Spending review and autumn statement 2015

Updated 27 November 2015

1. Executive summary

The first duty of government is to protect economic and national security, thereby allowing the government to extend opportunity for working people at every stage of their lives. The Spending Review and Autumn Statement delivers on that priority. It sets out a long term economic plan to fix the public finances, return the country to surplus and run a healthy economy that starts to pay down its debt. Debt is projected to fall in every year of this Parliament as a share of GDP and the surplus is forecast to reach £10 billion by 2019-20.

Over the last Parliament the country made huge progress in rescuing the economy. Now the task is to rebuild it. The Spending Review and Autumn Statement announces how the government will build on that progress while embarking on an ambitious plan to reform public services and devolve more power than ever before. Across the Spending Review period day to day departmental spending will fall on average at less than half the rate of the preceding 5 years.

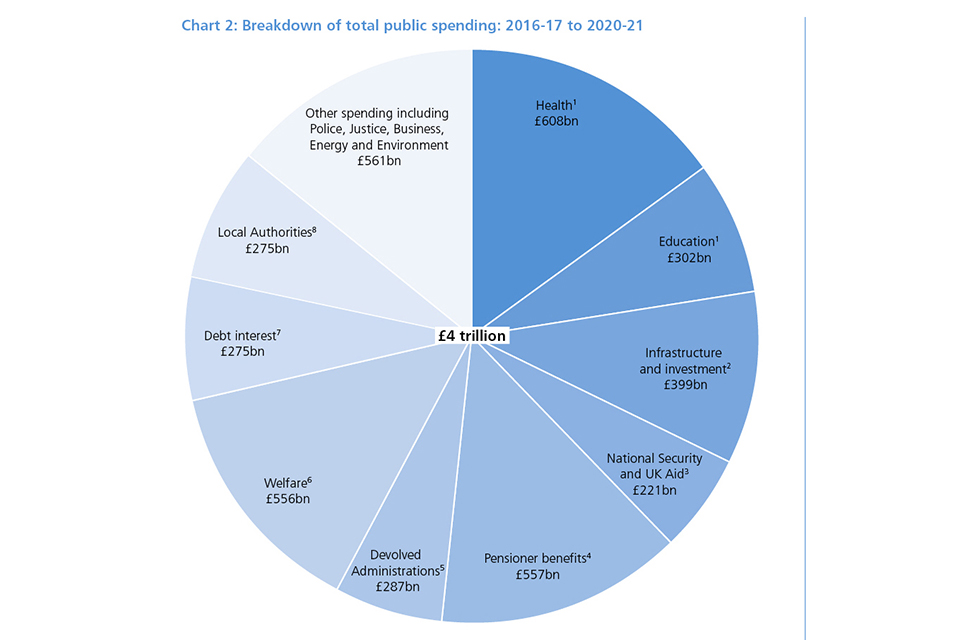

Compared to Summer Budget 2015, the Office for Budget Responsibility now forecasts higher tax receipts and lower debt interest, with a £27 billion improvement in the public finances. This means that, while the Spending Review and Autumn Statement includes difficult decisions to ensure Britain lives within its means, it has been possible to borrow less, invest more and smooth the path of consolidation. By ensuring Britain’s long term economic security, the government is able to spend £4 trillion on its priorities and will take action to:

- protect the UK’s national security by investing in defence, policing, intelligence, counter terrorism, cyber security and international aid, protecting British citizens at home and projecting British influence abroad

- provide opportunity for families through higher wages, lower taxes and lower welfare, saving £12 billion on welfare bills by 2019-20

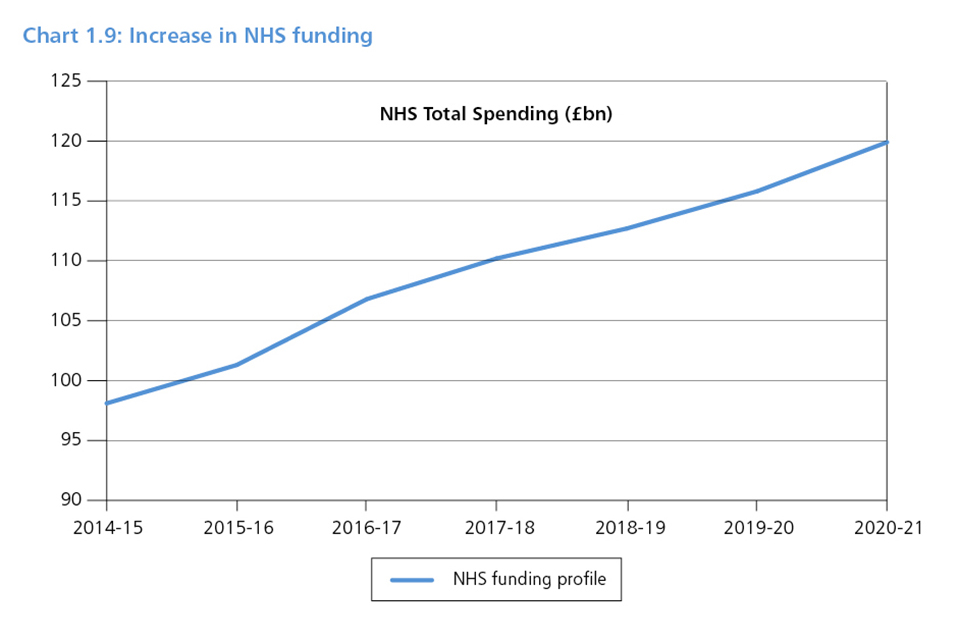

- prioritise the integration of the National Health Service and social care, spending £120 billion a year by 2020-21 to create a 7 day NHS and introducing a new social care precept

- invest in Britain’s future by providing education from childcare to college, with real terms protection for schools funding and paying for apprentices through an apprenticeship levy

- deliver a devolution revolution by returning power to the UK’s nations, cities and councils and rebalancing our economy, giving people greater control over the decisions that affect their lives

- double investment in housing to support home ownership, while also investing in the transport, science, energy and culture that are vital for the country’s long term economic future

- reform and modernise public services, from prisons and court rooms to the UK tax system, making citizens’ lives easier and offering a better deal for taxpayers

1.1 Economic and fiscal forecast

The Office for Budget Responsibility (OBR) now forecasts GDP growth of 2.4% in 2015, 2.4% in 2016 and 2.5% in 2017. It forecasts employment to be 31.1 million in 2015, rising each year to 32.2 million in 2020. CPI inflation is forecast to be below the 2.0% inflation target in 2015, returning gradually to 2.0% in 2019.

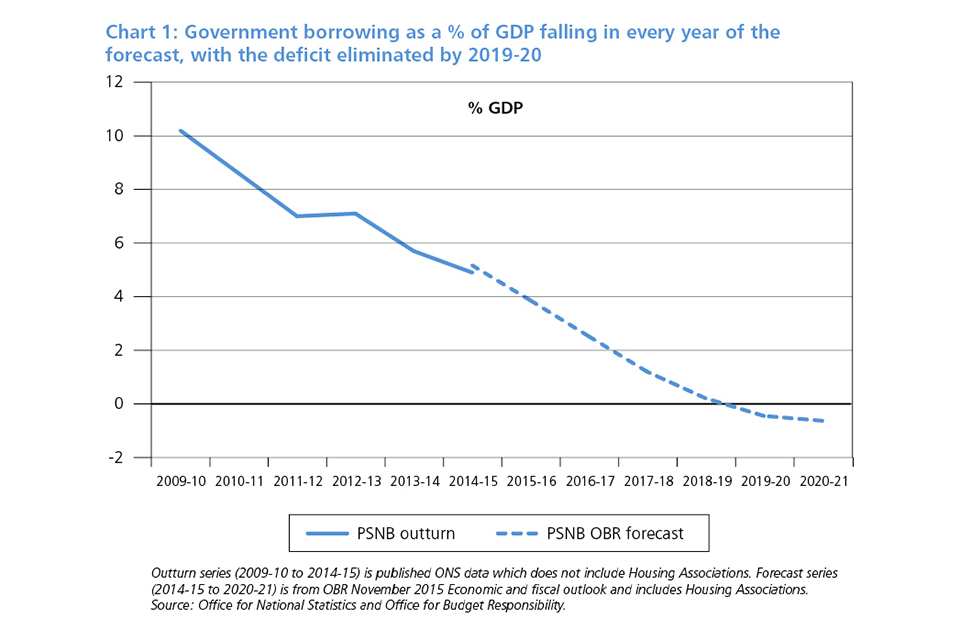

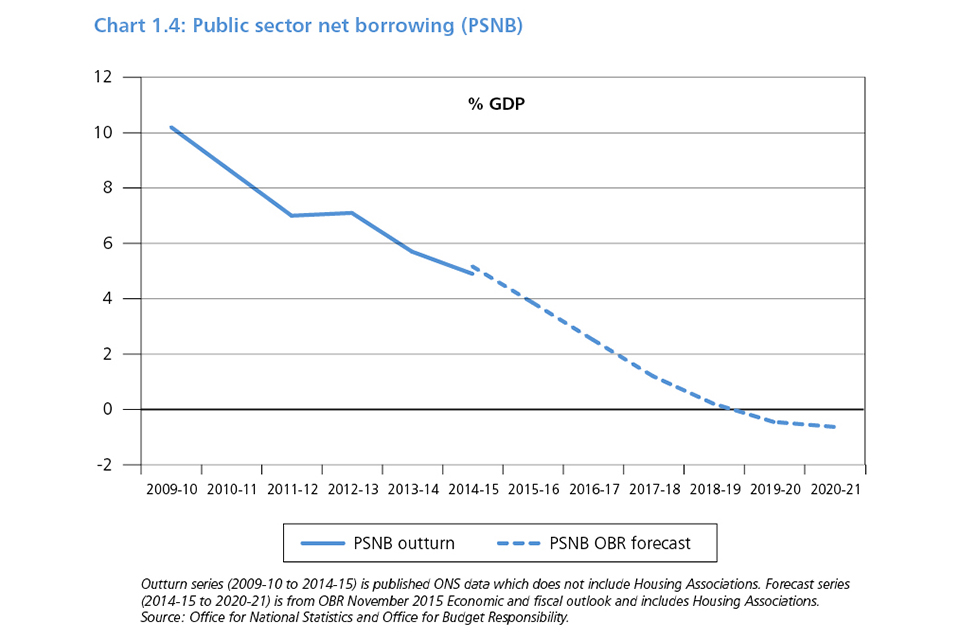

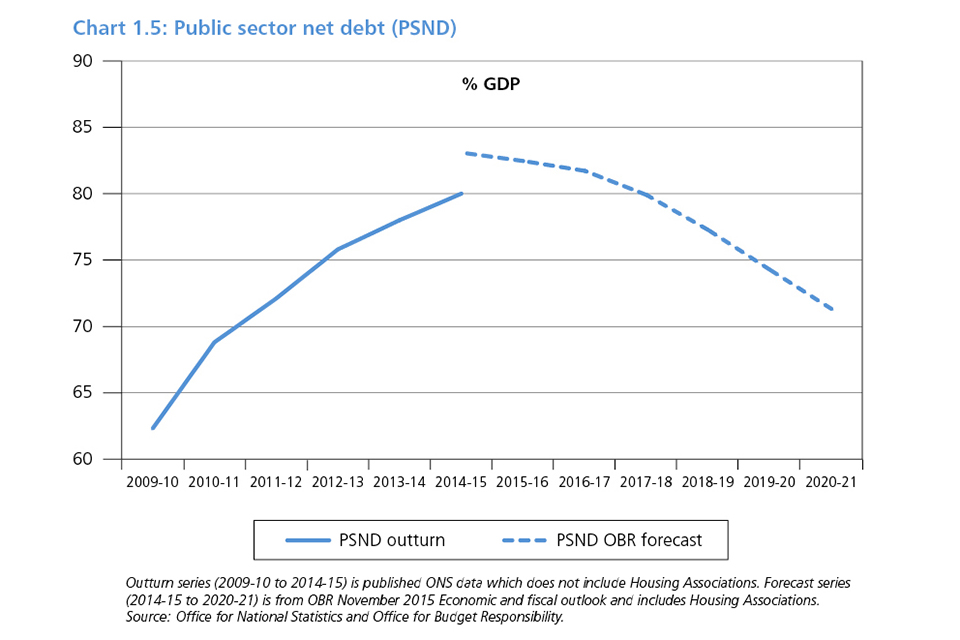

Public sector net borrowing is forecast to fall to 3.9% of GDP in 2015-16 and then to fall each year for the remainder of the forecast period. The OBR forecasts that the public finances will return a surplus of £10.1 billion in 2019-20 and £14.7 billion in 2020-21. Public sector net debt is forecast to fall each year reaching 71.3% of GDP in 2020-21.

1.2 Entrenching economic security

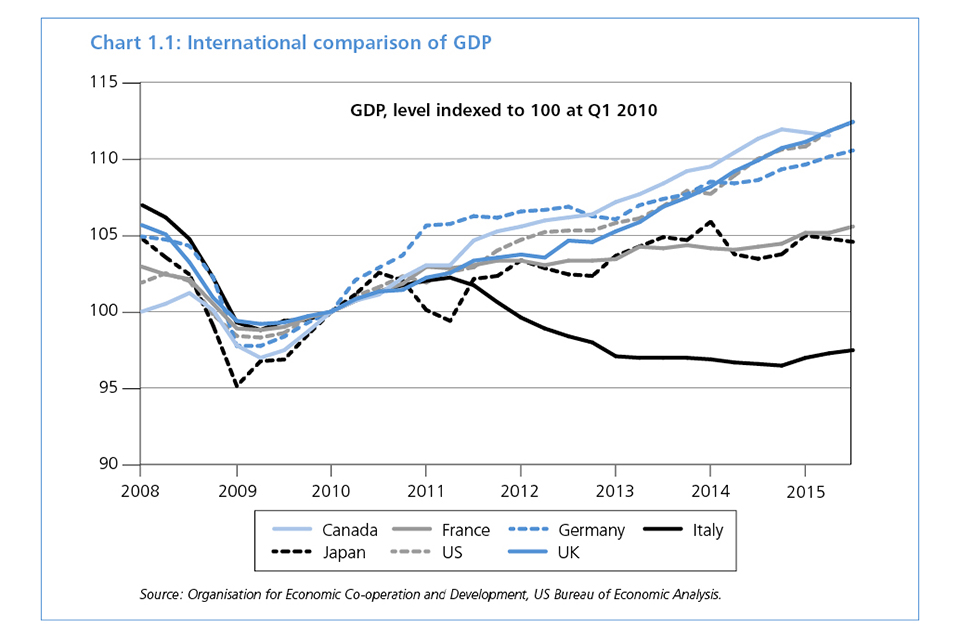

The government’s long term economic plan is securing the recovery. Since 2010, on average, the UK has been the joint fastest growing economy in the G7.

But with debt at the highest share of GDP since the late 1960s, risks remain and the job is not complete. The Spending Review and Autumn Statement sets out how the government will cut the forecast deficit by three quarters by 2016-17 from its peak, eliminate it altogether by 2019-20 and deliver a £10.1 billion surplus. This puts Britain in its strongest position for almost half a century, ensuring it can begin to reduce its debts. This will mean that Britain is better prepared for future shocks, ensuring long term economic security.

1.3 Protecting Britain’s national security

The first duty of government is to ensure the economic and national security of the country. Protecting the UK national interest means strengthening capabilities at home while projecting our influence abroad, ensuring Britain plays a leading role in shaping a more stable, secure and prosperous world. The Spending Review funds the Strategic Defence and Security Review in full and:

- protects police spending in real terms over the Spending Review period to maintain strong frontline policing and further strengthen police firearms resource to protect UK citizens

- commits to meeting the NATO investment pledge to spend 2% of GDP on defence for the rest of this decade

- allocates an additional £3.5 billion to a Joint Security Fund to 2021 to increase spending on the military and intelligence agencies

- invests £1.9 billion in cyber security and £3.4 billion in new counter terrorism activity, in response to changing threats

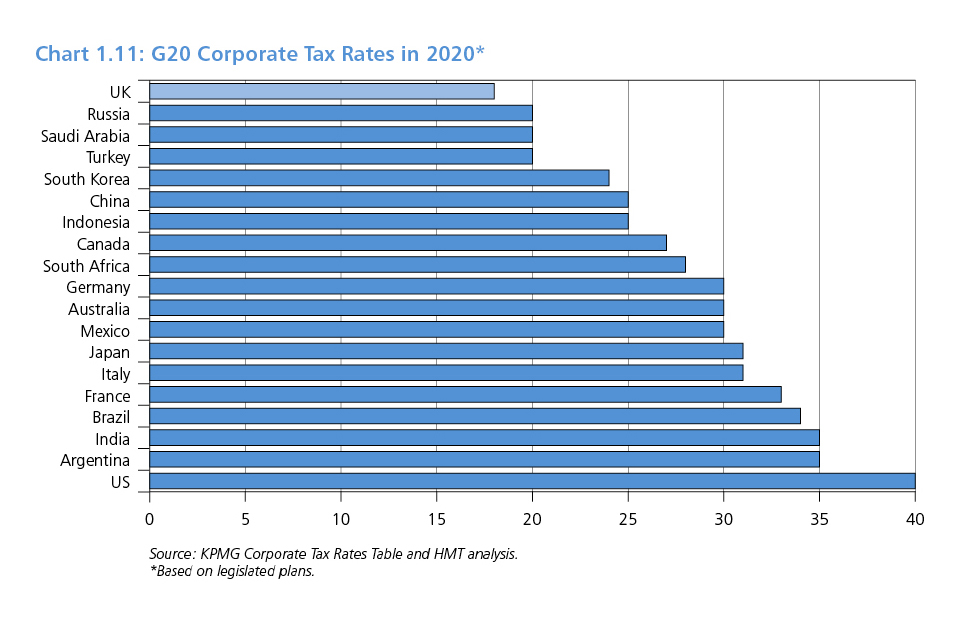

- cements the UK’s position as the only G20 country to spend 0.7% of national income on overseas aid, with a refocused budget that will be even more effective in eliminating poverty and also advancing the UK’s national interest

- maintains the country’s diplomatic network overseas and invests £290 million in the BBC World Service to strengthen democratic accountability, governance, and the soft power and influence of the UK

- creates a new £1.3 billion Prosperity Fund to assist the growth of emerging and developing economies

1.4 A sustainable health and social care system

The government has chosen to invest £120 billion a year by 2020-21 to protect the position of the NHS as a world class health system, and will drive forward ambitious plans to integrate health and social care services by 2020. The Spending Review:

- provides the NHS in England £10 billion per annum more in real terms by 2020-21 than in 2014-15, with £6 billion a year available by the first year so that the NHS’ own Five Year Forward View is fully funded enabling it to deliver services 7 days a week

- enables universities to provide up to 10,000 additional nursing training places this Parliament by replacing direct funding with loans

- gives local councils the power to increase social care funding through a new 2% Council Tax precept

- lays out a radical, local-led plan to create an integrated health and social care system by 2020, backed by an extra £1.5 billion in the Better Care Fund through local authorities

- invests over £5 billion in health research and development, as well as up to £150 million to launch a Dementia Institute and a new £1 billion Ross Fund, partnered by the Bill and Melinda Gates Foundation

1.5 Opportunity and security for families

The government will provide opportunity for working people through higher wages, lower taxes and lower welfare, and support them in retirement through the triple lock on pensions. The government is taking action to reward work and aspiration, reduce bills for households and support first time buyers in securing their own home. The Spending Review and Autumn Statement:

- gives working families on tax credits longer to adjust to the transition to a higher wage, lower tax, lower welfare society, takes further steps to ensure fairness in the Housing Benefit system, and ensures that reforms to welfare will save £12 billion a year by 2019-20

- sets out a five point plan for housing, including delivering 400,000 affordable housing starts by 2020-21, focussed on low cost home ownership and reforms to the planning system to free up land for homes

- supports families buying their own home through a 3 percentage point surcharge on rates of Stamp Duty Land Tax on purchases of additional properties like buy to lets and second homes

- takes an average of £30 off projected household energy bills from 2017 by reducing levies and reduces motor insurance costs by ending the right to cash compensation for minor whiplash claims

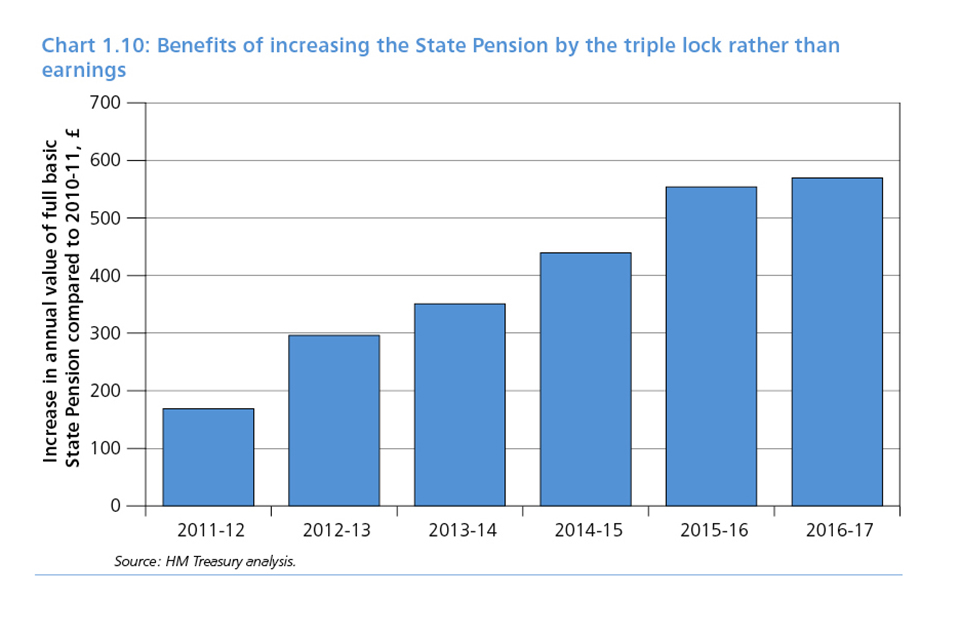

- confirms that the basic State Pension will once again be increased by the triple lock to £119.30 a week from April 2016 and sets the rate of the new single tier pension at £155.65 a week

1.6 Investing in Britain’s future

Because the government is taking the difficult decisions to fix Britain’s finances, it can afford to prioritise investment in Britain’s long term future: in education, skills, infrastructure and science. The Spending Review and Autumn Statement:

- prioritises investment in education from childcare to college, protects schools funding in real terms, and introduces a fairer new national funding formula for schools

- announces that the apprenticeship levy will be introduced in April 2017 at a rate of 0.5% of an employer’s paybill, to deliver 3 million apprenticeship starts by 2020

- ensures the UK remains a world leader in science and research by investing £6.9 billion in capital and by protecting today’s £4.7 billion resource funding in real terms

- sets out how the government will invest over £100 billion in infrastructure and extends the availability of the £40 billion UK Guarantees Scheme to March 2021

- increases transport investment by 50% to £61 billion over the Parliament – including starting construction on High Speed 2, spending £13.4 billion on the Roads Investment Strategy and over £5 billion on roads maintenance

- doubles spend on energy innovation and invests £250 million in an ambitious nuclear research and development programme

- delivers refocused export and investment promotion activity to support more exports and other business opportunities for British firms

- ensures that the arts, national museums and galleries have their funding protected in cash terms until 2019-20

1.7 A devolution revolution

The government is committed to the Northern Powerhouse and devolving unprecedented power across the country to give people control over decisions that affect their local communities. The Spending Review and Autumn Statement:

- transforms local government, enabling it to be self-sufficient by the end of the Parliament by paving the way for 100% business rate retention, giving councils the power to cut business rates to boost growth, and empowering elected city-wide mayors

- builds the Northern Powerhouse, including by investing £13 billion on transport in the North over this Parliament, backing innovative businesses with a range of investments in world-class scientific research, and supporting further Northern Powerhouse trade missions to key emerging economies

- demonstrates momentum on devolution to Scotland, Wales and Northern Ireland, including through a commitment to a relative funding floor for the Welsh Government and in principle to an investment fund for the Cardiff region.

1.8 A modern and reformed state

Building on the progress made over the last Parliament in public services, the government will introduce far-reaching reforms to create a more productive state, fit for the modern world. The Spending Review and Autumn Statement is taking action to:

- reform the prison estate by building 9 new prisons that are cheaper to run and better tailored to reduce reoffending, and invest in new technology to support rehabilitation

- invest a total of £700 million to modernise the courts and tribunals system, speed up justice and deliver savings of £200 million a year from 2019-20

- make the government simple to deal with by investing £1.8 billion in digital transformation, replacing tax returns with digital tax accounts, and building one simple payment mechanism for all central government services

- sell £4.5 billion worth of government land and property, creating space for more than 160,000 new homes, and implement a new commercial approach to land and property management

| (1) Department for Health/Education spending only (excluding capital spending). As the SR does not include an RDEL settlement for DfE in 20-21 a stylistic assumption has been used, constant in real terms. Also includes health and education net public service pensions AME. |

| (2) Total Public Sector capital spending including central government, local government, devolved administrations and public corporations. On this basis, no other segment in this table includes capital spending. |

| (3) Ministry of Defence (inc pensions AME), Single Intelligence Account and Department for International Development. |

| (4) Including OBR forecast for the State Pension, Attendance Allowance, Winter Fuel Payment and Pension Credit. |

| (5) Includes resource spending in the DEL block grants, resource local authority self-financed expenditure in Scotland, Wales and Northern Ireland, and public sector pensions in AME. |

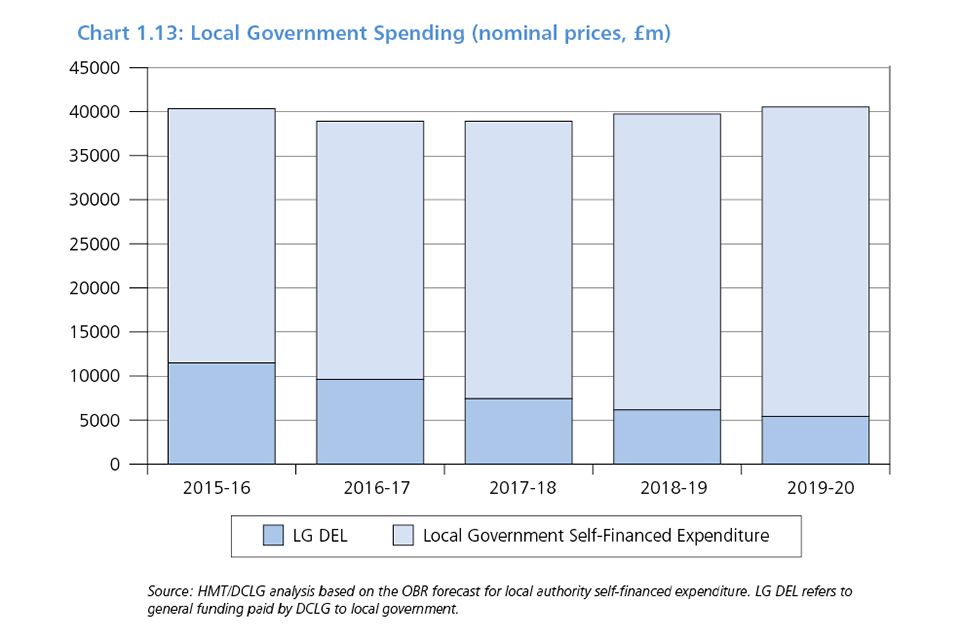

| (6) OBR social security forecasts, minus pensioner benefits. |

| (7) OBR forecast for gross central government debt interest. |

| (8) OBR forecast for resource Local Authority self-financed resource expenditure (excluding self-financed expenditure in Scotland, Wales and Northern Ireland), DCLG grant funding, pensions and current VAT refunds only. Does not include grants from other central government departments. |

2. The UK economy and public finances

2.1 UK economy

The government’s long-term economic plan is securing the recovery. Fiscal responsibility has allowed monetary activism to support demand in the economy, alongside repair of the financial sector. The government has undertaken supply-side reforms to deliver sustainable increases in standards of living.

The UK’s economic recovery is well established. Since 2010, on average, the UK has been the joint fastest growing economy in the G7. [footnote 1]

2.2 Employment and earnings

Employment

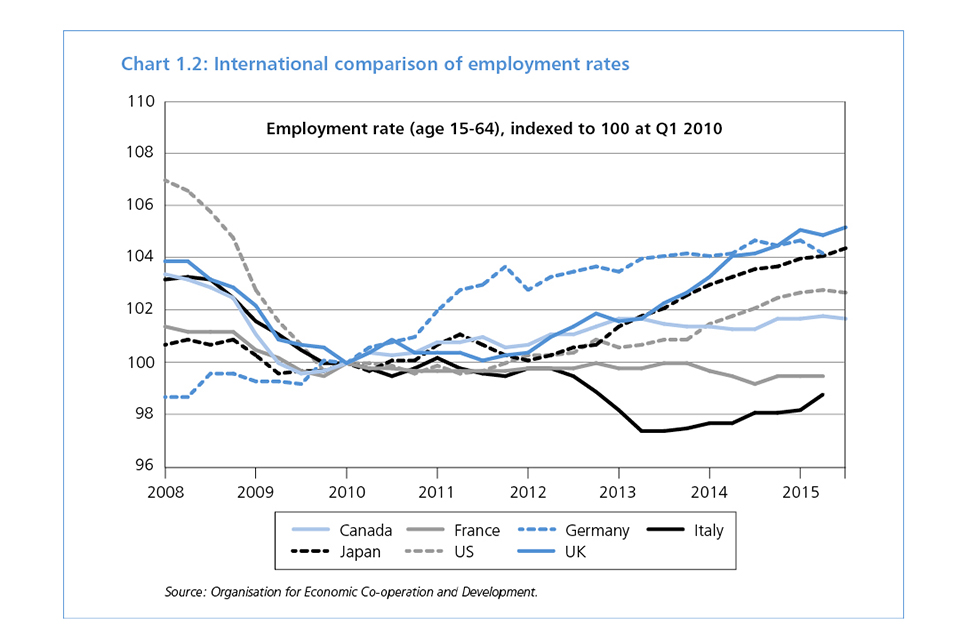

The UK’s labour market performance continues to be strong, underpinned by the government’s policies to support working people. Improvements in the labour market are broad-based, demonstrated by:

- the employment level hitting a record high of 31.2 million in the 3 months to September, representing over 2.1 million more people in work since the 3 months to April 2010 [footnote 2]

- a record employment rate of 73.7% in the 3 months to September

- the increase in employment over the last year being driven by full-time employees and high or medium skilled occupations [footnote 3]

- the female employment rate being at a record high, with around 975,000 more women in work since the 3 months to April 2010

- vacancies at a near record level of 736,000 in the 3 months to October, demonstrating a strong demand for labour

- over 5.5 jobs created in the private sector for every public sector job lost between Q1 2010 and Q2 2015

The UK labour market has performed well compared to other major advanced economies. Since Q1 2010 the UK employment rate grew more than in any other G7 country and employment has increased by more in the UK than the rest of the European Union (EU) combined. [footnote 4]

The government is committed to supporting those returning to work. In the 3 months to September, the unemployment rate fell to 5.3%, the lowest rate in 7 years. Over the last year, more than 80% of the fall in unemployment was due to the decline in long-term unemployment. Youth unemployment, those aged 16 to 24 years, fell by 83,000 on the year.

Earnings

Real wages are growing at rates not seen since before the recession. Nominal wages increased by 3.0% on the year in the 3 months to September, while real earnings grew by 2.9% over the same period. Low inflation, driven by falls in food and fuel prices, has helped support family incomes and household budgets. The Office for Budget Responsibility (OBR) forecasts nominal earnings growth to continue to outstrip inflation, reaching an annual growth of 3.9% by 2020 as inflation returns to target. [footnote 5]

Living standards were directly affected by the financial crisis. In 2015, Real Household Disposable Income (RHDI) per capita is forecast to be higher than in 2008 and to grow at its fastest rate since 2001. [footnote 6]

Workers currently on the National Minimum Wage (NMW) and benefiting from the introduction of the government’s National Living Wage (NLW) are expected to see their wages rise by around 40% over the next 5 years, the biggest increase over a 5-year period since the introduction of the NMW. The number of people benefitting is also greater than ever before. [footnote 7] 2.75 million low wage workers are expected to benefit directly, and the OBR forecasts up to 6 million could see a pay rise as a result of a ripple effect causing pay to rise further up the earnings distribution.

2.3 UK’s productivity challenge

Sustained improvements in productivity are critical to delivering long-term economic growth and a continued increase in living standards. UK productivity has for decades lagged behind other major economies and in 2014 output per hour remained 20 percentage points below the G7 average. [footnote 8] Recent data has shown encouraging signs, with output per hour growing 0.9% in Q2 2015 and 0.6% in Q3 2015. [footnote 9] In July, the government set out comprehensive reforms to support productivity growth. [footnote 10] This Spending Review and Autumn Statement contains further steps to invest in infrastructure, skills and science.

2.4 Rebalancing the UK economy

Regional rebalancing

The government has a bold plan to rebalance the economy and strengthen every part of the UK, building up the Northern Powerhouse and investing across the country.

The plan is working. Outside London and the South East, the number of private sector jobs increased by 1.6 million between Q1 2010 and Q1 2015, and there were over half a million more businesses at the start of 2015 than at the beginning of 2010. [footnote 11] In the north alone, there are over 328,000 more people in work than in the 3 months to April 2010. [footnote 12]

A crucial part of the government’s plan is to devolve powers on transport, skills and business rates to local leaders enabling them to make the decisions which drive growth, attract investment and create jobs.

Sectoral rebalancing

The government is committed to strong, sustainable and balanced growth. Business investment continues to grow and is now 5.1% higher than its pre-crisis peak, while gross fixed capital formation has increased by 21.4% since the start of 2010. The manufacturing, construction and service sectors are larger now than at the beginning of 2010. Within services, there has been strong growth in some high-value sub-sectors. Scientific research and development has grown by 21.3%, and architecture and engineering activities have grown by 38.8%. Over the last 5 years, 66.8% of employment growth has been in high-skilled occupations. [footnote 13]

External rebalancing

The UK is one of the most open economies in the world, so is affected by trends in global trade performance. Since the early 2000s, there has been a slowdown in global trade growth, and the UK has been affected by weakness in its main trading partners. [footnote 14] Goods exports to EU countries have been relatively subdued, having risen by 9.5% since Q1 2010. However, UK exports have continued to expand into other markets, supported by the government’s efforts to boost trade. UK goods exports to non-EU countries have increased by 30.2% since Q1 2010.

Weakness in the global economy has also depressed the income earned on the UK’s overseas assets. The fall in net investment income accounts for the widening in the UK current account deficit in recent years, which the OBR forecasts to reverse when the global economy strengthens. In 2014, the current account deficit was -5.1% of GDP, and narrowed to -3.6% in Q2 2015. The OBR expects the current account deficit to continue to fall, forecasting the deficit to narrow to -2.1% by 2020.

2.5 UK economic outlook

Table 1.1: Summary of the OBR’s central economic forecast

| Percentage change on a year earlier, unless otherwise stated | ||||||||

|---|---|---|---|---|---|---|---|---|

| Forecast | ||||||||

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | ||

| GDP growth | 2.9 | 2.4 | 2.4 | 2.5 | 2.4 | 2.3 | 2.3 | |

| Main components of GDP | ||||||||

| -Household consumption (2) | 2.6 | 2.9 | 2.6 | 2.3 | 2.3 | 2.1 | 1.9 | |

| -General government consumption | 1.9 | 1.7 | 0.4 | 0.6 | 0.5 | 0.5 | 1.1 | |

| -Fixed investment | 7.5 | 4.1 | 5.4 | 5.1 | 4.7 | 5.0 | 4.7 | |

| –Business | 4.6 | 6.1 | 7.4 | 7.1 | 7.0 | 6.6 | 4.5 | |

| –General government3 | 7.6 | 3.0 | 0.8 | 0.6 | -1.6 | 1.7 | 9.2 | |

| –Private dwellings3 | 14.2 | 0.3 | 3.8 | 3.4 | 3.1 | 3.1 | 3.0 | |

| -Change in inventories4 | 0.2 | -0.9 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| -Net trade4 | -0.4 | 0.1 | -0.2 | -0.1 | -0.1 | -0.1 | -0.1 | |

| CPI inflation | 1.5 | 0.1 | 1.0 | 1.8 | 1.9 | 2.0 | 2.0 | |

| Employment (millions) | 30.7 | 31.1 | 31.5 | 31.7 | 31.9 | 32.0 | 32.2 | |

| ILO unemployment (% rate) (5) | 6.2 | 5.5 | 5.2 | 5.2 | 5.3 | 5.4 | 5.4 |

| (1) All figures in this table are rounded to the nearest decimal place. This is not intended to convey a degree of unwarranted accuracy. Components may not sum to total due to rounding and the statistical discrepancy. |

| (2) Includes households and non-profit institutions serving households. |

| (3) Includes transfer costs of non-produced assets. |

| (4) Contribution to GDP growth, percentage points. |

| (5) International Labour Organization. |

| Source: Office for Budget Responsibility, Office for National Statistics. |

The OBR forecasts GDP growth of 2.4% in 2015. GDP growth is revised up in 2016 from 2.3% to 2.4% and in 2017 from 2.4% to 2.5%. The OBR expects the output gap to narrow slowly and to close during 2018.

The OBR forecasts employment to be 31.1 million in 2015, rising each year to 32.2 million in 2020. Unemployment is forecast to be 5.5% in 2015, 5.2% in 2016 and 2017, 5.3% in 2018 and 5.4% thereafter.

CPI inflation is forecast to be below target in 2015 and to remain below the 2% inflation target before returning gradually to 2.0% in 2019.

2.6 Housing

House price growth has moderated since 2014 with prices expected to rise by 6.2% in 2015, down from growth of 9.9% in 2014. Real house prices are now 3.0% below their pre-crisis peak. The OBR expects house prices to grow by an average of 5.0% a year between 2015 and 2020. There have been signs of a response in the housing supply with housing completions in Q3 2015 15.5% higher than a year earlier.

Household debt relative to income has fallen from 168% in Q1 2008 to 144% in Q2 2015. Household debt as a proportion of income is forecast to remain below its pre-crisis peak while household assets relative to income are expected to remain above pre-crisis levels.

2.7 Monetary policy and credit easing

Monetary policy has played a role in supporting the recovery. The Monetary Policy Committee (MPC) has full operational independence to set monetary policy to meet the 2.0% inflation target as measured by the 12-month increase in the Consumer Prices Index. Inflation was -0.1% in October. In November, as required by the MPC remit, the Governor wrote to the Chancellor a fourth open letter in the current series relating to inflation more than a percentage point below target. The Governor has explained that, in September, four-fifths of the shortfall in inflation from target was due to falls in food, energy and other goods prices. [footnote 15]

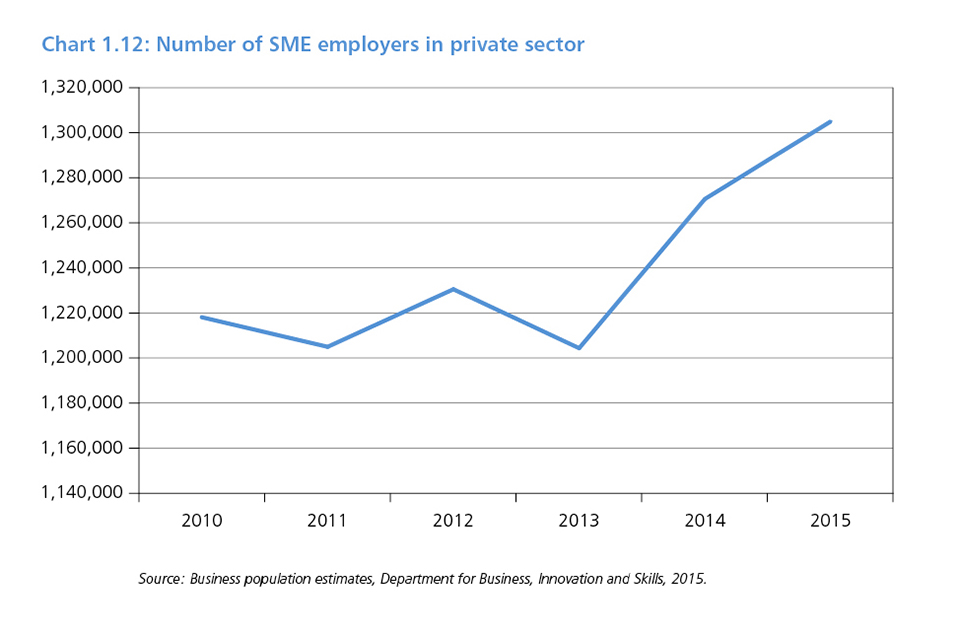

Bank funding costs have fallen substantially since the introduction of the Funding for Lending Scheme (FLS) in 2012. Annual growth in the stock of lending to small and medium sized enterprises (SMEs) also continues to improve, reaching 0.3% in September from a low of -4.5% in August 2012. [footnote 16] The FLS will continue to support lending to SMEs into 2016. Net lending to SMEs by participants in the FLS was £0.5 billion in Q2 2015, the second consecutive quarter of positive net lending. [footnote 17]

2.8 Reactions from the IMF and the OECD

Christine Lagarde, Managing Director of the International Monetary Fund (IMF), said “When we look at the comparative growth rates delivered by various countries in Europe it’s obvious that what is happening in the UK has actually worked”. [footnote 18] Angel Gurria, Secretary-General of the Organisation for Economic Co-operation and Development (OECD), said “The UK is an actual textbook case, or is fast becoming best practice on how labour market and good product market reform can support growth and job creation”. [footnote 19]

2.9 Global developments

As one of the most open trading economies in the world, the strength and stability of the global economic recovery is key to UK economic prospects. The UK is inevitably affected by problems in the world economy. The global economic recovery remains uneven, with weakness driven by the slowdown in emerging markets. Increased risks in the world economy demonstrate the need to continue to repair the UK economy in order to withstand future shocks.

In 2015 the global economy is forecast to record its lowest growth rate since 2009. The IMF October World Economic Outlook (WEO) forecasts global growth to weaken to 3.1% in 2015, from 3.4% in 2014. In advanced economies, the IMF forecasts economic growth to be 2.0% in 2015, including 1.5% in the euro area, 2.6% in the US, and 0.6% in Japan. In emerging markets, the IMF expects economic growth to slow to 4.0% in 2015, from 4.6% in 2014. Some emerging markets may face increased financial pressure as the US Federal Reserve considers raising its policy interest rate, and are also affected by slower growth in China and lower commodity prices. [footnote 20]

The UK is not immune from global risks which is why this Spending Review and Autumn Statement tackles the UK’s economic problems head on to deliver a surplus and reduce the UK’s debts.

2.10 Public finances

The government’s fiscal plan

Significant progress was made over the course of the last Parliament in fixing the public finances. The deficit has been reduced by almost two thirds as a share of GDP since its peak in 2009-10. [footnote 21] But in 2015-16, the deficit remains one of the highest among advanced economies. [footnote 22] This Spending Review and Autumn Statement sets out the action required to return the country to surplus by the end of the Parliament. As a share of GDP, the OBR forecasts that the deficit will be cut by three quarters in 2016-17 from its peak and eliminated altogether in 2019-20. [footnote 23]

The OBR now forecasts the economy to continue to grow robustly, and for the public finances to be in a stronger position over the forecast period than at Summer Budget 2015. [footnote 24] Changes to the underlying forecast show a £27 billion improvement in the public finances. The underlying forecast for tax receipts is stronger and debt interest is lower. [footnote 25] This presents the government with choices: to borrow less, increase capital spend, or smooth the consolidation while reaching the same surplus. The Spending Review and Autumn Statement sets out how the government will do all of the above.

On the basis of this Spending Review and Autumn Statement, borrowing will be over £8 billion lower over the forecast period and debt will be lower as a share of GDP in every year of the forecast compared to Summer Budget 2015. [footnote 26] The government will choose to invest £12 billion more in capital DEL than planned at Summer Budget 2015, and is also able to ease the transition to a higher wage, lower tax, lower welfare economy.

Table 1.2 sets out the forecast for the key fiscal aggregates at the Autumn Statement. In October 2015, the ONS classified Housing Associations [footnote 27] into the public sector. This is a statistical reclassification which does not affect the underlying performance of the economy. The OBR has shown what the forecast made at Summer Budget would have looked like had Housing Associations been included in the public sector then. Table 1.2 shows the comparison between the forecasts at Autumn Statement and Summer Budget. There are currently no published estimates for Public Sector Net Borrowing (PSNB) and Public Sector Net Debt (PSND) including Housing Associations before 2013-14.

Table 1.2: Comparison of key fiscal aggregates to Summer Budget 2015 restated to include Housing Associations

| Estimate | Forecast | ||||||

|---|---|---|---|---|---|---|---|

| 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | |

| Public sector net borrowing (£ billion) | |||||||

| Autumn Statement 2015 (1) | 94.7 | 73.5 | 49.9 | 24.8 | 4.6 | -10.1 | -14.7 |

| Summer Budget 2015 restated to include Housing Associations (1) | 93.7 | 74.1 | 46.7 | 26.5 | 8.2 | -8.5 | -10.0 |

| Summer Budget 2015 (2) | 89.2 | 69.5 | 43.1 | 24.3 | 6.4 | -10.0 | -11.6 |

| Change compared to Summer Budget 2015 restated to include Housing Associations | 0.9 | -0.6 | 3.3 | -1.7 | -3.6 | -1.6 | -4.7 |

| Public sector net borrowing (% GDP) | |||||||

| Autumn Statement 2015 (1) | 5.2 | 3.9 | 2.5 | 1.2 | 0.2 | -0.5 | -0.6 |

| Summer Budget 2015 restated to include Housing Associations (1) | 5.2 | 4.0 | 2.4 | 1.3 | 0.4 | -0.4 | -0.4 |

| Summer Budget 2015 (2) | 4.9 | 3.7 | 2.2 | 1.2 | 0.3 | -0.4 | -0.5 |

| Change compared to Summer Budget 2015 restated to include Housing Associations | 0.0 | -0.1 | 0.1 | -0.1 | -0.2 | -0.1 | -0.2 |

| Public sector net debt (% GDP) (3) | |||||||

| Autumn Statement 2015 (1) | 83.1 | 82.5 | 81.7 | 79.9 | 77.3 | 74.3 | 71.3 |

| Summer Budget 2015 restated to include Housing Associations (1) | 84.0 | 83.6 | 82.5 | 80.6 | 78.0 | 74.7 | 71.6 |

| Summer Budget 2015 (2) | 80.8 | 80.3 | 79.1 | 77.2 | 74.7 | 71.5 | 68.5 |

| Change compared to Summer Budget 2015 restated to include Housing Associations | -0.9 | -1.2 | -0.8 | -0.7 | -0.7 | -0.4 | -0.3 |

| (1) Includes the impact of the reclassification of Housing Associations as set out in the OBR’s Economic and fiscal outlook November 2015. |

| (2) Figures for 2014-15 were forecast at Summer Budget 2015. |

| (3) Debt at end March 2015 is outturn; GDP centred on end March 2015 reflects the November 2015 GDP forecast from the OBR. Therefore, the figure differs from the October Public Sector Finances release. |

| Source: Office for Budget Responsibility. |

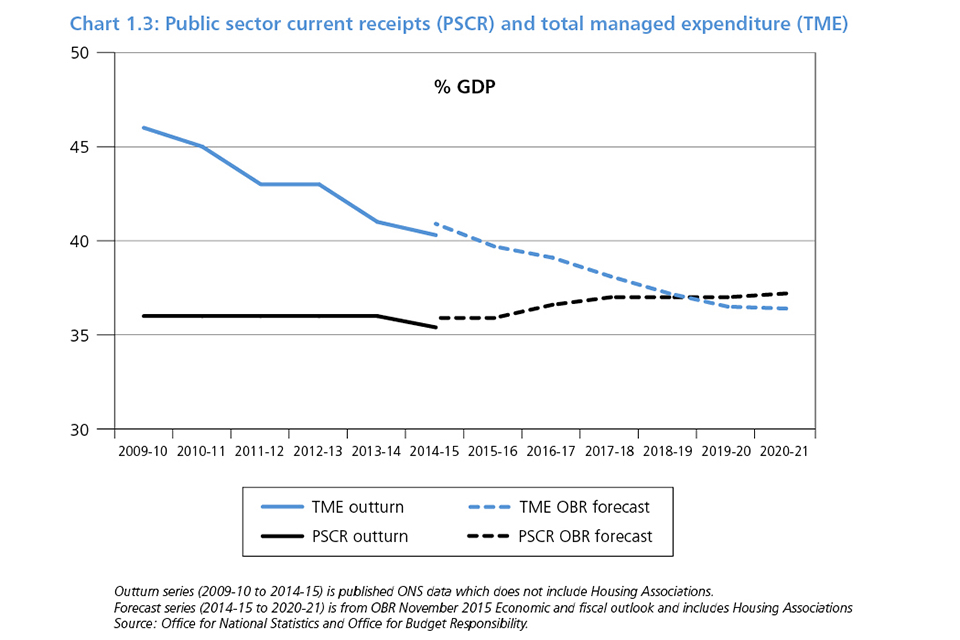

The reduction in the deficit as a share of GDP between 2015-16 and 2019-20 is mainly due to lower spending as a share of GDP. Total managed expenditure is forecast to decline by 3.2% of GDP, from 39.7% in 2015-16 to 36.5% in 2019-20, while public sector current receipts rise by only 1.1% of GDP (Chart 1.3).

At Summer Budget 2015, the government set out that around £37 billion of further discretionary consolidation would be needed to deliver the surplus in 2019-20. Summer Budget 2015 set out around £17 billion of that total: £5 billion from tax avoidance, evasion and imbalances in the tax system, and £12 billion from welfare.

The improvements to the forecast since Summer Budget 2015 mean that the remaining consolidation now required is £18 billion as set out in Table 1.3. Spending Review 2015 delivers £12 billion of savings to overall RDEL spending. As announced at Summer Budget 2015, the government is introducing the apprenticeship levy which will be worth £3 billion by 2019-20 and funds 3 million apprenticeships. The remaining £3 billion is being delivered through reforms such as Making Tax Digital and further measures to tackle tax avoidance.

Table 1.3: Consolidation plans set out in this Spending Review and Autumn Statement

| £ billion | ||||

|---|---|---|---|---|

| 2016-17 | 2017-18 | 2018-19 | 2019-20 | |

| Discretionary consolidation (1) | -1 | 7 | 13 | 18 |

| Welfare | -3 | -2 | -1 | 0 |

| RDEL Savings and Apprenticeship Levy (2,3) | 1 | 7 | 11 | 15 |

| Other tax and AME | 1 | 2 | 2 | 3 |

| (1) Totals may not sum due to rounding. | ||||

| (2) RDEL savings calculated compared to a counterfactual in which RDEL excluding depreciation grows in line with whole economy inflation from its 2015-16 level (excluding the OBR’s Allowance for Shortfall). | ||||

| (3) Apprenticeships spending in England will be ringfenced within DEL budgets. |

Returning Britain to surplus

The Charter for Budget Responsibility commits to achieving a surplus on the headline measure of the deficit, PSNB, in 2019-20 and to maintain a surplus in normal times in order to bring down debt as a share of GDP over the long term.

Independent monetary policy now delivers low and stable medium-term inflation, to the benefit of the whole economy. This contrasts with the experience after World War II, when very high inflation, together with artificially low interest rates, played a major role in reducing debt. [footnote 28] Responsible fiscal policy must also take into account the fact that the UK economy will continue to be hit by shocks in the future.

Once future economic shocks are allowed for, running a deficit to finance capital investment (balancing only the current budget) and relying on trend economic growth is insufficient to bring down debt, as set out in HM Treasury analysis at Budget 2014. [footnote 29] In a low inflationary environment, with economic shocks, the only reliable way to bring down debt as a share of GDP is to run an overall surplus in normal times.

The updated Charter for Budget Responsibility, approved by the House of Commons on 14 October 2015, defines the government’s targets as debt falling as a share of GDP each year until a surplus on the headline measure of PSNB is achieved by 2019-20, and to maintain a surplus in normal times thereafter. The simplicity and clarity of the metric ensure that governments will be held to account for their fiscal policy when the economy is performing well.

Under the updated Charter, the surplus rule will be suspended if the economy is hit by a significant negative shock (defined as 4 quarter-on-4 quarter GDP growth below 1%). This provides flexibility to allow the automatic stabilisers to operate freely when needed. Following a shock, the government of the day will be required to set a plan to return to surplus, including appropriate fiscal targets. The framework does not prescribe what the targets should be, allowing the government of the day to respond to the circumstances. However, the targets will be voted on by the House of Commons and assessed by the OBR.

The end goal is to ensure that long-term debt reduction continues, leaving the country better placed to withstand future economic shocks. Returning to a surplus in normal times will provide the government of the day with the fiscal space to allow appropriate action to be taken in the face of future shocks.

Performance against the government’s fiscal targets

The OBR’s November 2015 Economic and fiscal outlook provides an assessment of the government’s performance against its fiscal targets. It confirms the government is on course to achieve a surplus on public sector net borrowing of £10.1 billion in the target year of 2019‑20 and to maintain a surplus in the following year, 2020-21. The OBR’s judgement is that the government’s policies are consistent with a roughly 55% chance of achieving the mandate in 2019-20. The government’s fiscal strategy is to reduce the deficit by around 1.1% of GDP a year on average for the next four years – the same pace as over the last Parliament.

Chart 1.5 shows PSND as a percentage of GDP. At the beginning of the last Parliament, the government inherited the largest deficit in the post-war period. [footnote 30] Since 2010, the government has taken action to cut the deficit, but PSND has more than doubled since the pre-recession period. The gap between the outturn and the forecast series in Chart 1.5 in 2014-15 is due to the reclassification of Housing Associations. The government’s fiscal mandate is supplemented by a target for PSND as a percentage of GDP to be falling in each year until 2019-20. The OBR forecasts that the debt target will be met with debt falling by 0.6% of GDP between 2014-15 and 2015-16. [footnote 31] Public sector net debt continues to fall as a share of GDP across the forecast, reaching 71.3% of GDP by 2020-21.

The government remains committed to bringing the UK’s Treaty deficit in line with the 3% target set out in the Stability and Growth Pact. The OBR’s forcast indicates that this target will be met in 2016-17.

Table 1.4: Overview of the OBR’s central fiscal forecast

| % GDP, unless otherwise stated | |||||||

|---|---|---|---|---|---|---|---|

| Estimate | Forecast | ||||||

| 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | |

| Deficit | |||||||

| Public sector net borrowing | 5.2 | 3.9 | 2.5 | 1.2 | 0.2 | -0.5 | -0.6 |

| Public sector net borrowing (£ billion) | 94.7 | 73.5 | 49.9 | 24.8 | 4.6 | -10.1 | -14.7 |

| Cyclically-adjusted net borrowing | 4.4 | 3.4 | 2.3 | 1.1 | 0.2 | -0.5 | -0.6 |

| Primary balance | -3.5 | -2.2 | -0.6 | 0.7 | 1.7 | 2.3 | 2.4 |

| Treaty deficit (1) | 5.1 | 3.9 | 2.5 | 1.3 | 0.3 | -0.3 | -0.6 |

| Debt | |||||||

| Public sector net debt (2, 3) | 83.1 | 82.5 | 81.7 | 79.9 | 77.3 | 74.3 | 71.3 |

| Treaty debt (4) | 87.5 | 87.1 | 86.5 | 84.8 | 82.2 | 79.2 | 76.0 |

| Memo: output gap | -0.8 | -0.7 | -0.3 | -0.1 | 0.0 | 0.0 | 0.0 |

| Memo: total policy decisions (5) | 0.0 | -0.1 | 0.1 | 0.2 | 0.3 | 0.3 |

| (1) General government net borrowing on a Maastricht basis. |

| (2) Debt at end March; GDP centred on end March. |

| (3) Debt at end March 2015 is outturn; GDP centred on end March 2015 reflects the November 2015 GDP forecast from the OBR. Therefore, the figure differs from the October Public Sector Finances release. |

| (4) General government gross debt on a Maastricht basis. |

| (5) Equivalent to the ‘Total policy decisions’ line in Table 3.1 Autumn Statement 2015 policy decisions. |

| (4) Source: Office for National Statistics, Office for Budget Responsibility and HM Treasury calculations. |

Welfare cap

The government introduced the welfare cap at Budget 2014 to strengthen control of welfare spending, support fiscal consolidation and improve Parliamentary accountability for the level of welfare spending. The cap applies to welfare spending in Annually Managed Expenditure with the exception of the state pension and the automatic stabilisers. A full list of benefits and tax credits that are within scope of the welfare cap is set out at Annex B.

At the Autumn Statement, the government gives families longer to adjust to the higher wage, lower tax and lower welfare society, by not proceeding with the changes to the tax credit threshold and taper announced at Summer Budget 2015. As a result the OBR’s assessment is that the cap is not met in 2016-17, 2017-18 and 2018-19.

The government has taken action to ensure the cap is met in the medium term, and the government will retain the welfare cap at the current level. The OBR confirms that in 2019-20 and 2020-21 welfare spending will be within the forecast margin set at the Summer Budget.

As set out in the OBR’s November 2015 Economic and fiscal outlook, spending is expected to be in the forecast margin in those years because of revisions to “spending on disability and incapacity benefits” and “the latest ONS population projections”. Welfare spending within the cap is still set to fall by 1% of GDP over the welfare cap period – consistent with the 1% fall forecast at the Summer Budget.

Table 1.5: OBR assessment of the welfare cap

| £ billion | |||||

|---|---|---|---|---|---|

| 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | |

| Welfare cap | 115.2 | 114.6 | 114.0 | 113.5 | 114.9 |

| Forecast Margin (2%) | 2.3 | 2.3 | 2.3 | 2.3 | 2.3 |

| Total spending: change versus welfare cap | 4.0 | 3.1 | 1.9 | 1.8 | 2.1 |

| of which: | |||||

| Policy decisions (1) | 3.0 | 1.9 | 0.7 | -0.1 | -0.3 |

| Forecasting changes (2) | 1.0 | 1.1 | 1.2 | 1.9 | 2.4 |

| Total spending to which welfare cap applies | 119.2 | 117.7 | 115.9 | 115.3 | 117.1 |

| (1) Consistent with the welfare cap impact of total policy decisions set out in Table 3.1 (with signing convention reversed). |

| (2) Includes indirect effects. |

| Source: Office for Budget Responsibility and HM Treasury. |

In line with the requirements of the Charter for Budget Responsibility, and consistent with the Parliamentary accountability for welfare spending intended by the cap, the government will bring forward a debate on a votable motion in the House of Commons.

This Autumn Statement sets out in detail the action the government is taking to ensure that the welfare system is fair to both claimants and taxpayers.

The strategy for state-owned financial assets

The government is committed to returning the financial sector assets acquired in 2008-09 to the private sector. As there is no longer a policy need for the government to hold these assets, it will seek to dispose of them, reducing PSND while maximising value for taxpayers.

As set out in the OBR’s November 2015 ‘Economic and fiscal outlook’, the government has made almost £70 billion in recoveries from financial sector interventions to date.[footnote 32]

The government raised £2.1 billion with an initial sale of Royal Bank of Scotland (RBS) shares in August 2015.[footnote 33] The government will extend its commitment to sell over £25 billion of RBS shares over this Parliament and raise a further £5.8 billion in 2020-21.

The government will make shares in Lloyds Banking Group (LBG) available for sale to the general public in spring 2016, as part of its plan to fully exit from its stake in LBG. Members of the public will receive incentives including a discount and bonus shares. Over £16 billion has been recovered for the taxpayer through the government’s programme of LBG disposals, generating a surplus of £1.2 billion compared with the original investment price and reducing the taxpayer’s stake to under 10%.[footnote 34]

On 13 November, the Chancellor announced that UK Asset Resolution (UKAR) had sold £13 billion of former Northern Rock mortgages to Cerberus.[footnote 35] In line with its ongoing strategy to accelerate the run-down of its balance sheet and reduce PSND, UKAR will look to make further asset sales over the course of the Parliament, which are currently expected to total £7.5 billion, subject to market conditions and ensuring value for money.

Debt and reserves

The government’s revised financing plans for 2015-16 are summarised in Annex C.

3. The government’s spending choices

The Spending Review sets out how the government will deliver on its priorities, to eliminate the deficit, and deliver security and opportunity for working people. The government has focused on allocating resources – £4 trillion over the next 5 years – to long term investment and key public services. This spending is accompanied by significant reform.

A strong economy requires sound public finances. As part of that, the Spending Review makes the difficult decisions to:

- significantly reduce the central government grant to local authorities, while introducing a new council tax precept for social care, and undertaking the full devolution of business rates and new responsibilities so local areas have the tools to drive local growth

- reduce the costs of certain public services, while improving quality, through transformational changes to the criminal justice system, prisons, tax collection, and the delivery of welfare, enabling workforce reductions in the public sector

- change the balance of state support: offering health students more cash support while studying by moving from grant to loan funding, asking larger employers to contribute more to the cost of higher quality apprenticeship training whilst benefitting from higher skills of their employees, and replacing some innovation funding with loans

3.1 Spending contribution to fiscal consolidation

Table 1.6 sets out the path for total public spending (Total Managed Expenditure) from 2015-16 to 2020-21, split between current and capital spending. Total public spending in 2019-20 will be £821 billion.

The Spending Review period covers the four years from 2016-17 to 2019-20 inclusive. This is the period during which the government is taking the decisions needed to return the public finances to surplus. Resource DEL is therefore set to 2019-20. An exception is made for those departments whose overall budgets are protected. Their Resource DEL is set to 2020-21. This meets the government’s commitment to protect these budgets. Capital budgets for every department are set to 2020-21.

As set out in paragraph 1.32 the Spending Review delivers consolidation of £12 billion through savings to departmental resource spending by 2019-20. This is made up of £21.5 billion of savings from unprotected departments, of which £9.5 billion will be reinvested in the government’s priorities.

Overall Resource DEL will fall by 0.8% per year on average in real terms. The average rate of reduction over the preceding 5 years was 2.0%, more than twice as steep as the rate in this Spending Review period. Across all unprotected Whitehall departments the cumulative real rate of reductions over the Spending Review period is 19%.

Table 1.6: Total Managed Expenditure (1)

| 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | ||

|---|---|---|---|---|---|---|---|

| CURRENT EXPENDITURE | |||||||

| - Resource AME | 345.3 | 353.3 | 365.9 | 378.4 | 391.8 | 403.9 | |

| - Resource DEL excluding depreciation2 | 315.1 | 320.8 | 322.9 | 325.2 | 328.3 | 341.2 | |

| - Ring-fenced depreciation | 21.9 | 21.9 | 21.9 | 21.9 | 21.9 | 21.9 | |

| Public Sector Current Expenditure | 682.3 | 696.0 | 710.7 | 725.5 | 742.0 | 767.0 | |

| CAPITAL EXPENDITURE | |||||||

| - Capital AME | 31.7 | 33.4 | 31.7 | 30.7 | 31.7 | 34.5 | |

| - Capital DEL2 | 41.7 | 44.0 | 45.0 | 45.0 | 47.3 | 55.7 | |

| Public Sector Gross Investment | 73.4 | 77.4 | 76.7 | 75.7 | 79.0 | 90.2 | |

| TOTAL MANAGED EXPENDITURE | 755.7 | 773.3 | 787.5 | 801.2 | 821.0 | 857.2 | |

| Total Managed Expenditure (% GDP) | 39.7% | 39.1% | 38.1% | 37.2% | 36.5% | 36.4% |

| (1) Budgeting totals are shown including the Office for Budget Responsibility (OBR) forecast Allowance for Shortfall. Resource DEL excluding ring-fenced depreciation is the Treasury’s primary control within resource budgets and is the basis on which departmental Spending Review settlements are agreed. The OBR publishes Public Sector Current Expenditure (PSCE) in DEL and AME, and Public Sector Gross Investment (PSGI) in DEL and AME. A reconciliation is published by the OBR. |

| (2) Resource DEL excluding depreciation and Capital DEL form the envelopes for departmental settlements at the Spending Review. |

3.2 Major areas of public spending

The government has chosen to prioritise its day to day spending on national security and key public services while investing more for the long term in capital infrastructure.

The Spending Review sets out plans to increase departments’ capital spending by £12 billion over the next 5 years. It shows how the government is funding the unprecedented long-term capital plans set out at Spending Round 2013. The government will exceed its commitment to invest £100 billion in infrastructure by 2020-21.

Protections and priorities

The government has protected its core priorities from the spending reductions required to fix the public finances. The government will:

- spend 2% of Gross Domestic Product (GDP) on defence for the rest of this decade

- spend 0.7% of Gross National Income on overseas aid

- provide the NHS in England £10 billion per year more in real terms by 2020-21 than in 2014-15

- increase the basic State Pension by the triple lock in April 2016, so that it rises to £119.30 a week

- protect schools funding in England in real terms over the Spending Review period

- protect the national base rate per student for 16-19 year-olds in school sixth forms, sixth form colleges and further education colleges in England for the rest of the Parliament

- offer new financial support for further and higher education, with almost £1 billion of new loans by 2020-21 for part-time maintenance, postgraduate and higher level skills courses

- protect overall police spending in real terms over the Spending Review period

- maintain funding for the arts, national museums and galleries in cash terms over this Parliament

The government’s spending decisions have also been guided by a long-term focus – investing now to equip Britain for the future and to improve the productivity of the state. The government will:

- invest over £100 billion in the UK’s infrastructure

- protect the £4.7 billion science budget in real terms over the Parliament

- invest £1.8 billion to digitally transform government services

3.3 A progressive approach to spending

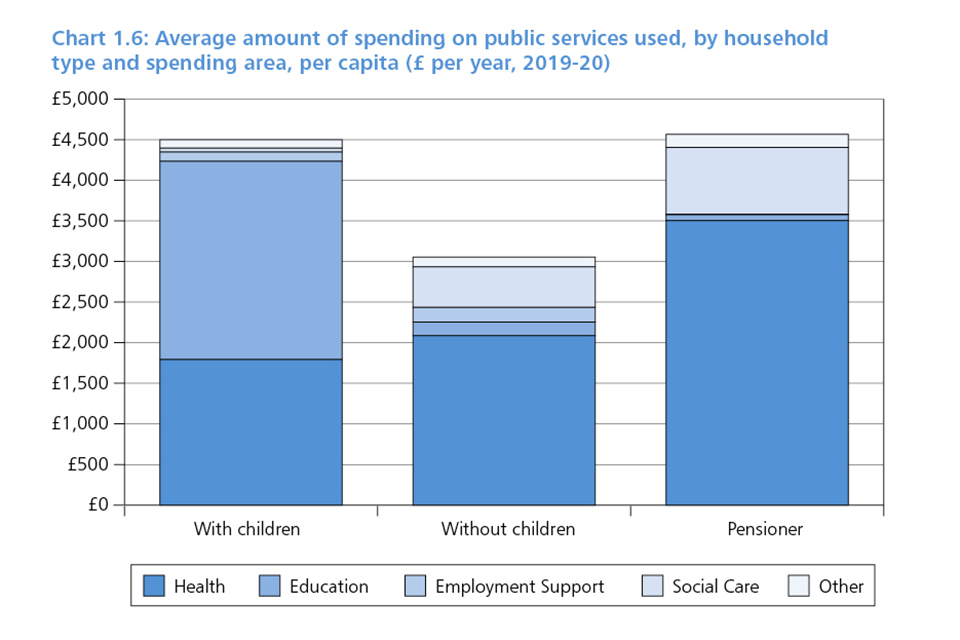

The decisions taken in this Spending Review will continue to protect the poorest and most vulnerable in society. In 2019-20, the poorest 40% of households will still receive 50% of the total benefits from public spending on welfare and public services, as they did in 2010-11. As shown in Chart 1.6, pensioners and households with children continue to be the largest beneficiaries of targeted public service spending. Each person living in a household which includes a child or a pensioner will receive around £4,500 of benefits in kind from spending on frontline public services in 2019-20, compared to £3,000 per person in working age households without children.

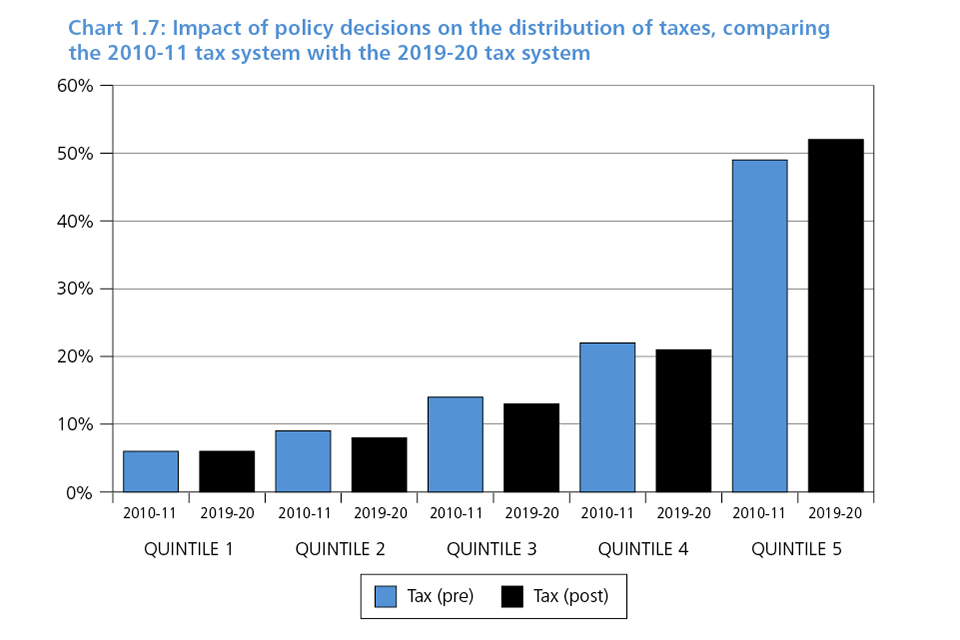

The progressivity of government spending is determined both by how the money is spent, and by how it is raised. Government reforms since 2010, including increases in the income tax personal allowance as well as action on tax avoidance and changes to pensions tax relief, have resulted in the richest households paying a greater share of the taxes paid by households than they were paying in 2010. Chart 1.7 shows the distribution of taxes paid by households in 2019-20, compared to what this distribution would have looked like without any policy changes since 2010-11. The chart shows that:

- the highest income households pay the bulk of taxes; the richest 20% of households will pay more tax than all the other households put together in 2019-20

- the richest 20% of households will be paying a greater proportion of taxes in 2019-20 than in 2010-11 as a result of government policy, while households in the remaining quintiles will be paying a smaller share

3.4 Carrying out the Spending Review

The government has undertaken a comprehensive programme of engagement to consult on the major spending challenges facing the country. Over the summer:

- the government invited written representations from organisations and individuals on the Spending Review – more than 500 submissions were received and considered as part of the decision-making process

- more than 22,000 ideas were put forward by public sector workers on how to reduce waste and deliver services more efficiently, as part of the Public Sector Efficiency Challenge – many of these will be implemented

- the government consulted experts across the public, private and third sectors through a series of workshops on issues such as exploiting technology to improve services and reduce cost, and greater collaboration between services

- the What Works centres submitted their key findings on the cost-effectiveness of spending programmes and discussed their evidence with the Chief Secretary

- the Chancellor chaired the Public Expenditure Committee (PEX), bringing together cabinet ministers to consider cross-cutting spending and policy issues

4. Protecting Britain’s national security

The first duty of government is to ensure the economic and national security of the country and its people. The UK’s national security rests on sound public finances and the Spending Review takes the necessary steps to deliver that. The investment decisions the government is making means the UK will continue to be protected with a cutting-edge military, strong domestic security, robust cyber defences and a truly global reach. The UK’s overseas aid budget, its diplomatic network and organisations like the BBC World Service and the British Council means we can project British values abroad.

The Spending Review delivers on the government’s commitment to increase defence and security spending over the next 5 years, spending 2% of GDP on defence and 0.7% of Gross National Income (GNI) on Official Development Assistance (ODA). The UK is the only country to meet both of these commitments, consolidating its leading role in shaping a more stable and secure world. The government has published a new ODA strategy setting out how it will meet its promises to the world’s poor and put international development at the heart of our national security and foreign policy.

4.1 Defence and security

Over the last Parliament, the government invested in new defence capabilities while bringing the defence budget under control and successfully drawing down from operations in Afghanistan.

4.2 Investing to secure Britain’s future

The Summer Budget announced that the MOD budget would rise by 0.5% above inflation each year to 2020-21. The Spending Review announces that an additional £3.5 billion will also be available from a Joint Security Fund over the next 5 years to fund new defence and security capabilities. The Security and Intelligence Agencies will see their budgets rise by 18% in real terms. The Home Office (HO) will make £500 million of new investments to 2021 in the UK’s core counter terrorism capabilities.

The Spending Review funds the Strategic Defence and Security Review (SDSR) in full, enabling the government to respond effectively to the strategic threats and opportunities that the UK faces.

Table 1.7: Joint Security Fund

| Department | £ billion |

|---|---|

| Ministry of Defence | 2.1 |

| Single Intelligence Account | 1.3 |

| Special Reserve | 0.1 |

| Total Joint Security Fund | 3.5 |

With the Joint Security Fund and a growing budget, MOD will invest £11 billion in new capabilities, innovation and the defence estate. F35 aircraft will be purchased sooner than planned, so that by 2023 Britain will have 1 of its 2 new aircraft carriers available at all times to operate anywhere in the world, capable of deploying with 24 F35 jets on board. The government will buy 9 Maritime Patrol Aircraft to protect the nuclear deterrent and develop plans for a new general purpose frigate for the Navy, as part of a national shipbuilding strategy to be published in 2016. The government will also make the necessary resources available to build 4 new submarines to renew the UK’s Trident-armed nuclear deterrent.

The Joint Security Fund will enable the intelligence agencies to increase their headcount by 15%, 1900 more intelligence officers, improving their capacity to investigate, analyse and disrupt terrorist threats. The Single Intelligence Account (SIA) will also invest in a bigger and more capable global network and enhance its capability to fuse intelligence with the armed forces to disrupt threats and take decisive action in the most hostile operating environments worldwide.

Counter-Terrorism

The UK, like other countries, faces a clear terrorist threat. At Summer Budget, the government committed to protecting cross-government Counter-Terrorism (CT) spend of more than £2 billion per year. This spending has been reviewed and tested within the SDSR to identify efficiencies for reinvestment and to ensure it reflects our highest counter terrorism priorities. On top of that, the government will spend 30% more overall in real terms on key counter terrorism capabilities over the Parliament. Together, this will mean:

- investment in new counter terrorism capabilities for the security and intelligence agencies worth £1.4 billion to enable them to investigate, analyse and help disrupt terrorist plots

- £2 billion of new investment in the capability of UK Special Forces to strike terrorists wherever they are in the world

- £500 million of additional investment in the Home Office to protect UK citizens from terrorist threats, including: a real terms increase to the CT Policing Grant; a new National Digital Exploitation Service to analyse the growing volumes of seized media for evidence and intelligence leads; an increased number of specialist firearms officers; improved intelligence and threat detection at the border; and increased efforts to counter the poisonous ideologies that feed terrorism and extremism

To enable the government to respond to emerging threats to UK interests overseas, including regional stability, the Spending Review announces that the government will expand the Conflict, Security and Stability Fund to more than £1.3 billion a year by 2020 to enable the UK to respond rapidly and effectively to crises and instability and meet our international peacekeeping commitments.

The National Cyber Security Programme will build on the successes of the last Parliament and expand in scope and ambition. The government will create a new National Cyber Centre to be a unified source of advice and support for the country and will continue its investment in the offensive cyber programme to ensure the UK has cutting edge capabilities in this new domain of warfare. In total the government will spend £1.9 billion on cyber capabilities, an increase of 76% on the last Parliament.

All of the departments and organisations involved in defence and security will achieve more within their budgets and deliver significant efficiencies. MOD will deliver £9.2 billion of savings, the SIA will deliver £1.3 billion and £400 million will be achieved from cross government counter-terrorism spending. Some of MOD’s savings will come from freeing up unused assets, including £1 billion from estate sales. All of these savings will be reinvested into capabilities to protect our national security.

To maintain the UK’s global influence, freedom of action and operational advantage, the government will broaden the supply base and encourage new and innovative companies by establishing a £165 million Defence and Cyber Innovation Fund. The government will ensure its buying decisions support defence exports where possible and will establish a dedicated team to support the negotiation and delivery of government-to-government defence and security deals. To further support innovation the government will dedicate 1.2% of its growing defence budget to science and technology over this Parliament.

4.3 Security at home: police and law enforcement

Police reform is working. Over the last Parliament, police constables showed extraordinary innovation and creativity to find £1.5 billion of savings in local police force budgets. During this time, crime has fallen by more than a quarter, the proportion of officers in frontline roles has increased to 92%, victim satisfaction with the police has remained strong and the local accountability of policing has been strengthened, with the first Police and Crime Commissioners (PCCs) elected in 2012.

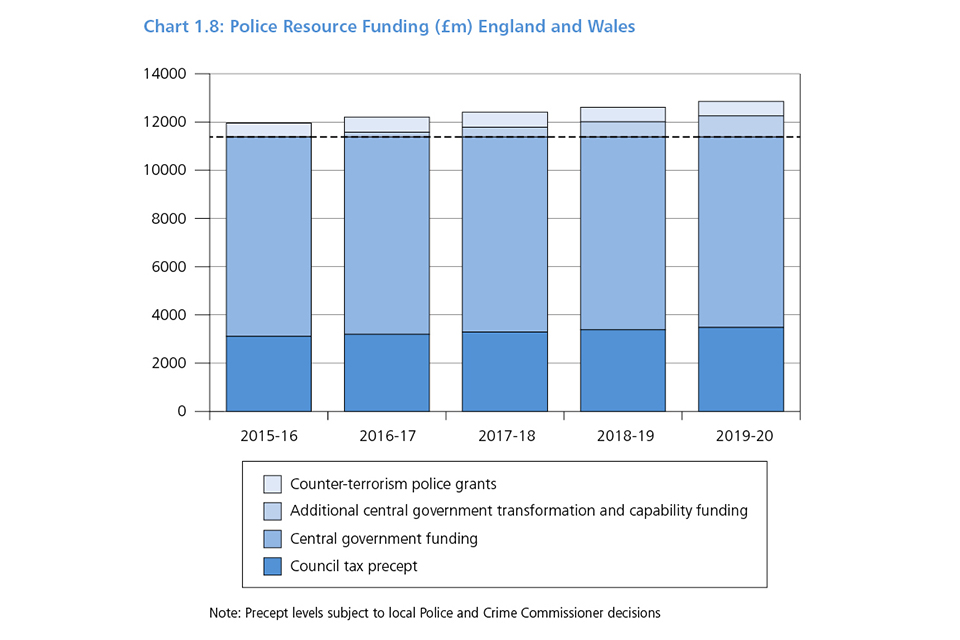

The government will protect overall police spending in real terms over the Spending Review period, an increase of £900 million in cash terms by 2019-20. This will provide funding to maintain overall police force budgets at current cash levels. The government will allocate additional transformational funding to those forces which have strong proposals to support efficiency and reform and to help transition to new funding arrangements in future. This funding will also allow forces to adapt to changing crime threats and to train more firearms officers to ensure the country extends its capability to protect its citizens from terrorist threats. The government will also protect the National Crime Agency’s budget as it leads UK law enforcement’s fight to cut serious and organised crime.

The government will offer PCCs greater flexibility in their local funding decisions by rewarding those areas which have historically kept council tax low. This will allow them to raise up to an additional £12 million per year compared to a 2% annual increase.

The government is taking steps to enable police officers to spend more time fighting crime. The Spending Review invests nearly £1 billion in the next generation of 4G communications network for the Emergency Services which will enable officers to access key police databases, take mobile fingerprints and electronic witness statements and stream live body worn video – all whilst on the move. This critical national infrastructure will free up officers’ time, save the taxpayer around £1 million a day when fully operational and connect all emergency services on the same broadband network for the first time. Alongside this the government will help forces to improve police efficiency by taking steps to drive down the cost of police procurement by up to £350 million and encouraging greater collaboration between police forces and with other public and emergency services.

The government will fund new digital and investigative capabilities for the National Crime Agency, transforming it into a world-leading law enforcement agency tackling cyber-crime, child sexual exploitation and the distribution of criminal finances.

4.4 UK aid: tackling global challenges in the national interest

The government is committed to spending 0.7% of GNI on ODA, as enshrined in law.

The government has published a cross-government ODA strategy, which outlines its new approach to UK aid spending. The strategy is underpinned by a very clear guiding principle: that the UK’s development spending will meet its moral obligation to the world’s poorest and also support the UK’s national interest. In line with that principle, the government will shape its ODA spending according to four strategic objectives: to strengthen global peace, security and governance; to strengthen resilience and response to crises; to promote global prosperity; and to tackle extreme poverty and help the world’s most vulnerable. The government will ensure that all ODA spend is good value for money.

The government will spend 0.7% of GNI on ODA every year, rising to £16.3 billion per year by 2020. This will include:

- an increase in aid spending for the Syrian crisis and the related region. This includes increased spending in DFID directly for the region and over £460 million of ODA to resettle up to 20,000 of the most vulnerable Syrian refugees, covering the full first-year costs to ease the burden on local communities

- a new £500 million ODA crisis reserve, enabling flexible, quick and effective cross-government responses to crises as they happen

- a new £1 billion Ross Fund over the next 5 years, partnered by the Bill and Melinda Gates Foundation, to invest in the research and development of drugs, vaccines, diagnostics and treatments which will combat the most infectious diseases, including the fight to eradicate malaria. The fund will also support work to fight diseases of epidemic potential, such as Ebola, neglected tropical diseases, and drug resistant infections. This will harness the best of British research to save millions of lives around the world while better protecting UK citizens from the threat of disease.

- a new Global Challenges research fund of £1.5 billion over the next 5 years to ensure UK science takes a leading role in addressing the problems faced by developing countries

- an increase in funding for the BBC World Service of £34 million in 2016-17 and £85 million a year thereafter, a significant proportion of which will be ODA. As a provider of accurate, impartial and independent news the BBC World Service helps to strengthen democratic accountability and governance, and promote Britain and our values around the world

DFID will remain the UK’s primary channel for aid, but to respond to the changing world, more aid will be administered by other government departments, drawing on their complementary skills.

4.5 Global prosperity: strengthening UK influence abroad

The government will use ODA to promote economic reform in the developing world. The Spending Review will create a new cross-government Prosperity Fund worth £1.3 billion over the next 5 years, to support global growth, trade, stability and reduce poverty in emerging and developing economies, which will also open up new markets and opportunities to the UK.

The government will protect the Foreign and Commonwealth Office (FCO) budget in real terms. This will enable the FCO to support successful Economic and Financial Dialogues with China, India, Brazil and others. The FCO will increase its engagement in the Middle East and the Gulf to maximise the UK’s influence on issues of security, stability and prosperity. The FCO will invest over £400 million in its estate, including new embassy buildings in Abuja and Budapest. This will open up global markets and safeguard British citizens overseas. The FCO’s global network will be strengthened, supporting UK businesses access to global markets and safeguarding British citizens overseas.

The government will do more to project the UK’s values and influence abroad, including by protecting funding for the British Council in real terms. The government will continue to invest in English language training for young people around the world. To help strengthen the governance and prosperity of developing countries and build strong relationships with global leaders of the future, the government will fund 2,200 scholarships per year to study in the UK.

To take advantage of trade and investment opportunities created by increasing global prosperity the government will refocus UK Trade and Investment (UKTI) to enable it to become a world-class export and investment promotion agency. The government will also make it easier for those coming to do business and visit the UK. The government will trial a 2 year visa for Chinese visitors from January 2016 with plans to extend this to a 10 year visa.

4.6 Climate change

The UK’s security and prosperity is vulnerable to climate change, and this challenge requires a global response. The government will continue to push for a strong global climate change agreement in Paris this December, to keep the goal of limiting global warming to 2 degrees above pre-industrial levels firmly within reach.

The Spending Review announces a 50% increase in funding over the next 5 years for developing countries to tackle and adapt to climate change.

The government will double its domestic energy innovation programme. In line with this, the UK will continue to play a leading role in international research efforts to reduce the costs of low carbon energy, working with other countries to strengthen international collaboration and transparency in clean energy research, development and demonstration.

5. A sustainable health and social care system

A fully funded NHS is only possible with a strong economy and strong public finances. The Spending Review announces the biggest ever investment in the healthcare system to ensure high quality and sustainable care for families across the country 7 days a week. The Spending Review also puts more investment into social care and devolves greater power to local areas to make decisions about their health and social care services to drive forward an ambitious plan to integrate health and social care by 2020.

5.1 A sustainable NHS ready for the future

The Spending Review confirms that the NHS will receive £10 billion more in real terms by 2020-21 than in 2014-15, with £6 billion available by the first year of the Spending Review so that the government fully funds the NHS’s own Five Year Forward View. By taking the difficult decisions required elsewhere, the government is able to increase NHS spending in England from £101 billion in 2015-16 to £120 billion by 2020-21. [footnote 43] This is £2 billion more than the NHS asked for in its Five Year Forward View. Alongside this, the government expects the NHS to deliver £22 billion of the efficiency savings it said it can find in the Five Year Forward View, to deliver the best value from NHS resources.

The government’s investment will ensure that everyone will be able to access services in hospitals 7 days a week and GP services in the evenings and at the weekend. By 2020-21 the NHS will be funded to provide:

- 800,000 more elective admissions to hospital for procedures such as operations

- 5.5 million more outpatient appointments

- 2 million more diagnostic tests

- over 100 million more free prescriptions every year

- new hospitals in Brighton, West Birmingham and Cambridge over the next 5 years

This investment will result in faster diagnosis, more effective treatment and greater choice of services, and provide greater funding for new clinical strategies such as cancer and mental health, including:

- implementing the recommendations of the Independent Cancer Taskforce so that by 2020 patients referred for testing by a GP should be diagnosed for cancer, or given the all clear, within 4 weeks. This will be delivered by investing up to £300 million a year by 2020 to fund new diagnostic equipment and additional staff capacity, including 200 additional staff trained to perform endoscopies by 2018

- investing an additional £600 million in mental health services. Additional investment will mean that significantly more people will have access to talking therapies every year by 2020. NHS England’s Mental Health Taskforce will report in early 2016 and the government will work with them to set out transformative plans, including for perinatal mental health and coverage of crisis care.

The Spending Review reforms the funding system for health students by replacing grants with student loans and abolishing the cap on the number of student places for nursing, midwifery and allied health subjects. The current grant system means that there is a cap on student nurses and over half of all applicants to nursing courses are turned away. This reform will enable universities to provide up to 10,000 additional nursing and other health professional training places this Parliament. This will ensure that there are enough nurses for the NHS while cutting the current reliance on expensive agency staff. The move to loans will also mean access to 25% more financial support for health students during their studies. The government will work with key stakeholders to implement the reforms.

The government will invest £1 billion in new technology over the next 5 years to deliver better connected services for patients and ensure that doctors and nurses have the information they need at their fingertips. By September 2018, 80% of clinicians in primary, urgent and emergency care will have digital access to key patient information. By 2020 integrated care records will give every health and care professional concerned with an individual’s care the information they need to provide safe and prompt care. The government will invest £10 million in expanding the Healthcare Innovation Test Bed programme. This facilitates partnerships between industry and the NHS to make healthcare more effective and efficient by testing combinations of new digital technologies and innovations in NHS services. The Test Bed programme will fund a testing site in every region.

The government is investing over £5 billion in health research and development to support work on some of the biggest health challenges facing the UK and the international community. This will include:

- £250 million for the 100,000 Genomes Project to introduce whole genome sequencing technology in the NHS, including funding for Genomics England

- launching the Global Antimicrobial Resistance Innovation fund, partnered with China, to combat the threat from emerging strains of diseases resistant to existing treatments. The government is investing £50 million in this fund to address underinvestment in antimicrobial resistance research and providing an initial investment of £4 million to establish an Antimicrobial Resistance Centre of Excellence in Research and Development at Alderley Park, subject to a business case

- the government will fund a new £1 billion Ross Fund, partnered by the Bill and Melinda Gates Foundation, to invest in the research and development of drugs, vaccines, diagnostics and treatments which will combat the most infectious diseases, including the fight to eradicate malaria

The Five Year Forward View set out how the NHS will deliver £22 billion in efficiency savings by 2020-21. This will come through improvements to quality of care and prevention, staff productivity and better procurement. For example, the Carter Review sets out how hospitals could save £5 billion by making better use of staff, using medicines more effectively, and buying the most cost-effective goods and services.

The government will make savings in local authority public health spending. The government will also consult on options to fully fund local authorities’ public health spending from their retained business rates receipts, as part of the move towards 100% business rate retention. The ringfence on public health spending will be maintained in 2016-17 and 2017-18.

The government remains committed to tackling society’s health problems, not just treating the symptoms. Key national services will continue to be mandated, and the government will look to devolve greater powers so that local authorities can take preventative action. The government will take a national lead in tackling obesity as the leading cause of preventable ill-health, with a specific focus on protecting the health of our children. Details will be set out in a Childhood Obesity strategy in 2016. This will take account of what the evidence says is needed.

In addition, the government wants to improve links between health services and employment support, recognising timely access to health treatments can help individuals return to work quicker. Over £115 million of funding will be provided for the Joint Work and Health Unit, including at least £40 million for a health and work innovation fund, to pilot new ways to join up across the health and employment systems. To further integrate services and help people back into work, where it has been agreed as part of a devolution deal, local areas will co-design employment support for harder-to-help claimants. The government will also publish a White Paper in 2016 that will set out reforms to improve support for people with health conditions and disabilities, including exploring the roles of employers, to further reduce the disability employment gap and promote integration across health and employment.

5.2 Adult social care

The Spending Review creates a social care precept to give local authorities who are responsible for social care the ability to raise new funding to spend exclusively on adult social care. The precept will work by giving local authorities the flexibility to raise council tax in their area by up to 2% above the existing threshold. If all local authorities use this to its maximum effect it could help raise nearly £2 billion a year by 2019-20. [footnote 44] From 2017 the Spending Review makes available social care funds for local government, rising to £1.5 billion by 2019-20, to be included in an improved Better Care Fund.

Taken together, the new precept and additional local government Better Care Fund contribution mean local government has access to the funding it needs to increase social care spending in real terms by the end of the Parliament. This will support councils to continue to focus on core services and to increase the prices they pay for care, including to cover the costs of the National Living Wage, which is expected to benefit up to 900,000 care workers.

The government will also continue to improve care for older and disabled people and support for their carers. The Care Act reforms introduced in April focus on wellbeing, prevention and delaying the need for social care. In support of these principles, the Spending Review includes over £500 million by 2019-20 for the Disabled Facilities Grant, which will fund around 85,000 home adaptations that year. This is expected to prevent 8,500 people from needing to go into a care home in 2019-20.

The government remains committed to introducing the Dilnot reforms to social care, with funding provided in 2019-20 to cover the costs of local authorities preparing for these changes. The cap on reasonable care costs and extension of means tested support will then be introduced and funded from April 2020. The deferred payments scheme already means that no one will be forced to sell their home in their lifetime to pay for care.

5.3 Integrating and devolving health and social care