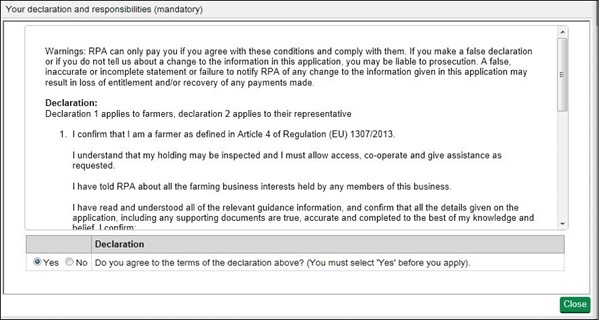

Complete your declaration

Before you can confirm your application and submit it, you need to complete your declaration.

You must fill in the ‘Your declaration and responsibilities’ section before submitting your application.

To complete your declaration, go to the ‘Manage your application’ screen. From the ‘Business overview’ screen, click ‘Apply for BPS or view status of your application’ (and ‘open’ your application).

If you need help, click the ‘Help’ link.

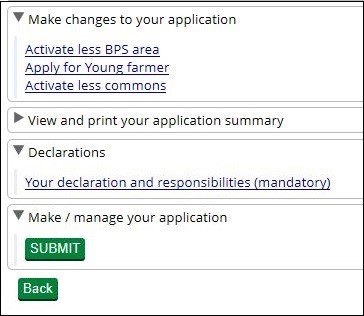

If you’ve made changes to Part C: Field data sheet, or Part E: Common land grazing rights, you need to make sure that the changes appear in your application and your application summary.

To do this, click on the relevant link under ‘Manage changes to your application’. You may see a message while your application is updating.

Once this is complete, check that the information is correct, click ‘Save’, and then ‘Close’ to leave the screen.

Read the ‘Important’ box within ‘Making changes to land use’ for more information.

From the ‘Manage your application’ screen, click ‘Activate less BPS area’.

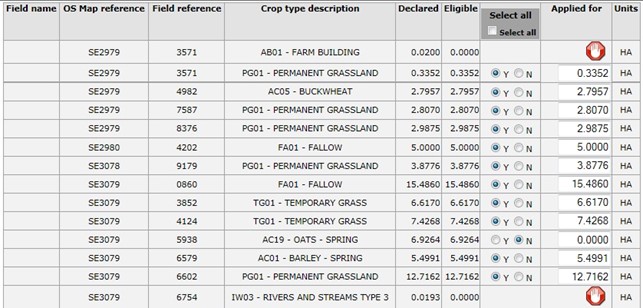

The information in column C8 (Eligible area you want to apply for payment on) on your application summary is based on the information in the ‘Update land use’ screen. It should update to make sure you are always applying for the maximum eligible area that you can (based on your land use).

The ‘Eligible’ area will show the eligible area you’ve declared in the ‘Update land use’ screen (C6 and C7). You can also see how much land you’ve ‘Applied for’ (C8). For BPS, the total eligible area of a land parcel needs to be at least 0.10ha to ‘Apply for’ payment for it. If the land parcel is below 0.10ha then C4 and C8 in your application summary will show as 0.0000ha.

Whether or not any changes have been made to the information in the ‘Update land use’ screens, it’s very important that you check the ‘Activate less BPS area’ screen to make sure that the eligible area you want to claim for payment (C) is showing correctly.

In some cases, the eligible area you want to claim for payment (C8) may have defaulted to 0.0000 in this screen. If this has happened, you can update it in the ‘Activate less BPS area’ screen.

After you’ve updated it, generate and download a copy of your application summary. Check this summary is showing the correct eligible area you want to claim for payment (C8).

If you want to reduce the area you are claiming a BPS payment for, you can declare this in the ‘Activate less BPS area’ screen.

You can make changes by typing the areas you want to claim into the ‘Applied for’ column. Click the ‘Help’ link on the screen for more information on how to do this.

If you do not want to claim for payment on a specific land parcel, for example, you are in a dual use situation, or you have transferred or removed the land parcel, you need to click the button next to the N to answer ‘no’ in the relevant row.

Make sure you save any changes before you close the screen.

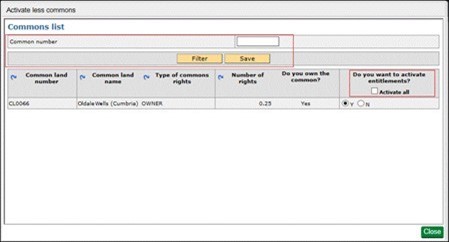

If you do not want to claim for payment on all your grazing rights (E6 on your application summary), you need to reduce the number of entitlements you use (activate).

From the ‘Apply for BPS or view status of your application’ screen, use the green button to open your application, choose ‘Make changes to your application’ then ‘Activate less commons’. This shows the grazing rights from your BPS 2021 application, and any additional changes that we’ve already agreed with you. It shows the maximum number of rights you can use to activate (use) payment entitlements for BPS 2022.

Any further changes that we’ve agreed with you but not yet entered, or changes that we may agree later, will show when we enter the updated information into the Rural Payments service.

For any common you do not want to claim for payment click ‘N’ in the ‘Do you want to activate entitlements’ column. Then choose the relevant common. (If you need more help to do this click the ‘Help’ link on the screen.) Then click Save. Click Close to go back to the previous screen.

If you make any changes to this information, please send us any supporting evidence you have showing the numbers you declare.

Change the information we have about your commons rights

You can also add and remove commons and change the name of a common, the number of rights or the type of rights. From the ‘Business overview’ screen, click ‘Update commons’.

Important

If you’ve added or made changes to your common land (read Make changes to Part E: Common land grazing rights), you need to click ‘Activate less commons’ to allow your application to update with the new information. You may see a message while your application is updating. Once this is complete, check that the information is correct, click ‘Save’ and then ‘Close’ to leave the screen.

If you are applying for the young farmer payment for the first time, go to the ‘Make changes to your application’ section of the ‘Apply for BPS or view status of your application’ screen and click ‘Apply for young farmer’. Click ‘Yes’ to apply for the young farmer payment, then ‘Close’.

You need to send us a ‘Basic Payment Scheme (BPS) 2022 ‘Young and new farmer application form’ together with the accountant or solicitor certificate to prove you are a young farmer. We need to receive your application by midnight on 16 May 2022.

If you were assessed as eligible for the young farmer payment in 2021, go to the ‘Make changes to your application’ section of the ‘Apply for BPS or view status of your application’ screen and click ‘Apply for young farmer’. Click ‘Yes’ to apply for the young farmer payment, then ‘Close’.

You do not need to send us another ‘Basic Payment Scheme (BPS) 2022 ‘Young’ and new farmer application form’ or any evidence, unless there has been a change to the structure of your business since you applied in 2021.

The same applies if you were assessed as eligible for the young farmer payment in an earlier scheme year but did not apply for the young farmer payment in 2021, and there has been no change to the business structure since you last successfully applied for the young farmer payment.

If your business structure has changed, you need to send us another ‘Basic Payment Scheme (BPS) 2022 ‘Young and new farmer application form’ and ‘Accountant or Solicitor certificate’.

Read the ‘Basic Payment Scheme: rules for 2022’ for more information.

To make your declaration, on the ‘Manage your application’ screen, click ‘Declarations’ then ‘Your declaration and responsibilities’. Please read these carefully and then click ‘Yes’ to confirm that you accept the terms of the declaration.

You need to complete this declaration before you submit your application.