The government’s planning and performance framework

Updated 14 June 2021

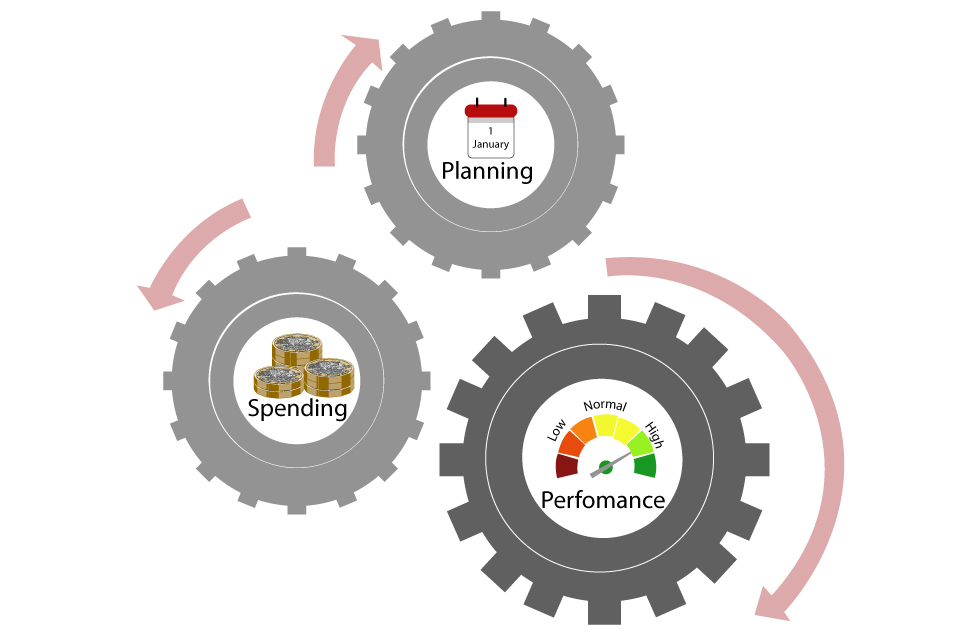

The government sets priorities, plans activity, allocates money and monitors its progress and performance using a collective set of processes – the government’s planning and performance framework.

The framework has developed and been improved over time to reflect the government’s approach to accountability, respond to the needs of new governments and Parliament (on behalf of the public) and support the government’s aim for transparency. It also forms part of the government’s approach to managing public money to ensure value for money in the short and long-term.

In the UK, the Prime Minister leads the government and appoints secretaries of state to take responsibility for each ministerial department. Non-ministerial departments and other government organisations do not have a secretary of state. Each department and organisation must have an accounting officer, who is usually the most senior civil servant in the organisation. Every secretary of state and accounting officer is directly accountable to Parliament and responsible for putting government policy into practice. They do this by planning and overseeing the performance and spending of their department or organisation in conjunction with many of the processes that make up the government’s planning and performance framework.

The government decides its policies through collective agreement within the cabinet. Many areas of the government’s work involve departments working together. The government manages this through the cabinet and its committees, inter-ministerial groups and implementation taskforces. For example, implementation taskforces bring together ministers from across different areas of government to track the implementation of specific policies ranging from housing to modern slavery, and seek to overcome barriers where they are identified.

The government’s planning and performance framework comprises several processes:

- Outcome Delivery Plans set out how each UK government department will use its resources to work towards the delivery of its priority outcomes, which capture the government’s long-term policy objectives

- Spending reviews, the Budget and Supply Estimates determine and set out publicly a department’s funding and how it will allocate its budget

- Annual Reports and Resource Accounts present a department’s performance in a financial year and the outcomes it has achieved as a result of its spending and activity

- Whole of Government Accounts and Public Expenditure Statistical Analysis set out public spending as a whole, giving a comprehensive picture of what the government receives, spends, owns and owes

Within the planning and performance framework, the government uses a budgeting system that has remained constant since its introduction in 1998. The government uses the system to consider all forms of public expenditure. The budgeting system:

- sets strict budget limits that cannot be exceeded, such as spending on services or resources. These are known as Departmental Expenditure Limits (DEL)

- agrees budgets for demand-led spending which can be reviewed, such as spending on benefits and pensions. This are known as Annually Managed Expenditure (AME).

The budgeting system makes sure that public spending is controlled. Together with the planning and performance framework it also encourages departments to manage spending efficiently and effectively. Together, this approach ensures government can provide high quality public services that offer value for money to the taxpayer.

Parliament and the National Audit Office (NAO) use many of the processes in the framework to hold the government to account. You can use the publicly available information from these processes to understand government’s planning, spending and performance over time. The government uses these processes to make decisions that can apply over multiple years or that can change activity in the short term. To manage this, many of the processes are designed to reflect where there have been changes to plans, spending or performance. A movement or change in one part of the framework will require the change to be reflected somewhere else. Below you can see how the framework currently works and how the processes interact with each other.

1. Spending Review

This is a planning process for the government.

HM Treasury carries out Spending Reviews to determine how to spend public money – usually over a multi-year period - in line with the government’s priorities. The overall amount of spending available is informed by the wider fiscal position. The money the government spends is reviewed to ensure future funding continues to be efficient and cost-effective. HM Treasury then sets the maximum amount each government department can spend in the years specified under the Spending Review; these are known as departmental settlements.

HM Treasury uses information and evidence from government departments and bodies, such as the Office for Budget Responsibility (OBR) during the Spending Review process.

Spending Reviews cover the whole of the UK including the devolved administrations in areas where spending responsibility is devolved, such as for education or health. The Barnett formula applies at Spending Reviews and fiscal events and allocations to each of the devolved administrations are calculated by HM Treasury on the basis of the settlements reached with UK government departments as set out in the Statement of Funding Policy. The devolved administrations also have their own revenue-raising powers. The devolved administrations then prioritise this funding themselves across policy areas for which they have responsibility.

Spending Reviews provide certainty to departments for several years and encourage consideration of long-term value for money when making spending decisions, by ensuring that spending is focused on the medium to long-term priority outcomes that government is aiming to achieve.. Such spending decisions might include near-term spending on a service such as day to day NHS spending or investing in decades-long programmes such as High Speed Rail to prepare for the future needs of the country. Departments are responsible for organising, allocating and managing their resources. The budgeting system is set up to make sure that departments have good incentives to manage their business well, prioritise across programmes, and deliver value for money.

Once a Spending Review is complete, the main government departments publish a plan for what they will achieve over the course of the Parliament, called an Outcome Delivery Plan. These plans are informed by Spending Review settlements.

Parliament votes to approve the release of funding through the Supply Estimates process. The government can adjust spending plans at fiscal events (such as the Budget).

2. Outcome Delivery Plans

This is a planning and a performance monitoring process for the government.

The government introduced Outcome Delivery Plans in 2021, which build on and improve the previous Single Departmental Plans. They set out how each UK government department is working towards the delivery of its priority outcomes.

Priority outcomes and metrics

Each UK government department has agreed priority outcomes which capture the government’s long-term policy objectives, from maximising employment and improving skills to achieving net zero by 2050. In areas where closer working between departments would achieve better results, outcomes are agreed on a cross-cutting basis between departments - reflecting the government’s commitment to breaking down silos and enabling stronger collaboration between departments. Further, metrics are identified and agreed for each outcome, against which progress towards delivering these outcomes can be measured.

Delivery plans

Outcome Delivery Plans set out how each UK government department is delivering its priority outcomes, together with clear deliverables and metrics for measuring success. In areas were outcomes are shared between departments, Outcome Delivery Plans enable departments to plan together. Delivery plans also set out how the Government is driving forward a modern and high-quality Civil Service that attracts and invests in great people, embraces new ideas, and is equipped for the delivery of better outcomes. Additionally, the plans place a greater emphasis on high-quality evaluation, which is critical to understanding what truly delivers outcomes for citizens.

Outcome Delivery Plans are revised annually. They are linked to the Spending Review and the Budget processes, as part of the planning and performance framework, so that a department can show how it will use its resources (the funding set in its departmental settlement and any adjustments to spending plans made at fiscal events, such as the Budget) to work towards priority outcome delivery.

Departments produce more detailed business plans to manage their activities. Cabinet Office and HM Treasury make sure departmental business plans reflect the whole of the government’s priorities and can be achieved within the departmental settlements agreed at the Spending Review.

The government uses regular reporting to monitor progress against Outcome Delivery Plans. Parliament and the public are able to review how each department is performing against its priority outcomes in their Annual Report and Accounts, which departments publish annually after the end of each financial year. More regular performance information for many of the metrics agreed for priority outcomes can be found in official statistics and other public datasets. Hyperlinks to these datasets have been included in Outcome Delivery Plans to make this data more accessible to the public.

3. The Budget

This is a planning and a spending process for the government.

The Budget is a statement the Chancellor of the Exchequer makes to the House of Commons on the nation’s finances and the government’s proposals for changes to taxation and spending. The Budget also includes forecasts for the economy by the Office for Budget Responsibility (OBR).

The Chancellor uses the Budget to set out his or her objectives for the government’s finances. In the Budget document, you can see:

- details on the wider economic context facing the UK;

- the outlook for the public finances;

- and a summary of the fiscal impact of all the decisions announced in the Budget statement.

Elements of the government’s spending plans may change as a result of decisions announced in the Budget. The Budget is an opportunity to consider what changes may be needed to public spending to respond to changes in the wider economic context.

Each Budget is accompanied by an OBR forecast and a scorecard which sets out the yield or cost of Budget decisions. The OBR certifies the policy costings of Budget decisions to provide an objective assessment of the government’s fiscal plans.

Parliament also scrutinises the Budget. Traditionally the Leader of the Opposition, rather than the Shadow Chancellor replies to the Budget Speech. The Budget is usually followed by four days of debate on the ‘Budget Resolutions’ - these are the tax measures announced in the Budget. Each day of debate covers a different policy area such as health, education and defence.

The Commons Treasury Select Committee - a cross-party committee of MPs – also holds an inquiry into the government’s proposals. The Committee gathers evidence from expert witnesses and publishes a report with its conclusions and recommendations.

At the Budget, HM Treasury sometimes adjusts the departmental spending limits of some departments set in the Spending Review to reflect changes in the government’s priorities. Outcome Delivery Plans are revised annually to reflect such policy decisions and spending adjustments.

4. Supply Estimates

This is a spending process for the government.

Supply Estimates are the bi-annual process by which HM Treasury presents the government’s spending plans, based on departmental settlements allocated at the Spending Review, to Parliament for approval. This covers ‘Main Estimates’ and ‘Supplementary Estimates’.

Main Estimates are published at the start of the financial year and contain spending limits for all government organisations. They include Departmental Expenditure Limits (DEL) and budgets for Annually Management Expenditure (AME). There are processes in place for Parliament to scrutinise the figures. These include scrutiny by departmental select committees and debates on chosen departmental Estimates in the House of Commons. Once the Main Estimates have been approved by Parliament and Royal Assent has been given (this is when the King formally agrees to make the Main Estimates bill into an Act of Parliament), government organisations are able to access the funds. The National Audit Office (NAO) and Public Accounts Committee (PAC) will check that departments adhere to the limits set for their DEL and AME budgets.

The Supplementary Estimates give the government a last chance to adjust the spending limits set in the Main Estimates before the end of the financial year. These take into account changes in departments’ activity resulting from Machinery of Government changes, and are a more accurate reflection of the government’s spending within the financial year. These are published in February and again are subject to the same approval and scrutiny processes.

Both the Main and Supplementary Estimates are publicly available on GOV.UK and allow users to be able to see the spending limits set for every department. HM Treasury arrives at these limits through the Spending Review process, process and sometimes adjusts the limits for some departments at fiscal events, such as the Budget. Departments and HM Treasury make minor amendments during the year. Departments publish their final spending against these limits in their Annual Report and Resources Accounts.

5. Annual Report and Resource Accounts

This is a performance reporting process for the government.

An Annual Report and Resource Account (ARA) provides an overview of what a government organisation has spent, received, owns and owes. Organisations prepare ARAs at the end of each financial year to report their financial results to Parliament. In each ARA you can find:

- A performance report setting out the structure, aims and objectives of the organisation and a review of how it has performed against these during the year. The report focuses on the previous 12 months. Central government departments will report against the priority outcomes and performance metrics set out in their Outcome Delivery Plans

- An accountability report which sets out how the organisation ensures good governance, and the systems and controls in place to manage risks. This section also includes a reconciliation of how the organisation has spent the resources allocated to them by Parliament through the Supply Estimates process

- Financial statements that cover the previous financial year and represent the organisation’s financial position in accordance with International Financial Reporting Standards (IFRS)

Organisations also publish a separate Accounting Officer System Statement. This shows you who is accountable for what at all levels in the organisation and provides clarity on internal governance arrangements.

The ARAs are independently audited to ensure both Parliament and the public can be confident in the figures presented. The audit report on the ARA is included in the document. Any material errors in the content or control breaches (spending money without the necessary parliamentary or HM Treasury approval) will result in a qualification in the ARA. This means that the auditor is stating that the accounts are not a true and fair reflection of the organisation’s financial results. The accounting officer could be called to their parliamentary select committee to explain the circumstances that led to the qualification, helping Parliament hold departments to account for their spending.

All government organisations covered in the Supply Estimates process are required to lay Annual Reports and Resource Accounts in Parliament each year, and are expected to do this before the summer recess in July. Organisations compile ARAs using an international framework (IFRS) and are therefore comparable to those produced by private sector organisations.

HM Treasury annually reviews the requirements for the ARAs, to accommodate changes in accounting policy and corporate reporting requirements. The Financial Reporting Advisory Board (FRAB) scrutinises and reviews any changes prior to adoption to ensure they are justifiable and appropriate. The Board is independent of government and reports its views on changes to the accounting framework to Parliament each year.

6. Whole of Government Accounts

This is a spending process for the government.

The Whole of Government Accounts (WGA) is a consolidated set of financial statements for the UK public sector. HM Treasury prepares it annually, bringing together the audited financial results of over 6000 entities. WGA includes central government departments, academies, devolved administrations, NHS trusts, local authorities and public corporations such as the Bank of England.

The WGA provides an overview of what government receives, spends, owns and owes (often referred to as income, expenditure, assets and liabilities). WGA includes other information, such as staff numbers across the public sector, and future spending that the government is committed to. WGA is unique, as it allows you to see the financial performance and position of the entire public sector. It is written in plain English, independently audited and supported by analysis to show how the public finances have changed over time.

WGA is increasingly important to the ongoing management of the public finances and to manage risks more effectively. For example, the Office for Budget Responsibility (OBR) independently reports on the future sustainability of the public finances in its annual Fiscal Sustainability Report, drawing on the data published in WGA. HM Treasury also uses WGA data to monitor contingent liabilities and potential future events that may have an effect on the value of what the government owns or owes, known as balance sheet risks. It complements other spending analysis such as the National Accounts that the Office for National Statistics publish, and provides additional information to provide insight into the public finances. WGA includes information of long term liabilities that are not included in the National Accounts. This information is available in the published accounts of individual government bodies, but WGA brings this together to provide a picture of the government’s total long term liabilities. Publishing the WGA is another way the government fulfils its promise to make more data available to the public.

The National Audit Office independently audits WGA, giving both Parliament and the outside world greater confidence in the figures. They are also scrutinised by Parliament through the Public Accounts Committee. HM Treasury first published WGA in 2012, for the financial year ended 31 March 2010.

7. Public Expenditure Statistical Analysis

This is a spending process for the government.

Public Expenditure Statistical Analysis (PESA) is a document prepared for Parliament. It includes a range of information on public spending statistics including:

-

Departmental budgets - the key central government departmental budgets that the Government uses to control spending. Departments have separate resource and capital DEL budgets

-

By function – public spending is shown against ten functions (e.g. education, health, defence) that are then further divided into more detailed sub-functions (education is split into categories such as primary and secondary)

-

By economic category – this shows spending against categories such as pay, procurement and grants

Statistics in most tables cover five years of outturn and also any years that the Spending Review spans.

8. Official statistics and other public data releases

Further official statistics and public data on performance, public spending, government major projects and workforce that the government uses to monitor performance are routinely released into the public domain when they become available. The Office for National Statistics (ONS) issues a variety of releases that cover both economic and non-economic statistics. This includes the National Accounts, and the monthly ‘Public Sector Finances’ release that is jointly prepared with HM Treasury. HM Treasury publishes Public Spending Statistics that provide information on departmental spending over the previous five years, which is updated on a quarterly basis. Departments publish data on the progress of projects currently in the Government Major Projects Portfolio (GMPP), which is updated annually.

Departmental performance statistics and other public data for specific areas of government activity are published regularly on GOV.UK. You can filter results in the statistics or publications section of GOV.UK to find the information that interests you.