Local government income compensation scheme for lost sales, fees and charges

Guidance for local authorities on how to access the local government income compensation scheme for lost sales, fees and charges as a result of COVID-19.

Applies to England

Background

What is the scheme?

1. COVID-19 has impacted local authorities’ ability to generate revenues in several service areas as a result of lockdown, government restrictions and social distancing measures, related to the pandemic. This one-off income loss scheme (the scheme) will compensate for irrecoverable and unavoidable losses from sales, fees and charges income generated in the delivery of services, in the financial year 2020/21 and the first 3 months of 2021/22 financial year (the extended scheme).

2. The scheme will involve a 5% deductible rate, whereby authorities will absorb losses up to 5% of their planned 2020/21 sales, fees and charges income, with government compensating them for 75p in every pound of relevant loss thereafter. By introducing a 5% deductible government is accounting for an acceptable level of volatility, whilst shielding authorities from the worst losses.

3. The definition of an eligible loss is one that meets the principles set out in paragraphs 17 to 19 of this guidance. Annex A of this guidance provides worked examples of how to apply the principles, which can be used to help inform local judgements as to whether losses will be eligible.

4. Data collection exercises will be used to collect information on relevant losses from all eligible local authorities, and this will be done three times throughout the year. Annex B of this guidance contains instructions on how to fill out the data return. Payments will be made to compensate for losses in line with the scheme periodically throughout the year as set out in paragraph 29.

Explaining the parameters

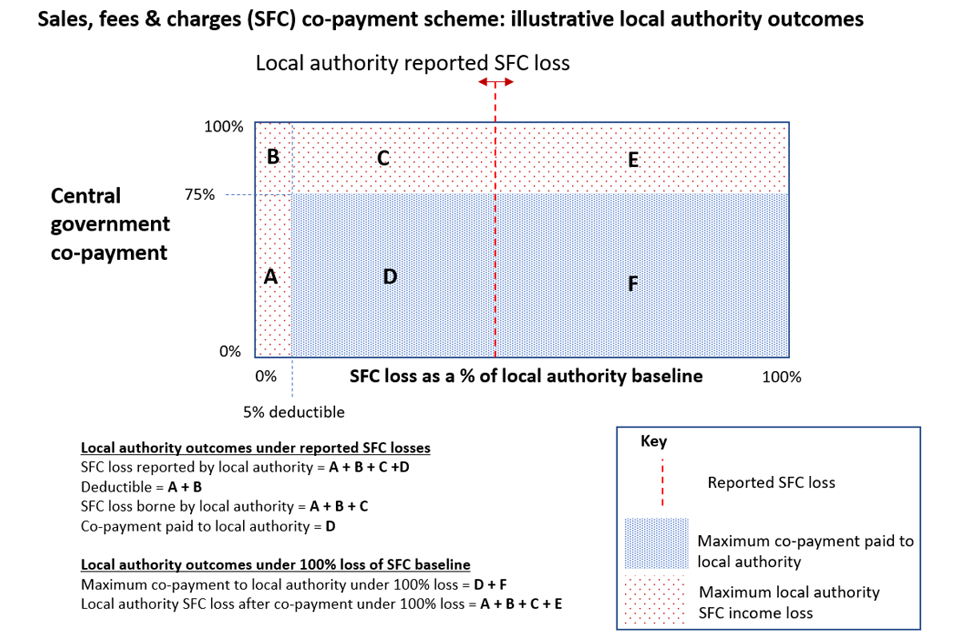

5. The amount an authority can be expected to receive through the scheme will be calculated by a set of parameters set out below. Figure 1 illustrates how the scheme will operate and the following formula can be used to help authorities understand the parameters in more detail:

6. The baseline [X axis of figure 1] – The gross income that an authority budgeted to collect in relation to relevant income streams at the start of the year (2020/21) which should be directly linked and reconciled to the published balanced budget set by the authority. More details on calculating this are included in Annex B, section 1.

7. The deductible [A + B in figure 1] – An amount equivalent to 5% of this budgeted income from eligible sales, fees & charges losses included in a local authority’s claim will be deducted from the losses claimed for, which local authorities will be expected to absorb.

8. The co-payment rate [D in figure 1] – Thereafter there will be a cost splitting arrangement where 75% of relevant losses will be compensated for by government, with the remainder being met by local authorities, up to a maximum of the baseline in paragraph 6.

Figure 1

Eligibility

9. The scheme is open to eligible authorities in England which have incurred relevant income losses and have been eligible for other coronavirus emergency funding for local government. Eligible authorities are:

- county councils (which may be a unitary)

- district councils (which may be a unitary)

- London borough councils

- the Common Council of the City of London

- the Council of the Isles of Scilly

- combined authorities

- fire and rescue authorities (which are constituted by a scheme under section 2 or the Fire and Rescue Services Act 2004 or a scheme to which section 4 of that Act applies, or which are created by an order under section 4A of that Act) and the London Fire Commissioner

10. Police and crime commissioners are not eligible for this scheme but should refer to separately issued guidance from the Home Office. Parish and town councils are not eligible for the scheme.

Scope of the scheme

What income losses can be claimed for under the scheme?

11. The scheme will compensate authorities for eligible losses of income from sales, fees and charges which they had forecast to collect through the usual delivery of local services in 2020/21.

12. The extended scheme will cover losses for the first 3 months of 2021/22, with local authorities asked to use budgeted data covering the same period from 2020/21 as the baseline.

13. This guidance sets out principles for determining whether losses are eligible. The principles-based approach acknowledges that individual authorities will be best placed to determine what losses from their forecast income are within scope of the scheme as set out in the guidance.

14. All claims for compensation under the scheme must comply with the principles set out at paragraphs 17 to 19 of this guidance, and this must be certified by the authority’s section 151 officer. The Department may require authorities to provide evidence to support claims and may make any payments conditional on such evidence being provided. Grant paid out may also be clawed back if it becomes clear that an authority has not complied with the principles included in this guidance. More details of this are set out in the ‘operating the scheme’ section of the guidance.

15. Grants paid out may also be clawed back at reconciliation if claims are not in line with the principles set out in this guidance. More details of the reconciliation process are set out in paragraphs 30 to 35.

16. Annex A provides a series of worked examples which have been included to assist local judgements on which losses will be covered under the scheme.

The principles defining relevant losses

17. Principle one: The income is transactional income from customer and client receipts (excluding commercial and residential rents and investment income), which is generated from the delivery of goods and services and which was budgeted for in 2020/21.

- Revenues that are collected in exchange for a good or service where demand has been reduced because of COVID-19, including budgeted management fee income.

- Income collection must be directly linked to the delivery of goods and/ or local services and must be categorised as such when submitting the data return.

- Income from traded services which generate the same types of income could be eligible where the losses meet the principles. However, commercial investment revenues and rental income are not eligible losses and will not be compensated for under this scheme.

18. Principle two: As a result of COVID-19, and consequent reductions in economic activity, this income has been unavoidably lost and will not be recovered across the 2020/21 financial year and, for the extended scheme, the first quarter of 2021/22.

- This principle is intended to apply where reductions in economic activity because of lockdown and social distancing restrictions directly lead to lost revenues.

- “Unavoidably lost” means that factors outside of the authority’s control caused the loss to be incurred. Voluntary decisions, which were made locally, and which were not aligned to relevant government guidance at the time, are not covered by this (e.g. closure of services by choice rather than because of government guidance). Authorities should use their judgement to determine whether a voluntary decision was made with the intention of supporting relevant government guidance, or whether it represented a departure from guidance in place at the relevant time. These judgements will be in scope of the assurance processes referred to in this guidance.

- “Will not be recovered in this financial year” means that, at the point of claim, the income is irrecoverable and will not be collected before 31 March 2021.

- For the extended scheme in 2021/22, the same principle applies until 30 June 2021. Deferred income meeting other principles, but which can be recovered within the specified timeframes will not be compensated for. The reconciliation processes will ensure that only irrecoverable losses are compensated for.

19. Principle three: Compensation will be based on net losses. Where a local authority has been able to reduce expenditure, or has received other compensation, compensation will only be provided for the residual loss.

- Compensation will be provided to mitigate the net budget gap which irrecoverable service income losses have created compared to the local authority’s balanced budget set before the start of 2020/21 (details of how this budget should be used as a baseline for the extended scheme are set out in paragraphs 28 and 46 to 50 below). Where possible, authorities should have taken action to mitigate the impact of losses, e.g. by reducing expenditure such as stock purchases or running costs.

- If other funding has been provided in relation to specific service area (e.g. other emergency government grant, or furloughing staff) it should also be netted off as this would have contributed to closing the net budget gap in the relevant service area.

- Where possible, the temporary reallocation of employees to deliver other services which have been supported by emergency grant funding should be appropriately accounted for as a net saving in the service that the unfunded income loss relates to. This is in order to identify and compensate for the net pressure the loss of income has had on the authority’s budget.

What isn’t eligible

20. Income losses which are not covered by the principles, and so which are outside the scope of the scheme, include:

21. Investment income

- Income losses resulting from investments are not eligible, as they are not transactional income (principle one). This covers all of the financial assets of a local authority as well as other non-financial assets that the organisation holds primarily or partially to generate a profit/surplus (e.g. investment property portfolios and investments that are managed as part of normal treasury management processes).

- Other commercial income such as from advertising, is outside the scope of the scheme (principle one).

22. Rental income

- Rental losses are not eligible, as they are not transactional income (principle one).

23. Compensation paid to third parties for loss of revenue

- Some local authority services are contracted out, such that the authority does not directly deliver the service.

- In some cases, local authorities subsidise services either directly or through a management charge. These authorities may have seen an unplanned increase in this budgeted expenditure because of COVID-19, which may be irrecoverable. This additional spending would not be in scope of the scheme, as the subsidisation of services through increased payments does not represent a loss of income to the authority (principle one).

- In other cases, authorities are making additional payments to a) ensure the wider sustainability of providers and/or b) support the extra costs of providing leisure services in a COVID-19 compliant way. These payments would not be in scope of the scheme as they do not represent a loss of income (principle one).

24. Income which was not included in the authority’s general fund budget for 2020/21

- For a loss to be eligible under the scheme the local authority must have a related budget amount built into its general fund revenue budget for 2020/21, this is relevant for both claims under the 2020/21 and under the extended scheme in 2021/22. Any other income losses (e.g. losses incurred directly by a local-authority owned school, or a local-authority owned company) will not be eligible (principle one).

- If a service is transferred back to the authority during the year (or the period covered by the extended scheme) this will not be covered under the scheme on the basis that it did not form part of the authority’s budget at the start of 2020/21 (principle one).

25. Income that can reasonably be recovered later within the relevant period covered by the full year and for quarter one of the extended scheme

- Where an authority knows that it can recover a loss within the 2020/21 financial year, or for the extended scheme quarter one of 2021/22, the Department expects the authority to take reasonable steps to recover that income and that loss will not be eligible (principle two).

- However, the Department acknowledges that authorities may not yet know whether some of these income losses may be recoverable. As such, authorities may claim for a loss if they have a reasonable basis to believe that recovery is unlikely (principle two).

- A reconciliation process (paragraphs 30 to 35) will be carried out after the end of the relevant financial year, and any grant paid in respect of losses that were ultimately recovered will be repayable to government.

26. Income losses which can be mitigated by reductions in expenditure, or which have already been compensated for by other government funding

- Whilst a reduction of service delivery may have led to a loss in income, it may have also led to some savings in planned expenditure. Where this is the case, an authority should only claim for the net loss. This will mean that the income scheme only funds the net budget pressure in relation to the service – (principle three).

- In the data collection exercise local authorities will be required to give adequate details of what steps they have taken to reduce associated expenditure, and if that has not been possible, why that is the case.

Operating the scheme

Period covered

27. The 2020/21 scheme compensates eligible authorities for irrecoverable losses compared to budgets that have been set for the period from 1 April 2020 to 31 March 2021.

28. The 2021/22 extended scheme compensates eligible authorities for irrecoverable losses in the period 1 April 2021 to 30 June 2021 compared to:

- Planned or forecast 2020/21 budgets that were set for the period 1 April 2020 to 30 June 2020, or 2020/21 ‘quarter one’, or where this is not available.

- Authorities may instead use 25% of the budget that was set ahead of the whole 2020/21 financial year (1 April 2020 to 31 March 2021).

Schedule of payments

29. This guidance supports the data collections which will be used to collect and calculate the compensation that each authority will receive under the scheme. The planned schedule of data collections is planned to be as follows:

| Release of data collection and payment | Period of loss covered |

|---|---|

| September 2020 data return (paid November 2020) | 1 April 2020 - 31 July 2020 |

| December 2020 data return (paid March 2021) | 1 August 2020 - 30 November 2020 |

| May 2021 data return (paid October 2021) | 1 December 2020 - 31 March 2021 |

| September 2021 extended scheme data return (intended payment January 2022) | 1 April 2021 - 30 June 2021 |

Reconciliation

30. All payments made under the 2020/21 and the extended schemes will be subject to a reconciliation process after data collections and payments have been conducted. This is necessary because the full picture on some losses may emerge over time and some losses claimed for in the early part of the scheme may ultimately be recoverable, and others might ultimately be irrecoverable when recoverability was originally considered possible.

31. This process will therefore be compulsory for any authority who has accessed compensation under the schemes. The reconciliation process will ask for information which will calculate the actual losses over the course of 2020/21, or for the extended scheme the period 1 April 2021 to 30 June 2021. This will be reconciled against payments made to ensure that the correct level of compensation has been awarded to each authority. The reconciliation processes will be separate from final payments.

Process

32. The claim form will include the same claim lines for rounds 1 to 3, and will automatically pre-populate the data previously entered across the 3 rounds. Authorities will be expected to edit this accordingly, either in line with their audited accounts, or where this is not available, authorities can complete this provisionally.

33. Where authorities have completed their reconciliation claim form provisionally, they will be required to revise and re-submit the claim form in line with full audited accounts once this becomes available. Should data entered significantly exceed data previously entered, the authority will be prompted to provide further information to explain the increase.

34. The Department will conduct assurance checks on the reconciliation returns, which will be followed by payments. Where authorities have submitted their reconciliation claim provisionally (i.e. before their final audited accounts), they will be paid based on their provisional returns. Once authorities have reviewed their provisional claim form and re-submitted in line with their final audited accounts, where the data differs from the provisional return, payments that have been made will reflect that and therefore may be subject to claw-back.

35. Any authority who does not comply with the reconciliation processes, which will form part of the grant conditions, will be required to pay back any grant that has been awarded to the authority under the scheme. Any excess grant that has been paid, where losses were recovered will also be repayable to government.

Local responsibility for validating losses

36. Individual local authorities will be responsible for making sure that the claims they make under the scheme meet the principles set out above. For each return, the authority’s Section 151 officer must certify that the claim is accurate, reasonable, and made in accordance with the principles.

The department’s assurance process

37. Payment of grant will also be conditional on the accuracy and reasonableness of the claims made. The Department may require authorities to provide evidence to support their claims. Where the Department requires such evidence, grant payments will either not be made until the relevant evidence has been provided or will be clawed back if a payment has already been made.

38. Authorities may also be required to provide evidence on the basis of random sample checking, or on the basis of potential discrepancies identified by the Department once submitted claims are made.

39. The Department intends to use the monthly COVID-19 data monitoring (section C) to assess whether claims made under this scheme are consistent with the amounts that the authority reported to the Department earlier in the year. There might be a difference in the figures that are submitted in the different returns, and these justifications should be included where relevant.

40. In addition, the Department will also check to ensure that claims are proportionate to the size and profile of the authority. It may be reasonable that an authority has income losses that are disproportionately high relative to its size, and in this instance justifications should be provided by the authority.

41. Failure to supply evidence to the Department could result in a grant payment not being paid. Where the Department is not satisfied that an authority’s claim has been made in accordance with the principles it will not pay those parts of the claim that it considers to be outside the scope of the principles. If payment has already been made this may be clawed back.

42. Instructions in Annex B outline how to fill in the relevant data form, and the authority must be able to justify the figures it submits in each return, with relevant evidence from its internal accounting records and other relevant financial information.

43. An authority may choose to engage their internal auditors to provide review and challenge on the appropriateness of the claims that are submitted in line with this guidance, and the Department would consider relevant internal auditor reviews as appropriate evidence in its the assurance processes.

Contacting the department

44. Authorities may contact the Department if they have any queries regarding the scheme by using the following email address: SalesFeesChargesScheme@communities.gov.uk.

45. This guidance will be kept under review and may be updated with each scheduled data collection/payment throughout the duration of the scheme.

The 2021/22 extended scheme

46. In February 2021, the government set out further details of the extended 2021/22 scheme. You must continue to use the principles set out in this guidance if you intend to apply for compensation under the extended 2021/22 scheme. The period of losses covered will be limited to 1 April 2021 to 30 June 2021.

47. As per the published policy paper, the 2021/22 scheme will utilise a 2020/21 baseline for budgeted income to assess losses arising in the 2021/22 financial year.

48. The budget figures you submit must be in relation to the April to June period of 2020/21. Where this is not available, you may submit a figure in line with a straight quarter of your whole year budgeted income. In either case, you should be prepared to justify the budget figures you submit under the scheme. The Department will use the data from the 2020/21 scheme to identify inconsistent entries.

49. The recovery period under the extended scheme will be limited to quarter one of the 2021/22 financial year. Local authorities are still expected to exercise diligence in ensuring that claims are for losses that are irrecoverable, as per Principle two.

50. Local authorities should only claim for relevant irrecoverable losses that would usually have been generated through the delivery of services in April to June 2021.

Annex A: Worked examples

Example 1: A local authority owned car park is largely left empty due to lockdown measures which have restricted social movement.

51. The car park generates revenues for the authority when visitors use the facility. The authority reasonably budgets to collect revenues each year. The impact of lockdown measures has meant that revenue collection has substantially fallen. Lost revenues from that period will not be replaced when government restrictions are lifted.

52. The car park might have been closed or made free of charge during this period to save on expenditure costs associated with the service on the assumption that the facility would only be used for essential purposes. Where this has happened, the savings on expenditure should be netted off the claim that is made for lost revenues.

53. The car park might be linked to another asset such as a shopping centre. In this instance, the revenues from the car park should be included in isolation. Supporting documentation will need to be provided if requested to show the relevant budgets for the car park revenue collection.

54. Voluntary decisions to keep the car park closed for extended periods contrary to relevant government guidance at the time, or making the car park free of charge on specific days to encourage local residents to the local area would not be compensated for.

Example 2: A local authority owned museum is closed due to lockdown measures. The museum normally generates income which cover the costs of offering the service.

55. A local authority charges visitors to enter the facility and budgets to collect an anticipated amount for the year. This service must close in order to comply with lockdown measures. This reduces the revenues collected and could not have been expected.

56. The authority decides to furlough their staff whilst the facility remains closed, or redeploys the staff to work on other service areas. Where possible, these expenditure savings should be netted off from the claims that are made for lost revenues.

57. Once the facility opens, it needs to operate at reduced capacity to comply with social distancing measures. This means that revenue collection is still below budgeted levels. These amounts can be claimed for. However, voluntary decisions to keep the service closed cannot be compensated for as this is a decision that has been made at the local authority’s discretion.

Example 3: A local authority with a relevant planning function sees a large-scale reduction in planning applications where the pre-set fees aim to cover the costs related to running the service.

58. A local authority processes (and provides advice on) local planning applications, for which it charges. A budget is set at the beginning of the year based on expected demand. Lockdown measures slowdown demand for planning fees which the authority could not have foreseen. The authority might be able to redeploy staff in its service during this time resulting in an internal recharge which would likely result in staff costs being chargeable to services which expenditure grant has been provided for. If this has contributed to a saving to the service, the authority should claim for the estimated net loss.

59. These revenues might pick up quickly once activities pick up. However, it will be difficult to know how recoverable the lost revenues are. In this instance local judgement is needed to estimate what amounts are irrecoverably lost in relation to the 2020/21 budget.

60. At the end of the year, the reconciliation process will seek to assess the true extent of irrecoverable revenue loss for the period covered by the scheme.

Example 4: A local authority runs a catering service where income is generated from meals sold based on contracts, for example, with local schools. Due to school closures, revenues have been lost which couldn’t have been budgeted for.

61. A local authority runs a catering facility where it has contracts with local schools to provide meals at a charge to pupils. Schools have been unexpectedly shut which will have reduced the revenues the authority budgeted to collect. These revenues will not materialise in the future.

62. The local authority might have been able to reduce some expenditure if it has purchased less stock than it planned to purchase at the start of the year, In addition, staff may have been redeployed. These savings should be netted off from the lost revenues that are claimed for.

Example 5: A local authority has a contract with an operator to provide local leisure services. The local authority budgets to receive a monthly management fee which has not been paid because of the closure of these facilities.

63. A local authority has a contract with a provider/operator to run a local leisure facility it owns. The contract between the provider and authority entitles the authority to a monthly income stream. Since the unexpected closure of these facilities none of the pre-agreed income has been paid to the authority.

64. These income streams are unlikely to be recovered in the future and the authority will consequently be left with a budget gap. The authority will be able to claim for the lost revenues which create an adverse variance compared to their set budget.

65. The authority may also have agreed to make additional payments to the operator/provider to help manage their financial pressures. These amounts cannot be compensated for under this scheme as they do not represent losses against an authority’s forecast income.

Example 6: A fire and rescue authority (or function integrated into a relevant authority) offers a training function to external clients which generate revenues. During the lockdown period these services have not been able to run as planned.

66. A fire and rescue authority runs a training programme where it charges clients for its services. It budgets to collect revenues which it uses to balance its annual budget. Lockdown measures have meant the authority cannot run its training programme; this results in lost revenues which will not be recovered in the future.

67. The authority might be able to save expenditure by reducing its rental of relevant training facilities and/or by purchasing less equipment. These savings should be netted off from the lost revenues that are claimed for.

Example 7: A local authority registrar service experiences a drop in planned revenues since wedding ceremonies are postponed because of government restrictions on these events. Later in the year, there is a subsequent increase in demand.

68. A local authority budgets to collect revenues from its registrars’ service throughout the course of the year. Due to lockdown measures, wedding ceremonies are put on hold which leads to an unplanned drop in revenue collection from these charges. The authority might also lose revenues from venue hire.

69. It is not known how these charges will recover, and it might be the case that budgeted collection is still possible over the course of a full year. However, the authority might reasonably also determine that a portion of the revenues that have been lost are irrecoverable in the current year. Local discretion should be used to inform the claim that is made and the local authority could claim for losses based on the best information at the time. Any change across the remainder of the year which could not reasonably be currently known at the time of a claim will then be taken account of in the reconciliation.

Example 8: A combined authority has received funding from the Department for Transport, for the continuity of bus and light rail services but is seeing losses in this area net of the grant allocation.

70. Any revenue loss on light rail services that is net of the Department for Transport light rail grant, is not eligible for the scheme. Any revenue loss on supporting bus operators that is in net of the Department for Transport bus support grant, is not eligible for the scheme.

71. Any revenue losses linked to a Combined Authority’s transport functions and is essential to providing a service, but not directly linked to the continuity of bus and light rail services (i.e. Departure Charges, Travel Passes) is likely to be eligible to be compensated through the scheme.

72. Any savings on expenditure should be netted off the claim that is made for lost revenues.

Example 9: A local authority planned to run a local event in the summer of 2020/21, which might be a one-off or recurrent. It has had to be cancelled.

73. A local authority hosts a local festival which it sells tickets for. At the start of the year, the local authority budgeted to sell out the event. The event has had to be cancelled this year and will not take place. These revenues are irrecoverably lost.

74. Depending on when the event was due to take place, the authority might have been able to save on some expenditure costs by cancelling orders. It is also reasonable to assume that some costs were committed and therefore cannot be avoided.

75.The authority should estimate the net loss that cancelling the event has had on its budget. This is the loss that the authority should claim for.

Example 10: A local authority has lost revenues from its adult social care budget in relation to charges that it assumed it would collect at the start of the year. The authority has received funding to support the care market and maintain service provision through COVID.

76. A local authority’s adult social care service may include income from services it offers which might have reduced as a result of COVID-19.

77. The authority should only claim for income losses which it can demonstrate have resulted in a net pressure on the authority after emergency grant funding has been applied. Adequate evidence would need to be provided to demonstrate how a reduction in revenues had contributed to a net pressure on the authority’s service budget.

78. Charges that are voluntarily waived by the authority should not be claimed for.

Example 11: A local authority museum chooses to remain closed after the government has announced that these venues may re-open.

79. The government has announced that museums can re-open or be it at a reduced capacity. Despite the guidelines changing, a local authority makes a voluntary decision to keep its service closed. This means that revenues continue to be lost.

80. In this instance, the authority may claim for losses up until restrictions requiring it to remain closed were lifted. Thereafter, losses should not be claimed for as the authority has made a local decision to keep its facility closed and continued lost revenues would have been a variable considered in that decision.

81. If the facility opens it might need to operate at reduced capacity to comply with social distancing measures. This means that revenue collection is still below budgeted levels. These amounts can be claimed for.

Example 12: A local authority owns an asset and budgets to generate investment income which may not materialise because of wider economic impacts.

82. A local authority owns a local asset which generates rental income from tenants who occupy the facility. Tenants have struggled to meet their rental commitments which has meant that the local authority has a reduced revenue collection which contributes to an adverse variance on its budgetary position.

83.The authority may not claim to have these amounts compensated for as the lost revenues are not covered by the principles of this scheme.

Example 13: The local authority holds financial investments which have generated less revenue than planned because of reductions in interest rates.

84. A local authority budgets to generate revenues from its treasury management investments. Unexpected drops in interest rates mean that the local authority has generated less of a return on its investment than it expected to collect.

85. The income streams are not directly related to the delivery of service and is not covered in the principles of this scheme. Therefore, the loss should not be claimed for.

Annex B: Guidance on filling out the Delta Return

86. One return per round should be submitted by each eligible authority. Users will be sent access to a DELTA form at the relevant times which they should use to enter all relevant losses for the relevant period under consideration.

87. If an existing user has recently accessed the DELTA system in order to complete the local government monitoring survey or any other DLUHC return, this account can be used to access the form. Please be aware, users may be required to reset their password if the account has not been accessed recently. The department will email out to the accounts it expects to complete the return.

88. If an authority is unable to self-register or has any questions about registration, all DELTA registration requests and queries can be directed to DELTAadmin@communities.gov.uk or 0203 829 0743.

89. This form will require completion and submission by one person who will then be unable to certify the return. The section 151 officer certifying the form following submission must not have submitted it at any stage. Should the section 151 officer wish to appraise the form before certifying, they can do so by selecting the ‘view form’ option, as opposed to ‘editing’.

90. The section below sets out how to complete the DELTA form by outlining what data should be included in each part of the form. This section will be kept under review and may be updated with each scheduled data collection/payment throughout the duration of the scheme.

Section 1

91. Eligible General Fund Sales, Fees and Charges Income Budgets 2020/21

-

Please include all eligible budgets which relate to the sales, fees and charges losses that the authority is claiming for under the scheme. These budgets should reflect what the authority planned to collect in 2020/21 when it set its balanced budget ahead of the year. This amount is required to calculate the 5% deductible which forms part of the scheme. Without this information it will not be possible to make payments to authorities to compensate for losses incurred.

-

As the extended scheme only covers losses for the first quarter of 2021/22, local authorities will need to provide information on their budgeted income for the first quarter of 2020/21. Local authorities should do this, where possible, in such a way that the seasonal nature of any income is reflected. Where this is not possible, local authorities should submit a figure in line with 25% of the whole year (2020/21) budgeted income.

-

The form will pre-populate 25% of a local authority’s annual budget, it is the responsibility of the local authority to adjust this according to seasonality, where appropriate.

-

Please be prepared to provide evidence of how these budget figures fits into the approved budget that the authority set for 2020/21, and the departmental control totals for each service area. Sufficient evidence would also include an illustration of relevant budgets which are quoted from the accounting ledger and/or budget book compiled by the authority.

-

Any loss that is claimed across the year will require a relevant budget figure to be submitted which will then form part of the total budget which the 5% deductible is calculated from.

-

For the reconciliation claim form, the form will pre-populate data previously entered by the authority.

-

Authorities will be expected to amend this accordingly, and where there are significant differences, be prepared to provide further evidence to explain.

92. Income source

- This column refers to the individual income sources where budgeted income has been lost because of COVID-19. Please only include the income sources which meet the principles set out in this guidance. Authorities must be ready to provide justifications and provide appropriate evidence for each claim it wishes to make.

93. Description on primary reason(s) for losses being incurred

- Please provide a brief description of the reasons why the reported losses have been incurred (e.g. car parking tickets not being collected due to lower visitor numbers)

94. Mitigation – Description of measures taken to reduce ‘net loss’ by minimising expenditure

- Please provide a brief description of the steps the authority has taken to mitigate losses wherever possible (e.g. we furloughed our on-street parking staff). This should be a descriptive entry to highlight the calculation which was made to fill out the losses reported in the relevant months.

95. Difference compared to losses submitted in COVID-19 monitoring (Highways & Transport and Cultural & Related)

- In the relevant sections of the form, losses that an authority reported in the monthly COVID-19 collections from these specific service areas will be pre-populated.

- Where an authority submits a figure which is different to what was reported in the separate data collection an explanation should be provided.

Section 2

96. Difference compared to losses submitted in COVID-19 monitoring (Total lost sales fees and charges)

- In the relevant sections of the form, total losses that an authority reported in the monthly COVID-19 collections will be pre-populated. As this is a total, it will include the specific losses from Highways & Transport and Cultural & Related service areas which have separate difference validations. Authorities should clarify whether the variation in this section is covered by justifications given in Section 1, or if there are other reasons for the variation from other claims.

97. Where a local authority enters a budgeted income that has decreased by 5% or more when compared to previous returns, the authority will be prompted to provide further detail to explain the difference.

98. In addition, for the extended scheme, where an authority has entered a figure exceeding 40% or more of their 2020/21 budgeted figure, they will be prompted to provided further detail to explain the difference.

99. The rest of this section does not require local authorities to fill out any information. This section should pre-populate based on the data submitted in section 1 and 2. The purpose of this section is to allow an authority to see what their estimated compensation is likely to be, based on the parameters of the scheme, and the data that has been submitted.

100. Actual payments will be subject to the assurance process outlined in this guidance. As a result, payments may be subject to change from what is presented on the DELTA return.

Last updated 12 November 2021 + show all updates

-

Updated section on reconciliation process.

-

Added details on the 2021/22 extended scheme.

-

First published.