Part 4 Quick Start Guide: Setting metrics and targets to measure and manage climate-related risk

Updated 23 September 2022

1. Role of Metrics

Metrics and targets have a key role to play in activities throughout the pension scheme’s investment decision-making process, not only in measuring their risk exposure (outcome metrics), but also in managing their climate risk exposure (process metrics).

It is important that the metrics incorporated by the trustees are chosen according to their relevance to the scheme.

2. Availability of Data

The lack of available data is a commonly reported pitfall when schemes seek to calculate the TCFD’s recommended metrics. Few, if any, trustees will be able to obtain full underlying data across their entire portfolio in the first instance. There are a number of ways in which trustees can compensate for this issue to ensure their metrics are decision useful:

- Where gaps in data do exist trustees could use modelling or estimation to fill them. Trustees may do this by utilising proxy data where direct measurement is not possible. For example, where you cannot find data for a specific asset or asset class it may be possible to acquire averages for the sector they sit in and make estimations based on that.

- Where incomplete data-sets exist for quantitative metrics, qualitative metrics may be used for analysis instead (or as well).

- If the company or asset manager does not report energy use and emissions data for its operations or a particular fund, trustees could use third-party data providers.

- Trustees may also choose to only report metrics and targets, or perform scenario analysis, for the sections of their portfolio for which reliable data can be found.

3. Selecting Metrics

The level of greenhouse gas (GHG) emissions is one key outcome metric by which pension schemes can measure their transition risk, as well as being the most straightforward.

Care is needed where data is not standardised – some firms quote only scope 1 (direct emissions) and 2 (indirect emissions from producing the electricity used); others also estimate scope 3 (all other indirect emissions).

However, firms with similar carbon intensities today can have divergent future trajectories.

Other metrics include Forward-looking outcome metrics such as “implied temperature rise” can be used to estimate that trajectory.; and process metrics such as shares of portfolio in which climate engagement is carried out, or for which acceptable quality data has been obtained.

Core Outcome Metrics

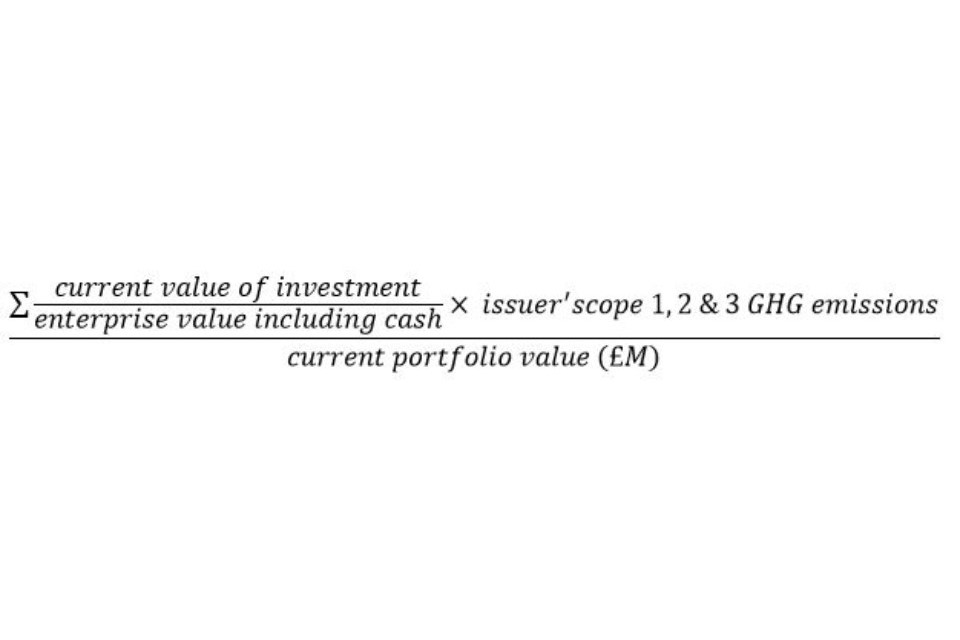

Carbon Footprint – measures how many tonnes of CO2e emissions each million (£m) invested funds.

- Can use to compare asset classes/portfolios to one another or to a benchmark

- Using the portfolio market value to ‘normalise’ data is intuitive to investors

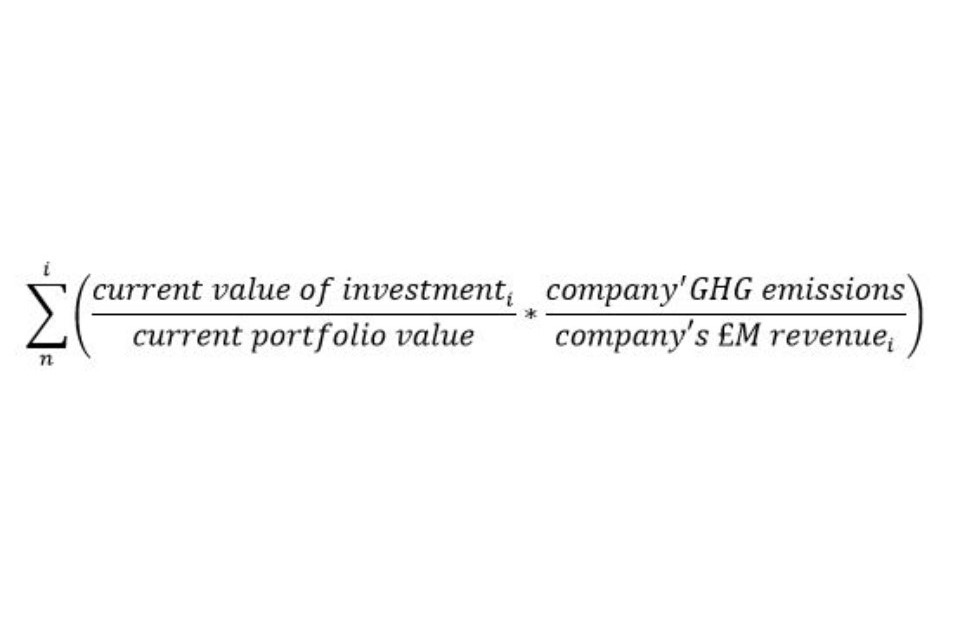

WACI - metric for measuring a fund’s exposure to carbon intensive assets

- Fairly easy to communicate to trustee board and members

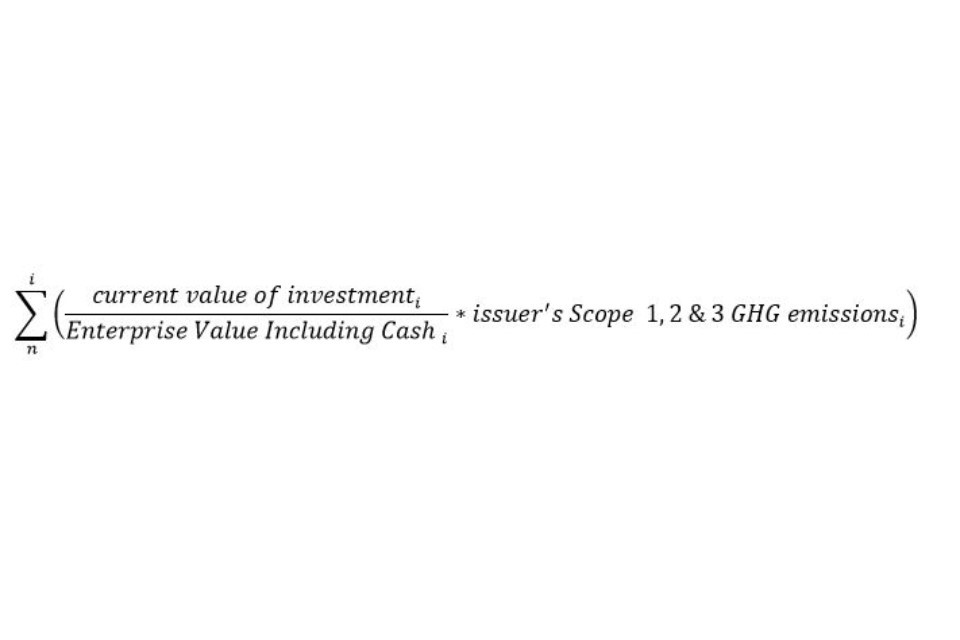

Total Carbon Emissions - measures the total absolute greenhouse gas emissions attributable to a portfolio.

- Simple to calculate and easier to track progress

- Enables trustees to set a baseline for climate action and to understand the climate impact of their investments

Implied temperature rise - forward-looking metric of future emissions, expressed as a projected increase in global average temperature.

- Provides forward looking measure – where investments will transition to, rather than where they are now.

- Expressed in easy to understand single temperature unit or range

Core Process Metrics

Share of portfolio held at year end for which engagement or voting on climate-related risk and opportunities has been a substantive topic

- Does not require complex data, useful for monitoring asset managers

Share of portfolio held at year end for which climate-related metrics of an acceptable quality have been obtained

- Very simple to understand

- Focuses trustee attention on improving data quality as part of asset manager appointment and monitoring decisions.

4. Targets

Once metrics have been established, TCFD recommends the setting of targets. These can be outcomes-based targets, such as a reduced portfolio carbon intensity; or process-based targets around data, engagement and voting.

Target-setting is a useful tool for trustee boards to track their efforts to reduce climate change risk exposure and maximise climate change investment opportunities. Targets should be embedded in governance processes, so that trustees can hold managers and consultants to account for performance against their prescribed objectives.

5. Examples of Targets

The targets trustees set should be useful and relevant to their scheme. Trustees should ensure they are measurable and be sufficiently stretching. The following are some examples of targets Trustees may wish to set:

Starting out:

- Percentage of shareholder resolutions on climate related risk the scheme or persons representing the scheme support.

- Number of conversations/engagements between pension scheme and its asset managers analysing/discussing their voting on ESG matters.

Good Practice:

- A reduction in the average carbon footprint of your investment portfolio

- A reduction in the implied temperature rise of your portfolio

Best Practice:

- A reduction in the carbon intensity or WACI of your portfolio or of a particular asset class / sector represented in their portfolio.

- A X% reduction in the total absolute greenhouse gas emissions attributable to your investment portfolio