Decision on Capita Interiors Limited

Published 28 September 2018

Order under the Companies Act 2006

In the matter of application No. 1410

For a change of company name of registration No. 10642868

Introduction

The company name CAPITA INTERIORS LIMITED (‘the primary respondent’) has been registered since 28 February 2017 under number 10642868. On 4 April 2017 (‘the relevant date’), Capita Plc (‘the applicant’) filed an application for an order to be issued changing the name of the company. This is on the basis that the applicant claims to have a protectable goodwill in the name CAPITA and that the respective names are sufficiently similar to CAPITA for the use of the primary respondent’s name in the UK to be likely to mislead by suggesting a connection between the company and the applicant.

Claims

At the request of the applicant, Mr Hitesh Hirji Gami, the sole director of the primary respondent, was joined to the proceedings under section 69(3) of the Companies Act 2006 (‘the Act’). Mr Gami was given notice of the applicant’s request for him to be joined and was given an opportunity to comment or to object to the request. Mr Gami did not object to being joined and confirmation of this was sent to him on 12 July 2017.

The applicant claims that the name associated with it is CAPITA. It is the parent group for 116 entities which use the name CAPITA as part of their company name. It claims that it has a vast reputation and goodwill in this name which has been used extensively in relation to business process outsourcing and professional services across a range of sectors, including central and local government, insurance, financial services, transport, education, health, ICT, HR and property. The applicant is the UK’s leading outsourcing company, employing over 68,000 people. In 2013, turnover amounted to £3.851 billion, with a pre-tax profit of £475 million. Over 98% of turnover is generated by companies and operations which use the CAPITA name. The applicant is listed on the London Stock Exchange and is a FTSE 100 company.

The applicant objects to the company name CAPITA INTERIORS LIMITED because it claims that it is sufficiently similar to CAPITA and its use in the UK is likely to mislead by suggesting a connection between the company and the applicant. This is a pleading under section 69(1)(b) of the Act. The applicant requests the Tribunal to make an order under section 73 of the Act for the name to be changed to a name which does not offend[footnote 1].

The primary respondent filed a notice of defence and a counterstatement which were completed by Mr Gami. The primary respondent denies all of the allegations made and stated that ‘We are quite simply, an interior design company providing bathrooms and kitchens and wardrobes’. It also stated that it is not seeking an award of costs in its favour and that he had contacted the applicant to resolve this matter amicably. This is a comment he has repeated throughout these proceedings and that his efforts for resolution have been unsuccessful with the applicant largely ignoring his correspondence.

The primary respondent seeks to rely upon various defences. In its words these are summarised as follows:

-

Our company is operating under the name of Capita Interiors Ltd. We got authorisation three times from Companies house to do this even after we showed them Capita’s PLC’s letters…

-

Our company name was adopted in good faith and does not inhibit the applicant in any shape or form whatsoever. As a result of Point 1 above being confirmed by Companies House 3 times we started to trade and have been trading for 4 plus months. No client of Capita PLC has ever got confused and contacted our company in error.

-

The interest of the applicant is in no way adversely affected to any significant extent or whatsoever. It is blatantly clear that we are a kitchen and bedroom interior design company providing the same to our clients.

-

We don’t need the applicant to prove that it has goodwill and reputation in the name of CAPITA. We need them to prove it has goodwill and reputation in the name of CAPITA INTERIORS LTD.’

The applicant is professionally represented by Irwin Mitchell LLP. The respondents are not represented. Both parties filed evidence. They were asked if they wished for a decision to be made following a hearing or from the papers. Neither side chose to be heard. We make this decision after having carefully read all the papers filed by both parties.

Preliminary issue

Mr Gami stated in his defence that the respondents don’t need the applicant to prove use of CAPITA but should prove it has goodwill in the company name in question, CAPITA INTERIORS LIMITED. The applicant’s claim is essentially that since the respondents’ company name includes the word CAPITA, which is associated with it, this is sufficient for an order for the company name to be changed.

If we are satisfied that CAPITA INTERIORS LIMITED is sufficiently similar to CAPITA for the use of the primary respondent’s name in the UK to be likely to mislead by suggesting a connection between the company and the applicant, and that the applicant has established the necessary goodwill in CAPITA then, subject to the various defences, a change of name can be ordered. Consequently, the primary respondent’s argument about the applicant having to establish goodwill under CAPITA INTERIORS LIMITED is dismissed.

For the sake of clarity, we do not consider the respondents comment at point 3 above to be an admission to goodwill in the name CAPITA solus.

The law

Section 69 of the Act states:

“(1) A person (“the applicant”) may object to a company’s registered name on the ground- (a) that it is the same as a name associated with the applicant in which he has goodwill, or

(b) that it is sufficiently similar to such a name that its use in the United Kingdom would be likely to mislead by suggesting a connection between the company and the applicant.

(2) The objection must be made by application to a company names adjudicator (see section 70).

(3) The company concerned shall be the primary respondent to the application. Any of its members may be joined as respondents.

(4) If the ground specified in subsection (1)(a) or (b) is established, it is for the respondents to show-

(a) that the name was registered before the commencement of the activities on which the applicant relies to show goodwill; or

(b) that the company-

(i) is operating under the name, or

(ii) is proposing to do so and has incurred substantial start-up costs in preparation, or

(iii) was formerly operating under the name and is now dormant; or

(c) that the name was registered in the ordinary course of a company formation business and the company is available for sale to the applicant on the standard terms of that business; or

(d) that the name was adopted in good faith; or

(e) that the interests of the applicant are not adversely affected to any significant extent.

If none of those is shown, the objection shall be upheld.

(5) If the facts mentioned in subsection (4)(a), (b) or (c) are established, the objection shall nevertheless be upheld if the applicant shows that the main purpose of the respondents (or any of them) in registering the name was to obtain money (or other consideration) from the applicant or prevent him from registering the name.

(6) If the objection is not upheld under subsection (4) or (5), it shall be dismissed.

(7) In this section “goodwill” includes reputation of any description.”

Evidence

Applicant’s evidence

The applicant’s evidence consists of a witness statement from Francesca Anne Todd who is the group company secretary for the applicant. This is a position she has held since 2006. Prior to this she was the deputy company secretary. The key points from the evidence and witness statement are as follows:

- half of the applicant’s business comes from the private sector (53%) and half from the public sector (47%)

- in 2016, its turnover was £4.9 billion, with pre-tax profits of £475.3 million. These figures are corroborated by extracts from the applicant’s company accounts[footnote 2]

- over 90% of the applicant’s turnover is generated by companies and operations that use the CAPITA name as part of their company names

- the applicant sponsors many significant corporate sponsorship agreements. Exhibit 5 consists of an extract from the applicant’s website which is headed ‘Charitable support’ and states ‘In just over two years we have managed to raise more than £853,000 for The Prince’s Trust’

- exhibit 6 comprises a list of some 10 awards that it has won in the past five years (i.e. up until 2017). These include ‘Corporate Advisor Firm of the Year’ Award 2017 and ‘Re Housing Design Custom Build Award 2017’ and ‘Re Housing Design Award 2017’

- the applicant also details correspondence between them and the primary respondent. We do not consider it necessary to set out in detail the correspondence here since it is not material to the matter in hand

The witness statement also includes criticisms of the primary respondent’s evidence. It refers to the claim made by the primary respondent that they have spent “close to £100,000 creating a show room” and points out that this figure has not been substantiated in evidence. Further, Ms Todd refers to the applicant’s prior trading under the name Sig Distribution (SIG Trading Ltd). However, this company is not relevant to these proceedings and therefore has no bearing.

Primary respondent’s evidence

The primary respondent’s evidence consists of two witness statements from the co-respondent, Mr Gami.

Mr Gami states that the primary respondent is a family run business established in February 2017. He states that they design make, sell and install kitchens, wardrobes, bathrooms and bespoke furniture. These goods are sold to householders and property developers who are mainly located in Middlesex and the southern corridor. Mr Gami states that since the company began trading they have opened numerous business accounts with various suppliers including Nobilla, Wicks and Constantino. Exhibit CIL5 to the witness statement includes letters from the aforementioned suppliers, namely:

- dated 20 July 2017 from Nobilla to ‘Hitesh’ stating ‘Please be advised that your Capita Interiors Ltd Account with Nobilla…is open’

- dated 23 March 2017 from Wicks Interior addressed to Capita Interiors Limited c/o Mr Hitesh Gami. The letter states ‘We are please[d] to inform you that following our full due diligence as regards your company Capita Interiors Limited. We are happy that we are now in a position to start supplying your company with the required goods’

- dated 31 July 2017 from Constantino to Hitesh (email address info@capitainteriors.com). The email states ‘I just wanted to confirm your participation in the Cosentino elite program. As per the elite agreement, you have agreed to exclusively display Cosentino material in your studio Capita Interiors Ltd’

Mr Hitesh claims that the primary respondent has “spent close to £100,000 creating a show room for our Business using products designed and manufactured ourselves or directly purchased from our suppliers”.

Exhibit CIL6 comprises various marketing material which has been produced to show that the primary respondent has created affiliate sales channels with Builders Merchants such as Burnt Oak and Euroken Limited. Copies of these advertisements are duplicated below. They are not dated.

In his first witness statement dated 27 October 2017, Mr Gami concludes that there have not been any instances of confusion. Further he states that:

- no objection was ever made to Companies House directly by the Applicant

- the name was registered before the commencement of activities

- the respondent has incurred substantial start-up costs in preparation for trading

- the name was adopted in good faith and registered in the normal course of a Limited company formation following all possible due diligence

Mr Gami’s second witness statement seeks to address a number of criticism raised by the applicant and restates a number of points raised in his first witness statement. These shall be borne in mind.

To demonstrate that the primary respondent is operating under the company name, Mr Gami submits a list of customers with details of 13 different instances of work (including repeat custom) which has either been completed or is in progress. The evidence includes a letter from a customer (Kaetan Patel), dated 4 September 2017 which states “I have now placed an order with Capita interiors for them to supply and fit a full kitchen”. Mr Patel’s name appears on the list of customers.

The primary respondent has also provided pictures (albeit undated) of showrooms which include place cards bearing the sign ‘CAPITA’.

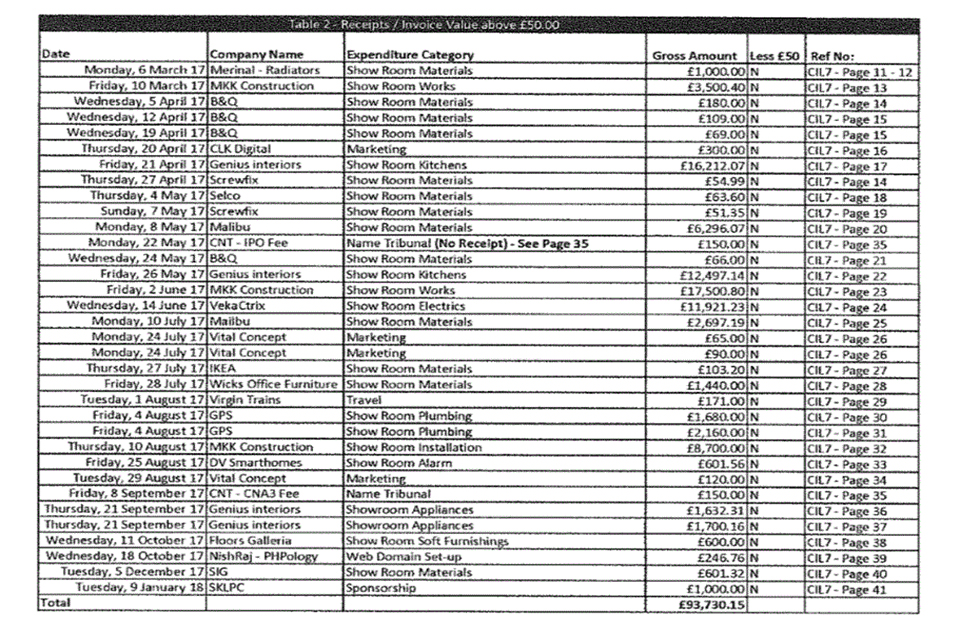

One of the criticisms raised by the applicant focuses on Mr Gami’s claim to have spent around £100,000 to create a showroom. Mr Gami provides a breakdown of the various costs incurred, with just over £93,000 being receipts and invoices valuing over £50.

Mr Gami provides the following table which is a list of receipts/invoices for goods which cost in excess of £50:

To support the various expenditure listed above, Mr Gami has provided numerous (too many to list) invoices and receipts[footnote 3]. The earliest invoice is dated 6 March 2017 and addressed to Mr Gami from ‘Merinal Ltd’ totalling £1,000 for a number of radiators. Another invoice is dated 10 March 2017 and addressed to Capita Interiors Ltd from MKK Construction. The invoice is for £3,500.40. This appears to be for the creation of a showroom since it’s description of works states: ‘Demolition of existing internals, Existing furniture, flooring, tiling kitchen, bathroom, carpets removed and disposed, External waste cleared up and disposed’. At the top of the invoice the word ‘Paid’ is handwritten.

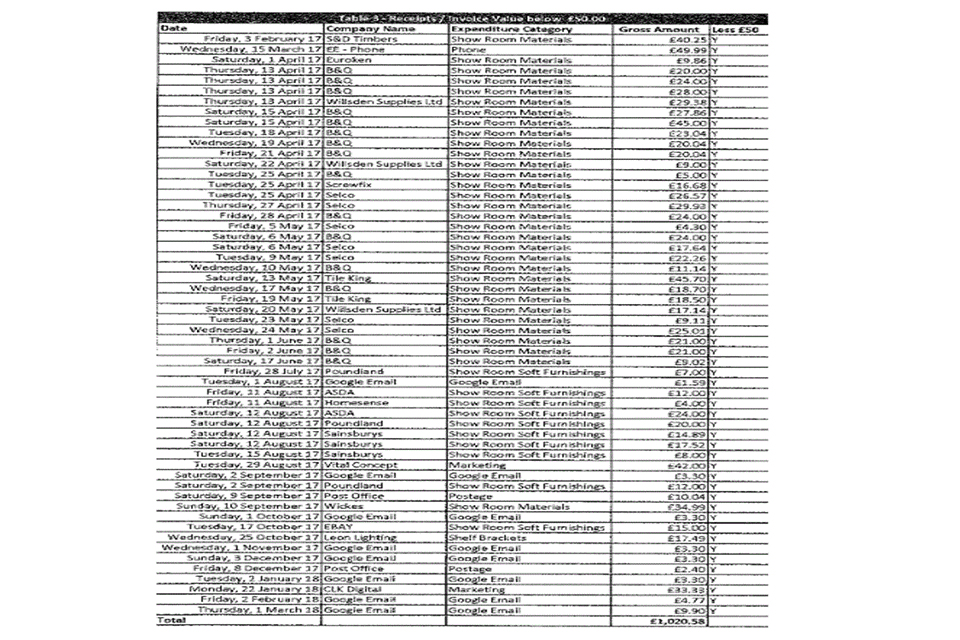

Mr Gami also submits the following table[footnote 4] which are expenses incurred for goods less than £50, which total around £1,000:

Decision

Since the primary respondent has defended the application, the first determination we must make is whether the applicant has goodwill under the name CAPITA. If goodwill is established, and the primary respondent’s name is the same, or sufficiently similar, to that of the company name in question so as to suggest that there is a connection between them, it is then necessary to consider whether the respondent may rely upon any of the defences set out under section 69(4) of the Act.

The relevant date for the assessment of goodwill is the date of the application which, in this case, is 4 April 2017. The applicant must show that it had a goodwill at this date associated with the name CAPITA.

The applicant’s goodwill

Section 69(7) of the Act defines goodwill as a “reputation of any description”. Consequently, in the terms of the Act it is not limited to Lord Macnaghten’s classic definition in IRC v Muller & Co’s Margerine Ltd [1901] AC 217:

What is goodwill? It is a thing very easy to describe, very difficult to define. It is the benefit and advantage of the good name, reputation, and connection of a business. It is the attractive force which brings in custom. It is the one thing which distinguishes an old-established business from a new business at its first start.

We have no doubt that the applicant’s evidence proves that it not only has goodwill but also a substantial reputation in business outsourcing and financial services. The applicant easily meets the initial burden of proving goodwill/reputation in the UK at the relevant date.

Similarity of names

We remind ourselves that the test is whether the primary respondent’s name is [footnote 5]:

…sufficiently similar to [a name associated with the applicant in which he has goodwill]…. that its use in the United Kingdom would be likely to mislead by suggesting a connection between the company and the applicant.

The presence of the word ‘LIMITED’ in the primary repsondent’s name is to be ignored from the comparison as a company designation is required for a company incorporated in the UK (other than in certain excepted circumstances). The comparison is, therefore, between CAPITA and CAPITA INTERIORS. We consider ‘INTERIORS’ to be a reference to the area in which the primary respondent intends to operate, this being the household interior, kitchen and bathroom design industry. Therefore, this is not considered to be a distinctive element of the name which means that the names are not similar. It is clear that the common, distinctive and dominant element of the respective names is CAPITA, which is a Latin word which means ‘by heads’ (as in ‘per capita’). We find that the primary respondent’s name is sufficiently similar to CAPITA and that its use in the UK would be likely to mislead by suggesting a connection between the respective parties.

Since the applicant has established goodwill and the name are similar enough for the purposes of s.69(1)(b) of the Act, the burden now switches to the primary respondent to show that it may rely on any of the defences it puts forward.

Defences

In its ‘Notice of Defence’ dated 25/05/2017 the primary respondent mentioned three potential defences.

The defences relied upon are as followed:

-

Our company is operating under the name of Capita Interiors Ltd. We got authorisation three times from Companies house to do this even after we showed them Capita’s PLC’s letters…

-

Our company name was adopted in good faith and does not inhibit the applicant in any shape or form whatsoever. As a result of Point 1 above being confirmed by Companies House 3 times we started to trade and have been trading for 4 plus months. No client of Capita PLC has ever got confused and contacted our company in error.

-

The interest of the applicant is in no way adversely affected to any significant extent or whatsoever. It is blatantly clear that we are a kitchen and bedroom interior design company providing the same to our clients.’

The claims made by the primary respondent seem to fall under the following statutory defences:

- Section 69(4)(b)(i): that the company is operating under the name;

- Section 69(4)(b)(ii): that the company is proposing to operate and has incurred substantial start-up costs in preparation;

- Section 69(4)(d): that the name was adopted in good faith;

- Section 69(4)(e): that the interests of the applicant are not adversely affected

Section 69(4)(b)(i): that the company is operating under the name

The primary respondent states that it has been operating its business since it was established in February 2017. To demonstrate this, it has provided a list of customers which details 13 different instances of work which has either been completed or is in progress. Some of these include repeat custom. The primary respondent has also provided pictures (albeit undated) of showrooms which include place cards bearing the sign ‘CAPITA’.

The evidence also includes ‘letters of support’ dated 4 September 2017 from a customer (Kaetan Patel) which states ‘I have now placed an order with Capita interiors for them to supply and fit a full kitchen’. Mr Patel’s name appears on the list of customers.

Taking all of the above into account, we find that the primary respondent has been operating under the name CAPITA. The purpose of s.69 of the Act is to provide a remedy against opportunistic company name registrations, or company name squatting. This is why operating under the name is a prima facie defence to an application of this kind. Applications to the company name adjudicators are not therefore a substitute for trade mark infringement or passing off actions. If the primary respondent is operating as a real business, this indicates that the name was not chosen for opportunistic reasons. Accordingly, we find that the primary respondent has made out a prima facie defence under section 69(4)(b)(i).

It is only necessary for the primary respondent to demonstrate that one of the defences applies. However, we shall also assess the defence under section 69(4)(b)(ii), namely that the company “is proposing to operate and has incurred substantial start-up costs in preparation”. We acknowledge that this defence was not specifically pleaded in the notice of defence. However, the primary respondent was requested to file its evidence first and this included a statement that “The respondent has incurred substantial start-up costs in preparation”. We are prepared to accept this to be a claim to a defence under section 69(4)(b)(ii) because the primary respondent is not professionally represented and may understandably consider operating and start-up costs to be one in the same thing. Further, the defence was expressly stated in its evidence and so the applicant is not prejudiced by this approach since it has had ample opportunity to consider the defence and respond in its own evidence.

It is clear from the evidence that the primary respondent is (and is now) proposing to operate and that it incurred significant start-up costs in preparation. The respondent has provided an invoice dated 10 March 2017 totalling £3,500.40 for the commencement of building a showroom. It has also provided details of its significant spend on materials and supplies in order for the business to be operational. There is nothing incredible about this evidence and no request has been made to cross examine Mr Gami on his evidence. Therefore, we accept his evidence on this matter.

In view of the above, we find that the primary respondent may also rely upon the defence under section 69(4)(b)(ii). The applicant has not shown that the main purpose of the respondents in obtaining registration of the company name was to obtain money (or other consideration) from the applicant or prevent it from registering the name. Therefore, the proviso to the defences in section 69(1)(b)(i) and (ii) set out in section 69(5) of the Act does not apply.

To conclude, the primary respondent has defended its registration of the company name under sections 69(4)(b)(i) and (ii). We are not required, and decline to consider, the remaining defences.

Outcome

The application is rejected and Capita Plc is unsuccessful with its claim.

Costs

When the primary respondent files its notice of defence it is asked at question 3 ‘Are you claiming costs? Yes or No’. The primary respondent ticked the ‘No’ box. Therefore, an award of costs shall not be made.

Dated 26 September 2018

Mark King, Allan James and Louise White

Company Names Adjudicators

-

Section 73(2) of the Act provides that an “offending name” means a name that, by reason of its similarity to the name associated with the applicant in which he claims goodwill, would be likely to be the subject of a direction under section 67 (power of Secretary of State to direct change of name), or to give rise to a further application under section 69. ↩

-

Exhibit 1 ↩

-

Exhibit CIL7 ↩

-

Exhibit CIL3 ↩

-

Section 69(1)(b) ↩