The CMA’s Digital Markets Strategy: June 2019

Updated 9 February 2021

In February 2021 we published a refreshed version of our Digital Markets Strategy. You can read the original, published in June 2019, below or visit the updated strategy.

The CMA’s digital market strategy

Summary

The digital economy is transforming the way we live our lives: people are in contact with companies 24/7 on their devices, business models are changing at pace, and innovation is the key to success across all markets.

Without doubt our lives are enhanced in many ways through digital developments: consumers can make more informed decisions with greater access to information, and businesses can reach millions of customers at lower cost. Digital advances make most markets truly international.

Competition principles are about making sure that markets work well for consumers across the entire economy. Not since the industrial age has the world gone through such a profound change as that unfolding today with the emergence of the digital economy, which is giving rise to new forms of employment, skills, and new leisure activities.

It is imperative that competition authorities, in collaboration with governments, consumers, and industry participants, develop a path that protects consumers while ensuring robust competitive and innovative digital markets. Most of the markets that are the focus of regulatory interest involve international companies, often headquartered outside the UK, and many are global in nature. We need to work with other authorities around the world to share knowledge and develop a common understanding where possible.

The profound changes being brought about by the digital economy have led us to develop this Digital Markets Strategy, which sets out the CMA’s approach to these challenges. As an organisation we have been working in this space for some time and we renewed our prioritisation of Digital in our recent Annual Plan. The purpose of this document is to draw our work together in one place and indicate our ambition for the coming years.

I welcome input from the many interested parties as our Strategy evolves over time. The CMA will draw on the suggestions made in the Furman Report by establishing ‘participative’ relationships where possible as we work out the right response to new challenges presented by digital markets.

Andrea Coscelli

Chief Executive Officer, Competition and Markets Authority

Introduction

Why are digital markets different?

Digital markets are those where companies develop and apply new technologies to existing businesses, or create brand new services using digital capabilities. Their reach can extend across the entire economy. This is very different from what people were familiar with ten or twenty years ago. Many services are completely new – whether social media, most apps, or any kind of online shopping.

Almost all aspects of our lives are touched by digital evolution. Many services are ‘free’ to consumers. People have benefited hugely, through new employment opportunities, greater convenience, personalisation of products and services, rapid delivery of products, easier connection to family and friends, and innovation from smaller companies now able to reach a global customer base.

Competition is the main tool to ensure that digital companies continue to innovate, support new entrants to the market so that monopolies do not form, and ensure that consumers have their rights protected and receive better products. The CMA oversees competition across the economy. This puts us in a unique position of responsibility to ensure that conditions exist to support strong competition and protect consumer interests.

Our position gives us particular insight into the underlying features of these markets, which are also increasingly well documented through a series of authoritative reports [footnote 1] including: substantial network effects, economies of scale and scope, the role of data and the computing power to use it, scope for personalisation, and market concentration.

Most of these are not new individually, but in combination they are novel. Combined with the pace of change, it can be hard for both consumers and public authorities to keep up. The speed of change and the vast international reach of major players are particularly challenging for authorities acting unilaterally.

Some of these features, or their effects, raise questions, including: firms’ use of people’s data, the market power or ‘gatekeeper’ status of certain platforms, use of increasingly sophisticated technology to target advertising; or the risk of so-called ‘killer acquisitions’ – big companies buying smaller innovative ones with a view to extinguishing them as potential rivals. And all the time consumers’ reliance on these services is increasing.

What are we trying to achieve in digital markets?

The CMA works to promote competition for the benefit of consumers, both within and outside the UK, to make markets work well for consumers, businesses, and the economy.

In digital markets this means first and foremost ensuring that the enormous innovation and benefits brought about through digitalisation can continue. There needs to be a level playing field so that all businesses – large and small, incumbents and new entrants alike – can compete on the merits of their offering; consumers should be able to feel trust in online markets; and new competitors need to be able to enter, bringing yet more services to the market.

The effects of digitalisation are felt across many sectors and in many dimensions. To achieve our aims we must work with a wide range of other authorities: other cross-sector bodies like the Information Commissioner’s Office and Trading Standards, sector-specific regulators like Ofcom and the Financial Conduct Authority, and our counterparts around the world as we all deal with these global changes.

Why a digital markets strategy?

The CMA and its predecessors have always attempted to keep pace with markets changing around us, in order to keep serving consumers’ interests. Examples include:

a) Policy and research papers, for example on personalised pricing and the use of algorithms.

b) Markets work, such as our retail banking market investigation, which led to the ground-breaking Open Banking remedy, and a major study on digital comparison tools.

c) Many competition and consumer enforcement cases, on subjects as varied as online poster sales, hotel booking sites, celebrity endorsements on social media, online gambling and online dating.

d) Merger reviews, in sectors such as cashback websites, credit comparison platforms and credit checking tools, and online food platforms.

The appendix gives a fuller sense of the range of work we have done in digital markets

But we need to become ever more effective at this, and to do so in a way that is unified across our tools, and in strong collaboration with other authorities in the UK and abroad.

In order to assist all interested parties in understanding our priorities, this document sets out five strategic aims, and seven priority focus areas. It is both forward-looking and explains how the work we are doing now builds on past outputs.

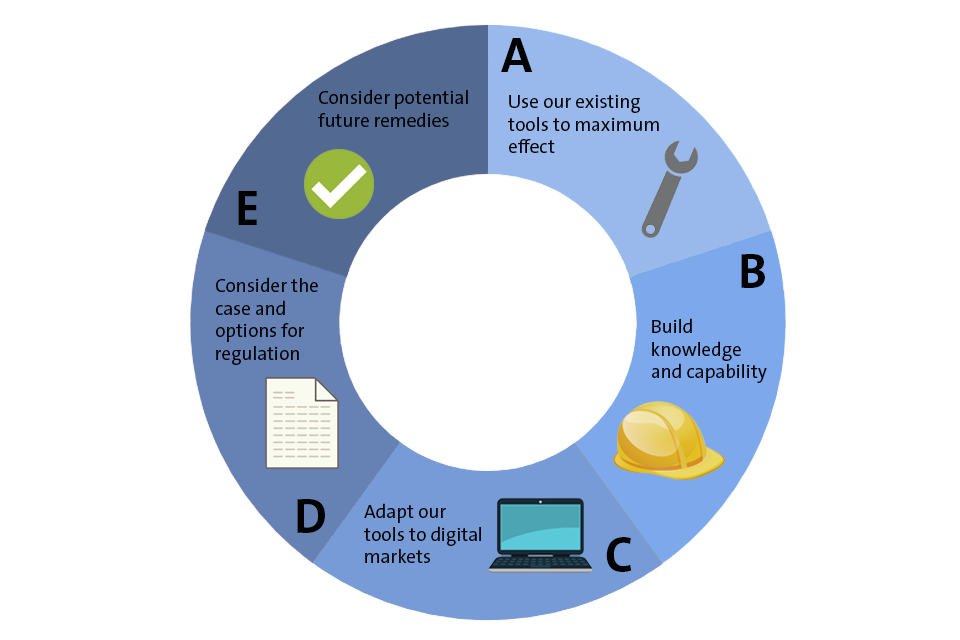

Our five Strategic Aims

Based on our previous work, and from engagement in public debate, we have developed five strategic aims, supported by seven priority areas of focus.

5 digital principles

Our strategic aims and priority areas of work

A. Use our existing tools effectively and efficiently

We will use our tools effectively and efficiently, considering how best to target our antitrust and consumer enforcement action, market studies, and merger assessment to digital markets.

B. Build our knowledge and capability

We will build knowledge and skills to ensure we understand digital business models, and their opportunities and risks.

C. Adapt our tools to the digital economy

We will adapt, or propose adaptations to, our tools where needed to meet the challenges of the digital economy.

D. Consider the case and options for regulation

We will support the Government’s consideration of the need, and options, for new regulatory structures in digital markets.

E. Consider potential future remedies in digital markets

We will build on our existing remedies expertise with an increased focus on potential digital-focused remedies, such as data portability or interoperability.

Priority focus areas

Priority 1: Consumer and antitrust enforcement and merger assessment

Strategic aim: A

Even though many of our enforcement and merger assessment tools were built for the analogue age, and would therefore benefit from certain reforms to future proof their effectiveness, it is important to use our existing powers to the fullest extent possible. Such action incudes investigating fake online reviews, celebrity endorsements, the conduct of price comparison websites and online platforms, and mergers in fast moving markets. We are increasing our efforts to scan the horizon to anticipate and target poor practices and areas of concern in digital markets which may form the basis for future enforcement action.

Priority 2: The work of our Data, Technology and Analytics (DaTA) unit

Since our 2018 - 2019 Annual Report announced that we would establish a new team to boost our digital capabilities, we established and are scaling up a Data, Technology and Analytics (DaTA) unit. The unit’s aim is to support the CMA with technical understanding of working with data and using algorithms.

The unit has team members with data engineering, data science, and data and technology market intelligence expertise. We have been building our ability to capture, analyse, and draw conclusions from small and large data sets, use machine learning and artificial intelligence techniques, and understand firms’ use of data and algorithms.

As part of this work we note the Furman Report’s Strategic Recommendation D to continue to monitor the development of Machine Learning and Artificial Intelligence to ensure it does not lead to anti-competitive behaviour or consumer detriment, particularly in relation to vulnerable consumers.

The unit conducts research and policy work, and supports data gathering and analysis for case teams across the organisation. It is also contributing to the creation of technology remedies, such as interoperability or techniques for anonymous data sharing, and understanding the data and analytical skills, and powers, that would be needed for a digital markets unit.

Priority 3: Market study on online platforms and digital advertising

We have launched a market study into online platforms and digital advertising. This is looking at a number of themes: the market power of digital platforms in consumer-facing markets; lack of consumer control over data; competition in the supply of digital advertising, and Furman proposals relating particularly to regime changes and institutional implications.

This study is a core part of our Digital Markets Strategy. A study like this could result in a range of outcomes, but it will certainly inform our thinking on platforms, and will help us to ensure that any future regulation is based on a good understanding of advertising-funded platform business models.

While our focus is on the UK market, the reach of many market players is global. While respecting the confidentiality constraints when we gather information in a study like this, we will look for opportunities to work collaboratively with other competition agencies as our work progresses.

Priority 4: Review our mergers approach to digital markets as necessary

The CMA has considered the case made for a change in merger control standards, including by the Digital Competition Expert Panel of the Furman Report, but believes that the legal framework remains largely fit for purpose. The possibility of under-enforcement on mergers has, however, been an increasing subject of debate in the digital space and more broadly. We are open to the possibility that our legal tests and framework as they apply to digital markets may need to evolve.

We are evolving our approach on how we assess digital merger cases. For example, we have launched a call for views on our approach to the assessment of digital mergers, to inform a review of our guidelines on how we assess merger cases. We also recently published an independent review of past digital mergers, to help us learn from previous cases. One area we are considering further is whether there might need to be some form of closer scrutiny for acquisitions by particularly powerful companies. We will continue to consider if any legislative changes to the merger regime are required.

Priority 5: Policy work to consider a possible ‘digital markets unit’

The Furman Report recommended the creation of a ‘digital markets unit’, which has been accepted in principle by Government. The proposal is to designate certain businesses as having ‘strategic market status’, to include a code of conduct and other possible remedies, not limited to data but including data interoperability, data mobility, and data openness.

Our market study on online platforms and digital advertising will play a major part in informing the development of this regulatory framework, but we are also carrying out a parallel and complementary piece of policy work. This will consider non-advertising funded business models, as well as the institutional questions, and make connections between the Panel’s recommendations and other policy issues or initiatives, for instance on online harms or ‘fake news’.[footnote 2] On this we will work with other authorities and with Government departments, particularly the Department for Digital, Culture, Media and Sport and the Department for Business, Energy and Industrial Strategy.

Priority 6: Proposals to reform our enforcement tools

Strategic aim: C

Our Chairman wrote in February 2019 to the Secretary of State for Business, Energy and Industrial Strategy with a range of proposals to reform the full range of our tools. Many of the proposals are important to ensure we are able to keep pace with the digital economy.

Consumers should not suffer unduly if the frameworks intended to protect their interests are slower to develop than the markets in which they consume. That gap is to some extent inevitable in fast-moving markets. So, we need to respond by being bold in using the available tools to the fullest possible extent, but also consider new tools.

An example of our proposals is the sharpening up of the interim measures regime to enable swifter action where detriment may be developing fast. We proposed strengthening the mechanisms for consumer enforcement to align more closely with those in competition enforcement. Some of these proposals overlap with recommendations made by the Digital Competition Expert Panel.

These proposals are now for the Government to consider and take forward as appropriate. We are working to support the Government as it does so.

Priority 7: International cooperation

The digital economy is almost unique in its reach across international boundaries, which means that it is essential for competition authorities to work with each other and with governments as we look to support innovation while protecting consumer interests.

The CMA and its predecessor bodies have always worked closely with counterparts abroad, through a combination of bilateral contact and multilateral arrangements: the European Competition Network (ECN), Organisation for Economic Cooperation and Development (OECD), International Competition Network (ICN) and International Consumer Protection and Enforcement Network (ICPEN); including assuming the presidency of the latter two in the past.

Given the global nature of the issues, we are increasing our efforts towards international cooperation and collaboration. We will capitalise on the significant synergies between our work on digital markets and that undertaken by our counterparts, such as recent antitrust cases by the European Commission into Google, the Bundeskartellamt action on Facebook, and the Australian Competition and Consumer Commission’s digital platforms inquiry. We will continue to strengthen ties with our international colleagues with the aim of more and closer collaboration; see for instance our joint open letter with ICPEN to businesses in the digital economy in relation to terms and conditions.

Appendix – examples of recent CMA digital markets work

Research and policy work:

a) Proposed reforms to Government in relation to the CMA’s existing competition and consumer powers to ensure they remain fit for purpose for digital markets, including developing a series of proposals by our Chairman.

b) Published research considering the use of pricing algorithms to facilitate collusion and personalised pricing, building on previous work carried out by the OFT.

c) Commercial use of consumer data – a call for information and report, 2015.

d) Online search behaviour – published research into areas such as how brand loyalty and online reviews affect consumer behaviour, and how firms use search engine optimisation and paid searches to gain visibility.

Markets:

a) Our retail banking market investigation and the subsequent introduction of Open Banking, the first major interoperability remedy in the world.

b) A major study on digital comparison tools, which led in turn to both consumer and competition enforcement action.

Consumer and competition enforcement:

a) The ‘posters’ case – a cartel between sellers on Amazon Marketplace enacted through a pricing algorithm.

b) Commitments from an online auction service provider to change its practices that may have prevented rivals from being able to compete effectively.

c) Investigation into the use of certain retail ‘most favoured nation’ clauses by a price comparison website in relation to home insurance products.

d) Social media celebrities who might not declare when they have been paid or rewarded to endorse goods and services.

e) Hotel online booking sites that have listed and ranked search results that could mislead as well as concerning discount and scarcity claims.

f) Online gaming console subscriptions, where Sony, Nintendo, and Microsoft automatically renew subscriptions for video gaming services risking additional costs for consumers.

g) Online gambling sites in relation to unfair ‘bonus’ promotions for casino-style games which had opaque rules on ‘abusive’ or low-risk gambling strategies.

h) Online dating sites, where we found misleading terms around use of consumer dating profiles affected privacy for users of the services.

i) Cloud storage services, where we found problems with cancellation and variation.

j) Online reviews, where we have concerns about fake reviews in particular.

k) Car hire, where we acted to improve the transparency of prices, terms and charges.

Mergers:

Many of our recent merger assessments involve digital markets and this list is merely illustrative. A full list of our merger cases is available on our website, with links to specific case pages for more detailed information.

a) PayPal/iZettle (2019) – transaction involving the supply of offline payments through mobile point of sale services.

b) TopCashback/Quidco (2019) – proposed acquisition (subsequently abandoned) involving the supply of cashback websites.

c) Experian/Clearscore (2019) – proposed acquisition (subsequently abandoned) involving the supply of credit comparison platforms and credit checking tools.

d) eBay/Motors.co.uk (2019) – transaction involving the supply of online classified vehicle advertising services.

e) Nielsen/AdIntel (2018) – transaction involving the supply of advertising intelligence.

f) Just Eat/Hungryhouse (2017) – transaction involving the supply of online food platforms.

-

J Cremer, Y-A De Montjoye, H Schweitzer, European Commission, Directorate-General for Competition, Competition Policy for the Digital Era (4 April 2019) (EC Competition Report)

J Furman and the Digital Competition Expert Panel, H.M. Treasury, Unlocking Digital Competition: Report of the Digital Competition Expert Panel (13 March 2019) (Furman Report)

George J Stigler Centre for the Study of the Economy and the State (15 May 2019), Study of Digital Platforms Market Structure and Antitrust (Stigler Review);

Lear report for the CMA, Ex-post Assessment of merger control decisions in Digital Markets (9 May 2019) ↩

-

Online harms white paper (8 April 2019) and Cairncross Review: a sustainable future for journalism, (12 February 2019) (Cairncross Review) ↩