Practice guide 78: overseas entities

Updated 13 October 2025

Applies to England and Wales

Please note that HM Land Registry’s practice guides are aimed primarily at solicitors and other conveyancers. They often deal with complex matters and use legal terms.

To view the update history for this practice guide, please see practice guide 78: update history.

1. Introduction

This guide primarily deals with the land registration requirements for overseas entities, in particular overseas companies and the requirements when they differ from those for UK companies some information about overseas companies, overseas limited liability partnerships and foreign states. The Register of Overseas Entities also includes guidance relating to dispositions involving overseas entities more generally, which are affected by the provisions of the Economic Crime (Transparency and Enforcement) Act 2022 (ECTEA 2022).

2. Definition of overseas company and overseas entity

For the purposes of this guide ‘overseas company’ means a company that is incorporated outside the UK. This includes companies incorporated in:

- one of the Channel Islands (such as Jersey or Guernsey)

- the Isle of Man

- the Republic of Ireland (companies incorporated in Northern Ireland are UK companies)

Reference to an overseas company includes an overseas limited liability partnership or UK Economic Interest Grouping (UKEIG) unless stated otherwise.

A ‘foreign state’ means any country which is not part of the UK, and includes foreign governments and some foreign public authorities.

For the purposes of ECTEA 2022 “overseas entity” has the meaning given by section 2 of that Act: a legal entity that is governed by the law of a country or territory outside the UK; and “legal entity” means a body corporate, partnership or other entity that (in each case) is a legal person under the law by which it is governed.

3. The Register of Overseas Entities

3.1 ECTEA 2022

The parts of ECTEA 2022 that created a Register of Overseas Entities maintained by Companies House came into force on 1 August 2022. The Act requires overseas entities that own UK land or are intending to acquire property in the UK to register with Companies House, unless they are exempt, to provide information about their beneficial owners or managing officers and to update or supplement this information annually, or in response to a specific notice issued by the registrar of companies. On registration, Companies House allocates a unique overseas entity ID (the OE ID) for each overseas entity. For information about Companies House’s registration requirements please see Register an overseas entity and tell us about its beneficial owner.

In relation to England and Wales, ECTEA 2022 only applies to overseas entities that were registered as proprietor of a qualifying estate on or after 1 January 1999.

ECTEA 2022 amends the Land Registration Act 2002 (LRA 2002) by inserting a new Schedule 4A.

This Schedule prevents HM Land Registry from registering an overseas entity as proprietor of a ‘qualifying estate’ unless the overseas entity has first obtained an OE ID. In some instances, an overseas entity will need an OE ID before it makes a disposition.

This guide sets out how to comply with ECTEA 2022 when applying to register an overseas entity as proprietor of a qualifying estate, or a disposition described below by an overseas entity of a qualifying estate.

3.1.1 Qualifying estate

For the purposes of ECTEA 2022 and Schedule 4A to LRA 2002, qualifying estate means a freehold estate in land, or a leasehold estate in land granted for a term of more than seven years from the date of the grant.

3.2 Restrictions on registration of disposals by overseas entities

The following restriction is entered in registers under paragraph 3 of Schedule 4A to the LRA 2002, for all overseas entities who apply to be registered as proprietor:

No disposition within section 27(2)(a), (b)(i) or (f) of the Land Registration Act 2002 is to be completed by registration unless one of the provisions in paragraph 3(2)(a)-(f) of Schedule 4A to that Act applies.

Additionally, the following restriction was entered in the registers for all qualifying estates where the registrar was satisfied that an overseas entity was registered as proprietor of the estate and became registered as the proprietor in pursuance of an application made on or after 1 January 1999:

After 31 January 2023 no disposition within section 27(2)(a), (b)(i) or (f) of the Land Registration Act 2002 is to be completed by registration unless one of the provisions in paragraph 3(2)(a)-(f) of Schedule 4A to that Act applies.

The reference to 31 January 2023 reflects the initial transitional period (see Transitional arrangements in 2022-23), during which someone taking a disposition from an overseas entity could apply to register the disposition even though the overseas entity may not have registered with Companies House by the date of the disposition.

3.3 Applications caught by ECTEA 2022

ECTEA 2022 applies to the following types of applications and dispositions.

- Transfers of a qualifying estate to an overseas entity.

- Transfers of a qualifying estate by an overseas entity.

- Registrable leases for a term of more than seven years from the date of grant to an overseas entity, which are granted out of a qualifying estate.

- Registrable leases for a term of more than seven years from the date of grant by an overseas entity, which are granted out of a qualifying estate.

- Registrable charges by an overseas entity.

- Applications for first registration of a qualifying estate where the applicant is an overseas entity.

- Adverse possession applications to register an overseas entity as proprietor of a qualifying estate.

You must provide a valid OE ID or, if applicable, specify which permitted exception (see Exceptions and exemptions) you are relying on when applying to register a disposition by an overseas entity caught by ECTEA 2022.

3.3.1 Deeds of variation

A deed of variation may require compliance with ECTEA 2022 in certain circumstances. For example, an application to register a deed of variation of a lease that amounts to a surrender and regrant (where the term is extended or the demised extent is increased) will be regarded as an application to register the surrender of the tenant’s existing leasehold title and to register the grant of the new lease from the landlord’s title. Therefore:

-

if the tenant is an OE and there is a restriction on the leasehold title:

-

the surrender will not be caught by the restriction, as surrenders are not dispositions within section 27(2)(a), (b)(i) or (f) of the Land registration Act 2002

-

the tenant will need to provide a valid OE ID in its application to register the new lease

-

-

if the landlord is an OE and there is a restriction on the landlord’s title, the registration of the lease will be caught by the restriction and evidence of compliance will be required (see Application to register or including a disposition by an overseas entity caught by ECTEA 2022)

3.4 The evidence required for dispositions affected by ECTEA 2022

3.4.1 Application to register an overseas entity as proprietor of a qualifying estate

Where an application is made to register an overseas entity as proprietor of a qualifying estate, the evidence needed to comply with the requirements of paragraph 2 of Schedule 4A to the LRA is a valid OE ID.

The OE ID must be valid at the time of application to HM Land Registry. If you do not provide a valid OE ID for the overseas entity, your application will be rejected.

The OE ID will be entered in the proprietorship register.

Please note that although paragraph 2 of Schedule 4A refers to exempt overseas entities, no regulations have yet been made specifying exempt overseas entities (under section 34(6), ECTEA 2022).

3.4.2 Application to register or including a disposition by an overseas entity caught by ECTEA 2022

In all the scenarios described below, where required, the OE ID must have been valid at the time of the disposition. If you do not provide a valid OE ID for the overseas entity or the overseas entity is unable to rely on one of the permitted exceptions (see Exceptions and exemptions) your application will be rejected.

-

Where a restriction as described in Restrictions on registration of disposals by overseas entities is entered on the register and has taken effect, the evidence required to show compliance with the restriction is either a valid OE ID for the overseas entity making the disposition or a certificate OE1 by a conveyancer as set out in Appendix 2 specifying which of the exceptions in paragraph 3(2) of Schedule 4A to the LRA 2002 applies.

-

Where an application is made to register a disposition of a qualifying estate by an overseas entity which became entitled to be registered as proprietor of that estate on or after 5 September 2022 (but was not so registered), the evidence needed to comply with the requirements of paragraph 4 of Schedule 4A to the LRA is either a valid OE ID for that overseas entity or a certificate OE2 by a conveyancer as set out in Appendix 2 specifying which of the exceptions in paragraph 4(2) of Schedule 4A applies.

-

Where an application is made to register a disposition of a qualifying estate and the application includes a disposition made by an overseas entity which became entitled to be registered as proprietor of that estate on or after 5 September 2022 (but was not so registered), the evidence needed to comply with the requirements of paragraph 4 of Schedule 4A to the LRA is either a valid OE ID for that overseas entity or a certificate OE2 by a conveyancer as set out in Appendix 2 specifying which of the exceptions in paragraph 4(2) of Schedule 4A to the LRA 2002 applies.

-

If, as a result of the registration of the disposition, the overseas entity will no longer be proprietor of the title, we will automatically cancel any restriction entered as described in Restrictions on registration of disposals by overseas entities.

3.4.3 Scenarios you might encounter with applications and dispositions caught by ECTEA 2022

We have set out some scenarios of applications and dispositions you might find helpful in Appendix 3.

3.5 Exceptions and exemptions

Paragraphs 3(2) and 4(2) of Schedule 4A to LRA 2002 prohibit the registration of any disposition within section 27(2)(a), (b)(i) or (f), LRA 2002 unless one of the exceptions in paragraphs 3(2) or (4(2) applies. If you are not providing an OE ID and are relying on one of the other exceptions, you should state ‘not required’ on the application and/or dispositionary form and provide either a certificate OE1 or OE2 (as applicable) from a conveyancer certifying which exception applies and the further information requested. The form of certificate to be used is set out in Appendix 2.

Please note that no regulations have yet been made providing for exempt overseas entities. ECTEA 2022 provides that in most cases an ‘exempt overseas entity’ is not subject to the requirements set out above but at present no regulations have been made specifying which overseas entities are exempt.

3.5.1 When it is appropriate to state ‘Not required’.

You may state ‘Not required’ in the following circumstances.

- On a disposition which falls outside sections 27(2)(a), b(i) or (f) of the LRA 2002 (see Applications caught by ECTEA 2022).

- When an exception in paragraph 3(2) or 4(2) of Schedule 4A to LRA 2002 applies (other than the provision of the OE ID) and you are supplying a certificate OE1 or OE2.

- Where an application affects an estate that is not a qualifying estate (see Qualifying estate).

- Where an existing registered proprietor is an overseas entity registered before 1 January 1999.

- Where an overseas entity is a party to a deed but is neither the registered proprietor nor applicant (for example a management company or guarantor).

These examples are intended to cover the most common scenarios and there may be other examples where stating ‘Not required’ is appropriate.

If you have an OE ID for an overseas entity we would encourage you to include it in your application so it can be added to the register even if you are stating ‘Not Required’. In these circumstances you may provide it in a covering letter or in the appropriate facility in our electronic services.

3.6 Adding an OE ID to the register as a standalone application

You can ask us to add an OE ID to the proprietorship entry for a registered title where the proprietor has one, even where none is required under ECTEA 2022 (for example where the title was acquired before 1999). The following parts to this section explain how to do this.

Note – at present, the update facility is not available to update other register entries that identify an overseas entity, such as charge proprietorship entries, unilateral notice beneficiaries, etc.

3.6.1 Digital Registration Service (DRS) customers

To add an OE ID to the proprietorship entry for a registered title as a standalone application through the DRS, you should select the ‘change of name’ transaction and upload confirmation of the update required as ‘correspondence’ and a copy of the OE01 provided by Companies House as ‘evidence’. You can do this using DRS for up to 25 titles.

Please continue to use the legacy electronic Document Registration Service for applications with 26 to 50 titles.

3.6.2 Bulk applications

For more than 50 titles, contact the Bulk Application Team directly. They will then arrange for someone to phone you to explain the procedures involved and the best way of preparing and lodging your application.

3.6.3 Business Gateway customers

To add an OE ID to the register as a standalone application through Business Gateway, you should either submit this in a covering letter with your application or use the existing ‘additional information’ field in the submission schema.

3.7 Transitional arrangements in 2022-23

ECTEA 2022 provided a transitional period beginning on 1 August 2022 and ending on 31 January 2023, during which a purchaser or new tenant from an overseas entity could apply to register their disposition without the overseas entity first registering with Companies House. The overseas entity would still have had to provide details of the disposition to Companies House under other provisions of ECTEA 2022.

3.7.1 Applications to register an overseas entity as proprietor that were made between 1 August 2022 and 5 September 2022

Although Schedule 4A did not take effect until 5 September 2022, it affected applications to register an overseas entity as proprietor made on or after 1 August 2022.

If you lodged an application to register an overseas entity between 1 August 2022 and 2 September 2022 inclusive (provided it was lodged in time for it to be entered on the day list on 2 September) you did not need to provide an OE ID, but a restriction was added to the title of the overseas entity on or after 5 September 2022. This is because Schedule 4A placed an obligation on the Registrar to enter a restriction where an overseas entity was registered as proprietor on or after 1 August 2022. On entry, the restriction took immediate effect. If the overseas entity had obtained an OE ID during this period, you could include it with your application and we would enter it in the register.

4. Registration applications made by overseas companies and limited liability partnerships

4.1 Evidence required on registration of overseas company as proprietor of an estate or charge

HM Land Registry must be satisfied as to the company’s corporate status and its powers of holding and dealing with land in England and Wales before registering it as proprietor of an estate or charge.

You must also consider the effect of ECTEA 2022 referred to in The Register of Overseas Entities.

Rule 183 of the Land Registration Rules 2003 requires you to supply one of the following forms of evidence with the application unless there is an arrangement for the company with HM Land Registry (see Arrangements with HM Land Registry regarding execution):

- a certificate in Form 7 completed by a qualified lawyer practising in the territory of incorporation of the company (see Appendix 1: Form 7 Certificate of powers of overseas companies).

- a certified copy of the charter, rules, statute, memorandum and articles of association or other documents constituting the company.

Any documentation in a language other than English or Welsh must be accompanied by a certified or notarised translation.

A legal opinion letter will only be accepted instead of either of the above if it conclusively provides all the information required by Form 7 and is neither qualified nor conditional.

The same evidence is required when an application is made to register an overseas limited liability partnership as proprietor of an estate or charge, but we also require evidence that the limited liability partnership has its own legal personality.

To register a UK Societas or UKEIG, in addition to the above evidence, you must provide us with:

- an up-to-date company search consisting of all the documents submitted by the UK Societas or UKEIG, which must have a UK establishment registration at Companies House (including the Companies House certificate of conversion to a UK Societas or UKEIG)

- evidence of appointment of the UK Societas or UKEIG’s manager(s) or other legal person(s) as its representative(s), if this is not clear from the other documents lodged

A UK Economic Interest Grouping (UKEIG) is an unincorporated association but with independent legal personality.

The official address for service of a UKEIG must be within the UK.

4.1.1 Company incorporated for a limited duration

If you are registering an overseas company as proprietor of an estate or of a charge, you must ensure that the company was in existence at the date of the application. If the company’s original lifespan provided for in its constitution has come to an end, you will need to provide evidence that the lifespan has been extended and confirm that this accords with the company’s constitution.

Where a company incorporated for a limited duration is being registered as proprietor of an estate, a non-standard restriction can be entered in the register to reflect this by submitting form RX1 (unless there is already an arrangement in place with us relating to the company for the entry of a restriction). An acceptable form of wording for this restriction is:

‘No disposition by the proprietor of the registered estate completed on or after (insert the date on which the life of the company expires here) is to be completed by registration unless a certificate is given by a conveyancer on behalf of the company that it remained incorporated under its domestic law on the date of such disposition.’

Similarly, where a company incorporated for a limited duration is being registered as proprietor of a charge and a short period of the company’s life remains at the date of the charge, for example 25 years, the following non-standard restriction can be applied for:

‘No disposition by the proprietor of the charge dated (insert the date of the charge here) in favour of (insert the name of the company here) completed on or after (insert the date on which the life of the company expires here) is to be completed by registration unless a certificate is given by a conveyancer on behalf of the company that it remained incorporated under its domestic law on the date of such disposition.’

4.2 Entry of overseas company in the register

When registered as the proprietor of an estate or charge, the name of the overseas company will be set out in the register followed by its territory of incorporation, OE ID and, if applicable, its UK registration number. For example:

‘[Name of Company] (incorporated in [territory of incorporation]) (OE ID: OExxxxxx) (UK. Regn. No. [FCxxxxxx]).’

The name of the company will be set out as it has been registered in its state of origin. If a company has an establishment name because it has a branch or place of business in the UK, we will not register the company as a proprietor using this name, although it can be recorded after the UK registration number if requested.

Companies incorporated in the United States of America and Canada are often incorporated within the states or territories comprised in those countries and this is also reflected in the register. The same is applicable to companies that are incorporated in a particular part of the United Arab Emirates, for example Abu Dhabi, and also where a company is incorporated in a free trade zone, for example Madeira Free Trade Zone.

4.3 Charges

HM Land Registry must be satisfied as to the company’s corporate status and its powers of holding and dealing with land in England and Wales before registering it as proprietor of a charge. You will need to upload one of the forms of evidence listed in Evidence required on registration of overseas company as proprietor of an estate or charge unless there is a pre-agreed arrangement for that company with us.

The charge must be executed in accordance with regulation 4 of the Overseas Companies (Execution of Documents and Registration of Charges) Regulations 2009 (SI 2009/1917) as explained in Execution of deeds by overseas companies.

The provisions of rule 111A of the Land Registration Rules 2003 no longer apply to charges created by an overseas company. It was necessary to register such charges at Companies House if they were created on or after 1 October 2009 and before 1 October 2011, but the relevant provisions in Part 3 of the Overseas Companies (Execution of Documents and Registration of Charges) Regulations 2009 were revoked on 1 October 2011 by SI 2011/2194. Our records indicate that applications to register such charges that were created before 1 October 2011 have ceased, and rule 111A is revoked by the Land Registration (Amendment) Rules 2018, with effect from 6 April 2018.

There is no requirement under the Companies Act 2006 to register at Companies House any charge created by an overseas limited liability partnership.

4.4 Change of name

Where an overseas company has changed its name we require evidence that the company has changed its name in its country of origin in accordance with the laws of that country. To register such a change, you must upload one of the following:

- where the company has established a place of business within the United Kingdom and the particulars of that company have been registered at the Companies Registry under section 1048 of the Companies Act 2006, a letter from the Companies Registry confirming that the new name has been registered with them, or

- a copy of a certificate of registration of a change of name of an overseas company issued by the Companies Registry. (A certificate relating to the establishment of a branch or place of business in the UK is not sufficient evidence of a change of name.)

Any documentation in a language other than English or Welsh must be accompanied by a certified or notarised translation.

4.5 Change of domicile

Where an overseas company has changed its territory of incorporation we will require the following forms of evidence to be uploaded:

-

a letter from a qualified lawyer practising in territory A (the original place of incorporation) that makes it clear whether the company will either:

- cease to be incorporated in that territory, or

- continue to be incorporated in that territory as well as in territory B

The letter must also state that the law of territory A recognises the company incorporated in territory B as the same legal person as the company that is or was formerly incorporated in territory A, and:

-

a letter from a qualified lawyer practising in territory B (the new place of incorporation) that makes it clear that:

- the company has been incorporated in territory B (not just registered as a foreign company with a branch or place of business there), and:

- the law of territory B regards the company as the same legal person as the company that is or was formerly incorporated in territory A, rather than as a new company, and:

- either a duly completed certificate in Form 7 by a qualified lawyer practising in territory B or a certified copy of the charter, statute, rules, memorandum and articles of association or other documents reconstituting the company in territory B.

Any document uploaded that is not in English or Welsh must be accompanied by a certified translation.

Examples of possible letters (depending on the circumstances) are set out in Example letters regarding change of domicile.

Unless the laws of both territories treat the company registered in territory B as the same legal person as the company registered, or formerly registered, in territory A, the company in territory B must be regarded as a new and different legal person, in which case it cannot be entered in the register unless the estate or charge is transferred to it by the company incorporated in territory A, or its liquidator, in the usual way.

4.5.1 Example letters regarding change of domicile

(A) Letter/certificate from qualified lawyer’s practice/workplace including country [territory A]

Name:

Address (of the foreign lawyer’s practice / workplace, including country [territory A]:

I practise law in [territory A] and am entitled to do so as a qualified lawyer under the law of the territory. I have the necessary knowledge of the law of the territory and of [name of corporation] to give this confirmation / certificate.

I confirm /certify in respect of [name of corporation] that (delete as appropriate):

-

[name of corporation] will cease to be incorporated in [territory A], or

-

[name of corporation] will continue to be incorporated in [territory A] as well as [territory B]

and that the law of [territory A] recognises the corporation incorporated in [territory B] as the same legal person as the company that is, or was formerly, incorporated in [territory A].

Signed:

Date:

(B) Letter/certificate from qualifying lawyer practising in territory B (the new place of incorporation)

Name:

Address (of the foreign lawyer’s practice / workplace, including country [territory B]:

I practise law in [territory B] and am entitled to do so as a qualified lawyer under the law of the territory. I have the necessary knowledge of the law of the territory and of [name of corporation] to give this confirmation / certificate.

I confirm /certify in respect of [name of corporation] that:

-

[name of corporation] has been incorporated in [territory B]. It is not just registered as a foreign company with a branch or place of business in [territory B];

-

the law of [territory B] recognises [name of corporation] as the same legal person as the company that is, or was formerly, incorporated in [territory A], rather than as a new company.

Signed:

Date:

Note: In both cases, the letter must be “open” – not marked ‘private and confidential’, or with any other restriction on disclosure – and must not be qualified or limited in any way.

4.6 Merger of overseas companies

A merger or amalgamation occurs when a new or existing limited liability company from one country acquires another company, with the effect that the acquiring ‘transferee’ company ‘absorbs’ the merging company/ies, which is/are dissolved without going into liquidation and whose assets and liabilities are transferred to the transferee company on its dissolution. In this guidance we will use the terms ‘merged entity’ for the company or companies which cease to exist following the merger/amalgamation and ‘continuing entity’ for the existing or new company which continues in existence as a result of the merger/amalgamation.

For any merger, the evidence required will depend on the circumstances of the application and the legal position in the relevant jurisdiction. In general terms, in addition to the evidence required on registration of an overseas company as proprietor of an estate or charge (including the requirements of ECTEA 2022), we will require evidence that the relevant territory (or territories) recognises that all property of the merged entity has vested in the continuing entity as a matter of universal succession and without the need for any further step(s) to be taken, such as a formal transfer of property.

If satisfactory evidence of universal succession cannot be provided, the general principle will apply that rights over immovable property (including land and mortgages or charges secured on land) are governed by the law of the place where the property is situated (the “lex rei sitae” – and see also Adams v Clutterbuck (1883) 10 QBD 403). In that case, a transfer of property assets consequent on merger would be a registrable disposition under section 27(1) of the Land Registration Act 2002, and we would require the completion of an appropriate Schedule 1 form of transfer pursuant to section 25(1) and rules 206 and 58 of the Land Registration Rules 2003.

If it is not possible to provide a Schedule 1 form of transfer or other satisfactory evidence of universal succession, it may be that we would not be able to register the continuing entity as proprietor without an order from a court in England and Wales recognising the effect of the law of merger in the overseas jurisdiction(s) involved or otherwise vesting the property in the new proprietor.

4.6.1 Merger with single jurisdiction

Where universal succession is stated to apply to a registered proprietor which is an overseas company registered in one jurisdiction and the continuing entity is an overseas company registered in the same jurisdiction, we suggest the following form of evidence may be appropriate:

-

a letter from a qualified lawyer practising in the place of incorporation that makes it clear that:

-

[name of corporation] has merged with [name of corporation], and

-

the law of the jurisdiction recognises the continuing entity as universal successor and continuing legal personality of the merged entity; and

-

the law of the jurisdiction recognises all property of the merged entity as belonging to the continuing entity without the need for transfer or other action to be taken to vest the property in the continuing entity.

-

-

either a duly completed certificate in Form 7 by a qualified lawyer practising in the jurisdiction or a certified copy of the charter, statute, rules, memorandum and articles of association or other documents reconstituting the continuing entity .

Any document lodged that is not in English or Welsh must be accompanied by a certified translation.

Unless the laws of the territory treat the continuing entity as the universal successor and continuing legal personality of the merged company, the continuing entity must be regarded as a new and different legal person, in which case it cannot be entered in the register unless the estate or charge is transferred to it by the e merged entity or its liquidator, in the usual way.

4.6.1.1 Example letter regarding merger within single jurisdiction

Letter/certificate from qualified lawyer’s practice/workplace including country [territory A]

Name:

Address (of the foreign lawyer’s practice / workplace, including country [territory A]:

I practise law in [territory A] and am entitled to do so as a qualified lawyer under the law of the territory. I have the necessary knowledge of the law of the territory and of [name of corporations] to give this confirmation / certificate.

I confirm /certify in respect of [name of corporations] that:

-

[name of merged corporation] has [merged/amalgamated] with [name of merging corporation(s)] and the continuing entity is [name of continuing corporation], and

-

that the law of [territory A] recognises the [name of continuing corporation] as the universal successor and continuing legal personality of [name of merged corporation]

Signed:

Date:

Note: The letter must be “open” – not marked ‘private and confidential’, or with any other restriction on disclosure – and must not be qualified or limited in any way.

4.6.2 Cross-Border Mergers

Where universal succession is stated to apply to a registered proprietor which is an overseas company registered in one jurisdiction and the continuing entity is an overseas company registered in a different jurisdiction, we suggest the following form of evidence may be appropriate:

-

a letter from a qualified lawyer practising in territory A (the original place of incorporation of the merged entity) that makes it clear that:

-

the company in territory A has merged with the company in territory B (the new place of incorporation of the continuing entity), and

-

the law of territory A recognises the company incorporated in territory B as universal successor and continuing legal personality of the company incorporated in territory A , and

-

the law of territory A recognises all property of the merged entity as belonging to the continuing entity without the need for transfer or other action to be taken to vest the property in the continuing entity.

-

-

a letter from a qualified lawyer practising in territory B (the new place of incorporation of the continuing entity) that makes it clear that:

-

the continuing company has been incorporated in territory B, and:

-

the law of territory B regards the company as the universal successor and continuing legal personality of the company that was formerly incorporated in territory A, and

-

the law of territory B recognises all property of the merged entity as belonging to the continuing entity without the need for transfer or other action to be taken to vest the property in the continuing entity.

-

-

either a duly completed certificate in Form 7 by a qualified lawyer practising in territory B or a certified copy of the charter, statute, rules, memorandum and articles of association or other documents reconstituting the company in territory B.

Any document lodged that is not in English or Welsh must be accompanied by a certified translation.

Unless the laws of both territories treat the company registered in territory B as the universal successor and continuing legal personality of the company registered, or formerly registered, in territory A, the company in territory B must be regarded as a new and different legal person, in which case it cannot be entered in the register unless the estate or charge is transferred to it by the company incorporated in territory A, or its liquidator, in the usual way.

4.6.2.1 Example letters regarding cross-border merger

(A) Letter/certificate from qualified lawyer’s practice/workplace including country [territory A]

Name:

Address (of the foreign lawyer’s practice / workplace, including country [territory A]:

I practise law in [territory A] and am entitled to do so as a qualified lawyer under the law of the territory. I have the necessary knowledge of the law of the territory and of [name of corporation] to give this confirmation / certificate.

I confirm /certify in respect of [name of corporation] that:

-

[name of corporation] has [merged/amalgamated] with [name of merging corporation] and the continuing entity is [name of corporation], and

-

that the law of [territory A] recognises the corporation incorporated in [territory B] as the universal successor and continuing legal personality of the company that is, or was formerly, incorporated in [territory A], and

-

that the law of [territory A] recognises all property of the merged entity as belonging to the continuing entity without the need for other action to be taken to vest the property in the continuing entity.

Signed:

Date:

(B) Letter/certificate from qualifying lawyer practising in territory B (the new place of incorporation)

Name:

Address (of the foreign lawyer’s practice / workplace, including country [territory B]:

I practise law in [territory B] and am entitled to do so as a qualified lawyer under the law of the territory. I have the necessary knowledge of the law of the territory and of [name of corporation] to give this confirmation / certificate.

I confirm /certify in respect of [name of corporation] that:

-

[name of corporation] has [merged/amalgamated] with [name of merging corporation/corporations] and the continuing entity is [name of corporation], and;

-

the law of [territory B] recognises the [corporation name of continuing entity] as the universal successor and continuing legal personality of [corporation name of merged entity], and

-

that the law of [territory B] recognises all property of the merged entity as belonging to the continuing entity without the need for other action to be taken to vest the property in the continuing entity.

Signed:

Date:

Note: In both cases, the letter must be “open” – not marked ‘private and confidential’, or with any other restriction on disclosure – and must not be qualified or limited in any way.

4.6.3 The Companies (Cross-Border Mergers) Regulations 2007

The Companies (Cross-Border Mergers) Regulations 2007 were revoked by the Companies, Limited Liability Partnerships and Partnerships (Amendment etc.) (EU Exit) Regulations 2019, SI 2019/348. When in force, the regulations implemented EU Directive 2005/56/EU, and established a framework for cross-border mergers between UK companies and companies from other European Economic Area member states.

Under the 2007 Regulations a UK court had to approve the merger if the transferee company was a UK company. If the transferee company was not a UK company, approval could not be given by the competent authority (which may or may not be a court; for example, it may be a companies registry) in the relevant member state.

A cross-border merger under the Companies (Cross-Border Mergers) Regulations 2007 took effect by operation of law and was a registrable disposition for the purpose of section 27 of the Land Registration Act 2002. There is no fee to register such a merger as it was a statutory vesting.

Where the estate was/is unregistered such a merger was not a trigger for compulsory first registration under section 4(3) of the Land Registration Act 2002, although an application could still be made for voluntary registration in form FR1, with the usual documentary evidence of title. Please note that a (reduced) scale 1 fee is payable for voluntary first registration under article 2(5) of the current Land Registration Fee Order (see HM Land Registry: Registration Services fees).

While it is no longer possible to effect a merger under the 2007 Regulations, we will continue to process applications relating to any merger which took place when the 2007 regulations were in force. Any application made to register a cross-border merger must be accompanied by a copy of the necessary court order. Where the transferee is a European Economic Area company we will also require one of:

- a duly completed certificate in Form 7 (see Appendix 1: Form 7 – Certificate of powers of overseas companies) by a qualified lawyer practising in the territory of incorporation or a certified copy of the charter, statute, rules, memorandum and articles of association or other documents constituting the corporation

- a copy of the order made by the competent authority in the relevant European Economic Area member state

- a copy of the relevant entry made in the UK companies register pursuant to regulation 21 of the Companies (Cross-Border Mergers) Regulations 2007 (confirming the effective date of the cross-border merger and the transfer of the UK company’s assets and liabilities to the European Economic Area company)

Any document uploaded that is not in English or Welsh must be accompanied by a certified translation.

4.7 Protected cell companies and incorporated cell companies

Some jurisdictions provide for protected cell companies and incorporated cell companies. This enables various assets and liabilities of the company to be partitioned off into separate ‘cells’, which may or may not have a separate legal personality. The precise nature of a protected cell company or incorporated cell company will depend on the law in the territory of their creation. When an application is made to register a protected cell company or incorporated cell company as proprietor of an estate or charge we will need evidence as to the constitution and legal personality of the applicant.

For example, under Guernsey law, a protected cell company is a single legal person and distinct cells within the protected cell company structure are not legal persons. A registered estate or registered charge can therefore be registered only in the name of the protected cell company whether or not the property belongs to the core of the protected cell company or only a cell. If the cell has its own trading name and a specific request is made in the application form or in a letter, then this will be included in the register entry.

In view of the company structure, an application for registration of a protected cell company may be accompanied by an application for entry of a restriction.

Unlike a protected cell company, if an incorporated cell company, under Guernsey law, creates a cell within its structure, each incorporated cell is a separate legal person.

4.8 Societas Europaea

A Societas Europaea is a form of European public company introduced into UK law with effect from 8 October 2004 by the European Public Limited Liability Regulations 2004 partly with the aim of facilitating transfers and mergers with companies in other parts of the European Union. It has a distinct legal personality from its members.

A Societas Europaea can be set up and registered in any European Union member state. It may transfer its registered office within the European Union without dissolving in one member state and reincorporating in another.

Following the exit of the UK from the European Union as of 1 January 2021 a Societas Europaea can no longer be formed in the UK, nor can an existing one be transferred into or out of the UK. Any Societas Europaea registered in the UK as at 1 January 2021 was automatically converted into a United Kingdom Societas.

When applying to register a Societas Europaea as proprietor of an estate or charge, we will need the evidence mentioned in Evidence required on registration of overseas company as proprietor of an estate or charge.

Under the European Economic Interest Grouping (Amendment) (EU Exit) Regulations 2018 (SI 2018/1299), as amended by section 2 of the European Union (Withdrawal Agreement) Act 2020, any existing Societas Europea (SE) still registered in the UK as at 31 December 2020 (IP completion day) was automatically converted to a “UK Societas”. A UK Societas is regarded for the purposes of section 1044 of the Companies Act 2006 as having been incorporated outside the UK.

An SE (and a UK Societas), whether having a “two-tier” or “one-tier” structure, must have at least 2 members of its “management organ” (“two-tier”) or administrative organ (“one-tier”) (European Public Limited-Liability Company Regulations 2004, regs. 61 & 64). So the requirements for execution of documents will be as for an overseas company but with 2 members of its management or administrative organ executing the instrument.

However, conversion to a UK plc is possible (existing SEs had to do this before IP completion day; for a UK Societas there is currently no time limit). Once converted to a UK plc, the requirements for execution of documents will be as for companies incorporated under the CA 2006.

5. Execution of deeds by overseas companies

The Overseas Companies (Execution of Documents and Registration of Charges) Regulations 2009 (OCR 2009) allow an overseas company to execute a document in one of the following three ways. The OCR 2009 apply section 44 of the Companies Act 2006 with some amendments.

Questions as to who is duly authorised to act on behalf of an overseas company in making a contract or executing a document are determined by the law of the company’s domicile, not the governing law of the contract or document (Integral Petroleum SA v Scu-Finanz AG [2015] EWCA Civ 144).

Unless the overseas company is already the proprietor of the land or charge, we will need to see evidence of their corporate status, which may consist of either a certificate in Form 7 provided by a qualified lawyer practising in the territory of incorporation or a certified copy of the constitution of the corporation - see Evidence required on registration of overseas company as proprietor of an estate or charge.

If the manner of execution by an overseas company includes an electronic signature, then the signature must comply with our requirements in practice guide 82: electronic signatures accepted by HM Land Registry. For the purposes of practice guide 82, “conveyancer” has the meaning given by rule 217A of the Land Registration Rules 2003 and “individual conveyancer” means an individual described in paragraph (2)(a) or (b) of that rule.

5.1 Execution under a common seal

An overseas company that has a common seal may execute deeds using that seal provided the deed is executed in a form appropriate to a company registered under the Companies Act, with such adaptations as may be necessary. Practice guide 8: execution of deeds – section 3.1 Execution by a company under its common seal sets out the methods by which a deed may be executed in this manner.

Where the seal is affixed in the presence of and attested by a permanent officer of the corporation who is not a clerk (or their deputy) or secretary (or their deputy), a note is required to be added to the description below the signature to the effect that the signatory is, in fact, a permanent officer of the corporation. A similar such note is required where the seal is affixed in the presence of and attested by a member of the governing body where their title does not make this clear.

We may also accept execution by this method even where an overseas company has not previously had a seal. Provided there is nothing in the corporation’s constitution or domestic law to limit its powers in this respect, it would appear to be open to the board, council or other governing body to adopt a seal for the purpose of executing deeds in relation to property in England and Wales.

5.2 Execution in a manner permitted by local law

Under Regulation 4 of the OCR 2009 a deed may be executed “in any manner permitted by the laws of the territory in which the company is incorporated for the execution of documents by such a company”. In this instance we will require evidence (which might include a letter from a qualified lawyer practising in or familiar with the domestic legislation of the territory of incorporation) to establish that the manner of execution used is indeed effective according to the law of the territory of incorporation. Such evidence must not be conditional or qualified in any way.

Any documentation in a language other than English or Welsh must be accompanied by a certified or notarised translation.

5.3 Execution by signature of authorised persons

5.3.1 Authorised person as an individual

The OCR 2009 apply section 44(2) of the Companies Act amended as follows:

“(2) A document which:

(a) is signed by a person who, in accordance with the laws of the territory in which an overseas company is incorporated, is acting under the authority (express or implied) of the company, and

(b) is expressed (in whatever form of words) to be executed by the company,

has the same effect in relation to that company as it would have in relation to a company incorporated in England and Wales or Northern Ireland if executed under the common seal of a company so incorporated.”

Section 44(3) of the Companies Act 2006 is modified as follows:

“(3) In favour of a purchaser a document is deemed to have been duly executed by an overseas company if it purports to be signed in accordance with sub-section (2).”

The OCR 2009 modify section 46 of the Companies Act to confirm that a document will be validly executed as a deed by an overseas company if it is executed by the company and delivered as a deed.

Where the deed is to be executed by the company by the signature of (an) authorised persons in accordance with section 44(2) of the Companies Act 2006 as modified by the OCR 2009, the following attestation clause is required to be used (paragraph E of Schedule 9 of the Land Registration Rules 2003). The Land Registration (Amendment) Rules 2018 amended paragraph E with effect from 6 April 2018 for deeds completed on or after that date, to more accurately reflect the OCR 2009.

Executed as a deed by (name of company), a company incorporated in (territory), acting by (full names of persons signing) who, in accordance with the laws of that territory, [is][are] acting under the authority of the company.

Signature in the name of the company

Signature of

Authorised [signatory][signatories]

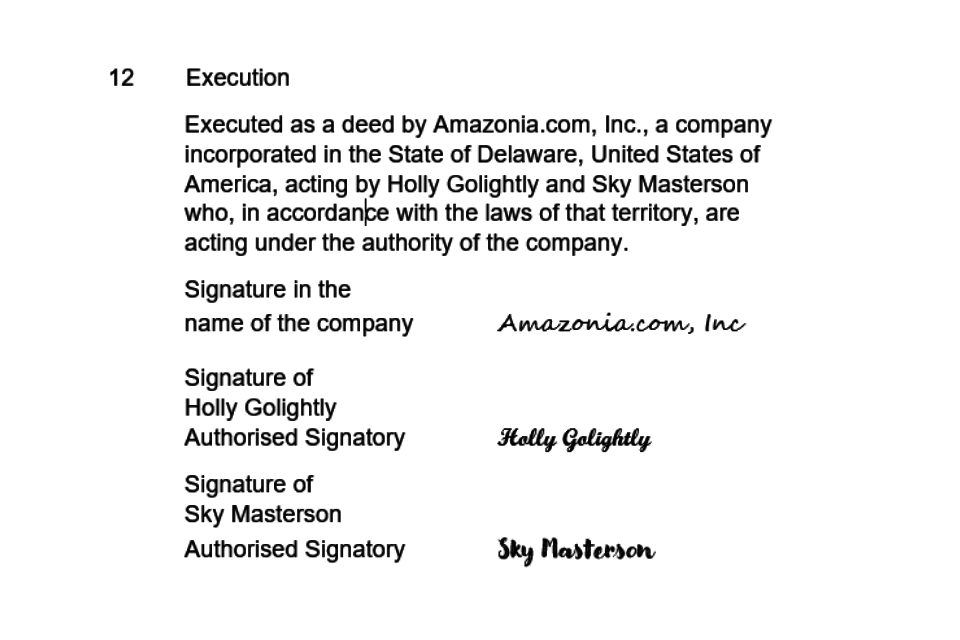

An example of how to fill in a form of execution:

A screenshot of a form of execution with examples of how to present signatures and company names.

Underneath ‘Signature in the name of the company’ in the signature box, the company name must appear. That name can be typed or handwritten by the person preparing the instrument in the space provided, or it can be handwritten by the authorised signatory. If there is more than one such signatory, the company name needs to be written only once, and if not included as part of the instrument in the course of its preparation may be written by any of the signatories.

The authorised signatory (or signatories) must sign below with their own signature. The size of the signature box can be increased as necessary to accommodate the signatures.

The attestation clause (the narrative panel to the left of the signature box) must be completed correctly. This confirms that the company is executing as a deed, to accord with modified section 46 of the Companies Act 2006 and confirms who is/are the authorised signatory(ies) who can validly execute for the company under section 44(2).

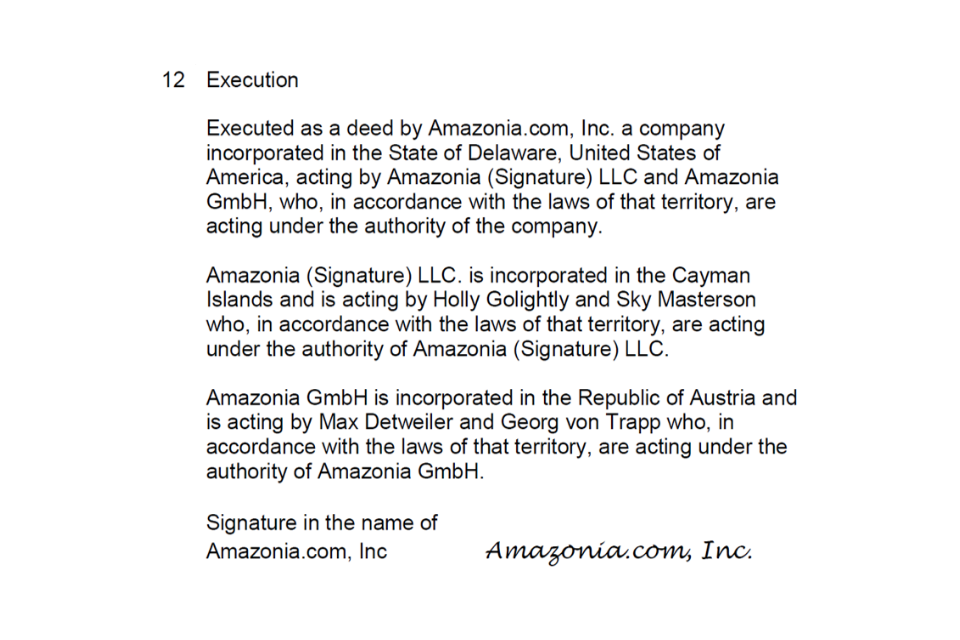

5.3.2 Authorised person is another overseas corporate body

Where an overseas company acts by authorised signatory/ies that are themselves corporate bodies, execution should comply with sub-sections 44(4),(5) and (6) of the Companies Act 2006 as modified by regulation 4 of the OCR 2009, and Schedule 9 Part E of the Land Registration Rules 2003 (though clarification as to the status of the signatory may be added). Where a document is signed by a person on behalf of more than one overseas company, it is not duly signed unless the person signs separately in each capacity. A suggested form of execution where the corporate body is also an overseas company might be:

Executed as a deed by (name of company A), a company incorporated in (territory), acting by (name of company B) {and (name of company C)}, who, in accordance with the laws of that territory, [is][are] acting under the authority of the company.

(Name of company B) is incorporated in (territory) and is acting by (name of individual[s] X [and Y]) who, in accordance with the laws of that territory, is [are] acting under the authority of (company B)

{(Name of company C) is incorporated in (territory) and is acting by (name of individual[s] Y [and Z]) who, in accordance with the laws of that territory, is [are] acting under the authority of (company C)}

Signature in the name of the company [A]

Signature in the name of company [B]

Signature of authorised [signatory][signatories] of company [B]

[Signature in the name of company [C]

Signature of authorised [signatory][signatories] of company [C]]

Otherwise, the requirements for ‘Authorised person is an individual’ apply (including the wording which must appear underneath “Signature in the name of the company”).

An example of how to fill in a form of execution:

A screenshot of a form of execution with examples of how to present signatures and company names.

A screenshot of a form of execution with examples of how to present signatures and company names.

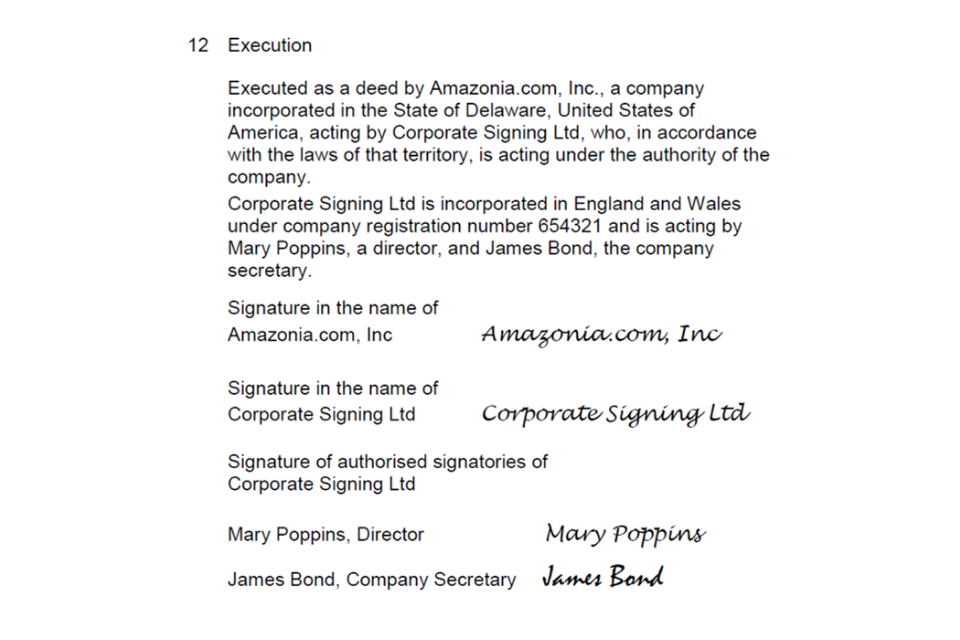

5.3.3 Authorised person is an English or Welsh corporate body

Where the authorised signatory/ies are incorporated in England and Wales, execution must still comply with sub-sections 44(4),(5) and (6) of the Companies Act 2006 as modified by regulation 4 of the OCR 2009, and Schedule 9 Part E of the Land Registration Rules 2003 (though clarification as to the status of the signatory may be added) . A suggested form of execution might be:

Executed as a deed by (name of company A), a company incorporated in (territory), acting by (name of company B), who, in accordance with the laws of that territory, is acting under the authority of the company.

(Name of company B) is incorporated in England and Wales under company registration number (number) and is acting by (name of individual), a director, and (name of individual), a director [the company secretary].

Signature in the name of the company [A]

Signature in the name of company [B]

Signature of authorised [signatory][signatories] of company [B]

An example of how to fill in a form of execution:

A screenshot of a form of execution with examples of how to present signatures and company names.

Otherwise, the requirements for ‘Authorised person is an individual’ apply.

5.3.4 Execution under an English or Welsh power of attorney

An overseas company may appoint an attorney using an English and Welsh power of attorney. If a document submitted to us is executed under such a power, we will require a certified copy of the power of attorney. Any such power must be executed as a deed. Consequently, it must be executed in accordance with the OCR 2009 (discussed above) and you will need to upload any appropriate evidence of this with your application.

If an overseas company appoints an individual as an attorney under an English and Welsh power, that individual may:

- execute in their own name as attorney for the donor (section 7(1) Powers of Attorney Act 1971), or

- execute in the name of the donor provided they comply with the requirements of section 74(3) Law of Property Act 1925

If an overseas company appoints a corporation as an attorney under an English and Welsh power, that corporation may:

- execute the deed in a manner permitted by section 44 of the Companies Act 2006 (as amended by any appropriate legislation, for example, regulation 4 Limited Liability Partnerships (Application of Companies Act 2006) Regulations 2009), or

- if they are an English or Welsh corporation, appoint an officer to execute in accordance with section 74(4) Law of Property Act 1925

In each case, section 10 of practice guide 8: execution of deeds includes examples of execution clauses appropriate in such circumstances.

Where the donee under the English and Welsh power is an overseas company, any execution clause would need to comply with the OCR 2009. In such circumstances, a suitable execution clause may be:

“Executed as a deed by (name of donee company), a company incorporated in (territory), acting by (full names of persons signing) who, in accordance with the laws of that territory, [is][are] acting under the authority of the company as attorney for (name of donor company).

Signature in the name of the donee company

Signature of

Authorised [signatory][signatories]”

In this instance ‘donee’ means the person/people/company/companies authorised to execute on behalf of the overseas company by the power of attorney.

5.3.5 Execution under a foreign power of attorney

An overseas company may appoint an attorney by a power of attorney created in and governed by the law of another jurisdiction. Such powers may permit the donee to execute documents on behalf of the donor.

In such circumstances, assuming the power is binding on the overseas company in accordance with the laws of its territory of incorporation, the donee will be a person acting under the express authority of the company for the purposes of the OCR 2009. Accordingly, it may use the execution clauses set out in section 5.3.1-5.3.3 (above). If the parties wish to clarify that the signatory’s/signatories’ authority comes from a foreign power of attorney, they may do so. In such circumstances, a suitable execution clause may be:

“Executed as a deed by (name of donor company), a company incorporated in (territory), acting by (full names of persons signing) who, in accordance with the laws of that territory, [is][are] acting under the authority of the company pursuant to a power of attorney dated (date) made under the law of (territory).

Signature in the name of the donor company

Signature of

Authorised [signatory][signatories]”

Where any document is executed pursuant to a foreign power of attorney, the applicant must provide:

- a certified copy of the power (together with a verified translation of the power if it is not in English or Welsh), and

- a legal opinion as specified below

Where the power is granted under the law of the territory of incorporation of the overseas company, the applicant must provide a legal opinion from a lawyer qualified to practice in that territory confirming:

- execution by an attorney is permitted by the laws of the jurisdiction in which the overseas company is incorporated

- the company has the legal capacity to appoint an attorney

- the overseas company has complied with any formalities governing the appointment of an attorney in the jurisdiction of its incorporation and is bound by the power of attorney

- the power authorised the donee to execute the relevant document on behalf of the donor, and

- the power remained valid at the time of execution

Any legal opinion must not be qualified or conditional. If it is in a language other than English or Welsh, the applicant must provide a certified translation of it.

Where the power is granted under the law of a jurisdiction other than the territory of incorporation of the overseas company or England and Wales, we may require additional evidence from a lawyer in that territory also to demonstrate the execution was effective.

5.3.6 Execution by European Economic Interest Groupings

For European Economic Interest Groupings, only their manager(s) (where the manager is a corporate body) or a representative duly appointed under regulation 5 of the European Economic Interest Grouping Regulations 1989 (SI 1989/638) can represent the European Economic Interest Grouping in dealings with third parties. We may query a disposition executed by a single manager if the disposition is in favour of one of the members of the European Economic Interest Grouping.

The following form of execution is suggested (none is prescribed):

“Signed and delivered (or signed as a deed) by [name]

The (sole)(joint) (representative of)/(managers of)

__________ European Economic Interest Grouping/EEIG

In the presence of________________.”

Under the European Economic Interest Grouping (Amendment) (EU Exit) Regulations 2018 (SI 2018/1299), as amended by section 2 and Schedule 5, paragraph 1 of the European Union (Withdrawal Agreement) Act 2020, any existing EEIG entities still registered in the UK as at 31 December 2020 (IP completion day) were automatically converted to a new UK corporate entity – a “UKEIG”.

The members of the UKEIG can require a “double signature” so that the UKEIG is only bound by the joint action of 2 more managers.

For a UKEIG, the above form of execution is suggested (none is prescribed) but replacing “European Economic Interest Grouping” or “EEIG” by “UK Economic Interest Grouping” or “UKEIG”.

5.4 Discharges and releases by overseas companies

A form DS1 or form DS3 must be executed as a deed (rule 114(3) of the Land Registration Rules 2003). The execution must therefore comply with one of the first three methods for execution of deeds by an overseas company outlined above. We will also need to see the same evidence as described above except for the company’s status where it is already registered as proprietor of the registered charge.

5.5 Arrangements with HM Land Registry regarding execution

An overseas company that is regularly party to documents lodged for registration may wish to consider seeking an arrangement with us whereby we look to approve the method of execution of deeds and discharges, and the evidence required to be produced when applying for registration as proprietors of a registered estate or of a registered charge. There is no guarantee that an arrangement will be provided in every case, however, such an arrangement should prevent the need for requisitions regarding the validity of an execution or the powers of an overseas company to hold estates or to borrow money on the security of estates. If approved, HM Land Registry’s Head Office will issue a ‘facility letter’ to confirm the details of the arrangement. A copy of any facility letter issued should be lodged with applications for registration.

If you consider that your client may benefit from an arrangement, please contact the Commercial Arrangements Section at HM Land Registry’s Head Office for further advice.

HM Land Registry Croydon Office

Commercial Arrangements Section

PO Box 2079

Croydon CR90 9NU

or

HM Land Registry Croydon Office

Commercial Arrangements Section

DX 8888

Croydon 3

Or you can email the application to CommercialArrangements@landregistry.gov.uk

Please note that this guide does not in any way affect arrangements already in force.

6. Insolvency

In addition to the guidance below, you may need to consider whether paragraphs 3(2)(f) or 4(2)(f) of Schedule 4A to LRA 2002 apply to the disposition, including whether the disposition is made by a specified insolvency practitioner in specified circumstances under paragraphs 3(2)(f) or 4(2)(f) of Schedule 4A. However please note that at present no regulations have been made specifying these circumstances.

The liquidation of an overseas company in its country of incorporation is recognised by English law. If you wish to make an application to register a disposition made by or on behalf of such a company then your application must be accompanied by appropriate evidence of the liquidation and of its effect. This might include:

- certified copies of the court orders or other documents relied upon, including the appointment of the overseas liquidator, and

- the written opinion of a lawyer qualified to practise company law in the country of incorporation as to the nature and effect of the proceedings on the company and as to the powers of the liquidator or other person representing the company, including the power to execute documents on behalf of the company

Any documentation in a language other than English or Welsh must be accompanied by a certified or notarised translation.

An overseas company that has been carrying on business in the UK may be wound up as an unregistered company under the Insolvency Act 1986 even though it may already have been dissolved, or otherwise ceased to exist, under the law of its country of incorporation (section 225 of the Insolvency Act 1986). The winding up will be by order of the court and a certified copy of the winding up order (under section 125 of the Insolvency Act 1986) will need to be produced in every case. If the official receiver is the liquidator, nothing more is required. For other liquidators, you must produce as evidence either:

- a certified copy of the resolution passed at the creditors’ meeting appointing the liquidator (under section 139(2) of the Insolvency Act 1986)

- a certified copy of the resolution passed at the contributories’ meeting appointing the liquidator and a certificate by the liquidator, or by their conveyancer, that a meeting of the creditors was duly held and that the creditors’ meeting either confirmed the appointment of the liquidator or did not pass a resolution nominating a liquidator. If the creditors’ and the contributories’ meetings nominate different liquidators, the person nominated by the creditors will act unless an order is made by the court on an application made within seven days of the creditors’ nomination – sections 139(3) and (4) of the Insolvency Act 1986

- a certified copy of the order of the court appointing the liquidator under sections 139(4) or 140 of the Insolvency Act 1986. At any time after the presentation of a winding-up petition, the court may appoint a provisional liquidator to carry out such functions as it may confer. The powers of a provisional liquidator may be limited by the order making the appointment, or

- a certified copy of the appointment of the liquidator by the Secretary of State (under section 137 of the Insolvency Act 1986)

6.1 Applications under the Cross-Border Insolvency Regulations

The Cross-Border Insolvency Regulations 2006 (the 2006 Regulations) give effect to the United Nations Commission on International Trade Law Model Law on cross-border insolvency. The Model Law is intended to cover cases such as where the debtor has assets in more than one state. An important objective of the Model Law is to provide direct access for the person administering a foreign insolvency proceeding (the foreign representative) to the courts of this country to seek a temporary respite and to allow the courts to determine what relief or coordination is needed for the optimal disposal of the insolvency.

The Model Law establishes criteria for a court in England and Wales to determine whether a foreign proceeding is to be recognised and if so, whether as a “main” or “non-main” proceeding (depending on whether the foreign proceeding is taking place in the country where the main centre of interests of a debtor company is located).

The Model Law sets out the effects of recognition of a foreign insolvency proceeding by a court in England and Wales and the relief available to a foreign representative.

One of the effects of an order for recognition of a foreign main proceeding under Article 20 of the Model Law is the automatic trigger of a suspension of the company’s right to transfer, encumber or otherwise dispose of its assets. This suspension is of the same scope as if the company had been made subject to a winding up order. However, no winding up order is made and there is no liquidation or appointment of a liquidator. The principal effect for the purposes of Land Registration is that the officials of the company will no longer have the power to execute documents on behalf of the company. The automatic suspension can be modified or terminated by court order.

The Model Law also provides for the court to grant either interim (Article 19) or discretionary (Article 21) relief to the foreign representative for the benefit of any recognised foreign proceeding. This includes relief to suspend the company’s right to dispose of or encumber its assets. It is envisaged that any court orders granting relief under either Article 19 or 21 will be specific in nature.

6.1.1 Applications to register a restriction based upon a court order under Articles 19, 20 and 21

Where an order is made by the court, the 2006 Regulations provide that the foreign representative shall make the appropriate application to the Chief Land Registrar to give effect to the terms of the order. Schedule 2 Part 7 of the 2006 Regulations sets out the form of protection which may be applied for. This will not affect the protection afforded to third party purchasers under section 26 of the Land Registration Act 2002.

6.1.2 Where the company is the registered proprietor of a registered estate

Where the order is a recognition order in respect of a foreign main proceeding under Article 20 or an order suspending the debtor company’s right to transfer, encumber or otherwise dispose of any of the assets of the company and the company is the registered proprietor of a registered estate which it holds for its sole benefit, then the Regulations prescribe that the application will be for a restriction to the effect that:

“no disposition of the registered estate…by the registered proprietor of that estate…is to be completed by registration within the meaning of section 27 of the Land Registration Act 2002 except under a further order of the court”.

It is anticipated that the usual form of application will be for the entry of a non-standard form restriction in those terms. This is similar in effect to the standard form restriction AA which is used to protect interests under a freezing order.

In any other case, the application will be for such entry as shall be necessary to reflect the effect of the court order.

To apply you should include the ‘restriction (standard wording)’ transaction and upload form RX1 and a certified copy of the court order.

It is possible that the court may direct the registrar to enter a restriction using its powers under section 46 of the Land Registration Act 2002. If a court directs the registrar to enter a restriction, then you should include the appropriate ‘restriction (standard wording)’ or ‘restriction (non-standard wording)’ transaction as part of your application and upload the Court Order. In the Digital Registration Service, you will be prompted to upload an RX1, you should upload the Court Order in place of the RX1.

The imposition of the suspension of the right to dispose of or encumber its assets does not affect the rights of secured creditors, nor does it prevent the subsequent initiation of insolvency proceedings under the Insolvency Act 1986.

6.1.3 Where the debtor company is the proprietor of a registered charge

The same principles as set out in Where the company is the registered proprietor of a registered estate will apply where the debtor company is the proprietor of a registered charge, except that the restriction will relate to dispositions of the registered charge rather than of the registered estate.

7. Foreign states

A foreign state is defined as any country other than England, Wales, Scotland and Northern Ireland. The following are therefore included in the definition of foreign states.

- One of the Channel Islands (commonly Jersey or Guernsey).

- The Isle of Man.

- The Republic of Ireland.

ECTEA 2022 applies to foreign states (see The Register of Overseas Entities).

7.1 Registration of a foreign state as proprietor

On the registration of a foreign state, along with the restriction referred to in Restrictions on registration of disposals by overseas entities we will enter the following restriction in the register:

RESTRICTION: No disposition by the proprietor of the registered estate is to be completed by registration.

The purpose of this restriction is to ensure that anyone who deals with the registered estate is duly authorised to do so and has observed all the necessary legal formalities.

We will accept as conclusive evidence satisfying the restriction, any statement confirming this made by the Ambassador, Head of Mission or other suitable senior diplomatic representative of the country concerned, or a certificate from a lawyer qualified to practice in the foreign state concerned, including that the appropriate execution formalities have been met.

8. Fraud prevention

8.1 Address for service

If we need to write or send a formal notice to a registered proprietor, we will write to them at their address(es) for service as shown in the register. It is essential that their address is correct and up to date and that we are informed of any change of address at the earliest opportunity. There is no fee for changing or adding an address for service, further details of which can be found on GOV.UK.

You can supply up to three addresses for service, one of which must be a postal address (but this does not have to be within the UK) and one or more of which may be an email address. It is strongly recommended that an overseas company supplies at least one email address, particularly where the registered property is not occupied by the owner or where the postal address is overseas. This is to ensure that any notices sent to the address for service are received by the company and as soon as possible. Please note that where notice is sent to an overseas address, we will not allow any additional time for the recipient to deal with the notice.

If you wish to update an address for service, you must include a ‘Change of address for service’ transaction if you are intending to change the address, otherwise no change will be made. See practice guide 55: address for service for more information.

8.2 Verification of identity

When dealing with an overseas company that is not represented by a UK conveyancer, you should expect to see, for example, a letter from a lawyer authorised to practise in the country of the body’s incorporation confirming that it still exists and that the representative is authorised to act for them. You must be satisfied that the party to the transaction with which you are dealing is one and the same organisation – a company search will show if a UK company has been set up with the same name.

8.3 Property Alert service

Our free Property Alert service allows you to monitor certain key activity on up to 10 properties. It is strongly recommended that this service is used. We will notify you each time that there is significant activity on any of the monitored properties, for example if an official search or application is lodged. This will allow you to assess whether or not the activity is suspicious and, if you think it is, to contact us as a matter of urgency so that we can take steps to prevent the matter from proceeding further. There is a dedicated HM Land Registry property fraud line available for this purpose, details of which can be found in Property Fraud Line. For more information and to set up an account, please see our Property Alert guidance.

8.4 Entry of a restriction

A company may request the entry of a counter-fraud restriction in the register that requires a conveyancer to certify they are satisfied that the company executing a deed in respect of the property is one and the same company as is the registered proprietor. The conveyancer must also certify they have taken reasonable steps to establish that anyone who executed such a deed on behalf of the company held the stated office at the time of execution.

You can request the entry of this non-standard restriction on up to three titles by using form RQ(Co), which can be downloaded from our website. There is no fee for this service. If, however, you wish to have the restriction entered on any additional titles, an application in respect of those additional titles must be made using form RX1 accompanied by the appropriate fee under Part 1(2) of Schedule 3 to the current Land Registration Fee Order.

8.5 Property fraud line

For any concerns regarding fraud, we have a dedicated property fraud line that operates between 8.30am and 5pm Monday to Friday. Call 0300 006 7030 from within the UK or +44 300 006 7030 from abroad. You can also contact us by email at reportafraud@landregistry.gov.uk.

If you believe you have been subject to fraud you should also contact Action Fraud by using their online reporting tool or by contacting their specialist fraud advisers on 0300 123 2040 from within the UK or +44 1475 650 451 from abroad. They will pass on information to the National Fraud Intelligence Bureau run by the City of London Police.

9. Appendix 1: Form 7 - Certificate of powers of overseas companies

The following is the wording of Form 7 as referred to in rule 183 and Schedule 3 to the Land Registration Rules 2003.

- I of [insert workplace address, including country] certify that –

- I give this certificate in respect of [the corporation],

- I practise law in [insert territory] (the territory) and am entitled to do so as a qualified lawyer under the law of the territory,

- I have the requisite knowledge of the law of the territory and of the corporation to give this certificate,

- the corporation is incorporated in the territory with its own legal personality, and

- the corporation has no limitations on its power to hold, mortgage, lease and otherwise deal with, or to lend on a mortgage or charge of, land in England and Wales.

Signature………………………………………

Date…………………………………………..

10. Appendix 2: Forms of certificate to provide an exception or exemption under Schedule 4A LRA 2002

10.1 Certificate OE1

Certificate OE1 - 1 August 2022 (pdf)

10.2 Certificate OE2

Certificate OE2 - 1 August 2022 (pdf)

11. Appendix 3: Scenarios relating to section 3 of this guide

We have included the following examples to help make clear the evidence you might need to provide with applications that involve one or more overseas entities. These are a selection of the most common scenarios but will not cover all situations.

Please also read the notes at the end of this section, which may help explain the examples in more detail and contains a glossary of the terms used.

11.1 Transfer by an overseas entity (OEX) to an overseas entity (OEY) and the application to register the transfer is lodged before 5 September 2022

As this takes place before commencement, OEX is not required to have an OE ID to be able to make the transfer and OEY is not required to have an OE ID to be able to register the transfer. However, after commencement:

-

Where the application is lodged before 1 August 2022, we will enter a transitional restriction in the register.

-

Where the application is lodged on or after 1 August 2022, we will enter a ROE restriction in the register.