Pre-pack sales in administration report

Published 8 October 2020

1. Foreword

1.1 Foreword from the Parliamentary Under Secretary of State for Business, Energy and Industrial Strategy

The Government wants to make Britain a great place to work and do business, where entrepreneurialism is encouraged, and innovation thrives. A key objective in supporting businesses is to have a strong business rescue and insolvency framework which preserves jobs and value where possible and returns money to creditors. This is why, in response to the unprecedented economic situation arising due to Covid-19, Government recently made changes to insolvency legislation. The new rescue and restructuring measures introduced in the Corporate Insolvency and Governance Act 2020 will help businesses bounce back from the current coronavirus pandemic and provide the road map to recovery and renewal.

It is important to have an environment where those who are affected by insolvency have confidence in a process that is fair and transparent and achieves the best outcome for creditors, encouraging inward investment and boosting growth.

I recognise that pre-pack sales are a valuable part of the insolvency landscape, representing around 29% of all administrations. They can be a useful tool to rescue businesses, saving jobs and preserving value. However, creditors are often unaware of the sale until the transaction has completed and pre-packs can be controversial where the business is sold to a person connected with the insolvent company, for example existing management or family members Although this may sometimes deliver the best outcome possible in the circumstances.

We have reviewed the effectiveness of the package of voluntary measures introduced in 2015 to improve creditor confidence in pre-pack sales. Despite some improvement in how businesses are marketed, and the provision of more information being made available for creditors, concerns remain about the transparency of pre-pack sales and whether they are always in the best interest of creditors. This is particularly the case where the sale is to a connected person, which represent around half of all pre-pack sales. These issues were highlighted during the recent Parliamentary debates on the Corporate Insolvency and Governance Act.

We need to address these concerns in order to improve confidence in the process and the Government will therefore, be bringing forward legislation which places certain conditions on connected person sales in administration. We will also take steps to strengthen professional regulatory standards and the improve the quality of the information provided to creditors.

Together, these reforms will improve transparency and creditor confidence in the pre-pack process, contributing to the strength of the UK’s first-class insolvency framework. The measures will promote viable business rescue while balancing the rights of those affected by failure and will contribute to leading the country’s economic recovery from Covid-19.

Lord Callanan

Minister for Climate Change and Corporate Responsibility

2. Executive summary

This report sets out the findings and recommendations of a review to assess the impact of voluntary industry measures introduced in November 2015 to improve the transparency of pre-pack sales in administration. Since then the business and economic landscape has changed dramatically as a result of the emergency restrictions that Government has had to impose on businesses, public services and individuals because of the COVID-19 pandemic.

The purpose of the review was to inform a decision on whether the government should use a power inserted into the Insolvency Act 1986 by the Small Business, Enterprise and Employment Act 2015 (the “SBEE Act”) to regulate or ban sales in administration to connected persons (including via a pre-pack sale). The power expired at the end of May 2020 before it was used but was revived in the Corporate Insolvency and Governance Act 2020 (the “CIG Act”), which introduced measures to help businesses survive the pressures of the COVID-19 emergency. The revived power will enable government to regulate connected person pre-pack sales, provided it is exercised before the end of June 2021.

There is no legal definition of a pre-pack sale in administration, but it is generally understood to be an arrangement for the sale of all or a substantial part of a company’s business prior to the company entering formal insolvency (administration), after which the appointed administrator completes the sale, usually on day one of the administration, thereby rescuing the business in whole or part. The attraction of the pre-pack sale as a business rescue tool is the speed of the transaction, which helps preserve the value of the business and save jobs, whilst avoiding the costs of trading a business in administration.

Pre-pack sales can raise concerns as they are often arranged between the company and persons connected with the company, such as directors or their family members, with creditors only being informed after the event, giving them no say in the sale. Criticism of pre-pack sales led to the Coalition Government commissioning Teresa Graham to carry out an independent review, which reported in 2014.

The report (“the Graham Review”) concluded, as noted above, that pre-pack sales were a valuable tool for business rescue and can often help to preserve jobs. However, it highlighted the lack of transparency around pre-pack sales for unsecured creditors, leaving them feeling aggrieved and excluded from the process and concerned that the deal was not always in their interests. This is particularly evident in cases where the sale is to a connected person [footnote 1] such as a former director(s) of the old company who are then seen operating the same business through a new corporate vehicle, while the debts of creditors of the old company remain unpaid.

The Graham Review recommended that the insolvency industry should implement a package of voluntary measures to address the issues identified; these recommendations were supported by the Coalition Government and adopted by industry at the end of 2015. The measures included the establishment of a group of experienced business people to give an independent review of a pre-pack sale, improvements to marketing and valuation requirements and to the information to be provided to creditors.

Should the voluntary measures not have the desired effect of increasing confidence and transparency of connected person sales, a power was introduced (s.129 SBEE Act [footnote 2]) to allow the Government to legislate to restrict (place conditions on) or prohibit connected person sales in administration. Section129 of the SBEE Act inserted paragraph 60A into Schedule B1 of the Insolvency Act. Sub-paragraph 60A (10) of Schedule B1 included a requirement for the power to be used within 5 years of its creation; that period expired at the end of May 2020. The CIG Act revived the power by substituting sub-paragraph 10 of paragraph 60A, with a new sub-paragraph 10, providing for expiry of the power at the end of June 2021, unless exercised before that date.

At the end of 2017 the government began a review of the impact of the voluntary measures to determine if the power inserted by SBEE Act should be exercised. The review consulted directly with the same groups of key stakeholders who participated in the Graham Review. It also analysed SIP16 [footnote 3] statements of connected party pre-pack transactions undertaken during the year 2016 to gauge levels of compliance with the voluntary measures and conducted a survey of insolvency practitioners and purchasers for their views on how effective the measures have been.

The review of the SIP16 statements found that there is some evidence of positive change arising from the voluntary measures. It noted an increase in the number of businesses being marketed, from 49% of sales prior to the introduction of the measures to 77% of sales in 2016. Improvements have also been made in the quality of the marketing undertaken. Most stakeholders who participated supported these findings. Some stakeholder concerns remain however regarding transparency and whether pre-pack sales, in particular those to connected persons, always represent best value for creditors. Over a third of cases reviewed were sold for less than market value, two thirds of which were at least 25% less than market value. Whilst this is a concern, the government recognises that there can be valid reasons for this and that the administrator has a duty to accept the offer that will deliver the best outcome for creditors in the circumstances, which may be less than market value.

Many stakeholders expressed disappointment at the low number of connected parties purchasing a business through a pre-pack sale who sought an independent opinion of the deal. The Pre-Pack Pool (“the Pool”), a group of independent, experienced business people, was formed to provide such an opinion; it was a key recommendation of the Graham Review and was set up by the insolvency industry. The number of referrals to the Pool since its creation compared to the total number of connected party pre-pack sales has been very low. Only 36 referrals were made in 2016 out of 163 eligible transactions, with the number of referrals declining to as low as 18 in 2018. Several stakeholders have called for mandatory referrals to the Pool in order to provide greater assurance to creditors that such a sale is appropriate in the circumstances. Aside from the Pool, stakeholders felt that the introduction of the voluntary measures in 2015 had contributed to the reduction in the “noise” surrounding pre-packs.

It was however clear from debates during the passage of the CIG Act that the possibility that more companies would become insolvent as a result of the COVID pandemic gave rise to concerns about the need to protect the interests of creditors while balancing the need to promote company rescue. A point that was emphasized during the debates was that a lack of regulation of pre-pack sales could create opportunities to abuse the system and undermine the new moratorium measure created in the Act.

The comments made in Parliament have been considered in conjunction with the findings of the review process and add further weight to the conclusions drawn.

The conclusion reached by the review and also taking account of concerns raised during the CIG Act, is that the findings of the Graham Review remain valid, in that in many circumstances a pre-pack sale provides the best outcome for creditors following an insolvency. The government does not, therefore, propose that the power to ban connected party sales in administration should be used. This view is supported by the stakeholders who participated in the review. The government also recognises the value and improvement brought to the pre-pack process where the industry measures recommended by the Graham Review have been adopted. However, it appreciates that some shortcomings remain, in particular the limited use of the Pool designed to give creditors and other stakeholders’ confidence that a connected party pre-pack sale is appropriate.

The government believes that introducing new regulations to ensure an independent opinion, or creditor approval, of the pre-pack sale is obtained will positively build on the existing voluntary measures and will help to mitigate any adverse consequences in the increased use of pre-pack sales arising from the pandemic.

The power in paragraph 60A of Schedule B1 of the Insolvency Act 1986 applies to all connected person sales in administration and is not restricted to those that would ordinarily be considered a pre-pack sale. Our proposal therefore only applies to sales that take place within 8 weeks of a company entering administration. The government has worked with industry and stakeholders to develop the technical details to support the proposed regulations. We will also work with the insolvency industry and its regulators to strengthen the regulatory guidance underpinning pre-pack sales, to improve compliance with SIP16 requirements.

A strong and robust insolvency framework, which promotes viable business rescue while balancing the rights of those affected by business failure is essential for encouraging investment and driving a competitive and inventive environment and is needed more than ever in the current emergency. These measures will contribute to the government’s aim to make Britain a great place to work and do business.

3. Background

3.1 The Graham Review

The Graham Review was an independent review commissioned by government to examine the wider economic impact of pre-pack sales and consider options to improve stakeholder confidence in the process. The terms of reference included considering whether pre-pack sales generally provide the best value for creditors as a whole and the importance of the practice in the context of business rescue. The findings of the review were supported by empirical data for 498 pre-pack sales collected and analysed by Professor Peter Walton and Chris Umfreville, with the assistance of Dr Paul Wilson from Wolverhampton University and engagement with key stakeholder groups.

The Graham Review found that pre-pack sales were a useful vehicle for rescuing struggling businesses, helping to preserve employment and at less cost than other insolvency procedures. However, it found pre-pack sales lacked openness, frequently with inadequate marketing being undertaken, particularly where the sale was to a connected person, which could often lead to lower returns for creditors. There was also limited explanation given to creditors of the methodology used to value the business and there were areas where it was felt insolvency practitioners’ regulatory requirements could be strengthened. In addition, it was found that insufficient attention was given to the potential viability of the new company and that there was a higher subsequent business failure rate where there was a sale to a connected party. 29% of connected party pre-packs were found to have failed within three years, compared with only 16% of those that were not sold to a connected party (Graham Review into Pre-pack Administration June 2014 pg. 39 )

The Graham Review recommended a number of voluntary industry-led measures to address the issues identified.

These were:

-

The establishment of a group of experienced business people which could be approached, on a voluntary basis, to offer an opinion on the purchase of a business and/or its assets by parties connected to the company where a pre-pack sale is proposed.

-

The possibility for a connected party purchaser to provide, on a voluntary basis, a “viability review” on how the new company will survive for at least the next 12 months.

-

Marketing to be carried out in accordance with a defined set of 6 principles of good marketing which should be fully explained by the administrator in the report to creditors (commonly known as the SIP16 report). These principles are:

- Broadcast rather than narrow cast -market widely but proportionately to the size of the company.

- Justify the media used - there should be a full explanation of the reasons underpinning the marketing and media strategy adopted.

- Ensure independence - the administrator cannot just rely on marketing carried out prior to their appointment without being satisfied that it was adequate.

- Publicise rather than simply publish - marketing should be undertaken for an appropriate length of time commensurate with satisfying the practitioner that the best deal has been sought

- Connectivity - include online communication alongside other media by default.

- Comply or explain - the administrator must satisfy all creditors by explaining fully their marketing strategy to achieve the best outcome for all creditors.

-

Valuations to be carried out by independent valuers with professional indemnity insurance.

- Changes to SIP16, which sets out the regulatory guidelines for insolvency practitioners on how to handle pre-pack sales.

- The Insolvency Service to withdraw from monitoring compliance of SIP16 statements and monitoring to be handed over to the Recognised Professional Bodies, which authorise and regulate insolvency practitioners.

The government at the time accepted all of Teresa Graham’s recommendations and the measures were introduced in November 2015.

3.2 Small Business, Enterprise and Employment Act 2015

The SBEE Act inserted paragraph 60A into Schedule B1 of the Insolvency Act 1986 to provide a power to enable Parliament either to ban sales in administration to connected persons or to impose restrictions on such sales through regulation. The power expired in May 2020 but was revived until end of June 2021 by the CIG Act. The government’s review of the impact of the voluntary measures was to determine whether the power should be used.

4. About the government’s review

4.1 Key aims

Our review set out to answer the following key questions:

-

Are connected party sales in administration still an area of concern?

-

Have the voluntary measures remedied the perceived lack of transparency and trust in the pre-pack sale process?

-

Have the voluntary measures had an impact on behaviours?

-

Is further regulation of pre-pack sales required?

-

Is the government’s use of the power in paragraph 60A of Schedule B1 of the Insolvency Act 1986 the right way to deal with any concerns that remain?

4.2 Research methodology

Our review gathered both qualitative and quantitative data in relation to connected party [footnote 4] sales in administration. For the purpose of this report the terms “connected party” or “connected person” are generally used interchangeably. A sale to a “connected party” or “connected person” is intended to convey the situation where the owners of the new company (after the pre-pack sale) are connected with the insolvent company or those who controlled the insolvent company. Commonly, the directors of both companies will be the same. However, it should be noted that in respect of the use of the reserve power revived by the CIG Act, the meaning of “connected person” is as defined in paragraph 60A of Schedule B1 of the Insolvency Act 1986.

The quantitative data is broadly comparable with that which was collated for the “Pre-Pack Empirical Research: Characteristic and Outcome Analysis of Pre-Pack Administration” by the University of Wolverhampton, which accompanied the Graham Review. The data used by the Insolvency Service is based on the 12-month period from 1 January 2016 to 31 December 2016, which was used for comparisons with the data collected for the Graham Review for the calendar year 2010.

The government’s review commenced with an initial analysis of all pre-pack sales that took place in 2016 to identify the sales that involved a connected party purchaser. From the information provided by the Recognised Professional Bodies (RPBs), which authorise and regulate insolvency practitioners, we were able to identify 345 pre-pack sales that took place in 2016. Of these, 163 involved a connected party purchaser. No further analysis was made in relation to non-connected party sales.

To analyse the connected party pre-pack sales, we reviewed the information supplied to creditors as part of the administration, including the SIP16 statements, administrators’ proposals and administrators’ progress reports. The following information was captured and reviewed:

- basic information about the companies involved in the transaction, including for the old company, size, age at formal insolvency, reason for insolvency and for the new company date of incorporation and whether it is still trading

- information about the administration including total debts owed to secured and unsecured creditors, whether the administration had come to an end and what, if any, distributions had been made to creditors

- details of the sale, including price paid, valuation obtained, whether there was deferred consideration and the date of the transaction

- details of whether the voluntary measures had been followed including details of approaches made to the Pool, whether viability reviews were provided and whether the 6 principles of marketing had been adhered to

In relation to the regulation of pre-pack sales and monitoring compliance we have referred to data post 2016.

We contacted the following stakeholders to gather evidence and views on the impact of the industry measures:

- British Property Federation (BPF)

- Pension Protection Fund (PPF)

- UK Finance

- R3 (Insolvency industry trade body)

- Chartered Institute of Credit Management (CICM)

- British Printing Industries Federation (BPIF)

- Pre-Pack Pool Limited management team

- H M Revenue and Customs (HMRC)

-

Recognised Professional Bodies:

- Institute of Chartered Accountants in England and Wales (ICAEW)

- Insolvency Practitioners Association (IPA)

- Institute of Chartered Accountants of Scotland (ICAS)

We carried out a survey of around 1500 insolvency practitioners (“IPs”) seeking their views about the effectiveness of the voluntary changes. We received responses from 228 IPs. We also sent out 112 surveys to directors involved in a connected party pre-pack sale, however the response rate was very low: only 13 responses were received.

We would like to take this opportunity to thank all those who have contributed to our review.

5. Review findings

This section details the voluntary measures recommended by the Graham Review in 2014 followed by the findings of the government’s review of their effectiveness.

5.1 Establishment of the Pre-Pack Pool

Graham Review findings and recommendations

Pool opinions: 1. Not unreasonable - Nothing found to suggest that the grounds for the proposed pre-packaged sale are unreasonable. The Pool member has been provided with sufficient information and nothing provided suggests the proposed pre-packaged sale to the connected party is unreasonable. 2. Qualified - Evidence provided has been limited in some areas, but otherwise nothing has been found to suggest that the grounds for the proposed pre-packaged sale are unreasonable. The Pool member has been provided with information and there is nothing within it to suggest the proposed pre-packaged sale is unreasonable. However, some elements of the evidence presented, or arguments made by the connected party (mostly likely to be considered by the pool member as not being of major significance) were limited and not sufficiently made out. 3. Negative - There is a lack of evidence to support a statement that the grounds for the proposed pre-packaged sale are reasonable. The Pool member was not persuaded the grounds for proceeding through a pre-pack transaction were sufficiently made out, on the basis of the evidence presented or arguments made by the connected party.

A key recommendation of the Graham Review was the establishment of the Pool, which was set up by the insolvency industry and instituted on 1 November 2015.

Teresa Graham noted that one of the main criticisms received about pre-packs from many of those who had engaged with her review was that there was a lack of transparency with pre-pack sales and that perceptions were that connected cases were inherently less fair to creditors. The objective in setting up the Pool was to alleviate these concerns and to provide greater confidence that a pre-pack sale was the best option in the circumstances, preserving value in the company, and thus benefitting creditors.

Connected person purchasers can approach the Pool on a voluntary basis to seek an independent opinion on a pre-pack sale proposal. The Pool is made up of a group of experienced business people who were recruited through an open competition. Current members include chartered directors and accountants. Further details about the Pool can be found on the website www.prepackpool.co.uk.

Applications to the Pool are considered by individual Pool members, who are required to give an opinion within 48 hours of the application being received. The fee to make an application to the Pool is £950 + VAT, which covers all costs associated with the provision of the opinion by a Pool member. There are three possible opinions (set out in the adjacent text).

A negative opinion from the Pool does not mean that a pre-pack sale cannot go ahead but, if the administrator decides to accept an offer from the connected party and proceed with the sale, they would have to explain to the creditors in the SIP16 report why they felt the sale was appropriate, given the opinion of the Pool member. The administrator also must set out in the SIP16 report whether the Pool was approached for an opinion where the sale has been to a connected party.

Government Review findings

Despite the number of connected party pre-packs increasing since 2016 as Table 1 below shows (in 2016 47% of all pre-packs were connected and this increased to 57% the following year) there has not been a corresponding rise in the number of referrals to the Pool. It was anticipated that the Pool would deal with around 200 applications per year, but uptake has been significantly lower than expected.

During 2013 (the year prior to the publication of the Graham Review) there were 600 administrations that involved a pre-pack sale, of which 438 were to a connected party. In 2016 there were 345 pre-pack sales and 163 of these were to a connected party. Whilst there was a fall in the number of eligible cases for referral to the Pool between 2013 and 2016, the proportion of those eligible cases that approached the Pool in 2016 was disappointing as only 36 applications were made. This represents 22% of eligible transactions. In comparison, in 2013 an expectation of around 200 cases per year would have equated to 46% of eligible transactions. Of the 2016 referrals, 33 received a ‘not unreasonable’ opinion, 3 a ‘qualified’ opinion and none received a ‘negative’ opinion.

The value of the sales referred to the Pool in 2016 ranged between £7,500 and £44 million. The combined total value of sales for which an opinion was sought was £94 million.

Since 2016 the number of referrals to the Pool has steadily declined until 2019 when there was a small increase in referrals. Although any increase of referrals to the Pool is a positive step, the number referred in 2019 (23), represents only a small proportion of eligible cases (9%), see Table 1 below. To the end of August, there have been 27 referrals made to the Pool this year.

Table 1 – Numbers of administrations and referrals to the Pool

| Administrations and referrals | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|

| Total number of pre-packs | 345 | 356 | 450 | 473 |

| Number of pre-packs which were a connected party sale | 163 | 203 | 241 | 260 |

| Referrals to the Pool | 36 | 23 | 18 | 23 |

| Proportion of connected party sales referred to the Pool | 22% | 11% | 7% | 9% |

The review sought to understand why there has been such a limited uptake in referrals.

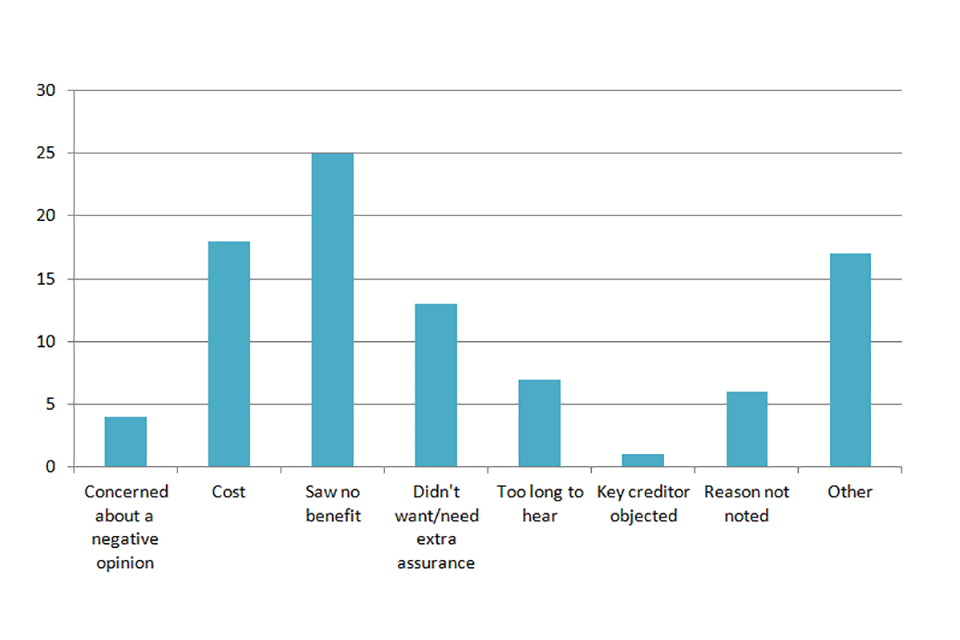

In response to our survey question seeking reasons why referrals to the Pool were not made, 91 insolvency practitioners provided the responses summarised in Chart 1. The most common response (25 responses) was that the purchaser saw no benefit in making a referral. 18 respondents cited the cost of a referral as a factor, and only 4 cited that concerns about a negative opinion may dissuade purchasers from making a referral.

Chart 1 – Insolvency Practitioner survey responses regarding purchasers declining to use the Pool

Others (17 respondents) suggested that the low number of referrals was due to a combination of reasons:

-

insolvency practitioners are only required (by SIP16, the regulatory guidance) to make potential connected party purchasers aware of their ability to approach the Pool, they are not required to recommend that the Pool be approached (although some insolvency practitioners do so);

-

there are no consequences to not seeking the Pool’s opinion, as it is a voluntary option and not a requirement for the sale to complete.

Whilst some stakeholders said that an opinion from the Pool (or lack of one) would not affect their decision to trade with a business that was sold to a connected party purchaser, other creditor groups said that their members valued the Pool’s decision, and that the opinion did influence their decision as to whether to trade with the new company. They also stated that where the Pool had been utilised, the opinion given helped to demonstrate to creditors that in some circumstances a sale to a connected party provided a reasonable outcome for creditors.

As data for only 36 sales could be collected for referrals made to the Pool in the year 2016, it is difficult to measure accurately the impact of the Pool. There was, however, general agreement that the operation of the Pool worked well and that the low uptake did not in any way reflect the functioning of the Pool itself.

Stakeholders were disappointed that the Pool is not being used effectively, or often enough. There was support from the insolvency industry trade body R3, the British Property Federation and the Chartered Institute of Credit Management for making referral to the Pool mandatory, or the establishment of a similar statutory mechanism to require an independent opinion for connected person pre-pack sales. Some stakeholders felt the remit should be wider and apply to all sales in administration and potentially other insolvency mechanisms as well. Importantly there was no appetite from the key groups the review engaged with to ban connected party sales. A small number of insolvency practitioners stated that they would welcome the opportunity for insolvency practitioners to be able to make a referral requesting an independent opinion from the Pool, rather than this being limited only to the potential purchasers’ willingness to do so.

During debate of the CIG Act, there were also a number of calls to implement mandatory referral to the Pre-Pack Pool as an immediate measure. While the regulations will require an independent opinion on a connected party sale, we are not proposing that the regulations should specify that an opinion must be obtained from the Pool, since this was not the intention when the enabling power was created.

5.2 Viability statements

Graham Review findings and recommendation

Teresa Graham’s report stated that a criticism of pre-pack sales was that businesses with fundamentally unviable business models were allowed back into the marketplace post pre-pack to fail again. The Wolverhampton research indicated that where the old company and new company were controlled by connected parties, the new company was more likely to fail than where the old company and new company were controlled by unconnected parties. This led the Graham Review to recommend that connected party purchasers complete (on a voluntary basis) a “viability statement” outlining how the company intends to survive for at least the 12 months following the date of the statement and to provide details of what the new company intended to do differently (from the old company) to avoid failing again.

Government Review findings

It is difficult to assess fully the impact of this measure due to the low number of SIP16 statements that included a viability statement.

Of the 163 connected party pre-packs reviewed as part of the evaluation:

* 45 (28%) SIP16 statements stated viability reviews/cash flow forecasts had been provided. Of these, 31 (69%) of the purchasers are known to have been still trading after a period of 12 months.

-

In 91 cases there was no evidence of a viability statement. 79 (87%) of these purchasers were still trading after 12 months. It is possible, however, that in these 91 cases, the connected party prepared a viability statement and/or cash flow forecasts but had not disclosed this to the administrator.

-

In 27 cases (16%) reviewed it was indeterminable whether a viability statement had been produced due to lack of detail in the SIP16 statement.

As stated above only about a quarter of purchasers involved in connected party pre-pack sales in 2016 provided a viability statement to the administrator. However, R3 indicated that suppliers generally want to see some form of viability reviews/cash flow forecasts prior to entering into business with a new company. As viability statements may contain confidential and commercial information as to what the purchasers intend to do with the new business, they may be unwilling to provide a viability statement when requested. Alternatively, it may be that the insolvency practitioner acting as administrator and overseeing the pre-pack is not requesting the purchaser to provide a viability statement, which would indicate non-compliance with the requirements of SIP16 regulatory guidance.

In discussions with stakeholders no concerns were raised regarding the lack of viability statements. However, the government considers that there continue to be benefits to completing viability statements for the reasons highlighted in the Graham Review. Therefore, we will work with stakeholders to encourage greater use.

5.3 Marketing

Graham Review findings and recommendation

The Graham Review found that administrators often wholly abstained from marketing pre-pack sales. In cases where marketing was carried out there was often no evidence of when or how it was carried out, or over what period.

The findings of the Graham Review led to Teresa Graham recommending that all marketing of businesses for the purpose of a pre-pack sale should comply with 6 principles of good marketing (detailed at page 8). It was accepted that in certain limited circumstances it may not be appropriate to conduct full marketing, for example it may be a niche business with no alternative buyer. Therefore, SIP16 states that any deviation from the marketing principles requires the administrator to explain how a different strategy will deliver the best available outcome.

Government Review findings

It is important to note that the data gathered on marketing during the government’s review was reliant on the information supplied by administrators in the SIP16 statements. The review included consideration of the level of detail provided in the SIP and whether the marketing principles were fulfilled in that respect. We found that the level of detail on marketing activities in the SIP16 statements varied significantly.

The review of SIP16 statements found that marketing activity has increased for connected party pre-packs, from 49% prior to the introduction of the recommendations of the Graham Review, to 77% of sales in 2016. In 2014, the year preceding the introduction of the Graham Review recommendations, connected party sales accounted for 67% of all pre-packs. In 2016 this had dropped to 47%, although increasing slightly to 53% in 2018. This may indicate that increased marketing has widened the pool of potential purchasers, resulting in potential connected party purchasers losing out to competitors. Feedback from many stakeholders about the positive impact of the marketing changes supports this conclusion.

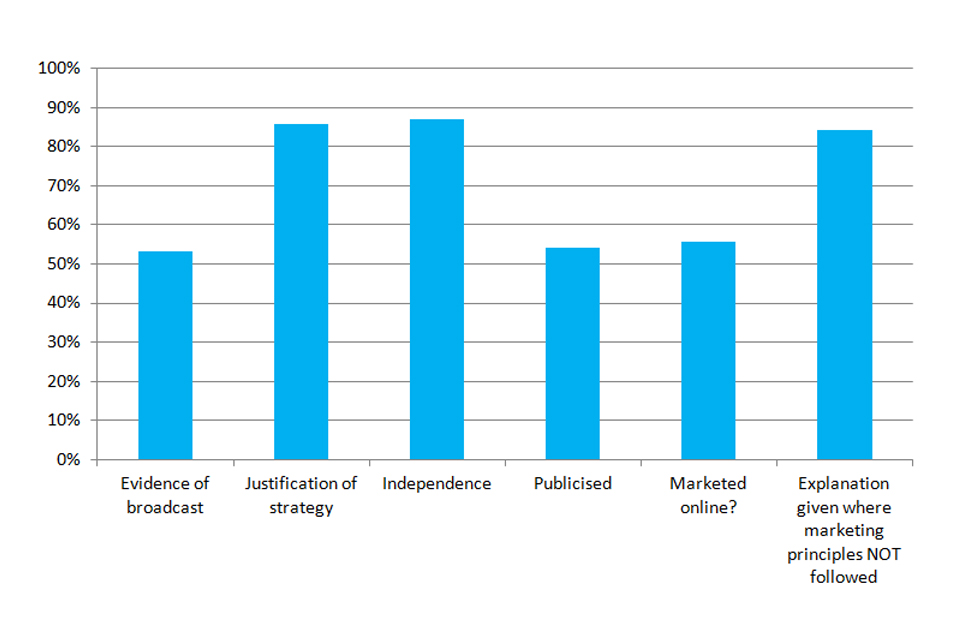

Although evidence shows increased marketing activity is being undertaken, our review has found that compliance with the ‘6 principles of marketing’ varies widely between insolvency practitioners and from case to case. It is notable that there was greater than 80% compliance in respect of 3 of the principles, but the principles that encourage exposure of the business to the market “publicised” (54% compliance) “broadcast” (53% compliance) and “marketed online” (56% compliance) have only been complied with in just over 50% of cases. See Chart 2 for a breakdown of compliance per marketing principle.

Chart 2 – Compliance with the marketing requirement and its “six principles of marketing” introduced following the Graham Review recommendations

SIP16 requires an administrator to “comply or explain” their marketing strategy and only after the sale has been completed. The administrator is thus able to deviate from the principles of marketing as long as an explanation is provided. The review found that of those that deviated from the marketing principles, over 80% of administrators provided justification for their marketing strategy.

The review identified 35 (21%) cases where there was no marketing carried out at all. Justification was provided by the administrator in all but one of these cases. It is for the RPBs in their role as regulators of the insolvency profession to determine whether the explanation provided by the administrator for not marketing the company stands up to scrutiny. We concede (as the Graham Review did) that in some limited cases it may be acceptable for no marketing (Graham Review pg. 47 ) to be undertaken but SIP16 emphasises: “marketing a business is an important element in ensuring that the best available price is obtained for it.” The implication of the SIP therefore, is that if a business is not marketed, the best available price may not be achieved.

Of the 35 cases where no marketing was carried out, 43% of these sales were sold below the valuation figure. This is comparable to cases where marketing was undertaken, out of 125 such cases, 46% of the sales were sold below the valuation. However, creditors tell us that where marketing is carried out there is transparency and creditors can have greater confidence that a fair price has been obtained. During the Graham Review, creditors said that a lack of marketing can impact on their perceptions of connected party sales and whether the business is being sold for fair value.

The government will work with stakeholders to improve adherence to the marketing principles and ensure that where no marketing has been undertaken, the explanation provided by the administrator is probed by the regulator where necessary.

5.4 Valuations

Graham Review findings and recommendations

In November 2013 an updated SIP16 was issued by the Joint Insolvency Committee which placed greater emphasis on the provision of information relating to valuation. The Graham Review acknowledged the changes made in 2013 to SIP16 to improve the quality of valuations. These changes were post the Graham Review’s 2010 data source.

The Graham Review recommended one further improvement to the valuation requirements. This improvement required insolvency practitioners to use a valuer who held professional indemnity insurance (PII) or explain why they had decided not to do so. This is because insurers will carry out checks before offering PII cover to a valuer. Creditors of an insolvent company can therefore have greater assurance that a valuation carried out by someone with such cover will represent a fair value for the business or the company’s assets.

Valuation v purchase price

The Graham Review found that independent valuations described in SIP16 statements or the administrator’s statutory proposals were often desk-top valuations only. While in some cases a desk-top valuation may be appropriate, for example, for most vehicles, in others it may not be appropriate. The researchers also found that it was common, where there had been a connected party sale, for the purchase price to exactly match the valuation figure. Teresa Graham raised concerns that this could lead to a suspicion on the part of creditors that a purchaser had set the valuation figure as an indicator of how much it was prepared to pay, rather than the market value of the assets in question.

Government Review findings

As with the data gathered on marketing during our review, the data gathered on valuations was obtained from the information supplied by administrators in the SIP16 statements.

The review of the SIP16 statements established that of the 163 connected party pre-packs in 2016, 149 (91%) had obtained an independent valuation and of these 122 had complied with the requirement to use a valuer who carries PII cover. However, in 27 cases (18%), the SIP16 report to creditors did not mention whether the valuer carried PII. While this does not necessarily mean that in 18% of cases the valuer did not have PII, it is noted that in 1 in 6 cases administrators failed to comply correctly with this requirement, either by not using a valuer with PII or by not recording it in the SIP16 report.

Valuation v purchase price

Of the 163 connected person sales reviewed, 142 had the necessary information available to compare the valuations to the purchase price. Of these 88 (62%) were sold at or above the valuation, demonstrating that in the majority of cases the connected purchaser was willing to pay the valuation price or more to ensure the business continued to trade. This indicates that there can be benefits to a connected party sale where existing management may place a higher value on the business than an outside purchaser.

Only 10 (7%) of the sales reviewed with information available to compare the valuations to the purchase price saw the purchase price exactly match the valuation. While there may be a number of reasons for this, the low number should alleviate concerns raised in the Graham Review about the perception of purchasers setting valuations as an indicator of how much they were prepared to pay, rather than the market value of the assets in question.

54 (38%) of the sales reviewed with information available to compare the valuations to the purchase price were sold for less than the market valuation, of these 36 were sold for at least 25% less than the market valuation. Whilst this is a concern, the government recognises that where this is the best offer made the administrator is under a duty to accept it, provided it will deliver the best outcome for creditors in the circumstances (Objectives of administration set out in paragraph 3 Schedule B1 Insolvency Act 1986 ).

5.5 Revisions to SIP16 (regulatory guidance)

Graham Review findings and recommendation

The revisions to SIP16 reflected the changes introduced as a result of the recommendations on the establishment of the Pool, viability statements, marketing requirements and valuations. Insolvency practitioners’ compliance with the SIP16 requirements has a direct impact on the success or failure of the overall package of changes introduced as a result of the Graham Review.

Handover of monitoring of compliance of SIP16 statements to RPBs

In November 2015, RPBs took over responsibility for monitoring of SIP16 statements from the Insolvency Service. The monitoring involves considering whether an insolvency practitioner has fulfilled the regulatory standards set out in SIP 16 and whether the information provided in the SIP 16 report to creditors is satisfactory. Table 4 shows the levels of compliance since November 2015 as reported by the RPBs.

Table 2 – Compliance with SIP16 requirements

| Monitoring period | Number of statements reviewed | Number of non-compliance | Percentage of non-compliance |

|---|---|---|---|

| 1/11/15 - 31/12/2016 | 401 | 153 | 38% |

| 2017 | 187 | 72 | 38% |

| 2018 | 261 | 77 | 30% |

| 2019 | 235 | 54 | 23% |

Between 2016 and 2017 compliance remained at the same level although we accept that this is not directly comparable as in 2017 some RPBs adopted a new risk-based approach/targeting model to select cases for review (2017 Annual Review of Insolvency Practitioner Regulation – pg. 9). Since 2017 compliance of the cases reviewed has increased. Where the non-compliance is serious the RPBs have taken regulatory actions. (In 2017 there was regulatory action taken against 2 insolvency practitioners, in 2018 this had increased to regulatory action being taken against 6 insolvency practitioners and in 2019 regulatory action was taken against 3 insolvency practitioners.)

The RPBs state that most of the non-compliance is due to minor technical breaches (2016 Annual Review of Insolvency Practitioner Regulation –pg. 7). Although there is evidence that the RPBs are tackling non-compliance, the level of non-compliance continues to be a concern, as SIP16 reporting is a key factor in ensuring transparency and maintaining stakeholder confidence in pre-pack sales.

Government Review findings

Our review of SIP16 statements has revealed a considerable degree of variation in their quality and detail. These variations relate to the level of detail on marketing activities, valuations obtained and the lack of reference to viability statements. The evaluation recognises that there is now more information available to creditors as a result of the SIP16 changes, but this information is not necessarily communicated to creditors in every case. Greater consistency needs to be promoted across the profession.

5.6 Deferred consideration

Graham Review findings

Deferred consideration refers to where a purchaser pays for the business over a period, rather than on the date of the purchase. Concerns about deferred consideration related to how often these promises to pay were honoured and the impact this may have on returns to creditors. The Graham Review found that deferred consideration for pre-pack sales was a common practice, especially where the purchaser was a connected party and that it often represented a high proportion of the full purchase price. However, when present, the deferred consideration was fully paid in most cases and often backed by security (Graham Review pg.20 ).

Government Review findings

Our review work confirmed the usefulness of deferred consideration as a purchase method in a pre-pack sale. In 72% of cases where there was an element of deferred consideration, the new company was still trading after 12 months [footnote 15]. Therefore, we do not propose any restrictions on the use of deferred consideration as a method of payment where the purchaser of a business through a pre-pack sale is a connected person.

6. Other considerations

6.1 Business rescue

The Graham Review emphasised that pre-pack sales in administration were a valuable business rescue tool and had an important place in the insolvency landscape. Teresa Graham stated: “8.13 It is clear from the evidence gathered from stakeholders and from the evidence from the 2010 pre-pack sample, that in many circumstances a pre-pack administration is the best or perhaps more fairly the least worst outcome for all stakeholders in a business – including all classes of creditors. Evidence from the Wolverhampton research indicates that, when comparing pre-packs and trading administrations on a like for like basis, sales following pre-packs are more likely to succeed.”

Since the publication of the Graham Review, the government has consulted on a number of measures aimed at supporting business rescue and improving corporate governance. The government’s response to the consultation on Insolvency and Corporate Governance which was published on 26 August 2018 [^16] announced a number of proposals to change corporate insolvency legislation. Changes to the corporate insolvency framework have now been introduced by the CIG Act. These changes include allowing companies in financial distress access to a moratorium against creditor enforcement action; measures to support continued trading of a company within an insolvency procedure, and a new ‘restructuring plan’ procedure that will allow the efficient restructuring of debt. Some stakeholders felt that the introduction of these measures would provide greater possibilities for business rescue, leading to a reduction in the use of pre-pack administrations, whereas others considered that the existence of pre-packs might have an adverse impact on the effectiveness and take up of the new measures.

6.2 Impact of COVID-19

The COVID-19 emergency is an unprecedented situation. The package of measures, both temporary and permanent, introduced by the CIG Act, along with other measures including fiscal support that the government has put in place, will help those companies which would be viable if not for COVID-19. It is anticipated that pre-pack sales during this period will also continue to be a valuable tool in the insolvency framework to help rescue viable businesses and save jobs.

6.3 Pensions and Pre-packs

High-profile pre-pack sales have led to criticisms in the media that they are a means to avoid pension responsibilities. As part of the review, the government worked with the Pension Protection Fund (PPF) to ascertain whether there is any evidence that pre-packs are being misused to evade significant pension liabilities. However, the PPF made clear to the review, and publicly in its response to concerns raised by the then Chair of the Work and Pensions Select Committee in 2019, that it does not generally see any evidence that pre-packs are being used as a vehicle for abandoning pension liabilities. Where the PPF has concerns it will refer the matter to the Pension Regulator for consideration, as it did in the case of the Johnston Press pre-pack sale in 2019 (See Chair’s letter and The Pension Regulator’s response). In most cases, the PPF (as a major creditor) stated that it has reasonable engagement with companies ahead of a pre-pack sale.

The PPF in its response to the then Chair of the Work and Pensions Select Committee stated that the Pension Regulator has adequate powers to deal with any misuse of pre-packs but has suggested that consideration should be given to making referral to the Pool mandatory.

7. Conclusions and outcome of the review

7.1 Conclusions

With consideration to the key aims of the review (as detailed on page 9) the following conclusions have been drawn:

Are connected party sales in administration still an area of concern?

Between 2016 and 2019 there were several high-profile pre-pack sales in administration. These led to renewed media and parliamentary interest in pre-pack sales generally. More recently, during the debate on the passage of the CIG Act 2020 concerns were raised about the potential impact of prepack sales during the current COVID-19 crisis, for example that there would be a significant increase in pre-packs to the detriment of creditors and that the ease of doing a pre-pack sale might impede the effectiveness of the new rescue measures introduced by the Act.

In some cases, a pre-pack deal may be the only option available for the company and a lifeline for employees and the survival of the business. In 72% of the 163 connected party pre-pack sales reviewed (all connected party pre-pack sales during 2016), there was some level of job preservation, which equates to circa 7,500 jobs being saved. However, our review has found that some connected party pre-packs are still a cause for concern for those affected by them and there is still the perception that they are not always in the best interests of creditors. The fact that evidence available indicates that over a third of the cases reviewed were sold for less than the market valuation lends weight to this perception, notwithstanding that in some cases the sale may have been the best offer on the table.

Have the voluntary measures remedied the perceived lack of transparency and trust in the pre-pack sale process?

7.2 Marketing

Although we have seen increased marketing of businesses as a result of the marketing requirements of SIP16, not all the principles of marketing that were introduced following the Graham Review are being used consistently. There is still room for further transparency for the benefit of creditors, particularly in cases where no marketing has been carried out - the reasoning for this should be properly explained by the administrator. The “comply or explain” approach allows the possibility of deviating from the marketing principles, but we have found that the explanations provided in some cases lack detail. A full explanation for the administrator’s actions where the business has not been fully marketed should be communicated to creditors in the SIP16 statement.

Pre-Pack Pool

A key recommendation for increasing trust in the use of pre-packs for connected party sales was the establishment of the Pool to instil confidence in creditors that a pre-pack sale was reasonable by offering the opportunity for independent scrutiny. As there has only been a low level of referrals to the Pool, it is difficult to conclude whether the original aims of the Pool have been achieved. Stakeholders (BPF, PPF, R3, and CICM) argued that making a referral to the Pool mandatory would help to ensure that this transparency is achieved.

Valuation

SIP16 requires that valuations be carried out by valuers who hold professional indemnity insurance. Our review has found that this measure has generally been complied with.

Viability report

The viability report should be attached to the SIP16 statement and show how the purchasing party will survive for at least 12 months from the date of the statement and what the purchaser will do differently from the insolvent company to avoid a further failure. This measure has not been successful due to the lack of take up - only 28% of 163 connected party pre-packs provided a statement. Given that in 72% of connected party pre-packs we reviewed there was an element of deferred consideration, it is perhaps even more significant for the purchaser to demonstrate the viability of the business going forward to give creditors confidence that the purchase will be paid for.

SIP16 compliance

As previously noted, SIP16 outlines the action that should be taken by the administrator in order to comply with the voluntary measures recommended by the Graham Review. Compliance with the requirements is a key measure in determining the success or failure of the package of reforms. While there has been an increase in the level of compliance (of those cases reviewed) since 2017 and this is encouraging, at least 1 in 5 of SIP 16 statements is still non-compliant.

Have the voluntary measures had an impact on behaviours?

The evidence indicates that there has been some positive impact on behaviours. For example, there have been improvements to marketing and the quality of information that is given to creditors as a result of the strengthened SIP16 report. However, the review has not found convincing evidence that the pre-pack reforms as a package have changed behaviours sufficiently in line with expectations at the time the voluntary measures were introduced. There has been a lack of referrals to the Pool indicating that this specific measure does not seem to have had an impact on the behaviour of purchasers nor encouraged them to take into account any concerns creditors may have about the transaction.

Is further regulation/use of the power in paragraph 60A of Schedule B1 of the Insolvency Act 1986 required?

In considering whether there is a need for further regulation we have had regard to the clear findings in the report that pre-packs are a valuable part of the insolvency framework. We do not therefore think there is a case to prohibit pre-pack sales to connected parties.

However, our findings indicate that some of the measures implemented by the Graham Review have clearly been more successful than others in improving transparency of pre-pack transactions. There has been a marked increase in the incidence of marketing of businesses, although our review found that some principles of marketing have only been complied with in around 50% of cases.

As noted in the report, uptake of the Pool has been low. Some key stakeholders suggested making referral to the Pool mandatory in order to provide greater assurance to creditors. Additionally, the review found that only 28% of SIP16 statements said that a viability review had been completed.

The Graham Review advocated that if the voluntary measures failed to have the desired impact and were not adopted by the market, then the government should consider legislating We have therefore concluded that further regulation and use of the power in paragraph 60A of Schedule B1 of the Insolvency Act 1986 is justified to ensure that proposed pre-pack sales are subject to a measure of independent scrutiny, given that this was a key recommendation in the Graham Review (see decisions and next steps).

We are also proposing non-legislative measures in respect of those issues where the report indicates that there is broad evidence of compliance, but where compliance is either not universal or fails to meet standards of best practice in all cases (see decisions and next steps).

We would propose to monitor the impact of changes made in response to the findings of this report to assess whether further reform in this area is needed.

Is the government’s use of the power in paragraph 60A of Schedule B1 of the Insolvency Act 1986 the right way to deal with any concerns that may remain?

The government is satisfied that the power will enable the legislative reforms to be taken forward which it considers necessary at this stage, to improve the scrutiny of the pre-pack sale process for all stakeholders, particularly creditors.

7.3 Decisions and next steps

Legislative measures

The government proposes that to provide stakeholders with greater assurance that such a sale is appropriate in the circumstances, the power revived by the CIG Act should be exercised to require an independent opinion on a sale in administration to a connected person. We have consulted key stakeholders to develop the policy on how this might work. Published with this report are the draft regulations, which Government intends to lay before Parliament. A summary of the proposed regulatory framework is set out below:

- The regulations will apply where there is a disposal in administration of all or a substantial part of a company’s assets.

- An administrator will be unable to dispose of property of a company to a person connected with the company within the first eight weeks of the administration without either the approval of creditors or an independent written opinion. The connected party purchaser will be required to obtain the written opinion.

- The provider of the opinion must be independent of the connected party purchaser, the company and the administrator and must meet certain eligibility requirements.

- The administrator must have no reason to believe that the opinion provider is not independent of the connected party or does not meet the eligibility requirements.

- The opinion provider will provide a written report to state that either the case is made for the disposal or that the case is not made.

- A connected party purchaser may obtain more than one report.

- An administrator must consider a report from an opinion provider.

- Where a report states that the case is not made for the disposal, an administrator can still proceed with the disposal but will be required to provide a statement setting out the reasons for doing so.

- An administrator will be required to send a copy of the report(s) to creditors of the company and to Companies House.

Non legislative measures

The government will work with the industry and the RPBs to prepare guidance to accompany the regulations and to ensure SIP16 is compatible with the legislation. We will also look to strengthen the existing regulatory requirements in SIP 16 to improve the quality of information provided to creditors. We will in particular work with the regulators to ensure:

- there is greater adherence to the principles of marketing;

- where no marketing has been undertaken that this is fully explained by the administrator and any explanation probed by the regulator where necessary;

- there is a continued increase in compliance with the reporting requirements under SIP16; and

- it is understood why viability reports are not being completed and how this could be improved.

Should these non-legislative measures be unsuccessful in improving regulatory compliance, the quality of the information provided to creditors and the transparency of pre-pack sales in administration, government will consider whether supplementary legislative changes are necessary.

Timing

The power revived by the CIG Act must be used before June 2021 and the Government will seek to bring forward regulations as soon as Parliamentary time allows within that period.

-

For the purposes of this report the terms “connected party” or “connected person” are generally used interchangeably. Please see page 9 and footnote 8 for a more detailed explanation. ↩

-

S.129 SBEE Act inserted para 60A in schedule B1 Insolvency Act 1986 ↩

-

Statements of Insolvency Practice (SIPs) are drawn up by the Joint Insolvency Committee to promote consistency and professional standards among insolvency practitioners. SIP16 deals with pre-pack sales in administration and details the requirements of the content of the SIP16 report, which must be sent to creditors regarding the pre-pack sale. Departure from the standard set out in the SIP is a matter that may be considered by a practitioner’s regulatory authority for the purposes of possible disciplinary or regulatory action. ↩

-

In this report where references are made to a ‘connected party’ the following modifications are applied to the statutory definition of a connected party (S.249 and s.435 IA 1986). Where reference is made to the Graham Review a ‘connected party’ excludes employees (who are not directors or shadow directors) and secure lenders with voting rights in the normal course of business of a third or more. Where reference is made to ‘connected party’ in the Insolvency Service’s analysis this excludes secure lenders with voting rights in the normal course of business of a third or more (as set out in SIP16) and where reference is made to the use of the statutory power contained in paragraph 60A of Schedule B1 of the IA 1986, the term ‘connected person’ is used, which excludes employees (who are not directors or shadow directors). ↩

-

At the time of analysis, it was not possible to determine whether deferred consideration had been paid in full due to the payment terms. ↩