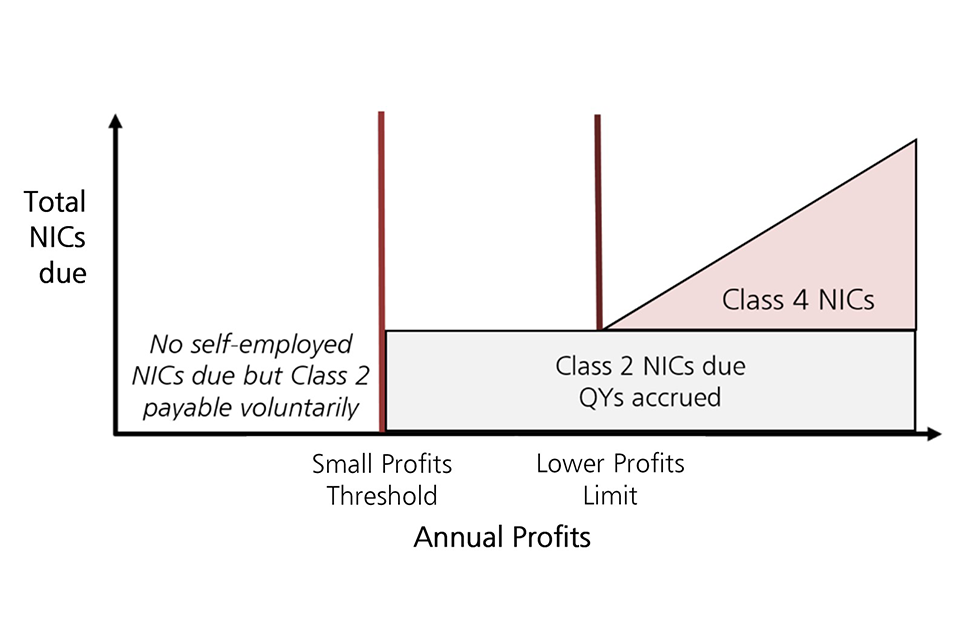

The self-employed currently pay two classes of NICs: Class 2 and Class 4.

Class 2 NICs are currently flat-rate weekly contributions (£2.80 per week in 2015/16). They are liable to be paid for every week or partial week of self-employment in a tax year, if the person’s profits for that tax year equal or exceed the Small Profits Threshold (£5,965 in 2015/16).

Payment of Class 2 is voluntary for those with profits below this level. Class 2 NICs currently helps individuals build contributory benefit entitlement.

Class 4 NICs are paid by the self-employed on net profits that are subject to income tax. Class 4 contributions are payable at a rate of 9% on profits between the Lower Profits Limit (£8,060 in 2015/16) and Upper Profits Limit (UPL) (£42,385 in 2015/16) and 2% on profits above the UPL.

They do not currently provide entitlement to contributory benefits; Class 4 contributions were introduced so the self-employed would pay a fairer share of the costs associated with providing contributory benefits.

Annex B sets out the current self-employed NICs system in more detail.

The recommendations of the OTS led to the collection of Class 2 contributions for the self-employed being brought into self-assessment from April 2015; this means that, for most self-employed people, Class 2 is now collected annually alongside Class 4.

The Chancellor announced at the March 2015 Budget that the government would go further to simplify NICs for the self-employed and abolish Class 2 NICs and reform Class 4 NICs.

Abolishing Class 2 NICs and reforming Class 4 NICs to introduce a new contributory benefit test

The abolition of Class 2 NICs requires the introduction of a new contributory benefit test for the self-employed. This consultation sets out the government’s proposal to introduce a contributory test based on profits into Class 4 NICs.

This means those with annual profits equal to or above a certain level could accrue qualifying years for entitlement to the State Pension and meet the new contributions tests for other contributory benefits through Class 4 NICs.

Chapter 2 considers how this could work and how it would affect self-employed NICs payers. The government welcomes responses on both the proposal itself and the suggested design of the profits test, set out in chapter 2.

The government will consider responses before confirming whether and how it would introduce such a test to determine benefit entitlement.

Taking account of existing provisions in the NICs and wider welfare system, the government will use the consultation responses to consider how to provide for those groups:

- who could not meet the conditions of the new benefit tests through a Class 4 profits test (the issue of Maternity Allowance access is discussed in chapter 3)

- for whom current Class 2 rules confer special treatment (discussed in chapter 5)

The abolition of Class 2 NICs and the reform of Class 4 NICs will not be implemented until April 2017 at the earliest. Responses to the consultation will be used to inform the government’s decision on how and when to proceed with the abolition of Class 2.

Objectives for reform

The objectives of this reform are to:

- deliver genuine simplification for self-employed NICs payers, making self-employed NICs more transparent and easier to understand

- make sure self-employed individuals have access to contributory benefits via the NICs system

- align the treatment of different self-employed NICs payers wherever possible, so contributory benefits can be accessed on a more equal basis to make the system fairer for all

- simplify the administration of self-employed NICs

In delivering these objectives, the government will seek to ensure that:

- the contributory principle is retained in the National Insurance system for self-employed people

- no-one loses access to the State Pension

- any changes to the benefit entitlement tests maintain access to Maternity Allowance

Purpose and scope of this consultation

This consultation sets out the proposed structure for Class 4 NICs as a mechanism for determining benefit entitlement that would follow Class 2 abolition.

It explores how access to contributory benefits could be determined using an annual profits test in Class 4 NICs (chapter 2), and how those who may not gain access through Class 4 would be affected (chapters 3-5).

To ensure that this reform meets the objectives stated above, the government will consider how to build on existing provisions within the NICs system to address the impact of Class 2 NICs abolition wherever possible, for instance by using the existing class of voluntary NICs, Class 3.

The government does not wish to reintroduce unnecessary complexity back into the NICs system. However the government has not made any final decisions on how to abolish Class 2 and reform Class 4; it will do so only after considering all responses to this consultation.

An individual who has already been awarded benefits based on the existing contributory rules and conditions will not be affected by the move to these new tests for the duration of their existing award.

Social security is a transferred matter in Northern Ireland and, with limited exceptions, broadly mirrors the system that operates in the rest of the United Kingdom in terms of the range of benefits provided, the conditions of entitlement and the rates. The National Insurance system itself is an excepted matter.

Although this consultation is concerned with entitlement to contributory benefits in Great Britain, comments are nonetheless invited from interested parties in Northern Ireland given the similarities of the benefit system there.

2. A reformed Class 4 NICs and an annual profits test

This chapter explores how a contributory benefit test based on profits in Class 4 NICs could work and how this could determine access to contributory benefits for the self-employed.

It explains how self-employed people would be affected by these proposals, noting how existing provisions in the NICs system could protect the State Pension record of those who may not meet the conditions of a profits test.

It notes that there are no similar provisions for working age benefits, and so confirms that the government will consider whether and how to enable the self-employed to continue to access these benefits based on voluntary contributions.

The impact of Class 2 abolition on access to Maternity Allowance is discussed in the following chapter.

In line with the objectives described in the previous chapter, the proposals below ensure that self-employed individuals can continue to build benefit entitlement through the NICs system, and that no-one would lose access to the State Pension as a result.

These are the government’s proposals only; it has not made any final decisions on how to abolish Class 2 NICs or reform Class 4 NICs.

The proposed structure of Class 4 NICs

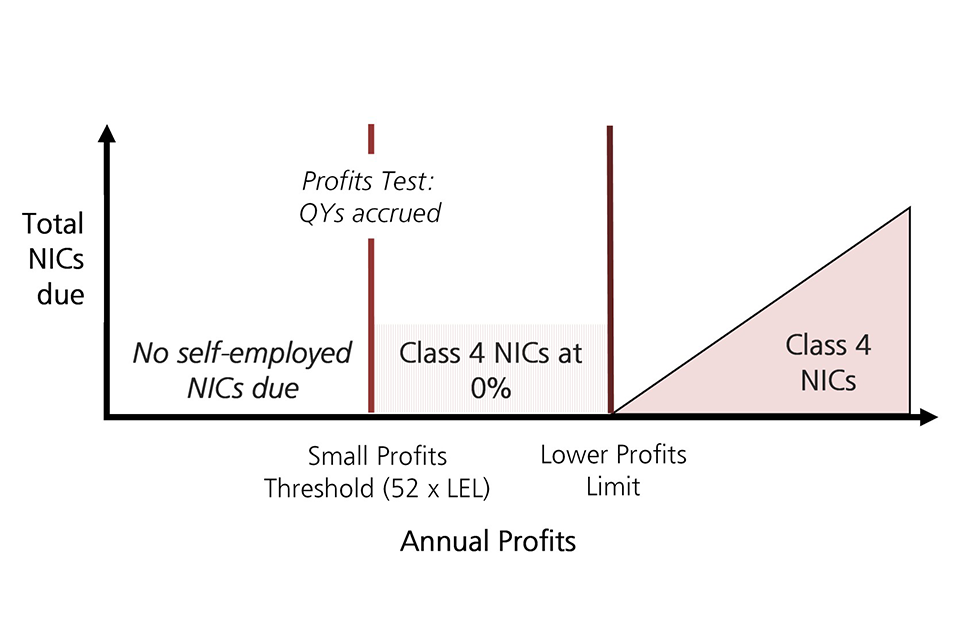

To simplify NICs for the self-employed, the government will abolish Class 2 NICs and introduce a new contributory benefit test into Class 4 NICs. To do this, the government proposes to:

- create a new zero-rate band of Class 4 NICs on annual profits between the Small Profits Threshold (SPT, currently £5,965) – the point at which Class 2 is currently liable to be paid – and the Lower Profits Limit (LPL, currently £8,060) – the point at which Class 4 becomes payable

- change the contribution conditions attached to the State Pension and other contributory benefits to enable Class 4 NICs (including those at the new zero-rate) to count towards benefit entitlement, so that self-employed individuals with annual profits at or over the Small Profits Threshold would be able to accrue qualifying years (QYs) for benefit entitlement

- align the SPT with the weekly Lower Earnings Limit (LEL) in Class 1: Primary (employee) NICs, by setting the SPT at 52 times the LEL.

The existing and proposed systems are shown in Figures 2.A and 2.B.

Figure 2.A: The existing Class 2 and 4 NICs structure

Figure 2A

Figure 2.B: The proposed Class 4 NICs structure

Figure 2B

How a profits test would confer contributory benefit entitlement

As noted above, the abolition of Class 2 NICs and the introduction of a contributory benefit entitlement test based on annual profits subject to Class 4 NICs means that the current contributory benefit entitlement tests would need to change.

The current tests for the self-employed are based on payment of weekly Class 2 NICs. They differ based on the actual benefit being claimed. For the State Pension, 52 Class 2 NICs are normally required to achieve a qualifying year towards the State Pension.

Class 2 NICs can be combined with Class 1 NICs and National Insurance credits (NI credits) and in some cases Class 3 (voluntary NICs) to achieve the 52 required. Background information about NI credits and Class 3 NICs is provided further below in this chapter.

Class 2 NICs can also be combined with Class 1 NICs for the purposes of entitlement to Bereavement Benefit (which will be replaced by Bereavement Support Payment from April 2017), Employment and Support Allowance and Maternity Allowance. Annex C provides more detail on the current contributory benefit tests.

The introduction of a profits test into Class 4 would mean that the new contributory benefit tests for the self-employed would operate on the basis that annual profits at or over the Small Profits Threshold in Class 4 NICs (~£6000 on introduction) confer one qualifying year towards benefit entitlement.

Table 2.A

| Benefit | Current entitlement tests | How this could change under a Class 4 profits test |

|---|---|---|

| New State Pension (from April 2016) | For those contributing for the first time under the new system, 35 x qualifying years are required to be entitled to the full amount on reaching State Pension age (a minimum of 10 qualifying years needed to be entitled to any State Pension) | No change required to the existing qualifying year rules |

| Bereavement Support Payment (from April 2017) | 26 weeks of Class 2 contributions in any one tax year | 1 qualifying year in any past year |

| Contributory Employment and Support Allowance | 26 weeks x Class 2 NICs in one of the previous two tax years and 50 weeks x Class 2 NICs or NI credits during both of the previous two tax years (which immediately precede the beginning of the benefit year in which a claim is made) | 1 qualifying year in one of the past 2 last recorded [footnote 1] tax years and 1 qualifying year or 50 Class 1 NI credits in both of the previous two tax years |

Impact on the self-employed with sufficient Class 4 profits or Class 1 earnings

The approach proposed above means that, following the abolition of Class 2 NICs, self-employed people with annual profits at or above the Small Profits Threshold (SPT) would build up their entitlement to contributory benefits automatically through Class 4 NICs.

Those with profits between the SPT and Lower Profits Limit (LPL) (£8,060 in 2015/16) would no longer pay any NICs but still build entitlement to contributory benefits.

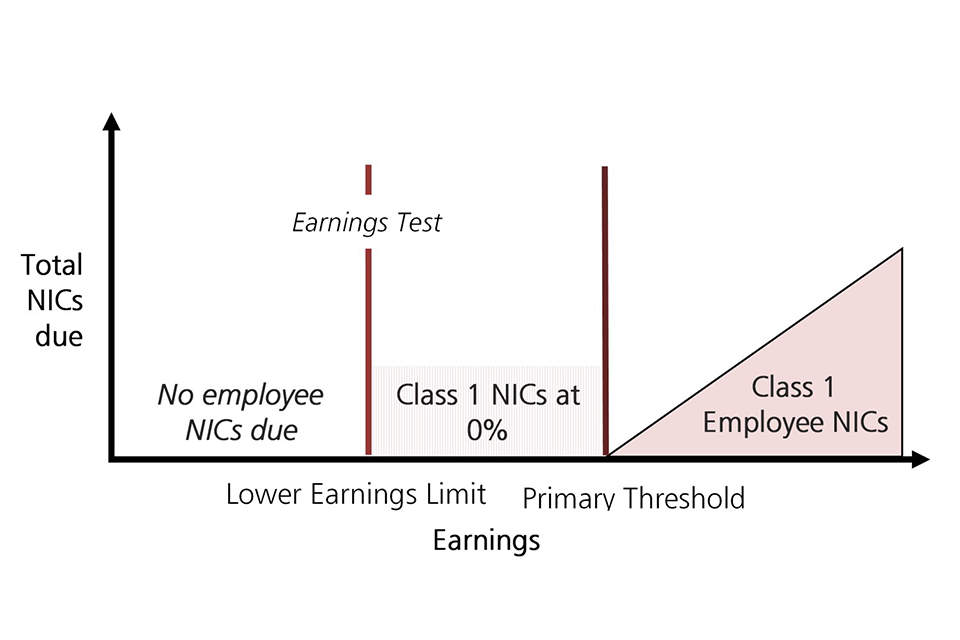

A Class 4 NICs zero-rate band would protect the benefit entitlement position of those with profits between the SPT (inclusive) and the LPL in a similar way that the structure of Class 1 NICs protects the benefit entitlement of those employees with earnings between the Lower Earnings Limit (LEL) and Primary Threshold (PT) [footnote 2].

Indeed this approach would mirror the structure of Class 1 NICs for company directors who have an annual earning period (except for when they first become a director, when it is pro-rata). The structure of Class 1 (Employee) NICs is shown below in Figure 2.C [footnote 3]

Figure 2.C: Class 1 Employee NICs

Figure 2C

Those whose profits are below the SPT but who have employment earnings may be able to accrue qualifying years for benefit entitlement via Class 1 NICs. To gain a qualifying year, an individual needs to have annual earnings above £5,824, made up of earnings between the Lower Earnings Limit (LEL, £112 per week in 2015/16) and the Upper Earnings Limit (UEL, £815 per week in 2015/16) [footnote 4].

Broadly, this means that a self-employed individual with low profits who also has a job from which they earned at least this amount during the tax year, would see no impact on their benefit entitlement position from the introduction of a Class 4 profits test.

They would not be liable for Class 4 NICs but would pay (or be treated as paying) Class 1 NICs on their employment earnings.

Impact on the self-employed without sufficient Class 4 profits or Class 1 earnings

Following the abolition of Class 2 NICs and the introduction of a profits test into Class 4, those with profits below the SPT and who have insufficient earnings from employment would need to accrue qualifying years for benefit entitlement in another way.

The impact of the proposed approach on the benefit position of those with profits below the SPT who have multiple sources of earnings – where each source of earnings falls below the qualifying annual threshold – within a single tax year is more complex. This is discussed in detail in chapter 4.

The impact that this reform would have on entitlement to the State Pension is different to the impact on entitlement to other benefits. These different impacts are discussed in turn.

State Pension entitlement

Following these reforms, those with profits below the SPT would need to make use of the existing provisions in the NICs system that serve to protect an individual’s State Pension record, in the same way as for employees who do not gain entitlement through Class 1 NICs. These are NI credits and Class 3 voluntary contributions.

National Insurance credits

Those self-employed people with profits below the SPT but who are eligible for National Insurance credits (NI credits) would continue to accrue qualifying years for the State Pension.

Below is background information on NI credits and an example of how this would work in practice for an individual with low profits.

Background

National Insurance credits (NI credits)

NI credits are available to individuals in certain circumstances and help to protect their future entitlement to contributory benefits.

Examples of NI credits are those for:

- parents of children under 12 (this is automatic for those eligible for Child Benefit)

- individuals who receive Carer’s Allowance (see below)

- foster carers

- individuals who are unemployed in receipt of Jobseeker’s Allowance (JSA)

- individuals unable to work through illness or incapacity and in receipt of Incapacity Benefit, Statutory Sick Pay or ESA

- recipients of Working Tax Credit or Universal Credit

There are two types of credit:

- class 1 credits which count towards entitlement to working age benefits (ESA and JSA), the State Pension and Bereavement Benefits (if other conditions are satisfied)

- class 3 credits which count towards entitlement to the State Pension and Bereavement Benefits only. Most credits awarded are Class 3 credits.

Credits can be awarded automatically alongside certain benefits (e.g. to those in receipt of Child Benefit) or by the individual making an application (e.g. jury service credits).

Carer’s Allowance (CA) for self-employed people

For self-employed people to receive CA, they must be earning no more than the CA earnings limit – currently £110 per week (after deductions for National Insurance, tax and other allowable expenses).

Provided that is the case, they will automatically gain a Class 1 NI credit for each week they are in receipt of CA.

Rules around a notional NI income which can be deducted in the absence of Class 2 are set out in Annex C.

Example A

Lucia is self-employed with annual profits beneath the SPT. She has two children under 12. She is married; her husband builds benefit entitlement entirely through Class 1 contributions from employment. Lucia has a high level of rental income which means she would pay the High Income Child Benefit Tax Charge, so opts out of receiving Child Benefit.

However, as she previously received Child Benefit, she is still entitled to Parent’s Credit in respect of her two children under 12, which enables her to build qualifying years for the State Pension.

Class 3 voluntary contributions

Self-employed individuals with profits below the Small Profits Threshold (SPT) who are ineligible for NI credits and who wish to fill gaps in their contribution record for the State Pension would need to pay voluntary Class 3 contributions.

Background:

Class 3 Voluntary National Insurance contributions

Individuals are able to pay Class 3 voluntary NICs for weekly, monthly or annual periods in which they have insufficient earnings from employment or self-employment and are not entitled to NI credits. This is to fill gaps in their NI record to protect future entitlement to the State Pension.

There are time limits and higher rate rules that apply to paying Class 3 NICs; voluntary contributions can usually be paid in respect of the past 6 years.

Individuals can check their National Insurance record before deciding whether to buy Class 3 voluntary NICs.

Class 3 vs Class 2

While most individuals currently have to pay Class 3 NICs to build State Pension entitlement voluntarily, self-employed people with profits below the SPT and a number of other prescribed groups are able to pay Class 2 NICs voluntarily. The current rate of Class 2 is £2.80 per week while the Class 3 rate is £14.10 per week.

Class 3 only confers entitlement to the State Pension and bereavement benefits; unlike Class 2, Class 3 does not confer entitlement to contributory ESA or Maternity Allowance.

While the Government recognises that the rate of Class 3 contributions is higher than Class 2 contributions, those for whom Class 3 may be prohibitively expensive may be eligible to claim means-tested benefits, which would protect their State Pension record via NI credits.

Prior to April 2000, the Class 2 rate of NICs was 10 pence higher than the Class 3 rate, because of this wider range of contributory benefits that it entitles the payer to receive. However, the Class 2 rate was considerably reduced in 2000 to lessen the cost of Class 2 for those self-employed individuals for whom it was compulsory [footnote 5].

Having a single class of voluntary NICs corresponds with the introduction of the new State Pension in April 2016. This will treat contributions from employees and the self-employed (and NI credits) on an equal basis[footnote 6]. This supports the case for having a one class of voluntary NICs for building State Pension entitlement.

As is the case currently, self-employed individuals would be able to check their National Insurance record before deciding whether they want to pay Class 3 NICs. For those contributing for the first time under the new system, individuals with 35 qualifying years (QYs) over their working life will be entitled to claim the full new State Pension on reaching State Pension age; those with fewer than 35 would receive less than the full rate[footnote 7].

This means that those whose profits are below the SPT in only a small number of years may not need to pay Class 3 NICs to fill gaps. It is those with successive years of low profits who may see their State Pension entitlement affected if they did not pay Class 3 NICs.

Examples B and C explain two scenarios involving Class 3 NICs to illustrate how different self-employed individuals might respond following the abolition of Class 2. They show how there are many different factors involved in an individual’s decision to pay Class 3 voluntary NICs. Nonetheless, Class 3 contributions remain an effective safety net for those who cannot build up State Pension entitlement any other way.

Example B

Hasan is 35 years old and has recently started out as self-employed after 15 years of employment (which give him 15 qualifying years towards the State Pension). However he has self-employed profits below the SPT, and expects to have similar profit levels again next year. He has no children and is not eligible to claim means-tested support so he is not entitled to NI credits.

He could choose to pay voluntary Class 3 NICs to address the gaps in his record resulting from these low profits. However, he anticipates seeing annual profits of over £6000 in two tax years’ time, and so believes that he will be able to accrue sufficient qualifying years necessary to receive the full new State Pension before he reaches State Pension age. On this basis he does not think paying Class 3 NICs is worthwhile.

Example C

Jenny is also 35 years old and has recently started out as self-employed after 15 years of employment (which give her 10 qualifying years towards the State Pension, as 5 of the years involved low paid part-time employment). At the end of her first tax year of self-employment, she has profits below the SPT.

She expects to have similar profit levels again next year. Jenny maintains an occasional part-time job to supplement her income, which means that in some weeks she earns over the Lower Earnings Limit of £112 (in 2015/16). She does not receive any means-tested support, and she has one child over 12.

Jenny is keen to protect her contribution record. Whilst completing her self-assessment return online in the January after the end of the tax year, she decides to pay the required amount of voluntary Class 3 NICs to build a qualifying year towards her State Pension. She does this again the following January.

Entitlement to Bereavement Support Payment and contributory Employment and Support Allowance

Class 2 NICs can currently be paid voluntarily by those with low profits to protect their benefit entitlement. In addition to the State Pension, payment of Class 2 NICs protects entitlement to contributory Employment and Support Allowance (c-ESA) and Bereavement Benefits (BB) / Bereavement Support Payment (BSP) (from April 2017).

Following the abolition of Class 2 NICs and the introduction of a profits test into Class 4 NICs, an individual with profits under the SPT would be able to protect their State Pension record through Class 3 voluntary NICs (or NI credits).

However, because c-ESA and (from April 2017) BSP are only currently accessible to the self-employed via Class 2 NICs, the removal of the ability to access contributory benefits based on voluntary contributions could have an impact on a self-employed individual’s entitlement to these benefits[footnote 8].

The circumstances in which individuals would be unable to access these benefits following Class 2 abolition are as follows:

- bereavement and Support Payment: Surviving spouses of those who die prior to completing a full year of self-employment and prior to accruing profits above the SPT, and who have not built up sufficient contributions in a previous tax year.

- contributory Employment and Support Allowance: Self-employed individuals with low profits in the last two recorded tax years who have no entitlement based on Class 1 contributions from employment.

The government will consider the case for retaining the ability of self-employed individuals to build access on a voluntary basis to Bereavement Support Payment and Employment and Support Allowance. This could be achieved by making the existing voluntary Class 3 NICs confer entitlement to these benefits as well as the State Pension[footnote 9].

Noting the potential impact of these proposals on self-employed people as described above, the government welcomes views on the entitlement conditions proposed. It welcomes any suggestions for alternative approaches to determine entitlement to these benefits.

Chapter 2 Questions

Question 1

Do you think that the government should seek to maintain the existing level of access to contributory benefits? If so, how do you think this should be achieved?

Question 2

This chapter explains the government’s proposed approach – a profits test at the Small Profits Threshold in Class 4 NICs – and how this could work for self-employed people with profits above the Small Profits Threshold to determine entitlement to the State Pension, Bereavement Benefit and contributory Employment and Support Allowance. Noting the difference between this and the existing benefit entitlement rules (set out in Annex C), what are your views on this general approach?

Question 3

What are your views on the proposed contributory tests in Table 2.A? Can you suggest any alternative contributory tests based on annual profits for: a. State Pension? b. Bereavement Support Payment? c. Employment and Support Allowance?

Question 4

To what extent do you think that people – and self-employed people in particular – are sufficiently aware of the existing provisions in the NICs system that currently protect entitlement to the State Pension and Bereavement Benefits, namely NI credits and Class 3 voluntary NICs?

Question 5

Do you agree that the government should align voluntary contributions (i.e. by making Class 3 the only voluntary NICs payment) for the new State Pension for employees and the self-employed? Please give reasons.

Question 6

Do you think the government should continue to enable individuals who have not made a contribution via sufficient self-employed profits to access: a. Bereavement Support Payment? b. Contributory Employment and Support Allowance?

Question 7

Do you agree that the government should consider facilitating this access through Class 3 voluntary contributions?

3. Access to Maternity Allowance

Maternity Allowance (MA) is not a contributory benefit. The current entitlement tests are two-fold: an employment test and an earnings test. For self-employed women, the employment test is to ensure that the claimant has been recently self-employed prior to claiming MA, and the earnings test determines the rate at which MA is paid.

The earnings test for self-employed women is based on payment of Class 2 NICs; sufficient Class 2 payments confers access to MA paid at the standard rate. Access to MA for women who participate in the self-employed business of their spouse or civil partner is also based on the spouse’s / civil partner’s Class 2 NICs record.

Table 3.A sets out the current rules for MA entitlement.

| What type of MA claimant | Current entitlement rules |

|---|---|

| Self-employed women | Employment test: The claimant must have been self-employed for at least 26 weeks of the 66 weeks immediately preceding the week the baby is due (this 66 week period is known as “the test period”). Earnings test: The claimant must have paid Class 2 NICs for at least 13 weeks in the test period to receive the standard rate of Maternity Allowance (currently £139.58 per week, paid for up to 39 weeks). A lower rate of MA (£27 per week, paid for up to 39 weeks) may be paid to self-employed women who have not paid Class 2 NICs for 13 weeks of the test period. |

| Women participating in the self-employed business of their spouse or civil partner | Employment test: The claimant must have taken part in the business for at least 26 weeks of the test period. “Earnings test”: The claimant will receive the lower rate of Maternity Allowance (£27 per week, paid for up to 14 weeks) if their self-employed spouse or civil partner has paid Class 2 NICs in respect of the same 26 weeks during which the claimant participated in the business. |

Following the abolition of Class 2 NICs, the employment test set out above would remain in place. However, a new ‘earnings test’ would be required for MA purposes.

In line with the government’s objectives set out in chapter 1, the government seeks to ensure that any changes to the benefit entitlement tests maintain access to Maternity Allowance.

As with the tests proposed for other benefits, the government will consider all responses to the consultation before making its final decision on how self-employed women – and women who participate in the self-employed business of their spouse or civil partner – would access MA after Class 2 is abolished.

Maternity Allowance for self-employed women

The government is considering two options for Maternity Allowance access for self-employed women. Option 1 looks to build on existing systems in the NICs system to facilitate MA entitlement, while Option 2 looks to move the qualifying rules for self-employed women more closely to those currently used for employed claimants of MA.

Option 1: An earnings test based on a profits test in Class 4 NICs (with an option to purchase Class 3 voluntarily)

Option 1 would operate along the lines of the test under consideration for other contributory benefits – based on profits – while replicating the existing provisions for self-employed women as far as possible.

Currently, in order to qualify for the standard rate of MA, self-employed women who have already submitted their self-assessment return and paid the Class 2 NICs for the test period will not need to take any additional action.

Following the abolition of Class 2, self-employed women whose most recent self-assessment return shows annual profits at or above the SPT, and that this covers 13 weeks of the qualifying period, would also qualify for the standard rate of MA, with no further action required. Self-employed women who did not meet this condition but did meet the employment test would be able to claim MA at the lower rate of £27 for up to 39 weeks, in line with those self-employed women who do not fulfil the current requirement to pay 13 weeks of Class 2 contributions during the test period.

The government recognises that this may not provide sufficient coverage for those self-employed women who currently rely on the ability to pay Class 2 voluntarily in order to claim the standard rate of MA. In order to maintain access to MA as far as possible, the government would build on the existing provision that enables self-employed women to make a one-off payment for the 13 voluntary contributions required to secure the standard rate of MA.

Voluntary payment of Class 2 NICs would no longer be possible after abolition. As part of Option 1, the government will consider enabling Class 3 NICs[footnote 9] to be used to maintain access to the standard rate of Maternity Allowance for self-employed women who do not meet the profits test.

In recognition of the higher cost of Class 3 (£14.10 per week instead of Class 2 at £2.80 per week), the government will consider whether to:

- require fewer than 13 Class 3 NICs

- amend the Class 3 rules so that – for Maternity Allowance entitlement purposes only – Class 3 contributions operate on a monthly rather than weekly basis. This would mean a single Class 3 contribution is equivalent to earnings equal to the monthly Lower Earnings Limit (LEL, currently £485), rather than the weekly LEL (£112). Three Class 3 contributions (representing monthly earnings of £485) would therefore be required to reach the same level of earnings deemed to be equivalent to thirteen Class 2 contributions (representing weekly earnings of £112), which is £1560 (a quarter of the LEL in 2015/16).

The government will also consider whether and how to enable Class 3 NICs paid specifically for MA purposes to be taken into account against any Class 4 NICs liability that may subsequently arise in the relevant tax year.

Option 2: Entitlement based on estimated earnings

The government acknowledges that a new earnings test could be based on information other than annual profits. It is therefore also considering an alternative option in which entitlement to MA could be based on estimated earnings, which is in line with the method used to calculate the rate of MA paid to employed women.

A self-employed woman would declare her estimated weekly earnings for 13 weeks during the test period. These estimated earnings would be averaged and the estimated average earnings would be used to determine the rate of Maternity Allowance the self-employed woman receives.

Maternity Allowance for women who participate in the self-employed business of their spouse or civil partner

3.16 A similar approach to Option 1 could be taken for the MA earnings test for women who participate in the self-employed business of their spouse or civil partner.

Those women whose self-employed spouse or civil partner had profits at or over the SPT in the most recent self-assessment return, which covers the test period, would be able to receive the lower rate of MA (£27 per week) for up to 14 weeks.

Those without sufficient profits would be able to pay Class 3 NICs voluntarily so that their participating spouse or civil partner could access this (providing the participating spouse or civil partner also met the employment condition).

As noted above in the case of self-employed women, the government will consider requiring fewer than 26 contributions (as per the current requirement for 26 Class 2 contributions), in view of the higher cost of Class 3.

In relation to Option 2, the government considers that it may not be proportionate or administratively efficient to require the claimant to provide estimated earnings for her self-employed spouse or civil partner, in order that she can receive MA at the lower rate for up to 14 weeks.

As an alternative approach to one based on profits and/or voluntary contributions, the government proposes simply that, for this group, any claimant who meets the existing employment test would receive the lower rate of MA for up to 14 weeks.

The government welcomes views on these possible approaches for the design of the new earnings test for Maternity Allowance, and welcomes any other suggestions as to what a new earnings test/s could be based on after the abolition of Class 2.

It will consider all responses to the consultation before making a final decision on how to reform the tests that determine MA access for the self-employed.

Maternity benefits for employees vs. the self-employed

This chapter is concerned with how self-employed women would access Maternity Allowance after the abolition of Class 2, which is paid to self-employed women at a flat rate (at £139.58 for up to 39 weeks if they have paid 13 Class 2 contributions).

The government welcomes responses on the proposals set out above.

The government will use responses to its proposals on Maternity Allowance to consider whether and how these changes could facilitate closer alignment between maternity benefits for employees and the self-employed. It welcomes views on this.

Chapter 3 Questions

Question 8

Do you have any comments on the approaches proposed for Maternity Allowance in this chapter? Do you have any preferences for an approach based on:

a. A profits test with optional payment of Class 3 NICs during the 13 week test period (to protect those with low profits or who have no recent profits) b. Estimated earnings during the 13 week test period c. (For participating spouses only) The conditions of the existing employment test only

Question 9

Can you suggest any alternatives?

4. Self-employed people with multiple sources of earnings

As explained in chapter 2, contributory benefit entitlement is based on earnings (using Class 1 NICs), payment of Class 2 or 3 NICs, and/or NI credits. These classes of NICs operate on a weekly basis, and can be combined together for the purposes of benefit entitlement.

For the 2015-16 tax year, employees need to have earnings which are at or above the annual equivalent of the Class 1 Lower Earnings Limit (LEL) of £5,824 (52 x the weekly LEL of £112) for the year to gain a qualifying year for State Pension purposes.

Where an individual is both employed and self-employed, this figure of £5,824 can be made up of a combination of earnings and Class 2 NICs. Each weekly Class 2 contribution (and each weekly Class 3 contribution or NI credit) is equivalent to the weekly LEL of £112.

Class 4 NICs does not operate on a weekly basis; it is an annual charge on self-employed profits. It cannot currently be combined with other classes of NICs for benefit purposes.

Therefore, the government needs to consider the particular impact of a test based on annual profits on self-employed people with multiple sources of earned income.

Example D explains how this currently works in the context of an individual moving from employment to self-employment.

Example D – moving from employment to self-employment

In 2015-16, Raj earns £150 per week for 10 weeks and then becomes self-employed for the rest of the year, with profits of £7,000. He pays Class 2 NICs for the 42 weeks of self-employment. Raj’s deemed annual earnings for contributory benefit purposes is £6,204 (£1,500 + £4,704 (42 x £112)). This is above £5,824 so he has a qualifying year for contributory benefits.

Those individuals with earnings below the LEL throughout the year and profits from self-employment below the SPT may have combined earnings from employment and profits from self-employment that exceed the qualifying threshold of £5,824, but they will not qualify for contributory benefits.

This is because NICs operates on a per employment basis; NICs cannot be aggregated into a single total amount of annual earnings. These individuals would currently need to pay Class 2 voluntarily for the whole year if they wanted to protect their benefit position.

This is shown in Example E.

Example E – concurrent earnings

Edward is concurrently employed and self-employed. As an employee he has earnings of £100 per week (£5,200 for the year) and has self-employed profits of £4,000.

Because Edward’s weekly earnings as an employee are below the LEL of £112, they are not counted for benefit purposes; and because his profits from self-employment are below the SPT, he is not liable to pay NICs as a self-employed person either.

So even though his combined earnings and profits for the year are £9,200, he does not have to pay any NICs at all. However, he is able to pay Class 2 NICs voluntarily to build contributory benefit entitlement.

Those self-employed people with low annual profits whose NI credits cease during the year, such as when a benefit claim ends or when their youngest child turns 12, can also pay Class 2 voluntarily, like those moving between employment and self-employment as shown in Example D.

This is shown in Example F.

Example F – moving off benefits

Maria was ill and received ESA for 6 months between April 2015 and October 2015 – as a result she was entitled to (Class 1) NI credits throughout her period of sickness. In October she is well enough to stop claiming ESA and resume her self-employed work. Her profits for the 2015-16 tax year are £5,000, below the SPT.

She pays Class 2 NICs voluntarily for the remaining 6 months of the tax year. The combination of NI credits and Class 2 NICs achieve a qualifying year for the State Pension, and would also enable her to qualify for contributory ESA if she fell ill again.

The abolition of Class 2 NICs (and the introduction of an annual profits test for benefit entitlement) means that individuals in situations such as those illustrated in Examples D-F would no longer be able to pay Class 2 voluntarily to protect their State Pension Record.

As with the State Pension position of employees who have earnings below the LEL, a self-employed individual’s future State Pension would only be materially affected if these situations occurred in multiple tax years during an individual’s working life.

In these cases, individuals would be able to pay Class 3 voluntary NICs retrospectively to fill gaps in their State Pension record.

There could however be an impact on access to other benefits, in the same way that other individuals in certain circumstances would be affected by the abolition of Class 2 (as set out in chapter 2, paragraph 2.26).

As previously noted, the government is considering whether and how to retain the ability of self-employed individuals to build access on a voluntary basis to working age benefits. It will take account of the potential impact on individuals in these situations before making a final decision on the new benefit tests for the self-employed.

The government will also consider enabling individuals who move from employment to self-employment (and vice versa) during the year to pro-rata their self-employed profits into weeks when filing their self-assessment return, to accord with the period of self-employment. If these ‘weekly profits’ are at or more than the level of the LEL (of £112 in 2015/16), these would confer benefit entitlement for those weeks.

These could then be combined with other weeks in which Class 1 contributions were made, or with Class 3 voluntary NICs, to reach a qualifying year. The government welcomes comments on this possible approach for this group.

Chapter 4 Questions

Question 10

Do you have any comments on the proposals to provide for individuals moving into and out of self-employed within the tax year, who may be less able to achieve annual profits at the Small Profits Threshold?

5. Impact on ‘special groups’ of Class 2 NICs payers

Currently, Class 2 contributions can be paid by certain groups who are not necessarily self-employed, in order to gain access to contributory benefits. For some specific groups, Class 2 can also be paid at prescribed higher rates, to provide access to contributory benefits not available to those who pay the standard Class 2 rate.

In line with the objectives described in chapter 1, the proposals below ensure that these individuals would continue to be able to build benefit entitlement through the NICs system, and that no-one would lose access to the State Pension as a result of Class 2 abolition. The proposed approach would also align the NICs treatment of these groups with other workers, so contributory benefits would be accessed on a more equal basis to make the system fairer for all.

These are the government’s proposals only; the government will consider responses to this consultation before reaching a final decision on how these groups will be able to access contributory benefits following the abolition of Class 2 NICs.

Who are the special groups?

Group 1: Those with special rates of Class 2

- Share Fishermen

- Volunteer Development Workers

Share fishermen are those who work in the UK fishing industry and are paid a share of the earnings or profits of the vessel they work on. They pay the share fishermen rate of Class 2 NICs (currently £3.45 per week).

This rate is slightly higher than the main Class 2 rate, so that these individuals will be eligible for contribution-based Jobseeker’s Allowance (JSA) when they are unable to work, for instance because of bad weather conditions. Share fishermen also pay Class 4 NICs on their profits on the same basis as other self-employed workers.

In the future, it is intended that, as with other self-employed workers, share fishermen with profits at or above the Small Profits Threshold (SPT) would gain entitlement to contributory benefits via Class 4.

In line with other self-employed workers, those share fishermen with profits below the SPT would need to receive NI credits or pay Class 3 voluntary contributions to build up qualifying years for the State Pension.

Following the abolition of Class 2 NICs, the government proposes that there would be no specific arrangement – such as a special rate of contributions – that would give share fishermen continued access to contribution-based JSA.

In common with other individuals who do not satisfy the conditions for contribution-based JSA, share fishermen may be entitled to income-based JSA for periods when they are not working.

This would simplify the self-employed NICs system, aligning the treatment of share fishermen with other self-employed workers with regards to their contributory benefit entitlement.

Volunteer development workers (VDWs) are those who take part in projects in developing countries. They are able to pay a special rate of Class 2 contributions (currently £5.60 a week[footnote 10]). Paying Class 2 contributions provides a specific route for VDWs to protect both their State Pension and their working age benefit entitlement through voluntary contributions whilst working abroad.

Under the proposals to abolish Class 2 contributions, VDWs would have to pay Class 3 voluntary contributions like other workers – including volunteer workers in the UK – if they wished to continue to build entitlement to the State Pension voluntarily.

Again, a self-employed individual’s future State Pension would only be materially affected if these situations occurred in multiple tax years during an individual’s working life.

As noted in the previous chapter, the government is considering whether and how self-employed individuals would be able to access ESA, BSP and MA voluntarily; it is envisaged that any such arrangements would apply to share fishermen and VDWs.

Chapter 5 Questions

Question 11

For the following groups:

- Share Fishermen

- Volunteer Development Workers

Do you have any comments on the proposed approach?

Group 2: Those who are not self-employed in the UK but can pay Class 2 voluntarily

They are:

- self-employed working abroad

- individuals employed abroad

- mariners on foreign vessels

Class 4 liability follows income tax liability – when a self-employed person is working abroad there is no tax liability and therefore no Class 4 liability.

This means these individuals could not accrue qualifying years for benefit entitlement via a profits test in Class 4. Therefore this group would need to pay Class 3 voluntary NICs instead to protect their State Pension record following the abolition of Class 2 NICs. This would align the voluntary NICs position of NICs payers overseas with those in the UK.

Question 12

For the following groups -

- self-employed abroad

- employed abroad

- mariners on foreign flagged ships

Do you have any comments on the proposed approach?

Group 3: Those who are treated as self-employed specifically for NICs purposes and other groups affected by this change

They are:

- examiners

- ministers of Religion

- foster carers

- some landlords

Self-employed women with a married women’s reduced rate election are also included within this group for the purposes of this consultation, despite the fact that the very small number of individuals to whom this special NICs treatment applies are otherwise fully self-employed for all intents and purposes, rather than simply for NICs purposes.

Women with a married woman’s reduced rate election cannot pay Class 3 NICs and, with very limited exceptions, do not receive NI credits.

The Government believes that the special rules for these groups are outdated. Following the abolition of Class 2 NICs, it is envisaged for these groups that:

- Individuals liable for Class 4 NICs could gain benefit entitlement through the new Class 4 contributory benefit test like other self-employed people.

- Individuals who are unable to meet the conditions of the Class 4 NICs benefit test could pay Class 3 voluntary NICs or use NI credits to build up entitlement to the State Pension (for instance, there is already a specific NICs credit for Foster Carers).

As noted in the previous chapters, the government is considering whether and how self-employed individuals would be able to access ESA, BSP and MA voluntarily; it is envisaged that any such arrangements would apply to those in this group.

Question 13

For the following groups:

- examiners

- ministers of Religion

- foster Carers

- some landlords

- self Employed Women with a reduced rate election

Do you have any comments on the proposed approach?

Annex A: Summary of questions

This annex lists all questions posed in this consultation document.

Chapter 2: A reformed Class 4 NICs and an annual profits test

Question 1

Do you think that the government should seek to maintain the existing level of access to contributory benefits? If so, how do you think this should be achieved?

Question 2

This chapter explains the government’s proposed approach – a profits test at the Small Profits Threshold in Class 4 NICs – and how this could work for self-employed people with profits above the Small Profits Threshold to determine entitlement to the State Pension, Bereavement Benefit and contributory Employment and Support Allowance. Noting the difference between this and the existing benefit entitlement rules (set out in Annex C), what are your views on this general approach?

Question 3

What are your views on the proposed contributory tests in Table 2.A? Can you suggest any alternative contributory tests based on annual profits for: a. State Pension? b. Bereavement Support Payment? c. Employment and Support Allowance?

Question 4

To what extent do you think that people – and self-employed people in particular – are sufficiently aware of the existing provisions in the NICs system that currently protect entitlement to the State Pension and Bereavement Benefits, namely NI credits and Class 3 voluntary NICs?

Question 5

Do you agree that the government should align voluntary contributions (i.e. by making Class 3 the only voluntary NICs payment) for the new State Pension for employees and the self-employed? Please give reasons.

Question 6

Do you think the government should continue to enable individuals who have not made a contribution via sufficient self-employed profits to access: a. Bereavement Support Payment? b. Contributory Employment and Support Allowance?

Question 7

Do you agree that the government should consider facilitating this access through Class 3 voluntary contributions?

Chapter 3: Access to Maternity Allowance

Question 8

Do you have any comments on the approaches proposed for Maternity Allowance in this chapter? Do you have any preferences for an approach based on:

a. A profits test with optional payment of Class 3 NICs during the 13 week test period (to protect those with low profits or who have no recent profits) b. Estimated earnings during the 13 week test period c. (For participating spouses only) The conditions of the existing employment test only

Question 9

Can you suggest any alternatives?

Chapter 4: Those with multiple sources of earnings

Question 10

Do you have any comments on the proposals to provide for individuals moving into and out of self-employed within the tax year, who may be less able to achieve annual profits at the Small Profits Threshold?

Chapter 5: Impact on ‘special groups’ of Class 2 NICs payers

Question 11

For the following groups:

- Share Fishermen

- Volunteer Development Workers

Do you have any comments on the proposed approach?

Question 12

For the following groups -

- self-employed abroad

- employed abroad

- mariners on foreign flagged ships

Do you have any comments on the proposed approach?

Question 13

For the following groups:

- examiners

- ministers of Religion

- foster Carers

- some landlords

- self Employed Women with a reduced rate election

Do you have any comments on the proposed approach?

Annex B: The current system of self-employed NICs

NICs Classes relevant to the Self-employed

The self-employed pay two Classes of NICs; Class 2 and Class 4.

Class 2 NICs are a flat rate weekly amount. For the tax year 2015-16 the weekly rate of Class 2 is £2.80. The total amount of Class 2 NICs due from someone who has been self-employed for the whole of the 2015-16 tax year is £145.60.

They are liable to be paid if relevant profits[footnote 11] are equal to or exceed the Small Profits Threshold (SPT) of £5,965 in 2015-16. They can also be paid voluntarily for periods of self-employment if profits are below the SPT.

Payment of Class 2 NICs gives the self-employed access to:

- basic State Pension (until April 2016) / new State Pension (from April 2016)

- bereavement Benefits until April 2017 / Bereavement Support Payment (from April 2017)

- the standard rate of Maternity Allowance

- the lower rate of Maternity Allowance (for women who participate in the self-employed business of their spouse or civil partner)

- contributory Employment and Support Allowance

- contributory Jobseeker’s Allowance (for Share Fishermen and Volunteer Development Workers only, who each pay their own special rates of Class 2 to do so).

Class 4 NICs are a profits related liability payable on annual taxable profits. They are currently payable at 9% on profits between the Lower Profits Limit (LPL) of £8,060 and the Upper Profits Limit (UPL) of £42,385 and 2% on profits above the UPL. Class 4 currently provides no entitlement to contributory benefits. More detail on Classes 2 and 4 is set out below.

The self-employed may also be employed, in which case they could be paying Class 1 NICs in addition to Class 2 and Class 4.

Class 1 NICs are earnings related and paid by employees and their employers. For the current tax year, employees pay 12% on earnings between the Primary Threshold of £155 per week and the Upper Earnings Limit (UEL) of £815 and 2% on earnings above the UEL. Employees earning between the Lower Earnings Limit (£112 per week) and the Primary Threshold per week do not pay Class 1 NICs but are treated for contributory benefit purposes as having paid Class 1 NICs.

Class 1 NICs gives employees entitlement to:

- contributory Employment and Support Allowance

- contributory Jobseekers Allowance

- basic State Pension (until April 2016) / new State Pension (from April 2016)

- additional State Pension

- bereavement Benefits (until April 2017) / Bereavement Support Payment (from April 2017).

The self-employed may also pay Class 3 voluntary contributions or receive NI credits.

Class 3 NICs are a flat rate voluntary payment of £14.10 a week which gives those who have gaps in their contribution record an opportunity to protect future benefit entitlement for certain benefits. Class 3 contributions gives employees entitlement to –

- basic State Pension (until April 2016) / new State Pension (from April 2016); and

- bereavement benefits until April 2017.

Some people are eligible for National Insurance credits (NI credits) which can give the equivalent eligibility as paying Class 1 or Class 3 contributions, depending on the type of credit.

Class 2 NICs

All individuals aged 16 or over and who are self-employed are required to pay a flat rate Class 2 contribution in respect of each contribution week in a tax year in which they carry on activities as a self-employed earner and profits exceed the SPT. This liability continues until the person:

- reaches State Pension age;

- stops being ordinarily self-employed; or

- is otherwise exempt from Class 2 NICs.

From April 2015, Class 2 NICs are paid through Self-Assessment (SA) alongside income tax and Class 4 NICs. Information about the SA process is set out below in this chapter.

Although every self-employed person who has profits equal to or above the SPT is required to pay Class 2 NICs, anyone who completes an SA return which indicates that their profits are below the SPT and are therefore not liable to pay, can currently pay Class 2 voluntarily to protect benefit entitlement.

Certain members[footnote 12] of the special groups in chapter 5 above – who are only self-employed for NICs purposes – are not liable to pay Class 2 but can pay on a voluntary basis. They are not required to file the self-employed pages of a SA return so alternative methods of payment are in place for them. They can either pay by annual payment or by direct debit.

National Insurance Contributions Act 2015 – Simplifying Self-employed NICs

Prior to April 2015, Class 2 NICs were collected through monthly direct debits or six-monthly billing and Class 4 NICs were collected alongside tax through Self-Assessment (SA).

This was confusing and administratively burdensome to have two collection routes. The Consultation Paper – Simplifying the National Insurance Processes for the Self Employed published in July 2013 proposed that Class 2 NICs were collected alongside Class 4 NICs through SA.

The consultation also proposed that rules regarding the Small Earnings Exception (SEE) were simplified. A feature of self-employed NICs was that a person was liable to pay Class 2 NICs if they were self-employed unless they registered in advance that they were likely to have low profits. If they failed to do this they were liable to pay Class 2.

Feedback indicated that it was very difficult to predict whether profits were going to be low and to therefore apply for an exception from Class 2 liability.

The consultation proposed that, instead of the self-employed having to predict their profits, Class 2 liability would be based on actual profits reported. If profits were below the SPT the self-employed person is not liable to pay Class 2 NICs but could pay voluntarily to protect benefit entitlement.

The National Insurance Contributions Act 2015 implemented the changes to the collection of Class 2 NICs, so the collection of Class 2 NICs due for 2015-16 tax year will now be through SA alongside tax and Class 4 NICs (in January 2017).

In addition, the self-employed no longer have to predict in advance whether or not they are likely to have low profits. They can now wait until they file their returns; if profits are below the SPT they are not liable to pay but can choose to pay Class 2 NICs voluntarily.

Class 4 NICs

As well as paying Class 2 NICs, most self-employed people who are required to pay Class 2 NICs are also required to pay Class 4 NICs. Class 4 NICs are paid by those whose profits are:

- immediately derived from the carrying on of a trade, profession or vocation;

- chargeable to income tax under Chapter 2 of Part 2 of the Income Tax (Trading and Other Income) Act 2005 (ITTOIA), (formerly Case I and II of Schedule D of the Income and Corporation Taxes Act 1988); and

- not profits of a trade, profession or vocation carried on wholly outside the United Kingdom.

Class 4 NICs do not currently give the payer any entitlement to contributory benefits. They were introduced so that the self-employed could pay a fairer share of the costs associated with providing contributory benefits.

As with all NICs receipts, a proportion of Class 4 NICs helps fund the NHS while the remainder is paid into the National Insurance Fund to fund contributory benefits.

How are Class 4 NICs assessed?

Class 4 NICs are calculated as a percentage of the taxable profits falling between a lower and an upper profit limit, in a year of assessment. The year of assessment is the income tax year for which tax under ITTOIA is payable.

The amount of tax and Class 4 NICs payable is normally based on the profits or gains for the accounting year which ended in the income tax year. The accounting year is normally the period of 12 months covered by a contributor’s accounts. It can start on any day.

Class 4 NICs are paid in respect of a person’s annual profits and are assessed and payable for the year, irrespective of whether the person commenced or ceased their self-employment part way through a tax year.

When are Class 4 NICs not payable?

Payment of Class 4 is not required where a person:

- does not derive their profits from a trade, profession or vocation (for example receives investment income);

- has taxable profits below the Class 4 lower profits threshold;

- is, at the beginning of a tax year, at or over State Pension age;

- is, at the beginning of the tax year, under the age of 16;

- is non-resident for tax purposes;

- is a trustee, guardian, tutor, curator, or committee of an incapacitated person who would otherwise be assessable and liable to Class 4 NICs;

- is any other form of trustee;

- works as a diver or diving supervisors in certain circumstances;

- Others who are chargeable to tax on business profits but who are treated as employed earners for contribution purposes.

Special Class 4 NICs

Special Class 4 NICs are payable by an earner who is treated as a self-employed earner by regulations. Special Class 4 NICs are calculated by reference to the same percentages and thresholds as ordinary Class 4 NICs but they are payable on what would otherwise be the earner’s Class 1 earnings. At present special Class 4 NICs are payable by some examiners.

The Self-Assessment (SA) process

When an individual becomes self-employed they are required to notify HMRC and register for tax and NICs. They can do this through the Online Tax Registration Service (OTRS) which currently registers the individual for SA.

After the end of the tax year, the individual will receive a notice to file an SA return which would be due by 31 October if filing a paper return (and by the following 31 January if filing online). The individual has until 31 January in the following calendar year to pay the SA liability that is due. This amount will include the income tax and Class 2/4 NICs that are due.

For the 2015-16 tax year, an individual will receive a notice to file in April 2016. If the individual’s SA liability is more than £1,000 they will also make an interim payment towards the next year’s SA liability (2016-17 tax year), with a second interim payment due by the 31 July 2016. The SA Return for the 2015-16 tax year and final balancing paying is due by 31 January 2017.

The collection of Class 2 through SA only started from April 2015 – from this year when a self-employed person makes their SA payment it will include their Class 2 liability.

Example G

For the tax year 2015-16 the rates and thresholds applicable to Class 4 NICs are:

| Lower Profits Limit (LPL) | £8,060 |

| Upper Profits Limit (UPL) | £42,385 |

| Class 4 percentage payable on profits between LPL and UPL | 9% |

| Class 4 percentage payable on profits above the UPL | 2% |

Pam started self-employment in mid-June 2015 and was self-employed for the remainder of the year (42 weeks). In respect of the 2015-16 tax year her profits from her business were £45,000.

Pam is required to pay the following Class 2 and 4 NICs for the 2015-16 tax year. 2015-16 SA return must made by 31 January 2017.

| Class 2 | 42 weeks x £2.80 | |

| Class 4 | £45,000 – £42,385 = £2615 x 2% | |

| - | £42,385 - £8,060 = £34,325 x 9% | £3,089.25 |

| - | Total | £3,259.15 |

2015-16 Class 2 and Class 4 liability are collected through SA alongside tax liability by 31 January 2017.

These examples do not take account of possible changes arising from Making Tax Digital.

Annex C: The current benefit tests for the self-employed

State Pension

The new State Pension will start from 6 April 2016 and will apply to anyone reaching State Pension age on or after that date.

Entitlement is based on a person reaching State Pension age and having satisfied the minimum qualifying period (MQP) which is set at 10 qualifying years.

To gain a qualifying year a person must have: * paid Class 1, 2 or 3 NICs, * been treated as having paid Class 1 NICs, or * been credited with NI credits

Equal to the LEL x 52 in any tax year. NICs and NI credits can be combined to make up a qualifying year.

- transitional arrangements will apply to people who have made NI contributions before the start date. NI contributions and credits made before 2016 will be recognised through the calculation of a “starting amount”, which will be the higher of a person’s entitlement as at 6 April 2016 calculated under old rules or the new scheme rules (assuming the new State Pension had been introduced at the start of their working life).

- where the starting amount is less than the full rate of the new State Pension, a person can increase it by adding further qualifying years up to that rate. Where the starting amount based on old rules exceeds the full rate of new State Pension as at 6 April 2016, the excess will be awarded as a protected payment.

- periods of contracting out will be taken into account in the starting amount calculation. Where entitlement is based on old rules a contracted-out deduction will be made. Where entitlement is based on new scheme rules a rebate derived amount will be taken into account.

- people who start making NI contributions for the first time after 6th April 2016 will need 35 qualifying years to gain the full amount; a pension will be paid at a reduced rate where a person has between 10 and 34 qualifying years.

- periods of foreign insurance can be used to meet the MQP. The current contribution conditions for the basic State Pension i.e. for those reaching State Pension age on or after 6 April 2010 up to 5 April 2016, are:

- 30 qualifying years for a full basic State Pension (before 6 April 2010 women normally needed 39 qualifying years and men 44 qualifying years);

- class 2 NICs do not count towards additional State Pension entitlement.

People with fewer than 30 qualifying years will get 1/30th of the full basic State Pension for each qualifying year they have up to a maximum of 30/30ths (This replaced the previous minimum contribution conditions that a person must have had at least 25 per cent of the qualifying years required for a full basic State Pension to get any basic State Pension at all, at least one qualifying year of which must have been paid, or treated as paid, NICs).

Maternity Allowance (MA)

Entitlement is based on satisfying two conditions and is payable for up to 39 weeks:

The employment condition:

Must have worked as an employee or as a self-employed person for at least 26 weeks in the 66 week period before the week in which the baby is due. This is 66 week period is called the test period.

The earnings condition (s):

-

must have earned at least £30 per week on average in at least 13 weeks in the 66 week period from employment. This minimum is called the MA Threshold

-

for self-employed women, they must have paid 13 weeks Class 2 NICs for at least 13 weeks in the test period to receive the standard rate; if this has not been paid they receive the lower rate

Women who participate in the business of their self-employed spouse or civil partner, but receive no pay, can also receive MA. They must not be self-employed, employed or a partner in the business. In these cases, MA is paid for up to 14 weeks, and there are two qualifying conditions.

Employment condition:

The woman must have taken part in the self-employed business of her spouse or civil partner for at least 26 weeks in the test period

Earnings condition:

The self-employed spouse or civil partner must have paid Class 2 NICs for the same 26 weeks in which the participating spouse took part in their business.

Bereavement Benefits

Bereavement Benefit is being replaced by Bereavement Support Payment (BSP) in April 2017.

Bereavement Support Payment:

NI Contribution condition is that from April 2017 they must have paid (or treated as paid) Class 1 or 2 NICs in any one tax year on earnings of at least 25 times the LEL for that year. Class 3 or NI Credits will not satisfy the contribution condition for BSP.

Employment and Support Allowance (contributory)

A claimant is entitled to contributory ESA if he satisfies the basic conditions set out in section1(3) and the first and the second contribution conditions set out in Part 1 of Schedule 1 to the Welfare Reform Act 2007.

The first contribution condition (FCC) is that, in respect of either of the last two income tax years immediately preceding the beginning of the relevant benefit year[footnote 13] (RBY), and before the beginning of the relevant benefit week (RBW), a claimant must actually have paid (or be treated as having paid) Class 1 NICs, or Class 2 NICs, or a combination of the two, for at least 26 weeks.

Only the earnings at the lower earnings limit (LEL) are taken into account each week. Any earnings above this level are disregarded. This means the claimant must have worked for 26 weeks to satisfy the FCC. The two income tax years immediately preceding the RBY are referred to as the “relevant income tax years” (RITYs).

The second contribution condition is that, in respect of both RITYs, the claimant must actually have paid (or be treated as having paid) Class 1 (standard rate) NICs on earnings of at least 50 times the LEL or been credited with Class 1 earnings for at least 50 weeks, or paid Class 2 NICs for at least 50 weeks, or paid a mixture thereof and/or been credited with Class 1 earnings which, in combination, amount to contributions on earnings of at least 50 times the LEL.

Jobseeker’s Allowance

A claimant is entitled to contribution-based JSA if he satisfies the basic conditions set out in section 1 of the Jobseekers Act 1995 and the four further contribution conditions set out in section 2.

The first and second contribution conditions are similar to the matching ESA conditions, with the following modifications:

- for references to the RBW read “the week for which a jobseeker’s allowance is claimed”;

- for the definition of the RBY read the “benefit year which includes the beginning of the jobseeking period which includes the week for which a jobseeker’s allowance is claimed”;

and

- Class 2 NICs do not normally count. The exceptions are the special Class 2 NICs paid by (a) share fishermen[footnote 14] and (b) volunteer development workers[footnote 15] .

The third and fourth contribution conditions are not relevant in this instance.

Carer’s Allowance

In Carer’s Allowance, the claimant may earn a net income up to the amount of the CA earnings limit (currently £110 a week) without losing CA entitlement.

For self-employed claimants, a notional NI contribution (Class 2 and Class 4) is calculated based on the profit figure in the claimant’s business accounts. Where the claimant’s profit is below the Small Profit Threshold (SPT), currently £5,965 (2015/16 rate), they will have no NI liability, so no NI deduction will be made in the earnings calculation.

For profits above the SPT, the NI notional liability will be calculated using the appropriate rate, including a Class 4 NICs deduction for those with profits above the Lower Profits Limit, currently £8,060 (2015/16 rate).

Universal Credit

Universal Credit provides a new single system of means-tested support, for working-age people who are in or out of work. Support for housing costs, children and childcare costs are integrated in the new benefit. It also provides additions for disabled people and carers.

Universal Credit also supports people to be self-employed where this is the best route for them to become financially self-sufficient. Entitlement is not dependant on National Insurance, but is subject to other conditions, including household income and capital.

Although the way Universal Credit treats a household’s earnings means that they are better off in work than they would be in the legacy system, household earnings may still mean that there is lower or no entitlement. Capital limits can have the same effect.

There are also specific conditions for the self-employed. Self-employed earnings are taken into account net of tax and national insurance, plus certain permitted business expenses.

For those who started self-employment more than one year ago, another condition is the Minimum Income Floor, an assumed level of earnings designed to encourage and incentivise individuals to increase their earnings through developing their business.

Working Tax Credit

The Working Tax Credit provides support to working adults who face disadvantage because they have a disability or are in low-income households.

To claim Working Tax Credit, a person or persons, in a joint claim, must be working a prescribed number of hours per week for payment or in expectation of payment. A claimant has to be 16 or over to qualify. They must be 25 or over if they are not responsible for a child or have a disability.

They must work a certain number of hours per week:

- aged 25 to 59 – at least 30 hours per week

- aged 60 or over – at least 16 hours per week

- disabled – at least 16 hours per week

- single with one or more children – 16 hours per week

- couple with one or more children (with one working at least 16 hours per week)

Work can be employment or self-employment. If self-employed, they must undertake a trade, profession or vocation, carried out on a commercial basis, which is regular and organised, with a view to a realisation of a profit.

-

This reflects the delay in reporting annual profits via self-assessment and recording entitlement from a profits test. ↩

-

See here in Annex B ↩

-

For employees this applies on a weekly or monthly basis rather than annually, because they are paid through PAYE. ↩

-

Earnings beneath the LEL or above the UEL are not counted towards this total of £5,824. ↩

-

This was in response to a report – “The Modernisation of Britain’s Tax and Benefit System: Number 2 (Work Incentives: A report by Martin Taylor)” – which was published in 1998. It recommended that Class 2 contributions were abolished and replaced by a more appropriate regime. ↩

-

Class 2 NICs only confers entitlement to the Basic State Pension; unlike employees, the self-employed cannot get the Second State Pension. ↩

-

Transitional arrangements will apply in respect of contributions made before the introduction of the new State Pension in April 2016; these are described in Annex C. ↩

-

The impact on Bereavement Benefits is not considered here in depth because they will be replaced by BSP by the time Class 2 could be abolished. ↩

-

Class 3 currently confers State Pension entitlement only – this would need to change to facilitate this option. ↩ ↩2

-

This corresponds to 5% of the weekly Lower Earnings Limit (LEL) in Class 1: Primary NICs ↩

-

Relevant profits are profits in respect of which Class 4 contributions are payable under section 15 of the Social Security Contributions and Benefits Act 1992 ↩

-

e.g. Ministers of religion, voluntary payers abroad, some landlords and examiners. ↩

-

A “benefit year” is defined in section 21(6) of the Social Security Contributions and Benefits Act 1992. It means a period beginning with the first Sunday in January in any calendar year, and ending with the Saturday immediately preceding the first Sunday in January in the following calendar year (but can be made to mean such other period as may be prescribed in regulations). ↩

-

Share fishermen are classed as self-employed earners by virtue of regulation 125(a) of the Social Security (Contributions) Regulations 2001 (made under section 2(2)(b) SSCBA) and pay - or are allowed to pay voluntarily - a special higher rate of Class 2 NIC (£3.45 for 2015/16) to retain entitlement to contribution-based JSA ↩

-

Volunteer development workers who, if employed under a contract of service, pay no Class 1 NICs on earnings under that contract, are treated as self-employed earners (by virtue of regulation 150 of the Social Security (Contributions) Regulations 2001) and are allowed to pay a special rate of Class 2 NIC (£5.60 for 2015/16) through which they can acquire entitlement to contribution-based JSA. ↩