Use of marketed tax avoidance schemes in the UK (2018 to 2019)

Updated 30 November 2022

Marketed tax avoidance schemes are contrived schemes that are sold to one or more individuals and employers for a fee, with the aim of reducing their tax liabilities. Where this report refers to avoidance schemes, we mean “marketed” tax avoidance schemes.

1. Introduction from Mary Aiston, Director Counter-Avoidance

Over the last six years, the amount of tax the UK loses to avoidance has fallen by around a half. The market has moved away from top accountancy firms and banks selling schemes, to boutique promoters selling online.

It’s no longer just about higher-income individuals using investment-based avoidance schemes involving Hollywood films or gold bullion. Instead the market has decisively shifted towards employment-based avoidance schemes, aimed at those with middle income levels, including contractors and agency workers.

This report responds to encouragement from the Treasury Select Committee to share what we know about the current state of the avoidance market.

Promoters are hugely opportunistic. Over the last year we have, for example, seen them target NHS workers who returned to the frontline to battle COVID-19. Promoters have also targeted those to whom they had already sold schemes that left them with big Loan Charge tax bills, with further schemes that they wrongly claimed get around the charge.

HMRC is determined to do all it can to stop unscrupulous promoters. We are targeting those who promote these schemes using all of HMRC’s powers. Increasingly, we are using sophisticated data analysis to identify people who may have got involved in tax avoidance schemes so we can warn them of the consequences as quickly as possible.

Ultimately, each of us is personally responsible for paying the right tax under UK law; anyone who enters into an avoidance scheme is taking a big risk. That’s why we are warning taxpayers to steer clear of avoidance schemes, which seldom achieve the tax advantages claimed. You don’t have to be a tax expert to know that an artificial or contrived arrangement that claims to cut your tax bill by 90 per cent is almost certainly too good to be true. Or that an arrangement that requires you to pay big fees to the person selling it, yet very little tax to HMRC, is probably one to steer clear of.

Please be vigilant. If you’re asked to sign lots of legal documents just to set up payment arrangements for your salary, then make sure you know what you’re agreeing to. Get independent advice from a reputable tax agent or speak to a tax advice charity before you sign on the dotted line. No legitimate employer would ever have a problem with you checking.

HMRC has heard the very real public anger about the people who market these schemes. The government has consulted on new proposals that will tighten the rules and close schemes faster. We’ll do all we can to disrupt promoters’ activities and help people identify the warning signs but we can’t do it all on our own. If you see adverts promising take home pay that looks too good to be true; or you are aware of a scheme that doesn’t look right, please report them to us.

Tax avoidance is not acceptable. It takes money from essential public services and it can leave those who get involved with big tax bills. Please help us stamp it out.

2. The size of the UK tax avoidance market

2.1 What is tax avoidance?

Tax avoidance involves bending the tax rules to try to gain a tax advantage that Parliament never intended. It usually involves contrived transactions that serve no real purpose other than to artificially reduce the amount of tax that someone has to pay. It’s about seeking to operate within the letter but not the spirit of the law.

It’s very different to legitimate tax planning, which is about following the letter and the spirit of the law, and taking advantage of tax breaks in a way that Parliament intended. Putting money into an ISA isn’t tax avoidance because Parliament introduced ISAs as a tax-privileged way of encouraging savings. In contrast, when Parliament passed legislation covering Employee Benefit Trusts, they didn’t intend that people could artificially reduce their tax liabilities through a convoluted process where so-called loans are routed through offshore tax havens.

The reality is that very few avoidance schemes give the tax advantage they claim. And as each of us is personally responsible for paying the right tax under UK law, anyone who enters into an avoidance scheme is taking a big risk.

And while using or selling avoidance schemes is not in itself a criminal offence, HMRC will always consider whether the scheme in fact involves fraud, for example, because it relies on false documents or misrepresenting the facts, and will investigate with a view to a criminal prosecution of the promoter and/or taxpayer where appropriate.

2.2 The size of the problem

Tax avoidance isn’t as widespread as people might think. In 2018 to 2019, we estimate that 95.3 per cent of all the tax that was legally due in the UK was paid. That’s £627.9 billion in revenues in 2018 to 2019. Of the revenues HMRC brought in, £34.1bn was additional tax from tackling avoidance, evasion and other non-compliance.

In the same year, HMRC estimates that around £1.7 billion was lost to tax avoidance. Around half of this gap (£0.9 billion) is attributed to Corporation Tax. The £0.6 billion element relating to avoidance schemes marketed to individuals is made up of unpaid Income Tax, National Insurance contributions and Capital Gains Tax, although it is likely to also include a small amount of Corporation Tax. Other direct taxes and VAT account for the smallest share of avoidance (each at £0.1 billion). The Income Tax, National Insurance contributions and Capital Gains Tax elements of the avoidance tax gap have been estimated using information HMRC collects on tax avoidance schemes that were marketed and sold to individual UK taxpayers. The £0.6 billion figure is a projection and is likely to be revised as we work through our data.

Although it’s a serious amount of money lost to public services, and the public can rightly expect HMRC to take action, far more is lost to error, criminal attack and evasion.

Figure 1: Why tax goes unpaid

| The reason tax goes unpaid | Amount of tax revenue lost |

|---|---|

| Failure to take reasonable care | £5.5 bn |

| Legal interpretation | £4.9 bn |

| Evasion | £4.6 billion |

| Criminal attacks | £4.5 bn |

| Non-payment | £4.1 bn |

| Error | £3.1 billion |

| Hidden economy | £2.6 bn |

| Avoidance | £1.7 bn |

Our analysis shows the overall amount lost to avoidance schemes targeted at individuals, has more than halved since the 2013 to 2014 tax year, when we estimate it cost the Exchequer about £1.3 billion. This reduction is the result of a series of policy and operational changes.

Most notably, the introduction of the General Anti-Abuse Rule in 2013, and Accelerated Payment Notices and Follower Notices in 2014, fundamentally changed the economics of avoidance (for example, by requiring any disputed tax to be paid in full up front while any dispute was resolved or went through the courts) while other measures strengthened HMRC’s operational response.

While we are clear on the overall trend, we need to do more to understand year-on-year trends given our latest estimate of the tax gap for avoidance schemes marketed to individuals is a projection. Our initial analysis shows the avoidance tax gap has levelled out over the last few years, indicating there is still more HMRC needs to do to further reduce the avoidance tax gap.

We believe about 30,000 individuals and 2,000 employers were involved in avoidance schemes in 2018 to 2019. In comparison, we estimate about 22,000 individuals and 6,000 employers were involved in avoidance schemes during 2013 to 2014. This includes individuals and businesses using avoidance schemes for the first time in 2018 to 2019, and those who had used them before and continued to do so.

HMRC is doing more work to understand why the number of individuals that we have identified as being involved in avoidance schemes has increased while the number of employers that we have identified as involved in has decreased.

In part, this is a result of our ability to identify individuals involved in avoidance at an earlier stage (for example through PAYE data in-year as opposed to analysis of tax returns). We are also looking at whether changes in the wider employment market, notably the increase in freelancing, have had an impact.

We are also investigating the use of certain umbrella companies by contractors and agency workers. These are employment businesses which typically engage the workers whose services they supply under contracts of employment. As the workers’ employer, they are required to operate PAYE on the workers’ income. While the majority of umbrella companies comply with their tax obligations, we have seen a small number who do not comply and continue to encourage their workers into avoidance schemes. Where HMRC identifies arrangements of this kind, we are stepping in to warn people who are using them.

2.3 Changes to the market for tax avoidance schemes

In 2013 to 2014, the main types of avoidance schemes were disguised remuneration and sideways loss; the latter involved artificial losses created to offset tax liabilities. Many of these schemes were said to involve investment opportunities and were marketed to higher-income investors.

For example, the “Ingenious” and “Icebreaker” avoidance schemes sought to use artificial losses arising from investments to avoid £568m of tax. The Ingenious scheme tried to use artificial losses arising from investments in a range of films, including the blockbusters Avatar, Life of Pi and Die Hard 4. The Icebreaker scheme attempted to create artificial losses from investments in limited liability partnerships. In both schemes, the individuals using them tried to claim more in tax relief than they had invested. These schemes did not work, and individuals faced big bills for interest and legal fees on top of the unpaid tax.

Case study: Higher-income individuals

In a landmark case against the Eclipse 35 avoidance scheme, HMRC protected £635 million in tax that would have otherwise been lost. Eclipse claimed to trade in film rights but was, in reality, a tax avoidance scheme.

People borrowed significant sums of money, at interest, to invest in Eclipse, and the scheme tried to create substantial tax relief on this interest, using artificial transactions relating to certain Disney films (Enchanted and Underdog). HMRC challenged this scheme through the courts, and ultimately in 2017 the Supreme Court found in our favour and ruled that the scheme did not work.

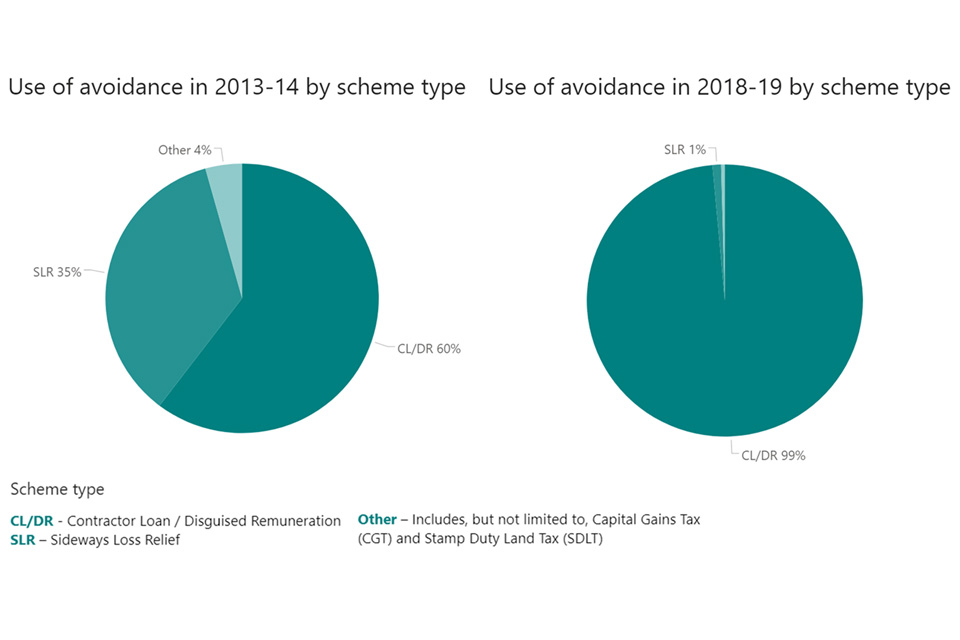

Figure 2: How the avoidance market has changed over time

These charts show the change in the proportion of the scheme types between 2013 to 2014 and 2018 to 2019. The difference in the overall amount of avoidance use is not captured.

| Scheme type | 2013-14 | 2018-19 |

|---|---|---|

| Contractor loan / Disguised remuneration | 60% | 98% |

| Sideways loss relief | 35% | 1% |

| Other | 4% | 1% |

Note: ‘Other’ includes, but is not limited to, Capital Gains Tax, and Stamp Duty Land Tax.

Today, the investment avoidance schemes have largely disappeared, and the market is dominated by disguised remuneration avoidance schemes. This type of avoidance uses contrived arrangements to make the taxable money someone receives for doing a job look like non-taxable money, all with the aim of avoiding the tax that is rightly due.

Typically, an individual will receive their income or earnings as, what are claimed to be, a series of loans. The terms of the loans mean the recipient is highly unlikely to ever have to repay them, and the loans will generally be made via an offshore trust, which has been set up in a tax haven.

We have also seen avoidance schemes where workers are paid their income in the form of what are said to be grants, salary advances, capital payments, credit facilities, annuities, shares and bonuses, or amounts claimed to be held in a fiduciary capacity. In all cases the scheme promises to put money in the worker’s pocket without them having to pay tax on it.

As these avoidance schemes are so similar, it has become less relevant to count the number of schemes being marketed. Many are simply tweaked versions of earlier schemes that are then marketed under a new name or to different audiences. What matters is the overall number of people who use avoidance schemes and the amount of tax they seek to avoid paying.

In 2013 to 2014 the typical use was by lots of small and medium sized employers operating Employee Benefit Trusts and Employer Funded Retirement Benefit Schemes. Most of these schemes have been shut down. We continue to challenge Contractor Loan schemes as well as marketed avoidance being undertaken by employer businesses and “umbrella” companies, engaging larger numbers of contractors or agency workers operating disguised remuneration schemes.

Case study: The shift to moderate incomes

- Beth: 34 year-old social worker from Manchester

- Total actual income: £36,000 (2016 to 2017 and 2017 to 2018)

- Declared income: £11,000 (2016 to 2017 and 2017 to 2018)

£5,300 additional tax paid

Beth was introduced to a tax avoidance scheme by her recruitment agency. The scheme promised her higher take home pay and her employment contract didn’t mention loans.

She received a payslip by email that showed she earned an average gross monthly salary of £790. On the same day she received a separate loan amount for the rest of her income, averaging £2,100 per month.

Beth received total income of £36,000 for the two tax years 2016 to 2017 and 2017 to 2018 combined.

She declared £11,000 of this income to HMRC - this left £25,000 of additional loan payments that she did not declare, avoiding £5,300 of tax and National Insurance contributions.

Beth didn’t declare her loan amounts on her 2016 to 2017 tax return. Beth was still in time to submit her 2017 to 2018 tax return. She entered £19,000 of loans as employment income for the year and was taxed £3,800 accordingly.

For the remaining £6,000 of undeclared loans from 2016 to 2017, the amount owed, including tax, student loan payment and interest, totalled £1,500. A flexible payment plan was put in place for Beth, an initial lump sum of £500, followed by equal monthly instalments of £55 for 18 months.

Beth paid £5,300 tax that otherwise would have been avoided.

Because Beth settled her tax on the loan amounts in full, the Loan Charge did not apply.

HMRC has consistently challenged disguised remuneration schemes and has always argued that they did not work. In 2017, the Supreme Court ruled that money paid into a trust that was then used to pay the so-called loans to individual workers, was subject to income tax and National Insurance contributions. Despite this ruling by the highest court in the land, promoters continued to sell disguised remuneration avoidance schemes and some contractors and agency workers continued to use them.

The government introduced legislation in Finance Act 2017 to draw a line under the use of historic disguised remuneration avoidance schemes. Known as the Loan Charge, it gave those who had used disguised remuneration avoidance schemes the choice of either repaying their outstanding loans, or paying to HMRC the tax and National Insurance that was due for the tax years the loans were made in, or paying tax on the total of all outstanding loans in one charge.

The government commissioned an independent review of the Loan Charge policy and implementation, which was led by Sir Amyas Morse. This was published in December 2019 alongside the government’s response.

The review concluded that it was right for the government to try to ensure that the tax was collected and that the Loan Charge should remain in force, but recommended some changes. The government agreed a series of changes to the Loan Charge following the review, accepting all but one of the 20 recommendations. These were legislated, where necessary, in the Finance Act 2020. HMRC will report to Parliament on the implementation of the Loan Charge changes following the independent review by the end of 2020.

2.4 Who uses avoidance schemes?

HMRC data shows that, for individuals involved in tax avoidance during the 2018 to 2019 tax year, use of tax avoidance schemes is most prevalent in the 41-60 years age group. On average, they are involved in tax avoidance for about three years. Almost half have been involved in more than one avoidance scheme.

Figure 3: Artificially reduced income levels among people who used tax avoidance schemes in the 2018 to 2019 tax year

Artificially reduced income for people who used avoidance schemes in 2018 to 2019 and are either on PAYE of filed a Self Assessment return.

| Income | Percentage |

|---|---|

| £0-25,000 | 61% |

| £25-50,000 | 30% |

| £50-75,000 | 6% |

| £75-100,000 | 2% |

| £100,000+ | 2% |

Note: The reported income has been extracted from HMRC’s real time information PAYE data and Self Assessment data. Where a person had more than one employment in the tax year, the income was summed across the employments. Amounts declared will not reflect the full income for tax purposes. As Loan Charge taxpayers had until 30 September 2020 to file their 2018 to 2019 Self Assessment tax returns, these figures are subject to revision.

More than nine out of ten people who used avoidance schemes reported an income of less than £50,000 per year for tax purposes. This is something we would expect, because people who used disguised remuneration avoidance schemes did not report their full income for tax purposes. That is because the avoidance scheme sought to artificially lower their taxable income.

It is unclear what proportion of the people who reported income of £0-25,000 were genuinely on incomes of this level. However, anecdotal evidence in the wake of the Loan Charge and the fact that promoters of avoidance schemes targeted nurses and other NHS workers, indicates an increased level of interest from promoters in individuals on middle-incomes.

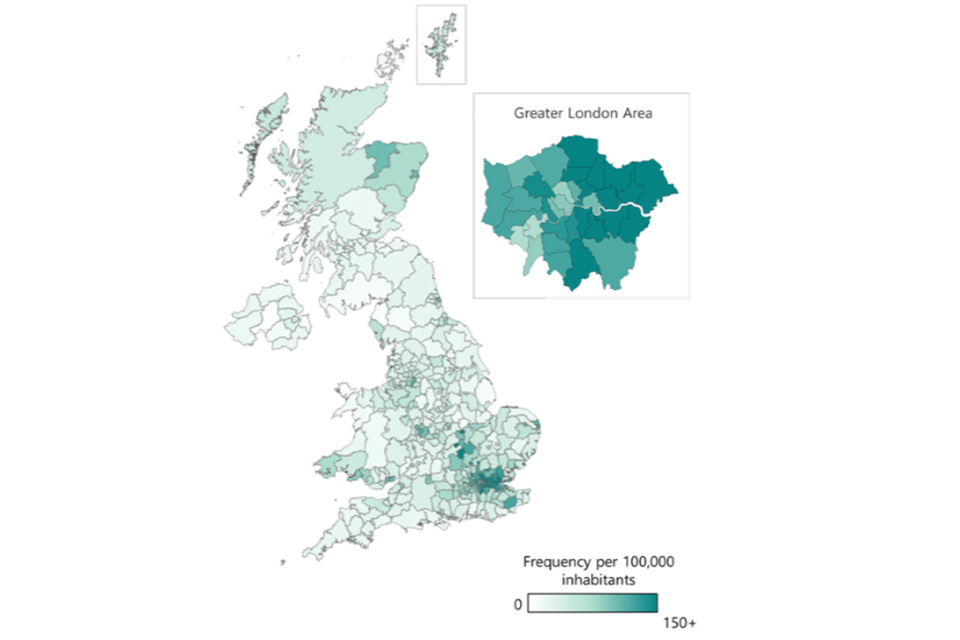

As would be expected, given the density of the population in these areas, tax avoidance in the UK is concentrated in London and the south-east of England. However, we are seeing a significant shift away from the London postcodes more usually associated with those on higher incomes, including the City of London and Knightsbridge, towards the outer boroughs and commuter belt. There are noticeable concentrations in Barking and Dagenham, Thurrock, Greenwich and Croydon.

Figure 4: Geographical distribution of people in the UK who used avoidance schemes during 2018 to 2019

The number of people who used tax avoidance in 2018 to 2019 by local authority, scaled by the local authority population.

Note: For each local authority, the number of people who used avoidance in 2018 to 2019 is scaled by the total population (mid-2019 Office for National Statistics (ONS) population estimates). The frequency is presented per 100,000 inhabitants. The darker colour represents areas where there is a higher prevalence of avoidance.

Figure 5: The table shows the distribution of people who used avoidance schemes during 2018 to 2019 across the UK local authorities

Number of people who used tax avoidance in 2018 to 2019 by local authority, scaled by the local authority population - the frequency is shown per 100,000 inhabitants.

| Local Authority | Frequency per 100,000 |

|---|---|

| Barking and Dagenham | 229 |

| Thurrock | 174 |

| Greenwich | 165 |

| Croydon | 136 |

| Lewisham | 136 |

| Havering | 135 |

| Dartford | 130 |

| Bexley | 127 |

| Stevenage | 125 |

| Hackney | 123 |

| Redbridge | 121 |

| Southwark | 119 |

| Harlow | 116 |

| Corby | 115 |

| Newham | 114 |

| Luton | 113 |

| Enfield | 111 |

| Milton Keynes | 108 |

| Waltham Forest | 104 |

| Slough | 102 |

| Northampton | 101 |

| Haringey | 100 |

| Basildon | 99 |

| Watford | 97 |

| Brent | 95 |

| Hammersmith and Fulham | 92 |

| Lambeth | 91 |

| Gravesham | 91 |

| Brentwood | 90 |

| Wandsworth | 89 |

| Chelmsford | 85 |

| Southend-on-Sea | 82 |

| Merton | 82 |

| Sutton | 81 |

| Hounslow | 81 |

| Ashford | 81 |

| Bedford | 80 |

| Broxbourne | 80 |

| Hillingdon | 80 |

| Hertsmere | 79 |

| Bromley | 79 |

| Ealing | 79 |

| Barnet | 78 |

| Welwyn Hatfield | 77 |

| Great Yarmouth | 76 |

| Manchester | 75 |

| Medway | 75 |

| Sandwell | 74 |

| Islington | 74 |

| Wellingborough | 72 |

| Harrow | 71 |

| South Tyneside | 70 |

| Newport | 69 |

| Aberdeen City | 69 |

| Epping Forest | 68 |

| Moray | 68 |

| Tower Hamlets | 67 |

| Reading | 67 |

| Birmingham | 67 |

| Wolverhampton | 66 |

| Kensington and Chelsea | 65 |

| Kettering | 64 |

| Woking | 63 |

| Swindon | 62 |

| Aylesbury Vale | 61 |

| Westminster | 61 |

| Walsall | 61 |

| Surrey Heath | 60 |

| Norwich | 60 |

| Swansea | 59 |

| Kingston upon Thames | 58 |

| Runnymede | 57 |

| Trafford | 56 |

| Camden | 56 |

| Reigate and Banstead | 55 |

| Peterborough | 55 |

| Elmbridge | 54 |

| Bracknell Forest | 54 |

| Neath Port Talbot | 54 |

| Middlesbrough | 53 |

| Spelthorne | 53 |

| Coventry | 53 |

| Colchester | 52 |

| Worcester | 52 |

| Central Bedfordshire | 52 |

| Oxford | 52 |

| Rushmoor | 52 |

| Southampton | 51 |

| Leicester | 51 |

Note: For each local authority, the number of people who used avoidance in 2018 to 2019 is scaled by the total population (mid-2019 ONS population estimates). The frequency is presented per 100,000 inhabitants and local authorities with fewer than 50 people per 100,000 inhabitants are not shown. Values for local authorities with fewer than 10 individuals have been suppressed for Statistical Disclosure Control.

Figure 6: Most common employment types for people who used avoidance schemes during 2018 to 2019

Top 10 most frequent employment types for people who used avoidance schemes in 2018 to 2019 and are on PAYE.

| Employment type | Percentage |

|---|---|

| Bookkeeping activities | 20% |

| Hospital activities | 18% |

| Management consultancy activities other than financial management | 9% |

| Temporary employment agency activities | 9% |

| Combined office administrative service activities | 6% |

| Other business support activities n.e.c. | 4% |

| Other professional, scientific, and technical activities n.e.c. | 3% |

| Other human health activities | 3% |

| Other activities of employment placement agencies | 3% |

| Primary education | 2% |

‘n.e.c.’: ‘not elsewhere classified’

Note: Sectors are extracted from HMRC’s Real Time Information PAYE data. A relevant code from the International Standard Industrial Classification is associated to each employment. Whenever someone had more than one employment on record, the sector associated with the highest paid employment was selected.

About a fifth of the people who used avoidance schemes during 2018 to 2019 had an employment categorised as “Bookkeeping activities”. Most of the employers in this group have been identified as umbrella companies. These are intermediaries who provide workers to other organisations. Where someone works through an umbrella company HMRC data does not show what type of business they are ultimately working for. Our data doesn’t give us a further breakdown of professions. Beyond bookkeeping activities, healthcare, temporary employment agency activities, consultancy, office and business support service activities are the most common sectors within this population.

There is a notable level of use of avoidance schemes within the healthcare sector. HMRC has already stepped in where promoters have targeted NHS workers returning to the workforce to support the UK’s COVID-19 response.

2.5 Why do people get involved in avoidance schemes?

There is relatively little hard data on why people get involved in tax avoidance and the evidence that we have points to a range of motives.

At one end, there is a hard core of serial tax avoiders who are actively seeking to reduce the amount of tax they pay. They will have been in multiple schemes and for a number of years. They are prepared to take the risk that the scheme they are using will not work and that HMRC will open an enquiry into their tax arrangements. Around 12 per cent of individuals identified as being involved in avoidance schemes in 2018 to 2019 had been in schemes for more than three years.

The motivations of taxpayers outside this group are less clear. Our assessment of taxpayer motivations and behaviour is partly based on feedback from our colleagues who work with taxpayers to get them out of avoidance and help them settle their affairs.

Some taxpayers who used avoidance schemes have told us that their aim was to simplify their tax affairs and reduce their administrative burden. In these cases, they did not appear to ask questions about the arrangements they were getting into so did not fully understand the risks. Others knew they were engaged in tax avoidance and were prepared to either take the risk, did not understand the consequences, or did not believe that HMRC would identify them and ask questions.

A number of people who used avoidance schemes have said they were instructed to join a scheme as a condition of securing a particular job. However, HMRC has not yet seen contracts or other paperwork that can verify this.

We suspect that the majority of people who used avoidance schemes, particularly in recent years, didn’t look too deeply into the tax arrangements they were being offered. In part, this may simply be because they believed they had handed their affairs to someone they viewed as competent and professional. Few understood that tax advice is unregulated, and many were surprised to find they were personally responsible for ensuring they pay the right tax.

2.6 How are schemes sold?

Historically, the prevalence of tax avoidance within certain sectors, such as IT contractors, is likely to be a reflection of the way schemes were marketed through word-of-mouth recommendation and advertising.

This is a pattern that continues today with a single individual or tax agent receiving a payment for introducing others to a scheme. As tax compliance is motivated by socially accepted behaviour, small clusters of avoidance of this kind are likely to arise where a number of people around an individual are using the arrangements, creating a sense that it is “acceptable”.

Promoters use advertising that sounds convincing and that easily draws in clients. Schemes are marketed online through price comparison-style websites. Common claims include “up to 90 per cent retention on contract income” and even “unprecedented support with HMRC”. HMRC continues to work with the Advertising Standards Authority and online search engines to get misleading material taken down.

We have increasingly seen evidence that non-compliant employment agencies are directing their clients to umbrella companies who operate avoidance schemes. Where HMRC identifies arrangements of this kind we will take action against the promoter, and step in to warn people who are using them.

Figure 7: Claims from typical advertisements

Typical promoter claims

- We lead the market in providing legitimate strategies for reducing tax liabilities

- Keep up to 90% of your contract income – we can put you in touch with highly tax-efficient remunerations options

- HMRC is aware of the arrangements (i.e. the tax avoidance scheme) and has approved them

- We provide everything you would expect from a payroll provider

- The arrangements are not caught by current tax law

- The arrangements are vetted by tax counsel, financial advisers and accountants

- Our methods are tried and tested, simple and easy to use

- We have negotiated the best umbrella rates for you

- 50% off processing charges for key workers

3. Tax avoidance promoters

3.1 Who is selling these schemes?

Around 20 promoters, many of whom were active in promoting disguised remuneration schemes, have moved out of promoting altogether in the last six years, as a result of the introduction of new HMRC powers and HMRC’s activity in tackling promoters.

This leaves about 20 to 30 promoters who are behind most of the tax avoidance schemes that are marketed to the UK public. These are the people who design, manage and organise avoidance schemes. Each promoter is supported by a network of related businesses. There has been a significant shift away from the past when avoidance schemes were promoted and enabled by some accountants, banks and major financial institutions. These organisations are now only very rarely involved in the promotion or marketing of avoidance schemes.

These days promoters are almost never members of the professional accountancy bodies (such as the Chartered Institute of Taxation, Institute of Chartered Accountants in England and Wales and Institute of Chartered Accountants in Scotland, Association of Chartered Certified Accountants and Association of Accounting Technicians).

Each of these professional organisations prohibits its members from creating, encouraging or promoting tax avoidance schemes.

In the past, promoters may have been tax agents who would advise their clients on other tax issues. Today, they are more likely to specialise in avoidance and nothing else. Many promoters are based offshore and will move jurisdictions as HMRC closes in on their operations.

3.2 What promoters don’t tell their clients

UK tax law is clear that taxpayers are accountable for getting their tax right. Taxpayers who enter schemes will eventually need to pay the tax they always owed, often having already paid out substantial fees to the scheme promoter or another intermediary.

In many cases, promoters wrongly reassure their clients that they do not need to be concerned when HMRC has contacted them to warn them about their use of an avoidance scheme, and also refuse to help their clients when their arrangements are challenged by us.

Promoters do not tell their clients of the risks of getting into avoidance, in particular that:

- most schemes do not work

- it could cost them more than they bargained for in terms of tax, NICs, interest, potentially penalties and the fee paid to use the avoidance scheme

- they may have to pay significant legal fees

- they may face a criminal conviction if they use false documents or make false statements

- avoidance schemes are never approved by HMRC

- they could be marked out as a high-risk taxpayer and be subject to ongoing in-depth checks by HMRC

- HMRC is likely to defeat the scheme in court

- the risk is normally all the client’s

Where an avoidance scheme does not work, it may be difficult, but not unheard of, for the people who used that scheme to take civil action against promoters for mis-selling, particularly when the promoter is based offshore.

3.3 How HMRC tackles promoters

HMRC investigates and contests the behaviour of promoters and enablers of avoidance schemes. We do this to change their behaviours, with the intention that they cease their avoidance activities entirely.

Promoters of avoidance schemes are legally required to disclose their schemes to HMRC. But they are increasingly unlikely to do so, so that they can continue to market them before HMRC can stop them. In the last two years, the majority of avoidance schemes were only disclosed to HMRC after we used our legal powers to force them to be disclosed.

HMRC identifies new avoidance schemes and the promoters behind those schemes using real time information from our PAYE systems and other intelligence. HMRC encourages anyone who is aware of avoidance schemes being marketed to provide details, including promotional material if you have it, so that we can pursue the scheme.

HMRC acts quickly once we are aware of a scheme to disrupt the promoter’s business and stop them selling the scheme, challenging schemes and promoters using our powers under the Disclosure of Tax Avoidance Scheme (DOTAS) and Promoter of Tax Avoidance Scheme (POTAS) rules. HMRC activity extends to investigations into any potential non-compliance across all of the promoter’s tax affairs, including, where appropriate, their income tax, corporation tax and VAT returns.

The Enablers penalty introduced in 2017 helps us to tackle the promoter’s supply chain including people like lawyers and company formation agents. We have used this legislation to challenge enablers and make them aware that by helping the promoter to sell the scheme they are making themselves liable to an enabler penalty. Sometimes this is enough to persuade enablers to pull out of any involvement in avoidance schemes which in turn disrupts the promoter’s business.

As well as its full range of civil sanctions, such as penalties for failing to disclose avoidance schemes or for failing to provide information to HMRC, where the avoidance scheme involves fraud or other criminal offences, HMRC will use the full range of criminal powers to tackle those who enable the avoidance scheme. This includes the corporate criminal offence of failing to prevent the facilitation of tax evasion. Whenever HMRC identifies a promoter or enabler of avoidance schemes we will always consider whether there is scope for a criminal prosecution. Promoting tax avoidance is not, on its own, a criminal offence but we will investigate with a view to prosecution where there is evidence that a promoter or enabler has committed fraud whilst designing or marketing avoidance schemes.

Since April 2016, more than 20 individuals have been convicted for offences relating to fraudulent arrangements promoted and marketed as tax avoidance schemes. The courts ordered over 100 years of custodial sentences. Most of these individuals were promoters.

HMRC published a Promoter Strategy in March 2020 that committed HMRC to work even more closely with partner bodies so the full range of sanctions available can be used against promoters. Most recently HMRC has worked with the Advertising Standards Authority to issue a joint Enforcement Notice to set out what promoters should and should not include in their internet advertising. We have also worked with the accountancy bodies to strengthen their code of conduct.

As well as tackling promoters and their supply chain directly, HMRC also aims to disrupt their market by reducing demand for their schemes. As set out in the Promoter Strategy, we will launch a new communications campaign aimed at getting taxpayers to steer clear of avoidance.

To help taxpayers stay out of avoidance HMRC has launched a new early intervention project. The aim is to support taxpayers to get out of avoidance schemes as early as possible and settle their tax bill before they have built up a large unpaid liability. HMRC is contacting taxpayers early, where possible within a couple of months of them entering a scheme and before they submit a Self Assessment tax return, to make them aware of our concerns and help them to understand what they need to do to pay the right amount of tax.

3.4 Further HMRC action against promoters

A hardcore group of promoters remain in the market who do not comply with their obligations and who take every opportunity to sidestep the rules, hiding their identity behind multiple companies and other types of business entity. These cases involve detailed investigation and it can take a long time to get the information and investigate, and to litigate at every stage.

Therefore, in addition to the activity set out above the government has also announced further measures to tackle the behaviours of promoters and enablers.

In March 2020, HMRC published its strategy Tackling promoters of mass-marketed avoidance schemes. It sets out how HMRC will:

- continue to tackle promoters and their supply chain, using the powers in the anti-avoidance regimes

- work more closely with partner bodies to make sure all government and regulatory powers are used to tackle promoters

- help taxpayers stay out of avoidance

The strategy also set out plans for bringing forward further policy measures to disrupt the business models of promoters, change the economics of avoidance and to tackle the behaviours of promoters.

In summer 2020, HMRC consulted on new policy measures to enable HMRC to act more quickly when tackling promoters. This includes powers to publicly name schemes and promoters where we believe the arrangements should have been disclosed to us, earlier than we can now. This will help us warn taxpayers about the tax avoidance schemes being marketed.

In July 2020, the government also launched a call for evidence on how best to tackle disguised remuneration avoidance schemes, which continue to be marketed despite legislation being enacted making it clear that they do not achieve the tax savings claimed for them. This included questions on how to tackle promoters.

The government announced on 12 November 2020 further proposals to tackle promoters, which it will consult on in spring 2021. This will include consulting on measures to ensure that promoters face significant financial consequences for promoting tax avoidance more quickly than under the existing regimes.

4. HMRC is here to help people get out of avoidance

4.1 HMRC is here to help

HMRC is keen to get the message out to people not to be tempted by tax avoidance schemes.

Here are some things to look out for:

- A scheme that promises you can keep more of your income than you would expect. When you see such offers, bear in mind the basic rate of Income Tax is 20 per cent and you also need to pay National Insurance contributions (NICs) on top.

- Some, or all the payments you get in return for your work are said to be non-taxable. These payments may not appear on your payslip and could be described as loans, annuities, bonuses, shares, fiduciary receipts, credit facility, capital payments/advances or something similar. These payments are no different to normal income, so you need to pay Income Tax and NICs on them.

- You are told the schemes are safe, compliant or approved by HMRC. This is not true, HMRC does not approve avoidance schemes.

- Your payments are split and only part of your total payments are taxed as income. If you are employed the amount taxed is often close to the national minimum wage.

- You are offered a choice between a standard or an “enhanced” scheme, which may be described as more tax efficient. The enhanced version is likely to be tax avoidance.

- Your total employment income is greater than the amount shown on your payslip or form P60.

- You are asked to sign more than one contract or agreement.

- Your employment contract or agreement does not state how your income will be paid or provide a breakdown of all deductions to be made from your income.

We want to help people steer clear of avoidance by asking them to stop, challenge and protect themselves, and others.

If you are worried about becoming involved in a tax avoidance scheme, or think you are already involved and want to get out of one, HMRC is here to help. We offer a wide range of support to get you back on track or avoid being caught out in the first place.

Anyone concerned about the schemes they are currently using should consider getting independent professional tax advice or speak to one of the tax charities. Anyone with concerns can also email HMRC at CAGetHelpOutOfTaxAvoidance@hmrc.gov.uk. There is further information on our Tax avoidance: getting out of an avoidance scheme page on GOV.UK.

4.2 HMRC support for those in avoidance

HMRC has a team dedicated to contacting people early where our systems show they might have got into avoidance. Where possible we want to do this within a couple of months of them potentially entering a tax avoidance scheme or before they submit a Self Assessment return, to make them aware of HMRC’s concerns and help them to understand what they need to do to pay the right amount of tax. This will mean that we can help them move out of their avoidance schemes before they have built up large tax bills.

4.3 Helping people with debt

Where someone is unable to pay the tax they owe on time, we want to work with them. We are always ready to help those who want to settle their affairs. We don’t want anyone to worry and we’re here to make things as straightforward as possible.

As we become aware that someone has a tax debt, we always try to contact them by phone, post or SMS so that we can talk about their situation and agree a way forward. We urge people to respond to these communications as soon as possible because, unless we can discuss their situation, we can’t tell if they need support or are refusing to pay.

In all cases, we want to work with people to find a way for them to pay off their tax debt as quickly as possible, and in an affordable way for them.

Everyone is different, so the support we offer differs from person to person – we tailor our support to their individual needs. Where people are facing difficulty in making a tax payment, they should ask us about affordable payment options. We’ll work with them to try and agree a payment plan (called “Time to Pay”), based on their financial position. We typically have more than half a million arrangements in place at any one time, and nine out of ten of them complete successfully.

4.4 Stopping tax avoidance early or before it starts

We’re going to do more to help contractors and agency workers stay clear of tax avoidance. For example, we’re running the Tax avoidance - don’t get caught out campaign, which aims to help people spot tax avoidance and make sure they understand the risks.

We want to get people out of avoidance faster and we’re here to help anyone who is worried they might be caught up in it.

This is, and always has been, about ensuring everyone pays the correct amount of tax, just like most people already do.

4.5 Other useful reading

HMRC has published several resources and guidance on tax avoidance over the years. Please find below a selection of other reading you, as a contractor or agency worker, may find useful.

- Guidance on how to identify schemes that wrongly claim to increase your take-home pay if you are a contractor or agency worker

- Ten things a promoter of tax avoidance schemes will not always tell you - guidance to help you think about the risks of taking up a tax avoidance scheme that a promoter or enabler may be concealing

- Spotlights on tax avoidance - a series of guidance articles focused on specific tax avoidance schemes and issues

- Spotlight 45: find out what to do if an agency or umbrella company offers to reduce your tax liability and increase your take home pay

- Spotlight 54: a guidance article on tax avoidance schemes targeting returning NHS workers during the COVID-19 pandemic

- Spotlight 55: find out what you should consider before using an umbrella company to make sure it complies with the tax rules

- HMRC: the Standard for Agents - provides what we expect from agents and can be used by individuals to challenge their agent or promoter asking them to confirm in writing why they believe the arrangement fully satisfies the Standard

- Call for evidence – Raising standards in the tax advice market

- HMRC Policy paper: Tackling promoters of mass-marketed avoidance schemes

5. Glossary

| Term | Definition |

|---|---|

| Accelerated Payment Notice (APN) | Introduced in Finance Act 2014, as part of a package of measures to change the economics of avoidance. APNs allow HMRC to collect amounts of tax and NICs under dispute as a result of the use of a tax avoidance scheme, including but not limited to loan schemes. When an APN is issued, scheme users must pay the amount of tax and NICs specified by HMRC within 90 days. |

| Advertising Standards Authority (ASA) | The UK’s independent regulator of advertising across all media. They apply the Advertising Codes, which are written by the Committees of Advertising Practice (CAP). |

| Agency, often referred to as intermediaries | Agencies are generally recruiters who look to supply engagers with flexible labour. There are often several agencies in the supply chain between the engager and the individual providing their labour. |

| Compliance activity | Actions undertaken by HMRC in the pursuit of getting individuals and businesses to pay the taxes owed as intended by the law. |

| Contractor | Individual providing flexible professional services to an engager, either directly or through an agency. |

| Contrived Arrangement or Transaction | An arrangement or transaction that has an artificial structure that does not accurately reflect the true nature and intention of the arrangement or transaction. |

| Direct taxes | Taxes, such as income tax, which are levied on the income or profits of the person who pays it, rather than on goods or services. |

| Disclosure of Tax Avoidance Schemes (DOTAS) | Introduced in Finance Act 2004 for HMRC to obtain early information about how tax arrangements work and information about who has used them. Disclosure has no effect on the underlying tax position of a taxpayer or tax avoidance scheme, but there may be penalties for failure to disclose on both the promoters and scheme users. |

| Disguised remuneration | Arrangements through which individuals are rewarded through a third party in the form of loans, or other payment arrangement, usually involving an offshore trust. Outstanding balances on these loans at 5 April 2019 are subject to the Loan Charge in the 2018 to 2019 tax year. Disguised remuneration tax avoidance schemes claim to avoid the need to pay Income Tax and National Insurance contributions. |

| Employee Benefit Trust (EBT) | A trust set up by a company to hold cash and/or other assets (e.g. shares) to provide benefit for employees and/or their families. These can be established either in the UK or offshore. There are legitimate uses for these, but they are also often used as part of disguised remuneration schemes. |

| Enabler | Any person who is responsible, to any extent, for the design, marketing or otherwise facilitating another person to enter into abusive tax arrangements. |

| Enablers Penalty | A penalty for any person who enables the use of abusive tax arrangements, which are later defeated. The legislation for this was introduced in schedule 16 to the Finance (No.2) Act 2017. |

| Enquiry | May also be referred to as a compliance check. It is the process by which HMRC check in detail that the information on a tax return is correct and complete. |

| Follower Notices | Follower Notices can be issued to scheme users of a scheme that has been shown in another litigation case to be ineffective. The Follower Notice tells the scheme user that they may be liable to a penalty of up to 50% of the disputed tax and/or NICs if they choose not to settle with HMRC at that point and are later defeated in court. |

| Form P60 | This shows the tax you’ve paid on your salary in the tax year (6 April to 5 April). You get a separate P60 for each of your jobs. |

| General Anti-Abuse Rule (GAAR) | Introduced in Finance Act 2013 to deter taxpayers from entering into abusive arrangements, and to deter would-be promoters from promoting such arrangements. Additional GAAR provisions were enacted in Finance Act 2016. The GAAR operates to counteract the abusive tax advantage which is trying to be achieved. The counteraction that the GAAR permits will be a tax adjustment which is just and reasonable in all the circumstances. The appropriate tax adjustment is not necessarily the one that raises the most tax. |

| HM Revenue and Customs (HMRC) | HMRC is the UK’s tax, payments and customs authority. |

| Limited Liability Partnership | A legal structure for businesses that allows for the business to be run with 2 or more members. A member can be an individual or a company, known as a ‘corporate member’. Each member pays tax on their share of the profits, as in an ‘ordinary’ business partnership, but isn’t personally liable for any debts the business can’t pay. |

| Loan Charge | Introduced in Finance Act 2017 to address tax loss to the Exchequer due to the use of disguised remuneration schemes. The legislation required scheme users to either repay their outstanding disguised remuneration loans, or declare them as income on their 2018 to 2019 tax returns. The Income Tax and NICs charges on this income is known as the ‘loan charge’. |

| Marketed tax avoidance | Contrived schemes that are sold to one or more individuals and employers for a fee, with the aim of reducing their tax liabilities. |

| PAYE, also referred to as Pay As You Earn | A system of paying Income Tax in which an employer pays an employee’s tax directly to HMRC. The taxes paid are then deducted by the employer from the employee’s salary/wages. |

| Promoters of Tax Avoidance Schemes (POTAS) | Introduced in Finance Act 2014, the legislation allows HMRC to issue conduct notices to promoters and subsequently monitor those who breach a conduct notice. Monitored promoters are subject to information powers and penalties, which will also apply to intermediaries that continue to represent them after the monitoring commences. |

| Promoter | Those who devise and market the use of tax avoidance schemes, including securing QC opinions, producing promotional material and marketing the schemes, either to agencies as an option for their staff or directly to contractors. Can be summarised as anyone who, in the course of providing tax services: is to any extent responsible for the design of a tax scheme (defined by reference to DOTAS) ; approaches others with a view to making a scheme available to them; makes a scheme available for implementation to others; organises or manages the implementation of a scheme |

| Self Assessment | Self Assessment is a system HMRC uses to collect Income Tax. Tax is usually deducted automatically from wages, pensions and savings. Individuals and businesses with other income must report it in a tax return. Completed for each tax year ending 5 April tax returns are due on 31 October (paper) or 31 January (online) following the end of the tax year. |

| Tax advantage | A reduction in the amount of tax due or increase in the amount tax reclaimable by a person or organisation in particular circumstances. |

| Tax avoidance | Tax avoidance involves bending the rules of the tax system to gain a tax advantage that Parliament never intended. It often involves contrived, artificial transactions that serve little or no purpose other than to produce this advantage. It involves operating within the letter, but not the spirit, of the law. |

| Tax evasion | Tax evasion is where there is a deliberate attempt not to pay the tax which is due. It is illegal. |

| Tax Gap | The difference between the amount of tax that should, in theory, be paid to HMRC, and what is actually paid. |

| Tax haven | A country or independent area where taxes are levied at a low rate. |

| Tax liabilities | The total amount of tax owed by an individual or business to HMRC. |

| Tax planning | The analysis of a situation and structuring of affairs in such a way to ensure tax efficiency. It involves reviewing the various opportunities and relief available within legislation to ensure that tax bills are minimised. |

| Tax relief | An intended reduction in tax owed by individuals or businesses brought about by government programmes or policies. Tax relief is often targeted to benefit a specific group or to aid in a specific goal of the government. It can also come in the form of a universal tax cut. |

| Tax year | For individuals, the Self Assessment tax year starts on the 6 April and ends 5 April the following year. For example, the 2019 to 2020 tax year began on 6 April 2019 and ended on the 5 April 2020. For corporate bodies, the tax year depends on the end of the accounting period. |

| Umbrella company | A UK limited company which acts as an employer to a number of individuals, meeting PAYE and other requirements where operating legitimately. It signs contracts to provide the individual’s labour to engagers, either directly or through another intermediary such as a recruitment agency. |