No Safe Havens 2019: leading internationally

Updated 16 May 2019

The UK has been at the forefront of international changes that are transforming tax authorities’ ability to work across borders to tackle emerging international tax risks.

Our leadership was key in initiating the Organisation for Economic Co-operation and Development (OECD’s) Base Erosion and Profit Shifting (BEPS) project to tackle multinational tax avoidance, and in setting standards for tax transparency and exchange of tax information, such as the Common Reporting Standard (CRS).

International leadership is the first of our 3 aims to help ensure the correct UK tax is paid. We will work with other jurisdictions to develop international tax standards that help ensure offshore tax compliance and prevent unfair outcomes. We will continue to champion international collaboration and the exchange of tax information to help us achieve these goals.

Championing international tax transparency

In the past it was very difficult for HMRC to find out about offshore assets, income, gains and transfers which should have been declared for UK tax but were not. Sometimes this was an inadvertent mistake, but sometimes it was a deliberate choice to declare, and try to pay, less tax than was owed.

However, now new international tax transparency standards are shedding light on our customers’ overseas arrangements. Jurisdictions that previously had strict banking secrecy rules are now sharing information automatically with HMRC.

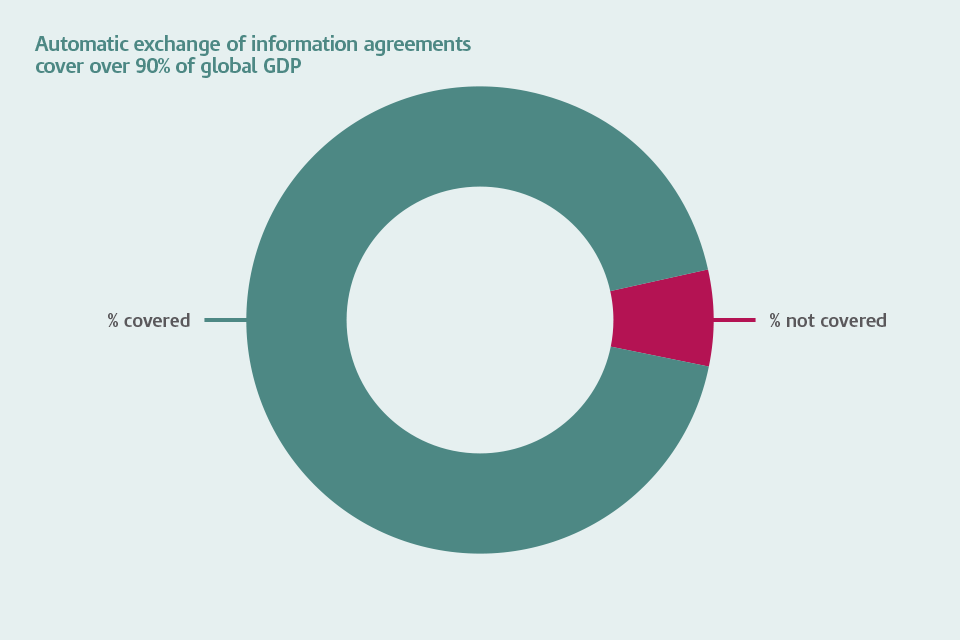

Over 100 jurisdictions have committed to exchange financial account information with each other about accounts held in their jurisdictions by individuals, or entities they control, that are reportable under the CRS.

In 2018 HMRC received information about around 3 million UK taxpayers who have offshore financial interests. We will use this information to promote compliance, detect possible offshore tax non-compliance and respond in the appropriate way.

This information exchange is happening now because the G8, under the UK’s presidency, called for a new global standard for automatic information exchange in 2013. This call was taken up by the G20 and the OECD, leading to the development of the CRS.

Image of pie chart graphic showing that automatic exchange of information agreements cover more than 90% of global Gross Domestic Product (GDP).

In addition, the UK is at the forefront of international efforts to bring greater transparency to offshore arrangements which could be used to evade tax, or to avoid reporting under the CRS. We will continue to work with our partners and the OECD to achieve this.

The UK was also amongst the first countries to implement country-by-country reporting, which requires large multinationals to provide a country-by-country breakdown of their profits, tax and assets to HMRC. These reports are then exchanged between relevant tax authorities, further increasing international tax transparency and helping with high level tax risk assessments. HMRC is using the data to identify new areas of risk and continues to engage with other jurisdictions to share best practice.

These new data sources are helping HMRC unravel offshore arrangements and detect possible non-compliance.

We can then intervene, appropriately and proportionately depending on the expected behaviour and risk, to ensure the correct tax is paid. In some cases we will ask taxpayers to check and confirm their affairs are in order, in others we will open a civil enquiry to verify the correct tax has been paid, and in the most serious cases we will start a criminal investigation.

When HMRC carries out tax enquiries our customers usually provide the information we need quickly and voluntarily. However, if they choose not to provide the information, or information required is held by a third party who will not provide it voluntarily, we use HMRC’s formal powers to obtain the information. These powers include safeguards to ensure they are used appropriately.

However, it is often more expensive, and time-consuming, for HMRC to obtain data from those who choose to hold information overseas.

Some businesses – including online platforms[footnote 1] – can choose whether to hold data within the UK or overseas.

Following a consultation on the role of online platforms, the government is developing potential solutions to help level the playing field for obtaining information.

We will consider opportunities in other sectors or industries to ensure that HMRC can obtain essential information without unnecessary delay.

Focus: Common Reporting Standard information exchange

In 2018, HMRC received CRS records relating to 5.67 million accounts.

This builds on 2017, when HMRC received 1.63 million records – these related to accounts held by 1.3 million individuals, and around 100,000 held by others, in around 40 jurisdictions.

Many customers have come forward to disclose offshore tax non-compliance through the Worldwide Disclosure Facility before they are detected by HMRC using the CRS data. Some chose to do so after receiving a letter from HMRC.

We have written to tens of thousands of customers we believed may have an overseas account or investment to ask that they check they have paid the correct tax. We are currently opening many enquiries where customers chose not to come forward, and may impose penalties if tax should have been paid.

Exchanging information internationally

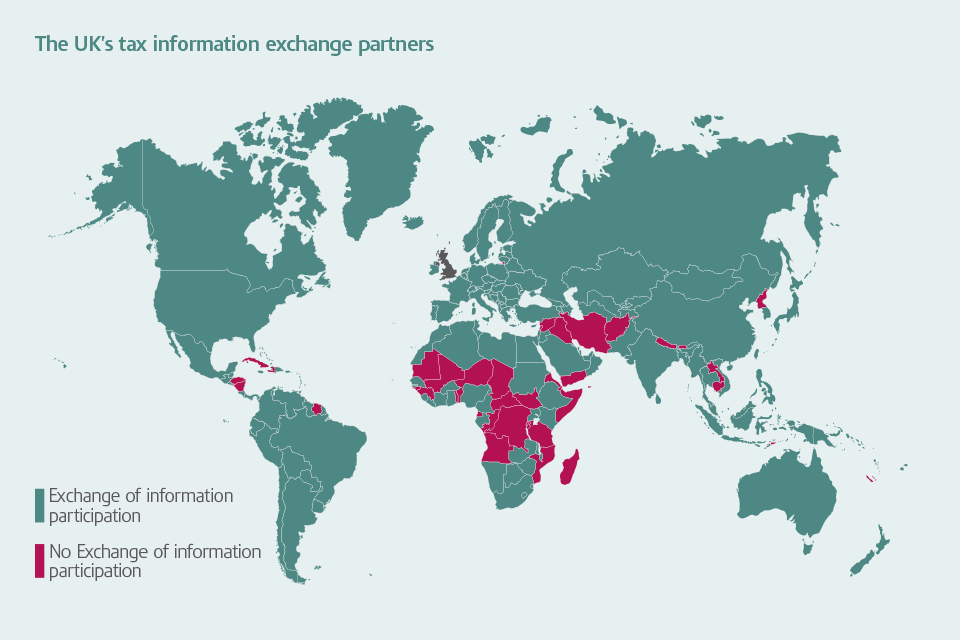

The UK has one of the world’s largest networks of international tax treaties. This extensive network includes around 150 jurisdictions around the globe and allows for tax information to be requested and exchanged where it is useful for tax compliance purposes.

Where relevant information is held outside the UK, HMRC can request it under the relevant treaty.

The tax authority that receives the request will obtain the information and provide it to HMRC to use in our investigation. These information exchanges with the UK’s treaty partners support our enquiries into our customers’ overseas tax arrangements, and likewise we support enquiries undertaken by our treaty partners.

Image of graphic showing the UK’s tax information exchange partners across the world.

The UK champions the Global Forum’s[footnote 2] standards for information exchange, which cover the timeliness and quality of exchange. These include requiring that jurisdictions are able to establish the true beneficial owners of legal entities and arrangements, so this information is available if requested by a partner tax authority.

Beneficial ownership transparency plays a central role in ensuring tax compliance. Whilst most companies and trusts are used legitimately, they can be used to hide the true owners of assets for tax avoidance and tax evasion and other illegitimate purposes including corruption, money laundering and the financing of terrorism.

Where companies and trusts are located outside the UK there are significantly higher risks[footnote 3] that they can be used for avoiding or evading tax or facilitating illicit finance.

Central registers of beneficial ownership (or their equivalent systems) help ensure that structures are not used to hide the ownership of assets. They are an important tool for tax and other law enforcement authorities to use to tackle structures set up to hide assets for illegitimate purposes.

The UK was one of the first countries to introduce a public register of company beneficial ownership[footnote 4]. We will build on this by creating a new register for non-UK entities that own or plan to purchase UK property by 2021.

This will help HMRC assess the risk these companies pose, complementing our existing collaboration with the Land Registry.

Recent reforms have increased the tax transparency of trusts when considered by tax authorities. These include international information exchange under the CRS (which includes financial accounts relevant to trusts) and a UK requirement that all trusts with a UK tax liability must register with HMRC’s Trust Registration Service (TRS).

HMRC recently consulted on the taxation of trusts[footnote 5] and will publish a response in due course.

We will continue to champion international initiatives promoting tax transparency. Working within international fora, such as the OECD and the Global Forum, HMRC will help to develop standards and ensure jurisdictions comply with their existing commitments. This will strengthen HMRC’s ability to challenge tax avoidance and tackle tax evasion.

Strengthening operational collaboration

Complex offshore cases can take HMRC much longer to investigate, and require more resources, when compared with equivalent domestic cases. This is especially true where the arrangements involve numerous entities in different jurisdictions. Financial innovations and new technologies are increasing the complexity faced by our investigators when considering offshore cases.

To help address these difficulties, Parliament extended the time limit for HMRC to assess offshore tax. HMRC will be able to raise assessments, going back up to 12 years. This will ensure HMRC has the extra time often needed to establish the facts for offshore matters.

In addition, HMRC is leading work with other tax authorities to identify new risks as they emerge and develop prompt and effective operational responses.

The UK is a leading member of the Joint International Taskforce on Shared Intelligence and Collaboration (JITSIC) network of 40 jurisdictions.

JITSIC members collaborate to share intelligence on cross-border tax avoidance and evasion, including co-ordinating work on specific taxpayers and developing common solutions to emerging tax risks, such as those posed by new technologies.

The UK will continue to fully participate in JITSIC, work which helps to protect the UK tax base and increase international co-operation and collaboration.

In 2018, the UK joined forces with Canada, the Netherlands, the United States and Australia to launch the Joint Chiefs of Global Tax Enforcement (known as ‘J5’).

The J5 alliance brings together the latest technology and sophisticated analytical capacity across these tax administrations to tackle those who enable international tax crime, cyber criminals and money launderers.

The J5 has identified, and is actively pursuing, a number of enablers suspected of facilitating significant cross-border tax fraud and money laundering.

These international partnerships complement HMRC’s collaboration with other UK government law enforcement agencies, including the police, the National Crime Agency and the Border Force, as well as regulators, such as the Financial Conduct Authority.

We will deepen our international and national partnerships, helping to ensure HMRC has access to the intelligence and information it needs to identify, understand and tackle offshore tax risks, including those posed by emerging technologies.

Case study: HMRC investigates a large multinational business

As part of HMRC’s Business Risk Review process for large businesses, we identified that a large multinational company had used a cross-border financing arrangement to avoid tax.

Following a detailed enquiry, our specialists successfully challenged the arrangement. As a result, HMRC determined the company had behaved carelessly in submitting its tax return and imposed a £1 million penalty, as well as requiring the company pay the £5 million in tax that it should have.

HMRC will always intervene where we suspect tax avoidance. We will intervene proportionately to put things right with all our customers, including large business.

Building tax capacity in developing countries

Greater tax transparency and the exchange of information makes information available that is vital to fight tax evasion and avoidance.

The UK is committed to supporting developing countries that wish to implement international tax standards and increase international cooperation. This in turn enhances the generation of government revenues to fund public services, reduces reliance on foreign aid, and assists in fighting illicit financial flows.

Some countries can face considerable challenges in implementing tax transparency standards. Building on HMRC’s depth of knowledge regarding the international exchange of tax information, the UK has run successful capacity building programmes to share this expertise with nine partner developing jurisdictions.

We will build on the success of these initiatives and expand HMRC’s team which helps developing countries, our Capacity Building Unit.

HMRC will invest up to £18.25 million of Overseas Development Assistance funding over the next 6 years, which will be used to improve the efficiency and effectiveness of revenue administrations in low and middle-income countries, by sharing UK knowledge and expertise.

This investment builds on a strong track record of HMRC developing long term partnerships and delivering peer-to-peer advice with tax authorities in developing countries. Embedded HMRC advisers have also been deployed to work in 6 countries, and HMRC’s tax experts have delivered training and advice around the world.

Ensuring offshore tax compliance requires strong leadership and collaboration with our international partners. Increasing international collaboration will help HMRC ensure there are no safe havens for evaders and avoiders as the world becomes more interconnected and our customers’ arrangements grow more complex.

You can read the next section: No Save Havens 2019: assisting compliance.

-

This includes online platforms that help connect buyers and sellers of goods and services or facilitate the gig and sharing economy. ↩

-

The Global Forum on Transparency and Exchange of Information for Tax Purposes (Global Forum) is the international body that ensures jurisdictions are living up to their commitments in respect of tax transparency. ↩

-

HM Treasury and Home Office: National risk assessment of money laundering and terrorist financing 2017. ↩

-

In this context a beneficial owner is any individual who controls, directly or indirectly, or benefits economically from an entity, arrangement, capital or asset. ↩

-

The taxation of trusts: a review. HMRC: 7 November 2018, last updated 18 January 2019. ↩