Chancellor launches vision for future public spending

Government spending plans to be set out at the Spending Review on 27 October alongside an Autumn Budget.

- The Spending Review will set out the plan for how public spending will deliver the people’s priorities over the next three years.

The Chancellor has today (7 September) launched Spending Review 2021 (SR21), which will conclude on 27 October 2021 alongside an Autumn Budget and set out the government’s spending priorities for the Parliament.

The three-year review will set UK government departments’ resource and capital budgets for 2022-23 to 2024-25 and the devolved administrations’ block grants for the same period.

When added to what we have already provided to invest in our future, our plans – including the additional funding for health and social care announced today (7 September) – mean core departmental spending will grow in real terms at nearly 4% per year on average over this Parliament. By 2024-25 that means that core departmental spending will be £140 billion more per year in cash terms than at the start of the Parliament.

At the Spending Review, the government will set out how we will Build Back Better, deliver the priorities of the British people and continue to support businesses and jobs through:

-

Ensuring strong and innovative public services - making people’s lives better across the country by investing in the NHS, education, the criminal justice system and housing;

-

Levelling up across the UK to increase and spread opportunity; unleash the potential of places by improving outcomes UK-wide where they lag and working closely with local leaders; and strengthen the private sector where it is weak;

-

Leading the transition to Net Zero across the country and more globally;

-

Advancing Global Britain and seizing the opportunities of EU Exit;

-

Delivering our Plan for Growth - delivering on our ambitious plans for an infrastructure and innovation revolution and cementing the UK as a scientific superpower, working in close partnership with the private sector.

The Chancellor of the Exchequer, Rishi Sunak, said:

Since the start of the pandemic, we’ve delivered on an unprecedented scale to protect people’s jobs and livelihoods.

Despite the worst economic recession in 300 years, we have not only got people back into work through the Plan for Jobs but continued to deliver on the priorities of the British people.

At the Spending Review later this year, I will set out how we will continue to invest in public services and drive growth while keeping the public finances on a sustainable path.

As part of today’s launch, the Chancellor set the envelope for spending over the next three years:

-

Core day-to-day departmental spending will follow the path set out at spring Budget 2021, with the addition of the net revenue raised by the new Health and Social Care Levy and the increase to dividend tax rates announced today. The Government will make available around an additional £12 billion per year for health and social care on average over the next three years.

-

This additional funding for health and social care allows the Government to announce an SR21 RDEL settlement for NHS England and Improvement rising to £160 billion by 2024-25

-

In total, day-to-day spending will increase to £440 billion by 2024-25, increasing by nearly £100 billion a year in cash terms over the Parliament.

-

We will also deliver a step-change in capital investment, as set out at Budget 2021. We will invest over £600 billion over five years, the highest sustained level of public sector net investment as a proportion of GDP since the late 1970s.

-

Overall, our record and our plans will see total core departmental spending (for day-to-day spending and investment) grow in real terms at nearly 4% per year on average (nearly 6% in cash terms) over this Parliament – a £140 billion cash increase and the largest real-terms increase in overall departmental spending for any Parliament this century.

This spending increase is part of our broader plan to return our public finances to a sustainable footing over the medium-term. The spending plans and focused tax changes we announced today, alongside the measures taken at the last Budget, show that we are determined to get our fiscal position back on track, so that we can continue to fund excellent public services in the future.

Given the impact COVID-19 has had on the economy, the Chancellor has been clear that our spending plans will be underpinned by a focus on ensuring every pound of taxpayer funding is well-spent, so that we can continue to deliver the highest-quality services to the public at the best value. Departments have therefore been asked to identify at least 5% savings and efficiencies from their day-to-day budgets as part of these plans, which will be reinvested in our priorities.

Further information:

-

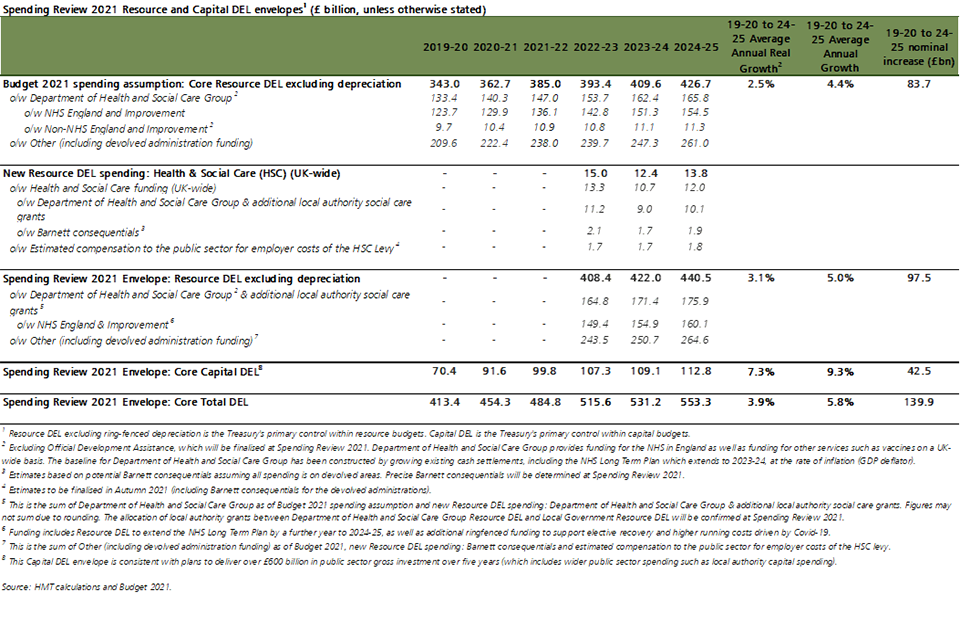

The table below sets out the envelope for core departmental spending for the SR. Given the continued uncertainty around the path of the virus, we recognise that some additional spending on top of these plans may be required in the immediate term as part of the remaining response to Covid-19. This will be considered in exceptional circumstances only, where reform and efficiencies are not sufficient to fund essential activity.

-

The table below also sets out the additional funding for health and social care which is expected to be made available by the Health and Social Care Levy and increase to dividend tax rates announced by the government today. As with all tax measures, the additional revenue from the Levy and the increase to dividend tax rates will be accounted for at the next fiscal event and the costing certified by the Office for Budget responsibility (OBR). The exact amount raised will depend on the OBR’s forecast in the autumn. In making these allocations, the government has taken into account the expected impact the Levy will have on profits, wages and prices, which in turn will lower the amount that would otherwise have been raised from personal and business taxes, and compensation for public sector employers. Around an additional £12 billion per year from these tax changes will be made available for health and social care resource spending, with the remainder offsetting the additional public sector costs from the Health and Social Care Levy. These estimates are based on how the OBR have considered previous similar changes.

-

The Office for Budget Responsibility (OBR) will prepare an economic and fiscal forecast which will be presented alongside the Autumn Budget and SR21 on 27 October 2021.

-

HMT has opened a process for the Spending Review and Autumn Budget to allow external stakeholders to submit representations. Representations can be submitted online by 30 September.