Housing Benefit debt recoveries statistics: April 2020 to September 2020

Published 3 March 2021

Applies to England, Scotland and Wales

The latest release of these statistics can be found in the collection of Housing Benefit: debt recoveries statistics.

This summary contains statistics on Housing Benefit Debt Recoveries (HBDR) covering the period from April 2020 to September 2020.

Data for the first two quarters of the financial year ending 2021 (April 2020 to September 2020).

Housing Benefit (HB) is an income related benefit that is intended to help meet housing costs for rented accommodation.

These Department for Work and Pensions (DWP) statistics show the amount of HB that is overpaid to claimants, the subsequent recoveries and amounts written off.

1. Main stories

During quarters 1 (Q1) and 2 (Q2) of the financial year ending (FYE) 2021:

-

£191 million HB overpayments identified

-

£202 million HB overpayments recovered

-

£26 million HB overpayments written off

During Q1 and Q2 of the FYE 2021, the outstanding overpayments decreased in both quarters.

The values provided for the identified overpayments, recovered overpayments and written-off overpayments all decreased in Q1 and Q2 of the FYE 2021 when compared with Q1 and Q2 of the FYE 2020.

Only the South West region experienced an increase in identified overpayments between Q1 and Q2 in the FYE 2021.

During Q2 of the FYE 2021, in Great Britain (GB) the average identified overpayments per claimant per month was £10, this compares to £15 in Q2 of the FYE 2020, a reduction of £5. Care must be taken when interpreting this yearly comparison as the makeup of claimants may have also changed, so this should be only used for indicative purposes.

2. What you need to know

This summary contains statistics relating to amounts of incorrectly overpaid HB.

Housing Benefit debt recoveries

Following the introduction of the Single Fraud Investigation Service (SFIS), which was live in all Local Authorities (LAs) by Q1 of the FYE 2017, this publication no longer includes fraud data. The publication was renamed to ‘HBDR statistics’ to reflect this change.

HBDR data is aggregate level data received on a quarterly basis from each Local Authority (LA) and published bi-annually each March and September. The March publication covers the first two quarters of the year (April to September). The publication in September covers finalised data for all 4 quarters of the year.

The amount of outstanding debt at the beginning of a quarter is a sum of the amount of debt outstanding at the beginning of the previous quarter and the debt recovery activities during the previous quarter. For example, the amount of debt outstanding at the beginning of Q2 is the sum of the amount of debt outstanding at the beginning of Q1 and the amount of debt identified during Q1, minus the amount of debt recovered and written off during Q1. In principle, the amount of debt outstanding at the beginning of any given reporting quarter could be estimated from the released figures of the previous quarter’s publication, as any new debt identified, written off or recovered related to a historic period would be reported in the current period and would be accounted for in the overall outstanding debt at the beginning of the following quarter. However, the reported debt at the beginning of the quarter is not always in line with these estimations. DWP is working with LAs to understand, address and minimise these discrepancies.

Some LAs do not send completed data forms every quarter, or cannot supply data for all fields. This produces missing data in the returns that affects the reported GB totals. In previous publications, statisticians filled the gap created by missing data by imputing or estimating what the missing value might have been. Read the methodology document for an explanation. In recent years the number of non-returner LAs have reduced to the point that imputation is now unnecessary. From September 2017, all figures in this statistical summary are based on returned data.

The number of people claiming HB has been gradually decreasing and will continue to fall as Universal Credit replaces HB for working age claimants. Accordingly, this is evident in decreases seen across HB debt recovery measures that LAs record and report to DWP between the Q4 FYE 2019 through to the start of COVID-19 pandemic lockdown in March 2020. Since then, the decrease in HBDR measures has also been further impacted by the COVID-19 lockdown.

Supplementary statistics

Data tables containing data that underpin the charts and figures featured in this statistical summary are available. These include information by LA on outstanding overpayments at the beginning of each quarter and identified, recovered and written-off overpayments at the end of each quarter.

Uses and users

HBDR are aggregate level data received on a quarterly basis from each LA. These data are used to produce established statistics on the amount of HB overpaid to claimants. The statistics also provide a means of comparing and contrasting information between LAs.

These data will also be used to feed in to a range of briefings for Ministers and other senior officials and will be used to answer Parliamentary Questions and Freedom of Information requests. The statistics will also be used for other policy functions including monitoring and informing changes to related policies.

LA and regional data

The HBDR data are generated from the HB claims that LAs administer on behalf of DWP and are reported to DWP as total sums of HB overpayments by each LA. While for all LAs the majority of HB claims administered relate to households within their respective administrative geographical boundaries, for some LAs a small number of HB claims could relate to households outside of their boundaries. Therefore, care needs to be taken when interpreting individual LAs HBDR data, as it is possible that not all the overpayment sums reported by a LA relate to households within its geographical boundaries. The HBDR data relates to the LAs and regions where the HB claims that have been overpaid were administered, regardless of where HB claimants reside.

The HB caseload data that some of the calculations in these statistics are based on also relates to the number of HB claims administered by LAs and regions regardless of where the claimants reside.

Rounding policy

Percentage figures provided in this document are based on data rounded to the nearest thousand (see the data tables) accompanying each release of these statistics.

Recalculating the same percentage figures from data in this document might yield different results due to differences in rounding order.

Coronavirus (COVID-19)

During April to September 2020, LAs made operational decisions to redeploy staff to frontline activities and moving to work from home, resulting in the majority of debt recovery staff not being in post for several months. Debt recovery resources remain below pre-pandemic levels at February 2021.

Levels of debt recovered and written off have been affected by less enforcement activity taking place, and DWP pausing all debt deductions from other DWP benefits for a period of at least 6 months.

There has also been less activity on identifying overpayments through redeployed staffing, as well as fewer people having improvements to their circumstances.

3. Housing Benefit outstanding overpayments at the start of the quarter

The total value of HB outstanding overpayments in GB continued to decrease during the first two quarters of the FYE 2021.

There was £1.97 billion in HB outstanding overpayments at July 2020 (the beginning of Q2 of the FYE 2021).

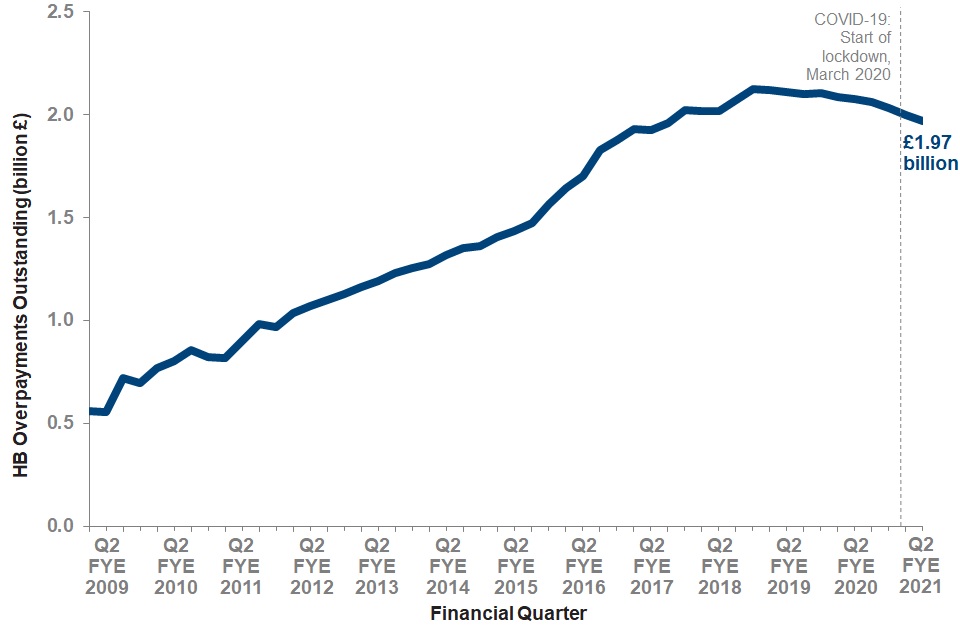

Time series of outstanding overpayments (£ billions) in GB from April 2008 to July 2020

The value of outstanding overpayments followed a generally increasing trend from £554 million in Q2 FYE 2009, until it reached a peak of £2.12 billion in Q4 of the FYE 2018 and has gradually declined since. During the first two quarters of the FYE 2021, the total value of outstanding overpayments continued to follow a decreasing trend.

The total GB value of HB outstanding overpayments at the beginning of July 2020 (Q2 of the FYE 2021) was £1.97 billion; a decrease of £106 million (5%) on July 2019.

Please see the Additional information about this.

London LAs reported 33% of the total outstanding overpayments at the beginning of Q2 of the FYE 2021.

Distribution across regions of outstanding overpayments, at the start of Q2 of the FYE 2021

| Region | HB outstanding overpayments at start of Q2 FYE 2021 (%) |

|---|---|

| North East | 3% |

| North West | 10% |

| Yorkshire and The Humber | 5% |

| East Midlands | 5% |

| West Midlands | 9% |

| East | 7% |

| London | 33% |

| South East | 12% |

| South West | 5% |

| Wales | 3% |

| Scotland | 7% |

At the start of Q2 of the FYE 2021 the value of HB outstanding overpayments reported by London accounted for 33% of the total GB figure, while the value of HB outstanding overpayments reported by Wales made up 3% of the GB total.

At July 2020, 90% (£1.77 billion) of the total outstanding HB overpayment was reported by England.

Outstanding overpayments (£ thousands) by country, at the start of Q2 of the FYE 2021

| Country | HB outstanding overpayments at start of Q2 FYE 2021(£ thousands) |

|---|---|

| England | 1,770,250 |

| Wales | 53,680 |

| Scotland | 147,156 |

At the beginning of July 2020 (Q2 of the FYE 2021), London reported £660 million of the national total amount of outstanding HB overpayments.

Outstanding overpayments (£ thousands) by region, at the start of Q2 FYE 2021

| Region | HB outstanding overpayments at start of Q2 FYE 2021 (£ thousands) |

|---|---|

| North East | 66,962 |

| North West | 196,311 |

| Yorkshire and The Humber | 106,377 |

| East Midlands | 95,836 |

| West Midlands | 173,774 |

| East | 136,073 |

| London | 659,512 |

| South East | 227,430 |

| South West | 107,975 |

| Wales | 53,680 |

| Scotland | 147,156 |

At the start of Q2 of the FYE 2021, £887 million of outstanding HB overpayments were reported by London and the South East. This represents 45% of the total GB outstanding HB overpayments.

4. Housing Benefit identified overpayments during the quarter

The total value of HB identified overpayments decreased in Q1 and Q2 of the FYE 2021.

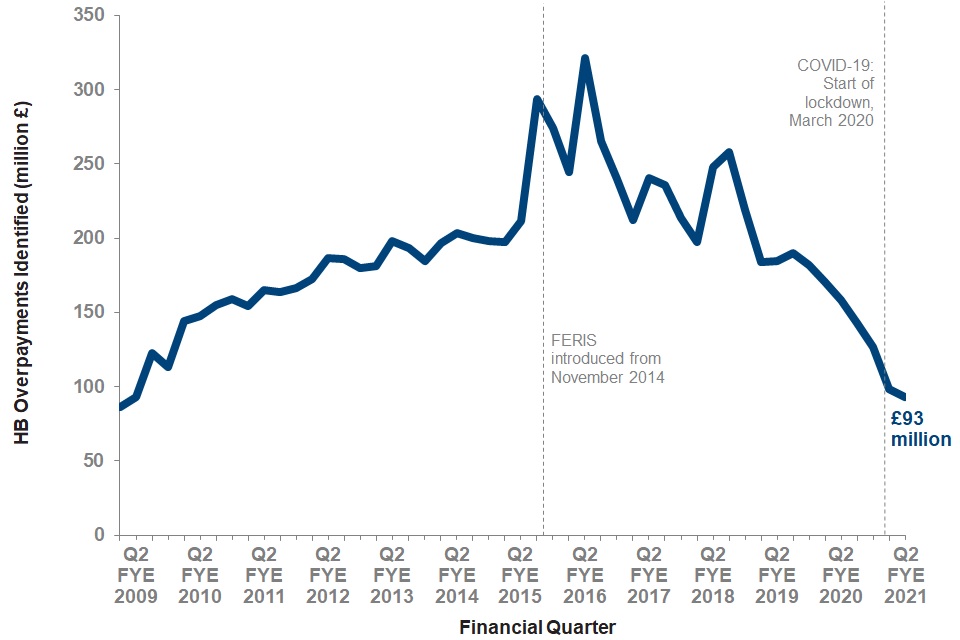

Identified overpayments (£ millions) in GB from Q1 of the FYE 2009 to Q2 of the FYE 2021

During the first two quarters of the FYE 2021, the total value of HB identified overpayments was £191 million; a decrease of £138 million (42%) compared to identified overpayments in the first two quarters of the FYE 2020.

The total value of identified overpayments decreased in Q1 of the FYE 2021 from £127 million at March 2020 (Q4 of the FYE 2020) to £98 million at June 2020. Identified overpayments continued to decrease further in the following quarter of the FYE 2021, to £93 million in Q2.

The total amount of HB identified overpayments in Q2 of the FYE 2021 was £93 million. This was a decrease of £66 million (41%) from Q2 of the FYE 2020.

There was an increasing trend on the amount of identified overpayments from the FYE 2009 to Q2 of the FYE 2016 where the amount identified in one quarter reached a record high of £321 million. The FYE 2016 also saw the introduction of the Fraud and Error Reduction Incentive Scheme (FERIS) and Real Time Information (RTI) identifying long-term overpayments. Since then, the quarterly amounts of overpayments identified have become more unstable. This decrease in stability reflects pauses in RTI to allow LAs to manage the financial year end activities. Q2 of the FYE 2016 was followed by a decreasing trend of quarterly identified amounts, with the identified amount in Q2 of the FYE 2021, being the lowest quarterly figure reported by LAs since Q1 of the FYE 2009.

Please see the Additional information about this.

In Q2 of the FYE 2021 the average amount of identified HB overpayment per claimant per month in GB was £10.

Average HB overpayment identified (£) per claimant per month by region during Q2 FYE 2021

| Region | Average HB overpayments identified per claimant per month during Q2 FYE 2021 (£s) |

|---|---|

| Great Britain | £10 |

| North East | £6 |

| North West | £7 |

| Yorkshire and The Humber | £6 |

| East Midlands | £7 |

| West Midlands | £13 |

| East | £10 |

| London | £18 |

| South East | £11 |

| South West | £9 |

| Wales | £6 |

| Scotland | £6 |

During Q2 of the FYE 2021, in GB the average identified overpayments per claimant per month was £10, this compares to £15 in Q2 of the FYE 2020, a reduction of £5. Care must be taken when interpreting this yearly comparison as the makeup of claimants may have also changed, so this should be only used for indicative purposes.

During Q2 of the FYE 2021, London reported the largest average amount of identified debt per claimant per month (£18), based on HB caseload figures during this quarter, as published in Stat-Xplore.

London reported the largest average amount of identified debt per claimant per month. This indicates that if all regions had the same number of claimants, London would still have the largest amount of identified debt.

£85 million (91%) of identified overpayments in GB, were reported from English LAs.

Identified overpayments (£ thousands) reported by country during Q2 FYE 2021

| Country | HB identified overpayments during Q2 FYE 2021 (£ thousands) |

|---|---|

| England | 84,915 |

| Wales | 2,831 |

| Scotland | 5,127 |

Of the £93 million of HB identified overpayments in GB during Q2 of the FYE 2021, £85 million (91%) were reported by England, £5 million (6%) by Scotland and £3 million (3%) by Wales.

5. Housing Benefit overpayments recovered during the quarter

There was a decrease in overpayments recovered during the first two quarters of the FYE 2021 compared to the first two quarters of the FYE 2020.

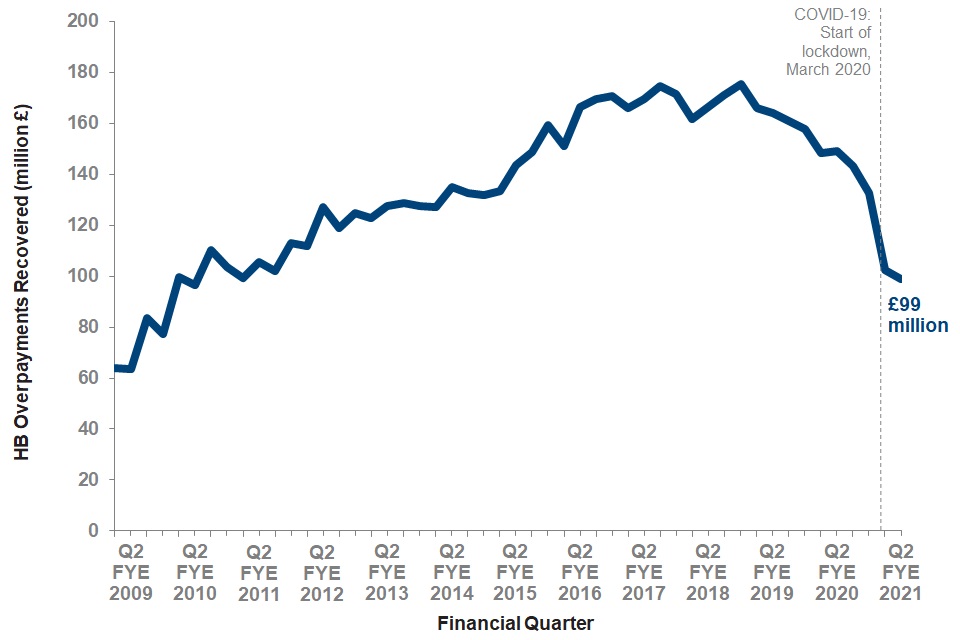

Recovered overpayments (£ millions) in GB from Q1 of the FYE 2009 to Q2 of the FYE 2021

Historically, the total value of overpayments recovered has tended to vary seasonally between quarters. Overall it has followed an upwards trend, reaching a high of £175 million in Q4 of the FYE 2018. The FYE 2019 was the first financial year where the amount of overpayments recovered saw a decreasing trend. There is a continuation of this decreasing trend in Q1 and Q2 of the FYE 2021, with the decrease from Q4 of the FYE 2020 and Q1 of the FYE 2021 (a decrease of £30 million) being the greatest decrease observed between consecutive quarters, within the time series. This decrease should be seen in context with the effects of the COVID-19 pandemic, which resulted in the majority of debt recovery staff not being in post for several months.

In the first half of the FYE 2021 the total GB value of HB overpayments recovered was £202 million, a decrease of £96 million (32%) when compared to overpayments recovered during the first half of the FYE 2020.

The total value of overpayments recovered decreased in Q1 of the FYE 2021, from £132 million at March 2020 (Q4 of the FYE 2020) to £103 million at June 2020. The figure of overpayments recovered continued to decrease at Q2 of the FYE 2021, to £99 million.

The total value of overpayments recovered in Q2 of the FYE 2021 was £99 million. This was a decrease of £50 million (34%) from Q2 of the FYE 2020.

Please see the Additional information about this.

During the first half of the FYE 2021, London and the West Midlands reported 42% of the total amount of HB overpayments recovered in GB.

Overpayments recovered (£ thousands) by region, during Q2 of the FYE 2021

| Region | Overpayments recovered during Q2 FYE 2021 (£ thousands) |

|---|---|

| North East | 3,034 |

| North West | 9,054 |

| Yorkshire and The Humber | 5,754 |

| East Midlands | 5,380 |

| West Midlands | 13,348 |

| East | 7,713 |

| London | 27,850 |

| South East | 12,712 |

| South West | 5,985 |

| Wales | 3,183 |

| Scotland | 4,995 |

In Q2 of the FYE 2021, £91 million (92%) HB overpayments were recovered in England.

Overpayments recovered (£ thousands) by country, during Q2 FYE 2021

| Country | HB overpayments recovered during Q2 FYE 2021 (£ thousands) |

|---|---|

| England | 90,830 |

| Wales | 3,183 |

| Scotland | 4,995 |

In Q2 of the FYE 2021 out of the £99 million of HB overpayments recovered in GB, £91 million (92%) were recovered by England, £5 million (5%) by Scotland and £3 million (3%) by Wales.

6. Housing Benefit overpayments written off during the quarter

The total value of HB overpayments written off in GB continues to fluctuate.

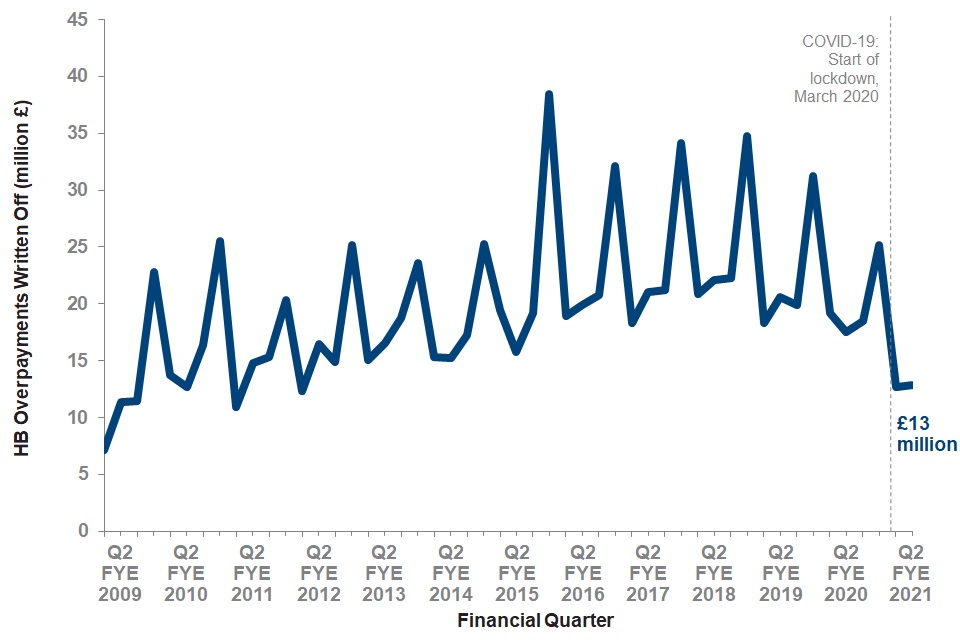

Overpayments written off (£ millions) in GB, from Q1 of the FYE 2009 to Q2 of the FYE 2021

The total GB value of HB overpayments written off during the first half of the FYE 2021 was £26 million; a decrease of £11 million (30%) in comparison to those overpayments written off during the same period of the FYE 2020. This decrease should be seen in context with the effects of the COVID-19 pandemic, which resulted in the majority of debt recovery staff not being in post for several months.

The amount of overpayments written off changes throughout the year. It is generally highest in Q4 (March) of each financial year, followed by a sharp decrease during Q1 of the following year. In line with this there has been a decrease in the total amount of overpayments written off from £25 million at March 2020 (Q4 of the FYE 2020) to £13 million in June 2020 (Q1 of the FYE 2021).

The total value of HB overpayments written off in Q2 of the FYE 2021 was £13 million. This was a decrease of £5 million (27%) from the total amount of HB overpayments written off in Q2 of the FYE 2020.

Please see the Additional information about this.

In Q2 of the FYE 2021, of the £13 million of written off HB overpayments in GB, £11 million (88%) were written off by England.

Overpayments written off (£ thousands) by country, during Q2 of the FYE 2021

| Country | HB overpayments written off during Q2 FYE 2021 (£ thousands) |

|---|---|

| England | 11,344 |

| Wales | 452 |

| Scotland | 1,034 |

In Q2 of the FYE 2021, of the £13 million of written off HB overpayments in GB, £11 million (88%) were identified by England, £1 million (8%) by Scotland and £0.5 million (4%) by Wales.

7. HBDR data: collection processes and accuracy

Data collection

The table below details the list of questions asked to LAs as part of the data collection process.

| Field | Overpayment Questions |

|---|---|

| 1 | Total value of HB overpayments outstanding at the start of the quarter |

| 2 | Total value of HB overpayments identified during the quarter |

| 3 | Total value of HB overpayments recovered during the quarter |

| 4 | Total value of HB overpayments written off during the quarter |

Average data return rates

| Collection Period | Average LA Return Rate (across all quarters) |

|---|---|

| FYE 2009 | 89.7% |

| FYE 2010 | 99.2% |

| FYE 2011 | 99.5% |

| FYE 2012 | 99.6% |

| FYE 2013 | 99.8% |

| FYE 2014 | 99.7% |

| FYE 2015 | 99.3% |

| FYE 2016 | 99.9% |

| FYE 2017 | 99.5% |

| FYE 2018 | 100% |

| FYE 2019 | 100% |

| FYE 2020 | 99.6% |

| Q1 and Q2 FYE 2021 | 99.5% |

In previous years, some LAs could not complete some questions, making the completion rate lower than the values quoted. DWP have previously published additional estimates, using imputation (at GB level), accounting for LAs unable to provide data. These additional figures gave a sense of scale of this impact. Since September 2017, all published figures in this summary are based on actual data returned by the LAs.

Additional information

HBDR is aggregate level data received from each LA, and is subject to a significant degree of variation both in and between different LAs. From 2014, we have observed a significant amount of variation in the overpayment data. This could be due to a wide range of factors such as:

-

differences and issues with LAs software suppliers

-

changes in LA return rates

-

additional side effects due to the phased implementation of SFIS

-

the implementation of the FERIS, RTI and factors unique to each LA (for example, increases or decreases in resources, bulk clearing of historical overpayments)

8. About these statistics

Known issues, changes and revisions

Our methodology and Background Information Note provides further information on the DWP HBDR statistics, including some of the processes involved in developing and releasing these statistics.

Data tables containing data that underpin the charts and figures featured in this statistical summary are also published.

National Statistics status

The UK Statistics Authority has designated these statistics as National Statistics, at June 2012, in accordance with the Statistics and Registration Service Act 2007 and signifying compliance with the Code of Practice for Statistics.

National Statistics status means that our statistics meet the highest standards of:

-

trustworthiness

-

quality

-

public value

Once statistics have been designated as National Statistics it is our responsibility to maintain compliance with these standards.

Since the assessment date the following improvements have been made to this publication

-

statistics have been made more accessible through improvement in presentation of the first release and formatting of supporting data tables

-

value has been added by including HB caseload data to calculate regional average HB overpayments amounts per HB claimant, and by introducing interactive visualisations of regional and LA data

-

quality assurance processes have been strengthened by optimising automation in implementing analyst checks and by putting in place a thorough peer review process for each publication cycle

-

increased user and stakeholder engagement activities by setting up working groups with participants from across policy and operations

-

in 2019, HBDR users were consulted on the frequency of publishing for these statistics – read the outcome of this consultation

Other National and Official Statistics

Details of other National and Official Statistics produced by the DWP:

- a schedule of statistical releases over the next 12 months and a list of the most recent releases

- detailed background notes and methodology relating to this publication

Feedback

Specific HBDR statistics feedback can be submitted via our HBDR user questionnaire

Completed questionnaires can be returned by email to Stats-consultation@dwp.gov.uk or by post to the following address:

Client statistics,

Data and Analytics,

Department for Work and Pensions,

Room BP5201,

Benton Park Road,

Longbenton,

Newcastle Upon Tyne,

NE98 1YX

Users can also join the “Welfare and Benefit Statistics” community. DWP announces items of interest to users via this forum, as well as replying to users’ questions.

Supplementary Statistics

Data tables containing data that underpin the charts and figures featured in this statistical summary include information by LAs on outstanding overpayments at the beginning of each quarter and identified, recovered and written-off overpayments at the end of each quarter.

Producers: Dominique Radcliffe Dominique.radcliffe@dwp.gov.uk and Harry Phasey harry.phasey@dwp.gov.uk

Lead Statistician: Ali Spahiu Ali.spahiu@dwp.gov.uk

DWP Press Office: 020 3267 5144

ISBN: 978-1-78659-293-4