Sector risk profile 2018

Updated 4 April 2019

Applies to England

Contents

Executive summary

Introduction

Strategic risks

- Health and safety

- Reputational risk

- Value for money

- Data and safety monitoring

Operational risks - stress testing

Operational risks - existing stock

- Stock quality

- Counter party risk

- Costs and inflation

- Rents and rental marke exposure

- Welfare reform

- Supported housing

Operational risks - development

- Low cost home ownership

- Market sales

- Diversification

Finance and treasury management risks

- Existing debt

- New debt

- Hedging strategies

- Lease structures and real estate investment trusts

- Pensions

Executive summary

The board of a registered provider of social housing is responsible for ensuring that the organisation has an appropriate risk management framework. This is essential, not only to meet the requirements of the regulatory framework, but more fundamentally to ensure that the organisation can remain financially viable and continue to meet its social objectives in a range of different circumstances.

Private registered providers manage around 2.8 million homes, and collectively have a turnover of around £20 billion. It is therefore important that providers’ risk management is appropriate to the scale, importance, and long-term nature of their businesses.

While the sector as a whole remains financially robust, the Sector Risk Profile sets out a wide range of common risks facing the social housing sector. A number of risks are increasing in importance, in particular:

-

Health and safety risks: Boards are ultimately responsible for ensuring the safety of their tenants and staff. Significant investments in fire safety measures are taking place in the aftermath of the Grenfell Tower fire, but it is equally important that boards have the appropriate controls in place to ensure compliance with the full range of health and safety requirements.

-

Reputational risk: The social housing sector is under greater scrutiny than ever before. It is vital that boards should have regard to stakeholders’ expectations in their decision making.

-

Sales risks: More registered providers than ever are reliant on sales income to fund their development programmes including some registered providers with limited previous experience in this area. While sales revenues can make a valuable contribution to delivering much needed affordable housing, it is vital that boards should understand the markets they operate in and have skills appropriate to the activities their business undertakes.

The risks facing each organisation will depend upon the nature of that business, and it is important that boards should understand the specific issues that they face. Some of these may be very particular to certain types of business. This publication summarises some of the specific risks that could affect specialist providers, for example lease-based supported housing landlords.

Boards should also ensure that they undertake challenging stress testing against the possibility that a number of risks crystallise simultaneously, for example in the event of a macro-economic shock or wider market downturn.

The regulator will continue to seek assurance that boards have appropriate risk management and internal control systems, and will reflect its level of assurance in its published judgments.

Introduction

1 - Registered providers’ boards are responsible for oversight of their organisation’s management of risk. Within the overarching role that boards need to play, risk management and mitigation strategies should underpin both the development of the business plan and all key decisions. A broad view of the risk universe is critical to ensuring that all the relevant risks are considered, assessed and controlled.

2 - It is important that boards have a robust understanding of the range of strategic and financial risks that their business might face, partly to ensure continued compliance with the regulatory standards, but more fundamentally to ensure that they can manage the risks that could prevent the organisation from achieving its objectives over the long term and in particular over the economic cycle.

3 - The regulator sets out its expectations of providers’ risk management in the Governance and Financial Viability Standard, and associated Code of Practice. Providers need to ensure that they have an appropriate, robust and prudent business planning, risk and control framework. The role of the regulator is to seek assurance on how those risks are being managed through this framework.

4 - Boards should understand the risks that are specific to their business. In preparing this publication we have reviewed a large sample of providers’ own risk registers, as well as the views of independent third party experts. This exercise suggests that the sector continues to monitor and manage a very wide range of risks. However, there are a range of common risks that are likely to apply to much of the sector, in varying degrees.

5 - This publication is designed as an update to help boards appreciate this range of common risks. It is divided into five main sections:

- Strategic risks

- Operational risks – stress testing

- Operational risks – existing stock

- Operational risks – development

- Finance and treasury management risks

6 - The regulator will seek assurance on registered providers’ risk management as part of its wider assessment of governance and financial viability and will reflect its level of assurance through its published judgements on individual registered providers.

Strategic risks

Health and safety

7 - As a landlord, registered providers are responsible for ensuring that tenants are safe in their homes and staff are safe at work. Compliance with statutory requirements is a basic minimum to provide assurance that tenants are safe. Registered providers should do whatever is necessary beyond this to demonstrate that health and safety risks are effectively managed. This will include identifying, managing, monitoring and reporting on them in a way that ensures that there is effective oversight by the governing body.

8 - Registered providers must demonstrate that they understand their statutory responsibilities (including, but not limited to, gas safety, fire safety, electrical safety, asbestos, Legionella and lift safety, as well as employee safety). If necessary, registered providers should take professional advice to ensure that they are clear about their responsibilities.

9 - Registered providers must be clear about their landlord responsibilities, both for stock that they own and stock that they manage, and they should understand what each property needs in terms of statutory safety checks and risk assessments. This includes confirmation that checks are being undertaken and demonstrating compliance, even if it is another organisation (for e.g. the building’s freeholder) that has the legal responsibility for undertaking the checks.

10 - Contracting out delivery of services does not contract out responsibility to meet the requirements of legislation or standards, and so registered providers need robust systems in place to give boards assurance of compliance across what can be complex subcontracting arrangements.

11 - Ensuring compliance with health and safety requirements requires good governance. This means identifying, managing, monitoring and reporting on risks in a way that ensures there is effective oversight by the governing body. Where health and safety issues do arise in the sector, we often see poorly designed or poorly implemented control systems. Good quality data on health and safety issues, for example on gas safety certificates, is essential to ensure compliance with statutory obligations.

12 - Registered providers should have assurance that their systems and processes are clear and comprehensive and that key staff know how to implement these processes to achieve compliance. The regulator will act where a breach of a consumer standard is found, and that breach causes potential or actual serious harm to tenants. Examples of where the regulator has taken action in response to health and safety failings are set out in our annual Consumer Regulation Review.

13 -Following the Grenfell Tower fire, there are expected to be significant changes to the requirements that landlords will need to fulfil. The independent Hackitt review of high rise building regulations and fire safety commissioned in the wake of the Grenfell Tower fire has set out a number of important recommendations for building safety. Registered providers need to consider the impact that these recommendations, and the government’s response to the review, will have on their businesses.

14 - They will also need to consider the impact of the government’s recent announcement and new policy banning the use of combustible cladding for all new buildings including care homes, student accommodation and residential buildings in England above 18m (60ft). The new ban will be implemented through changes to building regulations to be brought forward in late autumn.

15 - The government is currently considering a £400m fund to fully cover reasonable costs of removing and replacing unsafe Aluminium Composite Material cladding for local authority and housing associations. The funding is currently not being made available for any other works, including other fire safety works such as sprinkler systems. The decision as to whether to fit sprinklers in buildings is a matter for individual registered providers and their boards.

16 - While registered providers have made progress on replacing cladding identified following combustibility testing (by July 2018 work had started on over 70% of affected buildings in the social sector), providers who have identified such cladding must ensure that work on these buildings continues at pace.

17- Registered providers affected by tower blocks with cladding which needs to be replaced, should understand the costs associated with replacement material and any implications on other planned major repairs expenditure, particularly for large and complex buildings. Further detail on risks associated with repairs expenditure is set out later in this report.

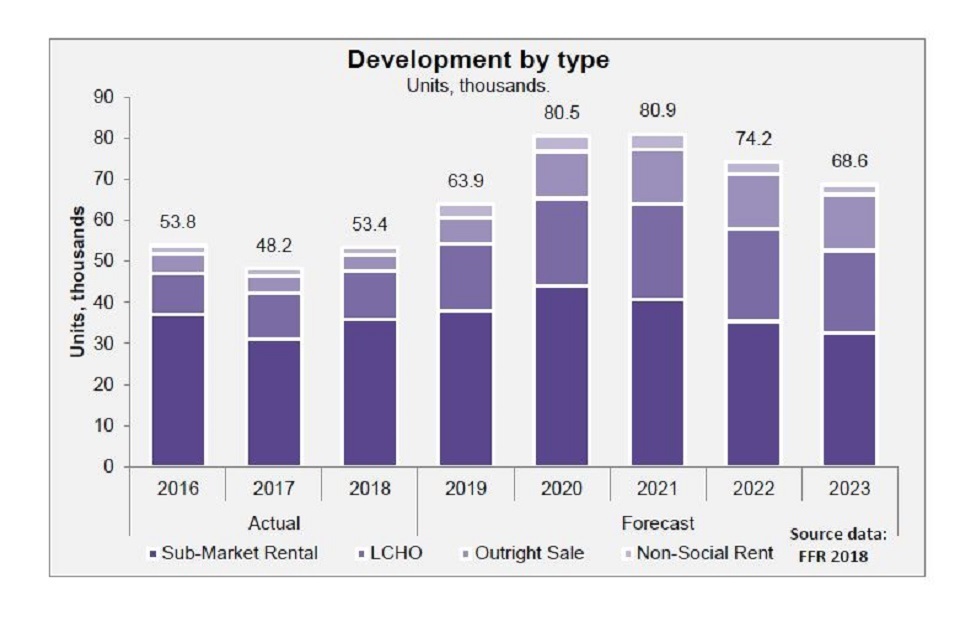

Reputational risk

18 - Registered providers of social housing are generally organisations with objectives to provide a good service to their tenants, invest in the homes they own and manage, regenerate their communities and build much needed new housing. The aftermath of the Grenfell Tower fire has seen unprecedented scrutiny of the social housing sector, landlords’ relationship with their tenants, and public interest in the sector’s wider social role. This culminated in the publication of the government’s Social Housing Green Paper in August 2018.

19 - Boards need to be aware that their actions will be scrutinised by a wide range of different stakeholders with a range of different perspectives, including tenants and residents, lenders and investors, central and local government, and the media.

20 - Registered providers should ensure that they manage their businesses and manage their risks in such a way that they have regard to stakeholders’ expectations in their decision making and do not damage the reputation of the sector as a whole. Retaining the confidence of key stakeholders including tenants, local authority partners, government and lenders is essential for registered providers in achieving their own objectives.

21 - As organisations with a social purpose, and often charitable status, registered providers will often be held to higher standards than others. While it is essential that boards manage and control risks such as health and safety and fraud, it is also important that they understand the reputational damage that other actions could have. For example, weak procurement policies or poor probity arrangements can have a significant impact on an organisation’s reputation. This can result in excessive pay and payoffs, excessive gifts and hospitality arrangements or abuse of company credit cards, all of which damage the valuable reputation that an organisation has built up over many years.

Value for Money

22 - Given that the vast majority of providers’ income comes from rent, it is vital that this income is used effectively. The regulator’s new Value for Money Standard came into effect from 1st April 2018. The Standard aims to drive improvements in value for money in the sector. At the heart of the revised Standard are expectations about the quality of governance, the development of organisational strategies and their translation into strategic objectives that can be measured.

23 - Transparency is a core element of the new Standard, with all providers expected to report both against a set of standard metrics, set out by the regulator, and against quantified targets for achievement of their own strategic objectives. It is important that boards understand and challenge performance against these measures particularly where they are not making the most effective use of their resources and assets to achieve the strategic objectives of their business.

24 - The regulator recently published sector and regression analysis to help registered providers to contextualise their performance and to compare themselves to their peers. While there are justifiable drivers for divergence between different providers (e.g. the higher costs and lower margins associated with supported housing), boards should avoid simply explaining away any areas of underperformance, and instead provide candid challenge where the data suggests that there is scope to achieve more for current and prospective tenants with the funds available.

25 - The regulator will be looking for evidence that boards are getting to grips with our new requirements through its programme of In Depth Assessments and annual stability checks. The regulator’s view of the level of assurance against the Value for Money Standard will continue to be reflected in our governance judgements.

Data and safety monitoring

26 - Two strategic risks arise from registered providers’ collection and use of data. It is important that providers ensure that their data is accurate, comprehensive, up to date and in an easily accessible format for the purposes for which it is required. As set out above, data accuracy is an important factor in enabling providers to ensure that they comply with all applicable health and safety requirements.

27 - Accurate data is also necessary to ensure compliance with the requirements of the Welfare Reform and Work Act, and ensure good quality regulatory returns. Good data and accurate, up to date information will also assist in other areas – such as the ability to identify properties which have been adapted to meet particular needs – supporting providers in meeting their equality and diversity obligations, and achieve value for money where properties can be allocated to households with particular needs.

28 - A further risk arises from data breaches, whether by the registered provider or by external parties. The Data Protection Act 2018 came into force on 25 May 2018 (the “Act”). The Act incorporates the EU General Data Protection Regulation into law in the UK, and supplements its provisions. Its main aim is to ensure our data protection laws are fit for the digital age when an ever increasing amount of data is being collected, processed and stored.

29 - The Act provides a comprehensive and modern framework for data protection in the UK, with stronger sanctions for malpractice. The Act also sets new standards for protecting general data, in accordance with the GDPR, giving people more control over use of their data, and providing them with new rights to move or delete personal data. Providers need to ensure that they understand the key requirements and sanctions imposed for those found in breach of the new requirements. Failure to abide by the requirements of the Act could lead to penalties for the landlord, and also lead to the potential for a breach of trust between the landlord and its tenants.

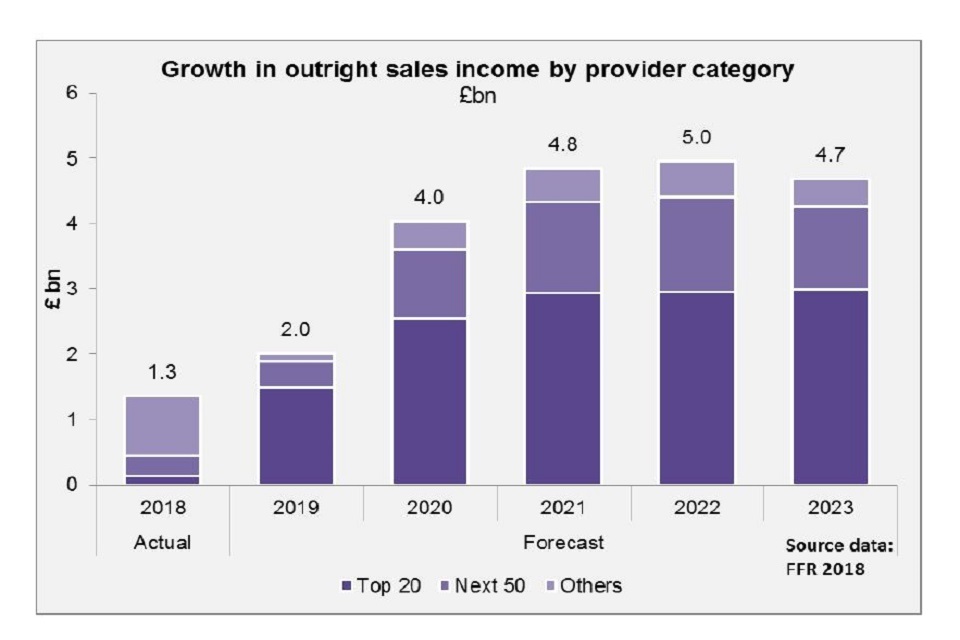

30 - Meanwhile the threat of cyber-attacks is not only growing but also mutating into new and harmful forms – understanding how data can be disclosed and what to do to protect it is the key to minimising data breaches and the risks associated with business interruption.

31 - RSH continues to rely on accurate and timely data which is fundamental to the work undertaken by it. As well as being able to meet statutory data protection requirements, providers need to ensure that they meet the regulator’s requirements for reporting of data. Failure to provide timely and accurate data will be reflected in the judgement of a provider’s compliance with the regulatory standards.

Operational risks – stress testing

32 - The rest of this publication considers a range of individual risks that can affect registered providers, and threaten the achievement of their objectives. Boards need to consider their appetite for risk in the light of the full range of uncertainties and maintain sufficient financial strength to cope with combinations of adverse circumstances.

33 - The Governance and Financial Viability Standard requires providers to carry out detailed and robust stress testing against combinations of risks across a range of scenarios and put appropriate mitigations in place as a result. Failure to meet this requirement risks breaching the regulatory standard, but more fundamentally undermines the board’s ability to ensure the long-term viability of the provider. The test should be designed to ensure that registered providers are in possession of the right tools – such as sufficient liquidity and relatively strong capital positions to weather an economic storm. We expect stress testing to be pivotal to, and integrated with, providers’ overall approach to business planning, risk and performance management - as stated in Regulating the Standards.

34 - The assumptions that underpin the plan and those that are tested must be robust. The regulator will seek evidence that providers go beyond simple sensitivity testing and ensure that tests taken are commensurate to the size and diversity of the business. This includes multivariate analysis which tests against relevant serious economic and business risks including a slowdown in housing markets, funding markets (including the availability of immediate liquidity), costs and general price inflation and demonstrate the effects against cash, covenants and security.

35 - For most providers it would be appropriate to include consideration of a severe general macro-economic shock in stress testing. The regulator does not mandate the use of any particular stress test. Boards need to have confidence that their stress testing is appropriate to the needs of their organisation. However, an example of such a scenario is the Bank of England’s Annual Cyclical Scenario (ACS 2018) [^10], used to stress test the resilience of the banking system.

36 - Further details of this stress test are set out in Box 1.

Box 1: Bank of England stress tests

The Bank of England runs an annual stress test of the largest UK banks and building societies. The result of this stress test informs policy making by the Bank of England’s Financial Policy Committee and the Prudential Regulation Authority.

Each year, the Bank of England publishes details of the stress test that it applies to the banks and building societies and scenarios, which other businesses can apply to their own stress tests.

The Annual Cyclical Scenarios (2018) is intended as a severe but feasible downside macro-economic scenario, reflecting an analysis of current economic risks, and is applied to manage risks in the financial sector and in public sector finances.

The 2018 Bank of England stress test is based on a global growth slowdown and sterling currency shock which leads to a sharp fall in house prices, increased inflation and an increase in interest rates. The scenario profiles LIBOR peaking at 4.5%, CPI peaking at 5.0% and nominal house prices falling by 33%. The Bank of England judges that this scenario encompasses a range of macro-economic outcomes that could be associated with Brexit.

Operational risks – existing stock

37 - The sector manages 2.8 million social homes of which 2.6 million are general needs social housing or supported housing. The majority of the remaining social homes are low cost home ownership properties. These homes generate annual social housing letting income (predominantly rent and service charge income) of approximately £15 billion per annum. This core income must cover day to day running costs and service debt and meet major repair liabilities.

38 - Social housing letting is the core business for most providers in the sector. Effective management of the risks associated with existing homes is therefore crucial for the achievement of the sector’s goals.

Stock quality

39 - The Home Standard requires registered providers to meet all applicable statutory requirements that provide for the health and safety of occupants in their homes. Boards and councillors are also responsible for ensuring that tenants’ homes meet the requirements of the Decent Homes Standard or, where relevant, any higher standards of design and quality that applied as a condition of publicly-funded financial assistance when the home was built. They must also ensure that they provide a cost-effective repairs and maintenance service to homes and communal areas, and that they have a prudent, planned approach to repairs and maintenance.

40 - Effective planning and delivery of responsive and planned major repairs is important for continued compliance with the economic standards. However, it is important that boards also have regard to necessary expenditure on other issues in order to maintain the quality of the housing provision. It is vital that providers understand the level of investment in existing stock that is required to meet the Home Standard, and that this is reflected in their long-term business plans. A well-integrated, strategic approach to asset management, based on a good and up to date understanding of stock condition, helps providers to avoid the long-term financial problems associated with underinvestment in stock.

41 - As well as posing risks to tenants, a failure to provide accommodation that is well-managed and of appropriate quality, or to promptly and effectively respond to complaints about this, can have significant implications for tenants’ trust and confidence in their landlord. It can also significantly damage a registered provider’s reputation.

Counterparty risk

42 - Over the past decade, there have been several cases of financial failure by large contractors, most recently Carillion. Lack of controls and monitoring of counterparty risk, including relationships with private firms involved in joint venture arrangements, contractors, lenders and pension providers can result in failures in services to residents and be costly to registered providers. Registered providers should ensure that management of risk plays a fundamental role in shaping contract terms. It would also be prudent for boards to consider contingency plans where the registered provider depends on a limited number of contractors for maintenance and development. Boards must ensure that they have a recovery plan in place for when important projects do not generate expected outcomes.

Costs and inflation

43 - A key factor shaping providers’ ability to invest in both their existing housing properties, and new supply, is the rate of inflation particularly construction cost inflation. The fundamental risk for the sector until 2020 is that while its costs will rise with inflation, its rental income is constrained by the rent reductions introduced by the Welfare Reform and Work Act.

Social housing letting costs (£bn)

| Social Housing letting costs (£bn) | |

|---|---|

| Management costs | 3.1 |

| Interest payable | 3.0 |

| Maintenance costs | 2.5 |

| Major repairs (inc capitalised) | 2.3 |

| Other costs | 2.4 |

| Total | 13.2 |

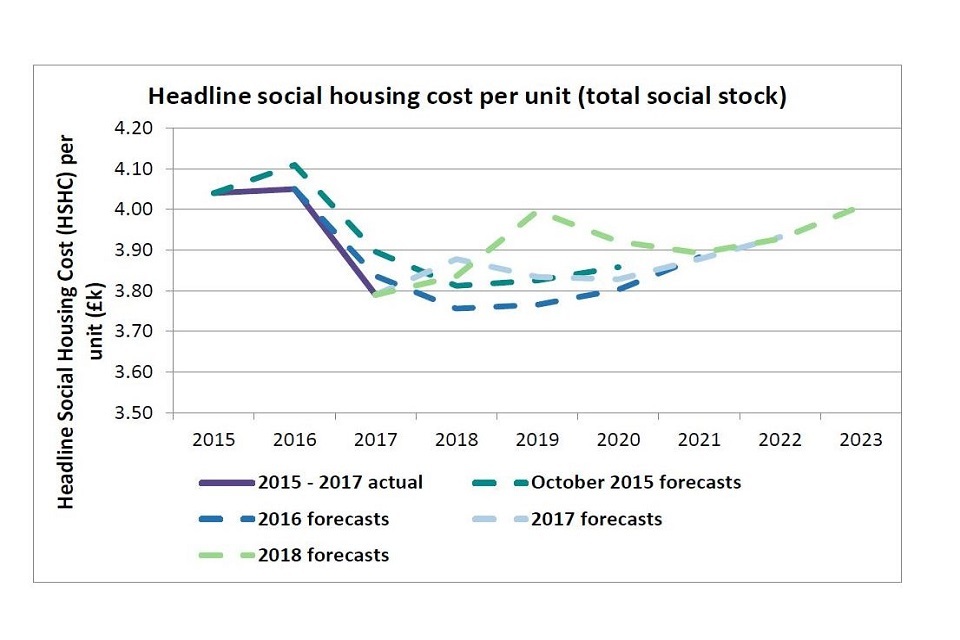

44 - The latest forecasts show that providers are still looking to make cost savings to off-set the loss of rental income since 2016. The 2018 FFR projections indicate that the average (mean) headline social housing costs per unit [^12] are expected to rise by 4% over the next twelve months before falling back in line with 2017 projections of £3,880 per annum until 2021. Thereafter costs per unit are forecast to rise to £4,000 until 2023. The initial increase in total forecast expenditure is driven by a rise to major repairs and maintenance costs which may be due to remedial works required following the Grenfell Tower fire.

Graph showing headline social housing cost per unit (total social stock)

45 - The Consumer Prices Index rose by 2.5% in the year to July 2018, below the 3.0% growth for the year to December 2017 [^13]. Despite the fall in inflation from its recent peak, registered providers may find it more difficult to contain costs as key elements of their cost base continue to grow more quickly than general CPI inflation. Latest estimates from the Office of National Statistics show that average weekly earnings increased by 2.7% (not adjusted for price inflation) excluding bonuses, and by 2.4% including bonuses, compared with a year earlier in the year to June 2018 [^14].

46 - Interim Construction Output Index figures for all construction also showed that costs increased by 3.4% in the year to June 2018 [^15]. With costs continuing to rise at a faster rate than social rents, effective boards should ensure that stress testing takes into account a range of different outcomes for different categories to inflation, and understand the implications that it may have on covenant compliance.

47 - Forecasters currently predict that inflation will remain steady at 2.4% for the year ending December 2018 and 2.2% for the year ending December 2019 [^16]. However, it is important that providers should test a wide range of potential outcomes. There are significant uncertainties around this forecast, as the UK has, at the time of writing, not agreed the terms of its departure from the European Union. Inflation in the price of materials has partly been as a result of the fall in sterling since June 2016, and further volatility in the exchange rate could have an impact on inflation. There may also be a risk of construction skills shortage, given the proportion of the labour force that comes from other EU nations.

Income collection

48 - Notwithstanding the social rent reduction that applies to the majority of the sector’s stock, income from social rented properties remains relatively dependable, with high demand for social housing in most of the country and a consequent low risk of voids. However, there remain key risks for the sector to manage around rental income, particularly arising from the on-going social rent reduction and the continuation of welfare reform.

Rents and rental market exposure

49 - In October 2017, the government announced that social rent controls will be linked to a formula of CPI plus 1% for five years from 2020. This policy announcement was intended to provide the sector with the certainty needed to invest and should provide the sector with greater surety over its main income stream with the return to index linked rent increases. The government has launched a consultation on a rent direction to the regulator and confirmed that from 2020 rent regulation will apply to local authorities as well as registered providers.

50 - However, the rent reductions required by the WRWA will continue until 2019-20. Across the sector as a whole, the impact of the social rent reduction has been reflected in the rent data reported to the regulator. The 2017 Statistical Data Return showed that average general needs rents fell by 1.3% per week.

51 - It is important that boards get appropriate assurance that rents have been and continue to be set at the right level in their organisation. The regulator will continue to seek assurance that registered providers have a comprehensive understanding of the rent rules and that this is accurately reflected in regulatory data returns. The application of the rule is set out under the WRWA.

52 - The conditions of the rent regime vary for different property types and there are a limited number of exceptions from the rent reductions for certain properties and providers (e.g. alms houses). In some respects, the rules are complex; in particular, providers need to ensure that they record Social Rent Rate and apply rules to fair rent properties [^19] correctly – areas where a number of providers have failed to apply the rules correctly in the past. Where providers are unsure about the fair rent exception or any other issue under the legislation they should take professional advice. Where we become aware of any material non-compliance with the legislative rent requirements, we will investigate and determine the appropriate regulatory response.

53 - The government’s policy statement, accompanying the consultation on the rent direction to the regulator reconfirms that providers should also endeavour to limit any increases in service charges to CPI +1%. Boards should ensure that they understand the expectations with regard to service charges, and that they have appropriate controls in place to ensure compliance with all relevant law, particularly the Landlord and Tenant Act.

54 - Some registered providers have diversified into the private rented sector. As with other forms of non-social housing investment it is important that boards should have assurance that the level of return is commensurate with the level of commercial risk involved. While this can provide additional income, PRS stock has the potential to increase cash flow volatility as rent levels can fluctuate as the market does.

55 - Boards will need to understand and ensure that the risk of falling market rents and any knock-on effects on Affordable Rents can be mitigated. They must also understand different regional and product markets they operate in and the expectations of different tenants before making investment commitments. The regulator will seek assurance that boards appreciate the opportunity cost and risk of entering into this activity.

Welfare reform

56 - Since many registered providers’ tenants receive Housing Benefit, existing welfare reform measures – in particular the roll out of Universal Credit – will need careful management to protect social rental income. The latest quarterly survey shows that 87% of registered providers are within business plan projections for rent arrears, rent collection and rent lost due to vacant properties.

57 - While most registered providers have invested and prepared for the roll out of Universal Credit (UC) since its announcement, it must be recognised that the majority of tenants are not yet in receipt of UC, so plans may not yet have been fully tested by the roll out of the new system.

58 - A number of additional welfare reform measures announced in the 2015 Summer Budget and Autumn Statements have now been implemented, and still have some time to run. For example, the freezing of working-age benefits applies for four years from April 2016. However, the government announced in October 2017 that plans to restrict Housing Benefit to a maximum of the Local Housing Allowance rate for households in social housing would not be implemented.

59 - Universal Credit, in particular direct payment of housing costs to tenants, remains the reform with the greatest potential risk for most registered providers. While the pace of roll out has increased in the last year, only a small minority of registered provider tenants have been affected to date. Up to June 2018, there were 980,000 live UC claims across all tenures in Great Britain compared to an expected total of around seven million claims at full roll out. Following recent announcements, the government currently expects to complete roll out of UC for new claims by December 2018 and transition existing claims between July 2019 and 2023 [^22] [^23].

60 -The majority of registered providers have undertaken extensive preparations for the roll out of UC, but it would be prudent to keep these preparations under review and to test them in the light of learning from the areas where UC has already rolled out.

61 - Key welfare reform timeline

Universal Credit

- June 2018 - 980,000 UC claims

- By end 2018 - UC covers all new claims

- Mid 2019-2023 - UC rolled out to existing benefit claims

Wider reforms

- 2019/2020 - Social rent reduction

- Autumn 2016 - ? - Reduced benefit cap

- 2019/20 - Benefits freeze

Supported housing

62 - Government has confirmed the outcome of its consultation on the funding regime for supported housing. The government has decided that Housing Benefit will remain in place to fund this accommodation. The outcome of the consultation has been widely welcomed as providing greater certainty by the sector and other stakeholders.

63 - Nonetheless, supported housing will continue to be a relatively low-margin activity for many registered providers. Local authority funding for housing-related support services continues to come under pressure as they balance other requirements placed on them. Registered providers must ensure that they understand the risks to funding mechanisms and continue to assess the loss of or reduction to contracts as a part of their own scenario testing.

64 - A further review of housing-related support will be carried out shortly by government to develop a robust oversight of supported housing funding with quality and value for money at the forefront of the review.

Operational risks – development

65 - The government has an ambition of delivering 300,000 new homes per annum by the mid-2020s, and has made another £2billion capital grant available, including funding for new social rent for the first time in several years. To achieve this level of supply, development of all tenures will be required, including new social housing provided by registered providers.

66 - RSH has a statutory objective to support new provision of social housing and consequently, the new VfM Standard sets out an expectation on providers to articulate their strategy for delivering homes that meet a range of needs. However, development poses potential risks to the financial viability of registered providers, and boards need the appropriate skills to oversee the control of these risks.

67 - The development of new homes by the sector has remained fairly stable over the past five years at just over 50,000 per year (including both affordable housing and non-social housing such as market rent and market sale). The latest forecasts show that the sector intends to significantly increase this level of output to just over 60,000 units in the current financial year and over 80,000 units per annum in 2020 and 2021 although two thirds of the planned development remains uncommitted over the next three years. The latest forecasts also show that the sector plans to increase the development across all tenure types; for-sale tenures, including outright sale homes are set to rise threefold while shared ownership is forecast to double in size.

Total development (Units, thousands)

Actual

| 2016 | 53.8 |

| 2017 | 48.2 |

| 2018 | 53.4 |

Forecast

| 2019 | 63.9 |

| 2020 | 80.5 |

| 2021 | 80.9 |

| 2022 | 74.2 |

| 2023 | 68.6 |

Total development, by type

Graph showing development by type 2016 to 2023

68 - Boards will need to carefully consider the trade-offs between development and reinvestment in existing stock and how these decisions generally fit with charitable objectives. With a more complex range of grant-funded rented products available – including Affordable Rent and Social Rent outside London, and the London Living Rent – comes a different range of risks. Providers will need to consider the most appropriate balance of tenure types and rent levels to develop.

69 - There are a range of risks associated with the development process itself. These can include risks around building a pipeline of land for future development, which could be subject to a risk of impairment in the event of an economic downturn. Boards should have mechanisms in place to effectively manage this risk; for example a policy that controls and provides clear oversight of the value of land being purchased.

70 - It is important that the appropriate searches and due diligence are undergone, and that any planning conditions are fully understood. As noted in the existing stock section, in working with development contractors, and through joint ventures, boards should be aware of the counter party risks involved and address these at the contract stage. In particular they should be aware of non-contractual expectations by stakeholders. As noted above, as social enterprises there are often higher expectations on housing associations than on other organisations. Where a joint venture struggles to fulfil its commitments, the registered provider may sometimes come under increased pressure to provide additional support from the social housing business.

71 - Finally, poor build quality, and in particular failure for new properties to meet health and safety requirements, and any persistent or difficult to remedy defects can be expensive to rectify. It can also harm the reputation of the provider.

72 - Boards will also need to consider the most appropriate way of funding new supply, and the balance between capital grant, borrowing, and cross-subsidy from sales revenues.

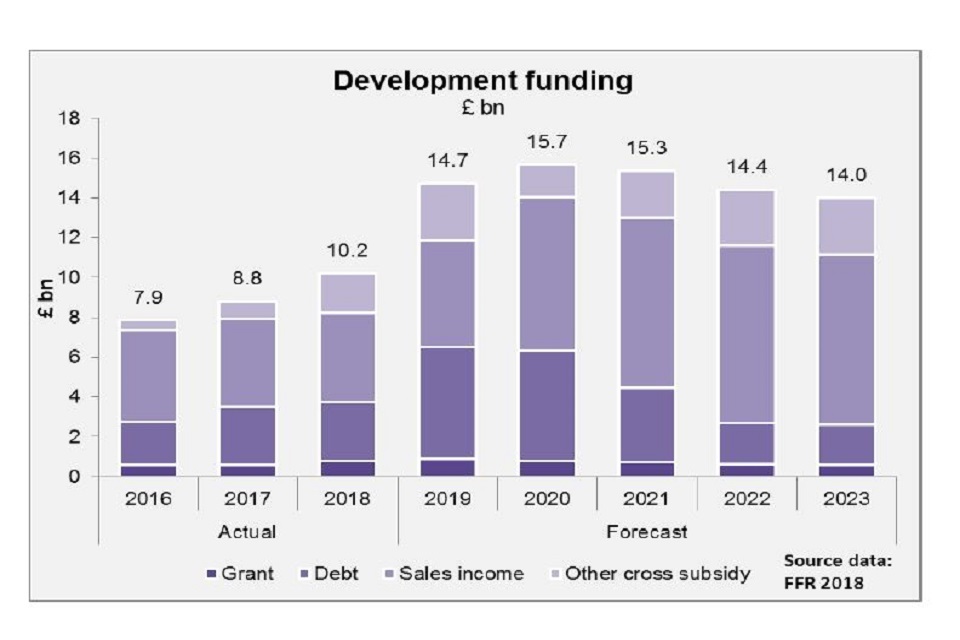

73 - The sector has forecast that it will invest £74 billion on its development programme across all tenures over the next five years if it delivers the full level of supply in the current forecasts. Of that £74 billion, £53.5 billion will be invested in sub-market rent properties. The most significant intended source of funding to deliver this level of development is from sales receipts of £39 billion.

74 - Some of the development will be funded through facilities that are already in place. However, registered providers have also forecast an increase in net debt of £19 billion to help fund their development programmes. Once repayments of existing debt are factored in, the sector will need to draw £31 billion to finance this spending.

Development funding (£bn)

Actual

| 2016 | 7.9 |

| 2017 | 8.8 |

| 2018 | 10.2 |

Forecast

| 2019 | 14.7 |

| 2020 | 15.7 |

| 2021 | 15.3 |

| 2022 | 14.4 |

| 2023 | 14.0 |

Graph showing development funding 2016-2023

75 - The figures above demonstrate that the sector has significant, and rising, exposure to the housing market, and has a significantly more pro-cyclical business model than it did in the past. Every UK recession over the past 50 years has been associated with a period of falling real house prices. The last property market downturn (2007-09) saw a peak to trough fall in real house prices of 22% (more in London) and sales delays of more than six months for many providers (following completion).

76 - The average house prices in the UK have increased by 3.0% in the year to June 2018 (down from 3.5% in May 2018). This is its lowest annual rate since August 2013 when it was also 3.0%. The annual growth rate has slowed since mid-2016 and has remained under 5%, with the exception of October 2017, throughout 2017 and into 2018. This slowdown in UK house price growth over the past two years is driven mainly by a slowdown in the south and east of England. The lowest annual growth was in London, where prices decreased by 0.7% over the year [^24].

77 - Providers with exposure to housing market risk should model the impact of a significant slowdown in the market and ensure that their mitigation strategies are well-developed, up to date, and can be implemented at short notice. In addition to cash losses, another key risk for registered providers who develop homes for sale is the impact of impairment in the value of investments in (sales-focussed) subsidiaries or joint ventures, unsold properties and work in progress against all loan covenants. Boards must have the right skills to understand these markets and the different risk profile of each business stream.

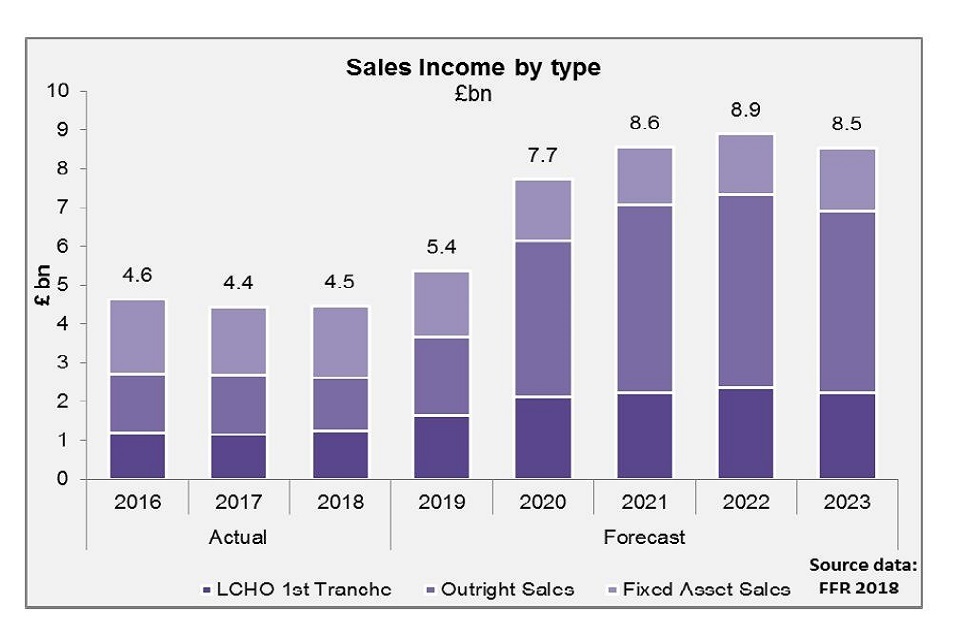

Low cost home ownership - Total sales income

Actual

| 2016 | 4.6 |

| 2017 | 4.4 |

| 2018 | 4.5 |

Forecast

| 2019 | 5.4 |

| 2020 | 7.7 |

| 2021 | 8.6 |

| 2022 | 8.9 |

| 2023 | 8.5 |

Sales income, by type

Graph showing sales income, by type 2016 to 2023

78 - First tranche shared ownership sales remain a significant source of income, and are expected to make a major contribution to the forecast sales income noted above. First tranche sales income is forecast to increase from around £1.2 billion per year to over £2 billion by 2020. During the last major housing market crash in 2008/09 some providers experienced significant reductions in values and long delays in sales to shared ownership properties. Registered providers were able to convert these properties to rent but this required a significant injection of additional grant from the government.

79 - It is crucial that boards understand the type of housing demand in key operational areas and continue to test the impact of the delay on sales to ensure their financial plans remain viable. Registered providers also need to be clear about what alternative options are available if sales and staircasing are not delivered in line with their plans, and should have fully considered their exit strategies and the impact on their cashflow.

Market sales

80 - Up until recent years market sale activity has been undertaken by a small number of large organisations. However more recently, a small number of medium-sized providers have begun to diversify into this previously niche area to generate surpluses for investment in social housing.

81 - Market sale activity is generally delivered through non-registered subsidiaries and joint ventures. These structures are often designed to meet charitable vires requirements and protect the social housing assets from a risk of failure in a commercial venture. It is designed to limit the exposure of the registered entity to the level of its investment should the non-registered business fail. Boards must assure themselves that a ring-fence is secure. Potential weaknesses in ring-fences relate to both its legal enforceability and the reputational damage of allowing a related business to fail.

82 - Initial analysis of the latest forecasts show that revenue from properties developed for sale is forecast to increase from £2 billion in 2018/19 to £4 billion in 2019/20 and around £5 billion per year thereafter. This increase in activity is due to the number of current registered providers entering to this market. This is a significant shift in risk for some registered providers in that income generated from open market sales will account for almost half of their overall turnover. However, the contribution to surpluses is lower and very few registered provider forecasts needing sales receipts to cover either operating costs or interest payments. It is for those boards to recognise the extent of the specific risks associated with market sale activity including the market cycle and ensure that they can effectively mitigate the risks of a slowdown in sales volumes or reduction in market prices.

83 - It is also important that boards consider the potential impact of a range of long-term policy scenarios particularly where they are dependent on government action, for example through Help to Buy, to support a large proportion of their sales programme.

Growth in outright sales income (total)

Actual

| 2018 | 1.3 |

Forecast

| 2019 | 2.0 |

| 2020 | 4.0 |

| 2021 | 4.8 |

| 2022 | 5.0 |

| 2023 | 4.7 |

Growth in outright sales income by provider category

84 - While overall development projections show a significant increase, the majority of the forecast expenditure is not yet contractually committed. Forecasts show that around three quarters of the units due to be delivered by 2020 are contractually committed but that the level of committed development forecast falls to one quarter thereafter.

85 - While the sector as a whole should have the ability to turn off its uncommitted development programme if it proves necessary, individual registered providers need to be clear about what alternative options are available if sales and staircasing from shared ownership fail to materialise. They must have exit strategies in place and test what impact a sales downturn would have on its cashflows and liquidity. Boards of registered providers must ensure that the information they receive on sales risk exposure is sufficiently robust to support the effectiveness of their decision-making processes.

86 - The regulator will continue to monitor the exposure that sales risks have on the sector as part of their quarterly review of providers’ overall financial strength.

Diversification

87 - Diversification can be an important way in which registered providers generate income to cross subsidise their main social housing purposes and support new supply. It can also offer the opportunity to deliver wider social or charitable objectives such as regeneration or the provision of care services. Much of this activity is development for market sale or rent, but the sector also undertakes a very wide range of other activities including student housing, commercial property, and care.

88 - While diversification supports core activities providers must ensure that social housing assets are not placed at risk. The regulator has made clear that it will not interfere in providers’ business decisions. However, the regulator’s economic standards require providers to consider the balance between risk and reward of investment in non-social housing activity. The regulator will seek assurance that an appropriate risk management framework is in place to manage non-social housing activities.

Financial and treasury management risks

89 - It is important that registered providers plan for a range of alternative scenarios and take into account the potential for increased market volatility driven by economic and political uncertainty in the short to medium term. Effective treasury management has become increasingly important due to significant changes in the finance markets and the different relationships that providers have with a wide range of funders. Boards should ensure that clear parameters are set that manage liquidity and ensure access to sufficient debt and to adequate security when it is required.

Existing debt

90 - August 2018 saw the latest interest rate rise by the Bank of England Monetary Policy Committee. It was only the second time in a decade that saw rates rise from of 0.50% to 0.75% with gradual further rises forecast. However, the latest quarterly survey shows that registered providers are generally well placed to service financial commitments and repay and refinance loans as they fall due. The sector’s total agreed borrowing facilities are £91.5 billion, of which £57.9 billion (63%) are bank loans. Total new facilities agreed in the year to 31 March 2018, including refinancing, totalled £10.1 billion. This was an increase on the £7.6 billion new facilities agreed in the year to March 2017. New facilities, including refinancing, agreed in the quarter to June 2018 totalled £3.2billion.

91 -The EBITDA MRI interest cover which is a key indicator for liquidity and investment capacity remains strong. Latest forecasts indicate that the aggregate cover for the sector over the next five forecast years is 190% – an increase of 2% in comparison to 2017 forecasts.

92 - While the financial profile of the sector remains strong, it is essential that registered providers have access to sufficient liquidity at all times. The latest annual forecasts show that the proportion of fixed-rate debt (greater than one year) comprises 73% of the sector’s drawn borrowings (2017: 71%), while the total amount of debt reported as floating, fixed for less than a year or otherwise exposed to fluctuation through inflation linking or callable/cancellable options, is 27% of drawn debt.

93 - The regulator engages with registered providers that have low liquidity indicators or are forecasting drawdowns from facilities not yet agreed or secured. The exposure of individual providers to refinancing risk is covered by routine regulatory engagement. It is also the responsibility of providers’ boards to ensure that arrangements are in place for the effective management of refinancing risk.

New debt

94 - Registered providers seeking new debt facilities will find available the following product types:

a) Bank debt

b) Bonds – either public or private placements or through an aggregator, as appropriate

c) Other products – leases and off-balance sheet structures

95 - A registered provider’s development programme is usually funded from a combination of funding streams which often includes grant, internally generated cash and debt. Internally generated cash will be derived through the diverse activities of a registered provider, which include the development of property for outright sale, shared ownership and other commercial activities in addition to the surplus generated by their social housing.

96 - A limiting factor to additional development may be the volume of debt relative to the value of operational assets, although in general the sector ‘gearing’ remains relatively benign at around 50% and is not forecast to increase significantly in the next five years.

97 - The cost of debt is currently measured by LIBOR. The March 2018 data indicates that the rate was expected to gradually move upwards – to 1.15% in a year and 1.56% in five years for commercial bank liabilities. Since the start of 2018, two notable trends have unfolded:

a) The margin on bank debt has been gradually reducing. There has been an increase in the number of funding investors in the market. Competition for smaller facilities is attracting up to a dozen bids for a funding mandate, while three-year revolvers for larger providers can be obtained for margins of close to 1%.

b) Since September 2017 in the region of £4 billion of public bonds have come to market and it is notable that margins for more recent issues are at or over 1.5% rather than 1.2% seen six months earlier. Market observers have speculated that this change reflects a certain degree of ‘fatigue’ from this market, but recent issues are still being significantly over-subscribed. While providers have clearly preferred to obtain 30 year or more maturity debt, the emerging risk is that market capacity may dictate that providers may need to also consider 10 and 20 year tranches or look to non-UK funders.

98 - Long-term fixed rate funding is nevertheless still possible within 4%, at the time of publication. The regulator has observed the finance deals being bought by providers and there are clearly different risk structures that can be identified with each. It is for the registered provider to decide what the most appropriate funding structure for their organisation is.

99 - Boards should critically assess the balance of risks and mitigations provided by the products and markets they enter into and build these into their stress testing. Boards must consider whether they need independent specialist external advice before processing or engaging in any complex funding structures. Where specialist advice is obtained, we expect registered providers to have the skills and expertise to be able to understand and, where appropriate, query that advice.

100 - The increased use of revolving credit facilities and short-term borrowing in recent years brings with it more frequent refinancing requirements which need to be adequately reflected in risk registers and mitigations.

Hedging strategies

101 - Registered providers buying debt products from financial institutions should have treasury strategies that reflect the potential exposure to risk. The standard product sold by lenders is variable rate linked to the cost of debt at that point in time for up to a year. Increased certainty can be achieved by agreeing longer-term fixed or index-linked facilities, typically an interest SWAP which can increase debt-pricing transparency.

102 - The use of free-standing derivatives can be an appropriate mitigation against interest rate risk and other exposures; however they can also be used speculatively or to create overly complex or expensive structures. Boards should ensure that they are aware of how derivatives are being used in providers and that appropriate advice is taken.

103 - The markets provide a range of financing opportunities but also expose registered providers to different risks. Registered providers should be clear on the relative risks of alternate funding options and ensure that cash and security are in place to accommodate even unlikely security calls. Where non-sterling debt is used, providers should appraise and manage the associated currency risk.

Lease structures and real estate investment trusts

104 - Over recent years there has been an increase in both not for profit and for profit providers who have entered into contracted lease arrangements for property. Much of this has been utilised to provide housing for clients with specialised support requirements and in many cases the housing support package is delivered by a third party specialist care providers.

105 - The recent growth in this area has often been supported by equity provided by private investment funds and real estate investment trusts. This has so far been concentrated in the cohort of smaller providers subject to a reduced regulatory regime, although the rapid growth of a small number has seen them move into full regulatory engagement.

106 - While lease arrangements or index-linked finance are not new to the sector it is important that boards maintain a long-term perspective on managing risk. Registered providers of any size need to protect social housing assets and provide assurance that their business plan has been thoroughly tested to ensure short and long-term viability.

107 - Boards need to understand what happens in a stress situation, how the need to service these long-term liabilities would impact the organisation if cashflows were adversely affected, as well as its ability to cope with that distress. Boards need assurance that suitable mitigations that are within the board’s control are available for key risks to the business.

108 - All providers should be properly governed and have assurance that they comply with Consumer Standards and that the requirements of the Home Standard – including decency, health and safety and repair services – are met over the long term. Where the properties are intended for use as supported housing, it is important that they are appropriate for that purpose, with suitable aids and adaptations for the client group.

109 - Key risks which may arise from this contracting environment could include:

-

index-linked rental payments for leased properties, which may or may not be backed with index-linked contracted income over the term of the lease

-

contracts which have few or no ‘break clauses’ which may leave the registered provider vulnerable should the external market conditions change

-

significant void risk due to reliance upon third parties in respect of renewal of nominations and housing management provision

-

highly dispersed stock patterns requiring understanding of disproportionate numbers of markets and partners as well as impacting the cost base

-

protection and management of sinking funds for repairs and counter party failure and changes in government policy / welfare reform.

Pensions

110 - Employer payments towards pension provision are today a standard part of most sector employees’ overall remuneration. All schemes have membership and legal obligations. The financial risk can be largely ameliorated through schemes that are defined contribution, which limits the employer’s liability to the period they are employed.

111 - Many providers, however, have legacy defined benefit schemes where the financial obligations have to be re-measured on a triennial basis. Following FRS102, this obligation will be reflected in the provider’s accounts which currently demonstrate that the majority of schemes are materially under-funded. Additional cash payments will be required from exposed providers over an agreed period to close the deficit. To mitigate this risk, boards should seek independent legal advice, where appropriate, to understand their risk exposure.

© RSH copyright 2018

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

Any enquiries regarding this publication should be sent via enquiries@rsh.gov.uk or call 0300 124 5225 or write to:

Regulator of Social Housing

Level 2

7-8 Wellington Place

Leeds LS1 4AP