CHERI adoption and diffusion research

Published 15 May 2024

Executive Summary

This research aims to help the Department for Science Innovation and Technology (DSIT) understand the potential market for Capability Hardware Enhanced RISC Instructions (CHERI) technology and how the Department can encourage and support the adoption and diffusion of the technology in semiconductors.

CHERI is a new technology which embeds security by design and aims to significantly strengthen systems security through the use of memory safe pointer architecture and secure compartmentalisation of memory.

The technology has been developed in the UK with support from the UK government through the Digital Security by Design (DSbD) programme, which has funded the development of a hardware prototype; enabled researchers and businesses to use the hardware and develop the software ecosystem; and demonstrate CHERI working in specific sectors and contexts.

The Current Potential Market for CHERI

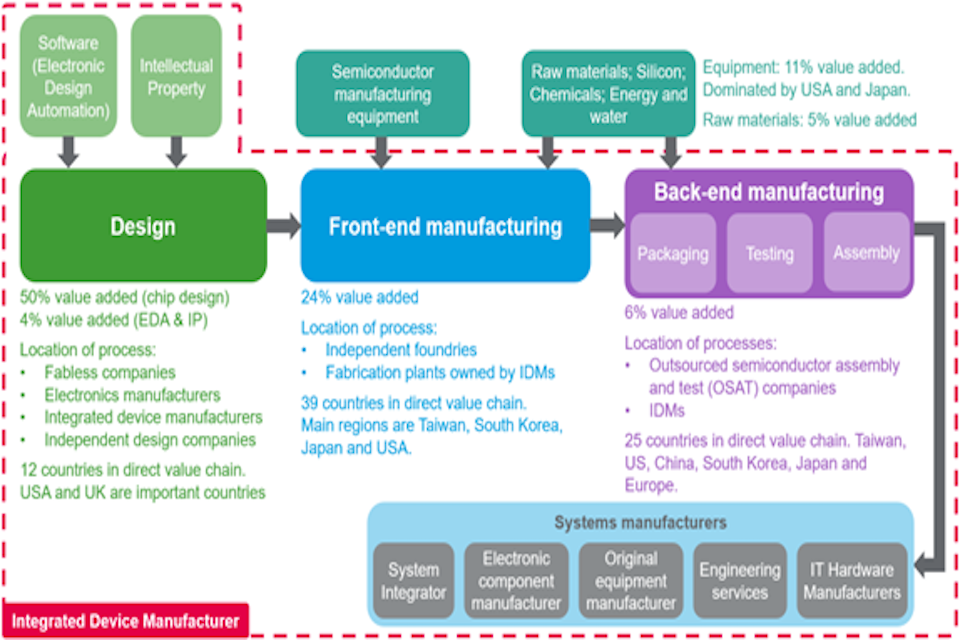

This research has not been designed to provide a formal assessment of the size and scope of the semiconductor market, or the market for CHERI, in the UK. However, a key aim for the research was to understand the key parts of the semiconductor supply chain where CHERI would need to be adopted. The semiconductor supply chain is long, global and complex and some parts of the process are more relevant for CHERI adoption than others.

The key market segments for CHERI adoption within the semiconductor supply chain are chip designers and systems manufacturers. Software engineering is also important, as program code needs to be rewritten for the CHERI architecture to ensure the benefits of CHERI are fully realised.

The semiconductor supply chain has high levels of regional specialisation, and the UK is strong in chip design. A number of systems manufacturers have offices in the UK even if they are not headquartered here.

We identified 394 firms in the current potential UK CHERI market through an iterative process of searching in business databases such as Fame, reviewing the outputs and adapting our search terms based on the details of the businesses that we found. These firms cover the semiconductor sector and key demand sectors who would benefit from adopting CHERI, and include multinationals and SMEs. These firms have a combined GVA (Gross Value Added) of £196.5 billion. Please note that this is not an estimate of the number of semiconductor firms active in the UK and should not be used as such.

Other key global markets for the semiconductor industry include the USA; China; Taiwan; Japan; South Korea; Southeast Asia; India and Europe.

We have identified several key sectors who would benefit from CHERI adoption including telecoms, automotive, defence, Information Technology (IT), finance, health and utilities. We have prepared case studies for the first four (others faced similar challenges, benefits and enablers for adoption).

Awareness of CHERI

Awareness of CHERI has been largely driven by the DSbD programme and other government funded competitions. This has helped to develop an ecosystem of academics and people in industry who have experience of using CHERI. This core ecosystem is mostly based in the UK and includes 136 companies and an estimated 875 people, not including people within government. This estimate of the number of people is based on survey results of DSbD participants in 2022 which showed around 7 people were involved per firm.[footnote 1] This is likely to be a low-end estimate of people who are aware of and actively engaging with CHERI currently as we are aware that some firms who are very active in the DSbD ecosystem have many more than 7 people involved in their DSbD project teams.

The UK is a key centre for chip design Intellectual Property (IP). Arm is a key player,[footnote 2] but there are other significant designers based here. The US and elsewhere in Europe are also regions for chip design and there is evidence of awareness of CHERI in these regions due to Morello Board distribution and government activities to promote CHERI such as visits by senior UKRI staff to Japan. Early development of CHERI was funded by DARPA (Defense Advanced Research Projects Agency) which has also helped to enable awareness of the technology in the US.

While the initial prototype of the technology (the Morello Board) was developed by Arm, there is growing awareness of CHERI among the RISC-V open-source ecosystem and a growing appetite to develop CHERI technology for this chip architecture.

People who are aware of CHERI are typically technical, research and cyber security officers. There is less awareness of CHERI among marketing and senior decision makers in large companies. This is where effort should be focused as many of the significant barriers to CHERI adoption are not technical, they are economic, and would be expected to accumulate over time. This audience could respond to a presentation of CHERI as an investment with a positive ROI through increased efficiency and capability, rather than an ongoing security cost.

Recommendations: Raising awareness of CHERI

Based on our research, the sector most likely to adopt CHERI first is embedded systems and the Internet of Things (IoT). Other sectors such as telecoms infrastructure, automotive and defence are also possible future markets for CHERI but the adoption cycles in these sectors are longer.

These are the sectors to target and build awareness in. Some recommended activities, which build on the outputs of the DSbD programme, include:

- Sensible (not fearmongering) presentation of increasing hostility of online environment to senior decision-makers in companies significant to CHERI adoption (such as systems manufacturers).

- Briefings from the National Cyber Security Centre (NCSC), intelligence services etc.

- Helping CEOs to understand the risks to their businesses from insecure hardware, whether to their customers or their own activities, using case studies and real-world examples[footnote 3].

- Sharing existing and future outputs of the Technology Access Programme (TAP), Discribe Hub and demonstrator projects.

Potential future adoption of CHERI

We explored the barriers and enablers to adoption in 5 potential adoption sectors.

Mobile devices: Low likelihood of adoption in the near term

The mobile phone and tablet market is highly concentrated, with a small number of dominant operating systems and a single dominant chip architecture provided by Arm. The chips are feature-rich and highly optimised for power with low energy consumption, and the design phase for each new iteration is long and expensive.

CHERI technology would have to compete for physical space on chips with other features with higher consumer demand. Extensive and mature software ecosystems would also need updating to make use of CHERI, which is a significant cost and barrier to adoption. Given this, there is relatively little incentive for private companies to push for the adoption of a security feature like CHERI into a chip design.

Key firms: Arm (Semiconductors), Google, Apple, Microsoft (Operating Systems). All of these companies have awareness of CHERI.

Telecoms Infrastructure: Some strong benefits of adoption, but also some challenges

This is a highly capital-intensive sector, with a large estate made up of expensive equipment. Firms need to gain positive Return on Investment (ROI) from technology investments which means there are slow lead times for adopting new hardware-based technologies.

The costs for CHERI adoption would come from re-compiling code, but this would involve less effort than using Rust (a memory-safe programming language).

CHERI adoption could reduce the lifetime equipment cost by reducing the costs of maintenance to offset the initial cost of adoption.

A more holistic conversation about the benefits of CHERI is needed to spur adoption, moving beyond consideration of the technical benefits alone to consider the long-term economic benefits and the potential to differentiate from the competition on security.

Key firms: Vodafone, Ericsson, Nokia.

IOT/Embedded Systems: Economics of adoption for embedded systems are advantageous for CHERI adoption

This sector is more likely to adopt CHERI over the next few years as individual processors are simpler and cheaper, the cost of design is lower, and there are open-source technologies and designs which can be used as a basis for experimentation and innovation.

The product range is diverse and, in many cases, does not carry the burden of a mature ecosystem with a codebase that would need updating. The best situation would be for an entirely novel product which can start from scratch and develop all code natively for CHERI.

In some areas (such as industrial process controls), the security/safety case might be strong enough for CHERI to be worth the investment despite the adoption cost, particularly if CHERI can be shown to reduce the overall cost of ownership of a device (e.g. if a product has a long lifetime, reducing the cost of maintenance through patching is significant; if the risk and cost associated with a successful attack is great, the adoption case is stronger).

Conversely, there are high-volume markets such as consumer IoT where although margins may be low, costs may be recoupable through volume sales.

DSbD has spurred innovation and business interest (Microsoft, Codasip, lowRISC, SCI Semiconductor etc). There is growing interest from RISC-V community which also supports adoption in this sector.

Key firms: Amazon, Microsoft, Sony, Bosch, IBM, Renishaw

Defence: Evidence of interest from the sector and possible routes to wider adoption through Government procurement levers

The Defence and Security Accelerator Catapult (DASA)/Defence Science and Technology Laboratory (DSTL) have already funded projects through a specific competition focusing on using CHERI in Defence. There is interest and awareness in the sector.

The Government Secure by Design procurement approach offers an opportunity to use CHERI for specifying and executing best practice in systems security.

There are sensitivities around sharing information about technology used in national defence, so sharing lessons and information on benefits of uses may be more complex in this environment.

Key firms: BAE, Qinetiq, Thales UK

Automotive: Some likelihood of adoption with some challenges to overcome

There is a strong case for cyber security to prevent vehicles being disabled or controlled by an attacker and increasing complexity and connectivity of vehicles through electrification.

There is interest from sector and high level of involvement in existing DSbD network and ecosystem.

Historically there are long adoption cycles for new technology in automotive, but these are getting shorter. However, the sector still has complex supply chains with a variety of suppliers.

Other barriers to adoption include the complex legal and regulatory environments with variation between different markets and jurisdictions. There is also a complex support ecosystem, with lots of standards and legacy software to update.

Key firms: BorgWarner, Jaguar Land Rover, Volkswagen.

Recommendations: Support adoption of CHERI

Further funding

To be targeted at:

- Continuing to build the software ecosystem by funding development of software development tools and operating systems[footnote 4].

- Maintaining and developing the existing skills base by providing further opportunities for businesses to use the technology (as with the DSbD Technology Access Programme), for researchers to investigate novel tools and uses (building on DSbD software ecosystem projects), and networking and presentation opportunities for business and academia to share promising developments.

- Supporting development of microprocessors at the microcontroller or mid-range application core level.

- Developing the compartmentalisation capabilities to explore how these could improve performance.

- Developing use cases to better understand and demonstrate the economic as well as security value of CHERI. In Chapter 5 of the main report, we provide case studies of routes to adoption for the following key sectors:

- Telecommunications (mobile devices and telecoms infrastructure)

- IT (IoT and embedded systems)

- Automotive

- Defence Selected use cases could build on these and the DSbD technology demonstrator projects.

Regulations, standards and procurement

- Ensure Government departments are aware of CHERI as a technology – lead from departments such as Defence which can provide use cases / demonstrations (via DASA/DSTL funding competition)

- Ensure suppliers are aware also: adopt “memory safety” as a recommendation or requirement in procurement, alongside clear guidance on which approaches meet this standard.

1. Introduction

Purpose of this research

The aim of this research is to help the Department for Science Innovation and Technology (DSIT) understand the potential market for Capability Hardware Enhanced RISC Instructions (CHERI) technology and how the Department can encourage and support the adoption and diffusion of the technology in semiconductors.

Seven specific research questions were set out in the specification from DSIT. These are covered in full in the technical report and summarised in Table 1 below.

Methodology

Our overall research design and strategy combines “top-down” and “bottom-up” exploratory analysis:

- We have mapped the CHERI technology market, using published data and statistics, and expert consultations, to estimate its scale and composition (“top-down” approach).

- In parallel, we have drawn up a database of firms in the market segments and established contact details to approach these companies for the primary research – this is done as part of the “bottom-up” pillar. This also helps to underpin the top-down element with firm level statistics.

Our rationale is to maximise robustness by combining two approaches with known strengths and weaknesses. The bottom-up approach focuses on known companies and lets us plan representative primary research; the top-down approach uses statistics to find “hidden” economic activity and market demand, providing a framework to weight the survey responses to reflect the market, and mitigate the risk of survey non-response.

We have used a mixed methods approach, with elements of quantitative estimation, desk research and primary data collection (surveys and interviews). The table below shows the methods we have used to address each of the research questions (RQ) in turn.

Table 1: Research questions and methods

| Research aims | Data review | Literature review | Top-down mapping | Interviews | Survey |

|---|---|---|---|---|---|

| 1. Assess size and scope of potential market for CHERI | Y | Y | Y | Y | |

| 2. Assess the number of semiconductor supply chain firms that could implement CHERI technology | Y | Y | Y | ||

| 3. Overview of market for CHERI over next ten years | Y | Y | Y | Y | |

| 4. Understand characteristics of firms in this potential market | Y | Y | Y | Y | |

| 5. Awareness of CHERI in the semiconductor supply chain | Y | Y | Y | ||

| 6. Current/projected CHERI demand in the semiconductor supply chain | Y | Y | Y | ||

| 7. Recommendations for barriers/enablers to adoption | Y | Y |

Report Structure

We have structured the report as a series of thematic chapters that are linked to the groups of research questions. The remainder of this report is structured as follows:

Chapter 2 provides some background about CHERI; its expected benefits and current status. It also provides background on the semiconductor supply chain as the aim of this project is to understand adoption of CHERI from a hardware point of view.

Chapter 3 examines current awareness of CHERI and explores barriers and enablers or drivers of that awareness (RQ5).

Chapter 4 looks at the size and scope of the market for CHERI, both in the UK and worldwide (RQ1), including the elements of the supply chain that are most relevant to CHERI (RQ2) and the characteristics of the companies within this market (RQ4).

Chapter 5 looks at the potential market and where CHERI might be in terms of adoption in around ten years (RQ3 and 6). It also addresses barriers and enablers or drivers to adoption.

Chapter 6 presents our final conclusions and recommendations (RQ7).

2. Background

2.1 Introduction

This chapter lays the groundwork for the research and findings in the following chapters. The chapter provides a comprehensive overview of CHERI technology, including its current level of implementation and some competing technologies. It presents a detailed supply chain diagram for the global semiconductor industry. Lastly, the chapter identifies key demand sectors for CHERI adoption.

2.2 Summary

-

CHERI is a new technology which embeds security by design and aims to significantly strengthen systems security through the use of memory safe pointer architecture and secure compartmentalisation of memory.

-

The technology has been developed in the UK with support from the UK government through the Digital Security by Design (DSbD) programme, which has funded the development of a hardware prototype; enabled researchers and businesses to use the hardware and develop the software ecosystem; and demonstrate CHERI working in specific sectors and contexts.

-

There are several CHERI products in development including the Arm Morello board, CHERIoT (developed by Microsoft for RISC-V) and the LowRISC Sonata and Symphony boards. Codasip have announced a first commercial CHERI enabled chip, but most of the other implementations are pre-market.

-

CHERI is a deep, system level fix and adoption will require changes in both hardware and software. Therefore, it is important to understand the semiconductor supply chain and drivers for the adoption of technologies that improve cyber security.

-

Important demand sectors to consider include automotive, utilities, telecommunications and embedded systems. These are aligned with national research priorities and also have some elements of cyber-physical risk.

2.3 What is CHERI?

CHERI is a fundamental redesign of microprocessor architecture, based on research from the University of Cambridge, that eliminates many common memory security vulnerabilities.[footnote 5]

2.3.1 Benefits of CHERI

The key benefits of CHERI compared to traditional hardware architecture have been identified by the University of Cambridge and SRI international[footnote 6] [footnote 7], and are as follows:

- The CHERI architecture guards against accidental or malicious manipulation of the contents of memory, removing a core source of vulnerabilities.

- CHERI can be applied to legacy C or C++ programs with minimal changes, making the transition to CHERI technology seamless.

- As CHERI is applied to existing languages that lack memory safety like C and C++, it has the potential to address memory safety issues without the overhead of software runtime checks.

- It provides the ability to create distinct compartments within one process which can be used to strengthen a system against attack and can also lead to performance benefits.

The main focus of research so far has been on the memory safety benefits of CHERI. Memory safety aspects of CHERI are at a higher technological readiness level (TRL) than compartmentalisation. Therefore, less effort is currently required to take advantage of the memory safety benefits than compartmentalisation.

CHERI prevents unauthorised or out of bounds memory access; it has been shown to prevent attacks using memory access in CHERI’s implementation of Linux/BSD and can also prevent damage from poorly written code. It is a systematic fix that addresses up to 70% of currently known common vulnerabilities[footnote 8].

Preliminary discussions with the DSbD advisory group revealed that research in compartmentalisation is not as advanced as research on the memory safety advantages of CHERI. Despite this, stakeholders mentioned that compartmentalisation holds promise for enhancing performance, boosting productivity, and conserving energy, potentially paving the way for innovative business practices and capabilities. Furthermore, stakeholders also opined that the combined benefits of memory safety and compartmentalisation would extend beyond merely bolstering security.[footnote 9]

2.4 Current implementations of CHERI

University of Cambridge and SRI initially received funding to develop CHERI from DARPA (the US Defense Advanced Research Projects Agency). UK Research and Innovation (UKRI) also recognised the potential of CHERI and, in 2019, funded the DSbD programme through the Industrial Strategy Challenge Fund (ISCF) to explore its practical applications.[footnote 10]

2.4.1 Digital Security by Design (DSbD)

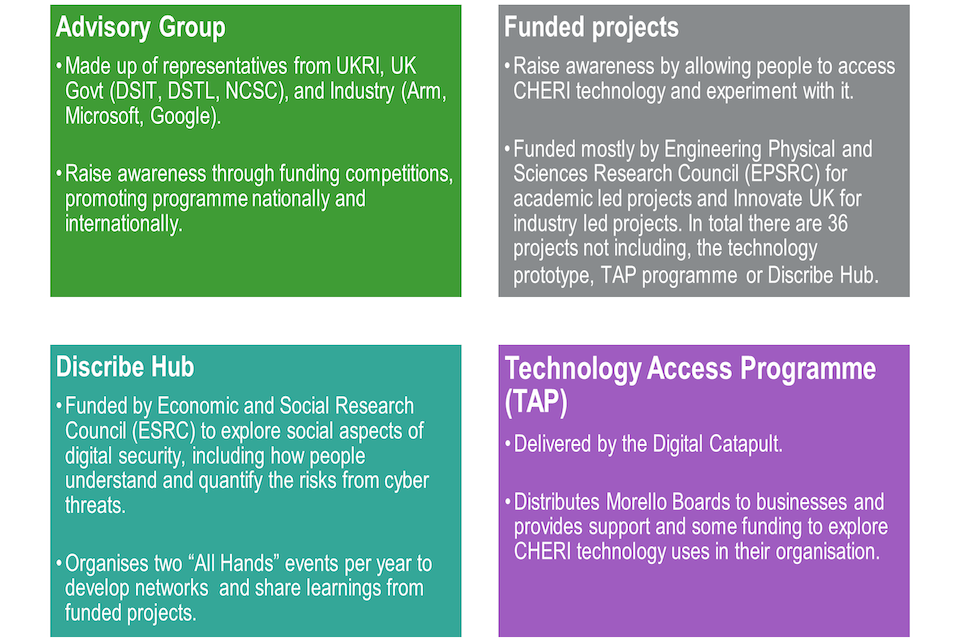

The DSbD Challenge was announced in January 2019 as a targeted investment within the government’s ISCF. It funds a programme of research which is intended to radically update the foundation of the insecure digital computing infrastructure that underpins the entire economy.

In doing so, it aims to overcome market failures in hardware security, as well as technological challenges. Problems with hardware security have been documented since the 1970s. Market forces alone do not seem strong enough to encourage firms to invest towards solving these issues, because:

- Hardware manufacturers will not produce something for which software does not yet exist as there would be no market for it.

- Software developers will not write code for hardware that does not yet exist.

- Consumers have not been demanding more secure technology as they are largely unaware of the inherent risks.

The programme has funded three activities which are summarised below:

-

Enable (industry and academia-led): A prototype implementation of a secure hardware platform with CHERI architecture (the Morello Board).

-

Use (industry and academic projects funded).

- Collaborative Research and Development (R&D), to develop the software and secure-by-design applications required to enable market use.

- Establish a national resource to upskill developers and users, enabling early adoption of the technology through business outreach.

- Create a community to investigate barriers to adoption and encourage businesses and society to move beyond management of risk.

- Demonstrate Impact: Business-led ‘demonstrators’ to develop and showcase specific uses of the new technology. There are seven demonstrators in e-commerce, automotive, utilities, embedded systems.

The programme was initially funded from 2020 to 2024, and extended to 2025. The programme team are looking for opportunities to continue the progress made in the last few years.

DSbD Programme achievements to date: The technology platform prototype design has been completed (ENABLE) and formally validated (USE), and has now been delivered in silicon in the form of the Morello Board. The primary vision set out in the business case – for the Challenge to overcome existing market failures and provide a new and secure computer hardware approach – is on course to be delivered if it can be proven in major industrial markets (DEMONSTRATE).

This initial success gives the programme scope to support the move towards adoption. Key takeaways on progress towards adoption are as follows:

- DSbD has good links with Government through the Programme Board and advisory group, and the technology features in recent strategy reports such as the National Cyber Strategy and National Semiconductor Strategy. This suggests that DSbD is on the UK research agenda.

- Capacity and capability building: DSbD projects have developed new skills and capacity in R&D. Academic projects have had only small impacts on researcher skills so far, but have built DSbD into Masters courses and PhDs, which can promote future knowledge transfer.

- Collaboration between academia and industry is built into all workstreams, resulting in multi- and inter-disciplinary publications, and a mixture of academic- and industry-led investigation of the technology.

- Industrial engagement has worked well to build an ecosystem for early adoption and testing but so far has focused on small businesses. There has been less interest in some parts of the programme from large companies (e.g. the Technology Access Programme and some of the demonstrators), although these are represented on the Advisory Group and have provided support for some individual projects.

DSbD has attracted investment from government and the private sector, including contributions from Google and Microsoft. Private investment is tracking above its 2023 target of £50m.[footnote 11] Further detail about how the programme is raising awareness of CHERI and supporting adoption is covered in section 3.3.1 of this report.

2.4.2 Other implementations of CHERI

Outside of the DSbD programme, some other organisations have designed other CHERI enabled hardware:

-

CHERIoT is a small version of CHERI for IoT devices based on RISC-V architecture. Work to adapt CHERI to smaller embedded systems was led by Microsoft through their involvement in the DSbD programme.

-

LowRISC is leading the Sunburst demonstrator project which aims to distribute Sonata Boards for use in embedded systems. These are low-cost evaluation boards with similar capabilities and capacity to the CHERIoT boards. They are also developing a higher cost board (the Symphony Board), which is more similar to Morello.

-

Codasip, a European company developing processor solutions using RISC-V, have released a fully commercial implementation of CHERI using its 700 processor family. This is a significant development as, unlike the other implementations, it has not resulted from a DSbD funded project. The decision to bring a CHERI processor to market has been taken independently for commercial reasons; (primarily to be the first mover in the market for memory-safe hardware).

Table 2: Summary of Current CHERI implementations

| Features | Morello [footnote 12] | CHERIoT [footnote 13] | Symphony [footnote 14] | Sonata | Codasip 700 family |

|---|---|---|---|---|---|

| Summary | The Technology Prototype Platform of the DSbD programme | Small, low power version for embedded devices | Evaluation platform allowing for full analysis of CHERI enhancements in a wider system | Low-cost evaluation board for investigating CHERI security enhancements | First commercial implementation of CHERI |

| Lead team/example projects | Arm, most of the DSbD funded projects | Microsoft | lowSRIC | lowRISC | Codasip |

| Architecture | Arm | RISC-V | RISC-V | RISC-V | RISC-V |

| Advantages | Has been distributed among DSBD and DASA-CHERI communities | Potential for deployment in cyber-physical systems that are hard to protect at a deep level | More fully featured than CHERIoT and Sonata, though less than Morello | As for CHERIoT: a low-cost option (around £300-£400) deployable in cyber-physical systems | Commercial design which demonstrates there is a market for adoption |

| Disadvantages | The costs of commercial development are likely to require offsetting by significant market demand. Expensive (around US$10,000 per board) | Lightweight version – a microcontroller rather than a fully-featured multi-tasking application core processor like Morello | High-cost option (similar price to Morello) | Lightweight version – does not have full CHERI functionality | As announced, less powerful than the Arm Morello design |

2.4.3 Other memory safety technologies

There are some alternative approaches to memory safety aside from CHERI.

Other approaches to memory safety are possible. One would be to rewrite code on existing hardware in a potentially memory-safe language such as Rust. This would offer equivalent protection if implemented perfectly, but errors in the code could leave vulnerabilities that could be exploited if discovered. Also, the effort of entirely rewriting existing code would inevitably be greater than modifying existing code to run on a CHERI processor, although for entirely novel products where there is no existing code base, a language-based solution would make sense.

Another approach in hardware would be probabilistic methods which attempt to detect memory safety violations in real time, such as Arm’s Memory Tagging Extension (MTE), available in its latest processors. These significantly increase the likelihood of detecting memory safety violations but does not guarantee that they cannot occur as CHERI does. CHERI has a higher adoption cost than MTE.

Other examples mentioned in stakeholder interviews include Arm’s TrustZone and SiFive’s WorldGuard (for RISC-V). These can isolate security-critical components in a system through hardware, such as system boot-up, cryptography, payment processing, or digital rights management. They are less sophisticated than CHERI in terms of the protection through isolation that it offers; CHERI’s compartmentalisation features allows for software to be written in such a way as to securely isolate any area of a program, and also offers potential improvements in performance.[footnote 15]

2.5 Supply chain for CHERI implementation

As CHERI is a hardware-based technology, the research aims to understand more about the semiconductor supply chain for the adoption of new hardware-based technologies.

Figure 1 below sets out the different stages of the global semiconductor supply chain and highlights the role of each supply chain segment. It also shows the value added at each stage.

It is important to note that the final product from the global semiconductor value chain, when supplied to systems manufacturers, contributes additional value to their respective sectoral supply chains.

Figure 1: Semiconductor Supply Chain – Production and Immediate

Source: Adapted from BCG/SIA (2021), Accenture/GSA (2020), Visual Capitalist (2021)

The section below describes these different segments in more detail.

2.5.1 Design (Fabless firms[footnote 16])

These firms design (but do not typically manufacture) the integrated circuits and chips which perform the critical tasks that make electronic devices work, e.g. computing, storage, connectivity to networks, and power management. Design includes electronic design automation (EDA) software, reusable architectural building blocks (“IP cores”), and in some cases also outsourced chip design services provided by specialised technology suppliers. It is a knowledge and skill intensive part of the supply chain and accounts for 65% of total industry R&D and 54% of value added[footnote 17].

The US is a key region for EDA, but the UK is a key region for IP. This is largely due to organisations like Arm, Codasip, MIPS, and SiFive.[footnote 18]

Key UK companies: Arm; Imagination Technologies; EnSilica

Key global companies: Codasip; Qualcomm; Broadcom

2.5.2 Fabrication (Front-end manufacturing)

Manufacture (“fabrication”) of silicon chips takes place in highly specialised manufacturing facilities called “fabs” or “foundries”, where nanometre-scale integrated circuits are printed on to silicon wafers.[footnote 19] Semiconductors are produced at different node sizes (measured in nanometres) with more advanced chips corresponding to smaller node sizes. The most cutting-edge chips are currently less than 10nm.

Around 75% of fabrication capacity is based in China and East Asia.[footnote 20] All advanced logic chips at 10nm node capacity or smaller are produced in Taiwan and South Korea.

Key UK companies: Clas-SiC Wafer Fab; PragmatIC; IQE

Key global companies: TSMC; SK Hynix; Sensata Technologies

2.5.3 Equipment and tooling

Fabs rely on specialist and sophisticated manufacturing equipment. The largest manufacturers for this type of equipment are Applied Materials; Lam Research, and KLA in the USA, ASML in Europe and Tokyo Electron in Japan. These companies tend to focus on very specific pieces of machinery: for example, ASML has a monopoly on the equipment for extreme ultraviolet (EUV) lithography[footnote 21] which is required for the production of the most advanced node sizes.

Key UK companies: Oxford Instruments; Infinitesima

Key global companies: Coherent; Applied Materials; KLA Corporation

2.5.4 Fabrication (Back-end manufacturing)

This includes the process carried out by firms that specialise in the outsourced assembly of semiconductor wafers and chip components, which are produced by front-end manufacturers. This includes the following processes:

- Packaging involves enclosing semiconductor chips in protective and functional encasements.

- Testing is a process to ensure functionality and performance of the chip/processor to certify reliability and quality.

- Assembly refers to integration of various components of a semiconductor chip.

As per Figure 1, it accounts for 6% of the value added in the supply chain. Key regions include Taiwan, the USA, China, Malaysia, and Singapore.[footnote 22]

Key UK companies: Clas-SiC Wafer Fab; INEX Microtechnology

Key global companies: Tokyo Electron; ASML; Lam Research

2.5.5 Integrated Device Manufacturers

Integrated Device Manufacturers (IDMs) are large companies which design, manufacture and sell semiconductors. They also function as systems manufacturers by incorporating these fabricated chips into their own product line. IDMs have their own branded chips, designs them in-house and own fabrication plants to produce chips.

The US and Southeast Asia are key regions for IDMs as companies like Samsung and Intel are headquartered here.

Key UK companies: N/A

Key global companies: Samsung; Intel; Volkswagen

2.5.6 Systems Manufacturers

System manufacturers are organisations that acquire packaged chips and integrate/facilitate their integration into hardware. Systems manufacturers typically buy the chips designed and manufactured by third-party companies and incorporate them into their product, which is then sold to consumers. For example, Dell sources chips from companies like Intel and integrates it into their laptops. The systems manufacturers include the following sub-categories:

-

System integrators are third-party entities adept at amalgamating component subsystems and ensuring their cohesive functionality.

-

Electronic components manufacturers are firms engaged in the production and supply of diverse electronic parts utilised across a wide range of applications. They typically manufacture components that are supplied to final product manufacturers for integration into their end products.

-

Original equipment manufacturers (OEMs) are firms that produce the final product, typically integrating components sourced from external manufacturers into their comprehensive end product designed for the consumer. Examples include car manufacturers, consumer electronics manufacturers. Some OEMs are also IDMs as they design chips in house and have their own fabs.

-

Engineering services encompass sector-specific traditional services, including engineering consultancy for product development and integration, as well as simulation and testing facilities.

-

IT hardware manufacturers produce IT components such as motherboards, CPUs (Central Processing Units), memory drives, etc. They cater to OEMs and also engage in the production of end-user IT products.

Key companies: See Table 13 for key examples.

2.5.7 Software

Companies that adopt CHERI hardware will need to re-compile and port their software code in order to use it. This is necessary in order to make existing software work on the new processor; one of the reasons is that some memory operations that are technically valid C or C++ code, and are used on current processors, are forbidden on CHERI because they would expose or compromise memory that is being safeguarded by CHERI’s memory safety technology (“capabilities”). Such code would need to be rewritten. Once code has been successfully ported to the new processor, there is additionally the potential to rewrite elements of the code to make best use of CHERI’s compartmentalisation feature, to improve security or performance.

The DSbD programme has funded a number of software projects to develop toolkits for the use of CHERI and investigate specific use cases, and there is an active, largely UK-based ecosystem around developing software for CHERI. There are also a large number of GitHub repositories for how to write code for CHERI.

The amount of work necessary to write code for CHERI varies from use case to use case. It will always need to be recompiled, and elements will usually need to be rewritten if they attempt to use memory operations forbidden under CHERI. Some ecosystems would require much more software to be checked for compatibility. For example, a mobile phone includes a set of complex, multi-purpose chips and a fully-featured operating system which needs to accommodate a whole ecosystem of apps, and so a large player in this sector such as Google or Apple would require many thousands, if not millions of engineering hours to re-compile code for CHERI and make best use of the technology. This is therefore a potential barrier to widespread adoption; although less than the effort required to re-implement from scratch in a memory-safe language such as Rust. Simpler processors with more specialised functions, such as smaller chips used in industrial control processes or Internet of Things devices, would require relatively less effort, and entirely new hardware with no code base to update would not face this barrier to adoption.

Key UK companies: N/A

Key global companies: Keysight Technologies; Altair; Ansys; Cadence Design Systems

2.6 Demand sectors

In addition to understanding the supply side for hardware technologies, we need to understand which demand sectors are likely to be relevant to CHERI adoption and how much of the semiconductor market these account for.

The table below outlines the main demand sectors for semiconductors. This is important to consider for CHERI adoption as these have different security priorities; key suppliers and adoption cycles for new technologies.

Table 3 Semiconductor Applications by Market Size[footnote 23]

| Application | Total semiconductor sales 2020 (in US$ billion) | Total semiconductor sales 2022 (in US$ billion) |

|---|---|---|

| Smartphones | 117 (25%) | 104 (19%) |

| Consumer electronics | 50 (11%) | 60 (11%) |

| Personal computing | 100 (21%) | 89 (17%) |

| Automotive | 40 (8%) | 79 (15%) |

| Industrial electronics | 51(11%) | 74 (14%) |

| Servers, data centres and storage | 76 (16%) | 78 (15%) |

| Wired/wireless infrastructure | 38 (8%) | 50 (9%) |

| Total | 472 | 534 |

Source: Statista[footnote 24]

The table below highlights the sectors chosen for the demonstrator projects funded by DSbD and the sectors of relevance:

Table 4: DSbD demonstrator projects by sector

| Demonstrator | Sector focus |

|---|---|

| Soteria | E-commerce |

| DEFGRID | Utilities (Gas network) |

| AutoCHERI and ResAuto | Automotive |

| MoatE | Edge Computing |

| High Security Communications Infrastructure using peer to peer Mesh VPN | Digital Computing Infrastructure |

| Sunburst Project | Embedded Devices[footnote 25] |

Source: DSbD Tech

Familiarisation interviews (mostly with DSbD Advisory Group members) highlighted automotive; utilities; infrastructure and IoT/embedded/remote systems as areas for CHERI deployment. Interviewees thought these sectors were significant as they are areas where a cyber security breach could lead to real-world physical harms, which overlaps with the sectors above. Risks in sectors such as E-commerce include theft; loss of data; compromised privacy. Interviewees also highlighted defence as an area of interest and DASA Catapult has launched a separate competition to explore CHERI within defence and security and awarded funding to 15 projects.[footnote 26] There is also alignment to other national priorities for research and innovation for sectors identified by stakeholders.

3. Current awareness of CHERI

3.1 Introduction

The chapter addresses RQ5 about the current levels of awareness of CHERI in the semiconductor supply chain. Evidence is drawn from interviews and surveys. It also considers some of the barriers to awareness and factors that will enable these barriers to be overcome and help drive the adoption of CHERI.

3.2 Summary

-

Activities that have driven awareness of CHERI to date include the DSbD programme, Morello Board distribution and the DASA CHERI for Defence competition. This has developed an ecosystem of around 875 people in 136 organisations who are aware of and have had some exposure to CHERI technology.

-

The technology has been referenced in papers produced by the UK government[footnote 27]; US government and key organisations including Arm[footnote 28], Google[footnote 29] and Microsoft[footnote 30]. This demonstrates awareness of the technology by these organisations and suggests they are raising awareness among the audience for these papers. This audience is mostly technical people interested in cyber security research.

-

Materials produced so far to raise awareness of CHERI have focused on technical aspects. As a result (and as suggested by interviews), there may be a lack of awareness about CHERI among senior decision makers in key companies. Engaging this audience would require more focus on the business case for adoption.

-

There are limitations to surveys used to assess wider awareness of CHERI, as these have relied on promotion through organisations involved in the CHERI ecosystem, potentially giving an inflated view of awareness (although this can be mitigated by asking participants in the ecosystem what the level of awareness among their own contacts is). One survey from 2022 suggested 9% of respondents were familiar with CHERI and just over a quarter had at least heard of it.[footnote 31]

-

Our survey of senior decision makers and technical experts in companies in the semiconductor supply chain; software companies; and those in key demand sectors for semiconductor applications, showed 11 out of 14 respondents had heard of CHERI, or were familiar with it.

3.3 Current drivers of awareness of CHERI

This section looks at current awareness of CHERI within companies, within the UK and across the world, as well as what has helped to drive awareness of the technology. It has focused on awareness of the technology of companies who would need to adopt it, i.e.

- Companies in the semiconductor supply chain, especially those involved as relevant for CHERI adoption as identified in Chapter 3 (chip design and software); and

- Organisations in key potential demand sectors for CHERI.

Key drivers of awareness to date have included the DSbD programme and other activities funded by the UK government.

3.3.1 The DSbD ecosystem

A key driver to date has been the DSbD programme, funded through UKRI. This section provides some high-level detail about the types of organisations involved in the different workstreams of the DSbD programme to give better insights on the types of people who have worked on the development of CHERI and are aware of the technology.

The diagram below summarises the overall structure of the programme.

Figure 2: DSbD activities and awareness raising

The Advisory Group, TAP and Discribe Hub are particularly important for raising awareness of CHERI.

1. Advisory Group

Government agencies involved in the Advisory Group have also helped to spread awareness of CHERI technology. The programme is referenced in the National Semiconductor Strategy[footnote 32]. For example, some have been involved in overseas visits to promote the DSbD programme and CHERI technology in Japan, the US and other countries. They have also raised awareness within the UK. For example, Advisory Board members play an ambassadorial role within UK semiconductor supply chain firms and have presented at CyberUK 2023[footnote 33].

2. Discribe Hub

The Economic and Social Research Council (ESRC) has funded the academic led Discribe hub as part of the DSbD programme. This is a social science led research programme exploring barriers and enablers to adoption of CHERI and digital security in general. It aims to explore the social aspects of digital security, including how people understand and quantify the risks from cyber threats.

- As of March 2024, 19 papers have been published as a result of the Discribe hub:[footnote 34]

- The Discribe Hub organise All Hands events twice a year for people involved in the programme to attend and share information. This has helped to develop the ecosystem and networks of organisations and people involved in the programme.

- The most recent All Hands event (March 2024) included panels about using the technology in the automotive industry and some considerations around this; promoting and announcing the Sonata Boards were now available and a panel session with representatives from DSIT, DSTL and the NCSC, so there were some important lessons on considerations for future adoption which are covered in more detail in Chapter 5 of this report.

3. Technology Access Programme

The Technology Access Programme (TAP) is led by the Digital Catapult and is responsible for providing interested companies and universities with access to CHERI technology and guidance, so that they can experiment with its features. So far it has distributed nearly 40 Morello development boards, mostly to SMEs (Small and Medium Sized Enterprises). There have been four cohorts of board recipients and there are plans for at least one more. Cohorts attend events organised by the Digital Catapult at the beginning and end of their projects (around 6 months). SMEs receive some funding for their projects as well as support.

Morello is quite complex to implement for smaller organisations. There has been interest in CHERIoT and Sonata as lower cost options that would be simpler to adopt and beneficial for technologies such as IoT, embedded systems and remote systems. Digital Catapult feel there is significant interest in this to want to distribute CHERIoT boards in a future cohort. The Sunburst project is also looking to distribute the lowRISC Sonata boards (a research and development platform prototype similar to CHERIoT).

Interviewees were broadly positive about the Technology Access Programme and felt it had been successful in engaging with businesses and raising awareness of the technology especially among software companies. They made the following observations about how the TAP could be improved:

- The TAP programme has not engaged as effectively with and raised awareness of CHERI among the types of large companies who could move the dial on adoption – the incentives are too small to be attractive to them. Other parts of the programme (e.g. the Advisory Group) have been more successful in engaging with this audience.

- Some of the guidance materials provided to TAP board recipients are very technical and more work is needed to make it more user friendly.

TAP projects and funded demonstrators from the wider programme have been successful in proving the technology works and providing use cases for specific sectors. They have been less successful in making a business case for CHERI adoption in relevant industries and demonstrating a return on investment. More work is needed to explore this aspect and share information about it.

4. Funded projects

The table below summarises the different funding competitions and who they have engaged:

| Funding competitions | Funded by | Projects led by | Number of projects funded |

|---|---|---|---|

| Academic Proof, System Software Impact Research | EPSRC (Engineering and Physical Sciences Research Council) | Academic | 9 |

| Development of the Digital Security by Design Software Ecosystem (De Minimis Projects) | Innovate UK | SMEs | 10 |

| Software ecosystem development | Innovate UK & EPSRC | Academics & Industry | 10 |

| Demonstrators | Innovate UK | Industry | 7 |

Source: Information provided by UKRI

The funded projects have all been awarded through competitions which have raised awareness of the technology through putting out information in application guidance and holding events about the competitions.

The projects allow access to a Morello board which means that award recipients have the opportunity to develop skills and knowledge of CHERI technology, raising awareness among the people at the organisations involved.

Funding projects attend the ‘All Hands’ events organised by the Discribe hub and share learnings from their projects and develop networks with other organisations who are also in the ecosystem.

The projects have produced outputs such as publications in academic journals which have also raised awareness with academic audiences.

Key takeaway about the DSbD programme and raising awareness: The DSbD programme has developed an ecosystem of organisations who are aware of CHERI which includes 31 UK universities and around 94 companies with a presence in the UK. Funded projects have increased awareness by allowing organisations to access the technology to experiment with use cases specific to their businesses and develop skills in using CHERI. While the programme funded the development of the Morello prototype based on Arm architecture, growing the ecosystem has also led to the development of other hardware solutions (Microsoft CHERIoT and the LowRISC Sonata and Symphony boards), based on RISC-V open-source architecture. Some of the barriers to adoption may be easier to overcome in RISC-V than for Arm (see sections 5.4.1 and 5.4.2 for further details)

The rest of this section summarises activity outside the DSbD programme.

3.3.2 Unfunded board distribution from UKRI

UKRI have also distributed around 30 Morello boards to academic and business organisations in the UK and internationally without funded projects. The table below shows where boards have been distributed.

Table 5: International distribution of Morello Boards through UKRI for unfunded projects

| Country | Organisations which have received at least one board from UKRI |

|---|---|

| UK | 23 |

| USA | 10 |

| Germany | 5 |

| Netherlands | 2 |

| Sweden | 2 |

| Canada | 1 |

| Denmark | 1 |

Source: Information provided by UKRI, February 2024

This includes some large multinationals such as Rolls Royce, Siemens and Boeing.

Codasip also became involved in CHERI through this route. As covered in Chapter 2, Codasip have announced the first commercial implementation of CHERI based on the RISC-V architecture. Interviews revealed that they are also developing their own ecosystem of business focused on CHERI for RISC-V, but we are not aware of specific firms involved, although there is likely to be an overlap with the DSbD ecosystem. This is being formalised through the CHERI Alliance Community Interest Company (CIC) which is being established to promote CHERI as an efficient standard for addressing memory safety issues and will further increase awareness of the technology.

Key takeaways about UKRI board distribution and raising awareness: While many of the boards have been distributed within the UK, a number have been given to organisations based overseas which has helped promote awareness internationally, further developing the ecosystem of organisations and individuals with some experience of using CHERI.

This has also led to the first commercial implementation of CHERI by Codasip. Codasip have now announced the CHERI Alliance which will further raise awareness of the technology, especially in RISC-V architecture. The CHERI Alliance would be a useful point of contact for DSIT to find out where demand is sectoral and what steps are being taken towards standardisation of requirements for memory safety, which could be adopted in government standards and regulations.

3.3.3 DASA/DSTL CHERI for Defence

In addition, the DASA CHERI for Defence competition has funded 15 projects. Many of these are led by organisations who are also involved in DSbD funded projects, but four organisations had not previously been involved in the programme.

UK Government has recently adopted a “Secure by Design” approach to the procurement and delivery of digital services. The implications for suppliers to the Ministry of Defence have been set out in an “Industry Security Notice” from July 2023, and the principles and activities of the approach were published in early 2024. The policy does not mandate use of CHERI or any other memory safety approach (and the “Secure by Design” nomenclature is not directly related to the “Digital Security by Design” programme). However, the framework’s core principles include elements which could be met by a CHERI solution (e.g. “source secure technology products”, “minimise the attack surface”, and “defend in depth”), and CHERI could be used as an element of providing secure hardware to the industry.

Key takeaways about the CHERI for Defence competition and raising awareness: This programme has mostly engaged with companies who were already aware of CHERI, but has brought in a small number of organisations who are new to the ecosystem. It is the first sector specific competition and has increased awareness among companies involved in providing defence systems, which the DSbD programme had not targeted specifically. This is likely to provide some interesting use cases which may help to promote further awareness if results are allowed to be published, and if a CHERI solution is used to meet the requirements of the “Secure by Design” government procurement approach this would help spread awareness.

3.3.4 Known levels of awareness (the CHERI ecosystem)

Based on the activities above we are able to provide an estimate of the lower end of organisations and people who are aware of CHERI based on those involved in the DSbD ecosystem, unfunded board recipients and DASA competition:

Table 6: DSbD Ecosystem Summary

| Type of organisation | Number of organisations | Involved in more than one funded project | Estimated number of people involved in DSbD funded projects |

|---|---|---|---|

| Academic | 31 | 10 | 217 |

| Businesses | 94 | 25 | 658 |

| Public Sector* | 11 | 0 | N/A |

| Total | 136 | 35 | 875 |

Source: Information provided by UKRI and Digital Catapult. Includes unfunded board recipients and DASA competition awardees.

*Public Sector Organisations are mostly involved through the DSbD Advisory Group rather than funded projects

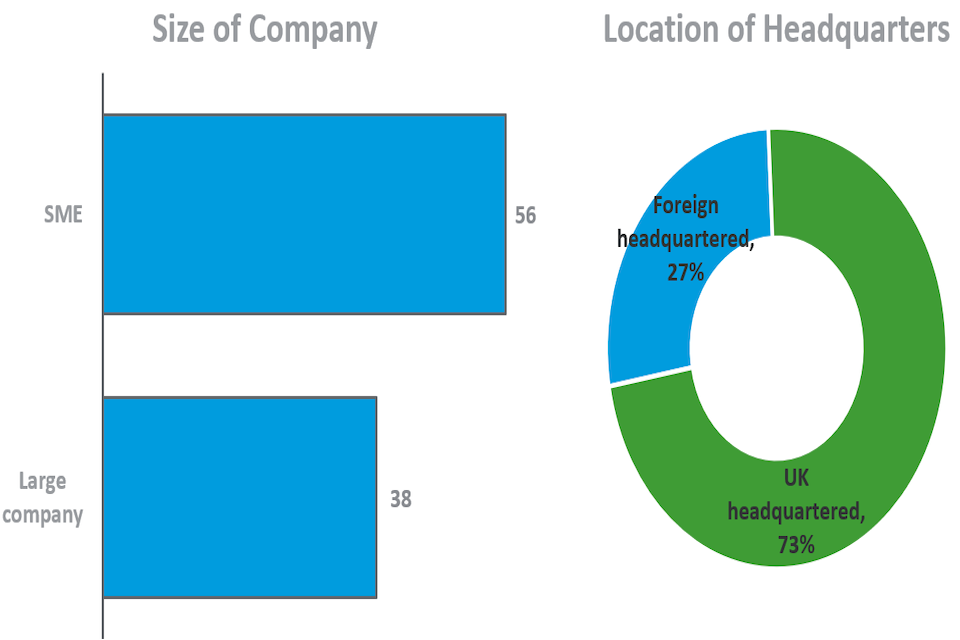

Figure 3:Profile of businesses in DSbD Ecosystem

Source: Data provided by UKRI about DSbD participants

The estimate of the number of people involved is based on results of a previous survey of DSbD funding award recipients suggests that around seven people per organisation have worked on funded projects on average.[footnote 35] There is considerable variation in this estimate – for example in Arm more than 100 engineers have worked on the Morello Board. Some of the SMEs who have accessed the boards through the TAP, only have one to three members of staff in total. Using this average as an estimate just under 900 people are in the current DSbD ecosystem and therefore aware of/have experience of using CHERI. Around 76% of these are currently working in industry.

3.4 Other factors that have enabled awareness of CHERI

The previous section covers the awareness of CHERI that has been enabled by programmes funded by the UK government to develop the technology. In addition, there is evidence of policy papers from government and corporations which reference the technology. This suggests an awareness of CHERI by those writing these papers. They are also sharing information about and raising awareness of the technology with their intended audience.

3.4.1 DARPA-funded CHERI research

Prior to the DSbD programme, Cambridge University and SRI international received funding from DARPA (Defense Advanced Research Projects Agency) in the US. This demonstrates some early awareness of CHERI by the US government. More recently they have published papers which reference the technology:

-

The US Cyber Security and Infrastructure Security Agency (CISA) recently published an article titled ‘The Urgent Need for Memory Safety in Software Products’. The article emphasises the ‘Secure by Design’ best practice guidance, which is influenced by work in the UK and EU (European Union) to build cyber security measures into the design and production of technology products. Memory safety has been highlighted as a key area of concern and CHERI is recognised as a potential solution to address this.[footnote 36]

-

‘Back to the Building Blocks: A path toward secure and measurable software’ report by the White House[footnote 37] conducted an extensive investigation into memory safety vulnerabilities. The study also explored secure programming languages and hardware architecture to increase resilience of future cyberspace. Notably, the paper cited CHERI as a potential technology for enhancing memory safety.

Key takeaway about DARPA funded CHERI research: The US government has funded the early development of the technology. Recent interest in promoting memory safety has led to the technology being referenced in papers produced by CISA and the White House. If the language around memory safety can be standardised internationally, and CHERI promoted as a best-in-class hardware solution for memory safety, it will become easier for CHERI to be referenced in internationally agreed standards, and for governments and companies around the world to procure CHERI as part of a requirement for memory safety.

3.4.2 Corporate papers, press releases and policies referencing CHERI or DSbD

The projects funded through DSbD have led to a number of mostly academic publications about CHERI, but of greater interest in understanding awareness for adoption is the number of corporate publications and government publications which reference CHERI. Here is a summary of significant items we are aware of:

-

In 2022, a representative of Arm referenced CHERI at the IEEE Institute of Electrical and Electronics Engineers Hot Chips Symposium[footnote 38]

-

Codasip producing the first commercially available CHERI design through their 700-processor series.[footnote 39]

-

In March 2024, Google released a White Paper about memory safety which references CHERI.[footnote 40]

-

Microsoft Research has also published a blog post about their work on CHERIoT.[footnote 41]

Key takeaway about corporate publications referencing CHERI: A few organisations are publishing documents on CHERI, although we can’t assess how many people have read these. These are mostly reports produced by significant multinational companies in CHERI relevant to their sectors.

3.5 Assessment of wider awareness of CHERI

To assess wider awareness of CHERI outside the ecosystem above, we undertook a survey and interviews. This section presents results from our primary research and includes information from other sources used to triangulate our findings.

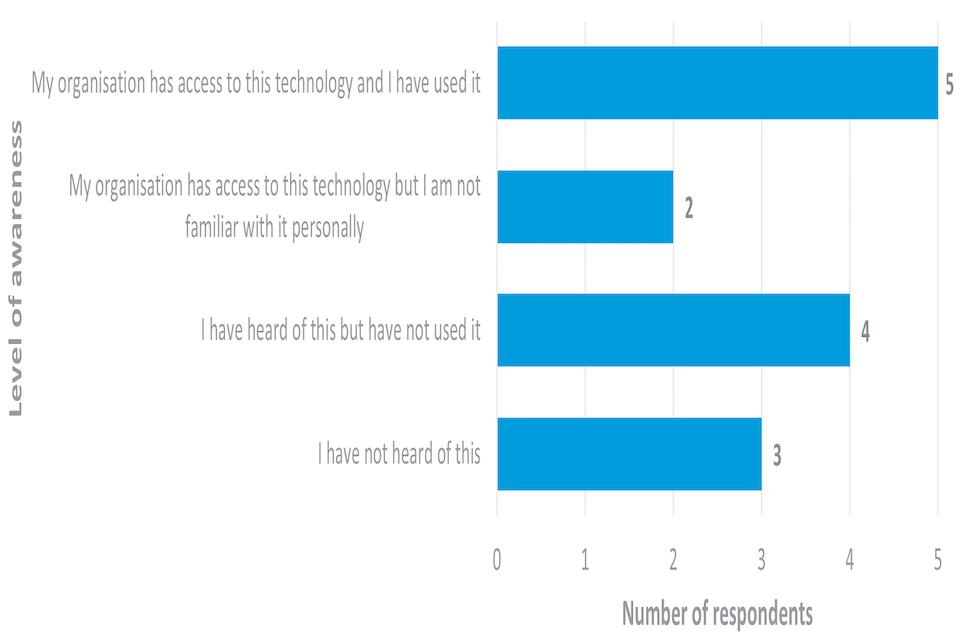

3.5.1 RSM Survey

We surveyed companies identified in the bottom-up analysis outlined in Chapter 3. This targeted senior decision makers and technical experts with roles such as CEO, CTO, CISO, Chief Security Architect, and IT Manager, among other roles relevant to CHERI. The companies surveyed spanned the semiconductor supply chain, software firms, and key sectors for CHERI applications including telecoms, automotive, utilities, and defence (as identified by the familiarisation interviews). To ensure maximum response from people with familiarity with the technology, our approach prioritised senior executives in small to medium-sized firms and technical roles in larger companies, resulting in a comprehensive contact list for all companies in the dataset.

The survey was open for four weeks and promoted by contacts in the DSbD advisory group, DSIT, the NCSC, the Internet of Things Security Foundation (IOTSF) and our advisors. Our bottom-up analysis identified further companies in these groups and contact details for relevant personnel were sourced through RocketReach[footnote 42].

The survey included a question about awareness of CHERI and other memory security technologies:

Table 7: Awareness of memory security technologies (N = 22)[footnote 43]

| Security Technologies | I have not heard of this | I have heard of this but have not used it | My organisation has access to this technology, but I am not familiar with it personally | My organisation has access to this technology, and I have used it | Total Respondents |

|---|---|---|---|---|---|

| CHERI | 3 (21%) | 4 (29%) | 2 (14%) | 5 (36%) | 14 |

| TrustZone | 4 (29%) | 1 (7%) | 2 (14%) | 6 (43%) | 13 |

| Root of Trust | 3 (21%) | 1 (7%) | 3 (21%) | 7 (50%) | 14 |

| Open Titan | 5 (36%) | 5 (36%) | 1 (7%) | 2 (14%) | 13 |

| Rust or other memory safe languages | 2 (14%) | 3 (21%) | 2 (14%) | 5 (36%) | 12 |

| WorldGuard | 8 (57%) | 3 (21%) | 1 (7%) | 1 (7%) | 13 |

| MTE | 8 (57%) | 3 (21%) | 1 (7%) | 1 (7%) | 13 |

| Other | 3 (21%) | 1 (7%) | 1 (7%) | 3 (21%) | 07 |

Source: RSM Survey February-March 2024

Only a small proportion of respondents (around a fifth) said they had not heard of CHERI. Many respondents also had experience of other memory safety technologies, especially Root of Trust, TrustZone and Rust.

Figure 4: Awareness of CHERI

Source: RSM Survey February-March 2024

We also asked about the relevance to the business of the technologies identified above. Respondents thought all the examples listed were important to some degree.

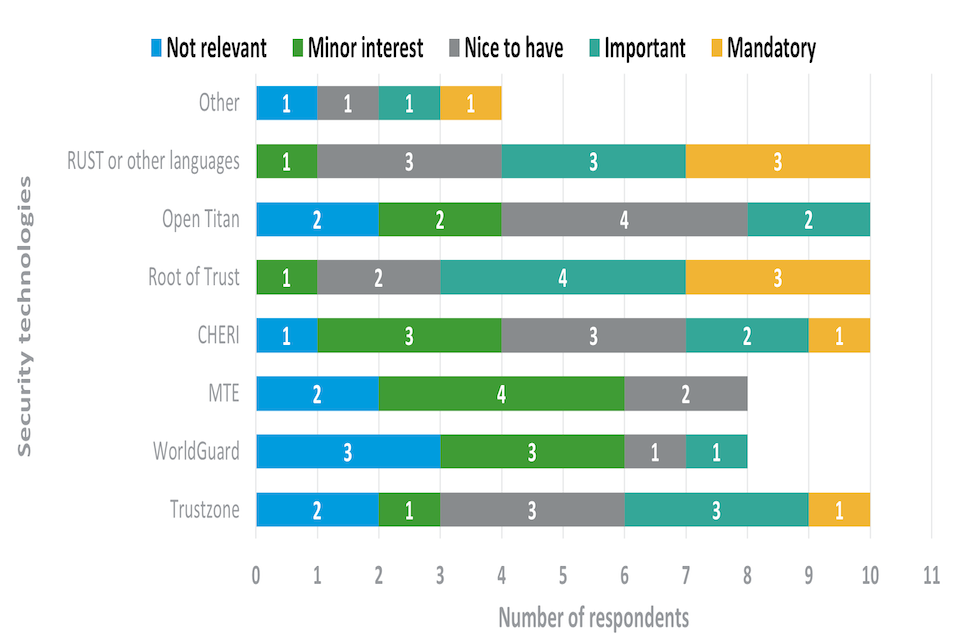

Figure 5: Relevance of security technologies (N = 22)

Source: RSM Survey February-March 2024

Many of the respondents to the survey were chief security or technology officers, so they saw action to protect memory safety as important and their view of a technology’s importance was guided by how familiar they were with it. Respondents had similar levels of awareness and experience of CHERI and Rust and therefore had similar views of the relevance of these technologies. Most of the interviewees who were aware of CHERI thought that it offered better protections and opportunities to improve security than Rust.

Limitations

Overall, only 22 valid responses were received for the survey as a whole. The survey was promoted by DSIT, the NCSC and the DSbD Advisory Group so there is some risk that responses for this question about awareness are not representative of the market as a whole as those publicising it are more likely to be networking with firms who are aware of the technology. These limitations mean the survey may not be representative of awareness of CHERI in the wider target market.

To compare and verify our results, we identified a previous survey[footnote 44] asked about awareness of CHERI among UK organisations. The survey was live from July to December 2022 and received 76 responses. It was promoted through the Chartered Institute of Information Security, DSbD mailing list, in-person security events and the DSIT (then the Department for Digital, Culture Media and Sport or DCMS) cyber security newsletter.

This survey had good coverage from a range of different sizes of organisations and sectors: 64% of respondents were from large organisations with over 500 employees and sectors covered include Finance and Insurance; Public Administration; Health and Social Work and Education, so there is a slightly different mix of sectors captured. There is no information about whether these were UK or multinational companies.

Just over half of the respondents to this - 51% - were in cyber security or wider IT roles, with a further 28% coming from senior managers. From this survey 9% were familiar with CHERI and 26% had at least heard of it. This is also based on a small sample size and was promoted through similar channels, so is likely to have similar limitations. But there is potentially some indication of awareness of CHERI beyond the DSbD Ecosystem.

Key takeaways about surveys of awareness of CHERI: Because of the limitations of both surveys (a low number of responses and some degree of promotion through the existing ecosystem) it is not possible to use either survey to accurately assess wider awareness of CHERI across businesses in the semiconductor supply chain as a whole.

3.5.2 Evidence from interviews

Interviews with DSbD members have confirmed awareness of CHERI with key semiconductor supply chain companies identified in our market research, especially among the parts of the supply chain relevant to CHERI adoption.

We interviewed representatives from 18 companies. While many interviewees were involved in the wider CHERI ecosystem at least six were not. Two interviewees said they were unfamiliar with CHERI before being approached for an interview (one came through contact via the survey; the other as approached by an advisor). The survey respondent was an organisational resilience and training consultant based in India. The other was a multinational automotive company with a presence in the UK.

Individual awareness

We also asked about the type of person within companies who was aware of CHERI. Four interviewees felt that there was good awareness among technical experts and cyber security officers, but that some awareness raising was needed among senior decision makers at large companies in the semiconductor supply chain.

A key challenge for engaging with senior decision makers was the view that security is a cost, and it is difficult to value the economic benefits of improving security. Some recommendations for improving awareness with this audience included sharing more learnings and information about the economic costs and benefits of adopting CHERI. Some of this material is being produced by the existing DSbD programme (especially case studies of the TAP and outputs of the Discribe Hub). Recommendations for targeting sectors and raising awareness are covered in more detail in Chapter 6.

3.6 Summary of Barriers and Enablers to Awareness of CHERI

Based on interviews, surveys and other data outlined above, the table below outlines barriers and enablers to CHERI awareness:

Table 8: Enablers and Barriers to CHERI awareness

| Facilitators of CHERI awareness | How this is enabling or driving awareness | Barriers or features hindering awareness and how these could be addressed |

|---|---|---|

| The DSbD programme | Enabling awareness by funding projects and providing access to the technology has developed an ecosystem of people and organisations who are aware of the technology. The Discribe Hub and TAP have been particularly important in spreading awareness of the technology. | Some of the guidance material for how to get started using CHERI requires very good technical expertise and experience. This material could be more user-friendly to a less specialist audience. Some of this is due to the overall readiness for adoption of the technology and improving this would help to address this barrier. |

| Learnings from DSbD funded projects including demonstrators | The funded projects and demonstrators have helped to prove the technology is effective in providing improved security and sharing learnings to make the technological case for adoption | Further work is needed to explore the costs and benefits of adopting CHERI, such as how much effort is required for porting to CHERI and the benefits of the improved security it provides. There is work underway on this, including a cost benefit simulator and case studies of TAP projects. |

| Policy papers by UK and US government | These enable awareness of the DSbD programme and CHERI technology. Within the UK, key examples are the National Semiconductor Strategy. | These currently raise awareness but do not mandate the use of CHERI. Chapter 6 of this report discusses issues around regulation; standards and government procurement guidance in promoting awareness and adoption of CHERI. The language of memory safety is critical: if it can be internationally agreed what constitutes memory safety and which approaches provide it, then CHERI can be more easily promoted as a best-in-class hardware-based solution. |

| Papers by companies such as Arm, Google and Microsoft also promote awareness of CHERI | Interviewees highlighted some of these papers to us in the course of our conversation, demonstrating a degree of awareness of what their own and other organisations were doing around CHERI adoption or where they thought adoption would be beneficial. | The current audience for these papers is mostly people interested in cyber security, technology and research and usually shared on company blogs, which may have a limited reach to a technical audience who are looking specifically for information about CHERI. Table 13 of this report highlights important companies to engage with on CHERI adoption which will enable a more targeted approach. |

| The CHERI Alliance will raise awareness within the RISC-V ecosystem | The CHERI Alliance aims to promote CHERI as an efficient standard for addressing memory safety issues, which will help to raise awareness of the technology. | This has only recently been announced, so it is too early to say yet how many people and organisations are engaging with it. |

4. The current potential market for CHERI

4.1 Introduction

This chapter addresses research questions about the potential CHERI marketplace as it currently appears; its key sectors and firms, and how it relates to the established semiconductor supply chain. It answers the following research questions:

-

RQ1: What is the size and scope of the potential market for CHERI technology?

-

RQ2: How many semiconductor supply chain firms are -

a. based in the UK that could potentially implement CHERI technology within semiconductors?

b. not based in the UK that could potentially implement CHERI technology within semiconductors?

c. The extent to which these maps onto the existing semiconductor supply chain or whether there is a distinction between the two? -

RQ4: What are the characteristics of the companies within this potential market, including their position within the semiconductor supply chain, their number of employees, their revenue, their geographical location and other demographics?

Further, the chapter also identifies the most influential organisations within this potential market when it comes to diffusion of CHERI technology.

4.2 Summary

The scope of the market and its global supply chain (RQ1, 2)

-

Key semiconductor market segments relevant to CHERI adoption are identified as Design (supply side), Integrated Device Manufacturing (IDM) (demand and supply side), and systems manufacturing (demand side). Software Development also features as a sector that could provide solutions to businesses and consumers using CHERI technology. Semiconductor manufacturing is identified as less critical, since the decision to adopt CHERI is unlikely to be made in this segment.

-

Globally, the US, Japan, Taiwan, South Korea, China, India, Southeast Asia (Philippines, Malaysia, Vietnam and Singapore), and Europe (Germany, Netherlands, Austria and Turkey) are identified as key countries and regions for parts of the semiconductor supply chain. These countries have headquarters of major semiconductor firms, including Samsung, TSMC, NXP, SK Hynix, Tokyo Electron, SiFive, Intel, and Codasip. They play different roles in the market:

a. The USA is an extremely important market player, dominating chip and CPU design and with strong presence in chip manufacture, systems manufacture and IDMs.

b. Despite their significant role in the global semiconductor market, the potential influence of Taiwan and China on CHERI adoption is limited as their strengths lie more in wafer fabrication (front-end) and semiconductor packaging (back-end) than in design and EDA segments. South Korea is also an important country for manufacture, but is also where Samsung is headquartered, and Samsung is an important firm for CHERI adoption.

c. India and Southeast Asia are well-positioned to adopt CHERI, having rapidly growing semiconductor industries, lower cost of skilled talent, and inward investment from multinationals in sectors that can integrate CHERI in design and manufacturing.

d. Japan is of key importance to the UK as it has distinct, yet complementary strengths backed up by the 2023 UK-Japan semiconductor partnership.

Quantitative research on the UK CHERI market (RQ2, 4)

- We have identified 394 companies that are directly relevant for CHERI adoption and diffusion in the UK through searches in financial databases, industry reports, etc as part of bottom-up research, and 17 industrial sectors of relevance through top-down analysis.

Bottom-up research on UK semiconductor supply chain firms

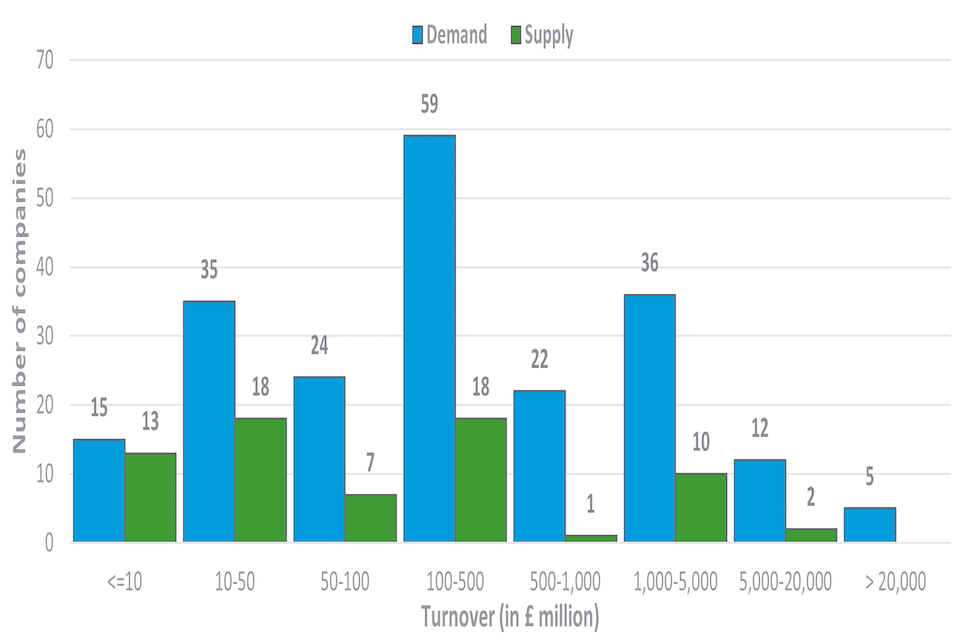

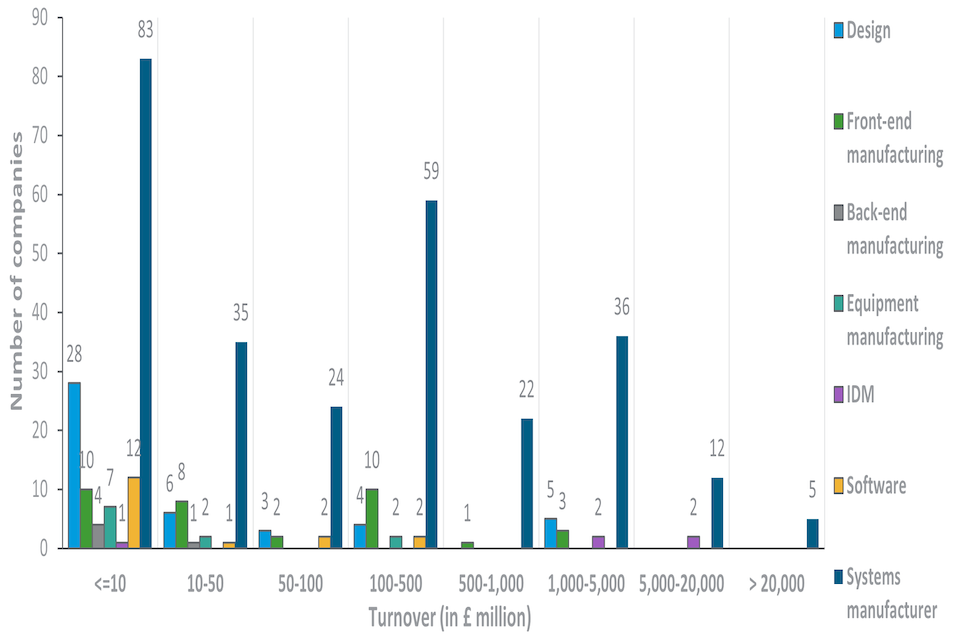

-

Of the 394 firms, 29% (114) are supply-side, mainly semiconductor (99) and IT equipment manufacturers (15) and 71% (280) are demand-side, including systems manufacturers and further downstream potential adopters of CHERI.

-

60% (238) of CHERI-relevant firms in the UK are headquartered and operate in the UK. These firms are primarily involved in semiconductor design (13%), software development (5%), and front and back-end manufacturing (6%). There are no integrated systems manufacturers headquartered in the UK.

-

Multi-National Companies (MNCs) operating in the UK but headquartered abroad comprise of 39% (155) of the identified UK CHERI market. These firms are primarily involved in semiconductor design (10%), software development (4%), and front and back-end manufacturing (15%). There are 5 MNC IDMs operating as subsidiaries in the UK.

-

DSbD participants make up 19% (76) of the total companies identified in the current UK CHERI market. This includes Arm, the market-leading chip design company who were funded to create the DSbD platform prototype (Morello).

-

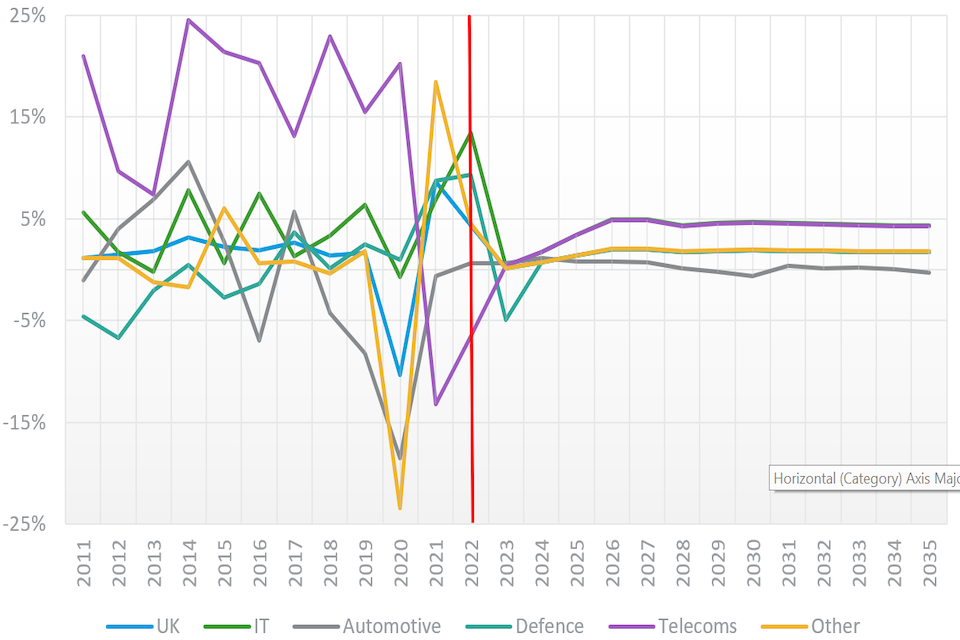

Based on interviews and reviews of the DSbD programme’s progress, automotive, defence, information technology, and telecommunications have emerged as key user sectors with the highest likelihood of CHERI adoption in the near future. This is driven by the escalating need for robust system security arising from increased automation, digitalisation, the rise of Artificial Intelligence (AI), and the demand for resilient infrastructure. These are all considered critical national infrastructure and are therefore strategically important.

Top-down analysis of key industrial sectors and their sizes

-

The top-down analysis identified 17 SIC[footnote 45] (Standard Industrial Classification codes 2007) industry segments in the UK that have the highest proportion of semiconductor designers and manufacturers, and immediate users such as systems manufacturers. In 2021, these SICs generated a turnover of approximately £94 billion and employed a workforce of around 288,000 employees.

-

The Gross Value Added by these 17 industry segments in 2021 is estimated to be around £25 billion. The most significant contributors to this GVA are aerospace manufacture (28%), motor vehicles (24%), and electronic measuring and testing equipment (15%).

Bottom-up analysis of individual companies by size

- Findings from the bottom-up approach indicate that out of firms that had turnover data, 93% (258) of the current CHERI market had turnovers under £5 billion, with 30% (82) SMEs with turnovers below £50 million. Five demand-side companies, namely Jaguar Land Rover, BAE Systems, Amazon, BT Group, and Vodafone, have turnovers exceeding £20 billion.

Geographical locations of companies (bottom-up)

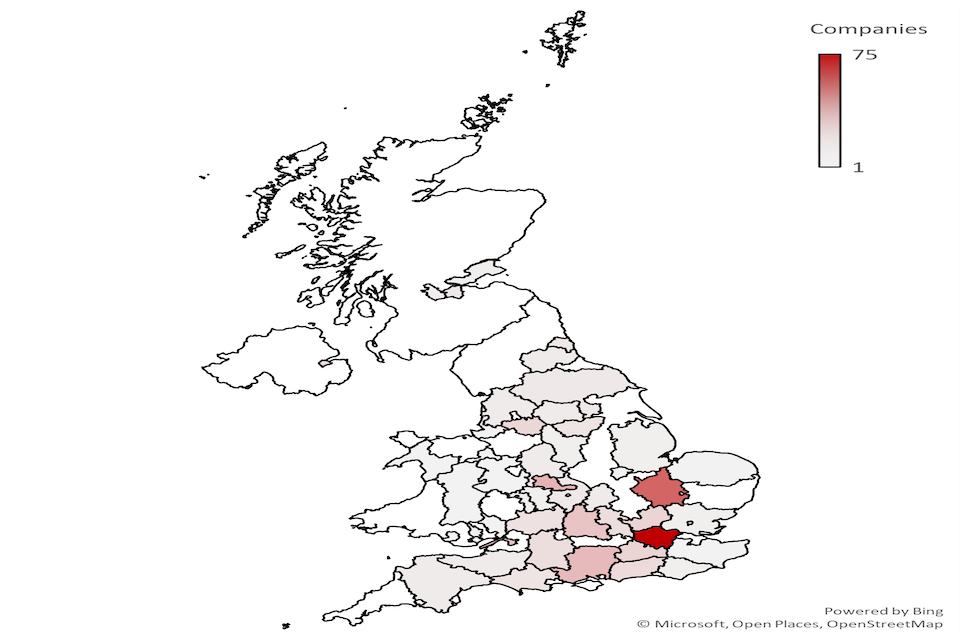

- A spatial distribution of geographical location of companies revealed a clustered presence of CHERI relevant firms in London, Cambridgeshire, Oxfordshire, Bristol, Berkshire (Reading) and West Midlands, in line with the National Semiconductor Strategy[footnote 46].

Most influential firms by sector

- Arm, Codasip, Qualcomm and Intel are identified as the most influential potential drivers of CHERI adoption based on our identification framework with multiple parameters such as Financial indicators, Location, Reach, and Activities in the UK. Intel has their own chip architecture which is dominant in data centres (x86). Consultation suggests Intel have their own security solutions (Software Guard Extensions or SGX)[footnote 47].

4.3 Methodology used to measure the current size and scope of potential market for CHERI

The research specification for this work asked for the size and scope of the potential market for CHERI technology, and whether this maps onto the existing semiconductor supply chain (which was described in section 2.5).

4.3.1 Defining the scope of the market and its global supply chain

Market definition: In the context of this study, the CHERI market is identified as the complete set of companies that have the potential to integrate CHERI into their goods and services.

The scope of this market was determined through insights from familiarisation interviews with stakeholders in the DSbD programme and in Government, qualitative interviews with companies, and literature reviews.

It also benefited from the iterative nature of the quantitative “top-down” and the “bottom-up” research on specific companies in the UK which we carried out (see below); as we learned more about the characteristics of companies that CHERI could potentially impact, we refined our search terms and modified the scope accordingly.