Guidance for charities with a connection to a non-charity

How to manage and review your charity's connection to a non-charity.

Applies to England and Wales

Making a positive difference for your beneficiaries

Your charity’s distinctive status is important. It allows certain freedoms and benefits, including tax reliefs. But its status also places important limits on your charity. To protect it, you and your co-trustees must be able to show that everything your charity does helps to achieve the purposes for which it is set up, for the public benefit.

Your charity can set up or keep a close connection with a non-charitable organisation. Its purpose must be to help you to make a positive difference for your beneficiaries. The connection can provide:

- a main source of funding for your charity

- other valuable resources which help to save money

- opportunities to strengthen the quality, reach and impact of your charity’s work

- a way of managing risk

- an effective trading structure to raise funds for your charity

- a direct way of furthering your charity’s purposes if you are, for example, a ‘friends of’ charity

Our engagement with charities shows that risks and challenges can come with a connection to a non-charitable organisation (a non-charity). Sometimes the risks are significant.

We have produced this guidance to help you manage your charity’s connection with a non-charity in line with your:

- charity’s best interests

- legal trustee duties

It says that your charity’s connection to, and work with, the other organisation must always further its purposes. You and your co-trustees:

- must not allow your charity’s resources or activities to fund or support non-charitable purposes

- should identify, properly address, and review any risks which come from the connection

Showing that you have applied this guidance

Where the Commission reviews a charity’s connection with a non-charity we will expect trustees to have applied this guidance. A charity following the principles in this guidance will have the following features. It:

- is always working on achieving its charitable purposes for the public benefit

- does not support or fund non-charitable purposes

- controls how it spends funds and uses resources

- understands the purpose of the connection with the non-charity

- ensures that the connection is always in the charity’s best interests. This includes properly addressing any conflicts of interest. It includes protecting the charity’s public image and reputation

- understands the responsibility it has to uphold the reputation of charity as a whole

- ensures that the connection does not result in any non incidental private benefit to the non-charity or people connected with it

In this guidance:

- ‘must’ means something is a legal or regulatory requirement or duty that trustees must comply with

- ‘should’ means something is good practice that the Commission expects trustees to follow and apply to their charity

Following the good practice specified in this guidance will help you to run your charity effectively, avoid difficulties and comply with your legal duties. Charities vary in terms of their size and activities. Consider and decide how best to apply this good practice to your charity’s circumstances.

The Commission expects you to be able to explain and justify your approach, particularly if you decide not to follow good practice in this guidance.

Who this guidance is for

It’s for the trustees of charities connected to a non-charity. It’s also for organisations setting up as a charity that have this type of connection.

The guidance applies to a wide range of connections between charities and non-charities. It applies to your charity if it:

- has set up and owns a trading subsidiary

- has been set up by the non-charity, for example: corporate foundations, or charities set up by social enterprises, campaigning organisations, or government or local authorities

- gets regular funding or support from the non-charity

- gives regular funding to the non-charity, for example: grant makers who regularly fund a non-charity; charities set up to support the activities of a non-charity, such as charities with a link to an NHS Trust, or other ‘friends of’ charities

- works regularly with a non-charity to deliver services, campaigns or other projects

- has a non-charity as trustee, or where the non-charity can appoint some of the trustees

- has a non-charity as its sole or significant member

These connections make it more likely that your charity will be exposed to the risks listed in principle 1. This guidance also applies to any other connection between your charity and a non-charity where those risks are present.

The guidance applies regardless of what type of organisation the non-charity is. For example it might be commercial, private, or not-for-profit or public. It might be a partner or a parent body, or the charity might own it.

This guidance is not intended to cover all connections that charities have to non-charities. It is not intended for your charity if:

- its connection to a non-charity is not in the list above, and

- the connection is only that:

- the 2 organisations have a single person who is on the board or staff of both

- your charity works, or has a funding arrangement, with the other organisation, on a ‘one-off’ rather than regular basis

- your charity regularly buys core services from a non-charity which is not its trading subsidiary, for example, it pays a professional fundraising organisation, or a letting or IT company

The next sections set out 6 principles for managing and reviewing your charity’s connections with non-charities. Following the principles will help you to do this in line with your legal trustee duties. Your trustee duties are set out in The essential trustee.

1. Recognise the risks

Most of the time charities work effectively with a range of other types of organisations. These connections help them to deliver good outcomes for their beneficiaries. They are not in themselves a cause for concern. Your charity’s connection with a non-charity can bring benefits and opportunities. But it can also bring new risks. It can increase risks that your charity:

- supports or carries out work outside its charitable purposes

- acts outside charity law rules, for example on conflicts of interest

- is controlled or inappropriately influenced in decision-making by the connected non-charity

- suffers reputational harm from its association with the connected non-charity and its activities

- provides inappropriate support, or benefit to, or investment in, the non-charity or people connected with it

- is hard to tell apart from the other organisation. You can share an identity with the connected non-charity. But this can bring reputational problems. Also, your donors must be able to tell whether your charity or a non-charity is asking for their support

Whether the risks listed are present in your charity’s case will depend on:

- your charity’s particular circumstances

- the type of connection you have with the non-charity

To meet your trustee duties you and your co-trustees:

- must not expose your charity to undue risk. This means excessive or unjustifiable risks or levels of risk

- should have systems in place to identify, review, and appropriately address any risks to your charity from its connection with a non-charity. This means being clear where you and your co-trustees should avoid a risk, and where a risk can be managed. It is part of your legal duty to act with care to protect your charity’s assets, reputation and beneficiaries.

- should keep your assessment of any risks, and your approach to managing them, under review throughout the relationship

- should be able to provide evidence that you actively manage and review your charity’s connection with the non-charity. You should periodically review:

- what your charity wants to achieve from the connection

- whether the connection still meets your charity’s needs in an effective way

- whether the risks have changed and how you should address them

How often you do this review depends on the level of risk and complexity in your case. Where more money or risk is involved you should review the connection at least once a year.

You can use the following principles and the checklists published in this guidance to help you to identify and manage any risks in your case.

2. Do not further non-charitable purposes

A charity is not like other types of organisation. Charities must have purposes that are only charitable. They must deliver public benefit and comply with charity law. Organisations that are not charities do not have to do this. They may be unfamiliar with charity law requirements. This means that there will always be limits, as well as opportunities, when your charity is working with a non-charity.

You and your co-trustees must:

- not allow your charity’s resources and activities to fund or support non-charitable purposes. For example, you must stay within your charitable purposes when working in the following ways with a connected non-charity:

- carrying out joint projects

- giving funding

- receiving funding

- be able to show that any benefit to the non-charity from the connection with your charity is incidental. An incidental benefit is one which is a necessary result or by product of carrying out the charity’s purposes

Your charity’s purposes are set out in its governing document.

You should understand:

- your own charity’s purposes, and know their scope and limits

- the similarities and differences between your charity’s purposes and the aims and scope of the connected non-charity. The other organisation may have similar or overlapping purposes, or be well known to your charity. You should still understand how it differs from your charity. This will help you to work together in an appropriate way.

Stick to your charitable purposes when carrying out the following activities with a connected non-charity.

Grant funding a non-charity

Your charity can make grants to a connected non-charity where it’s in your charity’s interests to work in this way. But you and your co-trustees:

- must ensure that you only give funding for activities, services or outcomes that will further your charity’s purposes for the public benefit, and for no other purpose.

- must ensure that the grant does not result in more than incidental benefit, which is defined above

- must carry out appropriate checks on the organisation. This will help you to ensure that it’s genuine, suitable for your charity to work with and competent to carry out the funded work

- be satisfied that your charity’s funds were actually used for the purposes given

Grant funding an organisation that is not a charity tells you what you need to do before deciding whether to give this type of funding.

Carrying out campaigning and political activity with a non-charity

Your charity can carry out campaigning, and political activity where the trustees have decided that this is an effective way to further its charitable purpose for the public benefit. Charities can only do this type of work within certain limits, so you must follow the legal rules. Your charity can carry out political and campaigning work with others to further or support your charity’s purposes. This can include working with connected non-charities. But there are certain risks to this, which you need to be aware of and manage.

Read section 6.6 of our campaigning and political activity guidance for charities (CC9).

Where your charity carries out campaigning or political activity through a connected non-charity which is either funded by your charity or closely associated with it, you and your co-trustees must ensure that you manage any risk that the activity is outside this guidance.

In particular, you must ensure that your charity does not carry out activity - directly or indirectly - which does not further its purposes for the public benefit.

Campaigning and political activity guidance for charities (CC9) tells you about the:

- rules which cover campaigning or engaging in political activity

- risks to be aware of when working in this way with non-charities

Furthering your charity’s educational purpose: producing research or other output with a connected non-charity

Your charity can fund a connected non-charity to carry out research or other output that furthers your charity’s educational purposes. Or your charity can receive funding from the other organisation to carry out this work. In both cases the reason for working in this way must be that it is in your charity’s best interests. But the research created to further your charity’s educational purpose must be educational in the charitable sense.

The Advancement of Education for the Public Benefit tells you the difference between advancing education in the charitable sense and promoting a particular point of view.

You need to protect your charity’s independence if your charity is:

- producing research or other output with a connected non-charity, and

- the output is to further your charity’s educational purposes

There is more information about this in the next principle.

Investing in your charity’s subsidiary trading company

You can only use your charity’s money, or other resources, to set up a non-charity where the purpose of doing this is to benefit the charity by:

- providing a return on its investment in the non-charity. For example, where the non-charity trades to raise money for your charity

- carrying out activities which your charity could carry out itself to further its objects

- managing the administration of your charity or its resources, more effectively

Your charity can invest in its trading company, as one way of giving financial support. You are a parent charity investing in its subsidiary. But the same considerations apply as to any other investment of a charity’s resources. You and your co-trustees must:

- have adequate investment powers

- when investing your charity’s resources, follow normal rules for investment. You should also follow your charity’s investment policy. This applies whether you are investing for the best financial return or making a social investment.

If you make investments and loans to prop up a failing trading company, this might not meet your investment duties. It can also result in tax liabilities. This is because HMRC can decide that the funding was not given for the benefit of the charity and is non-charitable expenditure.

Oversight and review of your subsidiary trading company

The trading company is a legally separate organisation. Its directors are responsible for its management. But your charity is the shareholder. You and your co-trustees:

- must regularly check the performance of your trading subsidiary. You must check its effectiveness at delivering for your charity

- must regularly check on any financial support you provide. You must be able to justify the support. This will help you to ensure the good and proper use of your charity’s assets

- must always put the interests of the charity first

- should be prepared to assert your charity’s rights as shareholder

- must identify and properly address any conflicts of interest where trustees are also on the company’s board

Trustees trading and tax: how charities may lawfully trade (CC35) tells you about running, reviewing and financing subsidiaries.

Charities and investment matters: a guide for trustees (CC14) tells you about:

- charities investing in their trading subsidiaries

- the duties and decision making processes needed for different categories of investment. This includes programme related investment and social investment

3. Operate independently

A charity must be independent of any connected non-charities it works or operates with. This includes organisations that:

- set the charity up

- provide a main source of funding to the charity

- receive significant funding from the charity

Independence means that your charity must:

- exist only to further its charitable purposes for the public benefit. It cannot exist for the purposes of the other organisation

- be governed by its trustees acting only in the interests of the charity

Protect your charity’s independence in these circumstances

You are a charity set up by a non-charity

Your charity may have been set up by the connected non-charity. For example, a commercial company or a government authority. The other organisation may also provide the main source of your charity’s funding. There is nothing wrong with this. But you must not commit simply to giving effect to the policies and wishes of the other organisation. You and your co-trustees:

- must have a choice about accepting funding and any terms attached to it

- must be able to recognise and properly address any conflicts of interest

- can have trustees appointed by the other organisation, but you must be free to make your own decisions about your services and products and who will benefit from them

There are particular risks to a charity’s independence where a local or other government authority is sole trustee. Local authorities as charity trustees is guidance for local authorities that are sole corporate trustees for charities in their area.

Carrying out or funding research, or other output, to further your charity’s educational purpose

Your charity can fund, or receive funding from, a connected non-charity to produce research and other outputs that further your charity’s educational purpose. But, as outlined above, you must protect your charity’s independence and political neutrality.

You and your co-trustees:

- should be aware of how the other organisation differs from your charity in interests and scope

- should manage any risks that your work with the non-charity could affect the charity’s independence and also consider external perceptions about your charity’s independence

4. Avoid unauthorised personal benefit and address conflicts of interest

Your duty to act in the best interests of your charity

Conflicts of interest affect all types of organisation, including charities. If there is a conflict of interest, this does not reflect on the integrity of the affected trustee. But it must be properly addressed.

Trustees have a legal duty to act only in the best interests of their charity. They must avoid putting themselves in a position where their duty to their charity conflicts with their:

- personal interests

- duty to another person or body

Identifying and properly addressing any conflicts of interest

Each trustee has an individual responsibility to declare conflicts of interest which affect them.

Conflicts of interest often come up where the charity has a connection with a non-charity. The conflict can be there because a trustee:

- will benefit personally in some way from the charity’s arrangement with the connected non-charity. The benefit may be direct or indirect.

- owes a duty or loyalty to the non-charity. For example, a trustee might be on the board of the connected non-charity or work there. This may (or may appear to) influence or affect their decision making at the charity.

In either case the trustee’s decision making at the charity could, on some matters, be influenced by their other interest. A trustee may also be unable to act only in the interests of the charity because of a connection they have to a person or an issue.

Your charity:

- must have authorisation in place, in advance, for any trustee benefit. This includes benefits to people and companies with a close connection to trustees

- must identify and properly address any conflicts of interest, including conflicts of loyalty. This means deciding whether the conflict should be removed or can be managed, and identifying conflicts which affect your decision to start work with the non-charity or come up after the arrangements start

- should have enough trustees who are not affected by a conflict of interest. This is so that they can they can, if needed, make decisions without the participation of those who are conflicted

Directors of charitable companies must follow company law rules on conflicts of interest and director benefits. These largely reflect those which apply to other types of trustee. The guidance listed below has more details about this.

Managing conflicts of interest in a charity tells you:

- how to identify conflicts of interest, including conflicts of loyalty

- how to prevent them from affecting trustee decisions at your charity

- who a connected person or company is

- about the importance of recording your approach

- the specific conflict of interest duties for company directors

Trustee expenses and payments (CC11) tells you about trustee benefits and when you need the Commission’s authorisation.

Handle trustee benefits and conflicts of interest properly in these circumstances

Appointing or employing a trustee to be a director, or hold another role, at the charity’s trading subsidiary

You may have some trustees who are also directors of your trading company. This can help your oversight of the company in your role as parent charity. But if the appointment will result in a benefit to a director who is also a trustee, check whether your charity’s governing document allows this. If not, you must get advance authority from the Commission. You must use your processes for identifying, addressing and recording any conflicts of interest:

- when you appoint a director who is also a trustee, and

- during their appointment

The non-charity appoints trustees

The connected non-charity can appoint one or more trustees to your charity. This is common, for example, where the other organisation is your charity’s founder or main funder.

Appointed trustees have exactly the same duties and responsibilities as other trustees. They must act independently of the organisation that appointed them and only in the interests of the charity.

On some matters, an appointed trustee may not be able to make a decision only in the interests of the charity. You:

- must have systems in place to identify conflicts of loyalty

- should use the Commission’s conflicts of interest guidance (listed above) to decide how to handle and record them

- should train any appointed trustees in their trustee responsibilities. You can also check that the appointing organisation is also informed about this

If you are a trustee appointed by the other organisation remember, that you must make decisions only in the best interests of the charity. You cannot represent the interests of the non- charity.

Other circumstances where a trustees is also on the board or committee of the non-charity

The examples above tell you what you need to consider and do if you:

- are appointing trustees to govern your charity’s trading company

- have trustees appointed by the non-charity.

The same rules apply in any other circumstances where your charity has a trustee who is also on the board of the connected non-charity. You must identify and properly address any conflicts of interest which come up.

One of your trustees has a financial interest in the non-charity

One of the trustees may own or have a substantial shareholding in the other organisation. You must follow the rules on getting advance authority for any trustee benefit and managing conflicts of interest. Use the guidance listed in this section to help you.

5. Maintain your charity’s separate identity

Public perceptions of your charity

Your charity is an independent organisation. It has its own legal identity and tax status. This means that you must keep it distinct from any from any connected organisation. If your charity has a close connection with a non-charity, you:

- must keep the financial structures of the 2 organisations separate

- should make a decision about whether your charity’s best interests are served by

- sharing an identity with the non-charity through use of a similar or working name, joint branding or shared website; or

- the charity and the non-charity having separate identities

You can decide to share an identity with the non-charity if it’s in your charity’s best interests. This arrangement can save money, or benefit your charity in other valuable ways. For example, it can allow you to trade on your charity’s name to raise money for its cause. But:

- your donors must be able to tell which organisation is asking for, and will receive their money, and they must be able to tell which organisation undertakes which activities

- you and your co-trustees should be able to show that you have identified, and assessed any risks to your charity from choosing to operate in this way. The type and level and risk from sharing an identity with a non-charity will depend on your own circumstances. Your assessment should include consideration of the following risks:

- that people outside your charity cannot tell it apart from the connected non-charity. For example, your beneficiaries, donors, supporters, people who do business with your charity, and the public. This can mean that these groups do not know if your charity or the non-charity is communicating with them. They do not know which organisation is asking for their support. In the worst cases, donations intended for your charity could instead be routed to the non-charity

- reputational risks for your charity. Your charity may be negatively exposed to the activities and reputation of the non-charity. This is because, from the outside, it looks the same

- internal confusion. If you or your staff blur the boundaries between the 2 organisations, your charity can be more exposed to risk. For example, if you or your staff do not make a clear distinction between the charity and the connected non-charity when sharing premises, services, communications or other resources, your charity might not be protected or get value for its money.

Rules and standards that apply to operating with a shared identity

If you and the non-charity operate with a shared identity, you and your co-trustees must:

- not allow your charity to raise money – with the tax advantages this brings – to be used by the connected non-charity in ways that you and your co-trustees have not agreed and that do not further your charity’s purposes. Your charity’s assets, including its name and reputation, cannot be used to inappropriately support the non-charity.

- in all of your communications which have a fundraising element, be clear with donors about whether your charity or the non-charity is asking for money and whether there is any percentage of funds that are shared. Donors need to know whether they are supporting your charity or the other organisation

- ensure that donations meant for your charity are not routed to the non-charity. This could happen if there is confusion about which organisation is asking for money. Not controlling and protecting funds raised in your charity’s name is a serious matter. You can also lose your charity’s entitlement to gift aid if money intended for your charity goes to a non-charity

You should:

- be open and clear with the public, and those who benefit from support and do business with your charity. You should help them to understand that your charity works with, but is separate from, the non-charity

- have a suitable licensing agreement if you are sharing your charity’s logo and branding, and the other organisation is using a similar name. This is because these are your charity’s assets and you need to protect their use and value. Your agreement should allow you to do this.

- explain, on your website and in other communications, that your charity is independent of the other organisation. You can explain how you work or operate together

- also consider (and, where appropriate, put in place) options for keeping the identity of your charity clear. You should do this even though the connection is structurally very close. For example, you can consider whether you can reduce some of the risks listed above by:

- having separate websites for the 2 organisations, or separate pages on a shared site

- in a charity shop or café, displaying a notice that tells customers that the trading company which runs the shop will pass any profits to the charity

- being clear about the separate status of your trading company. This applies to mailshots and your other communications with donors, supporters and beneficiaries

- agree rules for any content about your charity which the non-charity covers in its communications, or hosts on its website or other platforms. This is so that you can control how your charity is described and explained

- apply Code of Fundraising Practice standards to protect your donors. Principles 1 and 6 of the Code contain standards relevant to avoiding confusion

- review your approach and risk assessment. How often you do this review will depend on the level of risk and complexity in your case.

6. Protect your charity

Before you decide to set up or keep a connection to a non-charity you and your co-trustees must be satisfied that it’s in your charity’s best interests. You must protect its assets, reputation and beneficiaries. You:

- should consider alternatives for achieving your charity’s objectives. There may be good reasons not to put alternatives in place, but you should know why you are ruling them out

- must be fully informed about the connected non-charity. You must be satisfied that it’s a genuine competent and suitable organisation for your charity to work with. Appropriate due diligence or assurance is an important part of your legal duty to protect your charity’s assets. But see below for charities set up by the non-charity.

- should know the risks, how you will manage them, and how they might change

- must act with reasonable care and skill. Take professional or specialist advice if you need to

- must get value for your charity’s money where it’s

- paying the non-charity for services or resources

- sharing services or resources with it

- should have appropriate written agreements in place to protect your charity

Written agreements

How much you should include in your written agreement depends on the:

- complexity of your work with the non-charity

- amount of money and risk involved

In simple or low risk arrangements a letter which shows the terms that you have agreed with the non-charity is enough. For more complex arrangements, and those which are long-term or involve more money and risk, you will need a more formal agreement or a contract. Where you need a formal agreement, should:

- set out the responsibilities of each party

- include a way to exit from the arrangement

- adequately protect your charity

You must be prepared to enforce an agreement if required. Take advice if you need to. You:

- should regularly monitor and review the connection with the non-charity. This should be from the objective perspective of your charity

- must not renew arrangements without properly considering your trustee duties

- should be prepared to end any arrangements which are no longer in your charity’s interests

It’s your decision: charity trustees and decision making (CC27) outlines the principles you must use when making significant or strategic decisions.

Protect your charity’s interests in the following circumstances

Getting information about the non-charity before you fund or partner with it

Your charity can fund the connected non-charity to carry out a project or service. Or you might deliver projects or services together. These are very common and effective ways for many charities to work.

But before you fund or partner with a non-charity you must have enough knowledge about it. You and your co-trustees:

- must be satisfied that it’s a suitable organisation for your charity to work with: you’ll need to consider its solvency, integrity and reputation, and its ability to deliver to an acceptable standard in line with your charity’s values

- must still make checks, even when the other organisation is familiar to your charity. For example, it may be your trading company, or work in the same ‘group’ structure that your charity is in. Or it may be an organisation that you have grant funded before. You must still be satisfied about its suitability to work with, or deliver for, your charity. But you can take into account any up to date, relevant and reliable information that you already have

- can take a proportionate approach. The greater the risk the more you need to do. For example, there can be more risk where the non-charitable partner carries out work based overseas, carries out political activities or works with children or adults at risk

Our compliance toolkit tells you about carrying out due diligence on organisations that work closely with your charity.

Charities set up by the non-charity and due diligence

If your charity is set up by the non-charity, it’s unlikely that you will have used a formal due diligence or assurance procedure to ‘check out’ your founder organisation before working together. The other organisation started the relationship. But you should know about the business of the non-charity. You should know how it works, and how its aims, interest and scope differ from those of your charity. This will help you to identify and assess any risks to your charity from the connection.

But there may be circumstances where:

- your charity does need to use a due diligence or similar procedure to get information from or about your founder organisation. For example, you may need to do this before sharing staff or services, accepting new funding from the founder, or working in a new way together

- it’s not appropriate for you agree to arrangements with, or accept funds from, the founder organisation

In the same way as for other types of connection you should protect your charity by:

- being aware of alternatives, such as options for diversifying your sources of income

- identifying and managing risks

- taking advice where appropriate

- recording key decisions where appropriate

Sharing staff, services and other resources with the non-charity

Where your charity provides staff or services to the non-charity or shares its property, a similar name, branding, data or other assets with, the non-charity, you and your co-trustees:

- should be clear about the benefits to your charity of working in this way with the other organisation. You must have good systems for getting paid fairly and on time

- should charge a market rate unless it’s in your charity’s best interests not to do so. Record you decision in case you need to review or explain it later

- can only lease the charity’s property to the non-charity if there is authority to do so. In limited circumstances, you may need formal authority to lease the charity’s property. For example, where a trustee (or a person connected to a trustee) also runs the other organisation

- must protect your charity by using an appropriate agreement or contract. See the advice at the beginning of this section on written agreements. If you are sharing the charity’s logo and branding, and the other organisation is using a similar name you will need a suitable licensing agreement

- must protect your charity from costs or liabilities which relate to non-charitable use of its premises, services or staff

- must comply with General Data Protection Regulation, and other data protection law. This is when you are sharing or processing data about beneficiaries or donors

- should identify and assess any risks of internal and external confusion introduced by the sharing. You should take reasonable steps to manage them

Where the non-charity provides staff or services to your charity or shares its name, property, branding, data, or other assets with your charity, you and your co-trustees:

- should be clear about the benefits to your charity of working in this way with the other organisation

- must not pay more than the market rate for services, premises or staff

- must not renew arrangements without properly considering the best interests of your charity

- must protect your charity from costs or liabilities which relate to the staff, services or property of the non-charity

- must protect your charity by using an appropriate agreement or contract. See the advice at the beginning of this section on written agreements.

- should identify and assess any risks of internal and external confusion introduced by the sharing. You should take reasonable steps to manage them

- should, when the non-charity makes its staff available to the non-charity:

- be able to influence who is appointed based on their suitability for the charity role

- only agree payment arrangements which provide value for the charity’s money. You should take into account how much the charity would pay for its own employee

- be able to contribute to review and performance related processes

- have processes for managing any conflicts of interest in staff decisions or recommendations to trustees. This is particularly important for any senior staff. It will help you to ensure that only charitable purposes are furthered

Communicating jointly with the non-charity

Your charity can communicate jointly with the non-charity. It can help your charity to speak with a stronger voice to further its charitable purposes. But you must stick to your charity’s purposes. You must ensure that the joint work is in your charity’s best interests, and protect its reputation. You and your co-trustees should:

- know about, and agree in advance, any joint messages issued about your charity, or on its behalf

- where you share a website, ensure that your charity’s content is not changed without its knowledge and agreement.

- cover your arrangements for sharing communications or a website with an appropriate agreement. See the advice at the beginning of this section on written agreements.

- identify and assess any risks of external confusion introduced by the joint work, and take reasonable steps to manage them

Only funding or supporting the non-charity

Some charities are set up with the purpose of supporting a non-charity. For example, PTA charities or those that are a ‘friends of’ body to a hospital or other organisation.

If you are not set up in this way but your charity only (or mainly) furthers its aims by funding or supporting the non-charity you:

- must be able to show how it’s in the best interests of your charity to only fund or support the non-charity

- should address any increased or undue risk that your charity’s close association with the other organisation means that it:

- is furthering non-charitable purposes

- exists, or appears to exist, to further the purposes of the non-charity

- is negatively exposed to the activities and reputation of the non-charity

If things go wrong

The level of risk to your charity from its connection with a non-charity will depend on:

- the charity’s particular circumstances

- the type of connection you have with the other organisation

Use this guidance and supporting tools to help you extract the full benefit of the connection for the charity and minimise the risks.

When the Commission will intervene

Minor problems

The Commission recognises that relationships can go wrong. They can fail to achieve the intended benefits for the charity.

Where things go wrong, we expect you to act promptly to:

- put things right. This means taking appropriate action to minimise any financial loss or harm to the charity’s beneficiaries and assets, including its reputation

- prevent a repeat of the same, or a similar, issue

This could mean protecting the charity’s best interests by ending the relationship. It could mean resetting it if there is a reasonable prospect of making a success of it. You should be able to show that you have applied this guidance and taken reasonable steps to make the connection successful.

Serious breaches

If you do not manage the connection effectively in the best interests of the charity and this results in loss, serious risk of loss or other damage to the charity, the Commission expects you to put things right and report it as a serious incident to us. The Commission may also need to use its powers to protect the charity.

If you and your co-trustees have seriously breached your legal duties, resulting in serious harm or exposure for your charity, the Commission may:

- open a statutory inquiry, which will allow it to:

- obtain and assess evidence

- use enforcement powers to protect the charity’s assets or make sure they are properly used

- decide that your charity exists, partly, to further non charitable purposes. This means that it is not established for exclusively charitable purposes for the public benefit. This can, in rare cases, lead to your charity’s removal from the register. You could also face financial liabilities such as repayment of tax.

More rarely, the consequences can include:

- legal consequences such as fines or penalties

- trustee liability if your charity suffers a loss because of a breach of trustee duty

- HMRC investigation and penalties

You and your co-trustees are usually protected from personal liability to your charity if you have made honest mistakes but can show that you have acted reasonably, with care and in good faith.

When to report a serious incident

You should report serious incidents to the Commission. A serious incident is an adverse event, actual or alleged, which results in or risks:

- loss or misapplication of your charity’s money or assets

- damage to its property

- harm to your charity’s work, beneficiaries or reputation

Applying to register a charity with a connection to a non-charity

What you need to tell us

The registration application form asks about any connections the proposed charity will have with non-charities. We need to know this so that we can check:

- that the proposed charity has purposes that are exclusively charitable for the public benefit

- that the connection with the other organisation will not stop the charity from operating independently

- if any charity we register will need advice to help it comply with the law after registration

Use the application form to give as much information as you can to help us to understand the connection. If you can, include:

- the type of non-charity the proposed charity is connected with, for example: commercial, not-for-profit, charity in another country

- the other organisation’s business or aims

- how the connection will help the proposed charity to achieve its purposes

- any plans for working jointly

- how many people will be trustees/directors at both organisations

- whether the non-charity will be able to appoint or remove the charity’s trustees

- if the arrangements will result in any non-incidental benefits to trustees or people or companies closely connected to trustees

What we are looking for

Where a proposed charity will be connected to a non-charity, we expect to see that the charity will be:

- run and governed independently

- able to choose the activities it carries out to achieve its purposes. This includes the charity being free to negotiate (and if appropriate reject) any funding terms proposed by the other organisation

- able to decide how funds will be raised, held, accounted for and spent

- free to conduct its own meetings and decision making

- free to choose its legal, accountancy and other advisers

- able to identify and properly address conflicts of interest

- able to comply with this guidance

What documents you need to send

The following documents can be supplied in final draft form, if they have not yet been signed. The proposed charity’s:

- written agreement (or similar) between the proposed charity and any organisation setting it up

- statements made on fundraising literature, including websites, about its independence from the non-charity

The proposed charity’s policies for:

- how the charity will select its beneficiaries, projects and generally apply its funds

- identifying and managing conflicts of interest

- grant-making, including how you will monitor and evaluate grants

- agreeing to any joint activities with the non-charity

- managing risk

- sharing personal data with the other organisation

Use the checklists

We have produced 3 checklists to help you test that you are applying this guidance. Each checklist explains in what circumstances they can be applied.

The checklists are also an open document format, and can be edited to suit your needs.

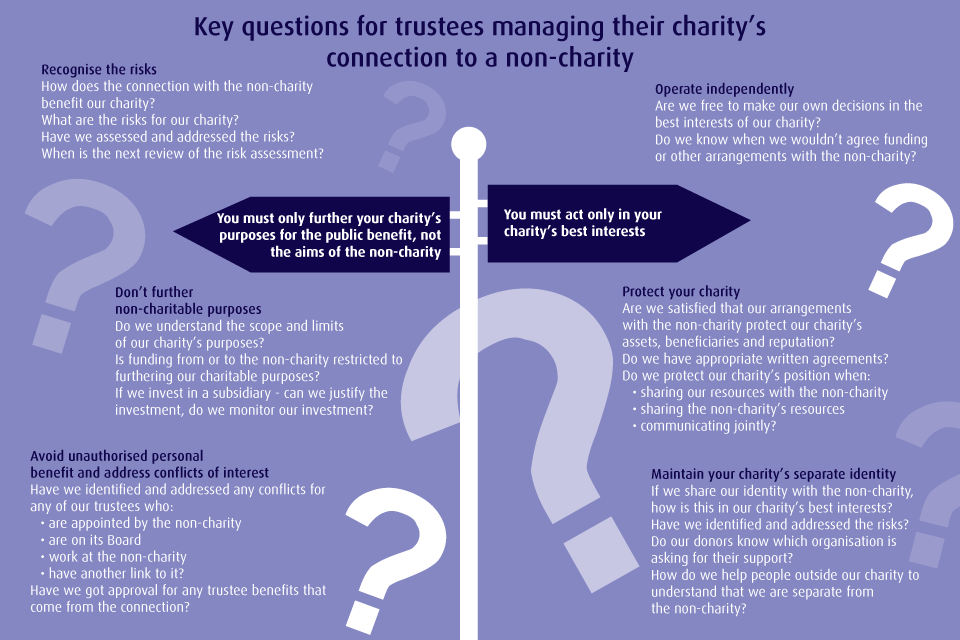

Download infographic

This infographic shows the key questions for trustees managing their charity’s connection to a non-charity.

Text version of infographic: Key questions for trustees managing their charity’s connection to a non-charity

Recognise the risks

How does the connection with the non-charity benefit our charity?

What are the risks for our charity?

Have we assessed and addressed the risks?

When is the next review of the risk assessment?

Don’t further non-charitable purposes

Do we understand the scope and limits of our charity’s purposes?

Is funding from or to the non-charity restricted to furthering our charitable purposes?

If we invest in a subsidiary - can we justify the investment, do we monitor our investment?

Operate independently

Are we free to make our own decisions in the best interests of our charity?

Do we know when we wouldn’t agree funding or other arrangements with the non-charity?

Avoid unauthorised personal benefit and address conflicts of interest

Have we identified and addressed any conflicts for any of our trustees who:

- are appointed by the non-charity

- are on its Board

- work at the non-charity

- have another link to it?

Have we got approval for any trustee benefits that come from the connection?

Maintain your charity’s separate identity

If we share our identity with the non-charity, how is this in our charity’s best interests?

Have we identified and addressed the risks?

Do our donors know which organisation is asking for their support?

How do we help people outside our charity to understand that we are separate from the non-charity?

Protect your charity

Are we satisfied that our arrangements with the non-charity protect our charity’s assets, beneficiaries and reputation?

Do we have appropriate written agreements?

Do we protect our charity’s position when:

- sharing our resources with the non-charity

- sharing the non-charity’s resources

- communicating jointly